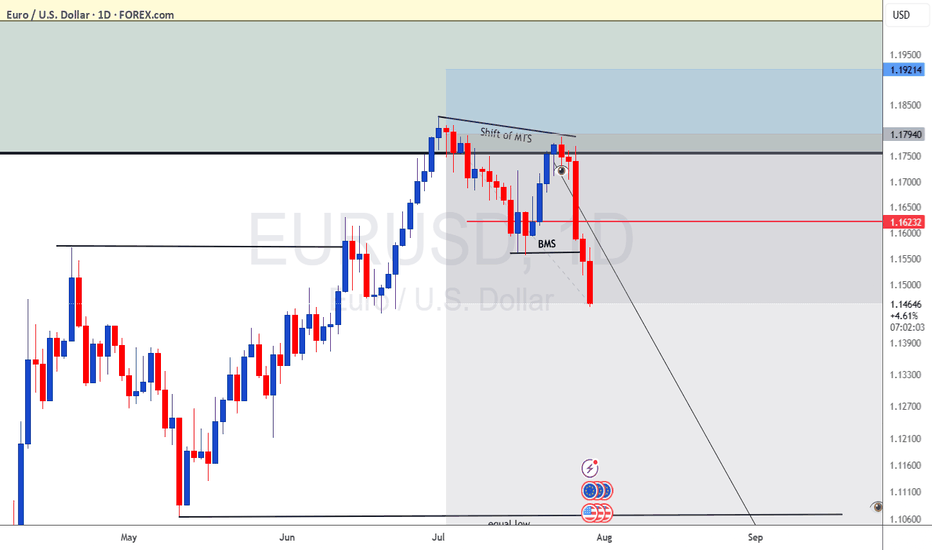

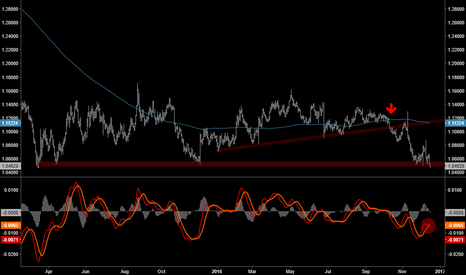

EURUSD DOWN SIDE The dollar index (DXY00) on Tuesday rose by +0.22% and posted a 5-week high. The dollar has carryover support from Monday following the EU-US trade deal that is seen as favoring the US. Also, expectations for the Fed to keep interest rates unchanged at the end of Wednesday's 2-day FOMC meeting are supportive of the dollar. The dollar extended its gains after the US Jun advance goods trade deficit unexpectedly shrank, a supportive factor for Q2 GDP, and after July consumer confidence rose more than expected.

Shorteur

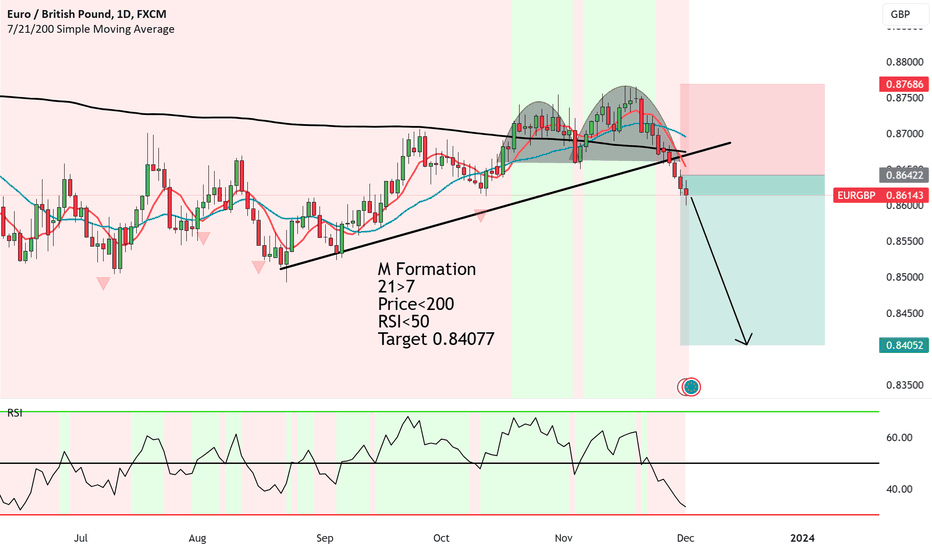

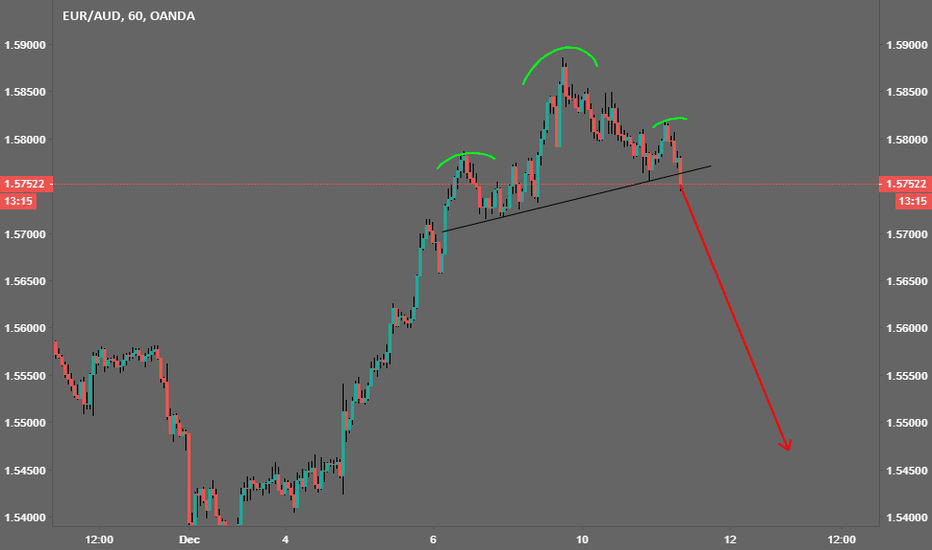

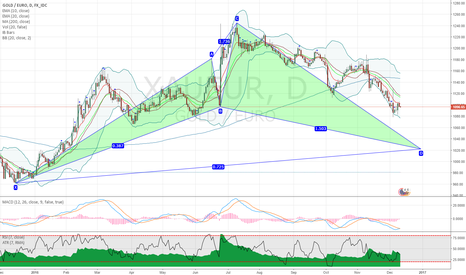

EUR/GBP broken uptrend - Heading to 0.8407M Formation has formed over the last month.

The price also broke below the uptrend, which signalled strong downside to come.

The EUR is not looking good along with other other counterparties.

And we have further downside signals like.

21>7

Price<200

RSI<50

Target 1 will be all the way to 0.8407 which gives this potential trade a Risk to Reward of 1:1.8

EUR/GBP short to retest 15m Lows . 2/18/2020We are making new Lows on the 1hr and we have 4hr Momentum. Price is creating steep LL's and LH's on the 15m. My entry was based off a bear 15m closing past the 15m bull pullback candles. My entry was late. If we are going down then we will probably continue to go down so it's about finding a nice entry with a good SL.

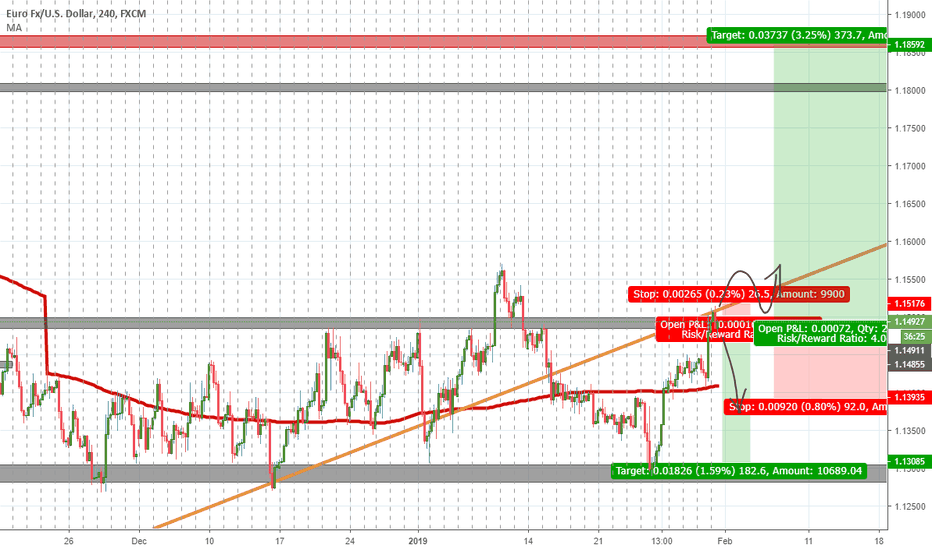

EURUSD going down with 70% probability than up.EURUSD stay on high of flat. Right now it can go down to low flat level - 1.1302. I think - its preferred situation. Near 70% probability.

Or after breakout flat highlevel and retest it - you'll see retest :) - EURUSD can go higher to 1.1859 - 30% probability.

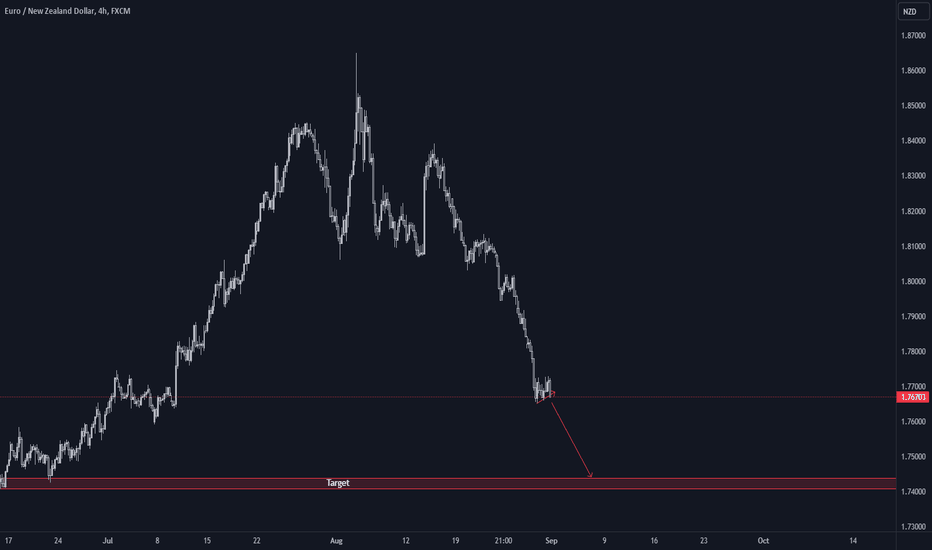

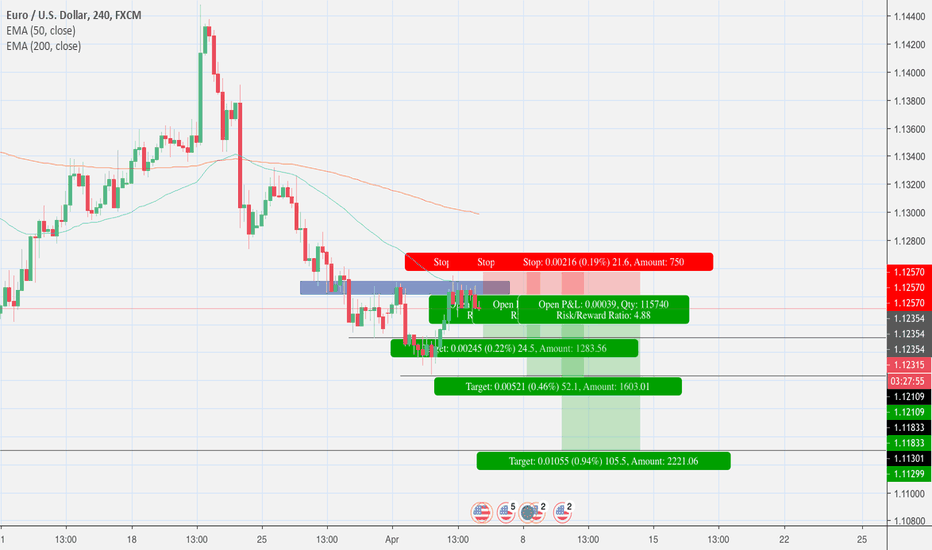

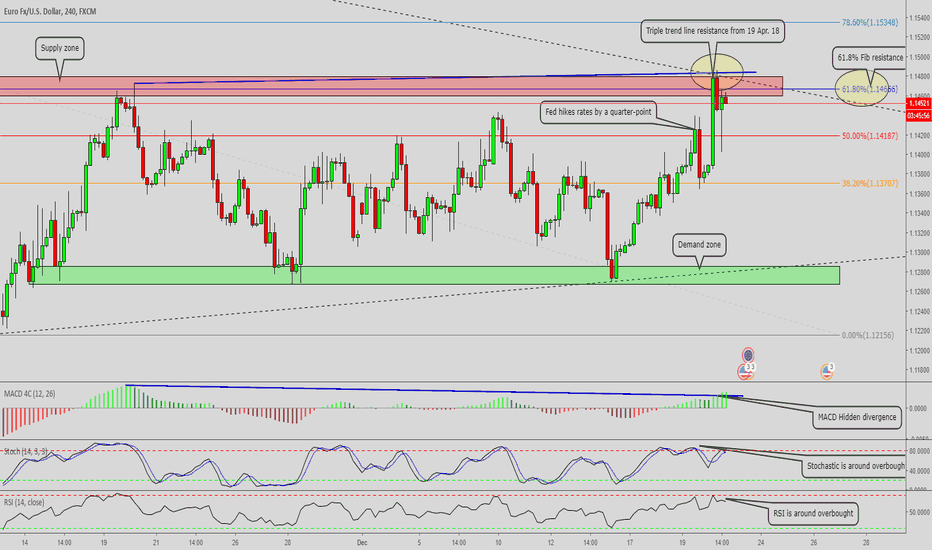

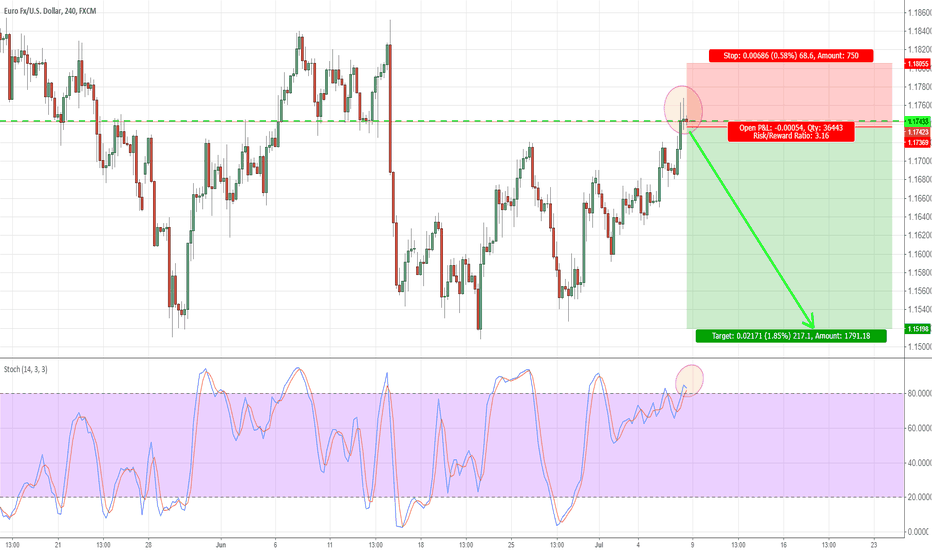

short EUR/USD Fundamentals:- Although there was some weak data from the US last week as a whole the economy is still on the upside. Non Farm payrole figures came in better than expected whilst unemployment creeped back up t 4% from 3.8%. Average hourly earnings also dropped from 0.3% to 0.2%. Over the long term I don't expect this to hold the USD down for any length of time. While on the Euro side it seems that the ECB are reluctant to move forward with interest rates even though the forcast for inflation has risen slightly for 2018/2019.

Technicals:- As you can see from the 4 hour chart the previous support from the 6th - 14th June has now come back into play and is acting as resistance. the overbought signal on the stochastic is also giving sellers some confidence to push the price back down. Keeping the stop loss tight on this one but I would hope for a return to 11500.

sell stop 11736

stop loss 11805

take profit 11520

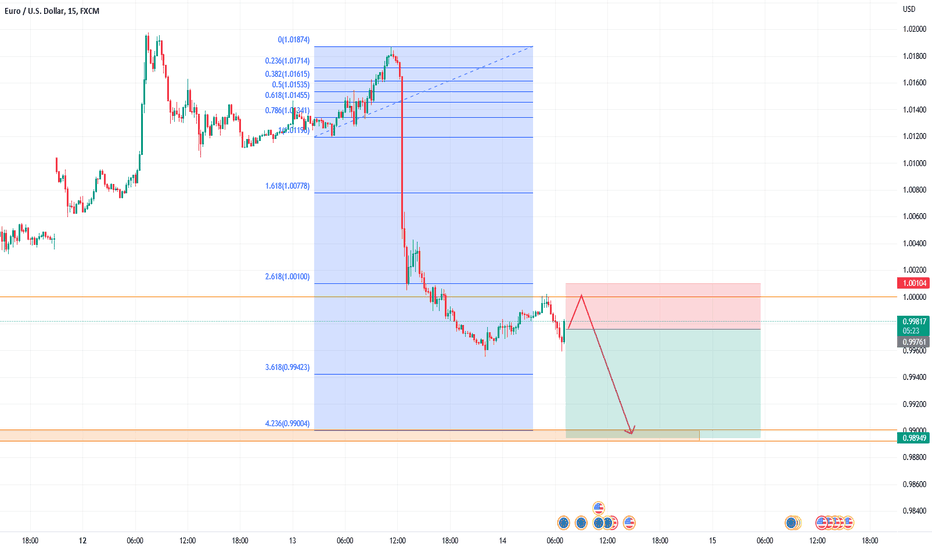

Good sell opportunity with a decent Risk reward ratioA few things here

Broken support line

MACD has just crossed and entered the sell zone, shown by arrow

RSI has a broken pattern as well, indicated by the arrow

To set stop loss level, it is clear there is a strong resistance at around 1.075, as it bounced back down twice from this price, so 1.08 is a safe level

As for the Reward, Fib and previous structures show there is a potential turn around at about 1.05 (also because its a round number as well)

Let me know what you think guys :)

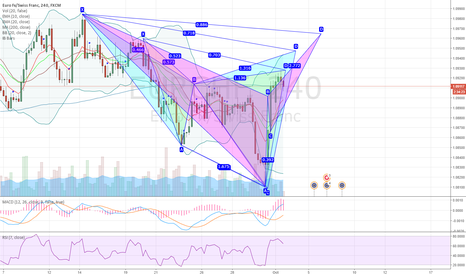

EURJPY 4H Short SetupWe have lots of fun stuff going on here. Price is heading into previous structure and resistance zone which have proven itself several times in the past. We have a bearish gartley just about to reach its D completion - which in turns comes very close to the previous, broken, bullish trendline which also should act as resistance.

Looking at the hourly we've also reached a overbought condition . And to tie things up we have a nice round number in our favor - 114.000. Which also is my entrypoint!

Happy trading!

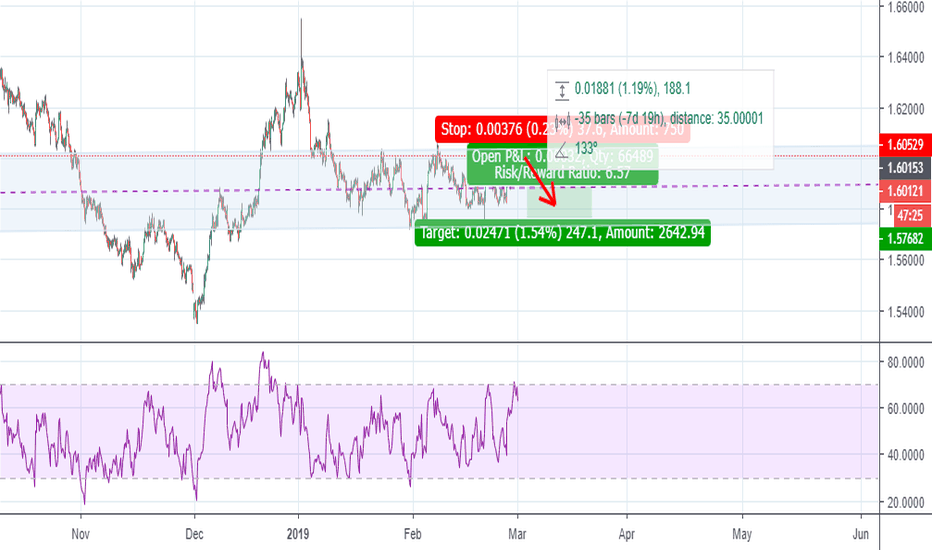

SHORT EURUSD: ECB MEMBER NOWOTNY + DOWNSIDE ECONOMIC REVISIONSECB nowotny reiterated senior member official sentiments regarding the situation with Italian banks unsurprisingly saying people "Should not over dramatise situation regarding Italian Banks". He also hawkish said that the Brexit impact forecasted on the EUROZONE economy would be less than the IMF forecasts. Perhaps the most important sentiment though was that regarding the ECB's APP which is due to end in March 2017 saying "Future path of QE decision to be made in Q4" and "Still open to whether to phase QE purchases out or not" - providing little inferences whether the ECB expects to extend or end their APP. However, one would think, unless the underlying inflation trend was to pick up, certainly there would be an extension/ phase out of QE. A source from social media reported on the matter with more conviction and to the hawkish side saying "Reports Said To See No Current Urgency For QE Action In September".

Nowotny playing his cards close to his chest regarding the future ECB QE path is unsurprising, however, the Social Media Report claims are a little more worrying given they somewhat write off fresh QE action for the ECB's september meeting - something which many banks/ consensus thought would be the case, given the persistently low Euro inflation and hints from ECB minutes/ Draghi that maturity extension would be likely at the September meeting. However, the authenticity/ reliability of the reports has to be considered given the source is social media.

On a more certain note the ECB Polled forecasters posted dovish/ EUR bearish economic outlook figures for EUR, downgrading GDP and inflation readings for 2017 and 18, with 2016 staying unchanged .

Trading strategy:

1. This personally doesnt change my material medium-term short EUR$ 1.1100 trade as the macro headwinds/ future headwinds described in previous posts still go unpriced. Though the short view is weakened slightly IF the above "no QE extension" is true since some of the future EUR$ downside was based on further ECB easing. Though all of which is just speculation, and without any conviction from officials, waiting for the September decision itself seems the smartest thing to do continuing short - especially as forecasted GDP/ Inflation figures have been reduced which is bearish for the EUR and as the USD leg of the trade continues to strengthen as rate hike expectations continue to increase in this risk-on market with Fed Funds Futures Opt Implied probs now trading at 19.5% for Sept, 20.8% Nove and 40% for Dec, up from yesterday at 18.8, 20 an 39.8 - the risk-on bias already started today will likely see these probabilities continue to strengthen until the end of the day.

ECB Member Nowotny Comments:

-ECB's Member Nowotny: "In principle decision from 2nd June not to employ new monetary tools remains true, new uncertainties have emerged."

-ECB's Member Nowotny: Still open on whether QE will be phased out gradually or not

-ECB's Member Nowotny: Future path Decision on QE to be made in Q4

-ECB's Member Nowotny: EZ 2017 Inflation Seen Over 1%, Sees No Acute Danger Of Deflation

-ECB's Nowotny: BREXIT Effect on Eurozone GDP expected to be less than IMF forecast

-ECB's Nowotny: Should not over dramatise situation regarding Italian Banks

ECB Polled Forecasters:

-ECB: Polled Forecasters See Eurozone 2016 HICP at 0.3%, Matching Previous Quarter

-ECB: Forecasters See 2017 HICP at 1.2%, vs 1.3% Seen in 2Q

-ECB: Forecasters See 2018 HICP at 1.5% vs 1.6% Seen in 2Q

-ECB: Forecasters See 2016 GDP Growth at 1.5%, Matching Previous Qtr

-ECB: Forecasters See 2017 GDP Growth at 1.4% vs 1.6% Seen in 2Q

-ECB: Forecasters See 2018 GDP Growth at 1.6% vs 1.7% Seen in 2Q

-ECB: 55% Of Respondents Included Estimate of UK Referendum Impact in Forecasts

*See attached posts for more EUR$ downside fundamentals*