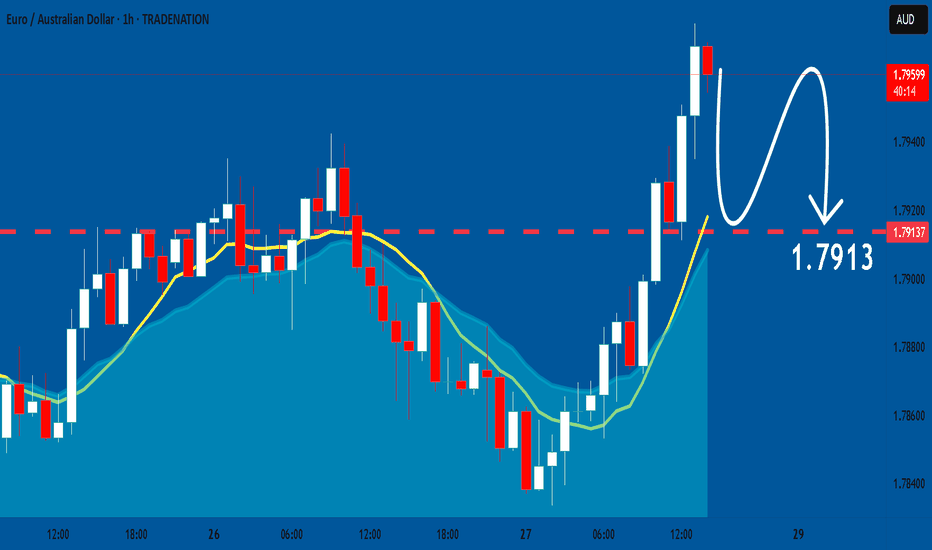

EURAUD: Weak Market & Bearish Continuation

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the EURAUD pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Short

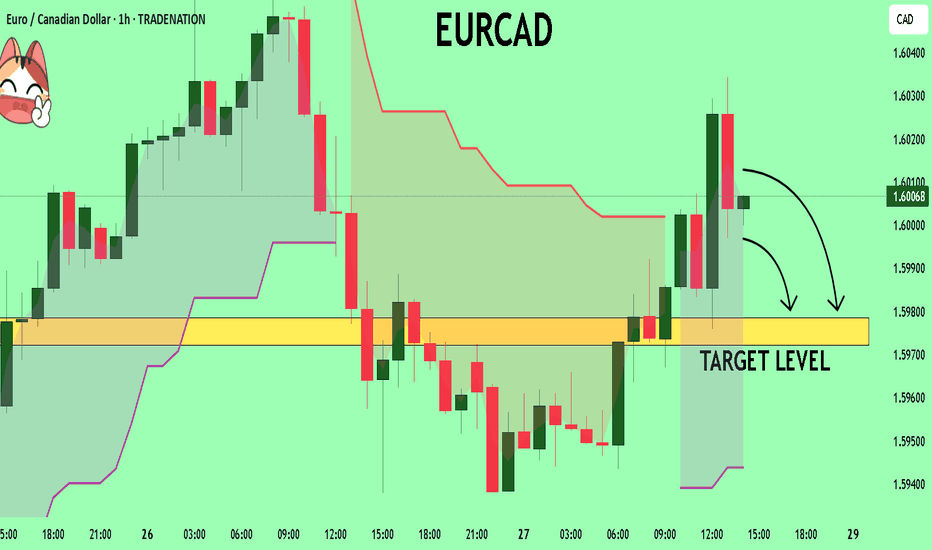

EURCAD My Opinion! SELL!

My dear friends,

Please, find my technical outlook for EURCAD below:

The instrument tests an important psychological level 1.6006

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.5978

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

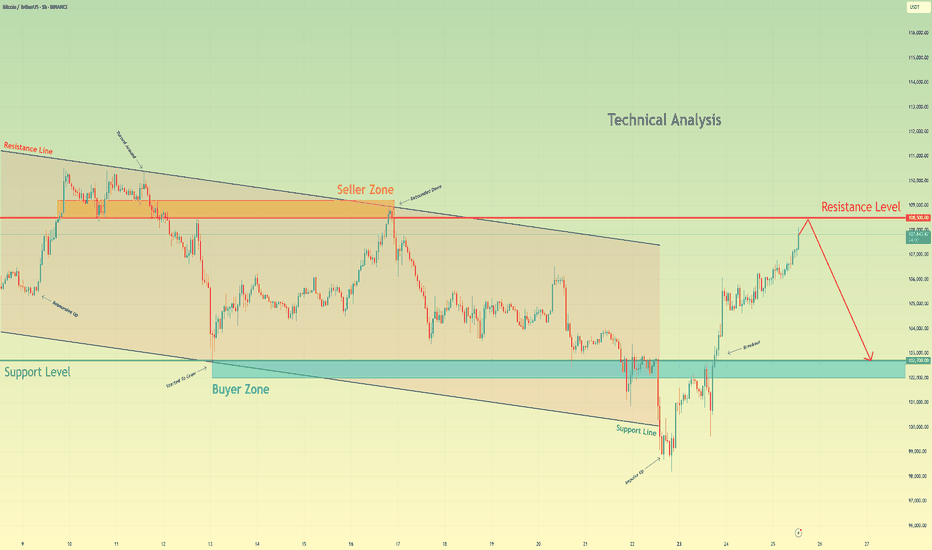

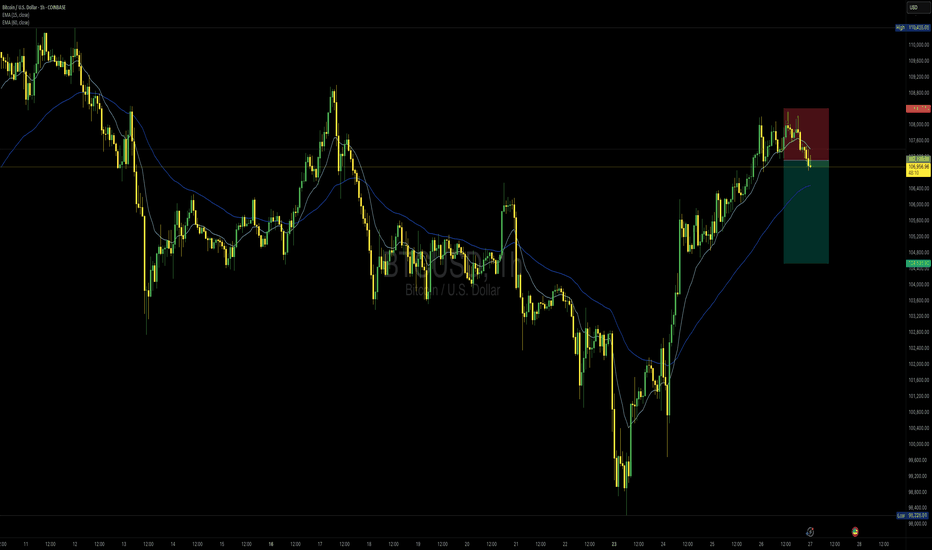

Bitcoin may reach resistance level and then start to declineHello traders, I want share with you my opinion about Bitcoin. Previously, the price was trading inside a well-defined downward channel, repeatedly rebounding from both the support and resistance lines. Each upward move got rejected within the seller zone, especially around the 108500 - 109200 range, which acted as a strong barrier multiple times. Later, BTC dropped to the buyer zone near 102700 - 102000, and from there, we saw a strong impulse up. This impulse broke through the channel resistance line and the support area, indicating a short-term bullish breakout. At the moment, the price is approaching the resistance level at 108500, which previously served as a turning point. Given that this area also aligns with the upper boundary of the seller zone, I believe we may see another reversal from this level. In my opinion, after reaching resistance, BTC may start a new downward wave, targeting the 102700 support level. This is where I’ve set my TP 1. Considering the recent breakout, the historical significance of the resistance, and the strong reaction from seller zones, I remain bearish in the short term and expect a potential decline toward support. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

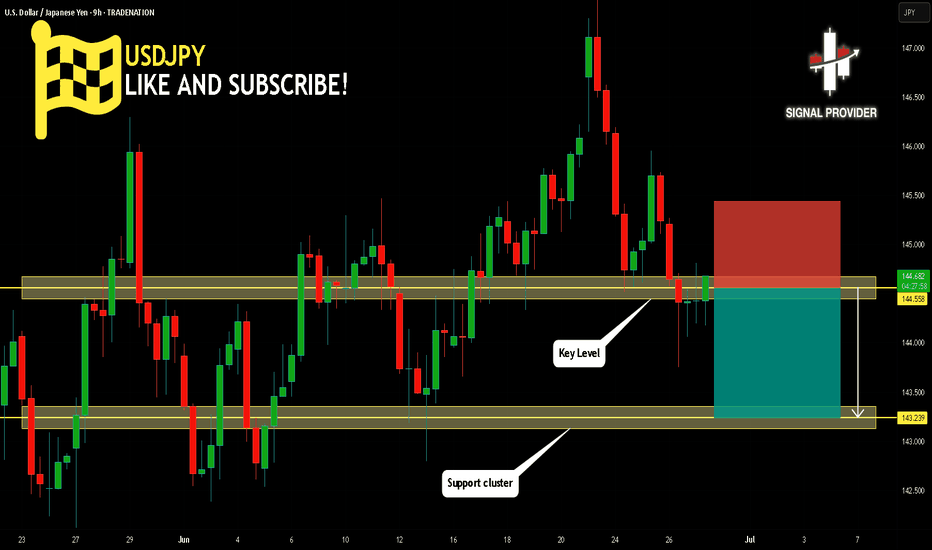

USDJPY Will Go Lower From Resistance! Sell!

Take a look at our analysis for USDJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 144.558.

Taking into consideration the structure & trend analysis, I believe that the market will reach 143.239 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

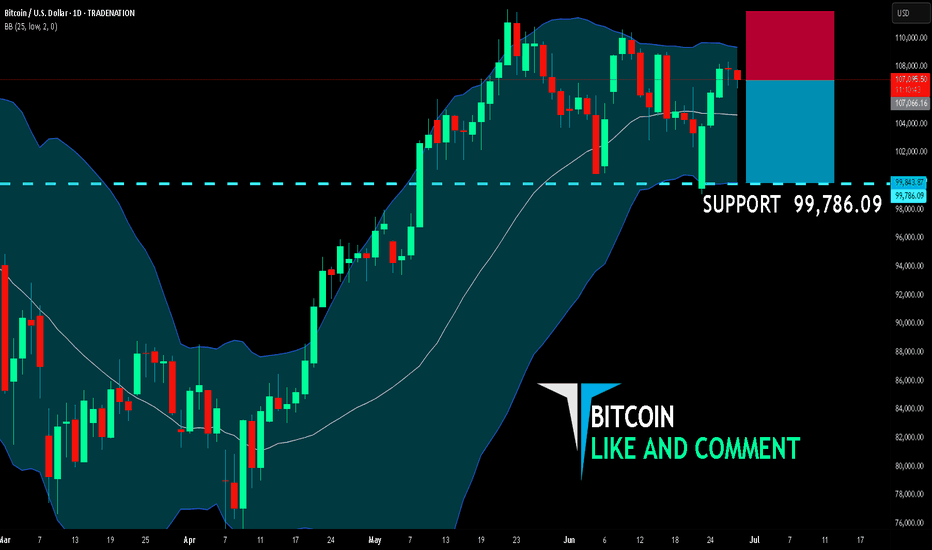

BITCOIN SHORT FROM RESISTANCE

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 107,066.16

Target Level: 99,786.09

Stop Loss: 111,861.76

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

LIKE AND COMMENT MY IDEAS

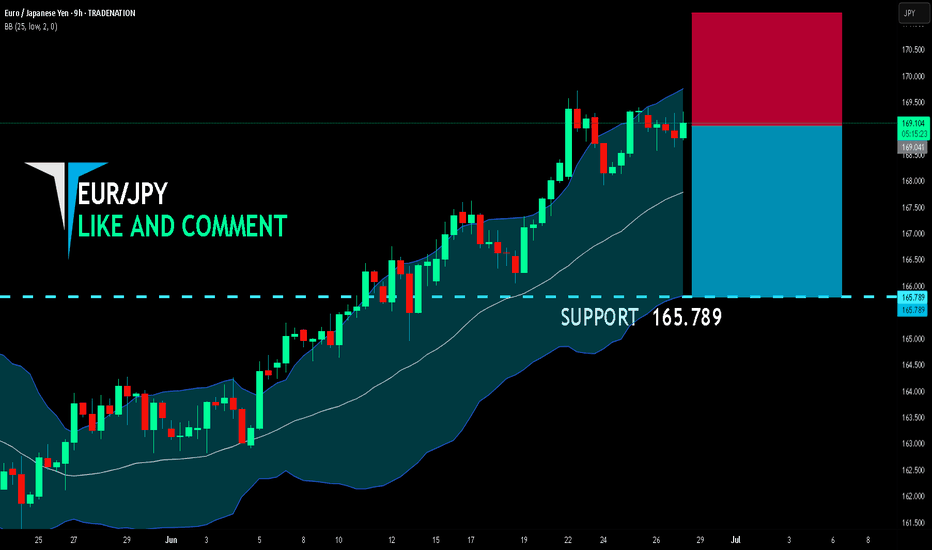

EUR/JPY BEARS WILL DOMINATE THE MARKET|SHORT

EUR/JPY SIGNAL

Trade Direction: short

Entry Level: 169.041

Target Level: 165.789

Stop Loss: 171.204

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

LIKE AND COMMENT MY IDEAS

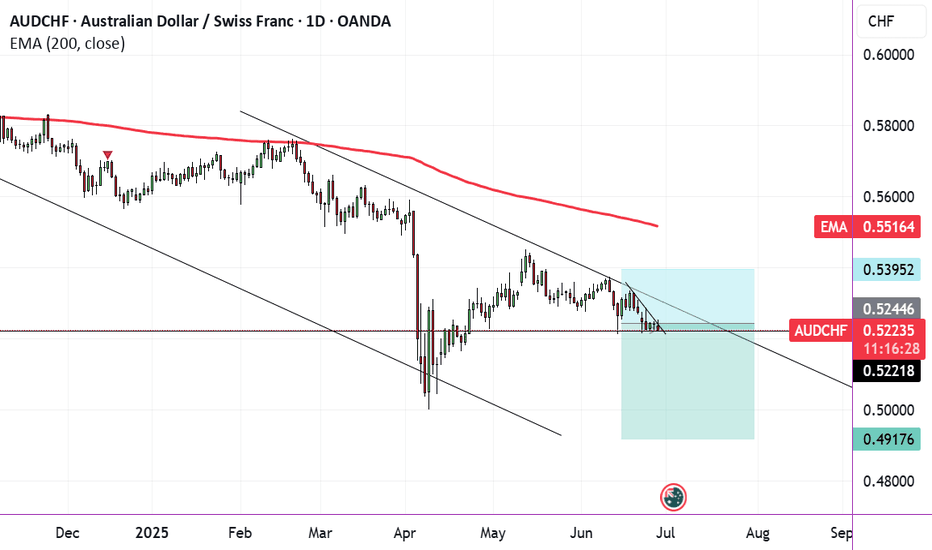

AUDCHF - ShortI have been short on AUDCHF for a few days. Here's my breakdown:

Technical:

- Descending channel

- Strong resistance on the upper channel line

- Potential descending triangle forming, suggesting continuation of this downtrend

- Following the overall trend of this pair, which is bearish

Fundamental:

- Risk off mood globally, CHF is a safe haven currency

- Dovish RBA

- Commodity pressure on AUD

- SNB stability

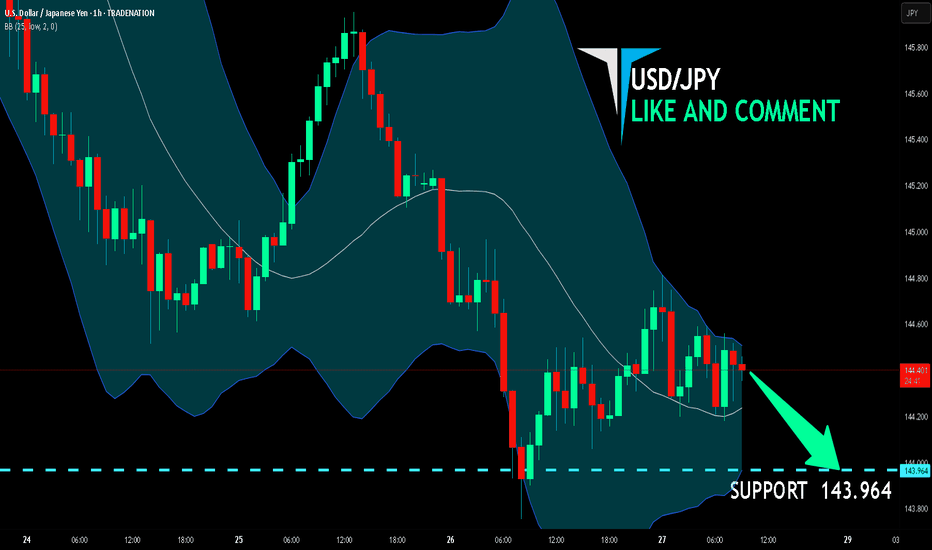

USD/JPY BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

Bearish trend on USD/JPY, defined by the red colour of the last week candle combined with the fact the pair is overbought based on the BB upper band proximity, makes me expect a bearish rebound from the resistance line above and a retest of the local target below at 143.964.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

LIKE AND COMMENT MY IDEAS

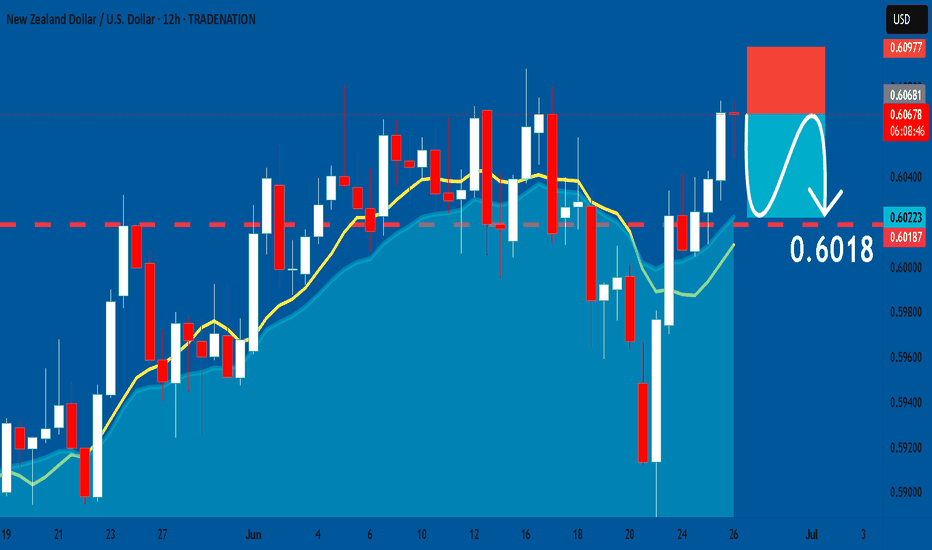

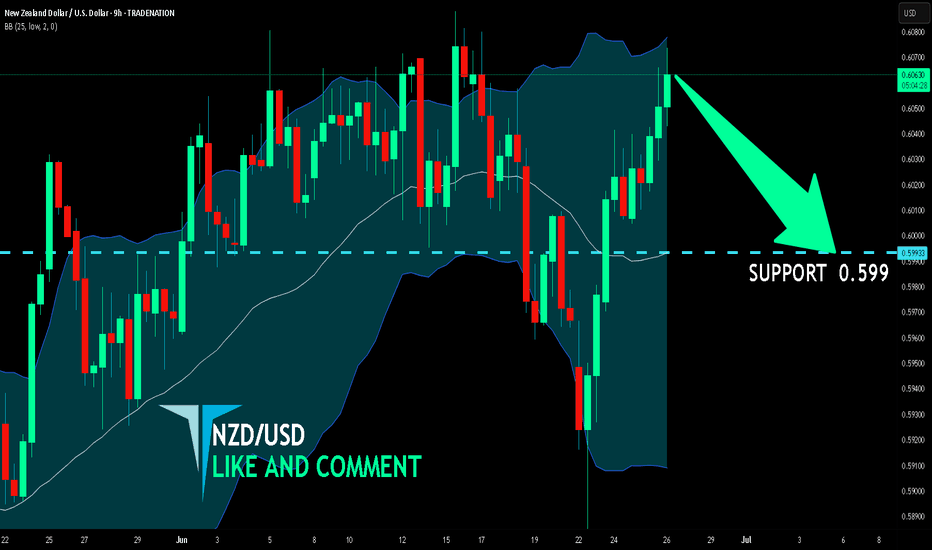

NZDUSD: Short Signal Explained

NZDUSD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short NZDUSD

Entry Point - 0.6067

Stop Loss - 0.6097

Take Profit - 0.6018

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

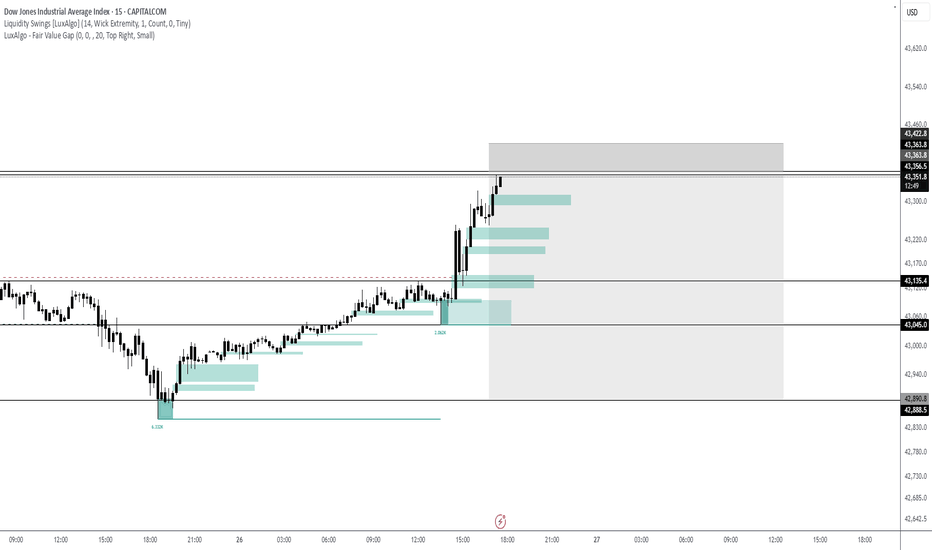

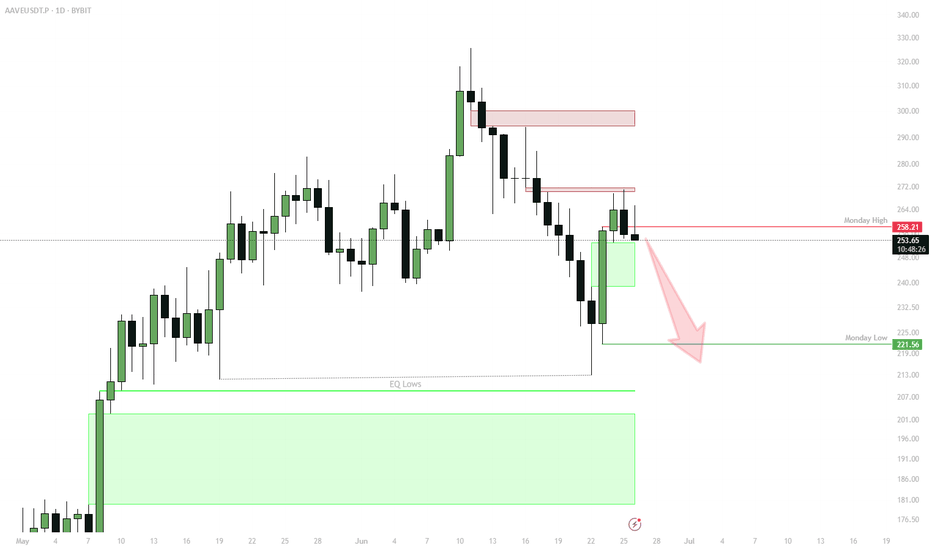

AAVE: Bearish Range Play — Watching for Move Back to Monday Low✅ Break above Monday high rejected, confirming resistance

✅ Structure is bearish — main scenario is return to Monday low ($221.56)

✅ Watch for reaction at target for partial profit taking

Active Scenario:

Hold/enter shorts while below Monday high

Target: $221.56 (Monday low)

Partial profit: On first touch of Monday low

Watch: Price reaction for potential reversal/setup at Monday low

🔔 Triggers & Confirmations:

Only consider reversal/long on strong bounce or reclaim at Monday low

Remain bearish while price is under Monday high

🚨 Risk Warning:

Local trend is bearish — don’t fight structure until reversal is confirmed

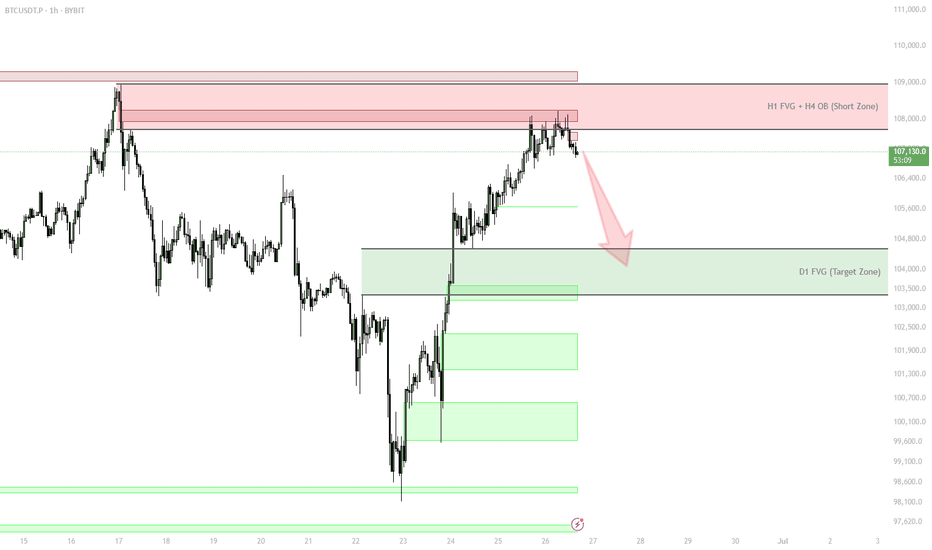

BTC Short from H1 FVG + H4 OB Confluence — Risky Setup✅ Price in strong supply confluence (H1 FVG + H4 OB)

✅ SFP & order block add to short case, but context is choppy

⚠️ Trade is low conviction, manage size and stops accordingly

Short Scenario:

Entry: In $107,500–$108,500 zone (confirmation from SFP/OB)

Target: $104,000–$105,000 (D1 FVG zone)

Stop: Above $108,500 or invalidate on strong reclaim

🔔 Triggers & Confirmations:

Look for reaction (SFP, rejection wicks) in FVG/OB zone before adding

Exit quick if invalidated or strong momentum up

🚨 Risk Warning:

Not a high conviction setup; use smaller position size and stay nimble

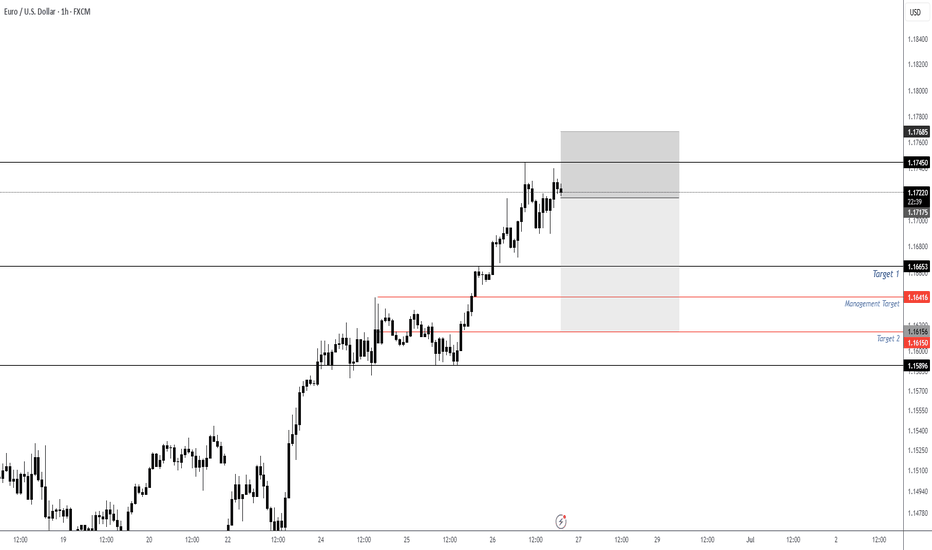

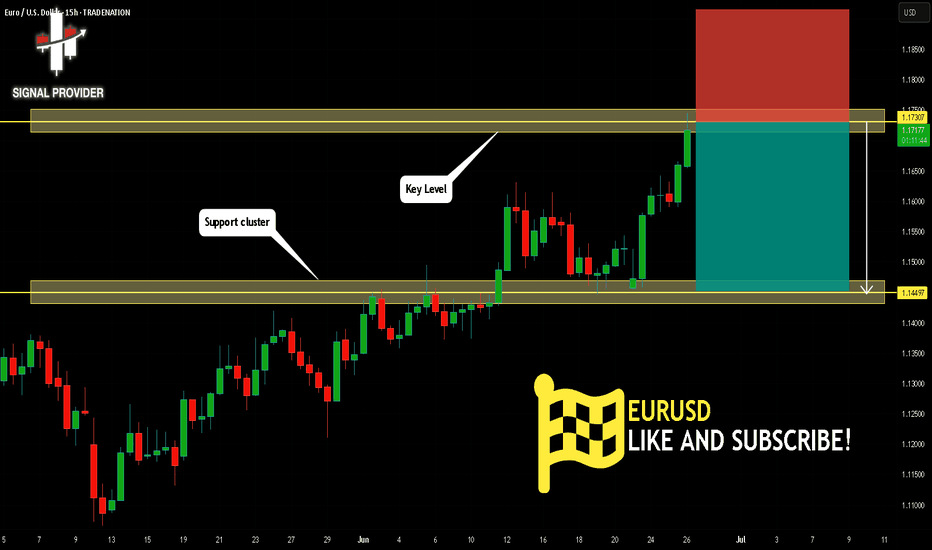

EURUSD Will Move Lower! Short!

Please, check our technical outlook for EURUSD.

Time Frame: 15h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 1.173.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 1.144 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

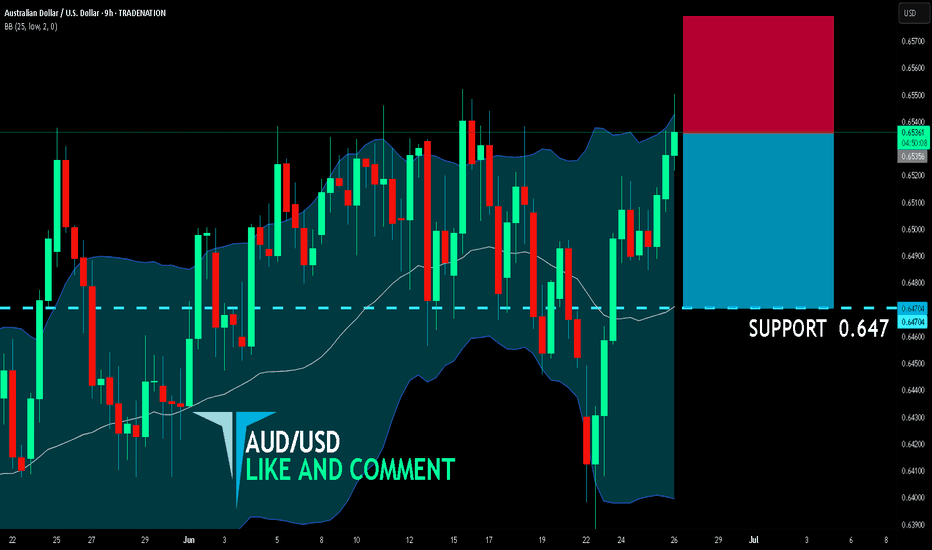

AUD/USD BEARISH BIAS RIGHT NOW| SHORT

AUD/USD SIGNAL

Trade Direction: short

Entry Level: 0.653

Target Level: 0.647

Stop Loss: 0.657

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/USD BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

NZD/USD is trending down which is evident from the red colour of the previous weekly candle. However, the price has locally surged into the overbought territory. Which can be told from its proximity to the BB upper band. Which presents a classical trend following opportunity for a short trade from the resistance line above towards the demand level of 0.983.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

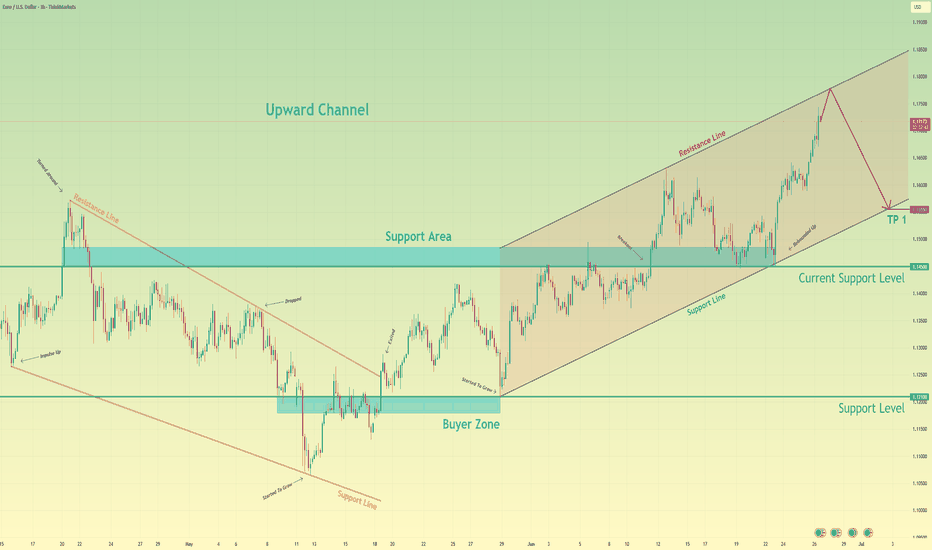

Euro may start to decline to support line of upward channelHello traders, I want share with you my opinion about Euro. Earlier, the price was trading inside a downward wedge, gradually making lower highs and lower lows. After reaching the bottom of the wedge near the buyer zone (1.1210 - 1.1180), we saw a strong bullish impulse that broke through both the resistance line of the wedge and the support area near 1.1450 - 1.1485. This breakout signaled the beginning of a new phase - a transition into an Upward Channel. Since then, the price has been forming higher highs and higher lows, respecting both the upper and lower boundaries of this new structure. Along the way, it has rebounded from the support line multiple times and recently made a strong move up toward the resistance line of the channel. Currently, the price is approaching that resistance line, which may act as a potential reversal area. Given the previous price behavior and the clearly defined channel, I expect the price to reach the top boundary and then start to decline toward the lower support line. That’s why I’ve set my TP 1 at 1.1555 points, which aligns perfectly with the support line of the upward channel. Based on the recent breakout, the structure of the trend, and the reaction from key zones, I remain short-biased for the upcoming sessions. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

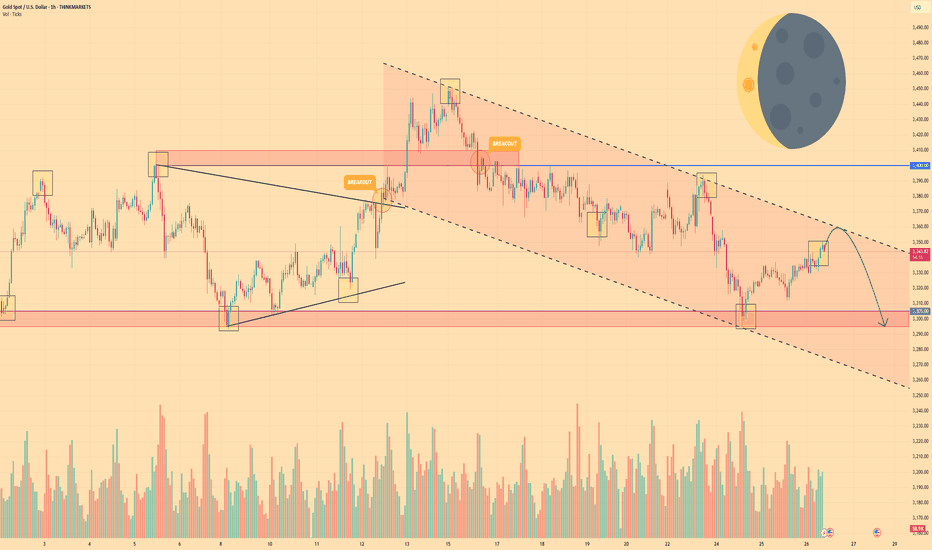

GOLD - Price can continue to move down in falling channelHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Some days ago price bounced from support level and started to grow to $3400 level, making a small correction before.

When it reached this level, price entered to wedge, where it made a correction and then started to grow.

In a short time, price exited from wedge and soon broke $3400 level, but then it started to decline in a falling channel.

In falling channel, Gold broke $3400 level one more time and in a short time declined to $3305 support level.

After this movement, Gold turned around and started to move up to resistance line of channel.

I expect that Gold can reach resistance line of channel and then start to decline to $3295 support area.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

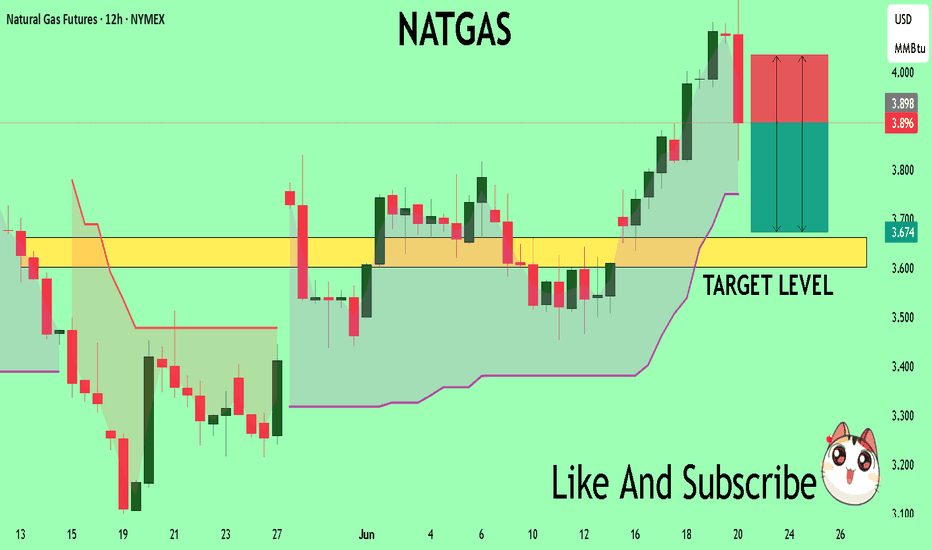

NATGAS Will Collapse! SELL!

My dear friends,

Please, find my technical outlook for NATGAS below:

The instrument tests an important psychological level 3.896

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 3.662

Recommended Stop Loss - 4.034

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

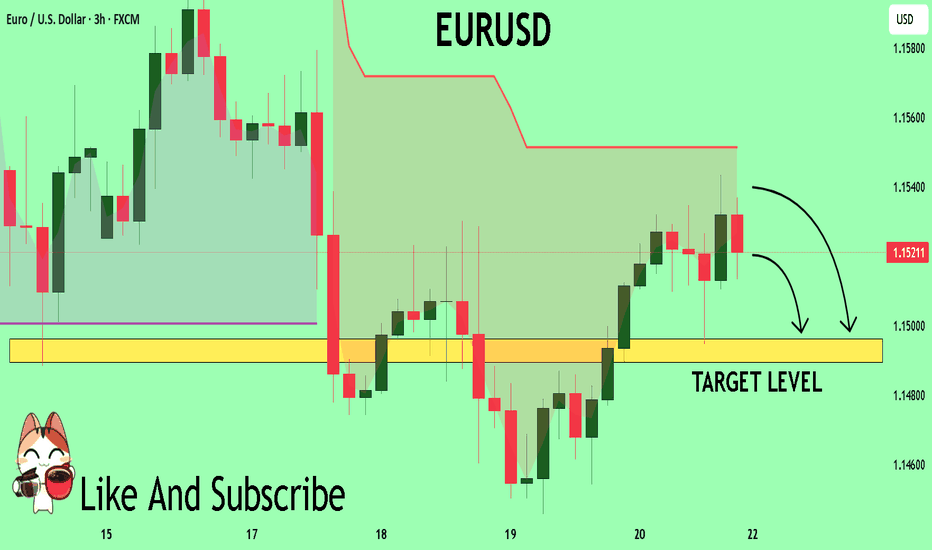

EURUSD Set To Fall! SELL!

My dear subscribers,

My technical analysis for EURUSD is below:

The price is coiling around a solid key level - 1.1521

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.1496

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

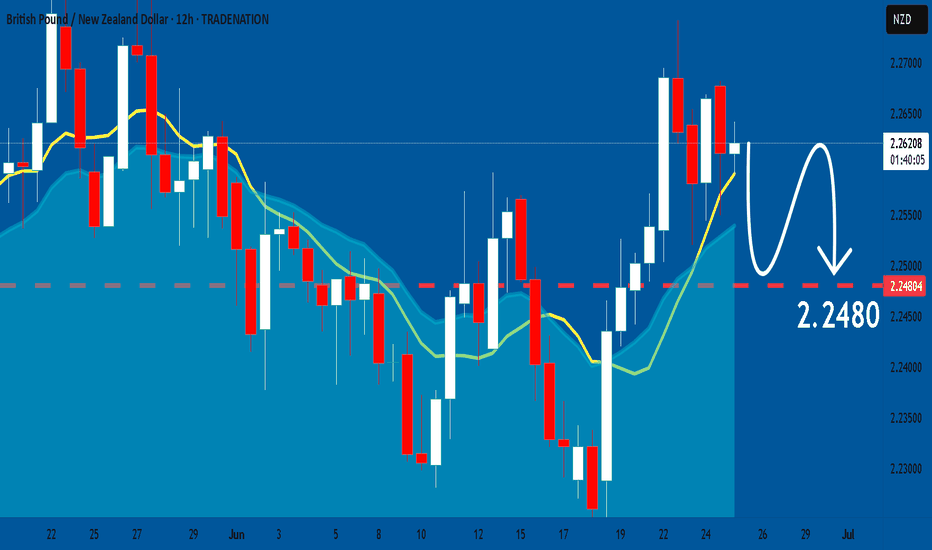

GBPNZD: Forecast & Trading Plan

The price of GBPNZD will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

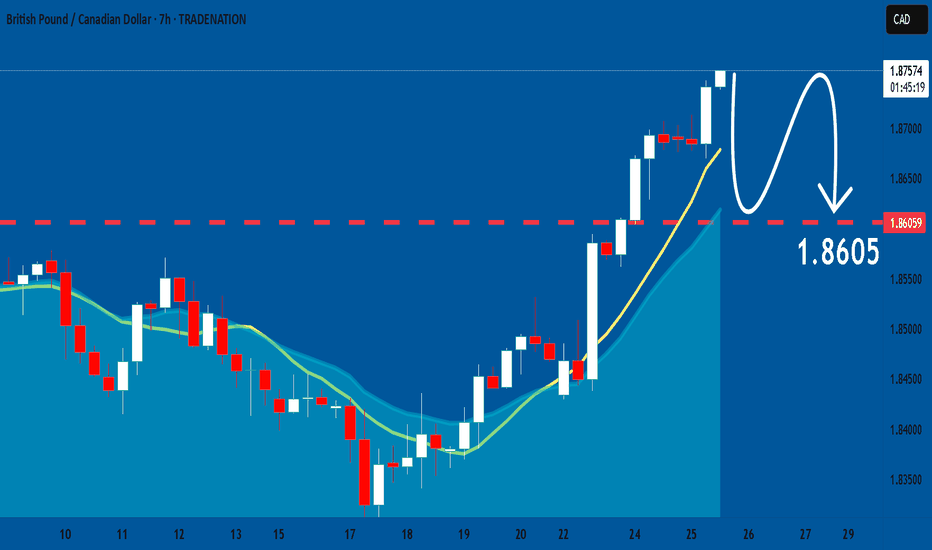

GBPCAD: Bearish Continuation & Short Signal

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to sell GBPCAD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️