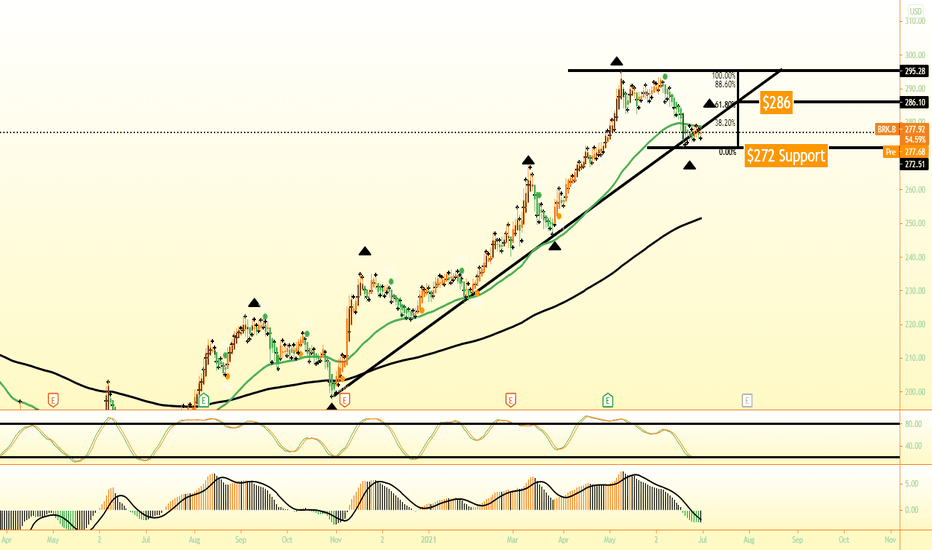

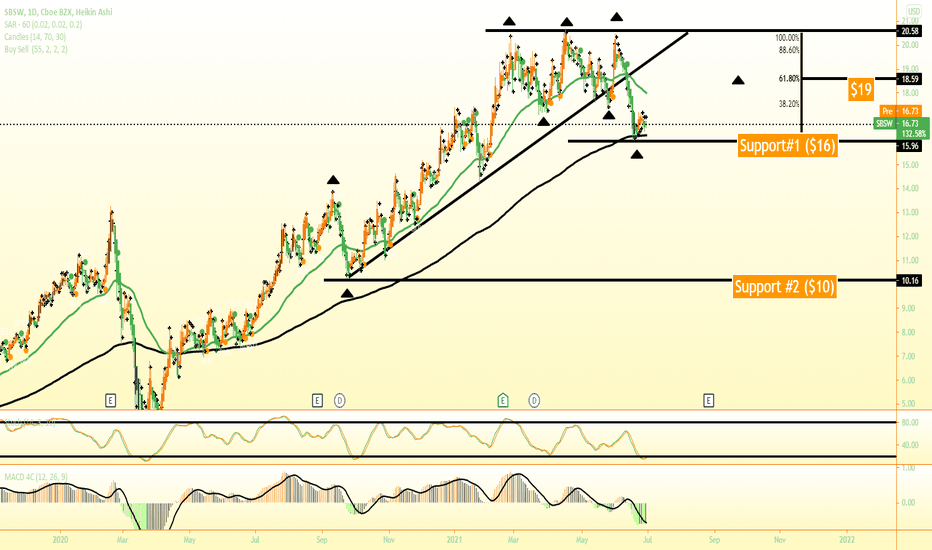

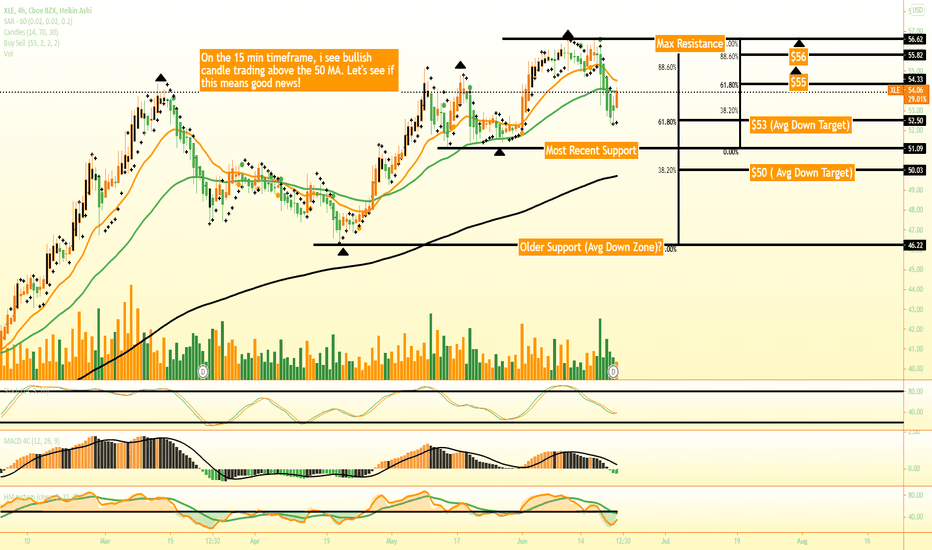

XLE SP500 Energy Sector SPDRWhen doing my sector research, I noticed that the stochastic levels were decreasing. I like levels under 50% and this is currently at 24% today. The put to call ratio is under 1 sitting at 0.92 post-market which indicates that there are a tad bit more puts that were closed today versus yesterday which indicates that more calls are slowly entering the market. The energy market is due for a spike in my opinion as the economy is slowly recovering and demand is slowly increasing with talks of the infrastructure bill along increased oil demand as of late. The only thing worries me is the lack of unemployment growth and job acceptance compared to job growth which has been increasing.

As far as the chart itself, on the Daily timeframe I noticed that the RSI is in the "oversold" territory and the MACD just crossed over to the green territory which indicates a possible reversal soon to come. I've also noticed that "Support #1" has potentially been broken. I want to make sure my 4HR and 1HR time frames match to the daily regarding the RSI and MACD which it is pretty close in my opinion. Since "Support #1" has been broken, I went to the 4HR and 1HR to confirm in which I saw the Support #1 being broke through with strong bearish candles. This indicates that price could potentially begin testing "Support #2". I used the fibonnaci indicator to trace a potential retracement from and to the resistance and the support levels to create the discount price area and the target price area.

Before entering I want to see bullish candles in the discount zone on the 1HR timeframe!

I hope this give you some form of sentiment.

Thanks for the support!

Setups

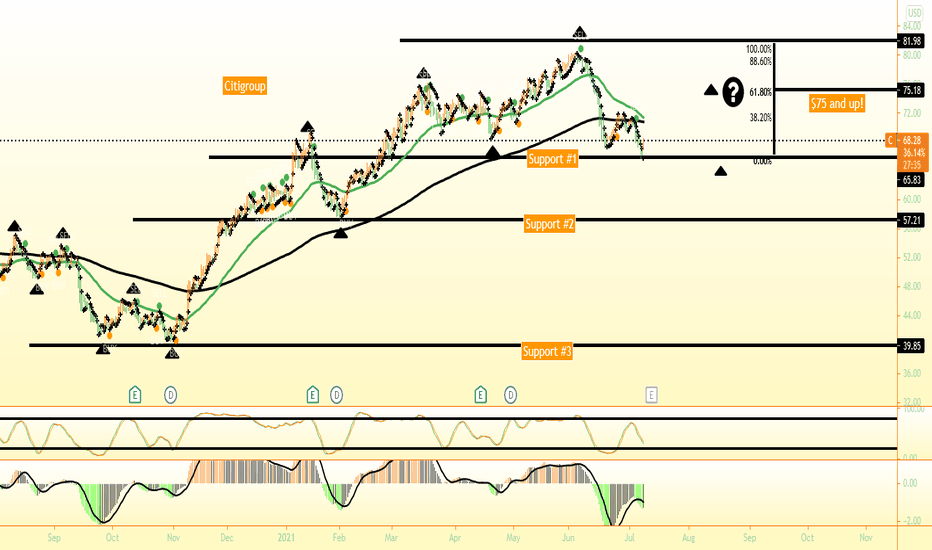

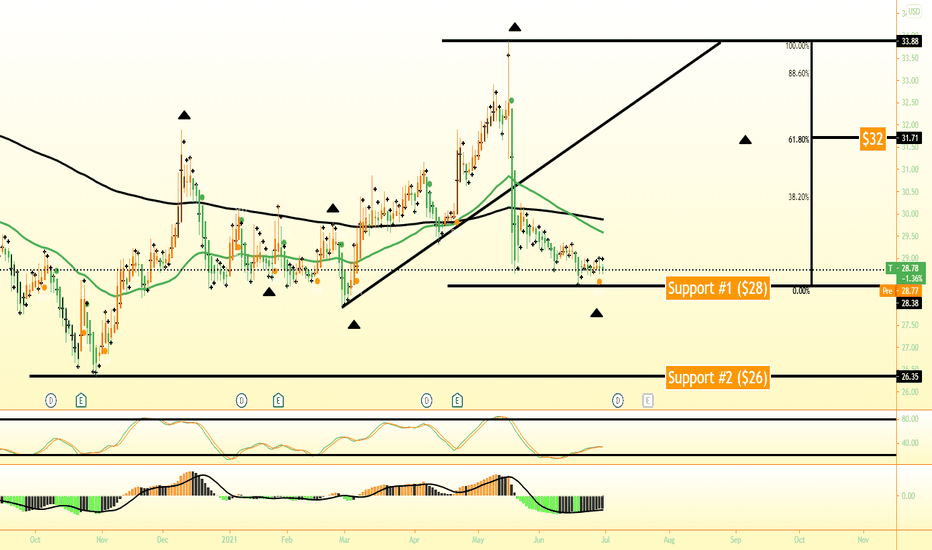

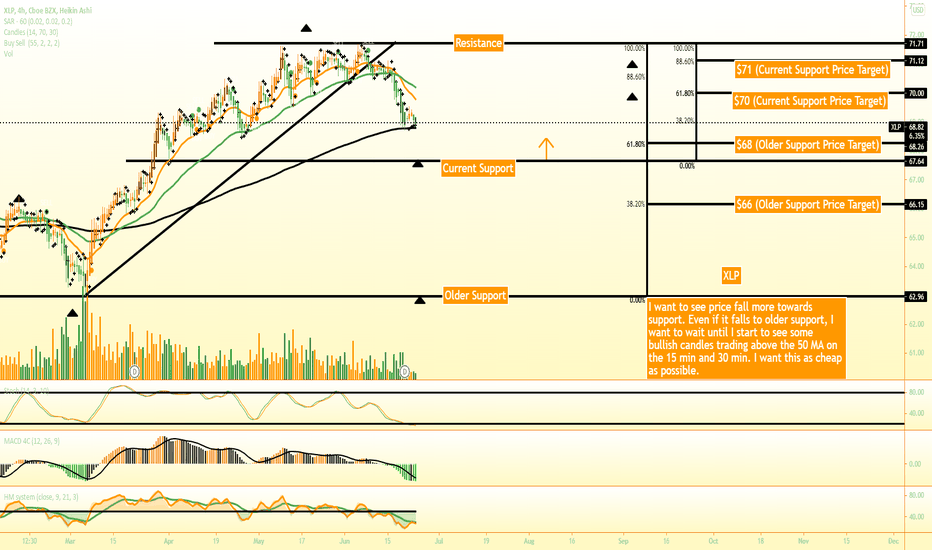

CitigroupSeems like XLF has been taking a brief dip. with a stochastic under 50% currently 44% I wanted to find a reasonable company that was near or at a support level on the daily, 4 hour, and 1 hour time frames. Citigroup seems like a good deal to me.

The rsi and the mac d both match on those three aforementioned time frames and I was waiting for some bullish candles to indicate a potential retracement to the upside which is why I used a fibonacci tool to retrace up to 61% of the previous high on the daily time frame. I will only purchase 1 share i case of a future crash and will be patient enough to wait a true discount.

What do you think?

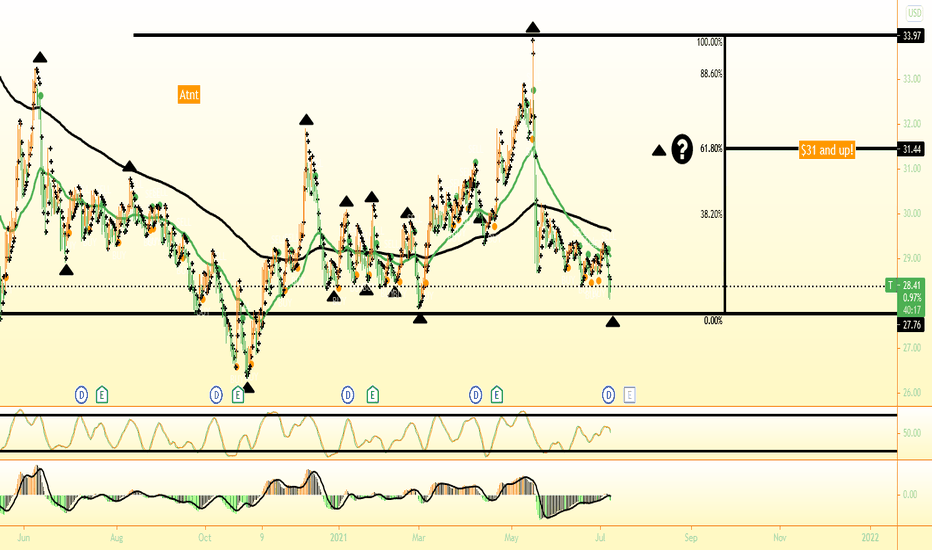

AtntI like Atnt even though their annuals financials are shaky. I love the acquisition of DISCA which will take effect next year. Atnt is at or near a strong support and I like the variety of things Atnt is involved with. I feel that they are making noise behind the curtain and is also claimed to be popularly known as a defensive stock. Stochastic is at support on the Daily and the 1 hour time frame matching the green of the Mac D. Previous was broken so I set a fibonacci tool to retrace up to 61% of the previous in case I want to take profit on some shares.

What do you think?

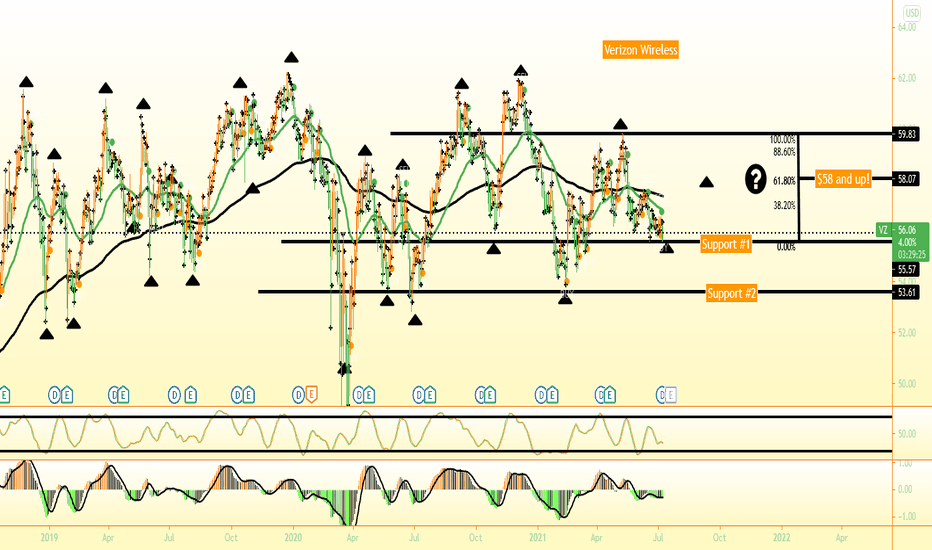

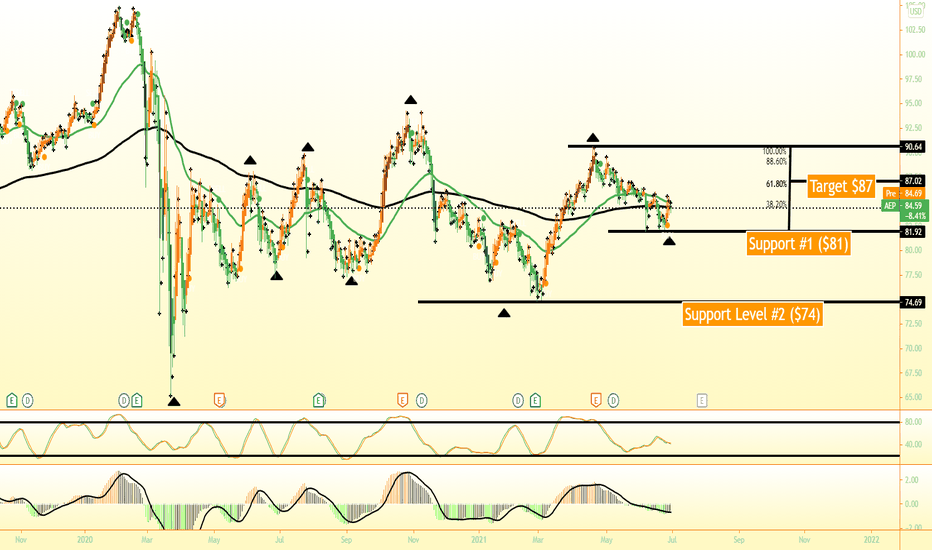

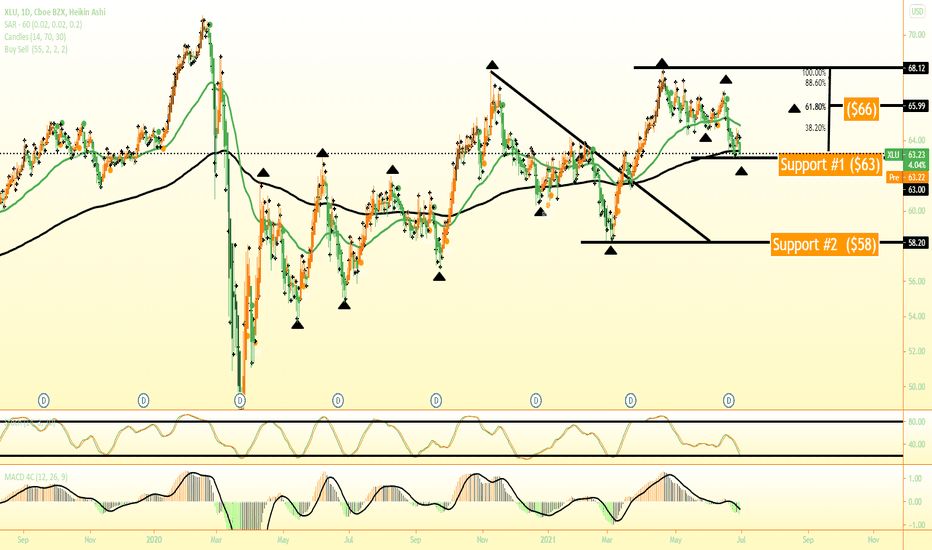

Verizon WirelessLooks like the XLC is down today when compared to yesterday. Went from a 90% stochastic to currently 79% around noon today. I've been watching sector for the past couple of weeks. In my opinion, this company has reasonable financials with a quality product and consistent customer base.

I noticed that price was at a support a few days ago and entered a debit spread last week. However, I want to own the company so I revisited. I saw last that the stochastic was oversold on the Daily, 4 hour, and 1 hour. Everything looks the same outside of the 4 hour. I'm giving this the benefit of doubt because of the way the market opened today. Price is still at support or close by and I have used the Fibonacci tool to retrace the previous high up to 38-61%.

What do you think?

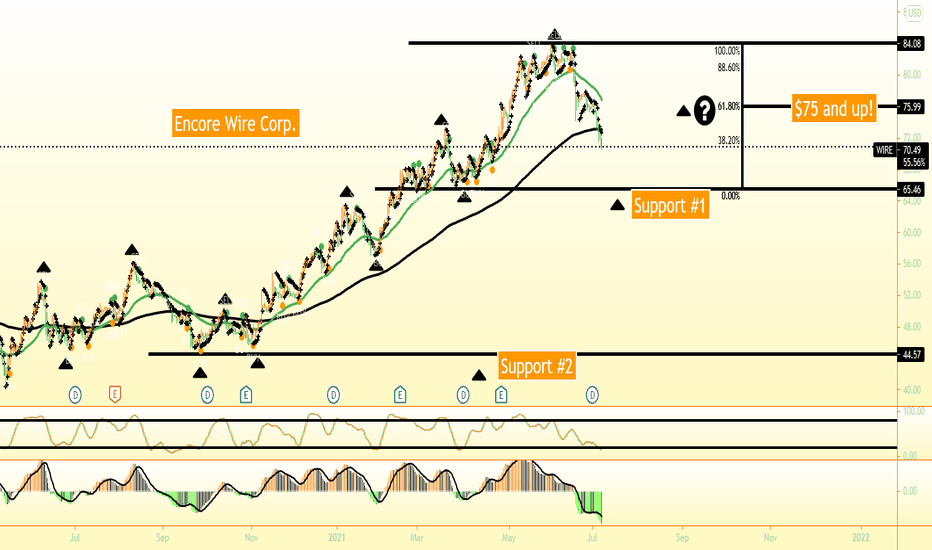

Encore Wire Corp.I wanted to make sure the Daily, 4 hour, and the 1 hour timeframe matched. The RSI needs to be oversold and the Mac D needs to be green on all time frames.

This ticker has solid financials but took a covid hit in 2019 and seems to be improving within the last 3 to 4 quarters!

I always want to make sue that my hard earned money is being invested into companies that have proven fundamental history.

This company is a copper, aluminum based company that works within the infrastructure realm and with Biden plan getting a go,I believe this company will get put to good use!

I plan on purchasing 1 share at support #1 ($65) and save my bigger purchase in case price falls to support #2!

I use a Fibonnaci tool to retrace the previous high ($84) up to 61% if possible!

I have a $75 price target.

Good luck! Let me know what you think?

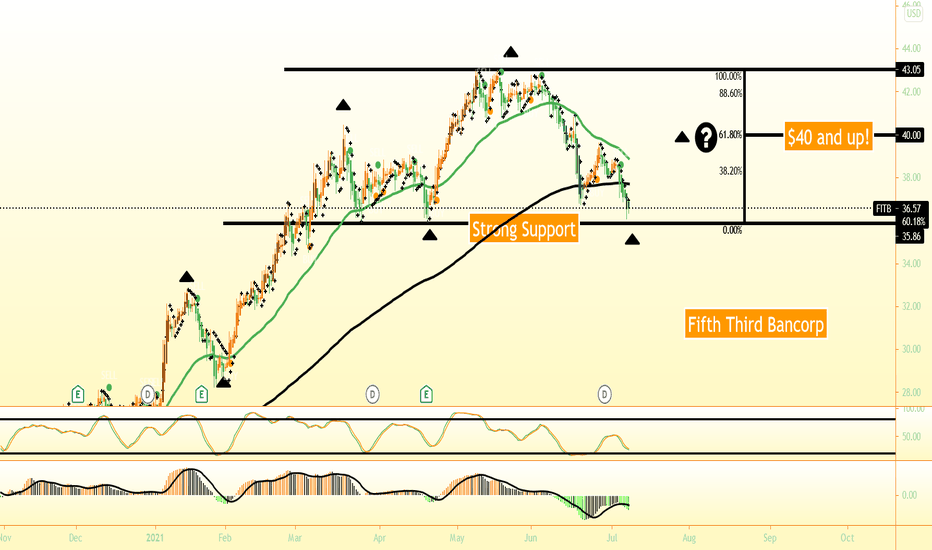

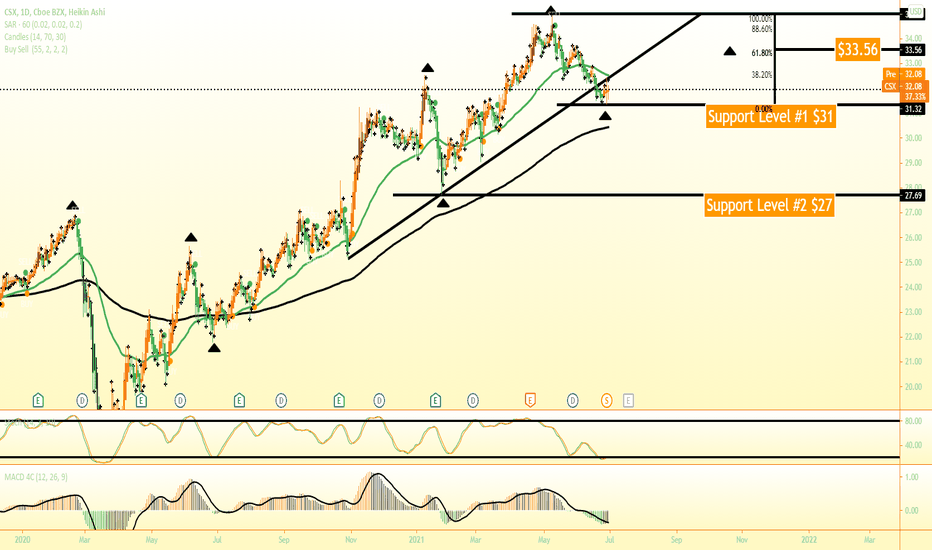

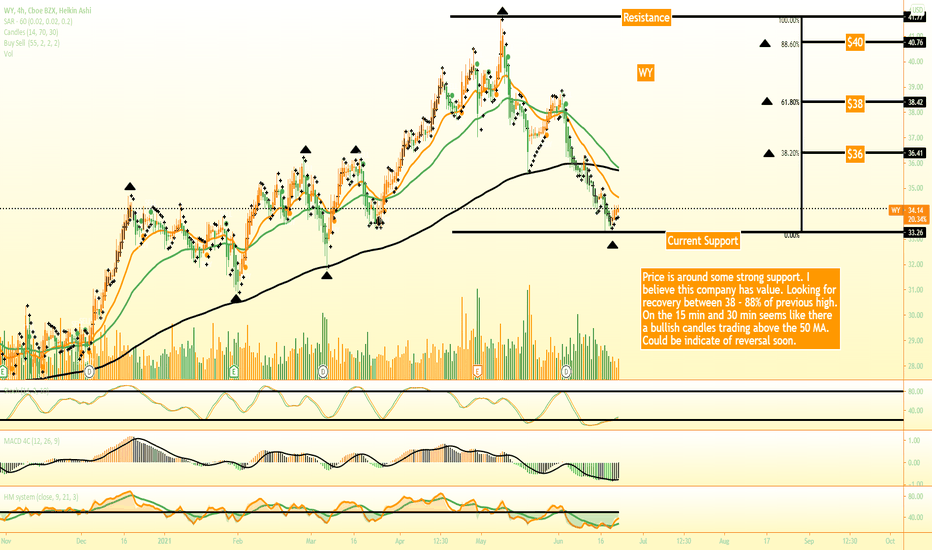

Fifth Third BankI chose this ticker mainly due to XLF reaching under the 50% stochastic zone (Currently 44%). The previous day was at 61%. This told me that I could possibly find a support on a stock within the sector. It just so happens that the IWM (Russell 2k) dipped down to 28%. During the middle to end of May the highs touched near the resistance price of $43 about three times. The previous high was broken and the current low hasn't broken the strong support "yet". Looks like a W pattern is setting up for a retracement up to 61% of the previous high. This company seems like a damaged company that has valuable growth. That's just my honest opinion.

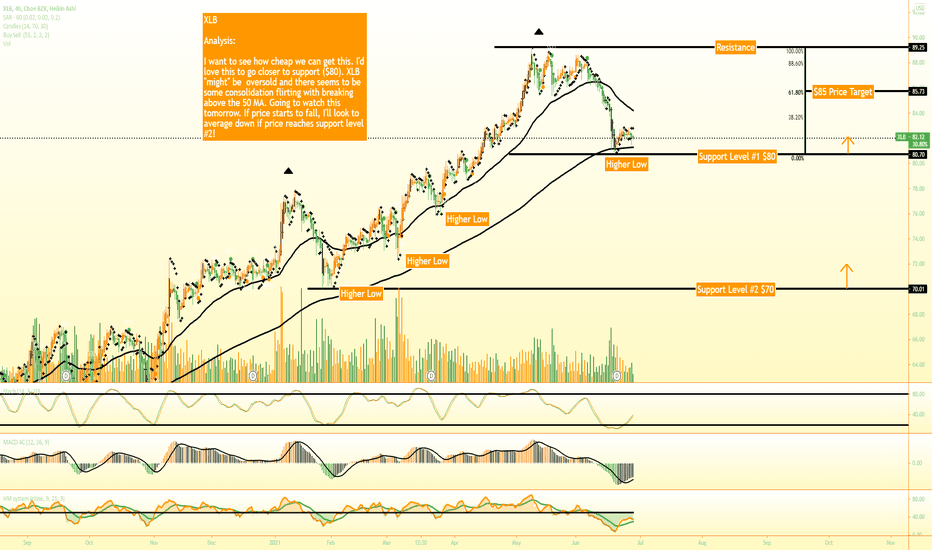

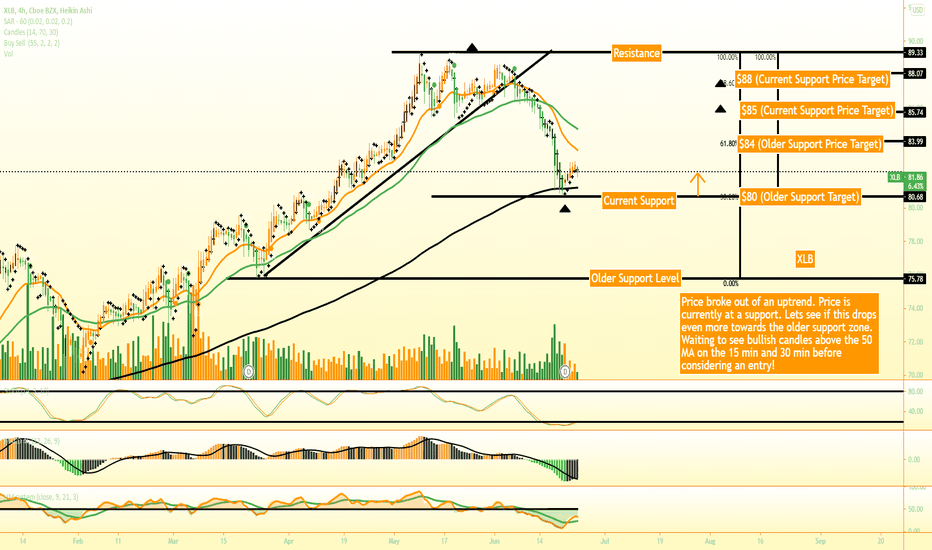

FMC CorporationThe reason I chose this ticker is due to the fact that XLB (basic materials sector) has fell under 50% stochastic currently sitting at 36%. Since Dec of '20, price has reached near the high of $120 about 4 times. It seems like price is currently testing support and is near a strong support. My daily, 4 hour, and 1 hour time frame matches with the RSI being oversold and the mac on the green side. I used a Fibonacci tool to track a retracement percentage up to 61.60% of the previous high. It looks like price could be ready soon for some type of retracement.

What do you think?

[Trade Review]How I traded $DIS 200% GAINS, $TLRY, $MSFT, FUMBLEIn this video I will reviewing trades I took on June 28, 2021 which were $TLRY, $DIS, $MSFT, $ZM from watchlist I provide from the stream on Saturday! Along with an explanation of my plan as well showed you guys my TA for some possible set ups! Traded these tickers using my knowledge of technical Analysis , sharing my levels: Support & Resistance , my trendlines , Fibs, Waves, Price Action, Channels , Emma's, and prior experienced , while providing both bullish & bearish scenarios for you to be able to understand my analysis and wait for confirmation as always!

Want to see more content like this? Make sure to Like and Subscribe!