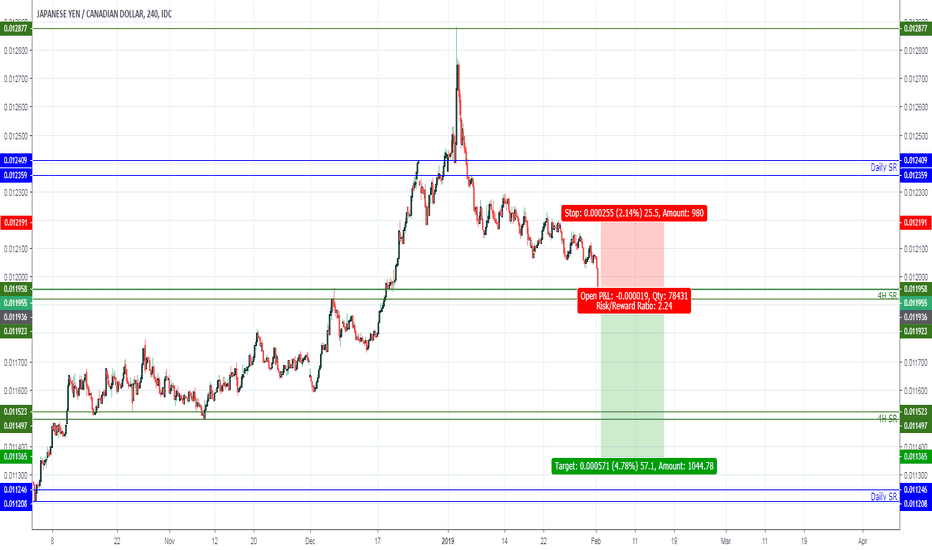

JPYCAD week 6-7 trading plan. Bearish. w5 PROFITS!Overall

on week 5 JPY was one of the weakest among pairs.

CAD was dominant

Therefore I expect bearish market and short.

Weekly

Exhaustion candle = short

Daily

It was bull market then exhaustion candle = short

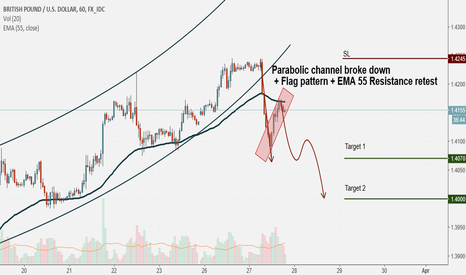

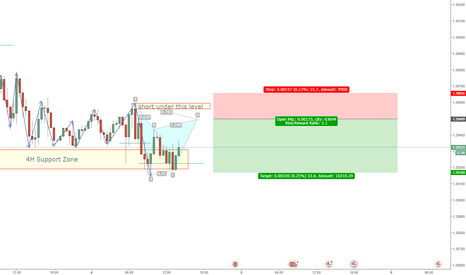

4H

Bearish market.

Open Short

ENTRY 0.01930

SL 0.012191

TP 0 .011365

RR 2.24

Short-pattern

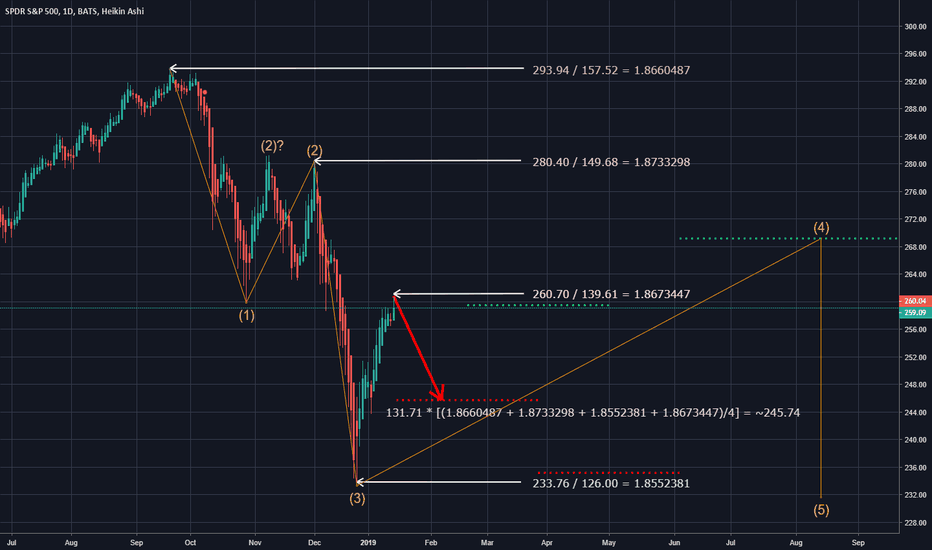

SPY Pattern Analysis - The Magic Ratio 1.865, Plus or Minus .01"My problem is that I have been persecuted by a (ratio). For the last few months this (ratio) has followed me around, has intruded in my most private data, and has assaulted me from the pages of our most public journals. This (ratio) assumes a variety of disguises, being sometimes a little larger and sometimes a little smaller than usual, but never changing so much as to be unrecognizable. The persistence with which this (ratio) plagues me is far more than a random accident. There is, to quote a famous senator, a design behind it, some pattern governing its appearances. Either there really is something unusual about the (ratio) or else I am suffering from delusions of persecution."

Dry humor aside - in comparing various inflection points and critical resistance boundaries of the SPY during the 2008-2009 recession and today's 2018-2019 "correction", I've identified one particular ratio that haunts my analysis. To be precise, 1.865 +/- .01 has appeared, without fail, at seemingly each and every corner - at every major toss and turn - of the present market. By simply dividing the daily lows or highs of the matched "reference points", such as 22 Jan 2008 and 26 Dec 2018, a ratio could be found - in this instance, ~1.8552381. When applied to the reference points shown in the chart above, we end up with a list of similar numbers:

293.94 157.52 ~1.8660487

280.40 149.68 ~1.8733298

233.76 126.00 ~1.8552381

260.70 139.61 ~1.8673447

Very interesting, isn't it? A tad off our usual fib 1.618, but nothing too difficult to work with.

By averaging the four reference points we have gathered, we can then determine a "working estimate" of ~1.8654903.

Apply this ratio to the next potential turning point in the market - for example, a local bottom at 131.73 on 07 Feb 2008 - and voila: a target estimate of ~245.74.

A range could be estimated as well, using 1.865 +/- .01 as the upper and lower boundaries. For the same example, the estimate target range would be 244.42~247.06, presenting a gap of 2.64.

Will this work to pinpoint exact dates or price targets? Probably not. Is this a potential fractal of human nature? Possibly. Either way, it presents itself as something potentially significant.

I recommend you to trade like you drive - safe and steady in a Benz or wild and out in a convertible roadster. Regardless, the wheel is in your hands, not mine.

Quick profit: BTC short = 2.8RBTC price still hovering near the high of it's bull run from last Thursday on the 12th.

We've had a break and hold above the yearly downtrend channel and created a bearish Flag pattern.

If we look closely we can see price consolidating and failing to close higher and thus a 1hrly Head and Shoulders pattern has forming horizontally along the Bearish Flag Pattern were the lower channel of the bearish flag pattern is acting as resistance suggesting a short for BTC. BITSTAMP:BTCUSD

We have a clear target of 7500; 50% of the Fib from last Thursdays surge which lines up nicely with previous highs and lows confirming a decent support and resistance flip. Nice easy conservative target with a risk reward of 2.8 your initial risk. Not bad for half a days work.

See you on the flipside.

Entry at 8130

Stop Loss 8350

Take Profit 7500

= 2.8R

"Play the Market, not the Game"

UKOIL bearish signalUKOIL made shark harmonic pattern it's started on 26 September (the pattern took a month to complete)

it's not clear till now if it will decline or will continue rising and try making alternate shark.

Now we have entrance point, the targets and stop loss (marked by green and red lines as usual)

Thank you

-----------------------------

Do not read and leave like, Comment and Follow ...... it's so easy :)