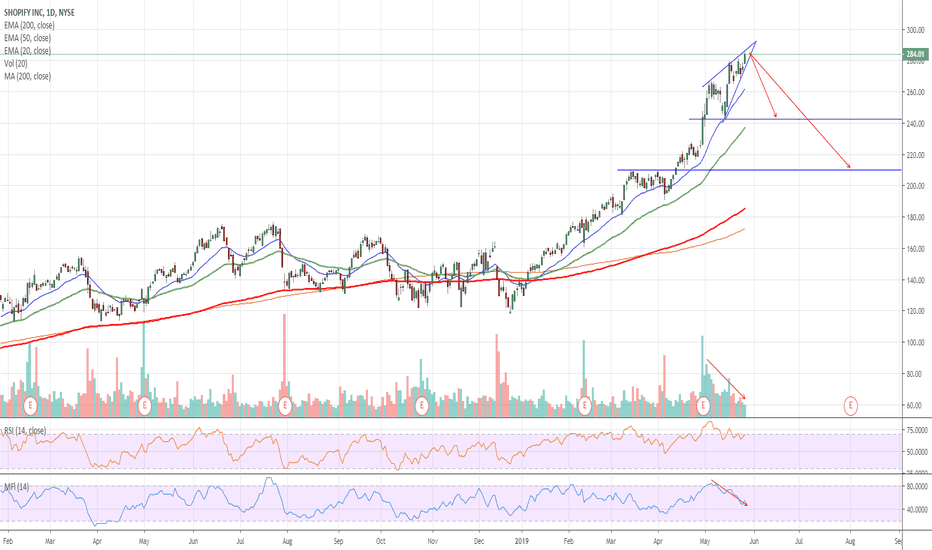

$SHOP Shopify Topping Out - Correction Upcoming$SHOP Shopify Topping Out - Correction Upcoming

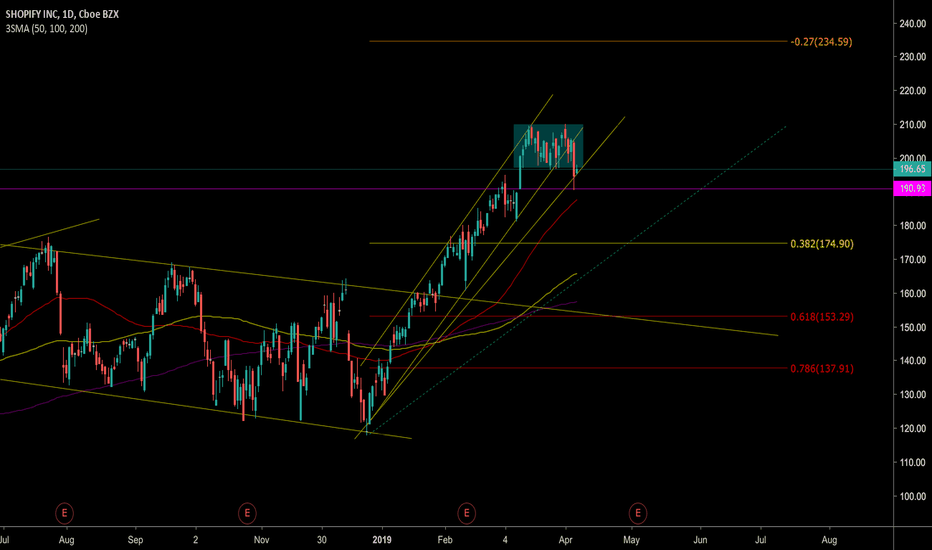

- Rising wedge pattern on daily - Bearish

- Volume & MFI divergence vs Price entire month of May - Bearish

- Price/Sales Ratio now over 25x (all time high for SHOP) vs most other top growth SaaS companies in mid-teens - Bearish

See chart for near and medium term targets.

For a possible options trade , I'm looking at buying the June 21st $260/$240 vertical put spread. Currently costing about $300 per contract with total possible profit of $1,700 or more than a 5x return. Definitely high risk as this stock has been propped up for several months now with no major draw downs, but I think it might be time.

Note: Informational, not investment advice.

SHOP

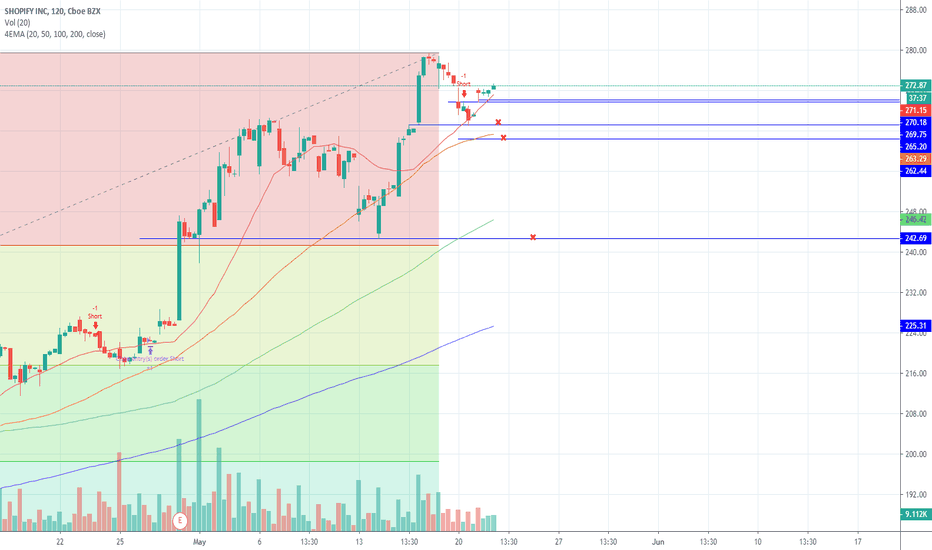

Going Short SHOP This one has had a good run. It looks like it has rolled over. I have my money on a pullback to $253-$255 (20 Day SMA) level at the very least.

Happy hunting. SHOP

Irrational Exuberance: How do we short this beast?We're way beyond reasonable valuation at this point. What we have here is a bubble that's gotten out of hand. See $TLRY's momentous run up last year, what goes up must come down. But how and when?

$SHOP is a pure momentum stock that people keep buying out of FOMO, it only just over 8 Million shares, which means it will move on you...FAST. THIS IS NOT FOR THE FAINT OF HEART, only use what you're prepared to lose.

Solution #1 : Purchase a Bear Put Spread. Buy 280, sell 250...or whatever width you desire. MAKE SURE this is far dated, July or August at least. What this will do is let you make money IF SHOP CONTINUES TO RISE, you're short put will lose theta and you can collect premium by buying it back cheaper. Once you're short put value has gone to nothing....the inevitable crash should plow right through your now naked long put. Giving you a nice payout. Cannot stress the importance of buying enough time here.

Solution #2 : Wait until its next consolidation and keep your eye on the pivot points (like the ones I highlighted). The reversals that have been happening have ignited massive short squeezes sending this higher every time. Usually the stock will break support intraday and chill there for a bit until it decides it's not having it and reverses. This is the stock telling you "I'm still not ready to collapse yet".

Wait for a CONFIRMED move to the downside. Allow it to close below the pivot and watch for follow-through the next day.

The way premiums are priced on this right now I would say Spreads are the way to go, but this is up to you.

Good luck out there.

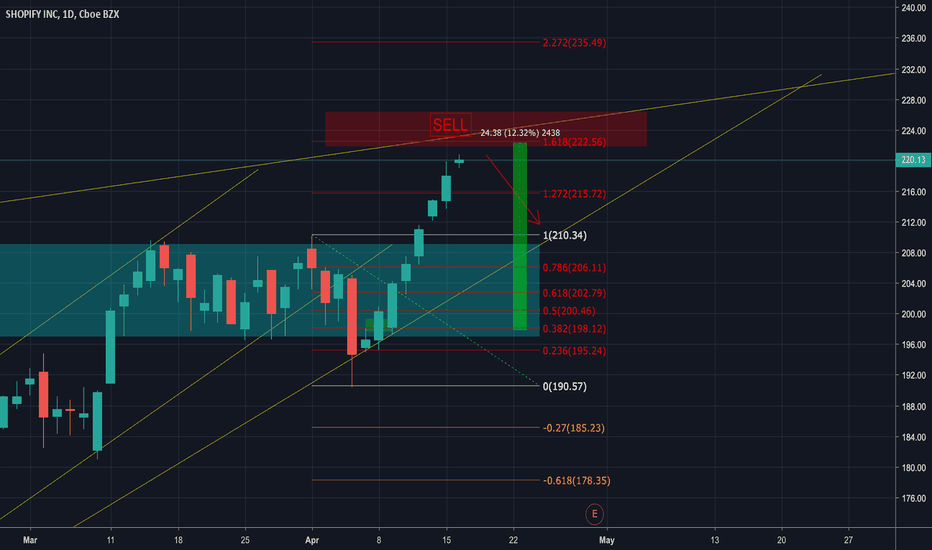

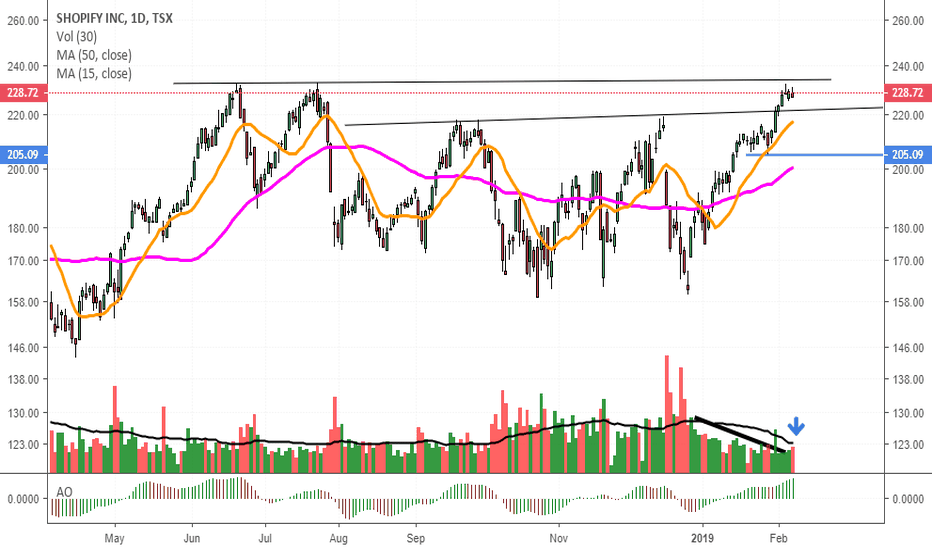

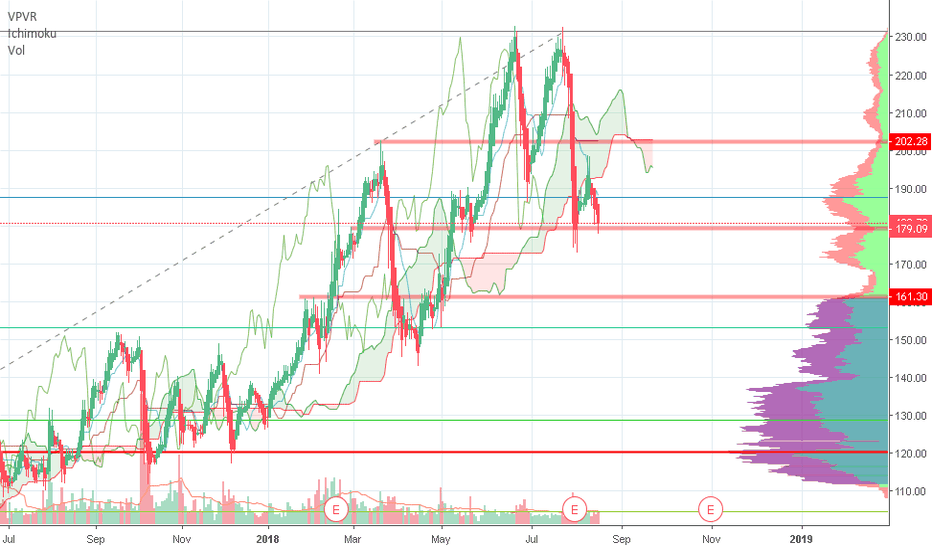

Short opportunity: SHOPMassive run appears to be topping out. Zacks just rated them as "bear of the day" because "they just don’t make very much money." Overextended after nearly 80% run in the last 4 months. Stock is not HTB

Short around 214

Target 1: 208.87 --- 2.48%

Target 2: 198.61 --- 7.3%

Target 3: 184.15 --- 13.8%

Target 4: 170.22 --- 20.55%

$SHOP, time to sell? $SHOP SHOPIFYSo i'm running +50% on this one. Nearing a big trendline, 1.618 fib and the steam maybe over for some days/weeks.

A correction to 210 should be in play i think

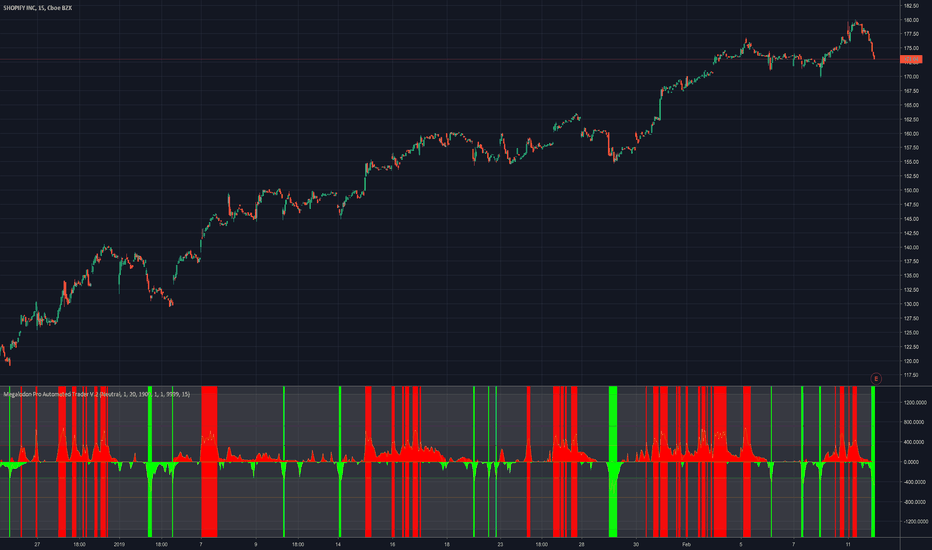

Buy Shopify?The Megalodon indicator speaks for itself on this chart!

The Megalodon indicator uses an artificial intelligence, combined with data from over 500 buy setups, and over 2000 indicators to produce extremely accurate buy signals on any and all asset classes! Send me a message if you would like to try it for yourself!

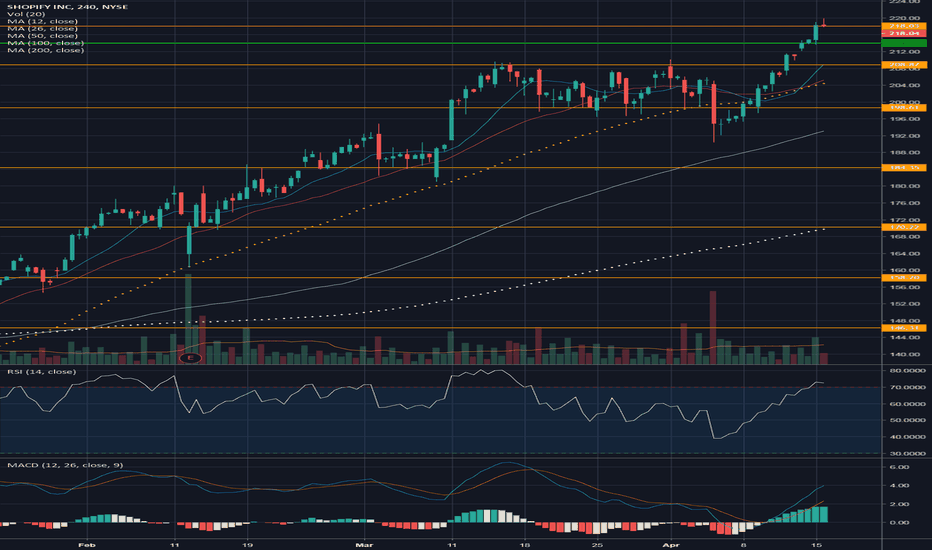

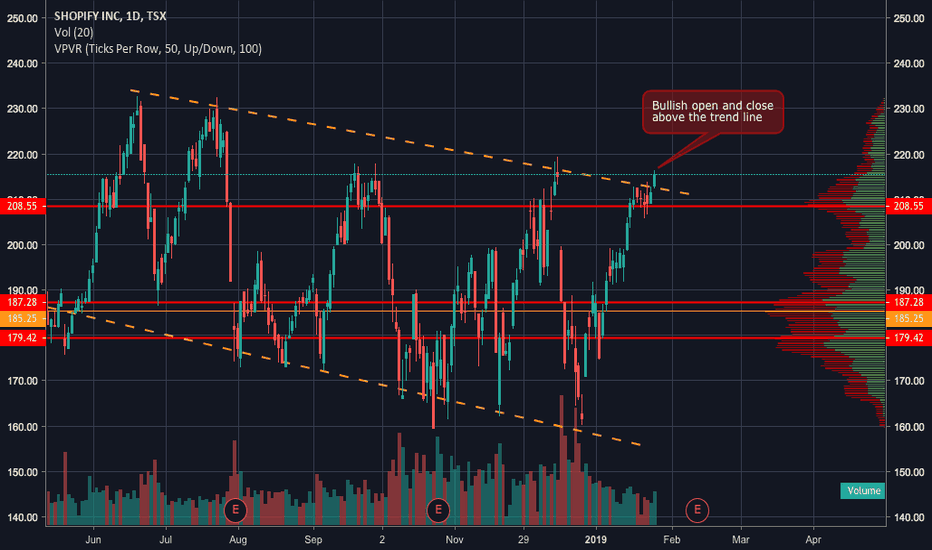

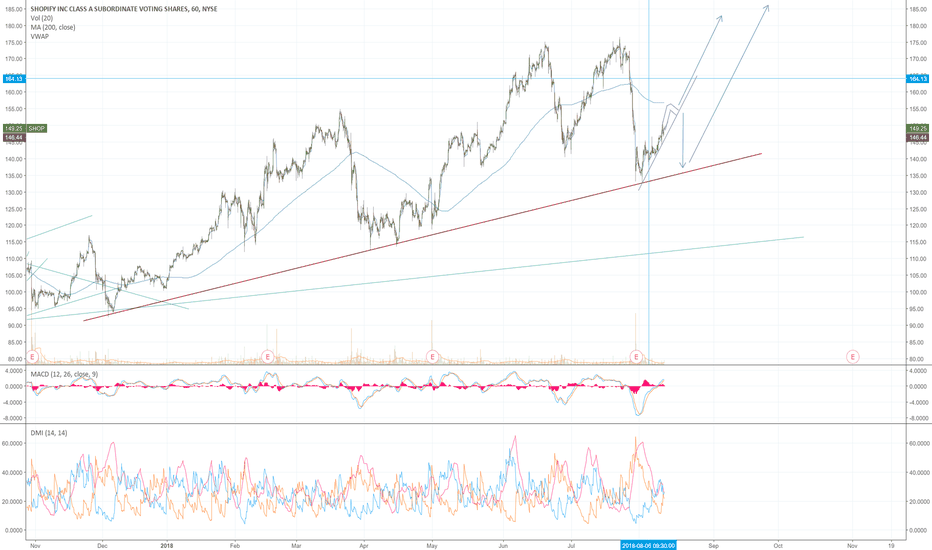

SHOP - Breakout from Bull Flag?Did SHOPify breakout of a bull flag?

1) Bullish open and close candle above the trend line.

2) MACD bullish (although histogram is slowing)

3) Force Indicator is bullish

4) RSI is not overbought or showing any signs of bearish divergence.

5) Parabolic SAR is bullish

6) 20 EMA is above the 40 EMA indicating a bullish trend

7) 50 EMA is above the 200 EMA also supporting a bullish trend

8) However, is the price to far overextended from the 20 EMA? Might it pull back? Is this a false breakout?

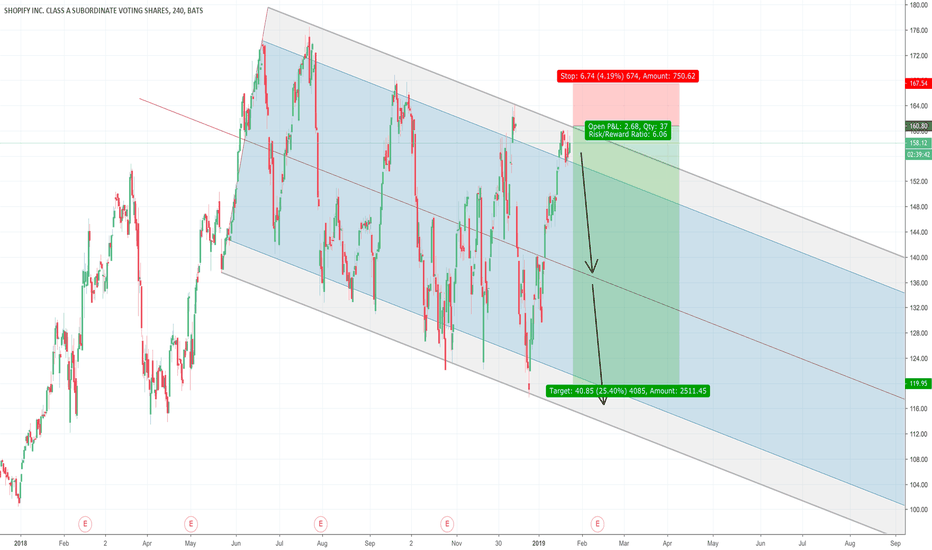

Shopify Clean Channel Potential ReversalTrade Idea: Bearish Reversal

Price has been consolidation at the edge of the channel for almost a week now, indicating that price is exhausting its bullish swing.

Trade Step-up: Short

Price rejects a breakout from the current channel trend. Look for a reversal to 140.00 & 125.00. Stop loss at 165.00.

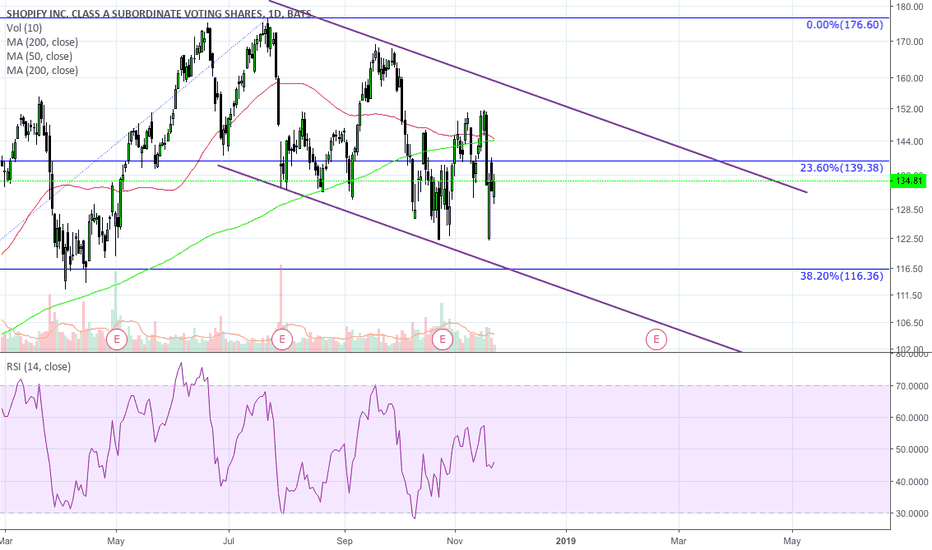

SHOPIFYAfter looking through finances I am not a fan of Shopify in the long-term being able to support itself in terms of it's finances. For the technical traders out there it looks like price could have bounced off of the resistance level. Just something to note or keep an eye on.

Time to return Shopify NYSE:SHOP is an opportunity to go short (after Cyber Monday) once the MAs complete forming death cross on daily chart, volume is already low and RSI has formed a bearish divergence

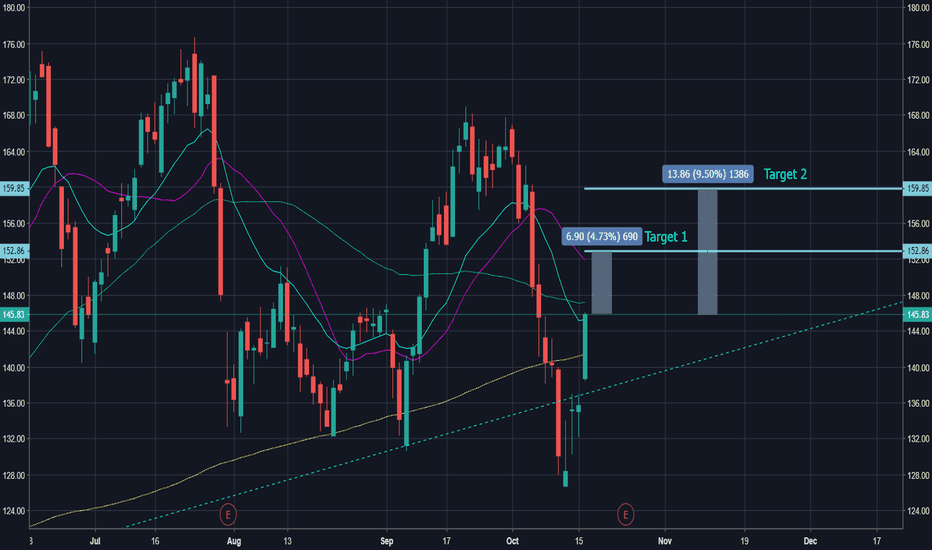

SHOPIFY Giving TreeSwing pick for the week. SHOP is looking great after this mini correction. The bottom dotted line is a trend line, with two targets listed. MACD and STOCH are looking great too.

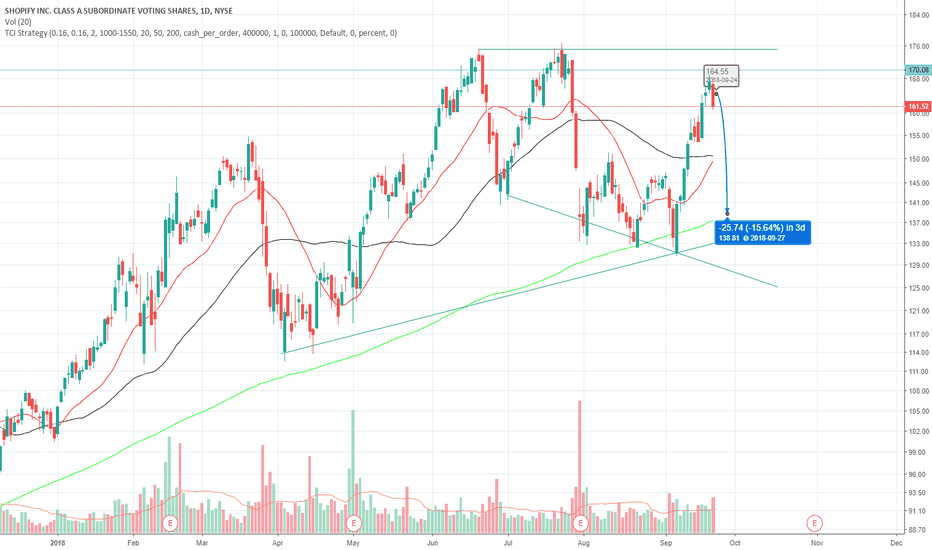

2018-09-24-SHOPOn the next week I will look for a SHORT on SHOP during the day while price on D is moving towards SMA200, and while SMA20<SMA50.

SL 0.54%

TP 1.62%

Shopify Day Trade September 19If Shopify breaks 166, I believe there's an opening between this range to make a day trade, as illustrated here. The momentum has shifted, and as seen by the shifting bottoms.

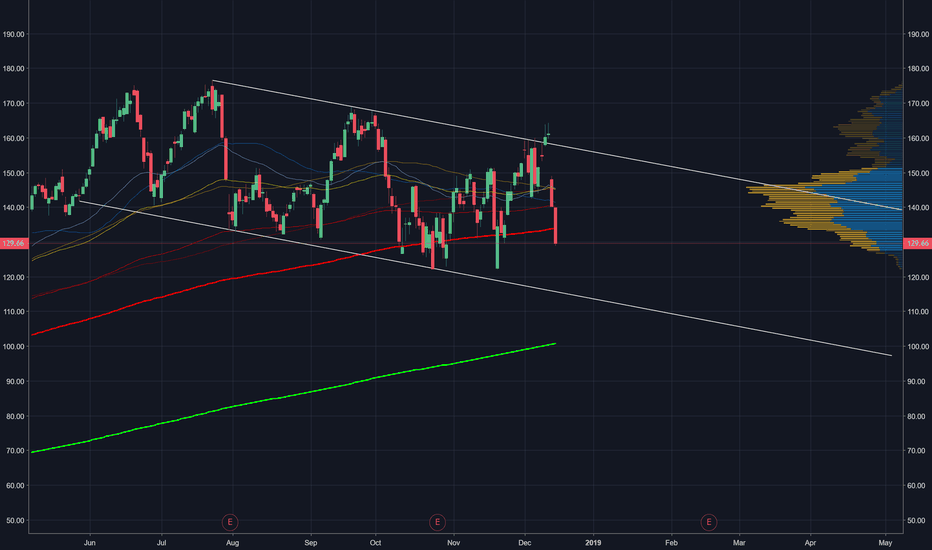

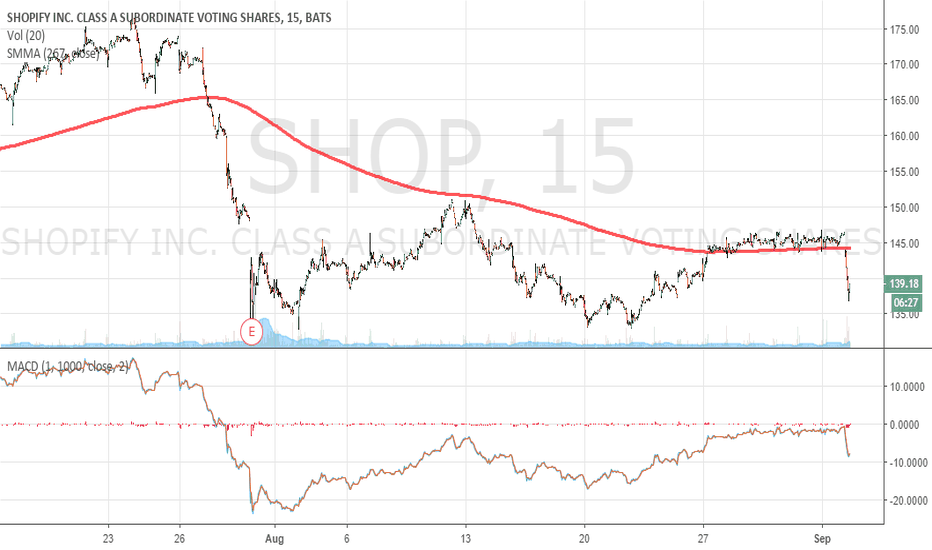

Shopify still looking down...Shopify still looking down... not much to stay. I prefer to wait for the upside to arrive... lets follow

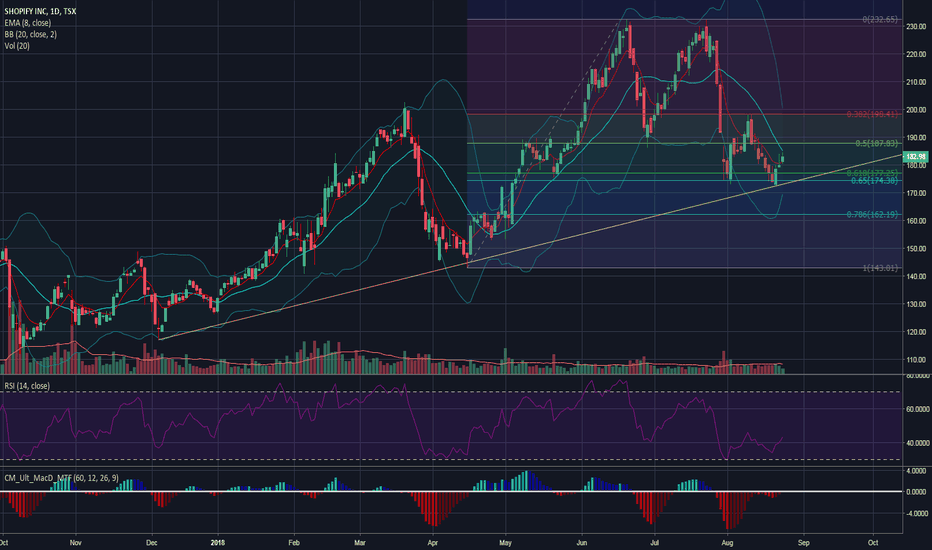

Shopify tightening range holding uptrend, preparing for breakoutSHOP.TO is tightening up on the daily as price forms an equilibrium. Decreasing bull volume on the daily tells me we're likely to set a lower high relative to 199.50 before coming back to test the uptrend that's held since Dec 2017, and set a higher low relative to 172.95. Volume within this pattern will be key clue about how the pattern will break

SHOP - The w[E]ed-[Commerce] solution from CANADA So you should know this buy now

www.cbc.ca

And if you are from Ontario and over 19 years old, I bet you also know what happens on October 17, 2018.

www.ontario.ca

Shopify Inc. (Nasdaq: SHOP) is a company that’s about to make billions from the end of marijuana prohibition without ever touching the leaf.

It’s the online retailer – not Amazon.com Inc. (Nasdaq: AMZN) – that just inked a contract to provide an e-commerce platform for a major Canadian cannabis retailer.

You see, when Canada goes fully legal later in summer 2018, pot companies will want to sell (and their customers will want to buy) their wares online. Makes sense.

And the great news for investors in Shopify? The Ontario Cannabis Retail Corp. (OCRC) – the government agency in charge of sales in the province – is relying on Shopify, and only Shopify, to make it happen.

That’s going to be a huge boon for cannabis investors. Ontario is home to 13.6 million people, with bustling Toronto and its financial sector at the heart of the province.

That’s the perfect place to begin cashing in on Canada’s legal weed market, which Deloitte says could hit $8.7 billion over the next few years.

But that’s really just the beginning for Shopify.

This tech-forward company develops the kind of sophisticated software that allows small retailers to plug into e-commerce platforms like Amazon and sell their stuff.

With Shopify’s platform, they can manage orders, collect sales dollars, and send out emails to buyers. Or, if they prefer to go it alone, Shopify can help small retailers build their own online storefront, handle multiple sales channels, and plug into social media for customer outreach.

That business model alone qualifies this as a solid choice for investors. Its sales grew an average 85% over the past three years, compared to 26% growth for Amazon during that stretch.

Now, OCRC has picked to exclusively use Shopify’s e-commerce platform for cannabis sales online. Shopify’s technology will also be used inside OCRC’s Ontario Cannabis Stores to process transactions and for digital kiosks displaying product information.

And Ontario is just the “first mover” here. Many of Canada’s other nine provinces are likely to follow the leader here in choosing the home-grown Shopify (which is based in Ottawa) as their e-commerce partner.

That could double Shopify’s total market opportunity there.

In fact, Quebec province-based grower Hydropothecary Corp. has already chosen Shopify to help it sell medical marijuana online.

Thanks to moves like the OCRC deal, Shopify’s total addressable market stands to exceed $50 billion…

As a side note, just imagine if they integrate cryptocurrencies