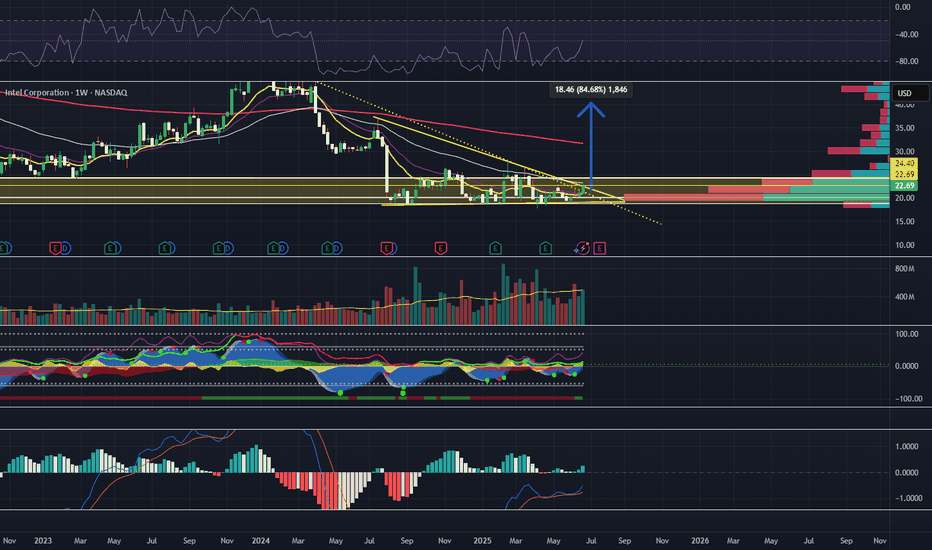

INTC getting ready to start it's upward trajectoryINTC has been ranging and coiling since July of 2024. It finally, is starting to look like bullish movement is about to break upwards.

As you can see, INTC has just broken the downward trend line as well as the triangle pattern. A break and hold above $24.40 would indicate the start of a new uptrend in the chart.

Indications that the stock is gaining bullish momentum on the weekly chart:

The Williams %R is approaching and getting ready to break the 50 line.

The MACD is bullish and approaching the zero line.

The stock has bounced off of the volume shelf on the AVP 4 times and is now breaking out of technical patterns.

Money flow on market cipher B has crossed over green.

EMA's are starting to turn upward to flip bullish.

The marked move on this triangle pattern is approximately $40.

From a fundamental standpoint, Intel is trying to fix the business on two tracks at one time:

1)Near-term – ship competitive AI-centric products now (CPUs, GPUs, Gaudi accelerators) to put revenue and margins back on a growth path.

2) Long-term – reinvent itself as a contract chip-maker (Intel Foundry) so it can win outside customers and leverage its huge fab investments.

Think of it as “sell more chips today, sell more manufacturing tomorrow.”

Let's see Intel can build enough momentum to break this range for the bigger move up. The table is set from a technical standpoint.

Not financial advice. Do your own research.