Daily Wave Rider - GBPCHF - SELLGBPCHF

Channel: RED

WK Pivot: RED

AOB: WP

CON: SBB

SELL Stop: 1.10843

Stop Loss: 1.11368

TP01: 1.10318

TP02: 1.09268

DWR present as a sell setup on 18SEP, with Channel and Pivot are red bouncing of weekly pivot.

Trade is taken as we are looking to sell Risk-Off currencies.

SPX500: BUY

DXY: SELL

OIL: SELL

GOLD: BUY

Shorttrade

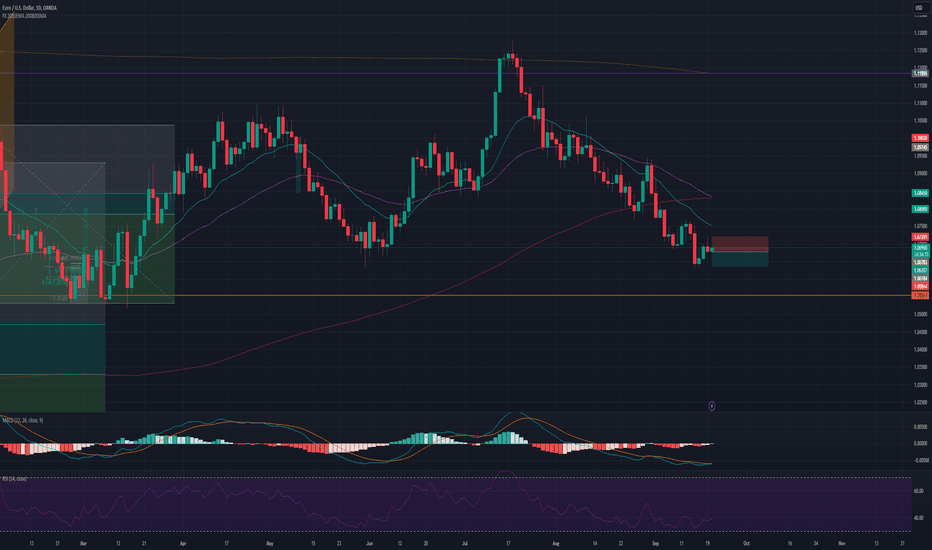

Daily Wave Rider - EURUSD - SELL

EURUSD

Channel: RED

WK Pivot: RED

AOB: EMA10

CON: SBB

SELL Stop: 1.06783

Stop Loss: 1.07209

TP01: 1.06357

DWR present as a sell setup on 18SEP, with Channel and Pivot are red bouncing of EMA10

However, trade is not taken/considered as it is not within our trading rules.

SPX500: BUY

DXY: SELL

OIL: SELL

GOLD: BUY

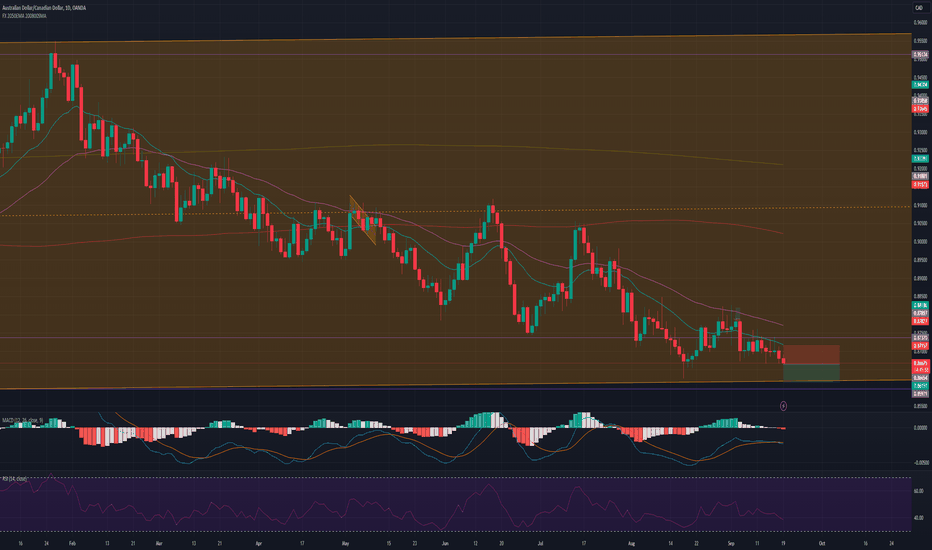

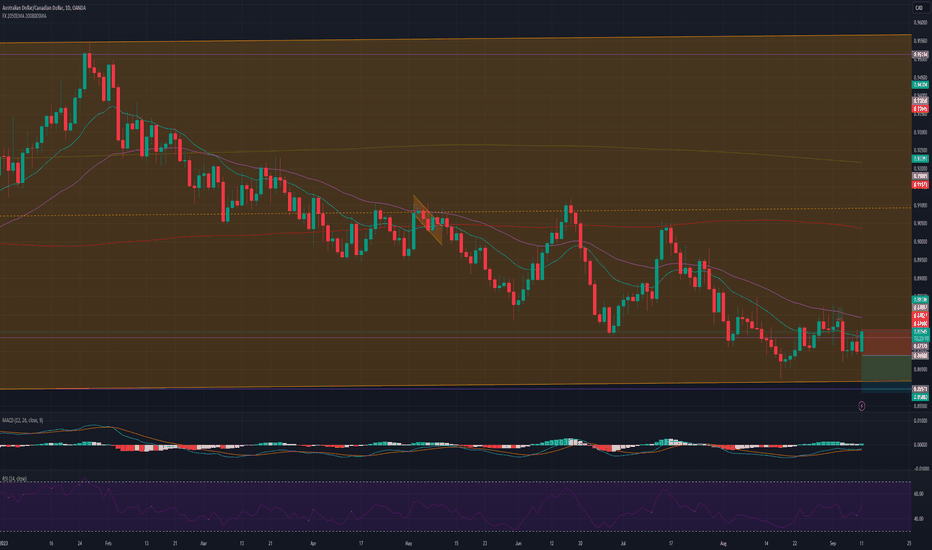

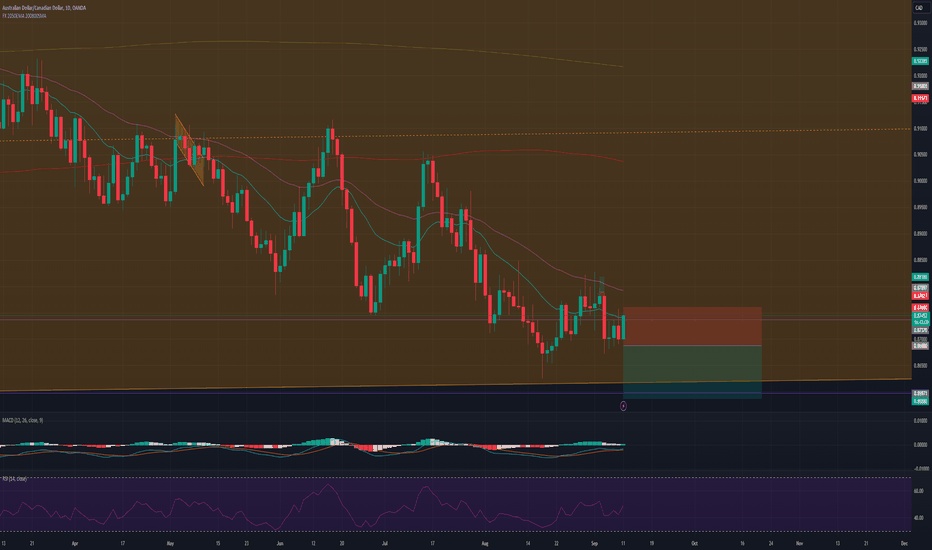

Daily Wave Rider - AUDCAD - SELLAUDCAD

Channel: RED

WK Pivot: RED

AOB: WP

CON: EngB

SELL Stop: 0.86654

Stop Loss: 0.87157

TP01: 0.86151

DWR present as a sell setup on 18SEP, with Channel and Pivot are red bouncing of weekly pivot

However, trade is not taken/considered as it differs from our Market Analysis Bias.

SPX500: BUY

DXY: SELL

OIL: SELL

GOLD: BUY

Reference to our WK38 analysis, we are anticipating a "Risk-On" sentiments thus will BUY AUD/NZD.

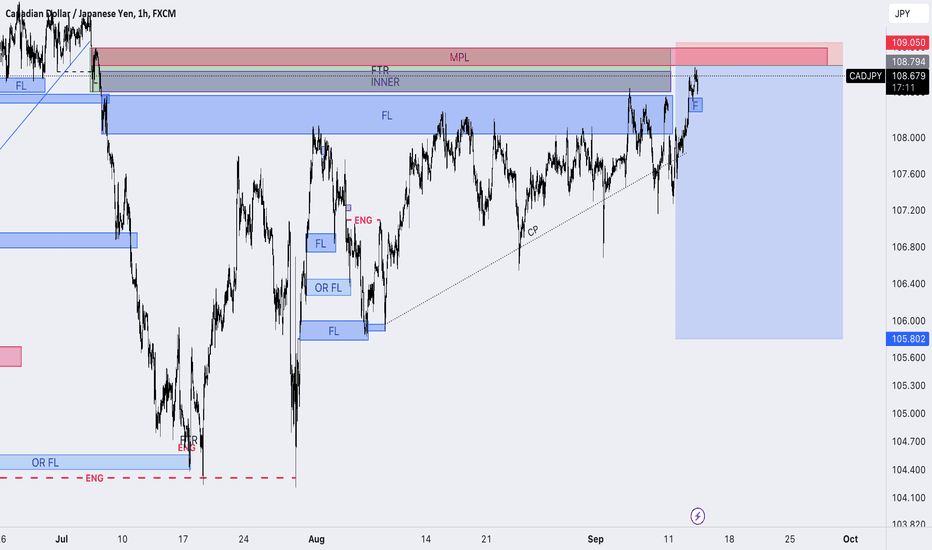

Daily Wave Rider - NZDCAD -SELLNZDCAD

Channel: RED

WK Pivot: RED

AOB: EMA10

CON: SBB

SELL Stop: 0.79689

Stop Loss: 0.80195

TP01: 0.79183

TP02: 0.78171

DWR present as a sell setup on 18SEP, with Channel and Pivot are red bouncing of EMA10

However, trade is not taken/considered as it differs from our Market Analysis Bias.

SPX500: BUY

DXY: SELL

OIL: SELL

GOLD: BUY

Reference to our WK38 analysis, we are anticipating a "Risk-On" sentiments thus will BUY AUD/NZD

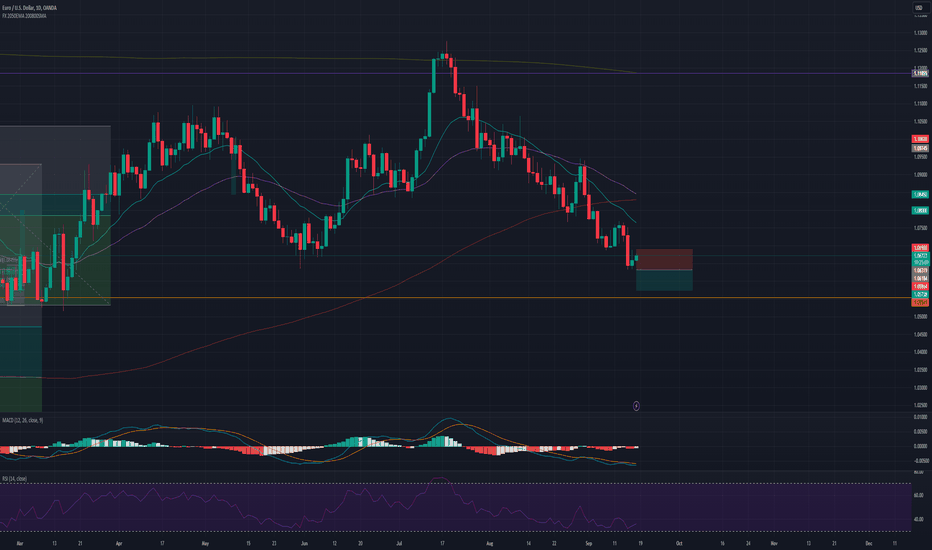

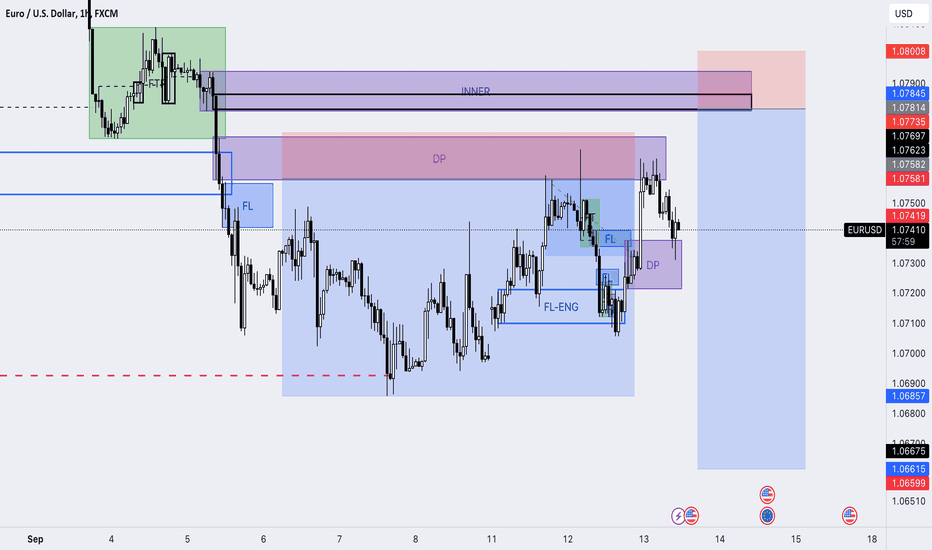

Daily Wave Rider - EURUSD - SELLEURUSD

Channel: RED

WK Pivot: RED

AOB: WP

CON: IB

SELL Stop: 1.06319

Stop Loss: 1.06900

TP01: 1.05738

DWR present as a sell setup on 18SEP, with Channel and Pivot are red bouncing of weekly pivot

However, trade is not taken/considered as it differs from our Market Analysis Bias.

SPX500: BUY

DXY: SELL

OIL: SELL

GOLD: BUY

Reference to our WK38 analysis, we are anticipating a "Risk-On" sentiments thus will BUY USD.

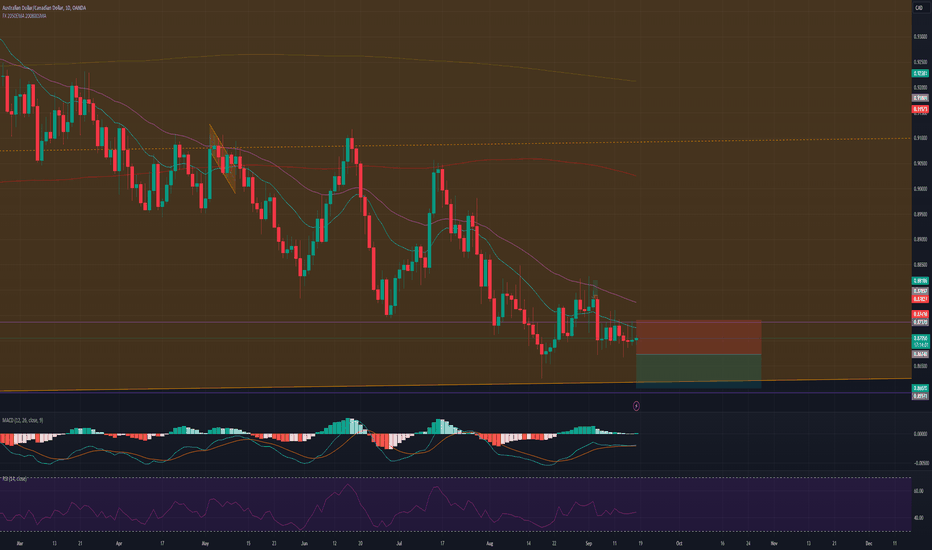

Daily Wave Rider - AUDCAD SELLAUDCAD

Channel: RED

WK Pivot: RED

AOB: WP

CON: SBB

SELL Stop: 0.86740

Stop Loss: 0.87410

TP01: 0.86070

DWR present as a sell setup on 18SEP, with Channel and Pivot are red bouncing off weekly pivot.

However, trade is not taken/considered as it differs from our Market Analysis Bias.

SPX500: BUY

DXY: SELL

OIL: SELL

GOLD: BUY

Reference to our WK38 analysis, we are anticipating a "Risk-On" sentiments thus will BUY AUD/NZD.

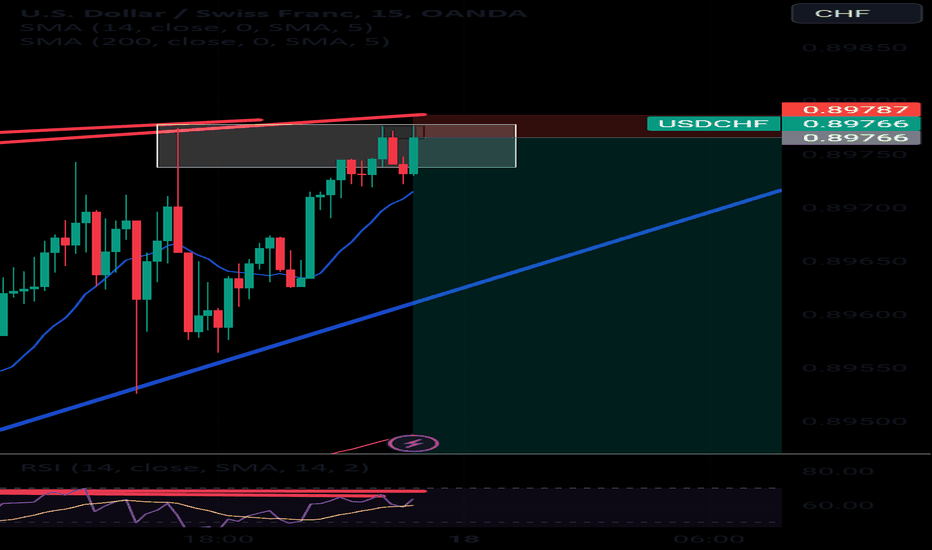

Possible USDCHF ShortThe Swissy is the nearing a resistance around the 0.89939 level that has been tested and proven strong from 17th April 23 to 6th July 23.

The pair is also displaying bearish divergence from the 4 hour to the 5 min chart.

I believe the bears will come into play as soon as Monday pulling the pair down and I intend to be one of those bears with an entry at the open or possibly once the 0.89766 level is breached to the downside . For now we wait to trade what we see.

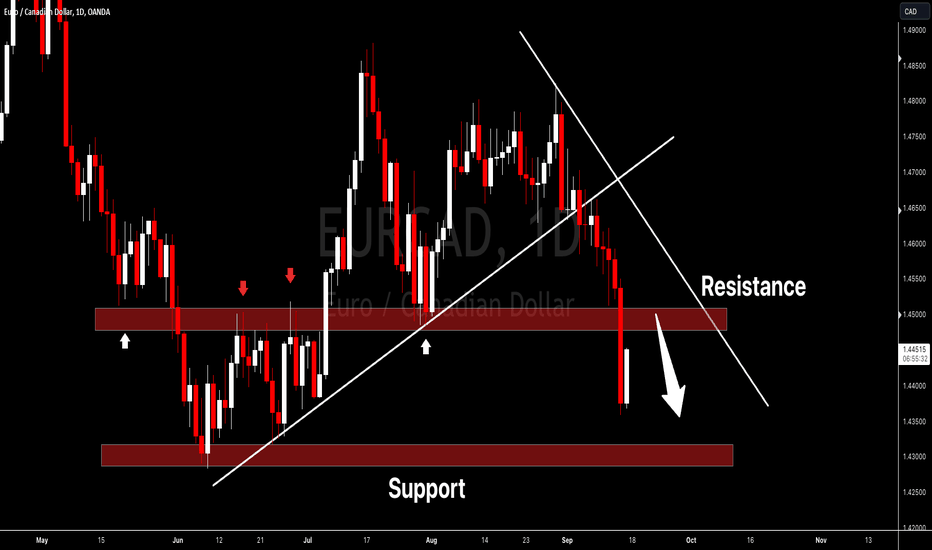

EURCAD I Potential short idea explainedWelcome back! Let me know your thoughts in the comments!

** EURCAD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

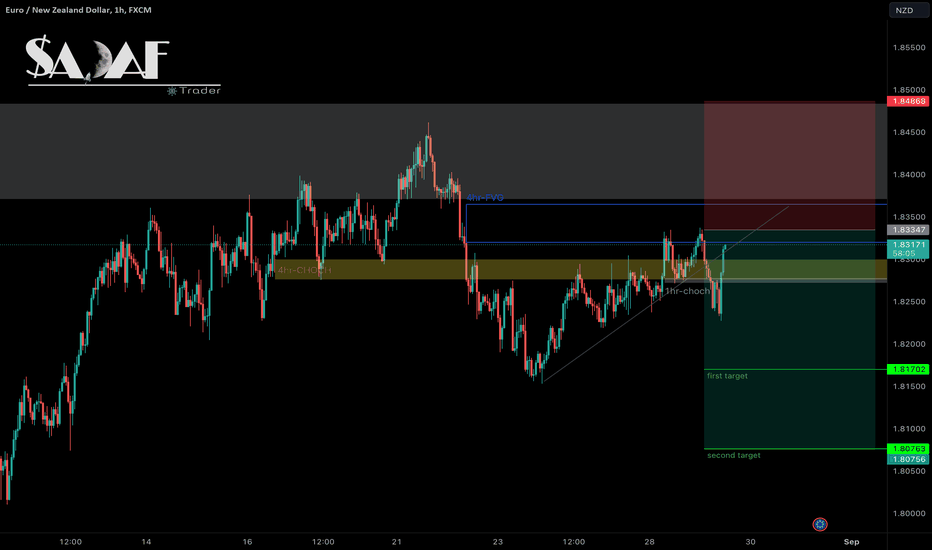

EURNZD SHORThello guys.in 4hr time frame a bearish candle closed under the last low and changed the trend direction/character (CHOCH).

also we have choch in 1hr.and as you we have FVG area in 4hr.

so in pullback we are waiting for confirmation to open sell position.

R:R 1:70

“”your follows and boosts encourage me to publish more analysis””

Risk to Reward Ratio is the key to constant wins at tradingI love writing those articles on my Blog, mainly because I learn from reviewing my trades & secondary for the value it gives back to the trading community.

I been preaching Trading is simple but not easy. It is based on following a winning trade plan. & how do you find such a plan? Try & fail, Try & succeed there is no other way. There is the possibility of a generous soul teaching how a winning strategy & thats what I hope to do in this article. I will share 2 rules

Rule number 1 Always trade the bigger picture.

Find out what the bigger picture chart is doing & trade based on that. In this trade am placing my trade decision in the (W) chart the top chart in white. My bigger picture chart is the monthly (M) not shown. And the chart I use to time my enter & exit is the Day chart (D) below in Black

Rule number 2 Risk to Reward ratio,

This should be rule #1 but I placed it as number 2 to add importance to the rules of trading the bigger picture. Aim for a Risk to Reward ratio of 3 to 5. This means you asses the Risk (how. much money you can loose) before you asses the Reward (how much money you can win).

In this trade, the bigger picture chart (M) is in a downtrend. The trading chart (W) comes into untested Supply Zone (SZ) with a Risk of less than a dollar. I take my SHRT in the red Circle

The reward is 4-5 dollars per share, mostly due to a price free fall zone, with little Demand zone (DZ) to challenge the price. I took profit at two point marked by the red X in the Daily chart.

There are odd enhancers as to why I took this trade, but they are outside the scope of this blog. If you like to learn more about my winning trading strategy that I been practicing for 11 years. Follow my Blog & learn to trade smarter.

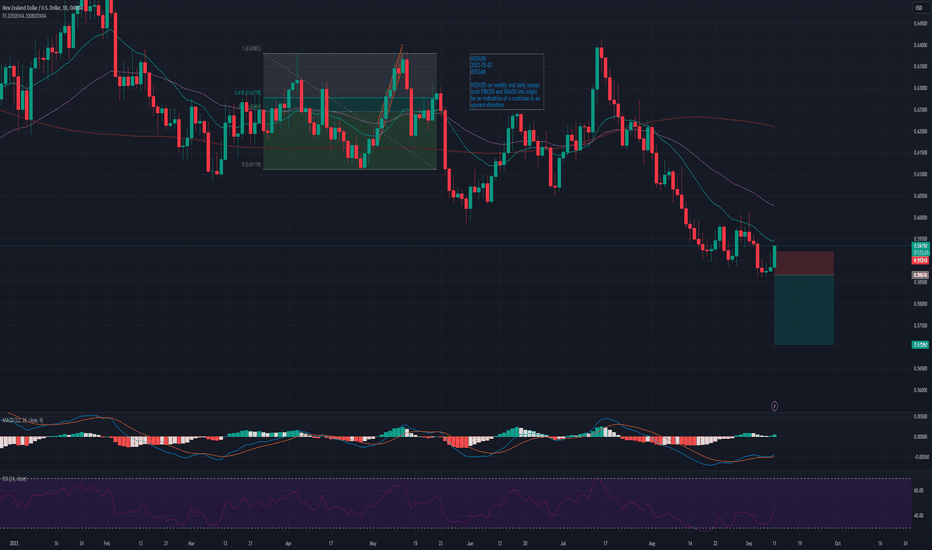

Daily Wave Rider - SELL NZDUSDNZDUSD

Channel: RED

WK Pivot: RED

AOB: 10

CON: SBB

SELL Stop: 0.5867

Stop Loss: 0.5921

TP01: 0.5813

TP02: 0.5705

DWR presents as a sell setup on 11SEP, with Channel and Pivot are red bouncing off SMA 10.

However, trade is not taken/considered as it differs from our Market Analysis Bias.

SPX500: Up

DXY: Down

OIL: Up

GOLD: Up

Reference to our WK37 analysis, we are anticipating a "Risk-On" sentiments thus will BUY AUD/NZD.

Daily Wave Rider - SELL NZDCADNZDCAD

Channel: RED

WK Pivot: RED

AOB: WP

CON: SBB

SELL Stop: 0.8022

Stop Loss: 0.8081

TP01: 0.7963

TP02: 0.7845

DWR presents as a sell setup on 11SEP, with Channel and Pivot are red bouncing off weekly pivot.

However, trade is not taken/considered as it differs from our Market Analysis Bias.

SPX500: Up

DXY: Down

OIL: Up

GOLD: Up

Reference to our WK37 analysis, we are anticipating a "Risk-On" sentiments thus will BUY AUD/NZD.

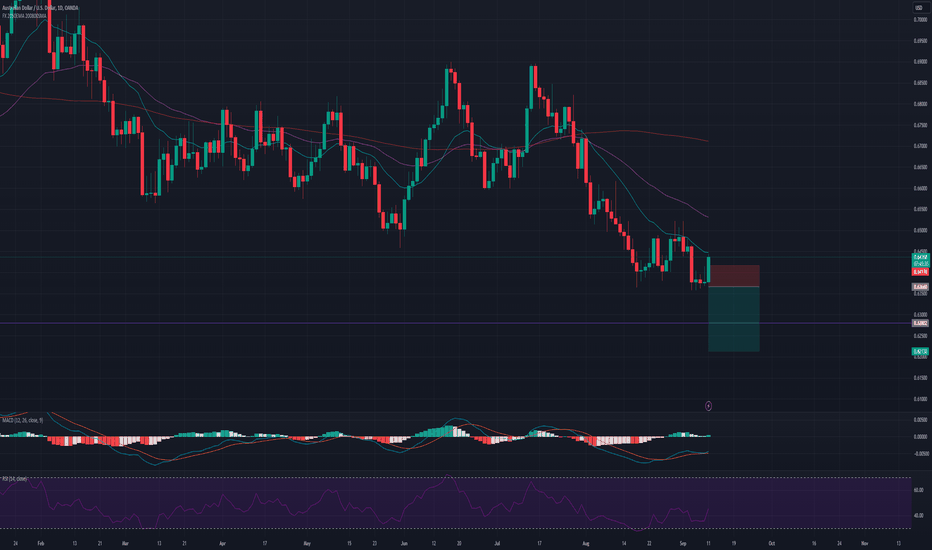

Daily Wave Rider - SELL AUDUSDAUDUSD

Channel: RED

WK Pivot: RED

AOB: WS1

CON: SBB

SELL Stop: 0.6366

Stop Loss: 0.6417

TP01: 0.6315

TP02: 0.6213

DWR presents as a sell setup on 11SEP, with Channel and Pivot are red bouncing off Weekly support 1.

However, trade is not taken/considered as it differs from our Market Analysis Bias.

SPX500: Up

DXY: Down

OIL: Up

GOLD: Up

Reference to our WK37 analysis, we are anticipating a "Risk-On" sentiments thus will BUY AUD/NZD.

Daily Wave Rider - SELL AUDCHFAUDCHF

Channel: RED

WK Pivot: RED

AOB: WP

CON: IB

SELL Stop: 0.5678

Stop Loss: 5711

TP01: 0.55826

TP02: 0.5630

DWR presents as a sell setup on 11SEP, with Channel and Pivot are red bouncing off Weekly pivot.

However, trade is not taken/considered as it differs from our Market Analysis Bias.

SPX500: Up

DXY: Down

OIL: Up

GOLD: Up

Reference to our WK37 analysis, we are anticipating a "Risk-On" sentiments thus will BUY AUD/NZD.

Daily Wave Rider - SELL AUDCADChannel: RED

WK Pivot: RED

AOB: EMA10

CON: SBB

SELL Stop: 0.8688

Stop Loss: 0.8760

TP01: 0.8616

TP02: 0.8588

DWR present as a sell setup on 11SEP, with Channel and Pivot are red bouncing off EMA10.

However, trade is not taken/considered as it differs from our Market Analysis Bias.

SPX500: Up

DXY: Down

OIL: Up

GOLD: Up

Reference to our WK37 analysis, we are anticipating a "Risk-On" sentiments thus will BUY AUD/NZD.

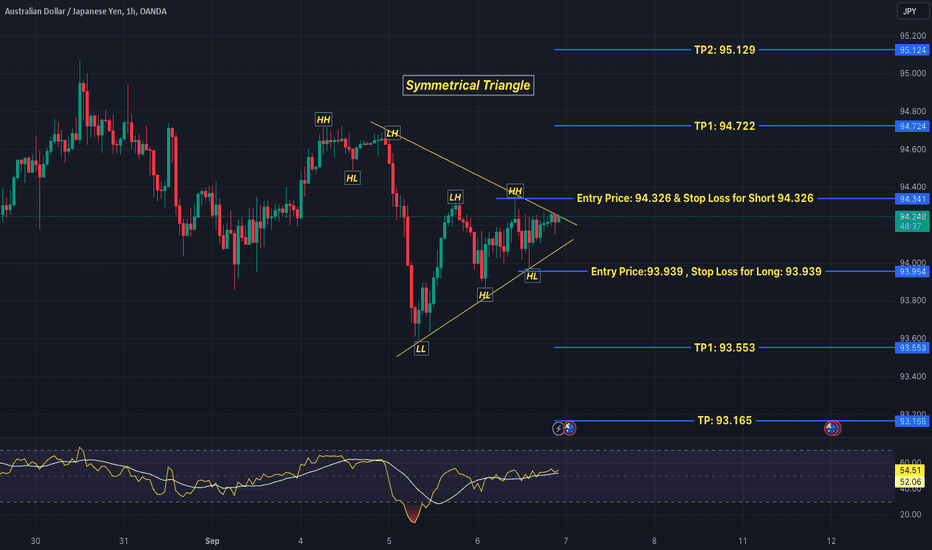

Symmetrical Triangle continuationAUDJPYSymmetrical Triangle continuation Pattern in 1 Hour Chart AUDJPY, its show that might they Break out from this point to Upward Direction, showing bullish Trend. Entry Price & TP1 & TP2 Set Accordingly Stop Loss for Long: 93.939,

For Plan B Entry price is also set for Short Trade might this go from this Point to down ward so we set trade accordingly & Entry Price & Stop Loss for Short Trade is 94.326 also Defined with TP1 & TP2 as well.

Symmetrical Triangle continuation Pattern might take break out both side so we already make plan for the both side trades, once one side trade is active, so cancelled the other side, wait & watch

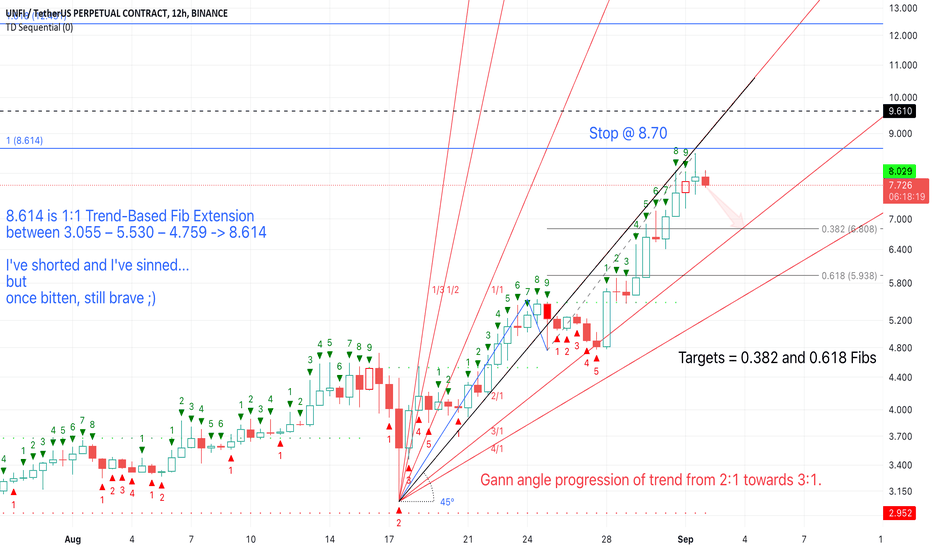

UNFI/USDT I've shorted and I've sinned... but 💪 😎I've shorted and I've sinned...

but

once bitten, still brave ;)

8.614 is 1:1 Trend-Based Fib Extension

between 3.055 – 5.530 – 4.759 -> 8.614

Gann angle progression of trend from 2:1 towards 3:1.

Stop @ 8.70

Targets = 0.382 and 0.618 Fibs, that is 6.81 and 5.94.