Weekly Market Forecast Jan 20-24thThis is an outlook for the week of Jan 20-24

In this video, we will analyze the following FX markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

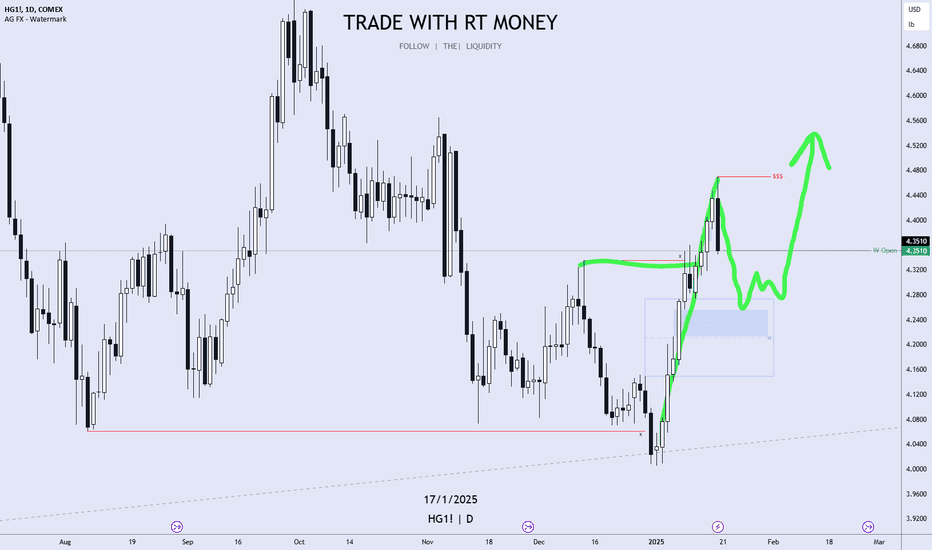

HG | Copper

The indices look set to move higher this week, as Trump is inaugurated Monday, bringing a possible "Trump Pump" to the markets. The metals are a bit mixed, but may continue upward this week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Silver

BRIEFING Week #3 : Peak Stupidity ?Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

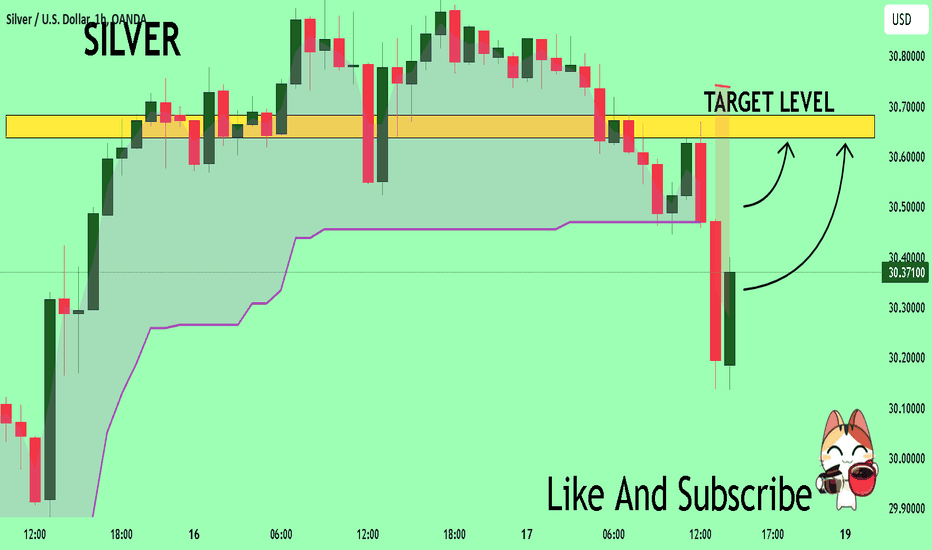

SILVER Trading Opportunity! BUY!

My dear subscribers,

SILVER looks like it will make a good move, and here are the details:

The market is trading on 30.376 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 30.638

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

———————————

WISH YOU ALL LUCK

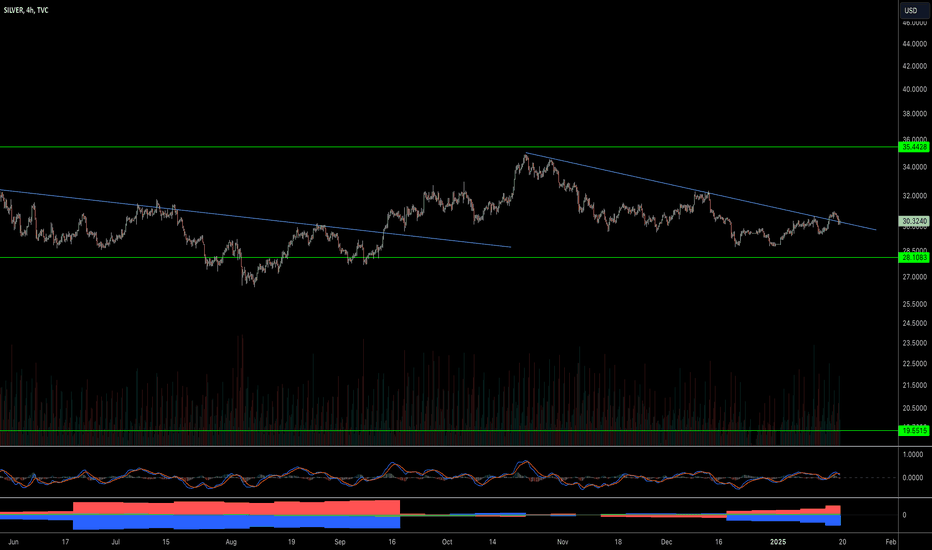

Silver Breakout? or FakeoutMetals look to have tailwinds with bonds finding support (real rates coming off), DXY stabilising, and the incoming trump administration. The charts are constructive with possible early breakouts. If upward momentum continues then price will likely target recent highs and then possibly higher after consolidation or pullback.

Possible risks to trade include resumption of bond decline with rising real rates and USD strength.

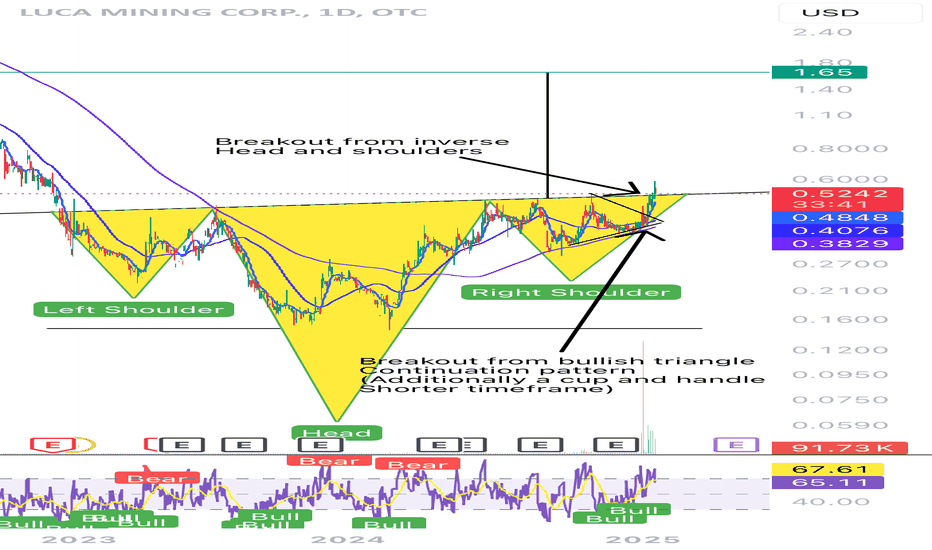

LUCMF Asymmetric Trade PossibilityLuca Mining Corporation high reward:ratio — multi-month swing trade Here we have an asymmetric trade potential on LUCMF. Price has broken a long term downtrend and seems to have been creating a reversal pattern in the form of an inverse head and shoulders, as many silver miners are currently doing. This same pattern is not only present on most miners, but on the silver futures or spot charts themselves, in which silver has already broken out of; seemingly following the exact pattern of gold, in the handle portion of its cup and handle In this sense, it is safe to assume the miners are lagging silver in such a way that silver has been lagging gold — same exact pattern just slightly late to the party — this gives traders a “second chance” at catching the move in which silver is currently completing — in the miners

Long term target: $1.65.

Speculative entry point — any price above .45 in case of a false breakout

Conservative entry point — any price above the neckline breakout level (you can adjust this lower according to your risk tolerance as many smaller cap miners often produce false breakdowns)

I suspect there will be a false breakdown after seemingly confirming the breakout, which may warrant a liberal stop loss according to your personal risk preference

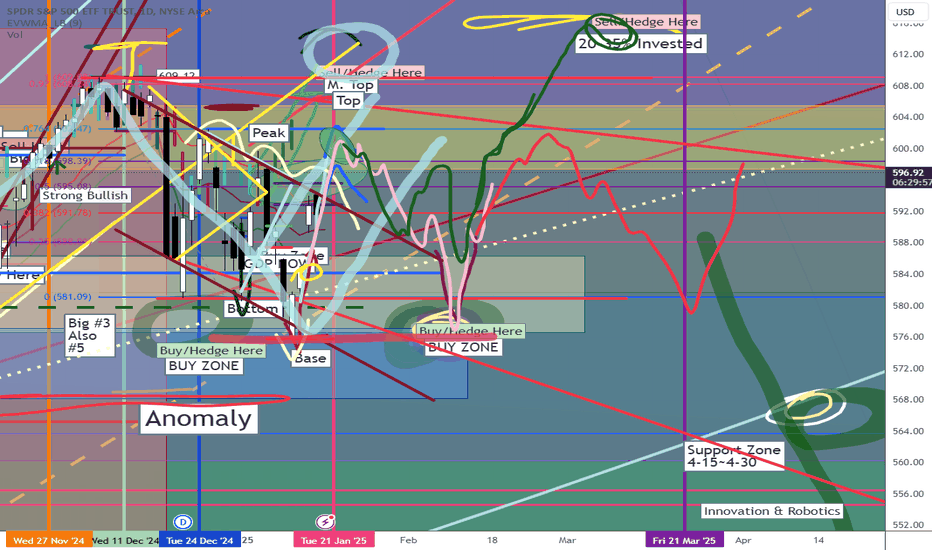

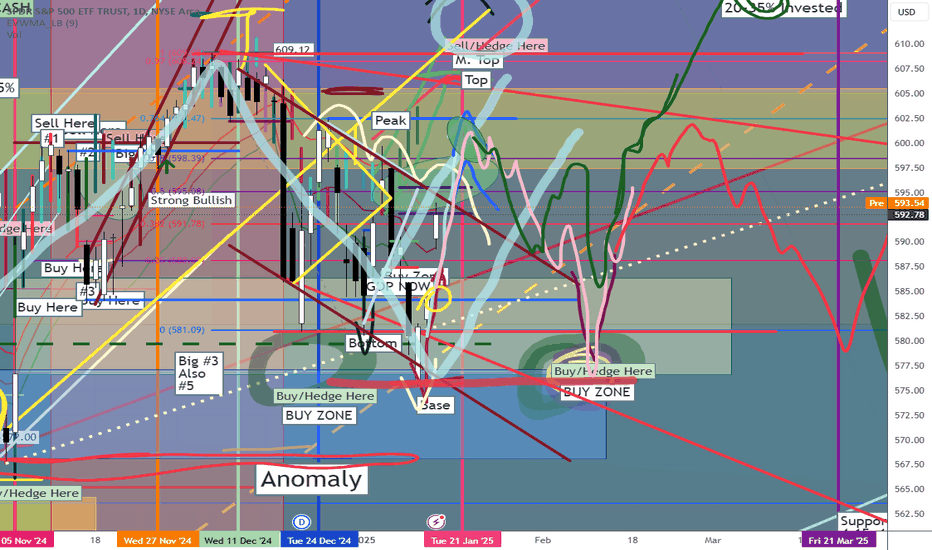

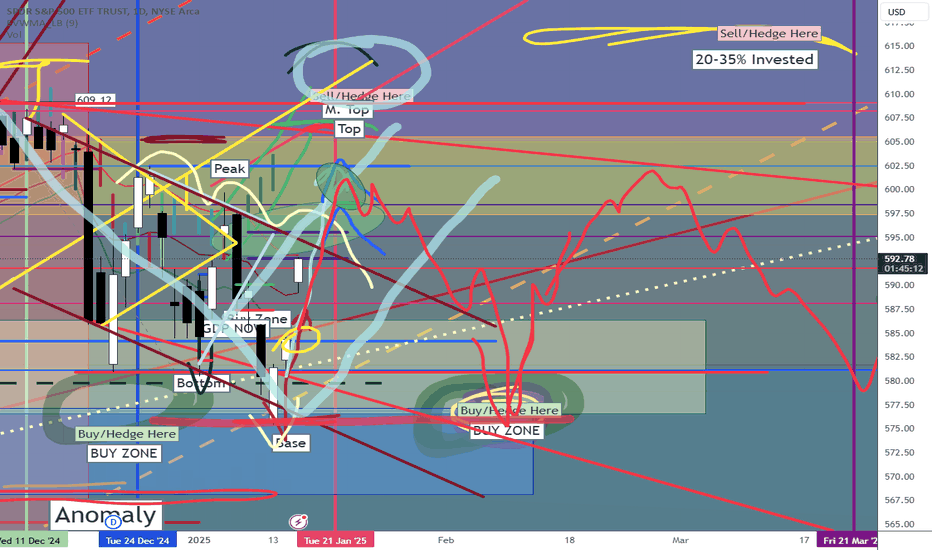

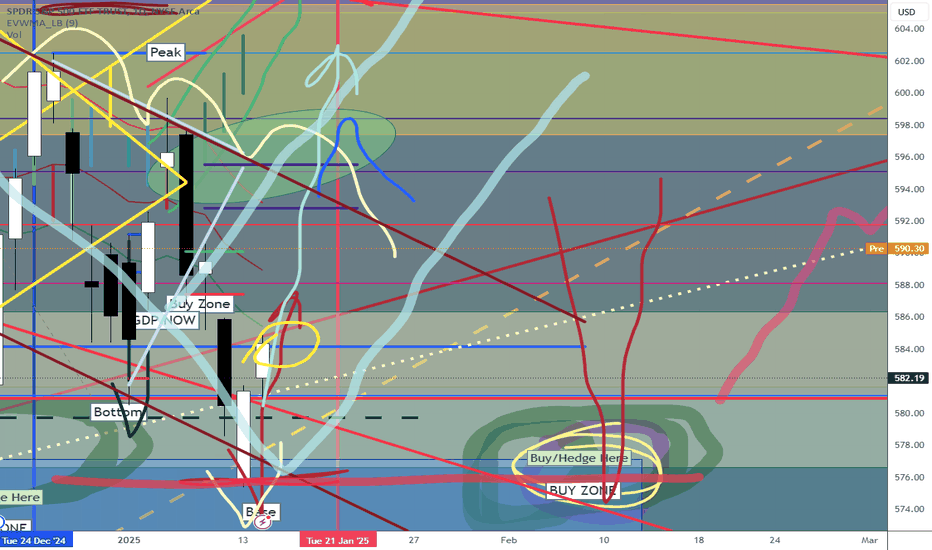

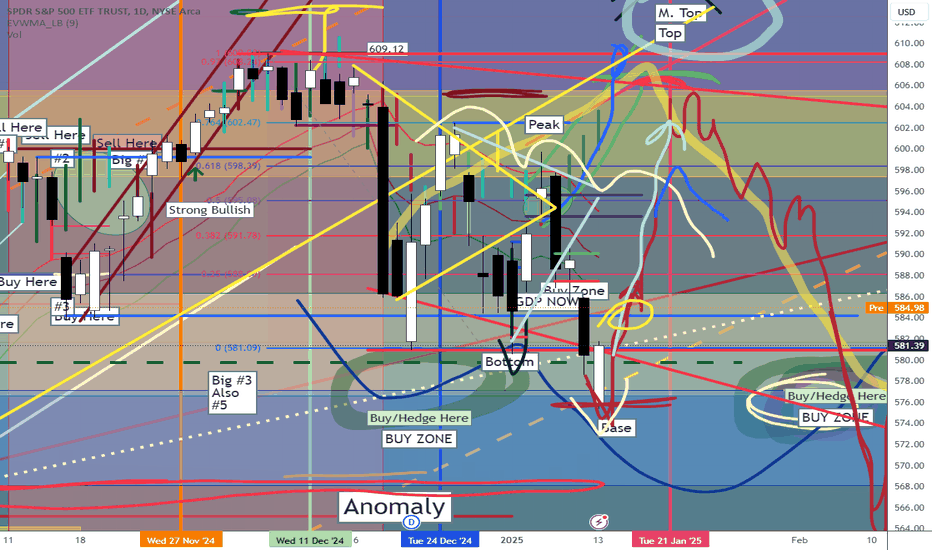

SPY/QQQ Plan Your Trade For 1-17-25 : Gap Up Higher PatternToday's pattern is a Gap Up Higher in Counter Trend mode.

I believe this pattern would have resulted in a Gap Down Lower price trend related to the counter-trend setup. But it looks like the foreign markets drove the SPY/QQQ higher.

The obvious disruption to the SPY Cycle Patterns recently has come from the post-election concerns and the expectations of a broader credit/debt market crisis (which seems to be subsiding).

I believe we have to get past the Inauguration before we'll be able to see if the markets attempt to establish any defined price trend or continue to trade in a sideways price mode.

Gold and Silver are struggling to muscle higher - which I believe is the likely outcome for metals.

BTCUSD has moved back above $100k - but may struggle above the downward-sloping price channel.

Overall, at this point, I would suggest traders pull profits on any trades they have open as we move into the new Trump Administration and a slew of new EOs and new policies that may disrupt the markets.

We are very likely going to see some new price volatility over the next 30+ days.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

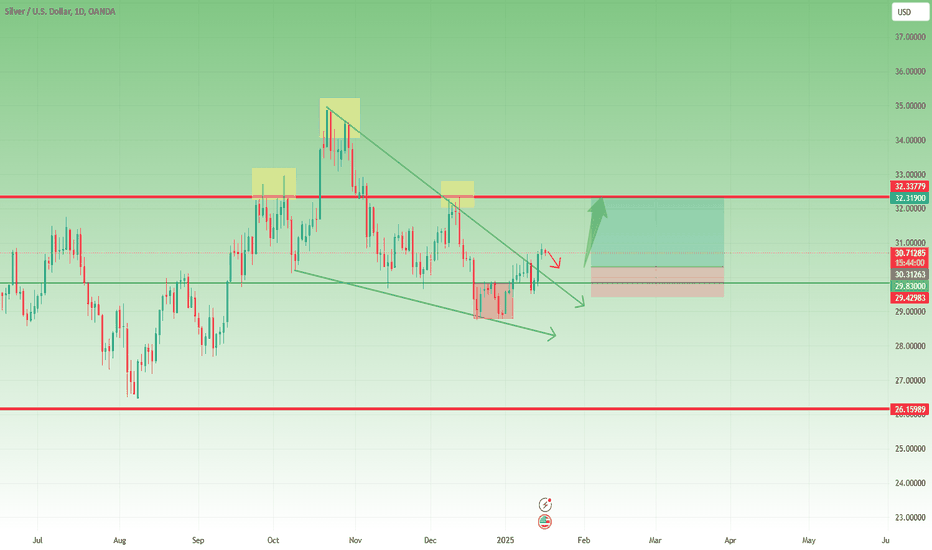

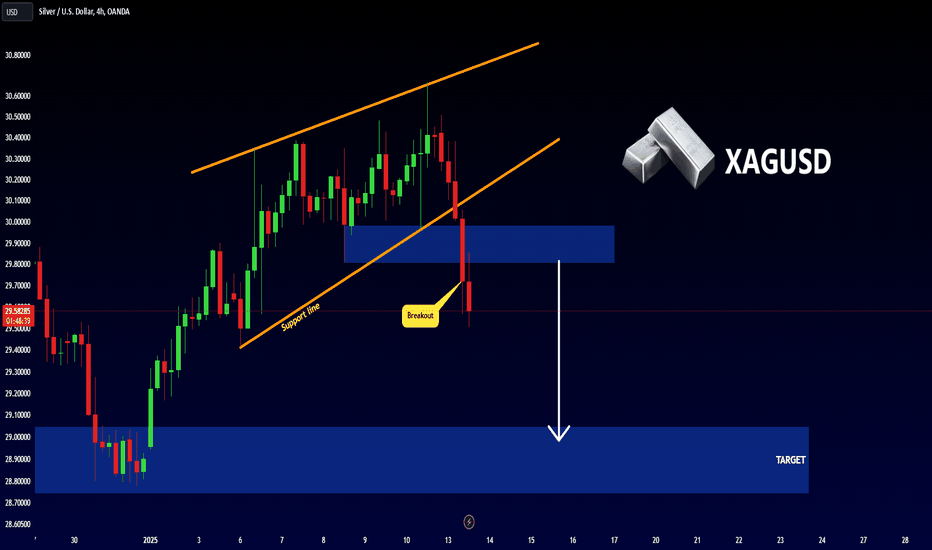

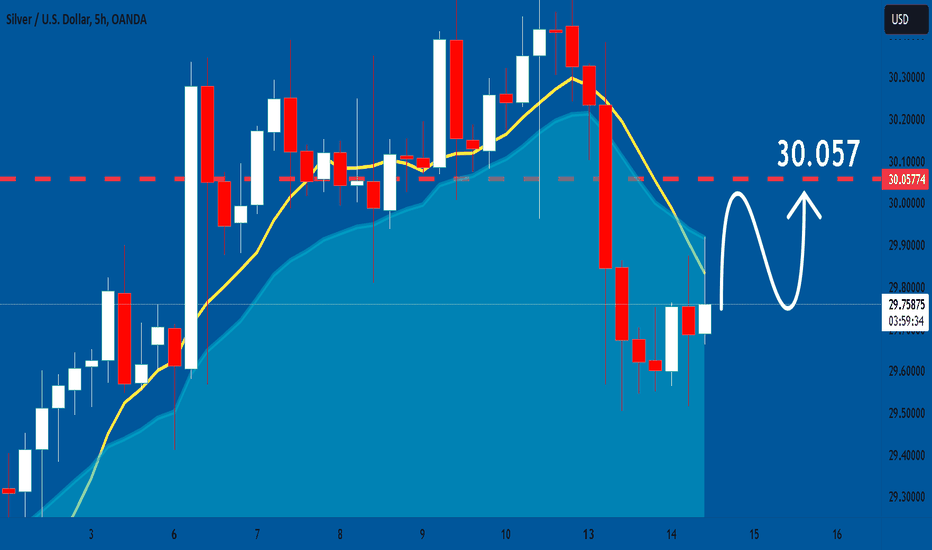

Silver could rise above 32 (1500+ pips target)In my previous analysis on OANDA:XAGUSD , I noted that the lack of bearish continuation following the break below the 30 level suggested a high likelihood of a false breakout.

I anticipated that the price would most likely reverse to the upside, and this scenario has played out as expected.

After breaking back above the 30 level and successfully retesting it, XAG/USD is now holding steadily above this important support.

Additionally, the price has broken out of the falling wedge pattern by moving above the descending trendline.

The morning star candlestick formation observed two days ago further reinforces the bullish outlook.

Adding to the positive sentiment, a strong close today could result in a continuation pin bar on the weekly chart, further supporting upward momentum.

In conclusion, the strategy remains to buy on dips, with an ideal entry around 30.30 and a target at the technical resistance above 32.

Silver (XAGUSD): Position Update and New TargetsBack in October 2024, we successfully closed our second position at the exact top of wave 3, capturing the peak before XAGUSD dropped by 17%. We’re still holding our first setup, which remains open with the stop loss set at break-even.

We believe the bottom of wave 4 was established around $29, and the chart now points towards a move higher into wave 5. Our focus is on a continuation above the Point of Control (POC) into the $31.35–$32.90 range. At that point, we’ll look for an entry during the pullback (wave (iv)).

Alerts are set, and we’re ready to capitalise when the opportunity arises.

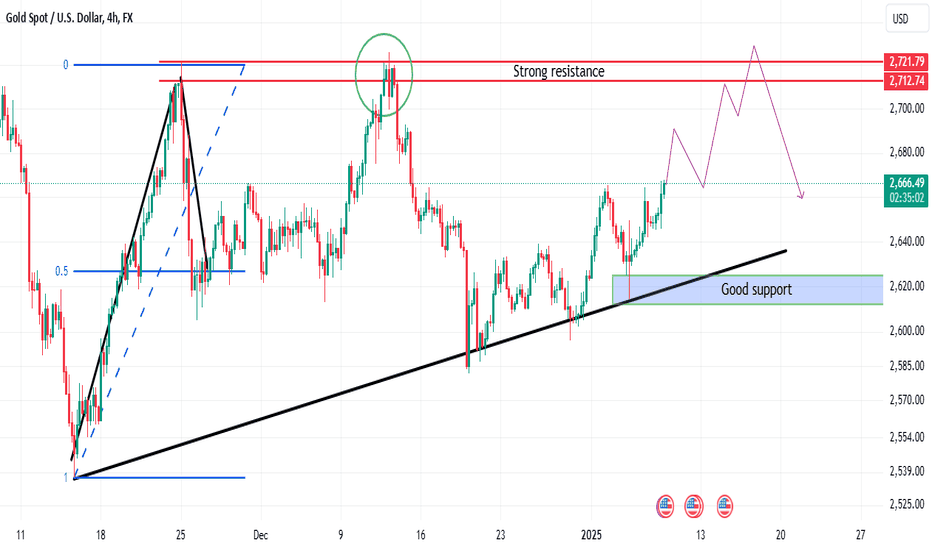

Analysis of gold review in simple languageHello guys

We came with gold analysis.

We have two scenarios:

1_ According to the upward trend, let the price reach the resistance range and maintain the range from there to open a sell transaction.

2- Let the price reach the support range and open the purchase transaction while maintaining the range.

In our opinion, the first scenario is more tolerant.

*Trade safely with us*

SPY/QQQ Plan Your Trade For 1-16 : Momentum Rally PatternToday's pattern suggests the markets will continue a rally phase - trending on the momentum from yesterday. It is likely the SPY/QQQ will attempt to rally and break away from the downward-sloping price channel I show on my charts.

Remember, my broader cycle pattern research suggests the SPY/QQQ will attempt to rally into Jan 20-23, then peak and roll downward/sideways into a Feb 9-10 V-Bottom pattern.

As I highlight in this video, the markets appear to be moving into a consolidation phase within the current downward-sloping price channel. I'm watching to see if the new Trump administration brings a BUMP (like last time) that breaks the US markets away from this consolidation trend.

Remember, the data on the US economy and earnings continues to be strong. A Trump-Bump will likely happen again, pushing the US markets into even greater dominance as the 900-lb Gorilla compared to other global economies.

However, until global central banks can move their economies to become more independent of US economic demand and imports, the process of working through the excesses of the COVID/Spending-spree administration (Biden) will continue as long as wealth in the US goes unchallenged (by some crisis or economic event).

So, again, expect the 900lb Gorilla to continue to dominate while there is no major crisis event in the future.

Gold and Silver should rally today on a RALLY pattern as well.

I believe BTCUSD is struggling to find support and may move downward over the next 10+ days.

We'll see what happens.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

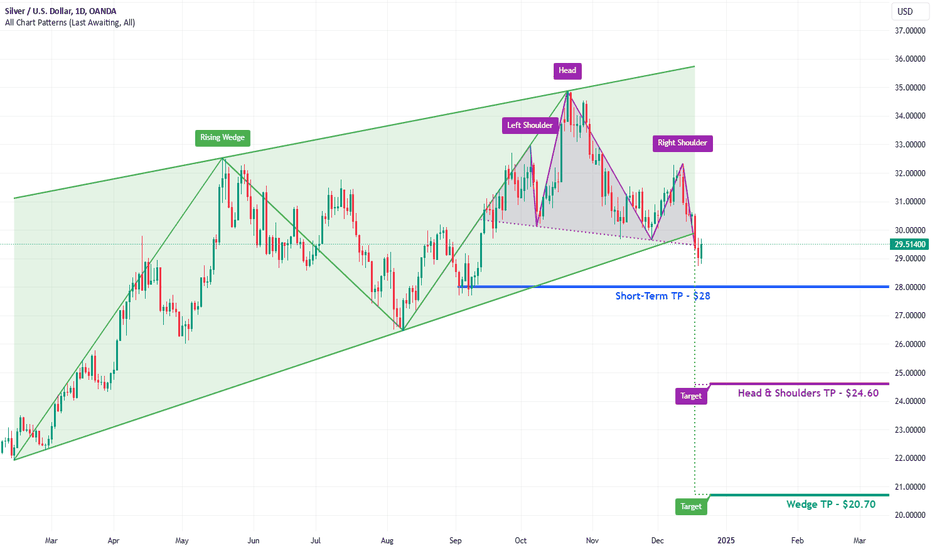

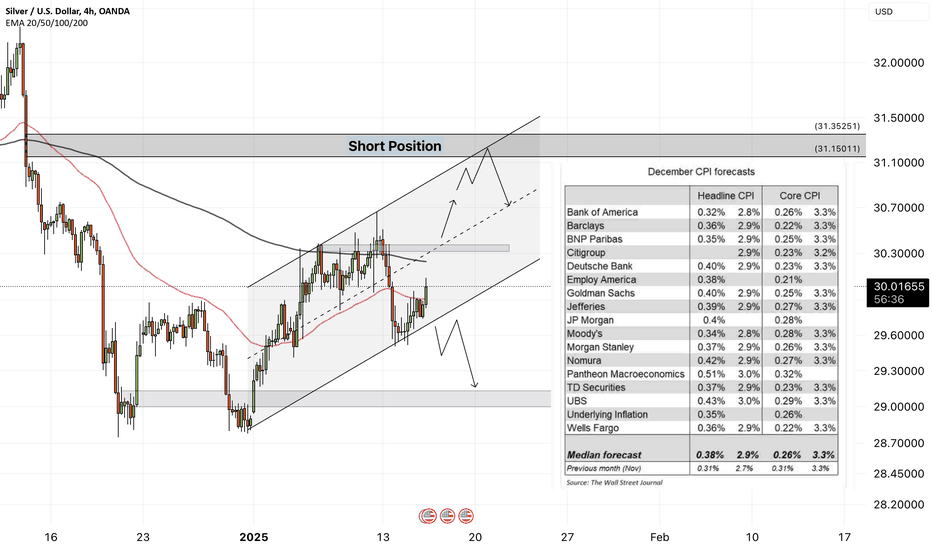

XAGUSD Silver BEARISH - Head & Shoulders and Wedge BreakSilver has two patterns on the Daily TF that indicate a bearish direction ahead.

There is a complete Head & Shoulders pattern and also a Rising Wedge pattern that has been broke. Silver (XAGUSD) has recently had a bullish retracement to re-test both patterns and should start falling soon.

Short-Term TP = $28

Long-Term TP (from Head & Shoulders) = $24.60

Long-Term TP (from Wedge) = $20.70

I expect the short-term TP to be hit at least. The longer-term TP's may or may not be reached. What will probably happen is that the Head & Shoulders target will be reached and Silver will hold up around the $25 level.

NOTE : I personally love Silver and think it's a great long-term investment. I also consider it a highly manipulated market. I am bearish now based solely on the chart, but keep in mind that anything can happen with Silver!

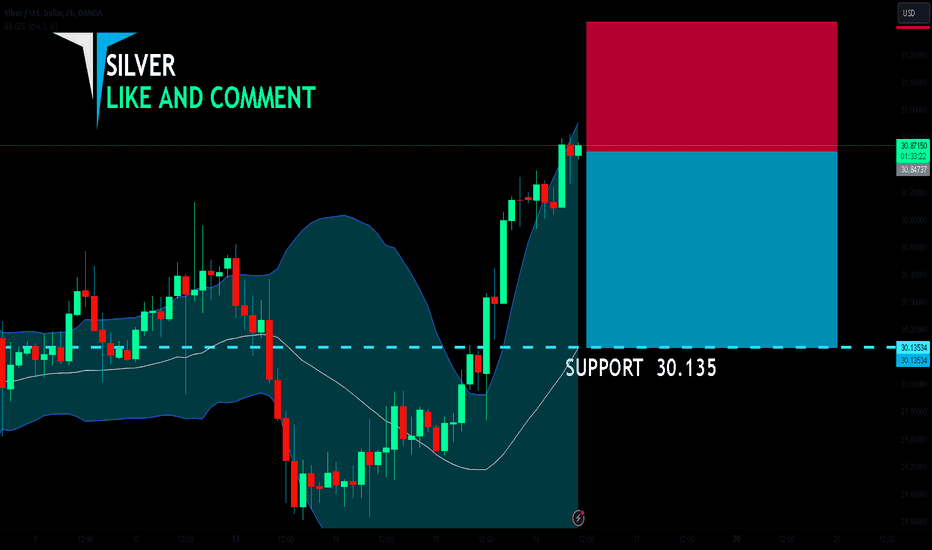

SILVER BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

SILVER pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 2H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 30.135 area.

✅LIKE AND COMMENT MY IDEAS✅

Silver H4 | Pullback resistance at 61.8% Fibonacci retracementSilver (XAG/USD) is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 30.966 which is a pullback resistance that aligns with the 61.8% Fibonacci retracement level.

Stop loss is at 31.70 which is a level that sits above the 78.6% Fibonacci retracement and an overlap resistance.

Take profit is at 29.54 which is a swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Forecast UPDATES! Jan 15, WedIn this video, we will update the forecasts for the following markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

HG | Copper

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

SPY/QQQ Plan Your Trade 1-15 Followup: Rally Into Jan 20-23This video was started to highlight the incredible predictive capabilities of my SPY Cycle Patterns and longer-term Cycle Research.

It seems almost impossible to be able to somewhat accurately predict future price moves - but I'm able to do it with moderate success - sometimes months and years into the future.

What does that mean to you - well, it should mean you want to pay attention to my research/videos and learn how to take advantage of my continued research.

This video highlights why the Doom-sayers are wrong. The markets will continue to trend upward until the 2030-2033 peak. That's when traders need to be prepared for a broad market downtrend.

But, it sure is fun getting emails and announcements from all the people that are now calling for a "great reset" to take place.

It may happen in certain countries, but this is a market of economies - not a single economic market. What happens in some countries does not always happen to all countries.

As the old saying goes - this is a market of stocks, not a stock market.

Get ready - the next 5+ years should be full of incredible opportunities for skilled traders.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

SPY/QQQ Plan Your Trade For 1-15 : Inside BreakawayToday is going to be a very interesting day.

Mortgage data came in very strong, while CPI data came in moderately weaker. That is setting up a very strong GAP RALLY phase in the markets.

Shorts are going to get SQUEEZED HARD this morning, and I suspect we may see a carry-through rally lasting most of the day.

Be cautious of a pullback after the big GAP opening (higher) this morning.

Gold and Silver are attempting to move higher - which is perfect if the US Dollar weakens moderately. Overall, Gold and Silver are attempting to hedge risk factors into 2025.

Bitcoin will likely run into resistance just below $100k and attempt to fall downward again.

This is a very exciting week because it appears the markets are shaking off the debt/credit/yields concerns and moving back to normal.

Remember, where else will investors place their capital for Growth and Returns - other than the US? As I see it, the US markets are still the 900lb Gorilla in the global markets simply because of the ability of the US economy to rebound and recover much quicker than other foreign economies.

Get some.

BIG SHORT SQUEEZE this morning.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

XAGUSD Short-term buy signal above the 1D MA50.Last time we looked into Silver (XAGUSD) almost 2 months ago (November 22 2024, see chart below), we gave an excellent bounce sell signal that easily hit our 29.500 Target:

Based on this +2 year Channel Up, which remains valid, another break above the 1D MA50 (blue trend-line), would be a buy signal similar to July 12 2023. As you can see, the price continues to repeat the Channel Down of the Bearish Leg that started on May 05 2023.

As a result, our short-term Target is just below the 0.786 Fib at 33.0000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

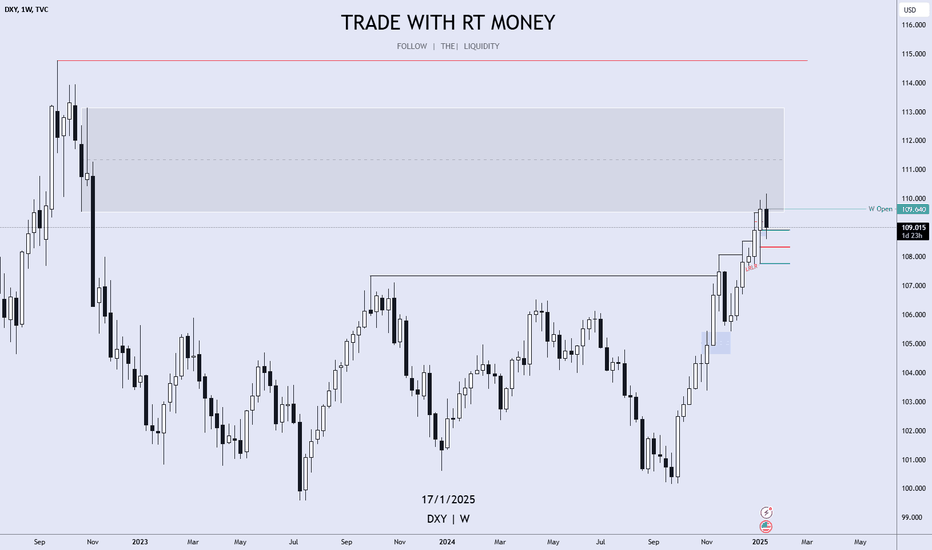

XAGUSD - Silver, waiting for the release of the CPI index!Silver is in a 4 -hour timeframe, between EMA200 and EMA50, moving in its upside channel. If you continue the decline, we can see the channel floor failure and a limited support. Silver stabilization above the resistance range will provide us with silver climbing route to the supply zone, where we can sell at a proper risk.

The U.S. employment report for December disrupted expectations regarding Federal Reserve policies, highlighting the Consumer Price Index (CPI) as a key market driver. Job creation surged by 256,000, significantly surpassing the forecast of 160,000, while the unemployment rate dropped to 4.1%.

This data triggered a sharp rise in Treasury yields, with the 10-year yield reaching 4.79%, the highest level since 2023. Higher yields increase the cost of holding non-yielding assets like silver, which could face headwinds if inflation accelerates. Markets now expect the Federal Reserve to hold off on rate cuts until at least June, a notable shift from earlier forecasts anticipating rate reductions in spring. A hotter-than-expected CPI report could further delay this timeline, strengthening the dollar and potentially putting pressure on silver prices.

Silver’s industrial role continues to support its prices, driven by robust global demand in industries like solar energy and electronics.The production of solar panels, a major consumer of silver, remains a key driver, while geopolitical and inflationary risks have boosted silver’s appeal as an inflation hedge.

Gold’s stability in a high-yield environment has indirectly supported silver as well. Amid stock market volatility, investors have turned to both precious metals. The S&P 500 has declined by 1% year-to-date. Additionally, concerns over tariffs and the fiscal policies proposed by President-elect Donald Trump have increased demand for safe-haven assets.

Meanwhile, speculation around Trump’s potential policies, including tariffs and spending programs, has heightened market uncertainty. Markets are grappling with whether these measures will stoke inflation or negatively impact growth, creating mixed conditions for silver.

Major global banks are revising their forecasts for Federal Reserve monetary policy. Bank of America has stated it no longer expects any rate cuts in 2025. The bank believes the Fed’s rate-cutting cycle has ended and sees the next move as more likely to be a rate hike.

Citi has also updated its projections, announcing that it no longer anticipates a Fed rate cut in January. The bank now forecasts a potential rate reduction in May.

Deutsche Bank has similarly noted that the Fed is unlikely to lower rates in the near term. The bank believes the Fed is currently in a wait-and-see mode, with future actions heavily dependent on incoming economic data.

Meanwhile, Goldman Sachs predicts the Fed will implement two 0.25% rate cuts in June and December, totaling 0.5% for the year. This marks a revision from its earlier forecast of a 0.75% reduction.

Finally, Morgan Stanley has indicated that the likelihood of a near-term rate cut has diminished. However, the bank still considers a rate cut in March plausible due to an improving inflation outlook.

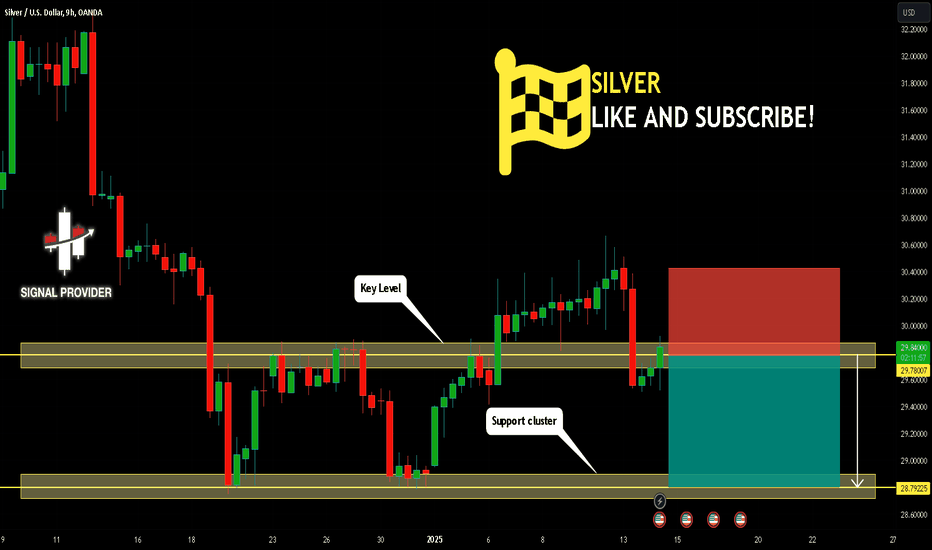

SILVER Will Fall! Short!

Take a look at our analysis for SILVER.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 29.780.

The above observations make me that the market will inevitably achieve 28.792 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

SPY/QQQ Plan Your Trade For 1-14 : Harami/Inside PatternToday's pattern suggests the markets will stay somewhat flat/sideways related to building a base.

Yesterday, 1-13, my broad cycle patterns suggested the markets would establish a "base" - leading to a "peak" on 1-18 and a major top on 1-20. Because of this, I believe the markets will attempt to melt upward into a peaking pattern (with the SPY possibly reach 595-598) before stalling out ahead of the Inauguration event.

Gold and Silver may follow this trend after stalling a bit today. Overall, I believe Gold & Silver will move upward attempting to hedge against global risk factors playing out over the next 30+ days.

Bitcoin rejected the breakdown move yesterday - setting up another attempt at a THIRD sideways FLAG formation in an EPP pattern. This is very unusual - but given what the markets have been doing over the past 30 days - it is what it is.

More than likely, we'll see Bitcoin rally a bit higher (near $100k), then stall again and attempt another breakdown event.

Yesterday's new low suggests a breakdown is likely.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

Weekly Market Forecast Jan 13, 2025This is an outlook for the week of Jan 13-17th.

In this video, we will analyze the following FX markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

HG | Copper

The indices look set to move lower this week, with the possible exception of the DOW.

The metals are rallied on Friday, and may continue upward this week, despite a relatively strong USD.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.