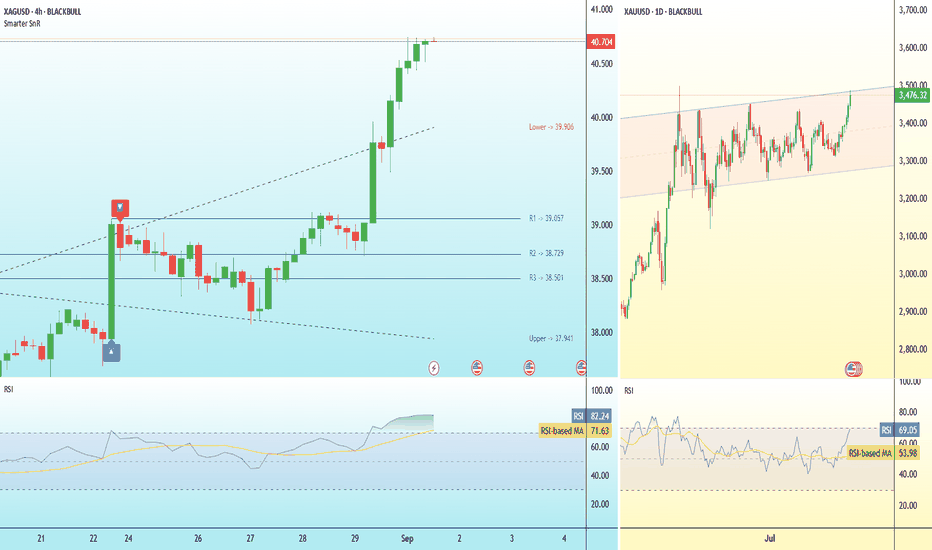

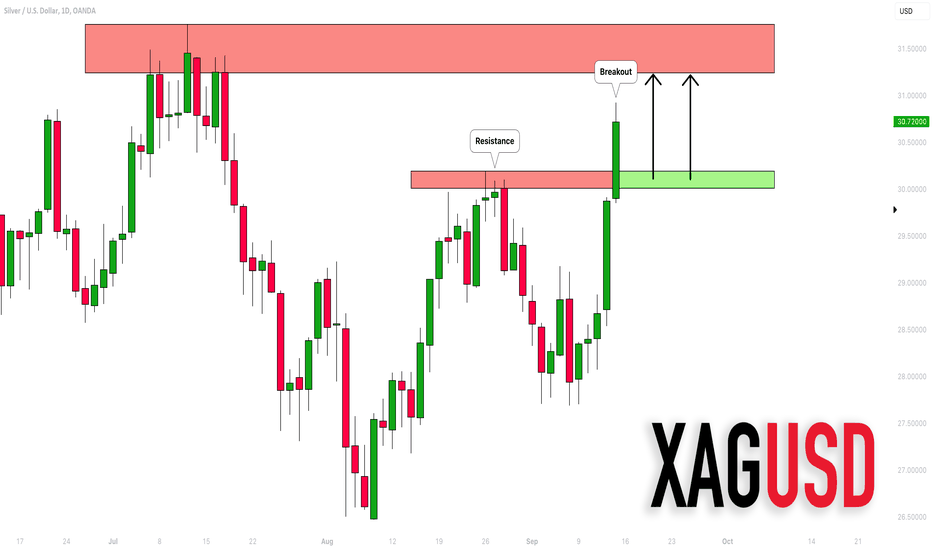

Silver’s 14-Year High: Can the Rally Continue?Silver is currently trading at a 14-year high, and the real test begins as price approaches key resistance levels near $41.00–$41.65.

The same factors pushing gold higher are likely behind silver’s climb. Traders remain confident that the Federal Reserve will cut interest rates in September. At the same time, there’s growing concern that the Trump administration is working to undermine the Fed's independence and jeopardise the US economy.

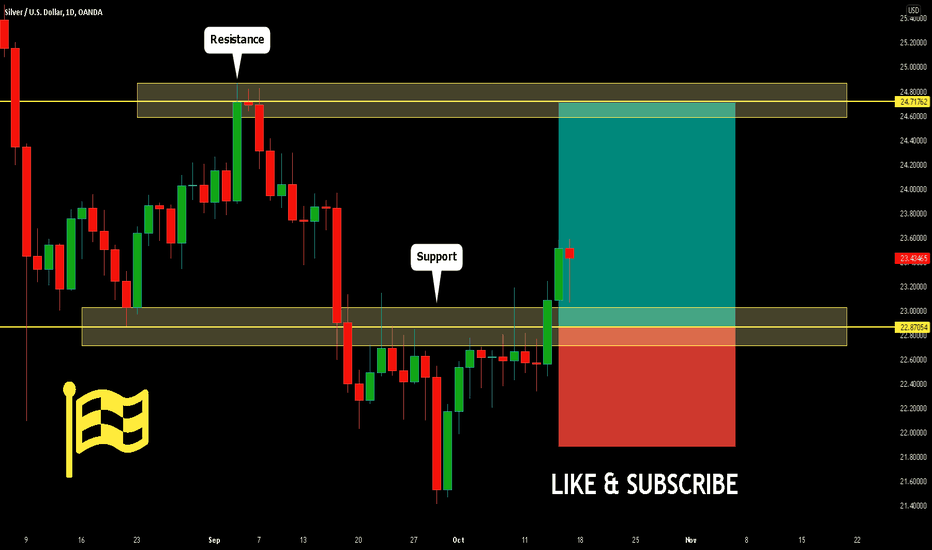

However, short-term conditions suggest that silver may be somewhat overextended, increasing the likelihood of a pullback or consolidation before any further upside. For now, the trend remains potentially bullish as long as XAG/USD holds above the critical trendline support at $39.906. In case of any sharp dips, the safety net might sit around $37.49.