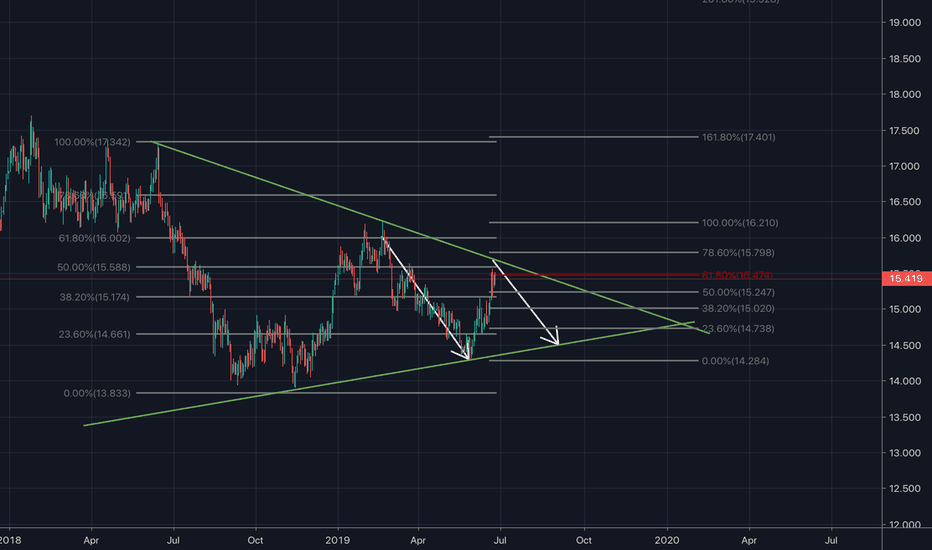

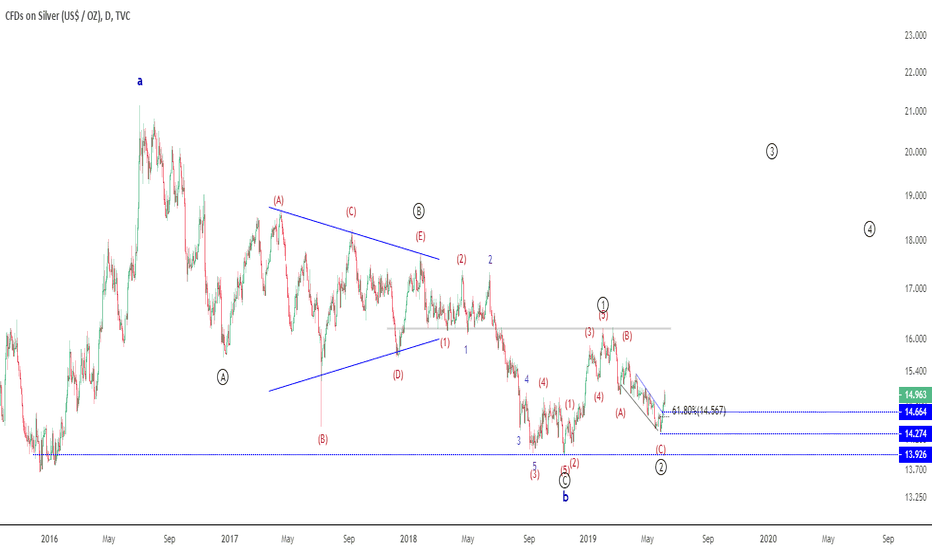

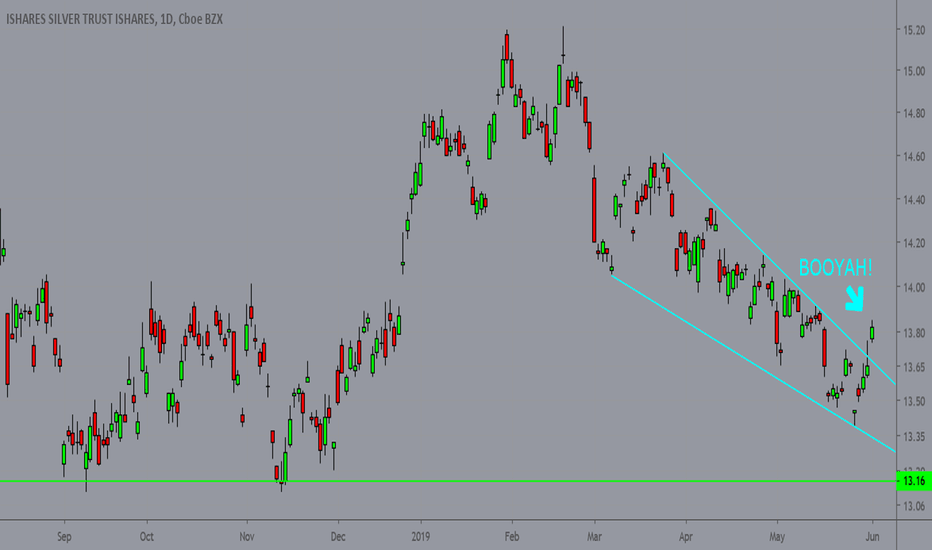

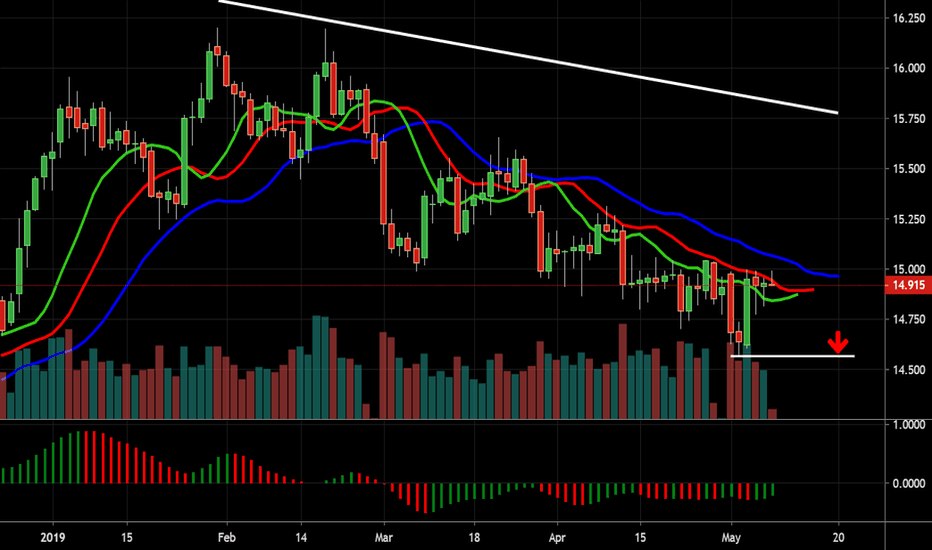

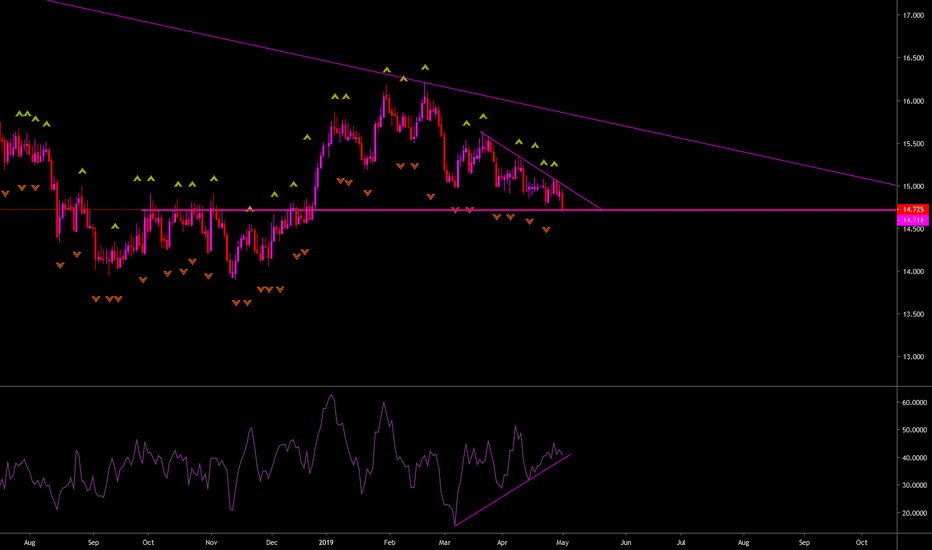

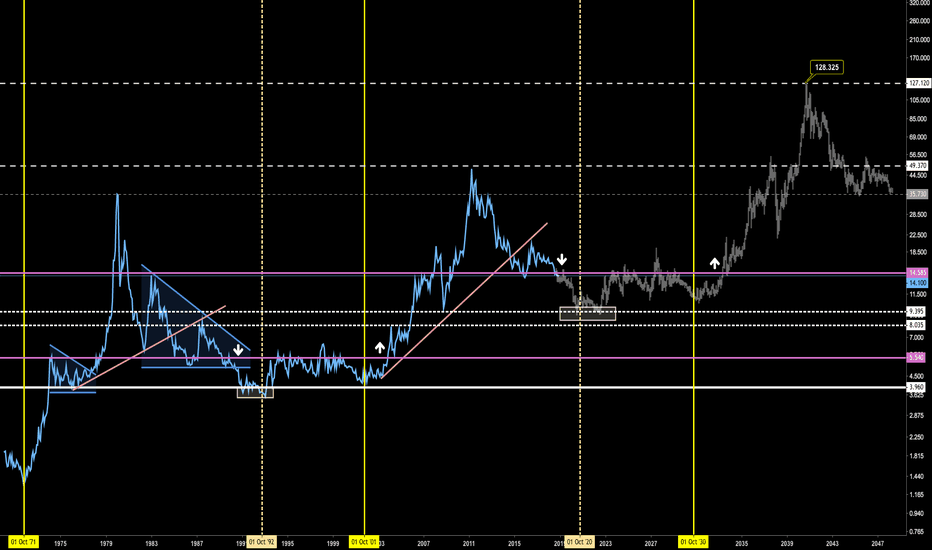

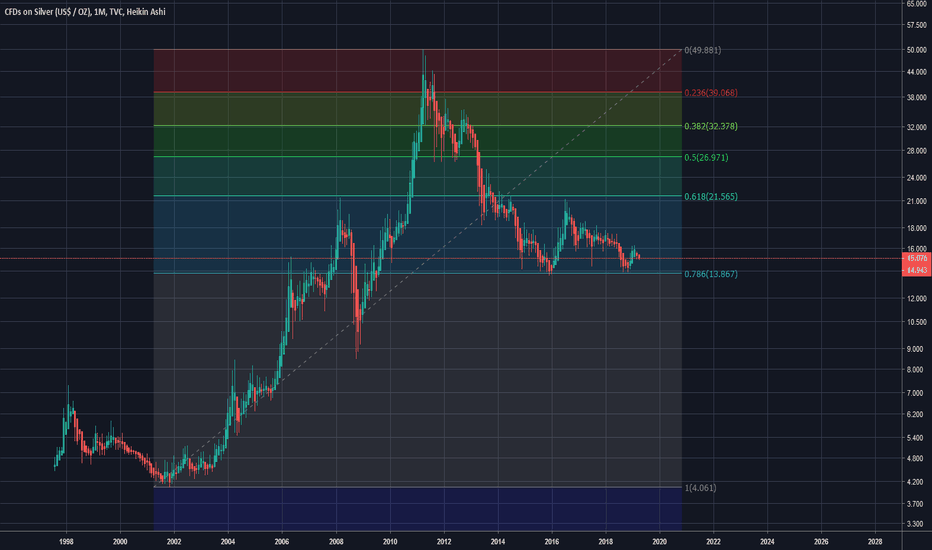

SLV LongSilver has broken out of a multiyear descending triangle pattern to the upside. Typically a descending triangle is a bearish pattern so for it to be foiled and having gone to the upside is extra bullish. Moreover, silver entered a bullish falling wedge pattern right after, back-tested the initial triangle's resistance-turned-support and continued upwards. There is likely going to be some consolidation/corrected in the very short term but as far as long term is concerned, silver has only up to go. Silver is also trading at roughly 93:1 compared to gold. This ratio has been proven to be a bottoming signal for silver before in the 90s before it corrects to a ratio of roughly 40:1.

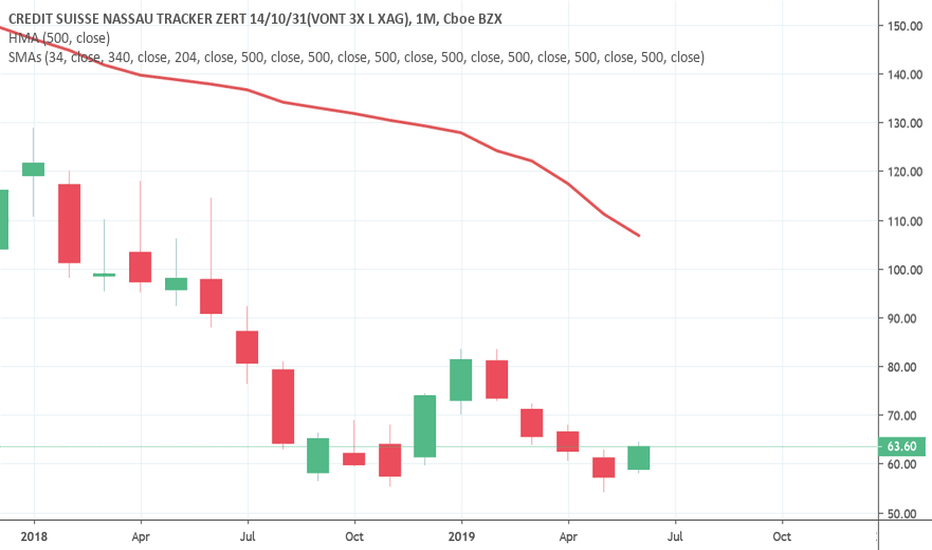

SLV

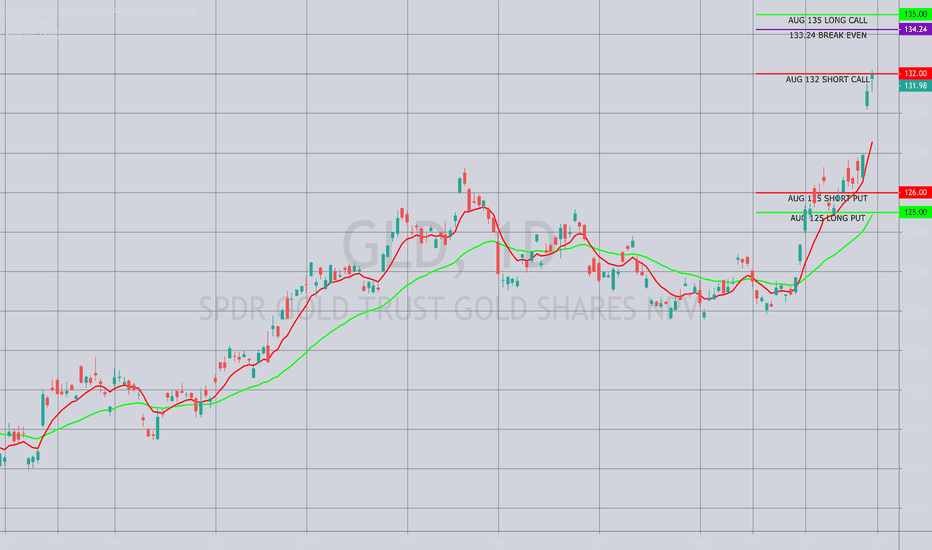

THE WEEK AHEAD: GLD, GDXJ, GDX, SLV, USOEARNINGS

No options highly liquid underlyings announcing earnings this week.

BROAD MARKET

EEM (15/18)

QQQ (19/19)

IWM (19/18)

SPY (19/15)

EFA (10/12)

One word ... . Well, maybe two: "Weak sauce," with ranks in the low quarter of their 52-week ranges and background implied at sub-20 across the board.

SECTOR EXCHANGE-TRADED FUNDS

Top 5 By Rank: GLD (92/16), GDXJ (71/33), SLV (64/21), GDX (48/28), USO (47/43) TBT (52/24).

Pictured here is a GLD Synthetic Reverse Jade Lizard, explained in the post, below. For those of a more nondirectional bent, the Aug 16th 127/140 short strangle is paying 1.72 with a 70% probability of profit, although I'd recheck that setup at New York open for delta balance ... .

GDXJ: August 16th 34 short straddle, 3.45 credit with >expected move break evens, delta/theta -11.03/3.02.

GDX: August 16th 25 short straddle, 2.12 credit with >expected move break evens, but a little on the weak side in terms of credit collection. Delta/theta: -10.52/1.84.

SLV/USO: August has yet to populate ... .

In petro, my go-to is generally XOP (34/35), but the August expiry has yet to populate. Given the size of the underlying, I would probably continue to short straddle it here, assuming that it's still paying greater than 10% of the price of the underlying (i.e., >2.70 or so in credit for the short straddle nearest at-the-money).

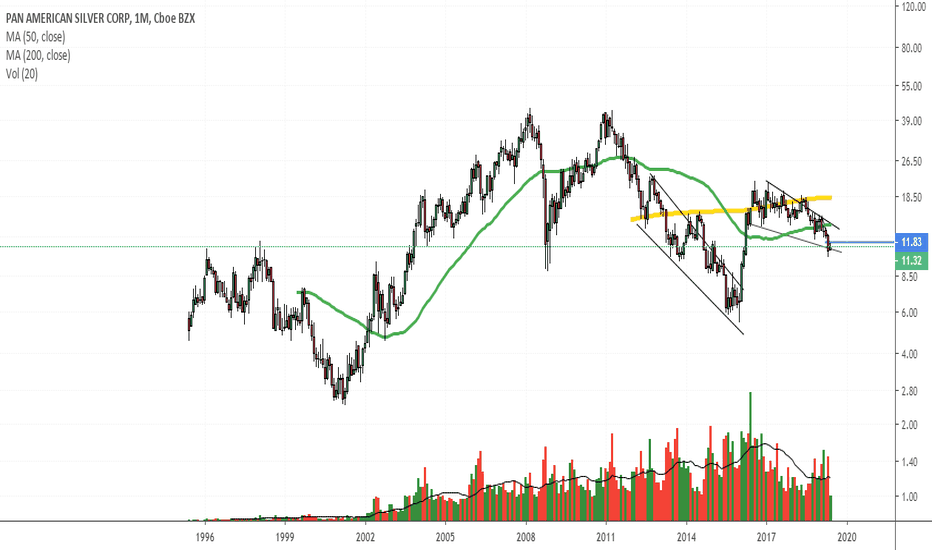

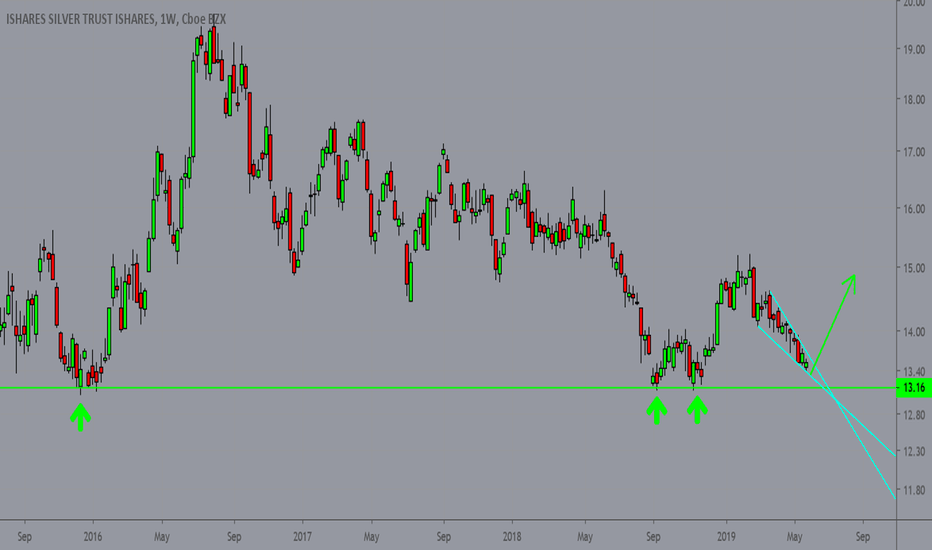

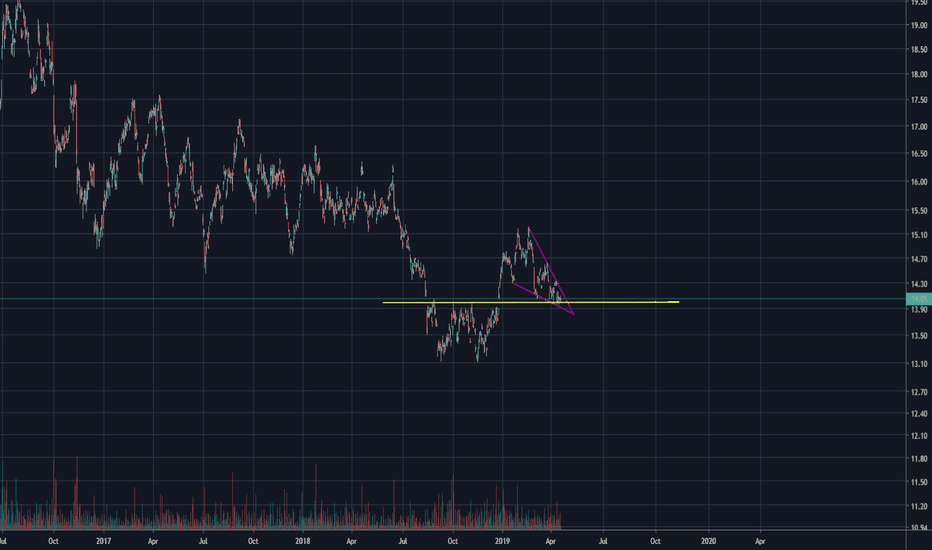

SLV - Silver double bottom and the falling wedgeIs anybody into precious metals? I am. I have been for years. I just put on some SLV today. The double bottom on the weekly and the falling wedge looks like it's time to go long. Normally I may not even bother because it has been such a slow mover for quite some time but as the stock markets continue to deteriorate and crypto continues to climb I think it is time to take shelter. I have zero in the stock market and have only taken defensive positions with SPXS, SLV, Bitcoin, Cash, etc. When the fecal matter hits the rotary device next month and beyond I don't want to be standing in front of that fan.

Good luck everybody!

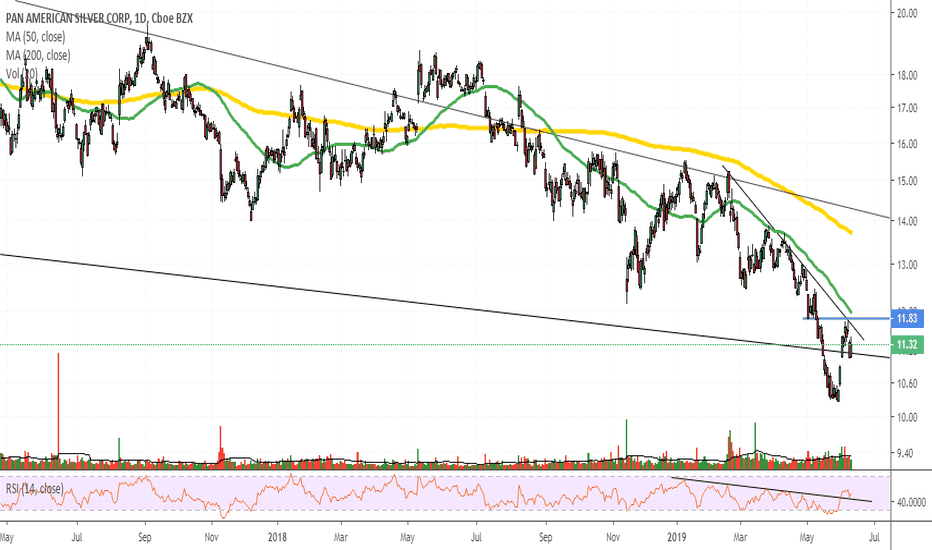

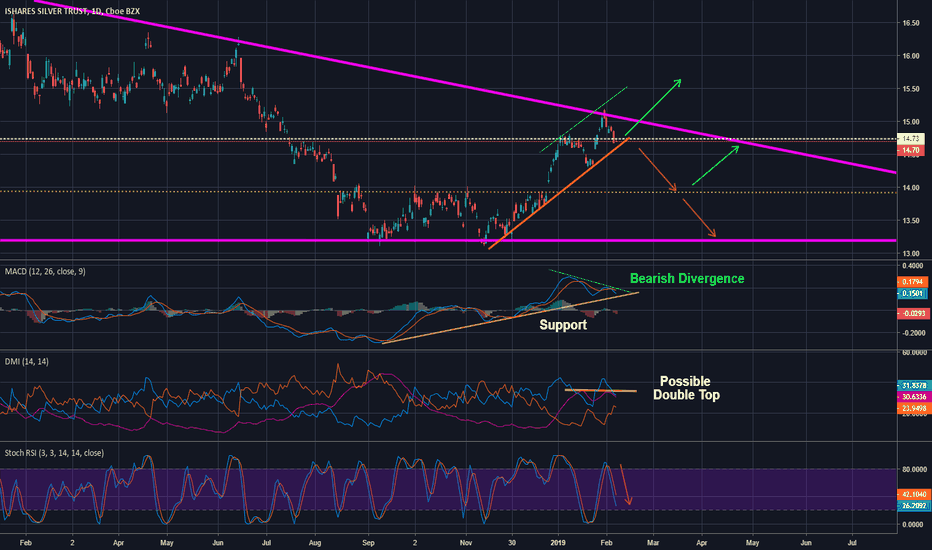

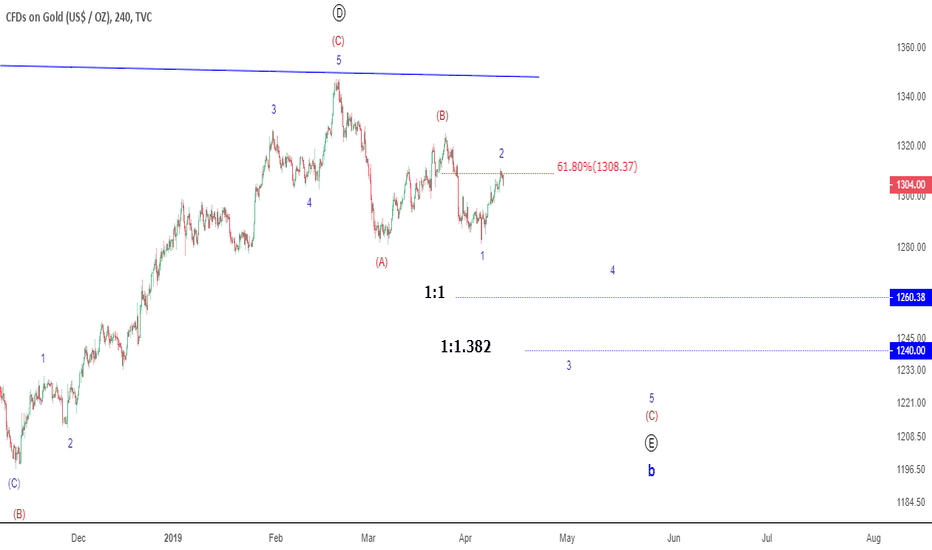

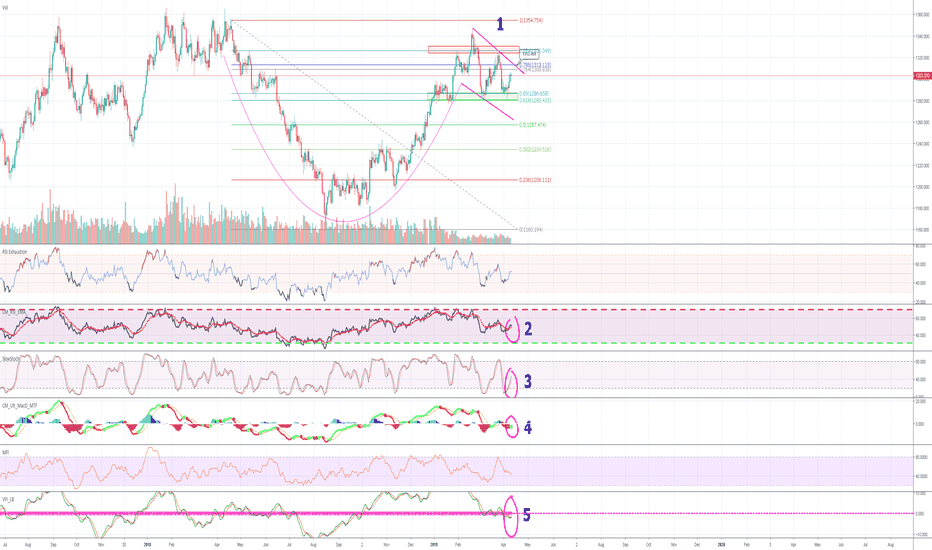

Silver - Running out of SteamLooking at the daily chart for Silver, we can see a solid push from the $13.11 range in November to over $15 in February. However, since hitting strong overhead resistance this run appears to be losing steam. The ADX which measures the strength of the trend appears to have double topped. The MACD is showing bearish divergence as well. There is still a chance for the price to rebound off support and retest the purple trend, but I am biased to the downside for now.

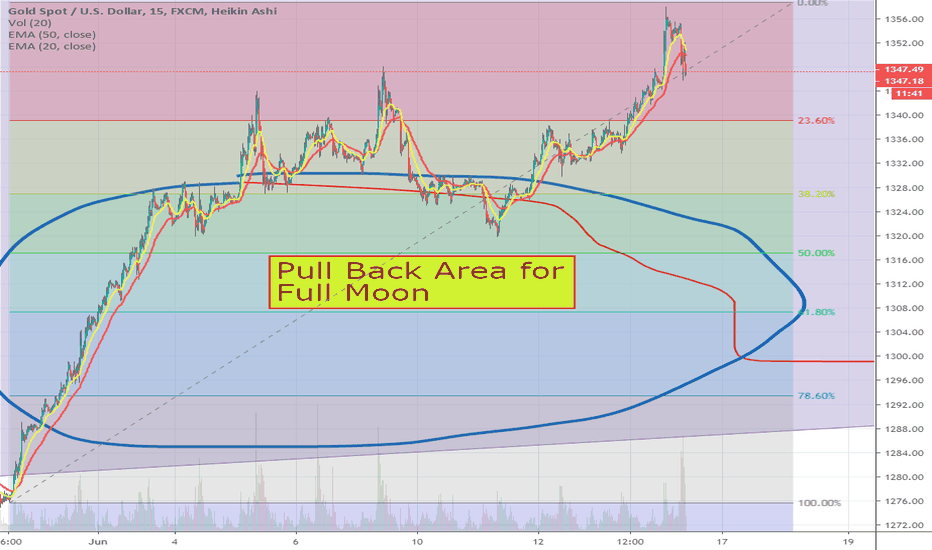

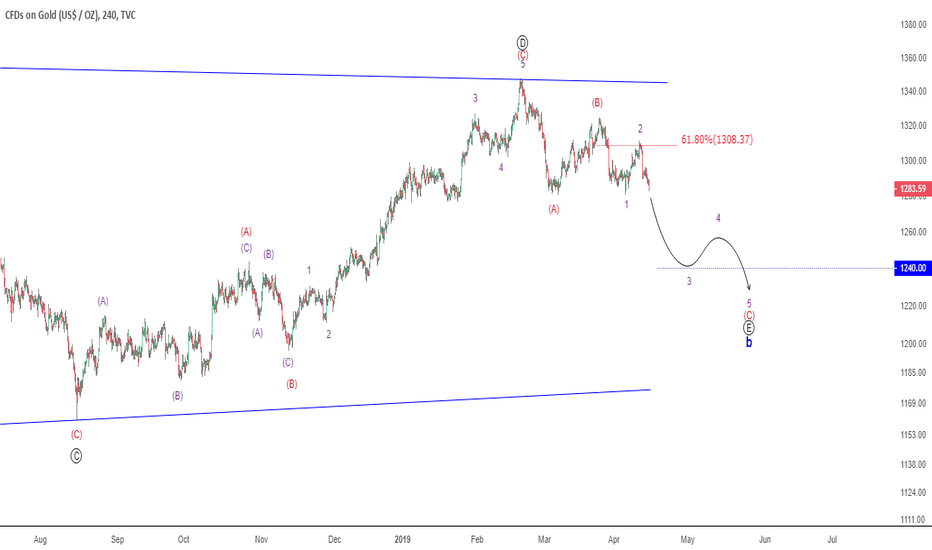

Gold - Bullish Indicators and Cup N HandleGood evening traders,

While I don't hold gold, I hold alot of silver. Due to the correlation, lately, you can practically trade silver using a gold chart.

I wanted to point out a few positive things gold has going for it currently.

1) We can see we have a cup and handle forming on the daily, now granted, the length of the handle is not well developed, and we could certainly see further downside to complete the handle.

2) RSI has crossed its average EMA, this is bullish.

3) Slowstoch is currently mid re-trace to the upper bounds.

4) MACD is currently crossing bullishly on the daily.

5) VFI is threatening to bullishly cross.

With all the market uncertainty, and what should end up being a red week for equities, we can expect a couple of things coming up for gold.

Firstly, as investors flee equities, the dollar index will most likely strengthen, this could be a catalyst to further breakdown past the value area between 1280-1286 (the corresponding .618 and .65 of the bearish structure).

Conversely, if investors seek risk off assets and diversify into gold, it could be just what the metal needs to break out.

Another item of importance is the head and shoulders that is forming on the daily and we must observe closely over the coming days.

As always, if you like my content, please hit the "Like" and "Follow" button. Additionally, you can always receive my updates by going to settings, notifications, check receive email updates, and follow this idea.