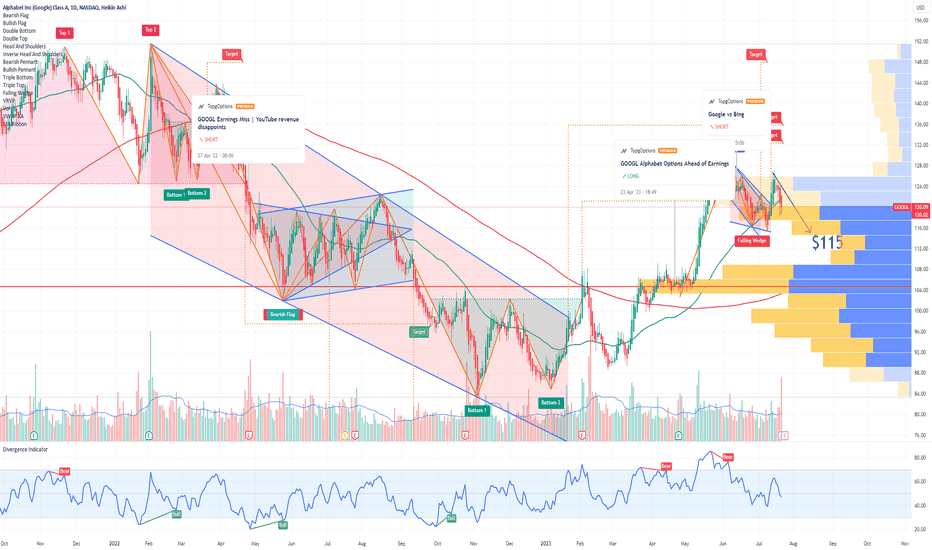

GOOGL Alphabet Options Ahead of Earnings ! Sell-Off Thesis !If you haven`t sold GOOGL here:

or reentered here:

Then analyzing the options chain and chart patterns of GOOGL Alphabet Inc prior to the earnings report this week,

I would consider purchasing the 115usd strike price Puts with

an expiration date of 2024-1-19,

for a premium of approximately $6.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

While Google currently holds a dominant position in the search engine market, the landscape is dynamic and subject to change. If Microsoft successfully leverages its partnership with OpenAI to enhance Bing's capabilities, coupled with strategic marketing initiatives, it could potentially chip away at Google's market share over time.

You can read my full GOOGL Sell-Off thesis here:

Looking forward to read your opinion about it.

Short-signal

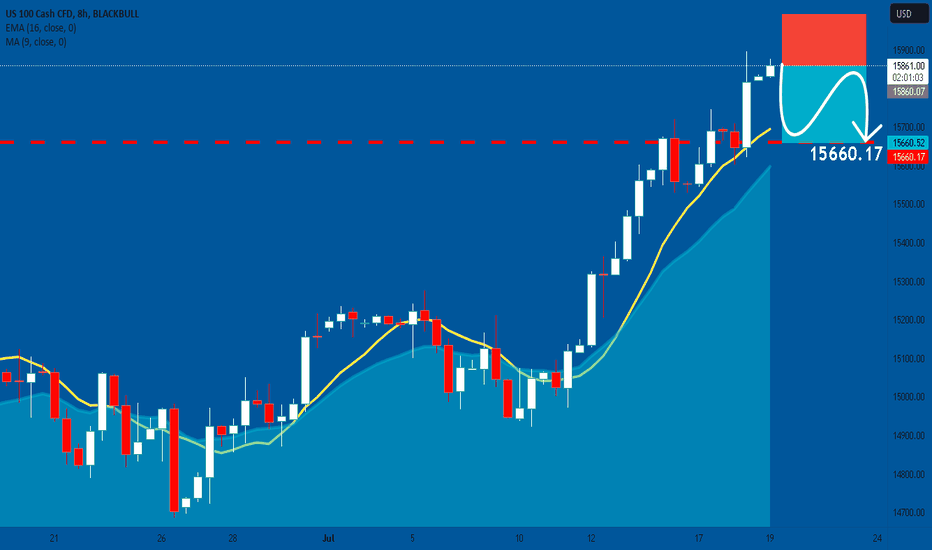

NAS100: Short Trading Opportunity

NAS100

- Classic bearish formation

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Sell NAS100

Entry - 15860.07

Stop - 15993.10

Take - 15660.52

Our Risk - 1%

Start protection of your profits from higher levels.

❤️ Please, support our work with like & comment! ❤️

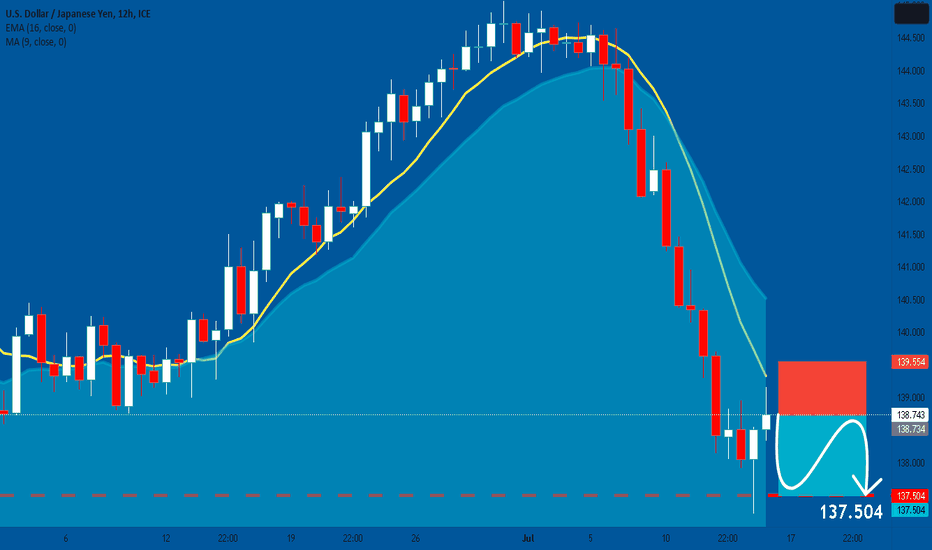

GBPJPY H4 - Short SignalGBPJPY H4

Looking like we want to slow down on the gains here amongst a handful of ***JPY pairs, GBPJPY looking like the most attractive for shorts at the moment, but a little more confirmation wouldn't go-a-miss.

Looking at USDJPY and EURJPY respectively, we have seen a downside dump and retest. Seeing shorts out throughout the start of Q3 and a deeper correction to warrant this latest bull rally would make sense to me. But lets see what starts to unfold.

EURCHF Selling Opportunity for Next Wave DownThe EURCHF downtrend remains firmly intact, with the support zone successfully transitioning into a robust resistance area. The price action consistently adheres to the downtrend trendline, and today we observe EURCHF retesting this trendline. This presents a compelling opportunity for sellers to enter the market and anticipate the next downward wave.

In the event that the resistance area proves formidable, EURCHF is likely to target the 161.8% Fibonacci support level. However, it is important to note that achieving this target may require several weeks, if not months, to materialize. Patience and careful monitoring of the price action will be key in navigating the ongoing trend in EURCHF.

EURCHF: Short Trade Explained

EURCHF

- Classic bearish setup

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell EURCHF

Entry Level - 0.98062

Stop Loss - 0.98238

Take Profit - 0.97798

Our Risk - 1%

Start protection of your profits from higher levels.

❤️ Please, support our work with like & comment! ❤️

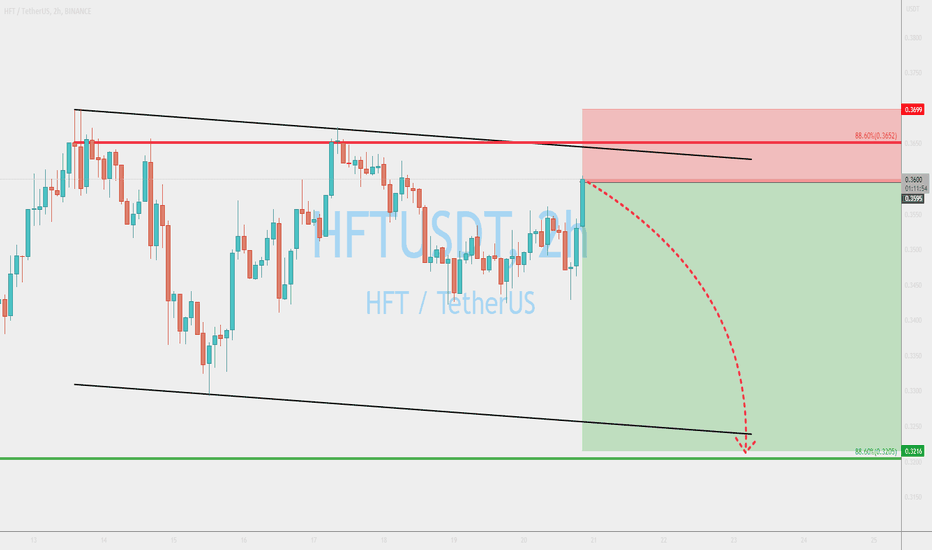

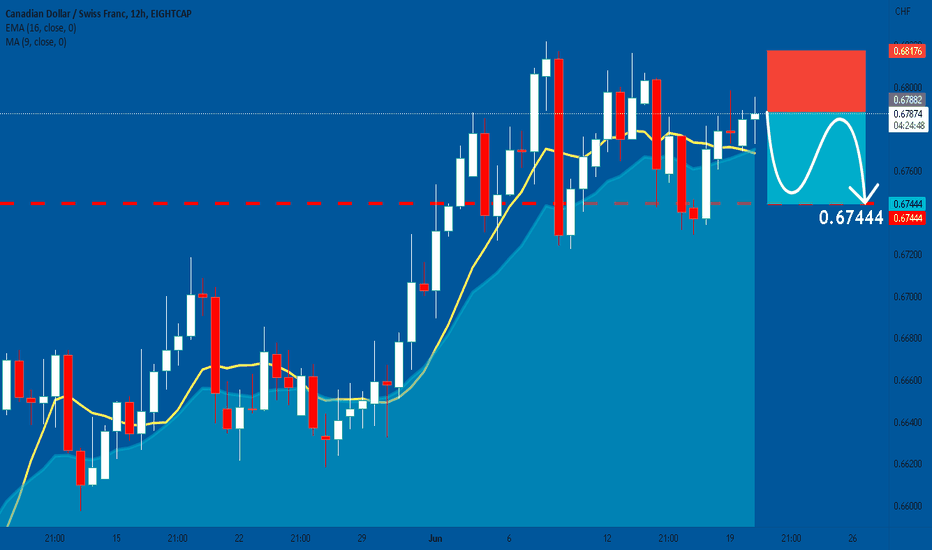

CADCHF: Short Signal with Entry/SL/TP

CADCHF

- Classic bearish pattern

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short CADCHF

Entry - 0.67882

Sl - 0.68176

Tp - 0.67444

Our Risk - 1%

Start protection of your profits from higher levels.

❤️ Please, support our work with like & comment! ❤️

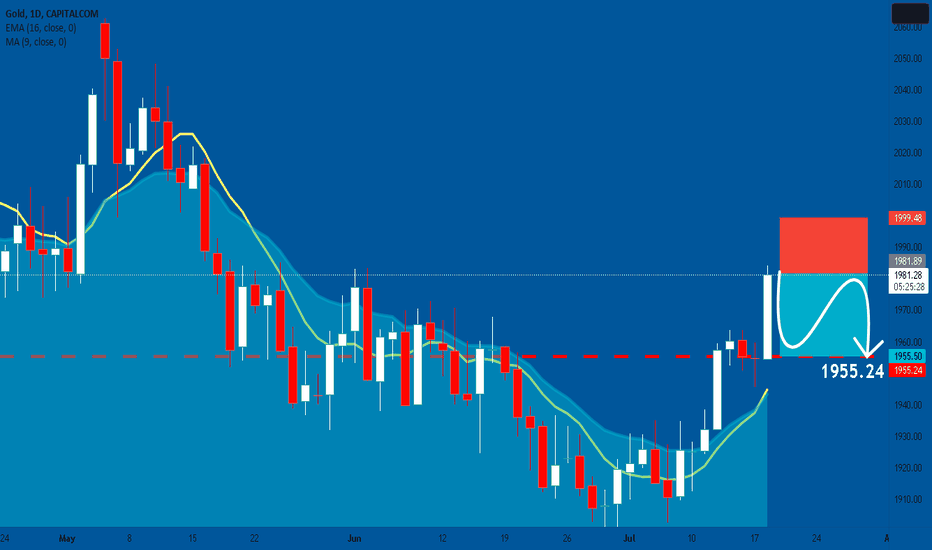

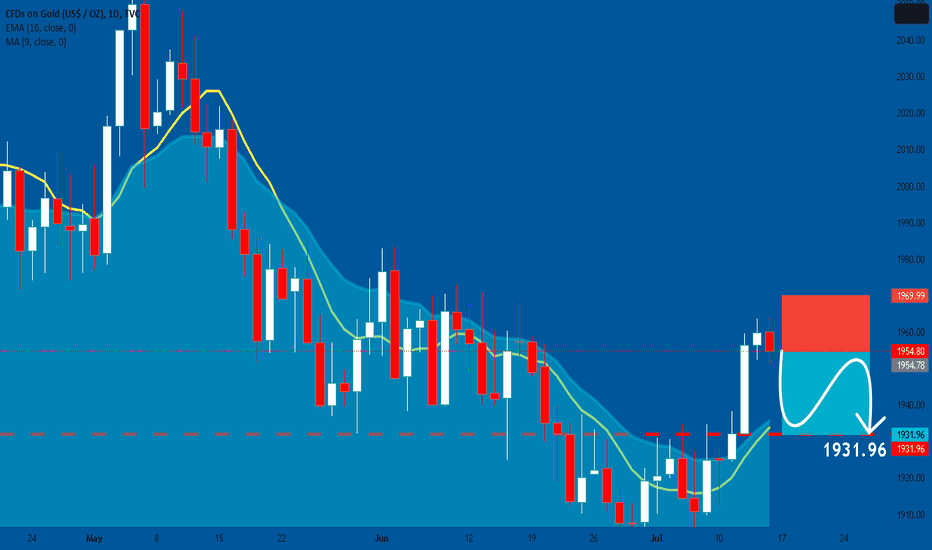

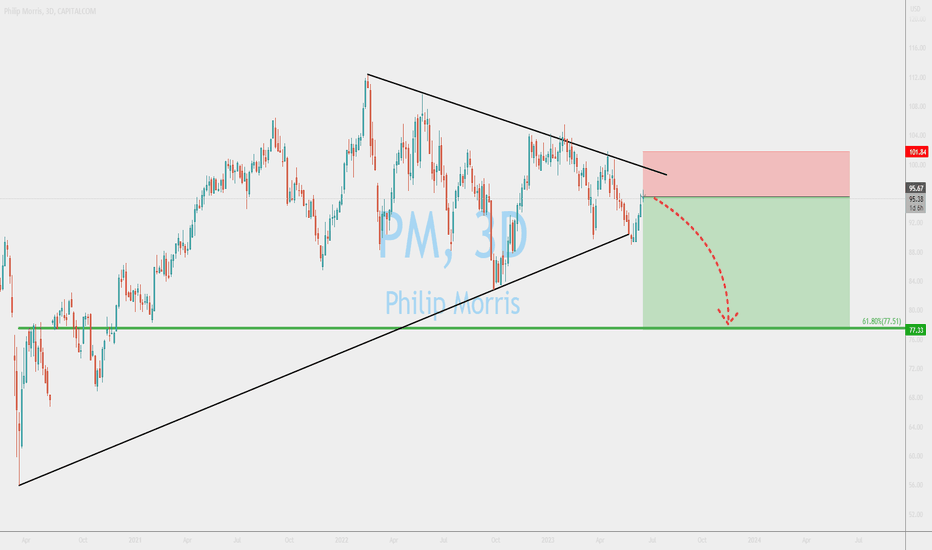

The Shift in Momentum for PM (Phillip Morris)PM has decisively broken below the uptrend trendline, signaling a significant shift in the trend. Simultaneously, the downtrend trendline has been consistently respected, suggesting mounting selling pressure.

Therefore, it is anticipated that Phillip Morris will face substantial downside pressure in the coming weeks. As a result, the price is likely to decline toward the crucial 61.8% Fibonacci support level.

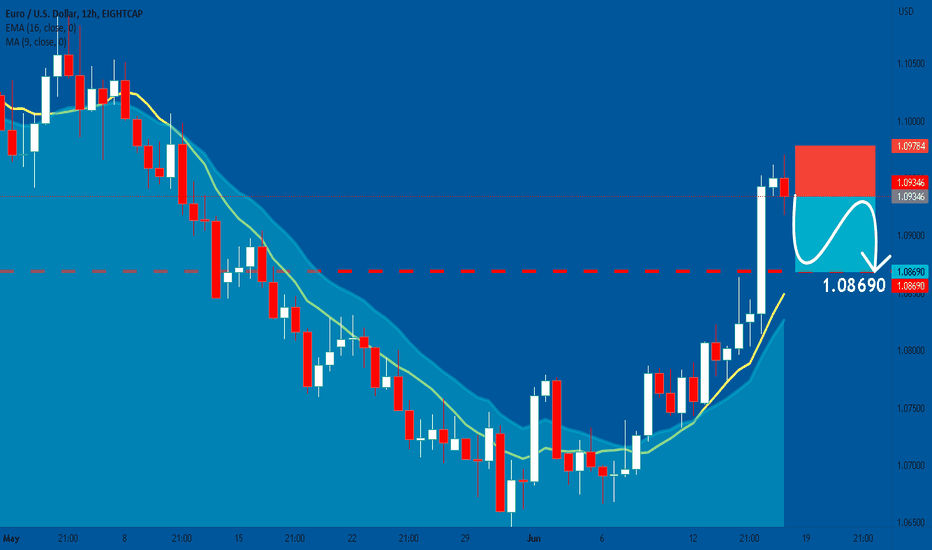

EURUSD: Short Trading Opportunity

EURUSD

- Classic bearish setup

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell EURUSD

Entry - 1.09346

Stop - 1.09784

Take - 1.08690

Our Risk - 1%

Start protection of your profits from higher levels.

❤️ Please, support our work with like & comment! ❤️