XAG/USD Analysis: Slight Bearish Bias Expected on 14/10/2024.The XAG/USD (Silver to US Dollar) pair is likely to exhibit a slight bearish bias today, driven by a combination of fundamental and technical factors. The global silver market is influenced by economic data, investor sentiment, and broader financial market trends. In this article, we provide a detailed analysis of the factors likely to drive XAG/USD lower, while optimizing for SEO ranking with relevant keywords.

1. Stronger US Dollar

The primary factor putting pressure on XAG/USD is the strengthening US dollar. Despite some recent softness, the US dollar index (DXY) remains elevated due to positive US economic data, particularly in the labor market. The recent release of robust non-farm payrolls (NFP) and a steady unemployment rate has reinforced the Federal Reserve's stance on keeping interest rates higher for longer. With the prospect of higher interest rates, the dollar is maintaining its appeal as a safe-haven asset, which tends to weigh on silver prices.

2. Rising US Treasury Yields

In tandem with a strong US dollar, US Treasury yields continue to rise, further pressuring precious metals like silver. Higher yields make non-yielding assets like silver less attractive to investors. The yield on the 10-year Treasury note is nearing multi-year highs, suggesting continued demand for safer, interest-bearing assets over riskier commodities such as silver. As long as yields remain elevated, silver prices are likely to stay under pressure, contributing to a bearish outlook for XAG/USD.

3. Silver's Role as an Industrial Metal

Silver is not only a precious metal but also an important industrial commodity . Given its extensive use in industries such as electronics, renewable energy (solar panels), and manufacturing, any slowdown in global economic growth tends to dampen demand for silver. Recent concerns over a potential slowdown in China’s economic growth—a major driver of global industrial demand—could lead to weaker silver prices. If demand for industrial silver weakens, this would likely contribute to a bearish trend for XAG/USD.

4. Geopolitical Tensions Easing

Silver, like gold, is often viewed as a safe-haven asset during times of geopolitical uncertainty. However, the easing of recent geopolitical tensions, particularly in the Middle East, has diminished the demand for safe-haven assets. This shift in sentiment could lead to further downside pressure on silver as risk-on market conditions prevail. If tensions continue to de-escalate, silver could see reduced buying interest, further supporting a bearish bias.

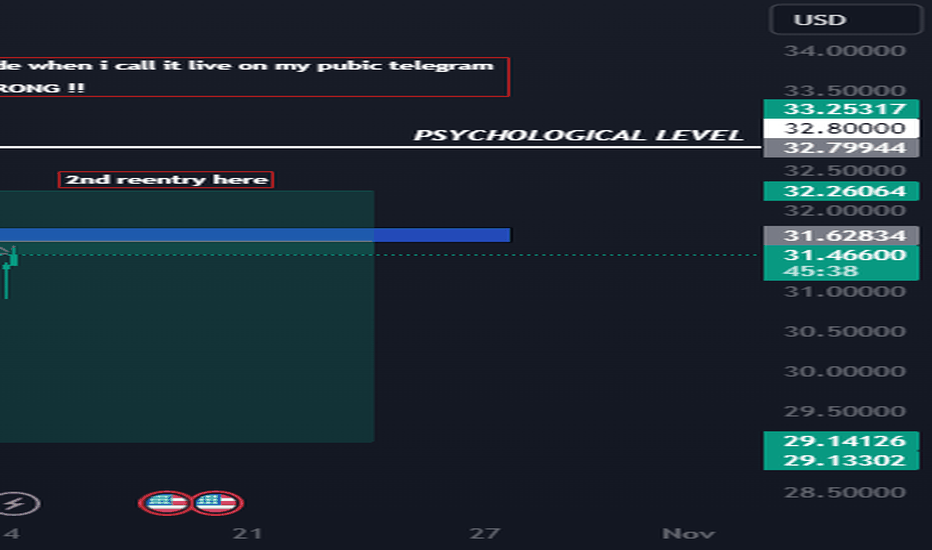

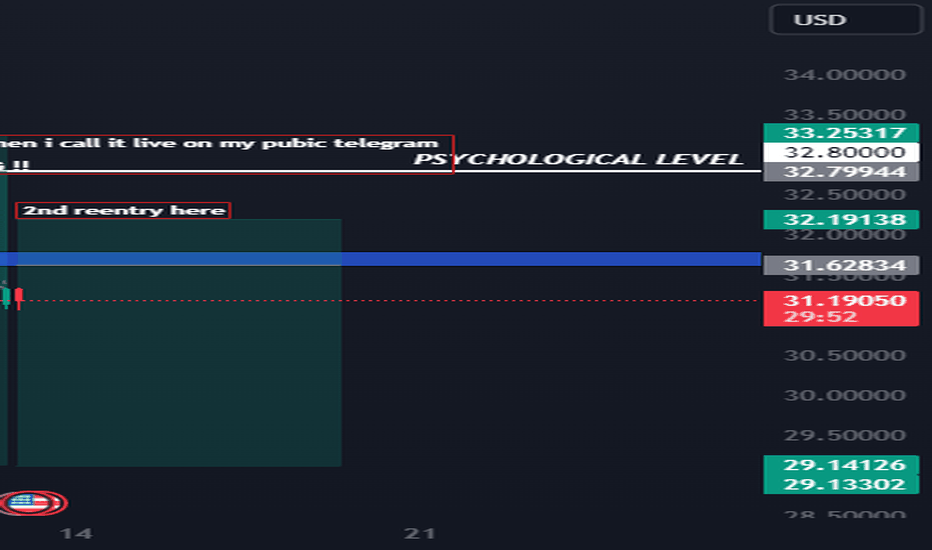

5. Technical Analysis of XAG/USD

From a technical perspective, XAG/USD is currently trading below its 50-day moving average, signaling a bearish trend . The pair is hovering near support around the $21.50 level, but a break below this level could open the door to further downside, potentially testing the $21.00 psychological support level. RSI (Relative Strength Index) is showing bearish momentum, while MACD (Moving Average Convergence Divergence) is also trending lower, indicating continued selling pressure.

6. Key Data Releases to Watch

Traders should pay attention to the following data releases, which could influence XAG/USD today:

- US Retail Sales Data: A stronger-than-expected result could boost the US dollar, further weighing on silver prices.

- Fed Speakers: Any hawkish comments from Federal Reserve officials regarding future rate hikes could add to the bearish sentiment for silver.

- China's Industrial Output: Slower growth in China’s industrial production could reduce silver demand, pushing prices lower.

Conclusion

Overall, XAG/USD is expected to exhibit a slight bearish bias today , driven by a stronger US dollar, rising Treasury yields, weakening industrial demand, and easing geopolitical risks. The technical outlook also supports a downside move, with key support levels in focus. Traders should remain cautious and monitor economic data releases that could impact silver’s price action throughout the day.

Keywords for SEO Ranking:

- XAG/USD analysis,

- XAG/USD bearish bias,

- Silver to USD analysis,

- US dollar strength,

- US Treasury yields impact on silver,

- Silver as an industrial metal,

- China economic slowdown and silver,

- Precious metals analysis,

- Technical analysis XAG/USD,

- Silver price forecast,

- Safe-haven assets,

- Geopolitical risks in silver market,

- US retail sales impact on silver,

- Federal Reserve rate hikes impact on silver,

- Trading silver in 2024.

Silvertousdanalysis

XAGUSD Analysis: Slightly Bearish Bias on October 11, 2024The XAGUSD (Silver to US Dollar) pair is expected to show a slightly bearish bias on October 11, 2024, as several fundamental factors and current market conditions weigh on silver prices. For traders and investors looking to make informed decisions today, it’s important to understand the key drivers influencing this precious metal.

Key Fundamental Drivers:

1. Stronger US Dollar:

- The US Dollar has shown some strength following slightly positive economic data releases, particularly in US jobless claims and PPI (Producer Price Index) figures, which came in higher than expected. A strong US Dollar generally pressures commodity prices, including silver, as it becomes more expensive for holders of other currencies to buy dollar-denominated assets.

2. Federal Reserve’s Hawkish Stance:

- Although the Federal Reserve has hinted at a potential pause in interest rate hikes, its overall stance remains hawkish. Comments from Fed officials about maintaining elevated interest rates to control inflation are causing investors to shy away from non-yielding assets like silver, which does not offer interest or dividends. Higher interest rates increase the opportunity cost of holding silver, adding to bearish sentiment.

3. Weakening Demand for Safe-Haven Assets:

- While geopolitical risks, particularly in the Middle East , continue to simmer, the demand for safe-haven assets like silver has not spiked significantly. Market sentiment appears to be stabilizing after recent volatility, causing investors to shift their focus back to riskier assets, which dampens the appeal of silver as a hedge against uncertainty.

4. Industrial Demand Outlook:

- Silver’s dual role as a precious metal and an industrial commodity adds complexity to its price movements. Concerns over a slowdown in global industrial activity, particularly from key consumers like China, are weighing on silver prices. The outlook for industrial demand has weakened, with recent reports pointing to sluggish manufacturing data, further reinforcing the bearish bias for XAGUSD.

Current Market Sentiment:

- Technical Analysis:

- XAGUSD is currently trading near $22.50, a key psychological support level. A break below this level could open the door for further downside movement, with the next potential target being the $22.00 mark.

- RSI on the 4-hour chart is trending below 50, indicating bearish momentum. The price action shows that silver is struggling to maintain any significant upward momentum, aligning with the overall bearish bias for the day.

- Moving Averages: XAGUSD remains below its 50-day moving average, signaling a bearish trend continuation. Traders are likely to view any rallies as selling opportunities, particularly near the $23.00 resistance level.

- Market Sentiment:

- The overall sentiment in the silver market is leaning bearish, as traders remain cautious about the potential for further downside risk in the near term. The strength of the US Dollar and lackluster industrial demand for silver are key contributing factors to this sentiment.

Conclusion:

In summary, the XAGUSD pair is likely to maintain a slightly bearish bias today, as the stronger US Dollar, a hawkish Fed, and weakening industrial demand weigh on silver prices. Traders should keep an eye on key technical levels, as a break below critical support zones could trigger further selling pressure. The fundamental outlook for silver remains subdued, with few catalysts for a bullish recovery in the short term.

Keywords for SEO Optimization:

- XAGUSD analysis

- XAGUSD forecast

- Silver price forecast

- Silver to USD analysis

- Silver market outlook

- US Dollar impact on silver

- Federal Reserve rate hike impact

- Silver technical analysis

- Precious metals trading strategy

- Industrial demand for silver

- Silver market trends

This XAGUSD analysis provides a comprehensive overview of today’s slightly bearish outlook for silver , giving traders insights into the key drivers influencing the market. Stay updated on forex trading and precious metals market analysis for better trading opportunities.