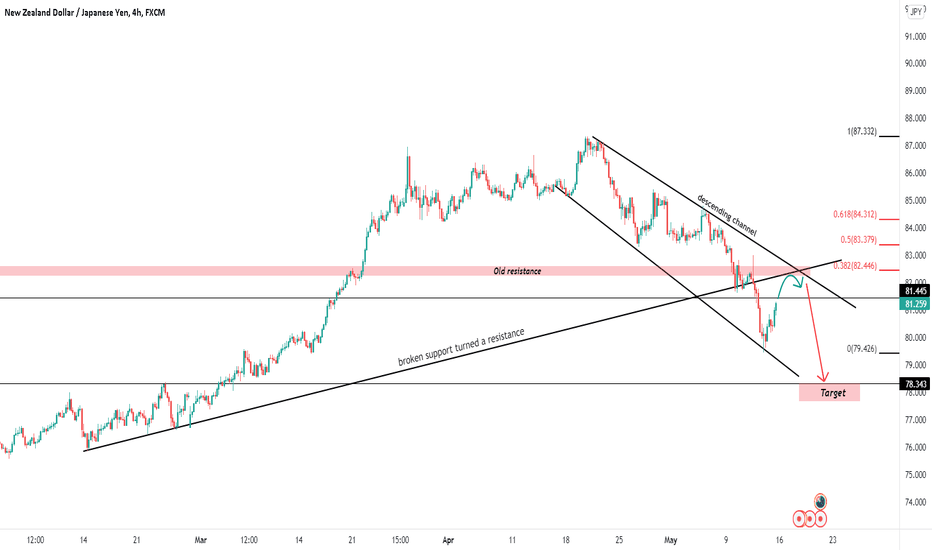

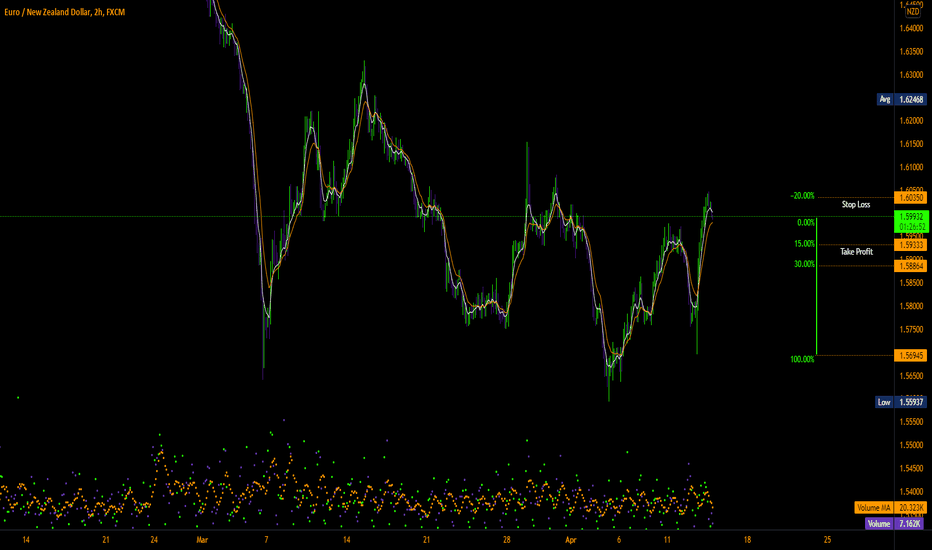

NZD/JPY New SetupsHello traders, we expect the rise to continue until the price faces the broken trend line, to retest i and reach the horizontal resistance + the 0.31 Fibonacci + top of decending channel then We have a strong selling deal.

If you like this idea, do not forget to support with a like and follow

Setups

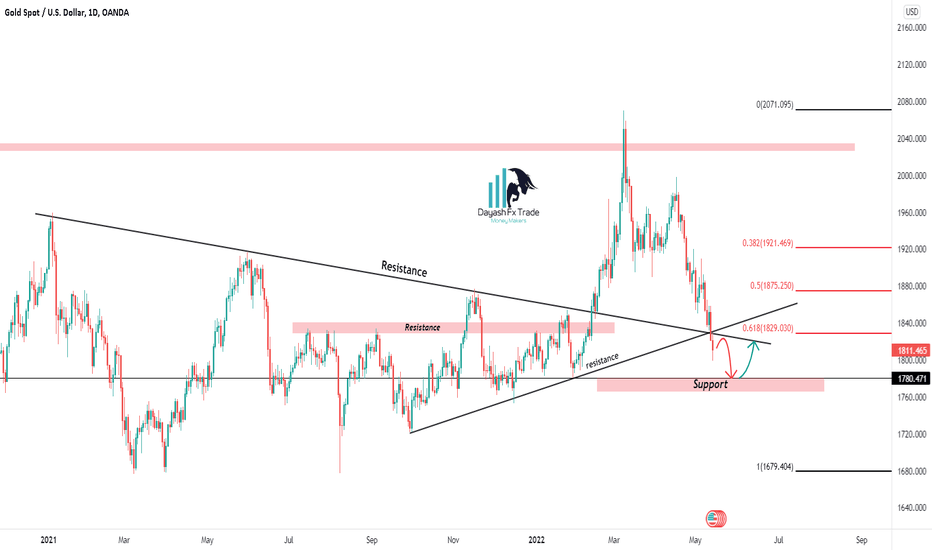

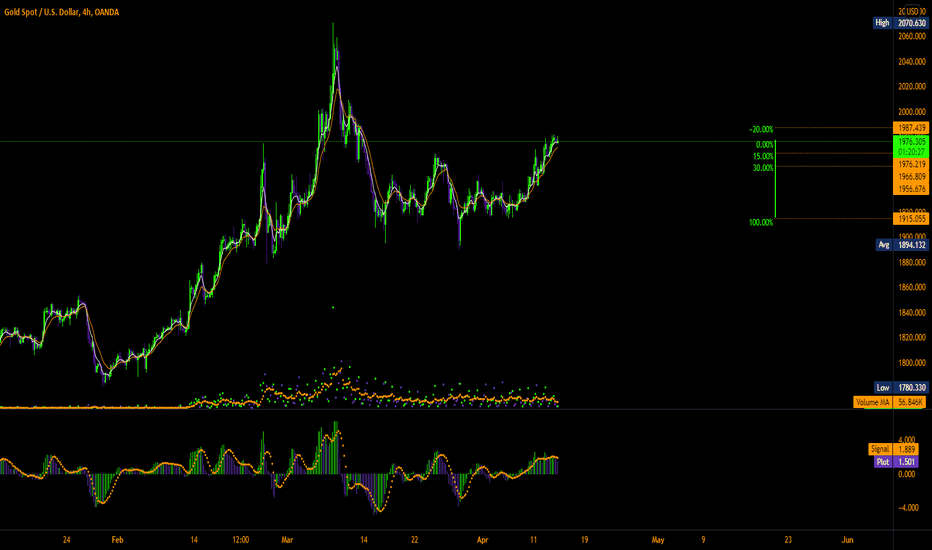

Xauusd new setupsHello traders, We have a excellent entry to a short deal in case we reach the level of 1826 with the opening of the market, our target is 1780, and in the event of a direct fall, we will have the opportunity to buy from 1780, we can Confirmation with the rejection or engulfing candle, but short is best,

If you like this idea, do not forget to support with a like and follow

Tue Apr 26, 2022 - This Week's Hotness!Traders,

Unfortunately, this week, my video failed to upload to TradingView. However, it is against house rules for me to suggest where you might be able to find the video, so I won't do that here either. 😉 And on TV, I can't simply upload the one I had already made because it takes a live stream and converts it. So, on this one I am stuck posting without the video attached (here at least 😉).

The video explains why I think all of the following coins should remain on "This Week's Hotness" list.

----

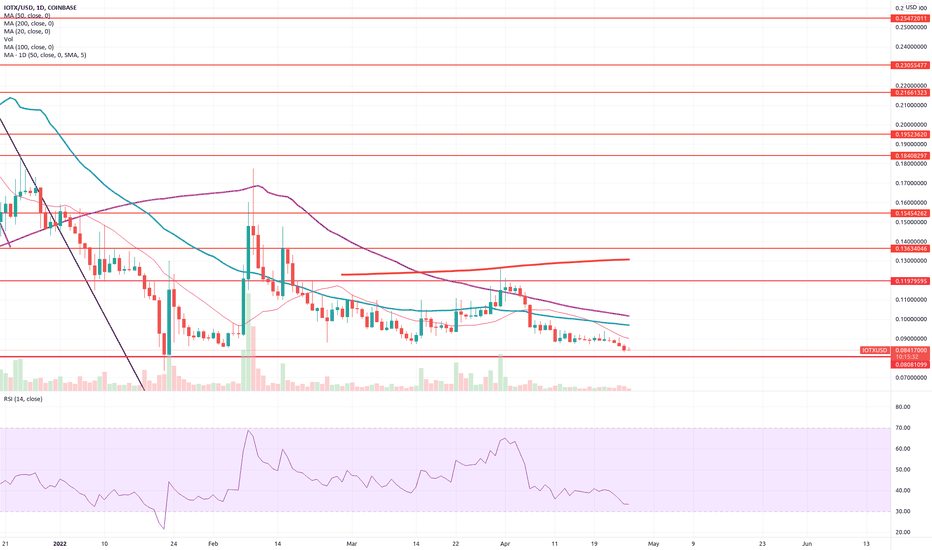

Despite our pullback in the markets, there are still some good trade setups to be found. Here are the coins that I have on “This Week’s Hotness” list:

LCX, CULT, SNX, CHZ, SKL, AAVE, EOS, Comp, FOX, Luna (wluna), AMP, DNT, ACH, ASM, Coval, IOTX.

As always, the standard warnings apply. Always keep your eyes on the big dawg, BTC. Never risk more than you can afford to lose. Don’t bet it all on one trade. Diversify your portfolio. Be disciplined about your entry/exit points. Set

stop losses. Etc.

Best of luck to you all!

- Stew

⛓️ 🔗 Useful Links 🔗 ⛓️

(see below - especially my signature 😉 )

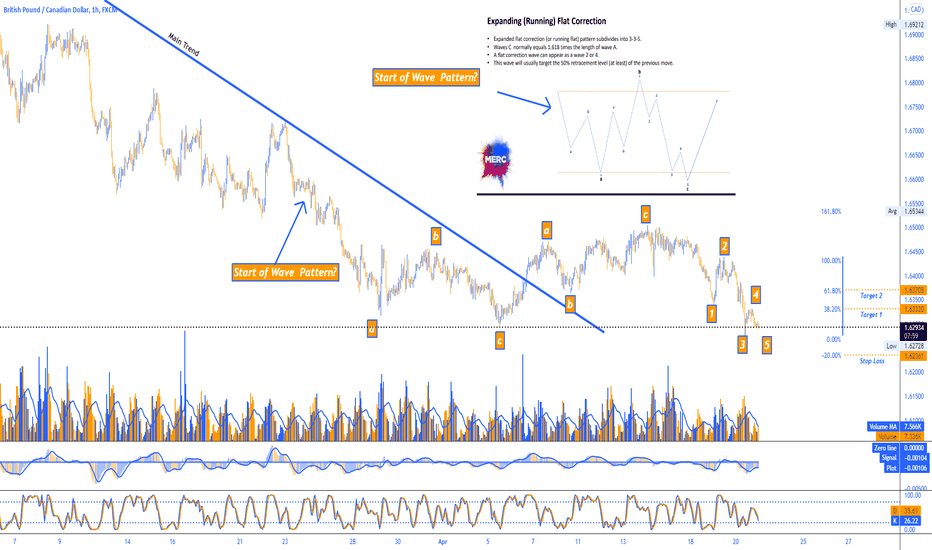

GBPCADMight be looking at an expanding running flat correction wave here. Phase "1" may be a bit over extended but the pattern may still be valid. We also have strong support at this level and is in accumulation stage potentially. Maybe we can get between 38 to 61% of the most recent high at some point down the road. I might've got n a tad bit early as the RSI hasn't reached an oversold point just yet. However, should be interesting how this plays out. Stop loss is set regardless for risk management.

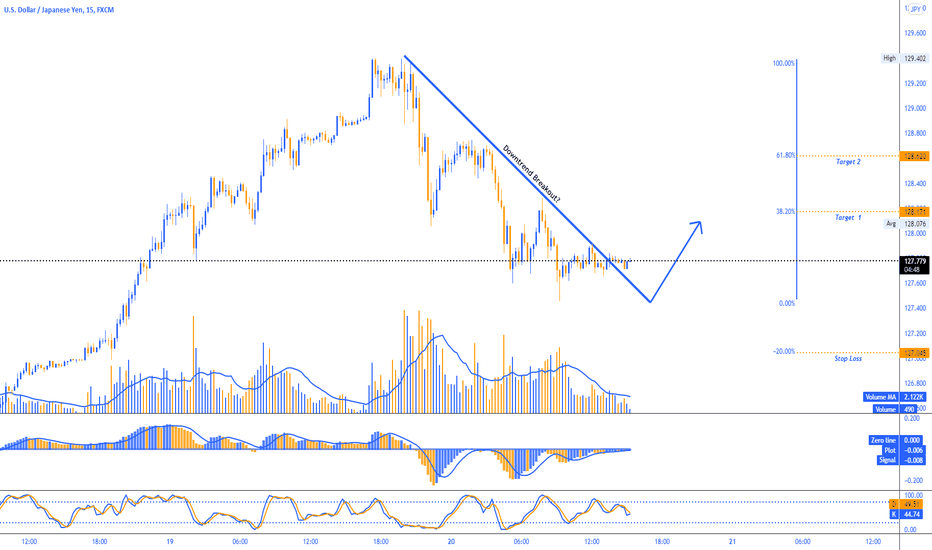

USDJPY Ready to test the high?Looks like a good chance here to grab a retracement! Downtrend with a nice consolidation period at the current phase . We may be able to to squeeze at least 38.2% of the recent high on this time frame as the RSI and MacD match time frames on the 1 hr and 15 min for the most part. Let's see what happens!

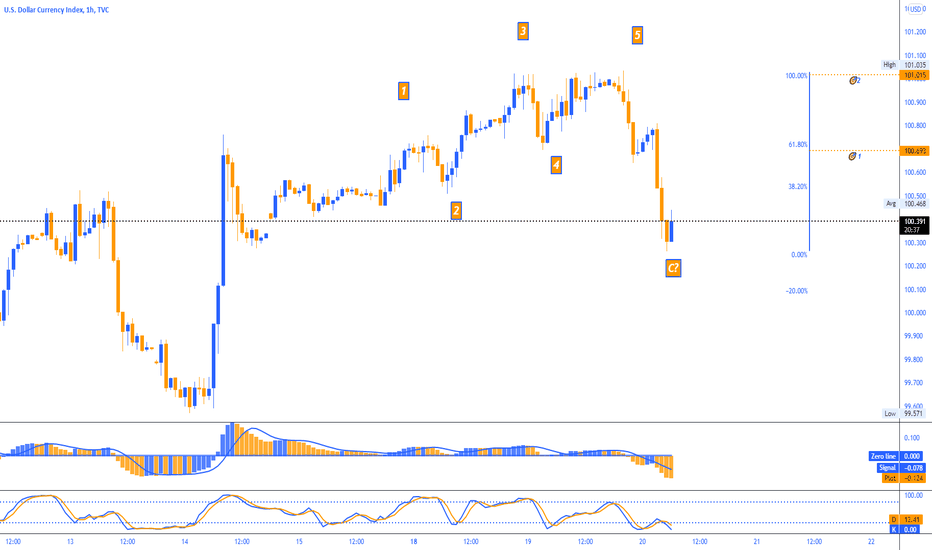

DXYI want another pullback in the markets. But the market don’t care what I think . Hopefully this works out and we get a pullback large or small .

We could be at the end of the C phase and am looking for a retracement to the "5" wave 38% to 61%. Mac D and RSI is matching with the zero signal line having crossed over towards the down side.

What do you think?

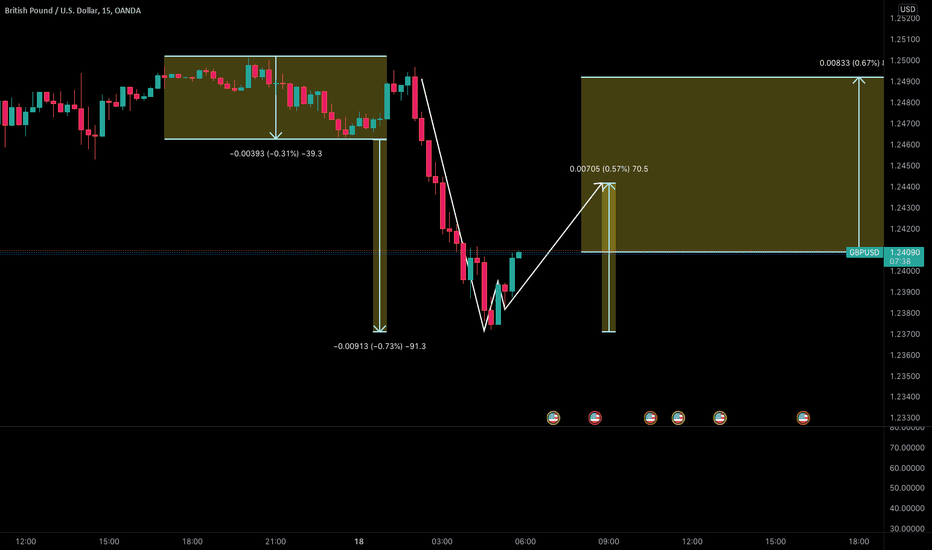

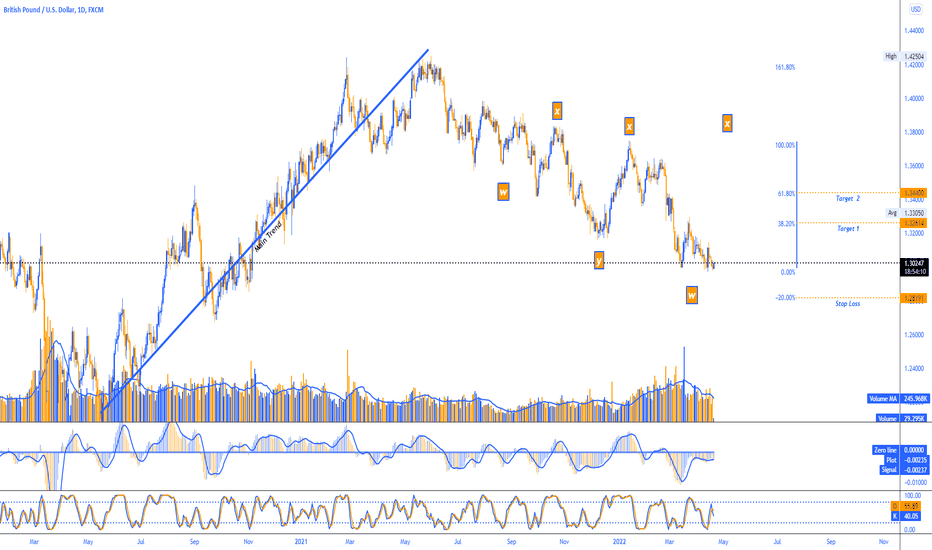

GBPUSDWorking on Elliot waves so correct me if wrong.

Looks like we are nearing an end to the w-wave phase and entering the "x" phase. If so I would like to see a retracement of 38-61% of the "x" at the most recent double top. The 4 hour is oversold but the daily isn't yet. Could have more room to drop but I want to scale in now for a long term hold.

What do you think?

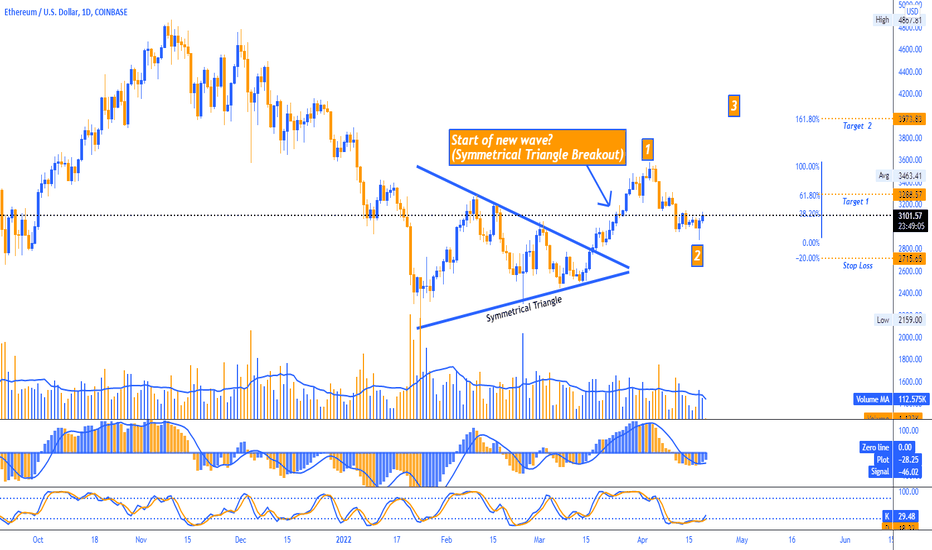

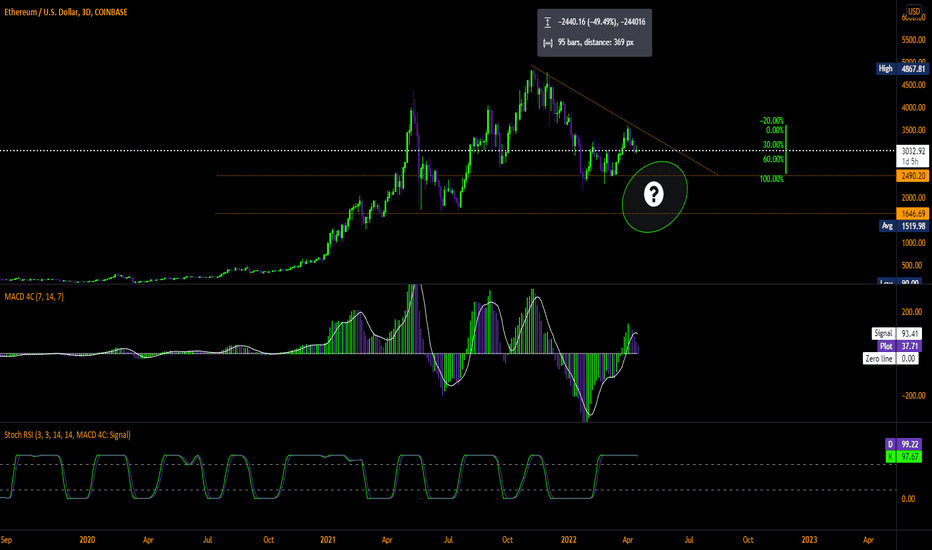

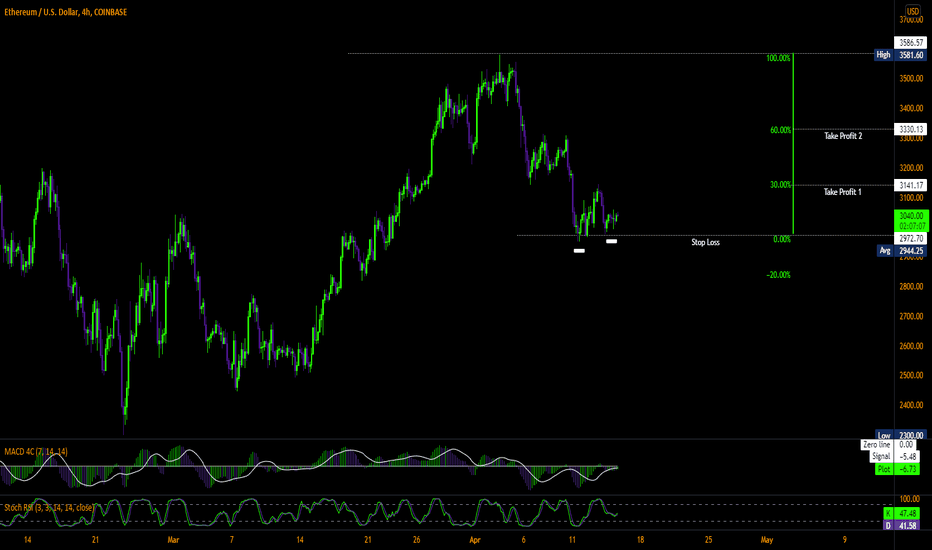

ETHUSDLooks like we broke out of a symmetrical triangle into a new wave phase! Could be wrong but let's see if we can hit target 1 or 2 as we move in the early phase of phase "3" before the next correction.

RSI is oversold and the MacD is on the bottom side along with the signal line with some small volume starting to kick in.

What do you think?

NZDUSDElliot Wave Spotted: Contracting Ending Diagonal 3-3-3-3-3

Trying something new here. Looks like we are in the "C" phase of our wave. Want to see price retrace 38.2% - 61.80% of the previous high ( 5 Phase). One can also argue that this could be a double bottom forming as well. On the Daily timeframe, we could be at the beginning of the 3 Phase. So i would expect price to move upside before the next correction.

What do you think?

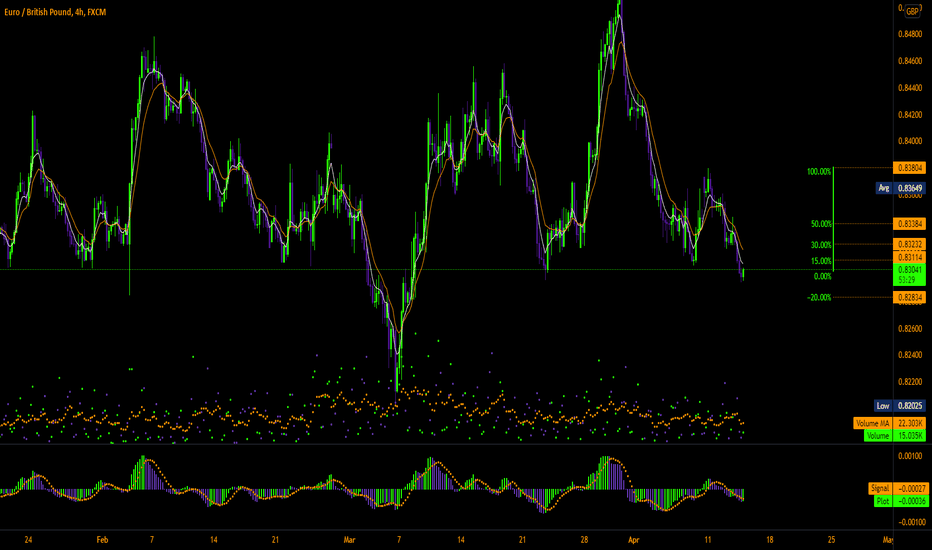

EURGBPObvious ranging here. Strong support zone since January 2022. Looking for retracement of previous high between 15-50%. Buy volume slowly kicking in as well with Mac D losing bearish momentum.

News to come in the morning (Monetary Policy Report/Interest Rate Decision) This may affect the trade.

What do you think?

XAUUSD Mac D is losing bullish momentum. Sell volume starting to kick in slowly on smaller timeframes. We have been on a hot run and my ema's are starting to bend downwards. I want to see a 15 to 30% retracement of previous low.

A holiday cool off? Mixed sentiment from CPI data causes some investors to pull out at these levels? Who knows?

This is against the grain but hey....that's where big money is made and big money is lost!

What do you think?

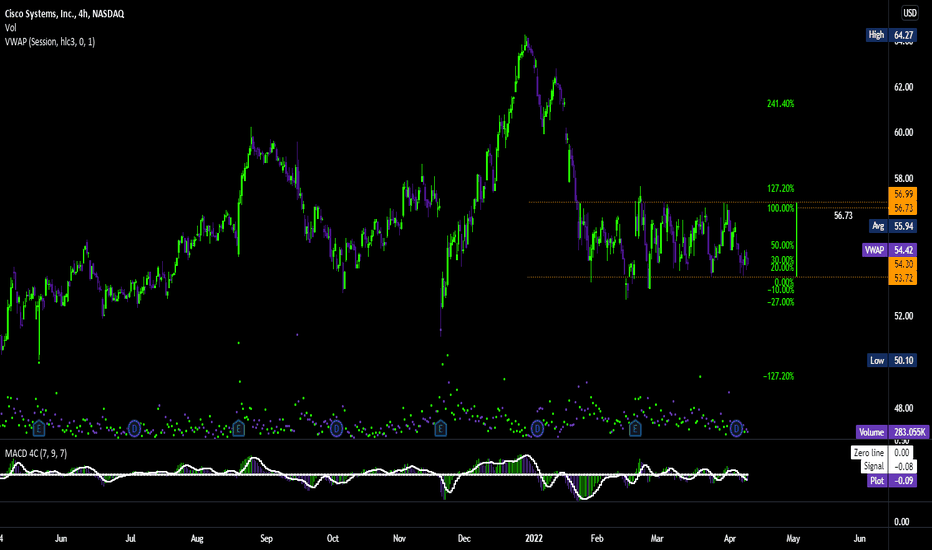

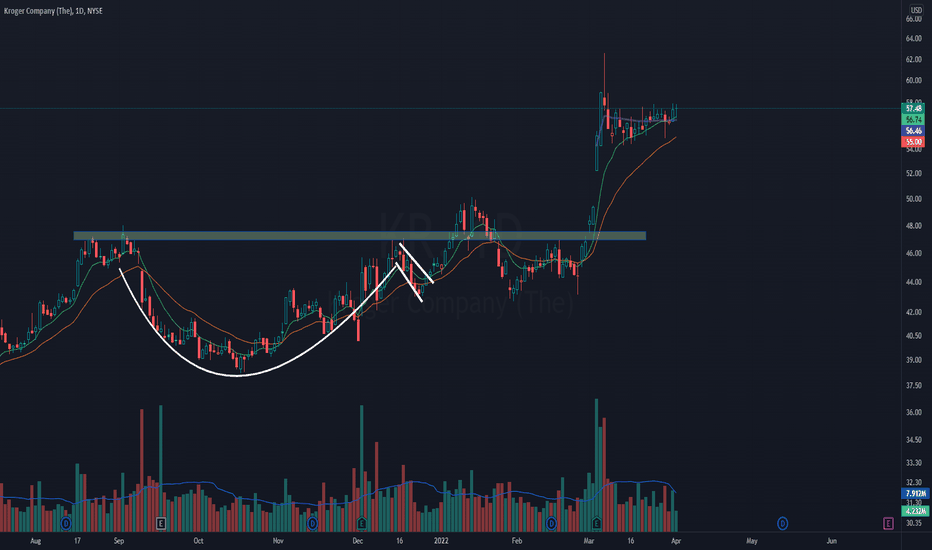

Stocks To Watch This WeekThere are no certainties in the stock market. These names have shown good relative strength and accumulation volume . This may give good risk/reward entries on some of the best names. Some of these charts still need to confirm their price action. This video is my watchlist. Most of these names are at or near all time highs or multi year highs. There are 24 total stocks on this list with 0 short squeeze candidates . Many of these have IPO'd in the last few years and still have a growth story ahead of them. Know your time frame and risk tolerance. Know your earnings dates! I go through these quickly so grab a pencil and paper and jot down the names that look interesting to you and then make the trade your own. Good Luck!

$CSCOTech sector. Has been ranging for a while (Orange lines) no home run but a small $1 or $2 move potentially depending on time.

Mac D on bottom side. Could be losing downward selling pressure. 50% to 100% previous Fib target!

What do you think?

Working towards becoming a full time trader one day. Dying to Live!

Not Advice!

Here are the coins that I've had to remove from "This Week's HotTraders,

I go through our list and remove 15 coins from the list, some of which have pumped and some which haven't. I'll give an explanation for the removal of each in the video. Six coins remain on the list. Link below.

⛓️ 🔗 Useful Links 🔗 ⛓️

(against house rules, see below)

Stocks To Watch This WeekThere are no certainties in the stock market. These names have shown good relative strength and accumulation volume . This may give good risk/reward entries on some of the best names. Some of these charts still need to confirm their price action. This video is my watchlist. Most of these names are at or near all time highs or multi year highs. There are 25 total stocks on this list with 0 short squeeze candidates . Many of these have IPO'd in the last few years and still have a growth story ahead of them. Know your time frame and risk tolerance. Know your earnings dates! I go through these quickly so grab a pencil and paper and jot down the names that look interesting to you and then make the trade your own. Good Luck!