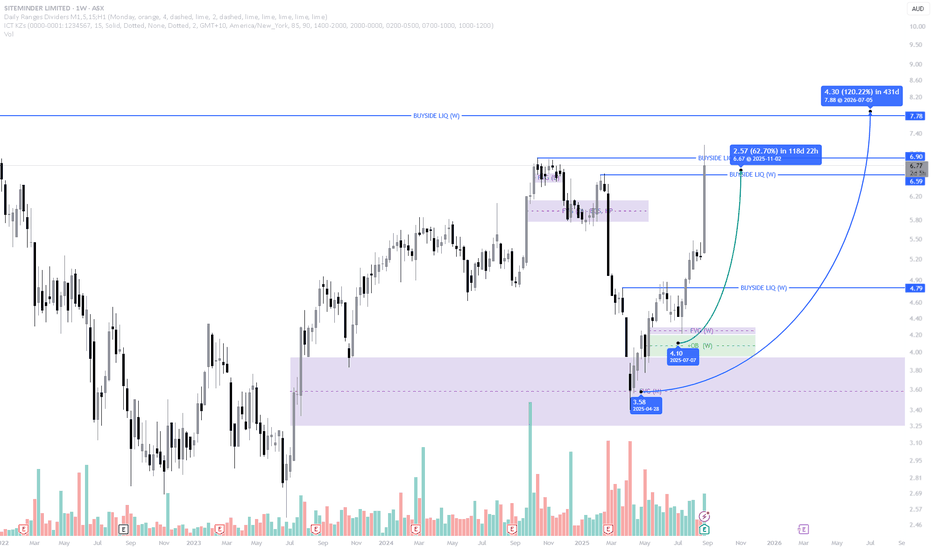

SDR – Textbook Respect of PD Arrays Leading to Explosive UpsideExplanation

The move we anticipated on SDR has now unfolded exactly as outlined, with price reacting strongly from the higher-timeframe PD arrays.

Fair Value Gap (FVG): Price tapped perfectly into the monthly/weekly FVG and used it as a springboard for accumulation. This zone served as the rebalancing point for inefficient pricing.

Order Block (OB): The bullish OB inside the FVG held as expected, providing the structural base for buyers to step in and defend.

Liquidity Dynamics: Prior to the move, sell-side liquidity was swept, clearing weak longs and fuelling the drive higher. Once liquidity was taken, momentum shifted sharply to the upside.

Buyside Targets: Price has now begun its run into the weekly buyside liquidity levels at 6.90 and beyond, with the higher target around 7.78 still in play.

This reaction is a textbook ICT move: sweep → rebalance via FVG → respect of OB → expansion toward buyside.

✅ Key Takeaway: The predictive model played out exactly, proving once again that respecting PD arrays across HTFs provides a high-probability roadmap for price action.

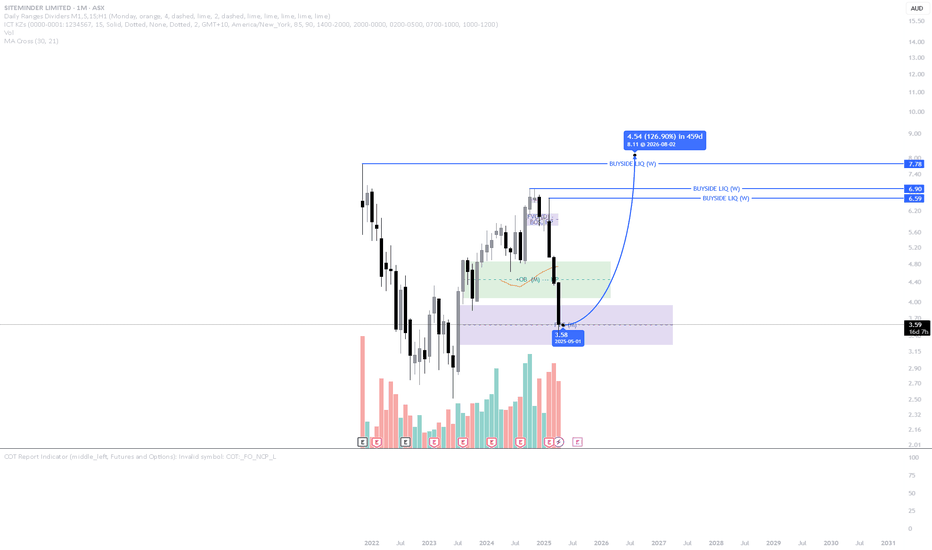

Siteminder

This Aussie Tech Gem Is Screaming BUY – If This Zone Holds!SDR (SiteMinder) is showing massive potential both technically and fundamentally:

- Trading 75.4% below fair value

- Forecasted to grow 65.36% YoY

- Earnings up 28.2% p.a. over the last 5 years

- Analysts expect 91%+ upside

On the chart, we’re sitting right on a high-probability monthly FVG + OB zone. If respected, we could see a strong rally back toward the $6.90–$7.78 buyside liquidity levels and beyond.

Key Levels to Watch:

📍 FVG support: ~$3.50

📈 Targets: $6.90 – $7.78

🧠 Confirmation needed via strong candle closes

🔥 Could be a high-reward play — but as always, DYOR!

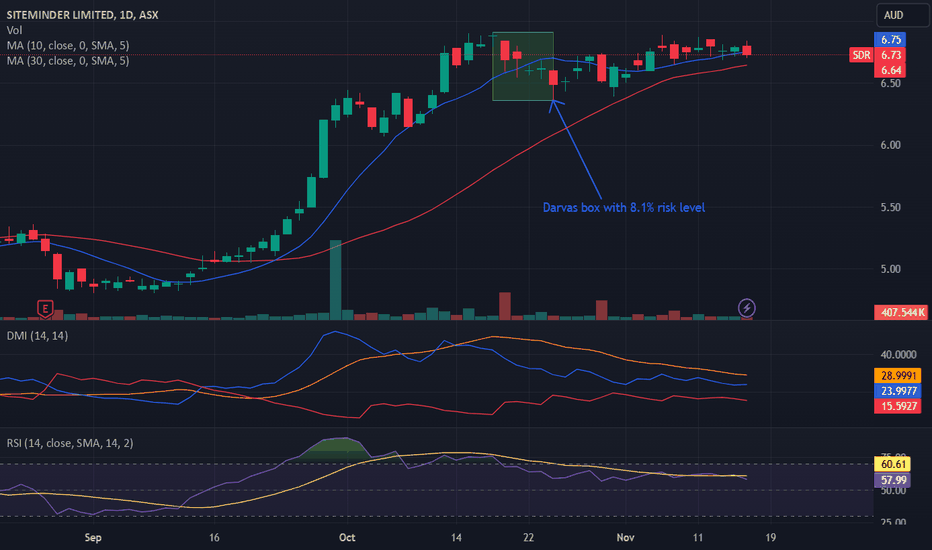

Bullish potential detected for SDREntry conditions:

(i) breach of the upper confines of the Darvas box formation for ASX:SDR - i.e.: above high of $6.91 of 17th October (most conservative entry), or

(ii) swing up of indicators such as DMI/RSI along with a test of prior level of $6.84 from 18th October.

Stop loss for the trade (based upon the Darvas box formation) would be:

(i) below the support level from the low of 24th October (i.e.: below $6.36).