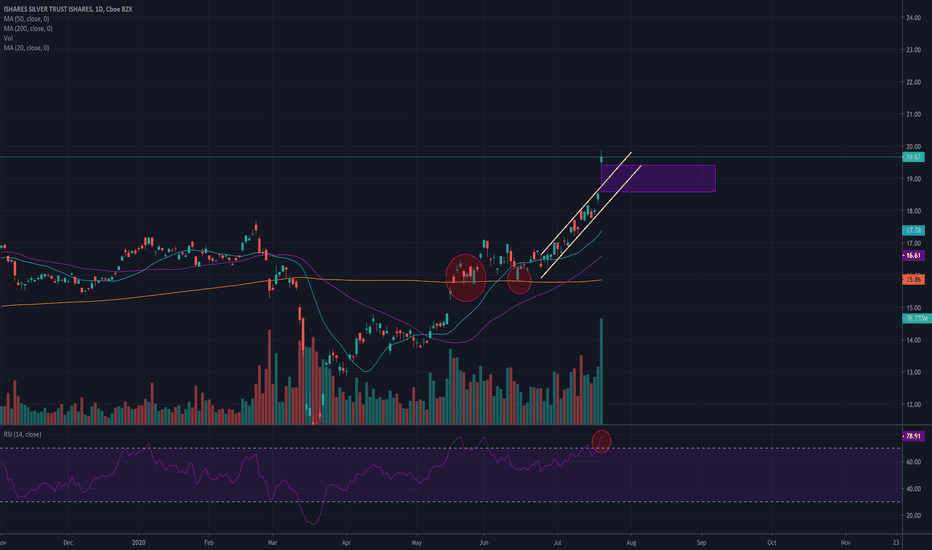

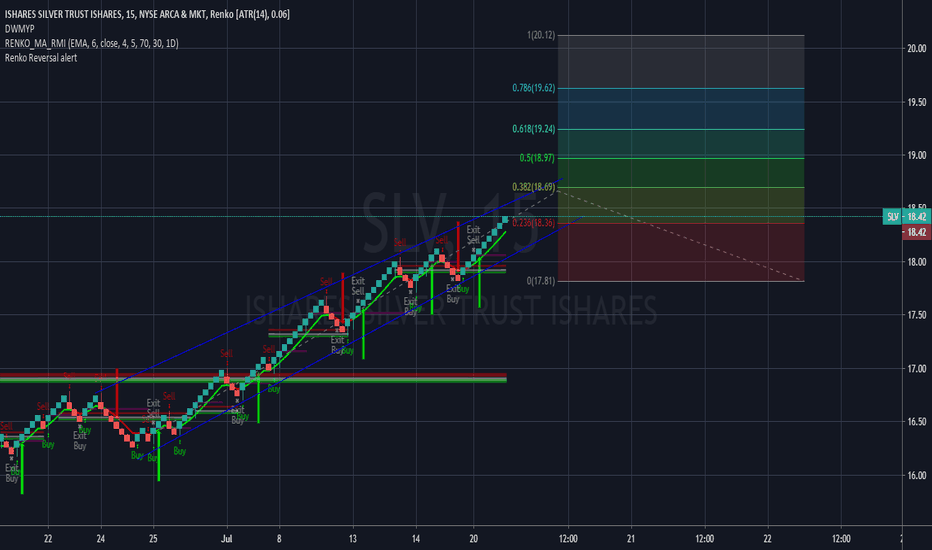

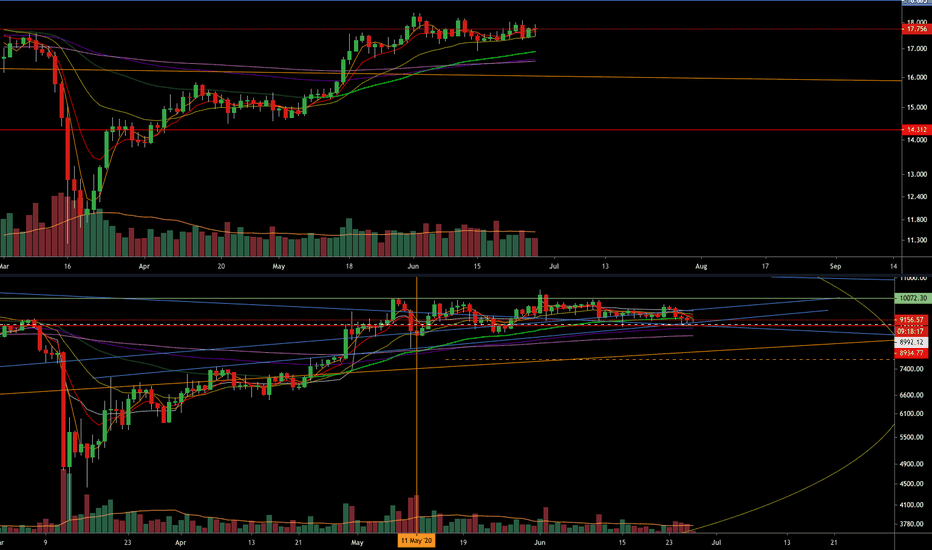

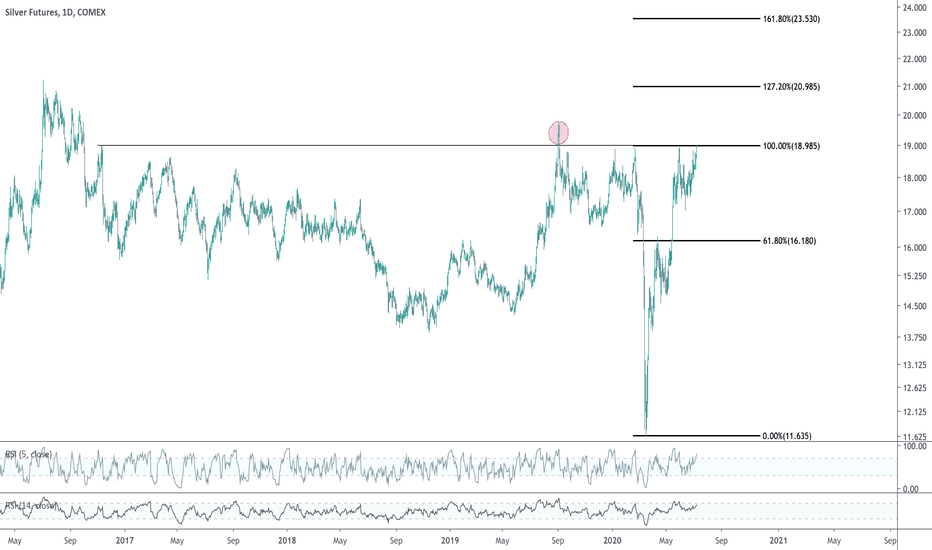

SLV

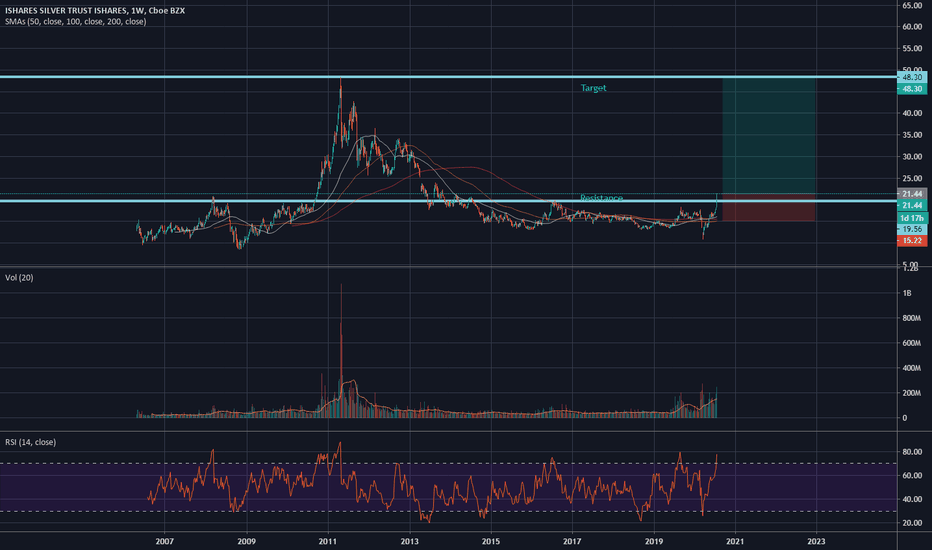

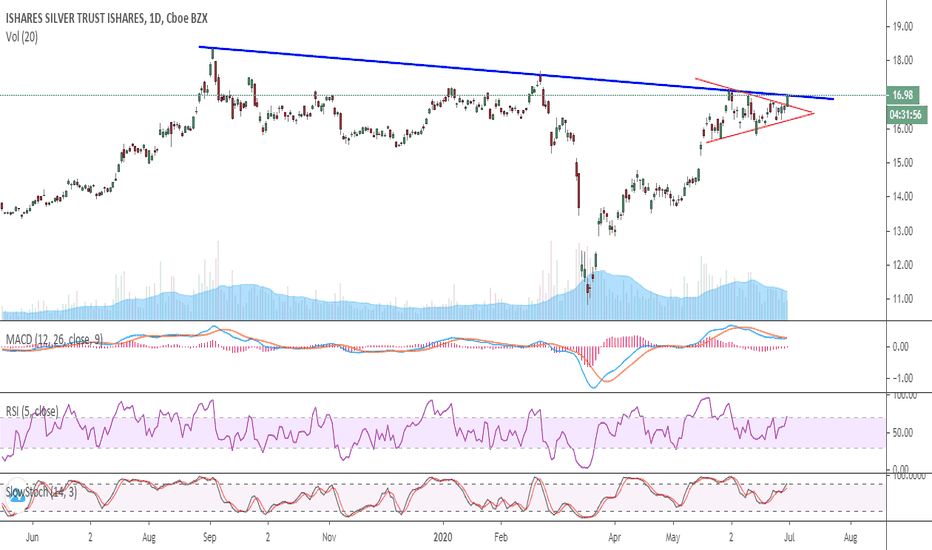

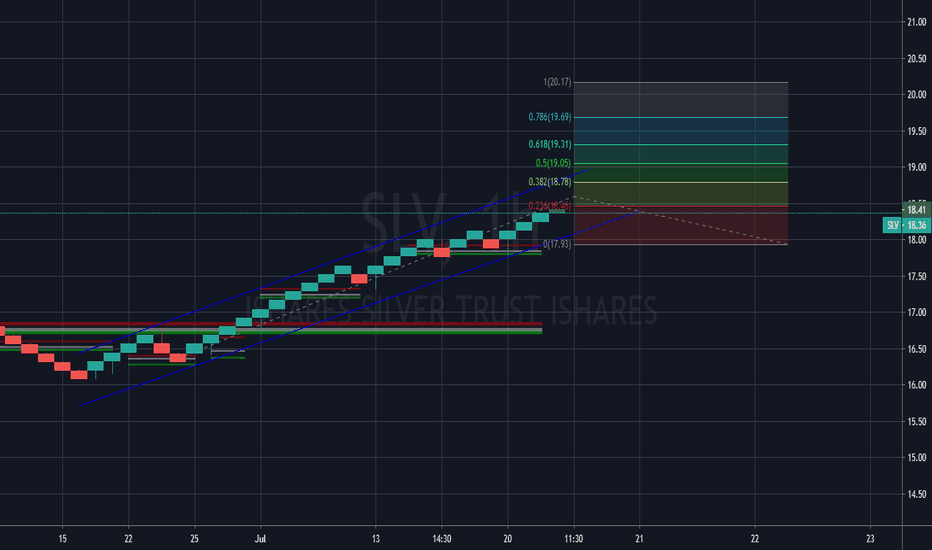

SLV and InflationGoing off of my previous chart on DXY, SLV showed multiple bounces off the 200MA before trading upwards in a channel, and just today breaking out with a huge bullish kicker. As the Fed may work to avoid rising inflation levels and reverse the price action of DXY, SLV ma look to fall back into its channel and fill the gap down.

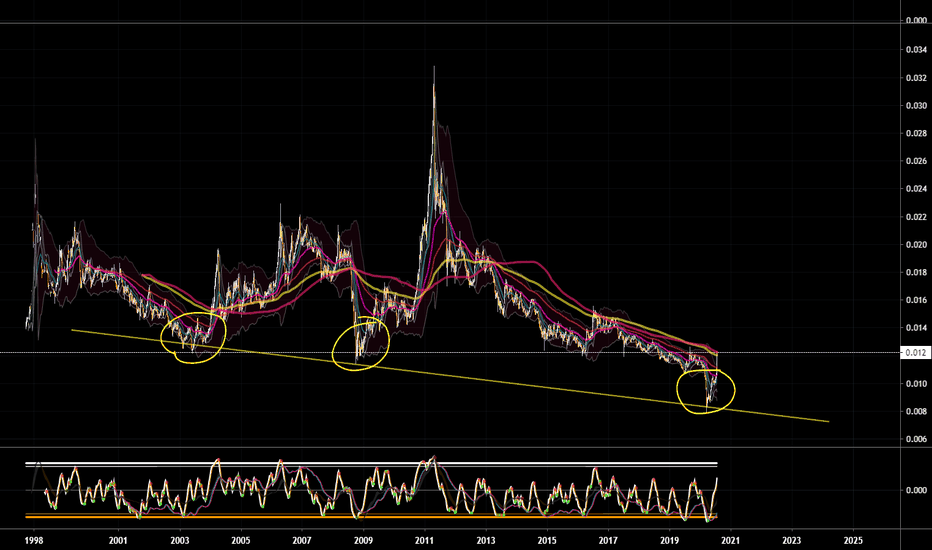

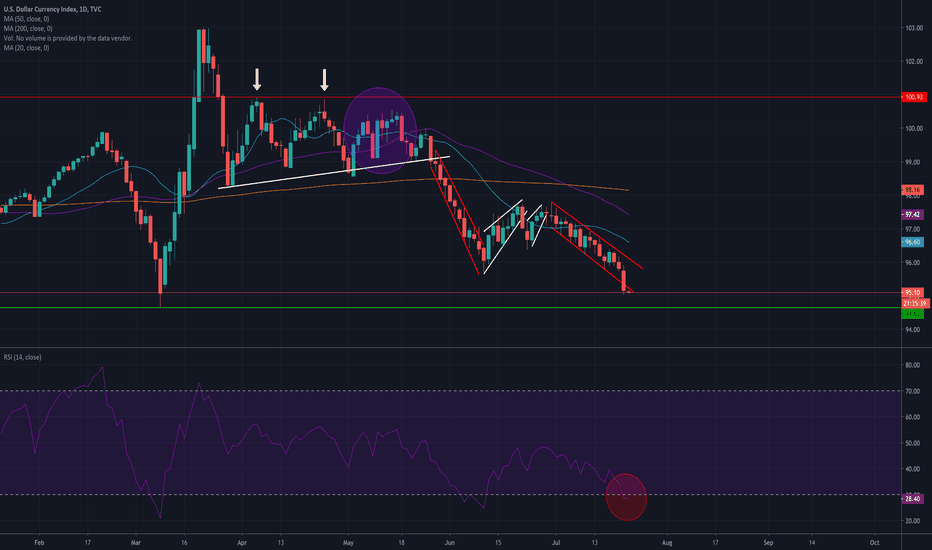

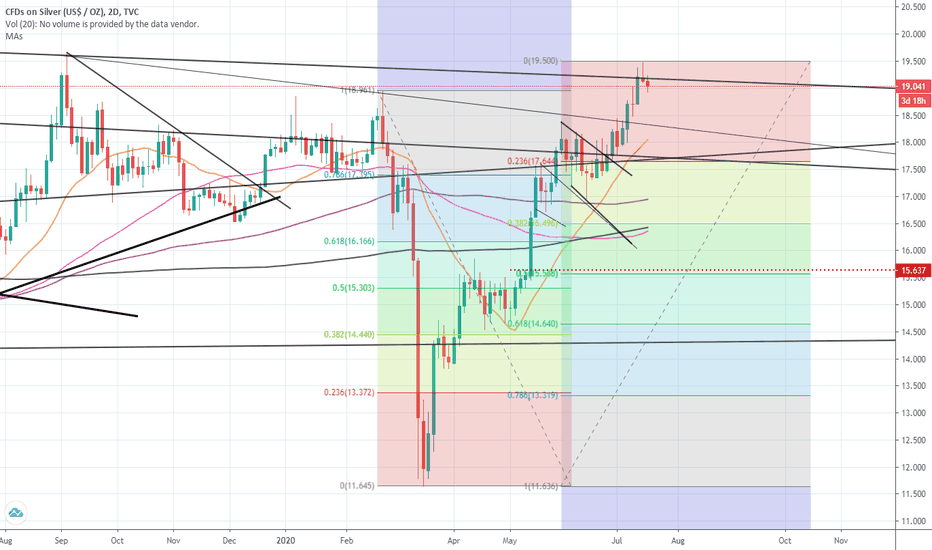

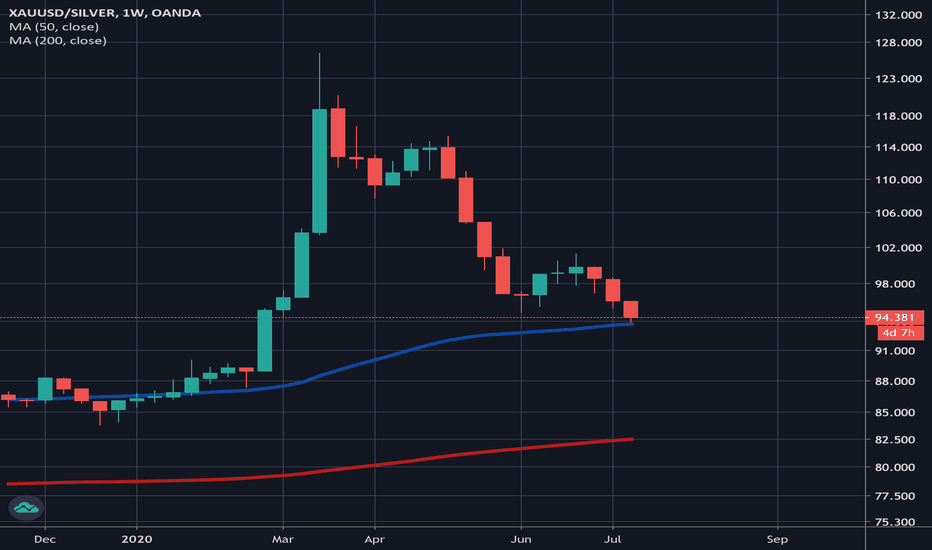

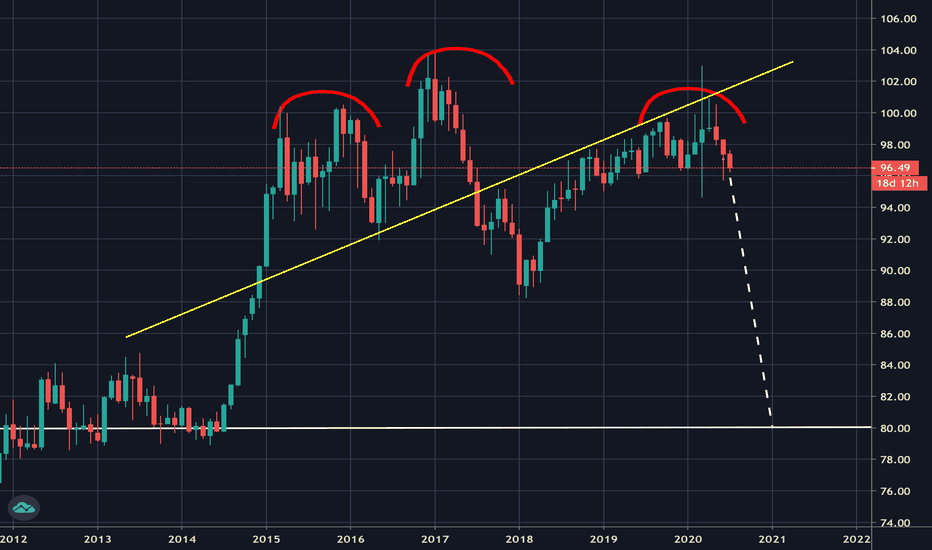

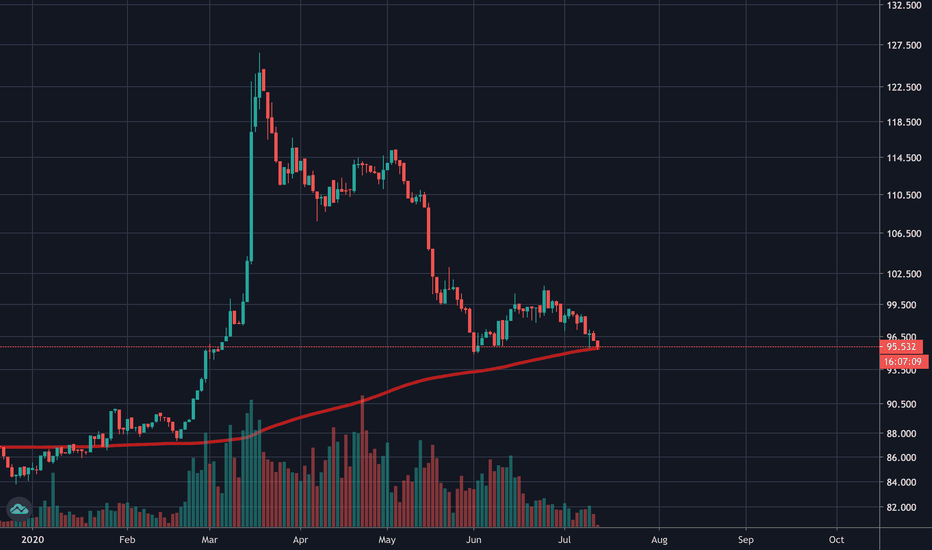

$DXY and Inflation$DXY, the U.S. Dollar Currency Index has been steadily declining for some time now. Based on a chart analysis, we can see a double-top formation followed by a price consolidation that ultimately led to a breakdown once closing under a support trend line. After a fall of about 4%, an attempt was made to retrace. After a pullback, a second attempt was made, but that uptrend was much weaker, leading to the current downtrend. (Also noteworthy is the death cross of the 50SMA below the 200SMA which was followed by a strong bearish candle the next day). As the USD's value falls, we are getting closer to inflation, however it is approaching a support line. Additionally, GLD and SLV, the Gold and Silver ETFs have been on a strong bull run lately. While DXY may look to reverse back into a stronger value area, Silver and Gold, which are strong fallbacks when the value of the USD decreases, may look to pair the DXY reversal with an inverse price action.

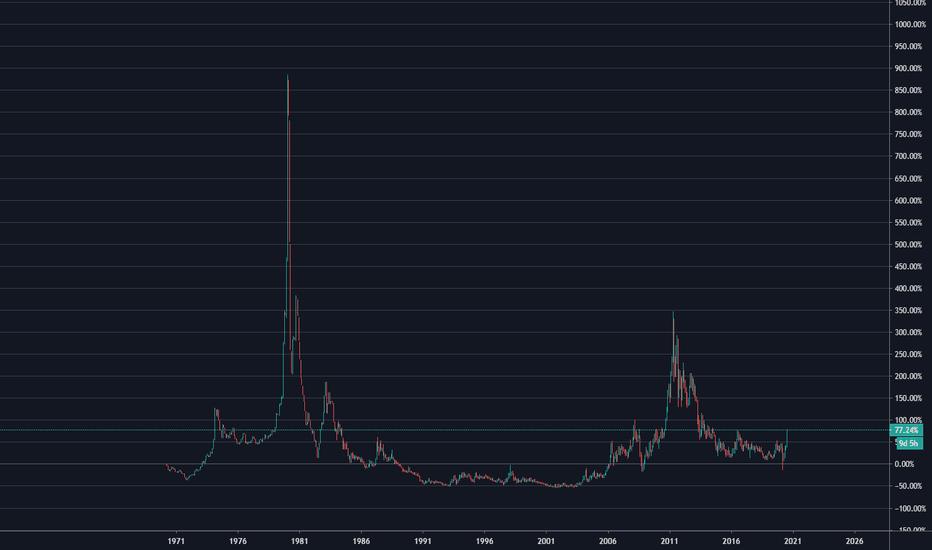

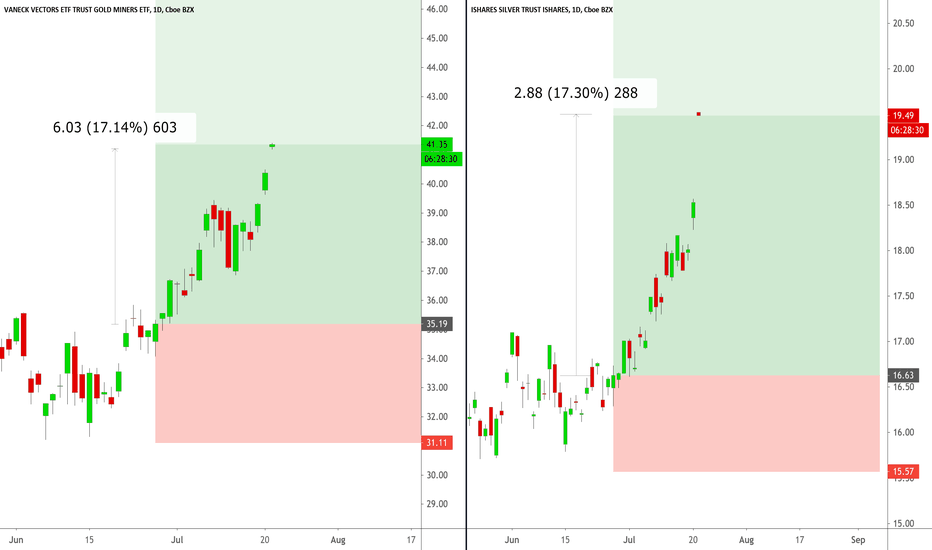

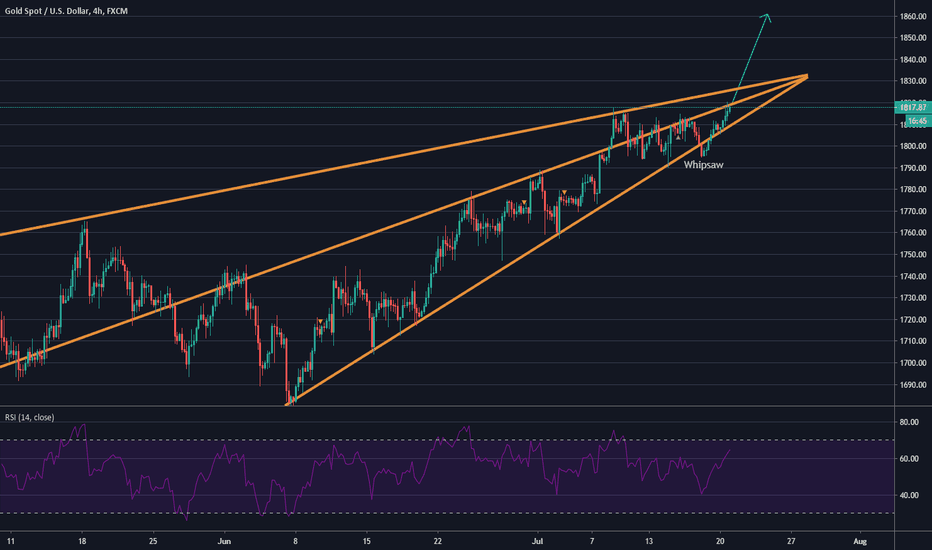

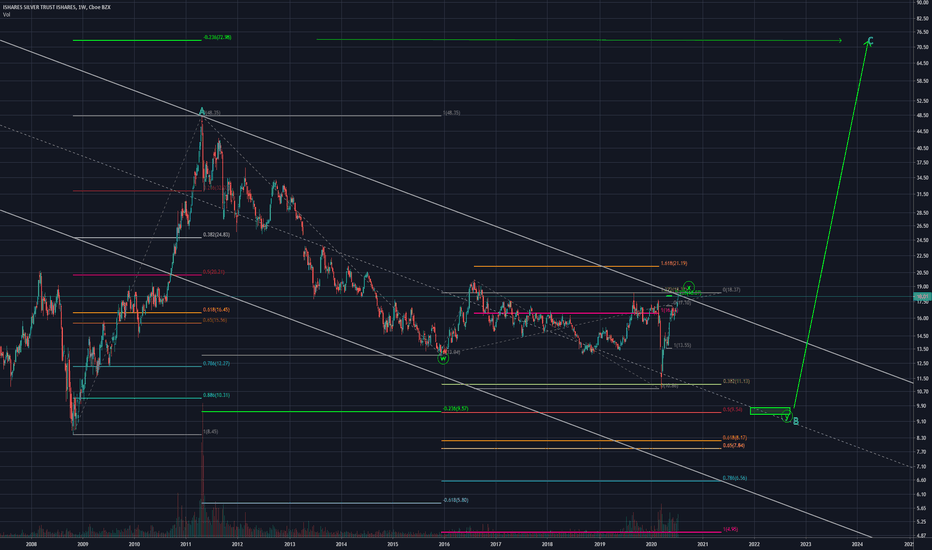

It has begun...It appears the path has been chosen. Bears may have a chance at the primary trend, but bulls look very very strong. A new all time high is in the cards for the summer season. Technically it should arrive in about 6 weeks.

Sept 1st prediction

AXUUSD 1900

GDX 52

GDXJ 66

XAGUSD this wild beast has broken free today. Who knows where he will fly to...

Eyeing a potential pullback in SilverI longed some silver via SLV since $15.50 spot. Silver is now at a major trendline and horizontal resistance area . I am looking for a correction in metals ( gold , silver ) to shake out weak hands, which may be a buying opportunity for the future. Ideally, silver may get back to the $16-14 handle. Above $20, I may add to my position on a breakout.

Gold is at a similar resistance; I would expect them to correct together.

Major bull flag in PlatinumPlatinum is breaking out of a 5-6 week bull flag after tagging its 50 day moving average and reversing from major structure. Precious metals seem to be breaking out in general, but I particularly like the pattern in platinum. I am long all three (gold, silver and platinum).