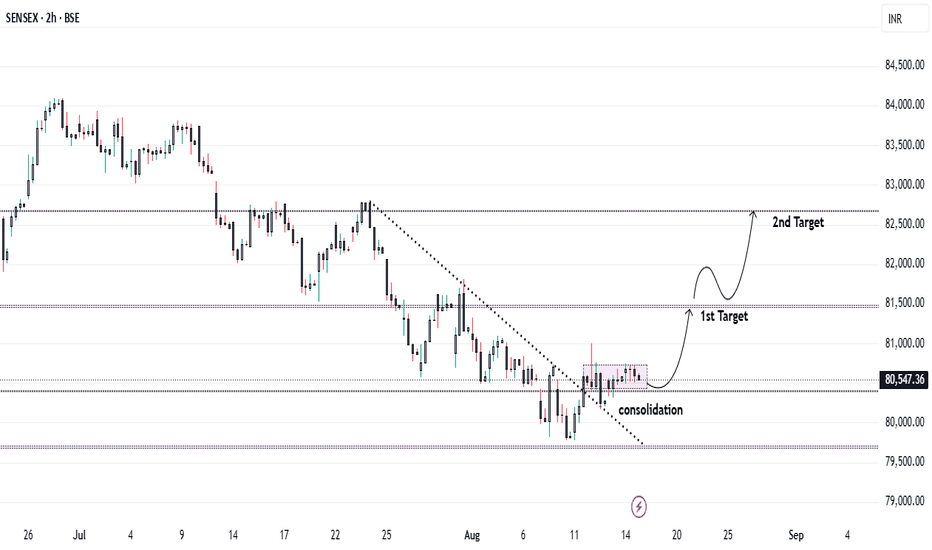

Can SENSEX Hit 82,600? Breakout + GST Reforms Explained.The SENSEX has successfully broken its downtrend and is now consolidating after a healthy retest, indicating strength and stability at current levels.

Key Macro Triggers

📊 Inflation Cooling:

* July CPI fell sharply to1.55%, the lowest since June 2017😮

* Food Inflation came in at -1.76%, down from -1.06% in June, signaling strong disinflationary trends.

This cooling inflation provides the RBI more room for policy support, boosting overall market sentiment.

⚖️ Policy Catalyst – GST Reforms by Diwali 2025:

In his Independence Day speech, PM Modi highlighted “Next-Gen GST Reforms,” which could act as a major structural trigger for the markets:

* 12% GST slab ➝ May shift to 5% 💡

* 28% GST slab ➝ May shift to 18% 📉

* New 40% slab** for sin goods (tobacco, beer, etc.)

These reforms, if implemented, would lower tax burdens, increase consumption, and improve corporate profitability**, setting the stage for a sustained equity rally.

Trade Setup – SENSEX

With strong macro tailwinds and technical breakout confirmation, we can look for long trades in the index:

* Entry: Current consolidation zone

* Stop Loss: Below recent retest level

* Target 1: 81,500

* Target 2: 82,600

⚠️ Risk Note:

While domestic triggers look favorable, Trump’s additional tariff policies could weigh on global risk sentiment and temporarily hinder momentum in Indian equities.