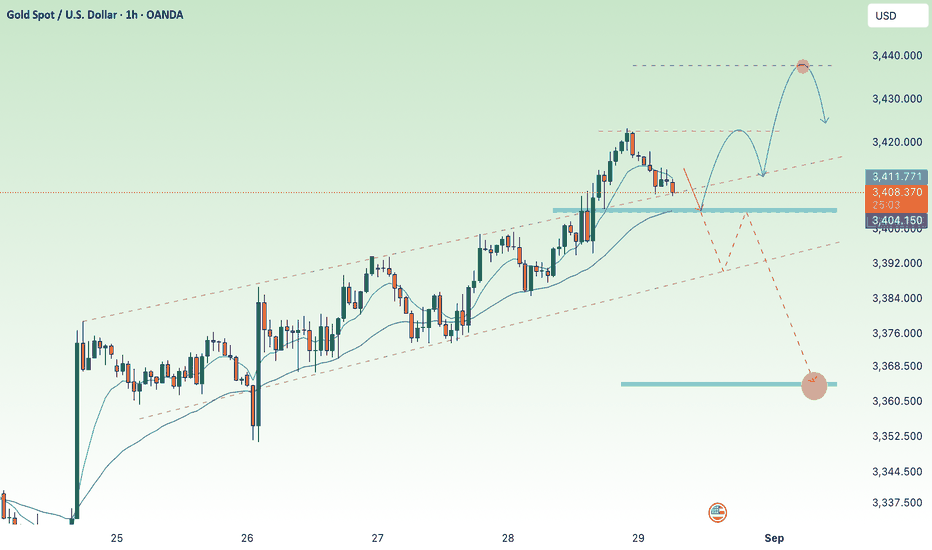

Is the price of gold really going up? 3500?⭐️GOLDEN INFORMATION:

Gold (XAU/USD) slips in Friday’s Asian session, pulling back from a five-week high near $3,425 as profit-taking and strong US GDP and jobless claims data lift the Dollar. Still, growing expectations of a September Fed rate cut, reinforced by dovish comments from NY Fed’s John Williams, help limit the downside for the non-yielding metal.

⭐️Personal comments NOVA:

Gold prices increased thanks to expectations that the FED will cut interest rates in September. However, the large fomo market will cause the market to be too optimistic, requiring adjustments to accumulate before that time.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3437- 3439 SL 3444

TP1: $3430

TP2: $3420

TP3: $3410

🔥BUY GOLD zone: $3366-$3364 SL $3359

TP1: $3375

TP2: $3383

TP3: $3390

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Selltrade

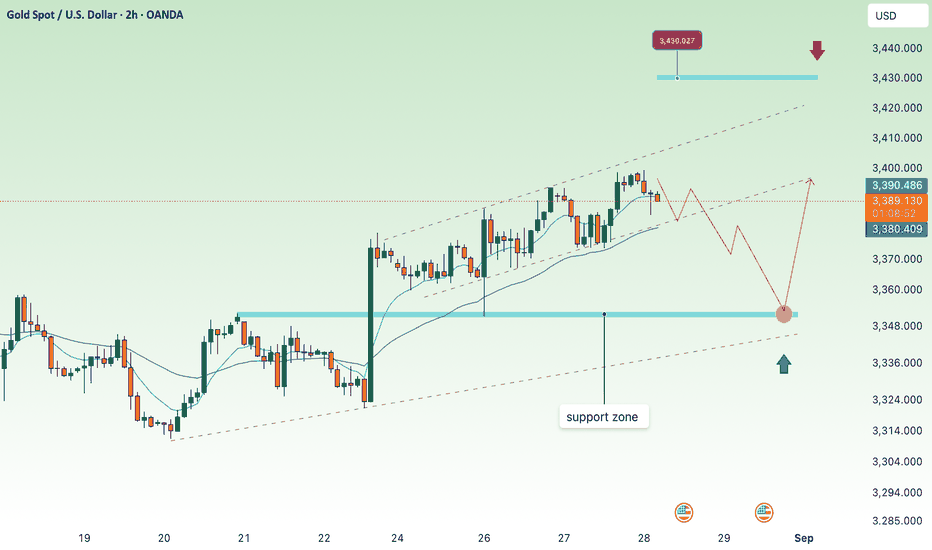

Continue to accumulate below 3400⭐️GOLDEN INFORMATION:

Gold (XAU/USD) dips during Thursday’s Asian session, pulling back from a three-week high near $3,400 as the US Dollar rebounds and traders book profits. Ongoing concerns over Fed independence, following President Trump’s removal of Governor Lisa Cook, lend some support to the safe-haven metal.

Markets now await the second estimate of US Q2 GDP, expected at 3.1%. A stronger print could boost the Greenback and pressure Gold, while focus will shift to Friday’s PCE inflation data for clues on Fed rate-cut prospects

⭐️Personal comments NOVA:

Gold prices continue to accumulate below 3400, according to experts expecting GDP data to support DXY. This could contribute to putting pressure on gold prices.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3418

TP2: $3407

TP3: $3392

🔥BUY GOLD zone: $3350-$3352 SL $3345

TP1: $3360

TP2: $3370

TP3: $3380

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

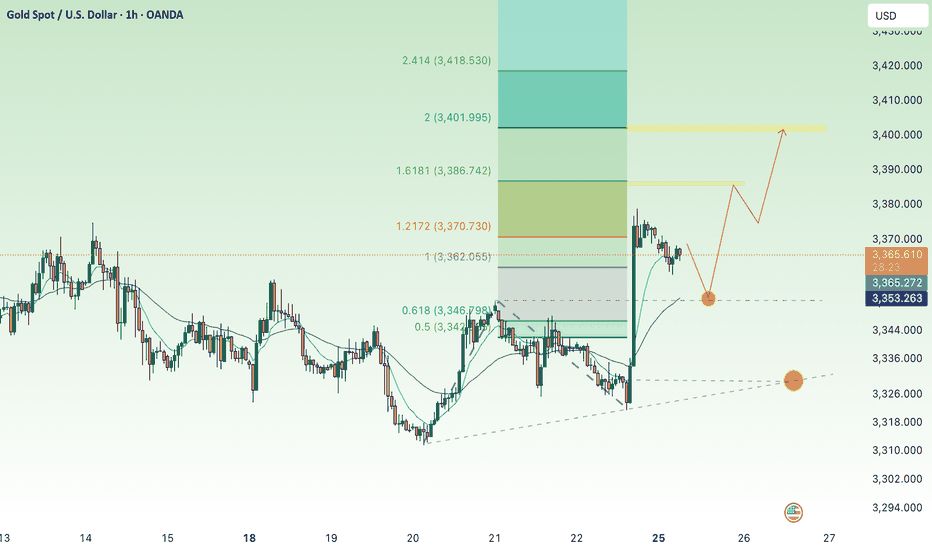

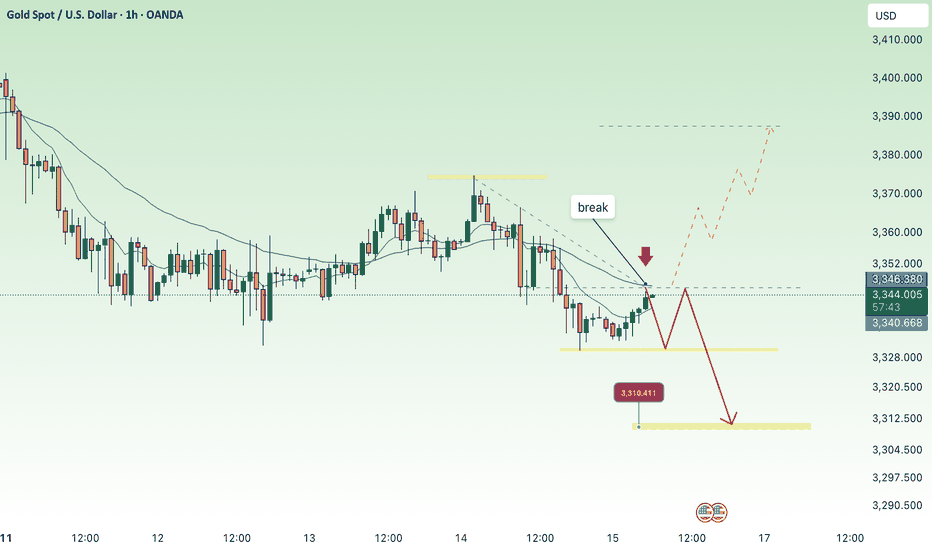

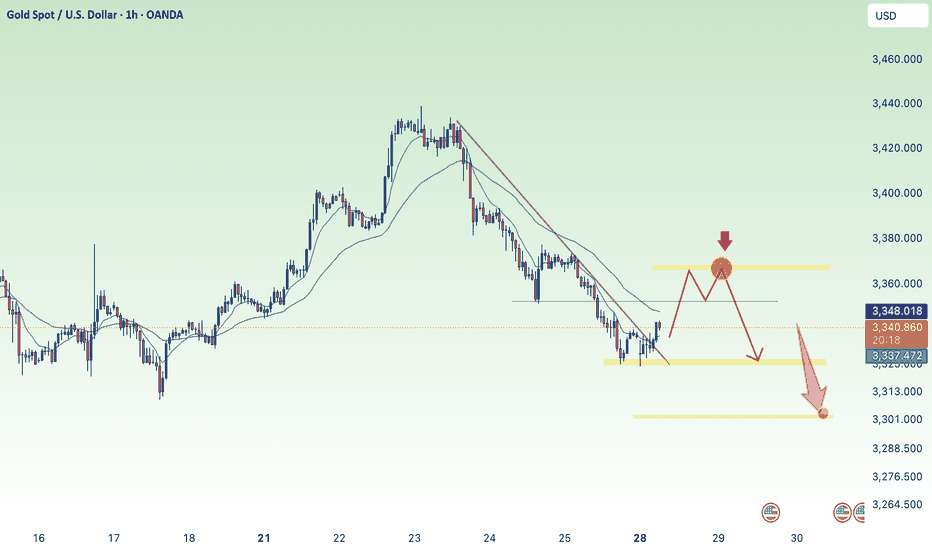

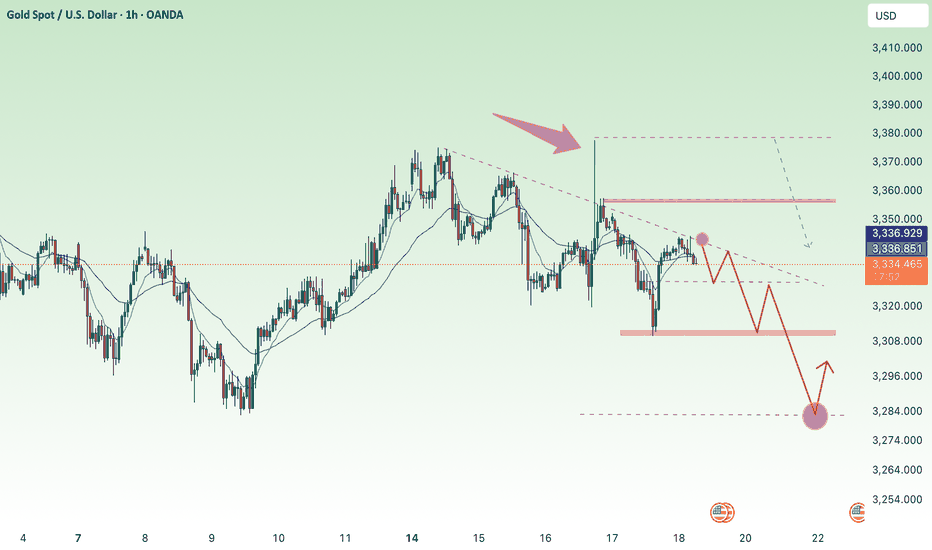

Slight decrease in the new week, accumulation above 3330⭐️GOLDEN INFORMATION:

Fed Chair Jerome Powell signaled openness to a rate cut at the September meeting, though persistent inflation pressures could complicate that outlook. Powell described the US economy as facing a “challenging situation,” noting inflation risks remain skewed to the upside while employment risks lean to the downside.

Following his remarks, traders boosted their bets on a 25 basis-point cut next month to nearly 85%, up from 75% prior to the speech, according to the CME FedWatch tool. Powell’s dovish tone could lend support to gold prices, as lower interest rates diminish the opportunity cost of holding the non-yielding metal.

⭐️Personal comments NOVA:

Gold price decreased and adjusted, pay attention to liquidity zones 3351, 3330

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3400- 3402 SL 3407

TP1: $3388

TP2: $3373

TP3: $3360

🔥BUY GOLD zone: $3330-$3328 SL $3323

TP1: $3340

TP2: $3350

TP3: $3360

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

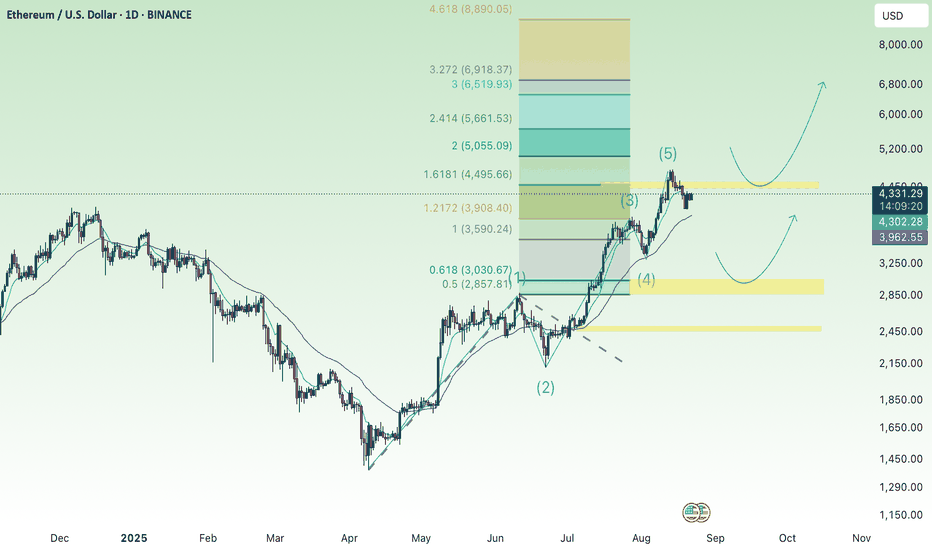

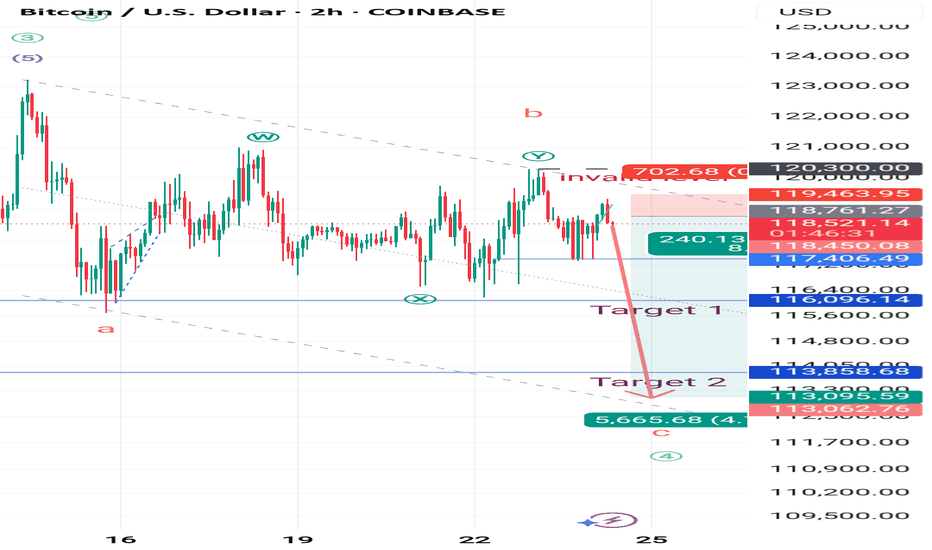

short term adjustment, accumulation for uptrend ETH💎 ETH WEEKEND PLAN UPDATE (August 22 , 2025 )

ETH is in a medium-term uptrend, having just completed wave (5) according to Elliott Wave, and is now undergoing a slight correction.

The current price zone around 4,200 – 4,300 USD is a key area to watch:

• If it holds, ETH may rebound higher.

• If it breaks down, it could retreat to deeper support levels.

Key Levels

Near Resistance:

• 4,500 – 4,600 USD: Strong resistance zone, aligning with wave (5) and Fibonacci 1.618.

• If this level is broken, the next target is 6,000 USD (Fibo 2.618).

Near Support:

• 3,800 – 3,900 USD: Confluence with EMA34 and an intermediate support zone.

• 3,200 – 3,250 USD: Strong support, intersecting EMA200 and key Fibonacci cluster.

• 2,500 – 2,600 USD: Final support, a solid base before the last strong rally.

Trend Outlook

• Short-term: ETH may continue correcting towards support to accumulate before forming a new rally.

• Medium-term: The main trend remains bullish as long as ETH holds above 3,200 USD.

• Long-term: If ETH breaks above 4,600 USD, it is highly likely to target 6,000 USD.

👉 Summary:

ETH is in a consolidation phase after a strong rally. Investors should watch the 3,800 – 3,900 USD zone closely. If it holds, the chance of retesting 4,600 USD and potentially 6,000 USD remains strong.

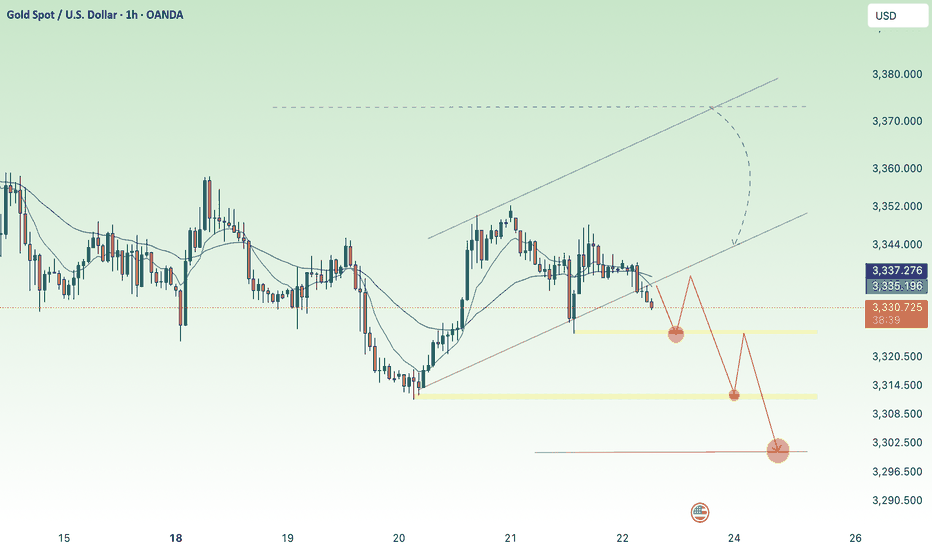

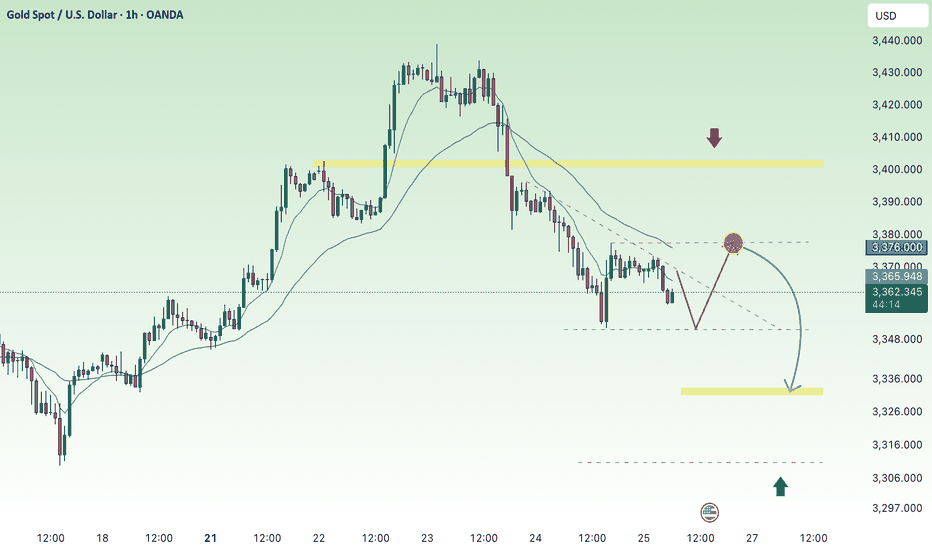

Selling pressure, gold price drops back to 3300⭐️GOLDEN INFORMATION:

Gold (XAU/USD) remains under pressure for a second consecutive session on Friday, though it continues to trade above Thursday’s swing low. Market participants appear cautious, avoiding large directional positions ahead of Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole symposium later today. His remarks will be closely analyzed for clues on the Fed’s policy outlook, which could shape near-term U.S. Dollar dynamics and provide fresh impetus for the non-yielding metal.

Meanwhile, the Dollar has paused after Thursday’s sharp rally to a two-week high, offering some relief to gold prices. Additionally, strengthening expectations that the Fed will restart its rate-cutting cycle in September—combined with a generally cautious market tone—suggest that bearish positions on XAU/USD warrant caution. Furthermore, the metal’s recent bounce from the 100-day Simple Moving Average highlights the need for confirmation through follow-through selling before anticipating any significant downside move.

⭐️Personal comments NOVA:

H1 frame sees gold price breaking short-term trend, selling pressure as % of interest rate cut expectations decrease

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3368

TP2: $3352

TP3: $3340

🔥BUY GOLD zone: $3303-$3301 SL $3296

TP1: $3312

TP2: $3323

TP3: $3339

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

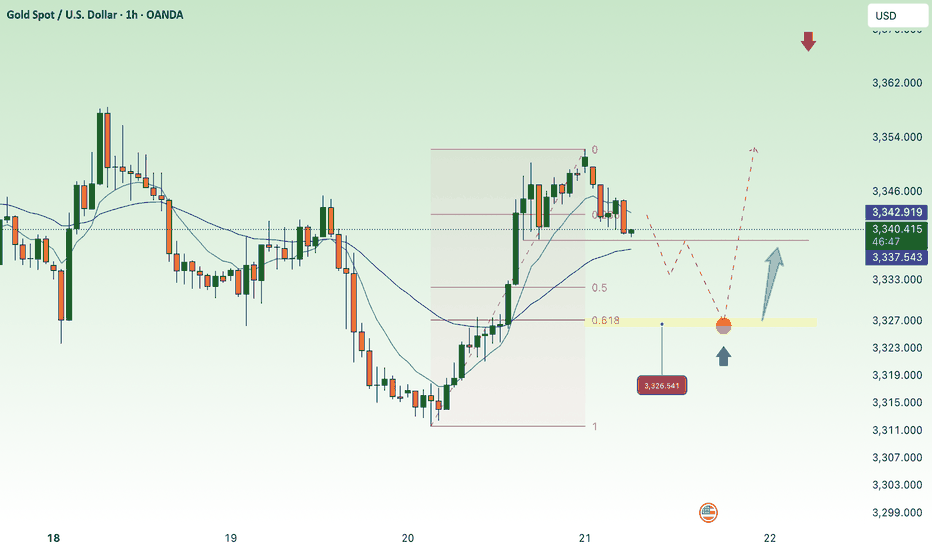

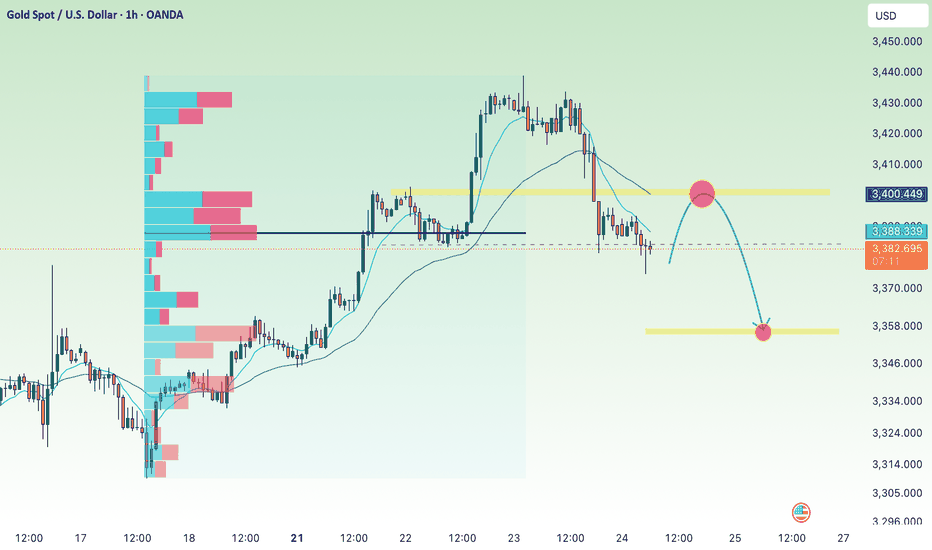

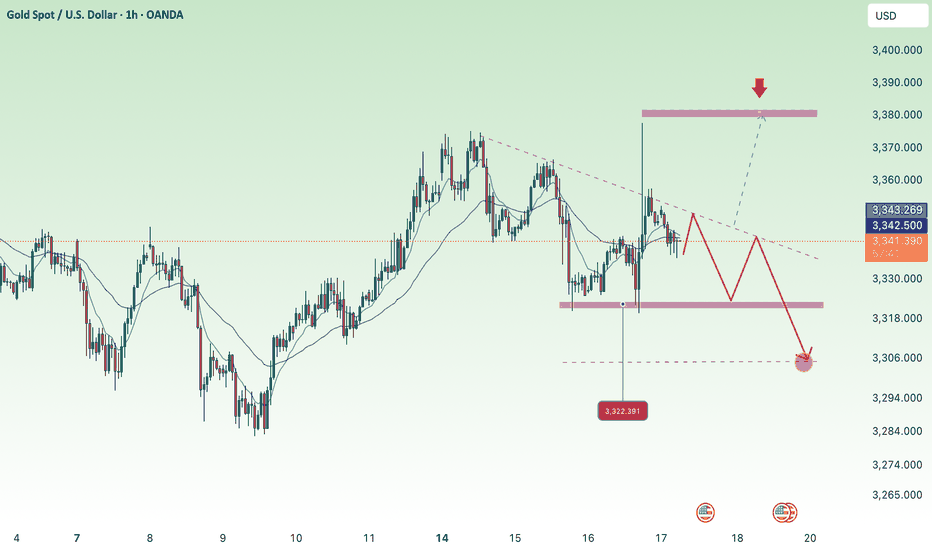

Recovered and traded below 3374 , XAU today⭐️GOLDEN INFORMATION:

Gold (XAU/USD) came under renewed selling pressure in Thursday’s Asian session, stalling Wednesday’s solid rebound from the $3,311–3,312 zone, its lowest level in nearly three weeks. The release of the late-July FOMC minutes revealed a hawkish tilt, with policymakers voicing greater concern over inflation than labor market conditions. This has tempered expectations for a jumbo Fed rate cut in September, bolstered the U.S. Dollar, and diverted flows away from the non-yielding metal.

Further weighing on gold, optimism surrounding a potential resolution to the Russia–Ukraine conflict has dampened safe-haven demand. At the same time, political noise added uncertainty after President Donald Trump called for Fed Governor Lisa Cook to resign amid mortgage fraud allegations, raising questions over the central bank’s independence. This could limit aggressive USD buying and lend some support to bullion. Looking ahead, traders will eye global flash PMI readings for fresh cues before Fed Chair Jerome Powell’s highly anticipated remarks at the Jackson Hole Symposium.

⭐️Personal comments NOVA:

Short-term downtrend line, gold price maintains accumulation at 3300 - 3374, use fibo to find support reaction points

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3373- 3375 SL 3380

TP1: $3366

TP2: $3354

TP3: $3344

🔥BUY GOLD zone: $3302-$3300 SL $3295

TP1: $3313

TP2: $3325

TP3: $3337

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

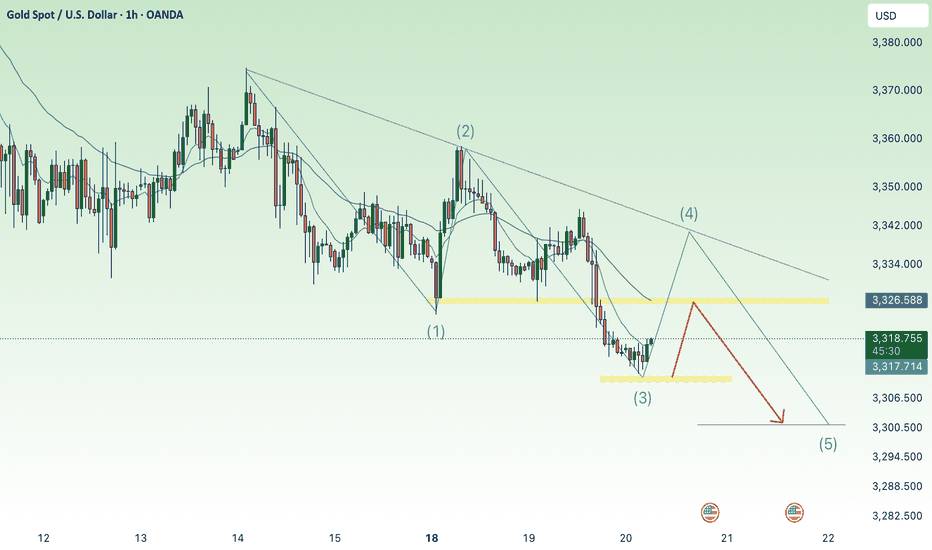

Gold price drops to 3300, accumulation⭐️GOLDEN INFORMATION:

Gold prices fell on Tuesday as the U.S. Dollar extended modest gains for a second session, while geopolitical optimism weighed on safe-haven demand. XAU/USD is trading near $3,317, with markets eyeing the potential for progress in peace talks following U.S. President Donald Trump’s meetings with Vladimir Putin, Volodymyr Zelenskiy, and European leaders.

Speculation over a possible de-escalation of the Ukraine–Russia conflict has pressured bullion, which typically benefits during times of heightened uncertainty. Last Friday’s Trump-Putin talks laid the groundwork for further dialogue, and on Monday Trump met with Zelenskiy and European counterparts to push for a ceasefire and set the stage for trilateral negotiations between Kyiv and Moscow.

⭐️Personal comments NOVA:

Gold prices under selling pressure ahead of today's FOMC meeting, aiming to fall back to psychological support zone 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3339- 3341 SL 3346

TP1: $3330

TP2: $3320

TP3: $3310

🔥BUY GOLD zone: $3302-$3300 SL $3295

TP1: $3313

TP2: $3325

TP3: $3337

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

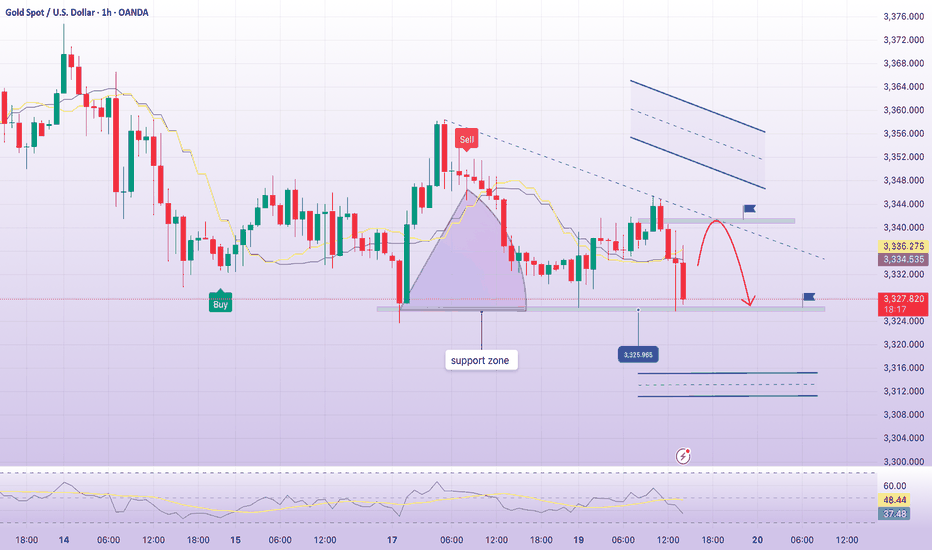

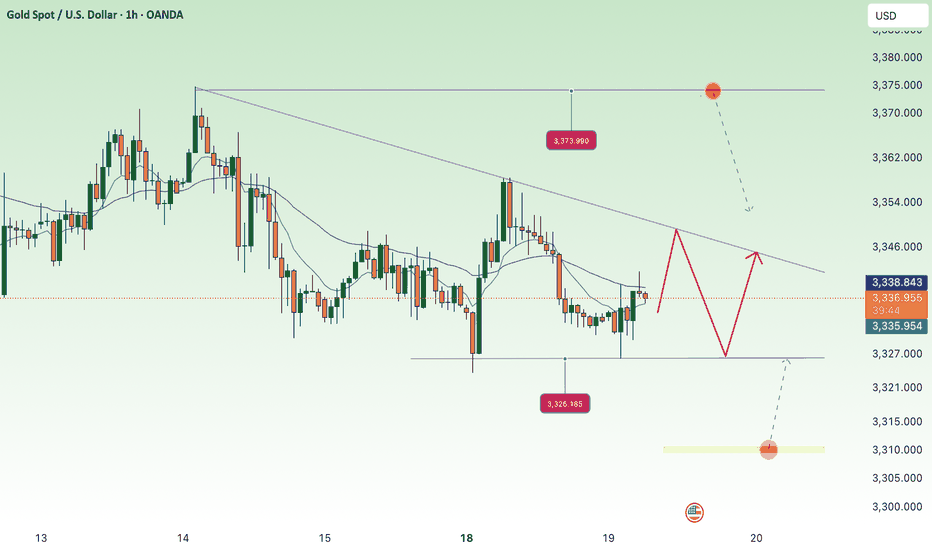

Accumulate, price range 3341 decreases along the trend linePlan XAU day: August 19, 2025

Related Information:!!!

Gold (XAU/USD) has surrendered part of its intraday advance and moved lower during the American session on Tuesday, as the resilience of the US Dollar (USD) weighs on the precious metal. Earlier in the day, Gold rebounded from an overnight dip triggered in the wake of Monday’s White House summit between US President Donald Trump, Ukrainian President Volodymyr Zelenskyy, and key European leaders. Although the talks underscored diplomatic alignment, the absence of a ceasefire has sustained elevated geopolitical uncertainty, thereby offering a degree of support to safe-haven assets.

As of writing, XAU/USD is trading near $3,335, retreating from an intraday peak of approximately $3,345. A stronger US Dollar continues to cap bullish momentum, while slightly softer US Treasury yields—following three consecutive sessions of gains—provide only limited relief for the metal. Looking ahead, market participants will turn their focus to the Jackson Hole Symposium and Wednesday’s release of the FOMC meeting minutes for clearer guidance on the Federal Reserve’s policy outlook. With markets still pricing in a September rate cut, any dovish signals could help re-energize demand for Gold in the sessions to come.

personal opinion:!!!

Support zone 3327, gold price reacted to recover showing that gold trend today is still mainly accumulating and decreasing according to the formed H1 trend line

Important price zone to consider : !!!

Resistance zone point: 3341 zone

Sustainable trading to beat the market

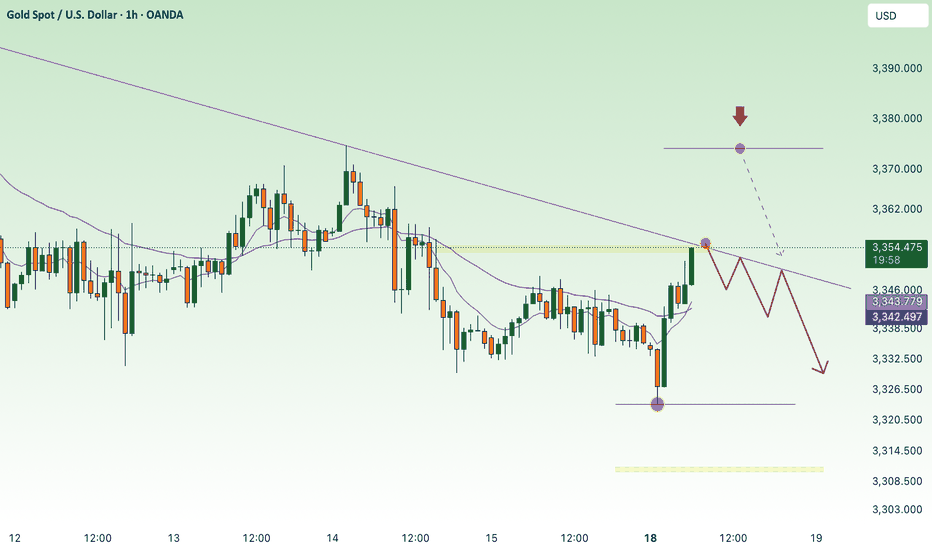

continue to accumulate waiting for FOMC, above 3300⭐️GOLDEN INFORMATION:

Gold (XAU/USD) found dip-buying interest in Tuesday’s Asian session, rebounding from the more than two-week low hit a day earlier. Support for the non-yielding metal comes largely from rising expectations that the Federal Reserve will restart its rate-cutting cycle in September. In addition, a cautious tone across broader markets is fueling safe-haven flows into bullion.

⭐️Personal comments NOVA:

Gold price continues to maintain the accumulation zone above 3300, the market moves sideways waiting for FOMC information

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3355

TP3: $3342

🔥BUY GOLD zone: $3311-$3309 SL $3304

TP1: $3322

TP2: $3333

TP3: $3348

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

XAU recovers, mostly sideways below 3375⭐️GOLDEN INFORMATION:

Gold (XAU/USD) slipped toward $3,330 in early Asian trading on Monday, pressured by stronger-than-expected U.S. Producer Price Index (PPI) data. Investors now turn their attention to the meeting later today between U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskiy for potential market-moving headlines.

Thursday’s hotter inflation print forced traders to scale back expectations for a September Federal Reserve rate cut, weighing on the yellow metal. The U.S. PPI rose 3.3% year-on-year in July, sharply above June’s 2.4% increase and well beyond the 2.5% forecast, reinforcing headwinds for bullion.

⭐️Personal comments NOVA:

Gold price recovers around 3353, downtrend line. Maintain accumulation below strong resistance zone 3375

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3355

TP3: $3342

🔥BUY GOLD zone: $3312-$3310 SL $3305

TP1: $3322

TP2: $3333

TP3: $3348

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price pressure down, DXY recovers⭐️GOLDEN INFORMATION:

Gold (XAU/USD) found some buying interest in Friday’s Asian session, rebounding from the two-week low near $3,330 hit the day before. Thursday’s data showed that U.S. producer prices rose in July at the fastest monthly pace since 2022, prompting markets to scale back expectations for a jumbo 50-basis-point Federal Reserve rate cut in September. This has emerged as a major headwind for the non-yielding metal.

Additionally, a generally upbeat risk tone is limiting safe-haven demand, capping gold’s upside. However, fresh selling pressure on the U.S. Dollar has provided some support to the Dollar-denominated commodity.

⭐️Personal comments NOVA:

Gold prices fall after ppi news, negative market sentiment as fears of inflation return will affect September rate cut decision

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3389- 3391 SL 3396

TP1: $3380

TP2: $3367

TP3: $3350

🔥BUY GOLD zone: $3311-$3309 SL $3304

TP1: $3324

TP2: $3333

TP3: $3348

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

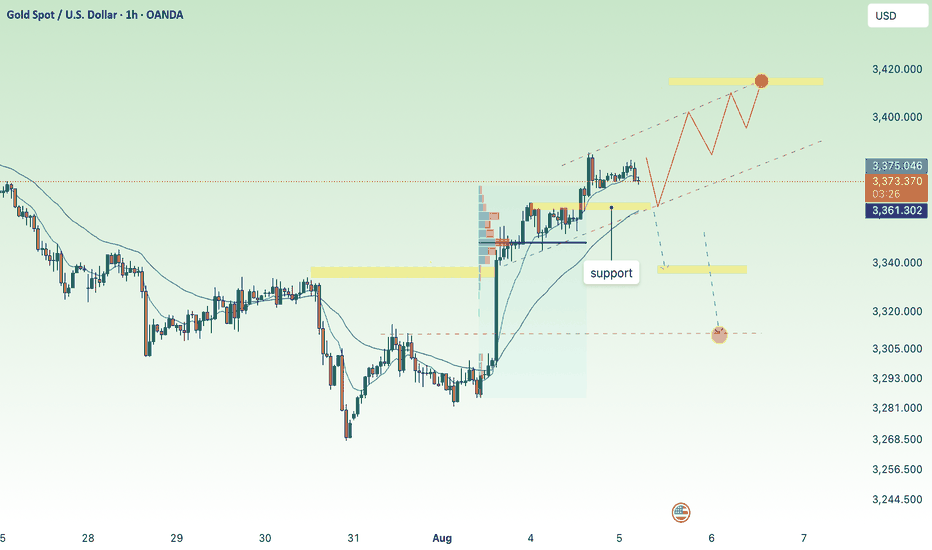

continue to maintain gold purchase, 3400⭐️GOLDEN INFORMATION:

Gold prices edged higher on Monday, supported by growing expectations of a Federal Reserve rate cut following last Friday’s disappointing U.S. Nonfarm Payrolls report. XAU/USD is trading around $3,375, up 0.39% on the day.

Speculation over a potential policy shift has strengthened, with markets now pricing in an 87% chance of a rate cut at the Fed’s September 17 meeting — a boost for the non-yielding yellow metal.

Last week’s labor data revealed early signs of weakness in the job market. The U.S. Bureau of Labor Statistics (BLS) revised May and June payrolls down by a combined 258,000 jobs, reinforcing dovish remarks from Fed Governor Christopher Waller, who downplayed tariff-driven inflation and emphasized concerns about the Fed’s full employment mandate.

⭐️Personal comments NOVA:

Uptrend, gold price is maintaining stability. Heading towards 3400, before the expectation of interest rate cut is becoming more and more obvious.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3415- 3417 SL 3422

TP1: $3405

TP2: $3394

TP3: $3380

🔥BUY GOLD zone: $3311-$3313 SL $3306

TP1: $3325

TP2: $3338

TP3: $3350

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

NF news, can gold selling pressure drop to 3240?⭐️GOLDEN INFORMATION:

Gold (XAU/USD) is trading lower, around $3,285 in early Asian hours on Friday, as a firmer U.S. dollar weighs on the non-yielding metal following new tariff measures announced by President Donald Trump.

The White House said late Thursday that Trump will set a 10% baseline tariff, stepping back from earlier speculation about hikes to 15% or higher, according to Bloomberg. He also signed an executive order raising the tariff on Canada from 25% to 35%, effective August 1, 2025, while extending Mexico’s current tariff rates for another 90 days to allow more time for negotiations.

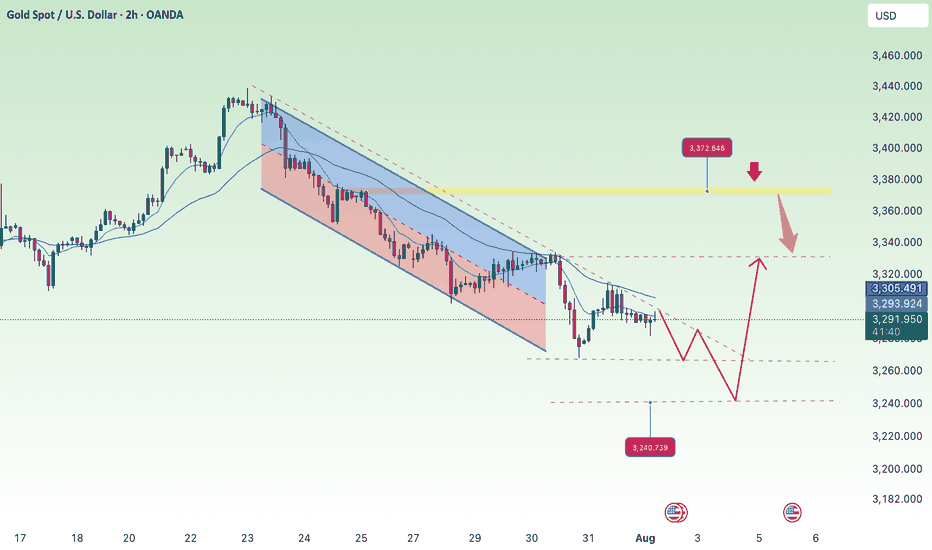

⭐️Personal comments NOVA:

large frame, gold price is still moving in the downtrend line. will wait for NF result to have strong selling force again 3240

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3350

TP3: $3333

🔥BUY GOLD zone: $3242-$3240 SL $3235

TP1: $3255

TP2: $3268

TP3: $3280

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

downtrend below 3300 , after ADP-NF⭐️GOLDEN INFORMATION:

The Federal Reserve’s policy statement noted that economic activity has slowed in the first half of the year, although the unemployment rate remains low and inflation is still “somewhat elevated.” The Fed reaffirmed its commitment to achieving maximum employment and returning inflation to its 2% target, while also acknowledging that “uncertainty around the economic outlook remains elevated.”

Earlier data showed that U.S. GDP grew in the second quarter, but underlying details painted a softer picture. Consumer spending cooled, and business investment declined significantly. According to Reuters, most economists now forecast full-year GDP growth at 1.5%, below the Fed’s 1.8% projection.

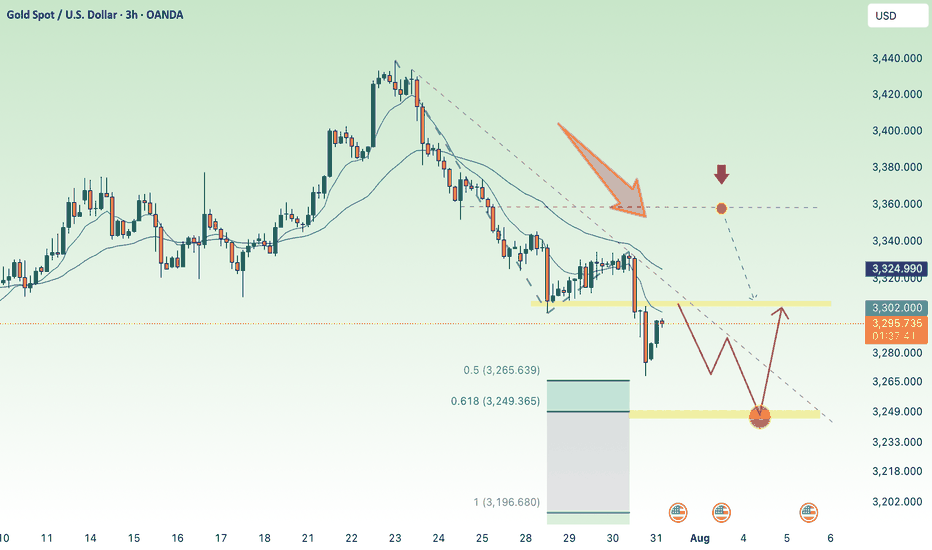

⭐️Personal comments NOVA:

Gold prices reacted negatively as the FED kept interest rates unchanged and Chairman POWELL's hawkish stance. Selling pressure below 3300 is being maintained.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3360- 3362 SL 3367

TP1: $3350

TP2: $3340

TP3: $3330

🔥BUY GOLD zone: $3249-$3247 SL $3242

TP1: $3258

TP2: $3270

TP3: $3285

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Is the market panicking over FOMC today?⭐️GOLDEN INFORMATION:

Gold (XAU/USD) fluctuates within a narrow range during the Asian session on Wednesday, showing only modest gains and losses as traders tread carefully ahead of the Federal Reserve’s policy announcement. The metal’s recent rebound from the $3,300 area faces hesitation, with investors awaiting clearer signals on the Fed’s rate-cut trajectory before committing to new positions. As such, attention remains firmly on the outcome of the two-day FOMC meeting, set to be released later today.

In the meantime, pre-Fed uncertainty is lending some support to the safe-haven appeal of gold. Additionally, a slight pullback in the U.S. Dollar—after hitting its highest level since June 23 on Tuesday—is providing a mild lift to the metal. However, expectations that the Fed will maintain elevated interest rates for an extended period are limiting the dollar’s decline and capping upside potential for the non-yielding yellow metal. Adding to the cautious mood, recent optimism on global trade also tempers bullish momentum in XAU/USD.

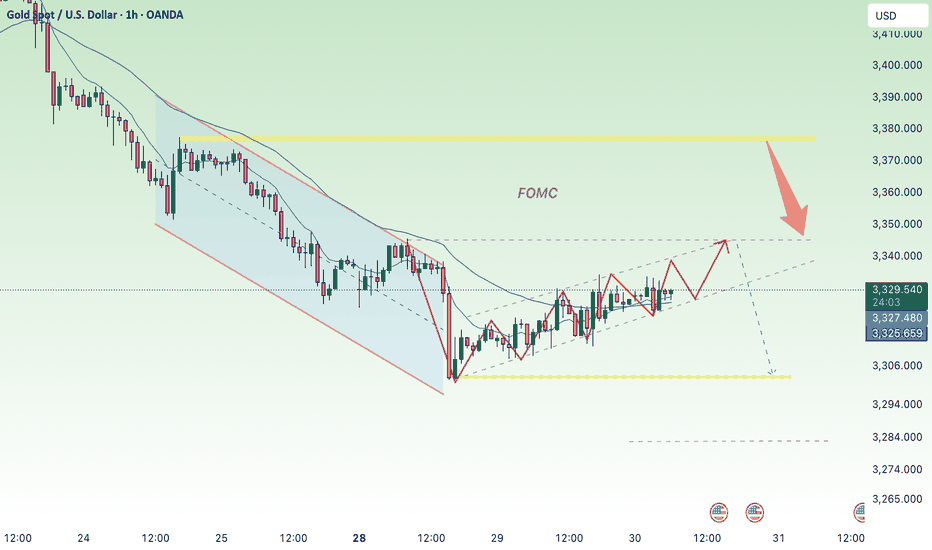

⭐️Personal comments NOVA:

slight recovery, not big before FOMC news. Gold price will still be under selling pressure when interest rate stays at 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3373- 3375 SL 3380

TP1: $3360

TP2: $3344

TP3: $3330

🔥BUY GOLD zone: $3283-$3281 SL $3276

TP1: $3295

TP2: $3307

TP3: $3320

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

maintain selling pressure around 3300, GOLD ⭐️GOLDEN INFORMATION:

Gold prices extended their slide for a fourth straight session, falling over 0.60%, as the U.S. and European Union reached a weekend trade agreement that halved proposed tariffs on EU goods—from 30% to 15%. XAU/USD is currently trading around $3,312, after earlier touching a high of $3,345.

The trade breakthrough lifted market sentiment, boosting risk appetite. Meanwhile, the U.S. Dollar is regaining strength, with the Dollar Index (DXY)—which measures the greenback against a basket of six major currencies—rising 0.99% to 98.64.

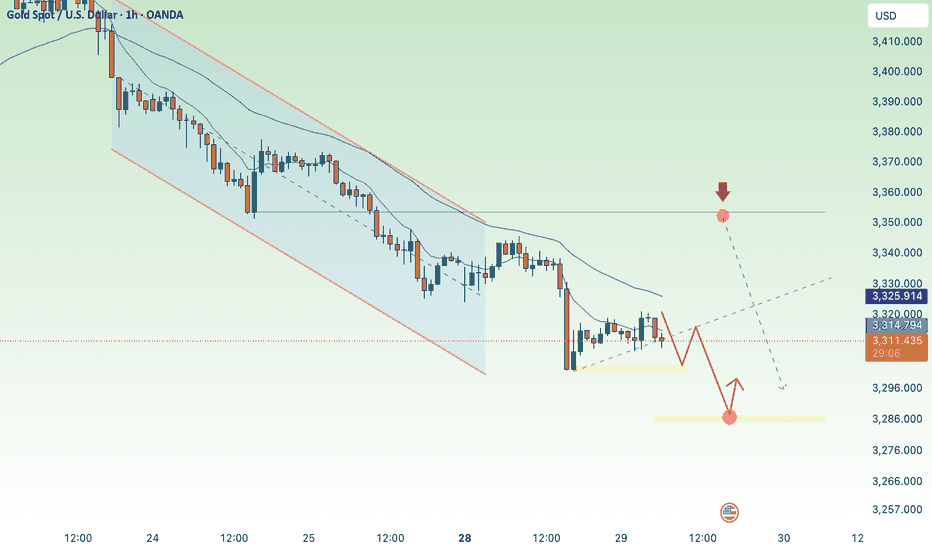

⭐️Personal comments NOVA:

Gold price maintains selling pressure around 3300, continuing the downtrend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3353- 3355 SL 3360

TP1: $3345

TP2: $3332

TP3: $3317

🔥BUY GOLD zone: $3287-$3285 SL $3280

TP1: $3295

TP2: $3307

TP3: $3320

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Get liquidity at the beginning of the week, continue to decrease⭐️GOLDEN INFORMATION:

Gold (XAU/USD) continues to lose ground, slipping to around $3,335 in early Asian trading on Monday. The metal is on its fourth straight day of declines as easing geopolitical tensions and trade progress weaken safe-haven demand. Investors are now turning their focus to the upcoming FOMC policy decision on Wednesday.

Market sentiment has improved following a breakthrough in US–EU trade talks, with both sides agreeing to a uniform 15% tariff on traded goods, effectively ending months of stalemate. The new tariffs will come into effect on August 1. Meanwhile, the US and China are reportedly planning to extend their tariff truce for another three months, according to the South China Morning Post. The renewed risk appetite continues to pressure gold, traditionally favored in times of uncertainty.

⭐️Personal comments NOVA:

Short-term recovery in Asian session, gold price takes liquidity and continues to accumulate below 3369

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3369- 3371 SL 3376

TP1: $3360

TP2: $3350

TP3: $3340

🔥BUY GOLD zone: $3305-$3303 SL $3298

TP1: $3314

TP2: $3330

TP3: $3342

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

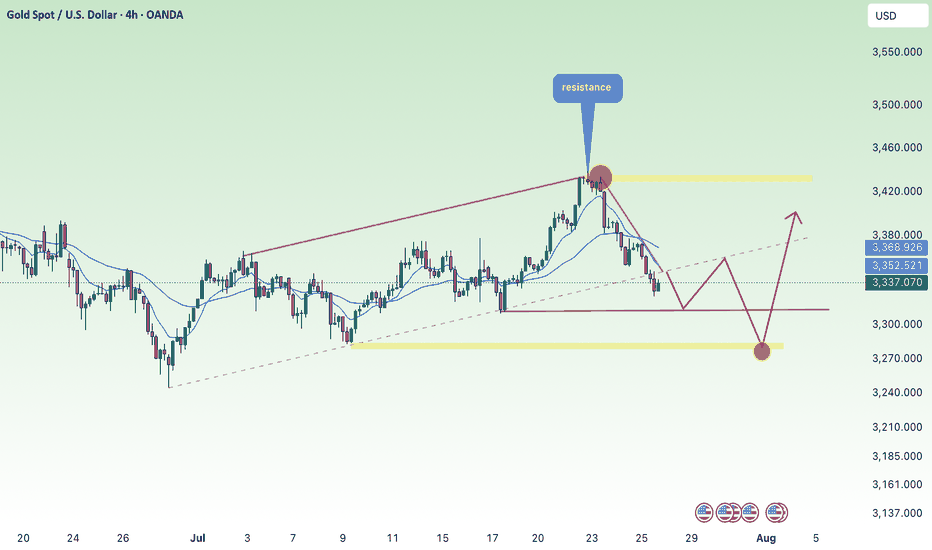

Gold price continues to decrease, keep the rate unchanged✍️ NOVA hello everyone, Let's comment on gold price next week from 07/28/2025 - 08/1/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) looks set to close the week lower, pressured by upbeat U.S. economic data and progress in trade negotiations, which have reduced demand for safe-haven assets. Despite declining U.S. Treasury yields, the U.S. Dollar regained some ground. At the time of writing, XAU/USD is trading around $3,336, down nearly 1%.

Looking ahead, the Federal Reserve is widely expected to keep interest rates steady at 4.25%–4.50% for the fifth time this year. Recent data supports this stance, with Initial Jobless Claims falling for the fourth straight week—signaling a resilient labor market—while Friday’s sharp drop in Durable Goods Orders, driven by weaker aircraft demand, adds a mixed tone to the outlook.

⭐️Personal comments NOVA:

Gold prices continue to fall as interest rates remain unchanged almost this week. Along with the H4 time frame, prices continue to break important support and continue to follow a downward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3350, $3428

Support: $3312, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold selling pressure decreased at the end of the week⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) remains under modest pressure during Friday’s Asian session, unable to build on the previous rebound from the mid-$3,300s. Renewed strength in the US Dollar, which extends its recovery from a multi-week low, acts as a headwind for the non-yielding metal. Additionally, fresh optimism surrounding the US-Japan trade agreement has dampened safe-haven demand, keeping gold on the defensive for the third consecutive day.

That said, lingering uncertainty over the Federal Reserve’s rate-cut trajectory, along with concerns about its independence amid growing political pressure, could limit the USD's upside. Meanwhile, rising geopolitical tensions—this time along the Thailand-Cambodia border—may lend some support to bullion. Investors now await US Durable Goods Orders data, which could influence the greenback’s direction and provide short-term cues for the XAU/USD pair going into the weekend.

⭐️Personal comments NOVA:

Gold prices are consolidating and starting to fall below 3400 to stabilize. The momentum for an early rate cut is waning.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3399- 3401 SL 3406

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3310-$3312 SL $3305

TP1: $3325

TP2: $3333

TP3: $3345

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices under selling pressure from tariff policy⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) stays under pressure during Thursday's Asian session, extending the sharp pullback from its highest level since June 16 seen the previous day. Optimism surrounding global trade continues to build, fueled by reports that the United States and the European Union (EU) are nearing a tariff agreement, following progress in the US-Japan trade deal. This upbeat sentiment has dampened safe-haven demand and is a major factor weighing on gold prices.

⭐️Personal comments NOVA:

Gold price adjusted down, broke support, faced selling pressure again, accumulated below 3400

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3400- 3402 SL 3407

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3356-$3354 SL $3349

TP1: $3365

TP2: $3373

TP3: $3382

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

sideways in weekend downtrend⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) struggle to extend Thursday’s recovery from the $3,309 region—a one-week low—consolidating within a tight range during Friday’s Asian session. The US Dollar (USD) continues to retreat from its peak since June 23, pressured by dovish signals from Federal Reserve (Fed) Governor Christopher Waller.

Additionally, growing concerns over US President Donald Trump’s unpredictable trade policies and their potential consequences for global growth are keeping investors cautious, supporting demand for the safe-haven metal. These factors collectively help limit deeper losses in Gold, though the metal lacks clear bullish momentum for now.

⭐️Personal comments NOVA:

Gold price is moving sideways, accumulating in the downtrend line, not much fluctuation in weekend news

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3381- 3379 SL 3386

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3293-$3295 SL $3288

TP1: $3308

TP2: $3318

TP3: $3330

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price moves sideways above 3320⭐️GOLDEN INFORMATION:

Gold prices advanced during the North American session, gaining 0.78%, supported by headlines suggesting US President Donald Trump had discussed firing Federal Reserve (Fed) Chair Jerome Powell. Although Trump later denied the reports, calling it “highly unlikely” unless fraud was involved, the speculation lifted demand for the precious metal. At the time of writing, XAU/USD is trading around $3,348, after briefly reaching a daily high of $3,377 following Trump-related headlines.

According to Bloomberg, Trump floated the idea during a meeting with GOP lawmakers focused on cryptocurrency regulation, noting that most attendees reportedly supported Powell’s removal.

Beyond political drama, softer US economic data and ongoing geopolitical tensions also underpinned gold’s gains. The latest US Producer Price Index (PPI) came in below expectations but remained above the Fed’s 2% inflation target. Meanwhile, Israeli airstrikes in Syria helped limit downside pressure on bullion, though Gold’s upside remained capped below the $3,400 level following the recent US consumer inflation report.

⭐️Personal comments NOVA:

Gold price moves sideways in the price range of 3306 - 3380, accumulating and waiting for information on US tariffs and interest rates

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3381- 3379 SL 3386

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3306-$3304 SL $3299

TP1: $3318

TP2: $3330

TP3: $3343

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account