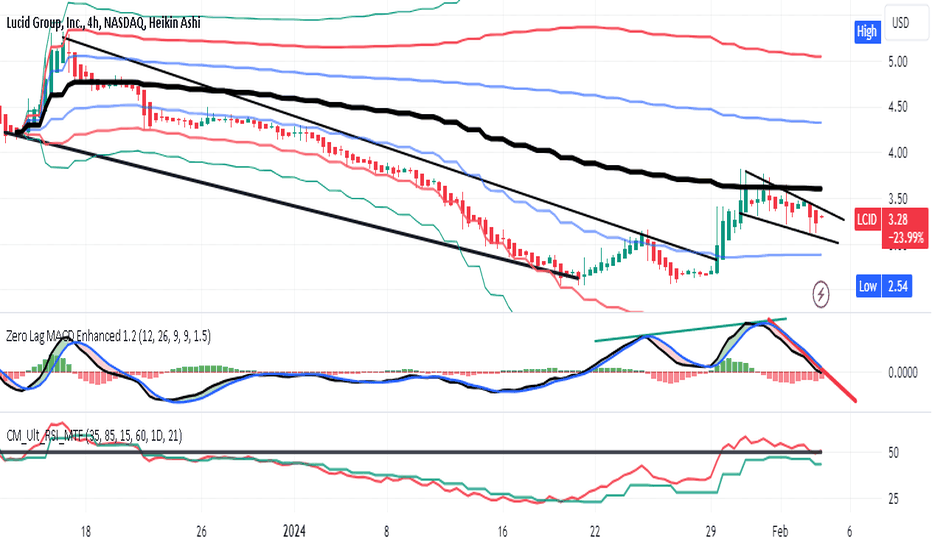

LCID SHORT on VWAP rejecting price rise.In my previous idea of January 29, I bought LCID as it broke out of a falling wedge on news from

Saudi Arabia fixing supply chain and production issues for body parts. LCID ascended the

following day to fall down on rejection from the mean VWAP band line anchored in mid-

December. On the 4H chart, another smaller and more condensed falling wedge is found

and price is moving down toward the one standard deviation line below the mean VWAP ( the

jagged blue line ) which is now horizontal. The last candle is red and narrow bodied. It is near

the top of the channel. Trade plan- I will short LCID here and add to the position each time

price returns to the top of the channel as monitored on a lower time frame such as 15-45

minutes. I will watch for a reversal of the down-trending lines of the zero-lag MACD

and a cross at the bottom. Similarly for the RSI indicator and its green fast and red slow line

in the range of RSI value of 20-35. Likewise, if price rises above the channel in an early

breakout, the trade is over as the downtrend is correcting again. If the price were to break

resistance of the mean VWAP zone, this would represent a break of the down supertrend and

could cause a bit of a short squeeze to get underway. If I see that, I will get into a long

position with more position size as it could become lucrative.