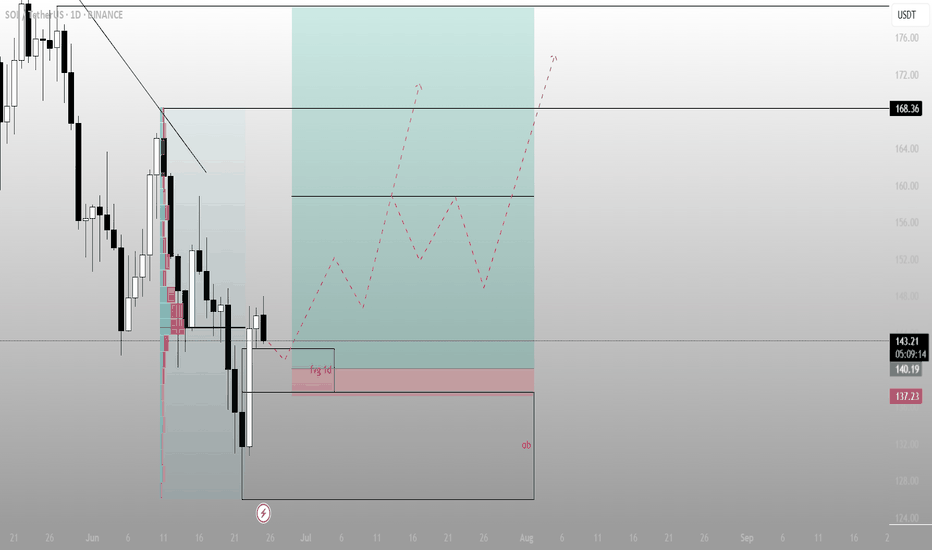

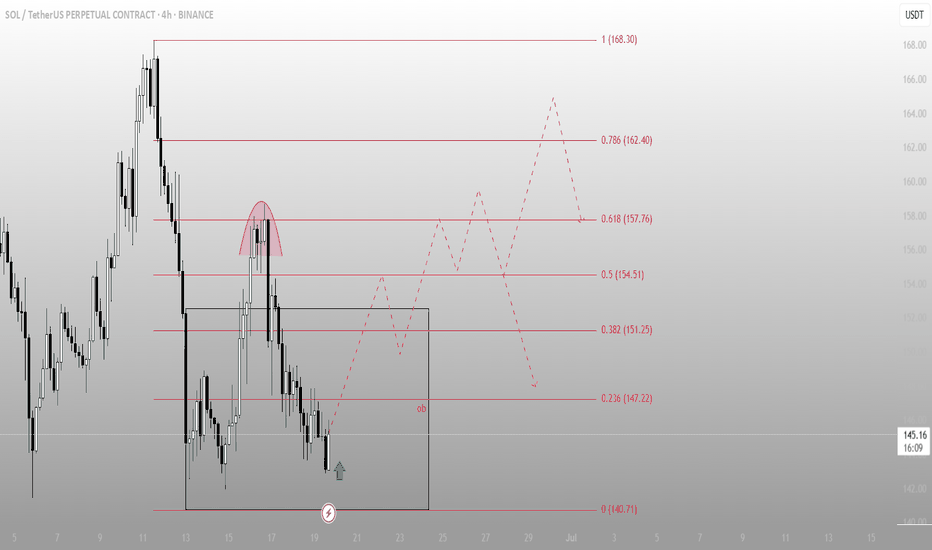

Most see rejection. I see a launchpadWhat looks like a failed breakout is actually SOL setting up for a higher timeframe reversal, right at a refined zone of inefficiency and Smart Money interest. The narrative isn’t over — it’s just beginning.

Technical Breakdown:

Current Price: ~$143.30

Context:

Price tagged the Fair Value Gap (FVG) on the daily and showed reaction — a sign of algorithmic awareness

Volume profile suggests thin liquidity above, ripe for expansion if momentum kicks in

Key Levels:

FVG (1D) zone: just under current price (~140.19)

Order Block (OB): ultimate demand zone near 137.23 — strong structural support

Downtrend Line: recently broken, retest in motion

Major Upside Target: 168.36 — a clean liquidity magnet

Strategic Thesis:

Price dipped into FVG but held above the OB — a classic Smart Money accumulation setup

The dashed projection shows potential higher lows forming, giving fuel for a push through prior highs

FVG + OB form the discount zone, where risk/reward is maximized before the next impulse move

Execution Plan:

Entry zone: $140.00–137.50

→ Expect small shakeouts before confirmation

Invalidation: Daily close below $136 kills the bullish case

Target:

Primary: $168.36

Stretch Goal: $172–176 if momentum is sustained into August

Smartflow

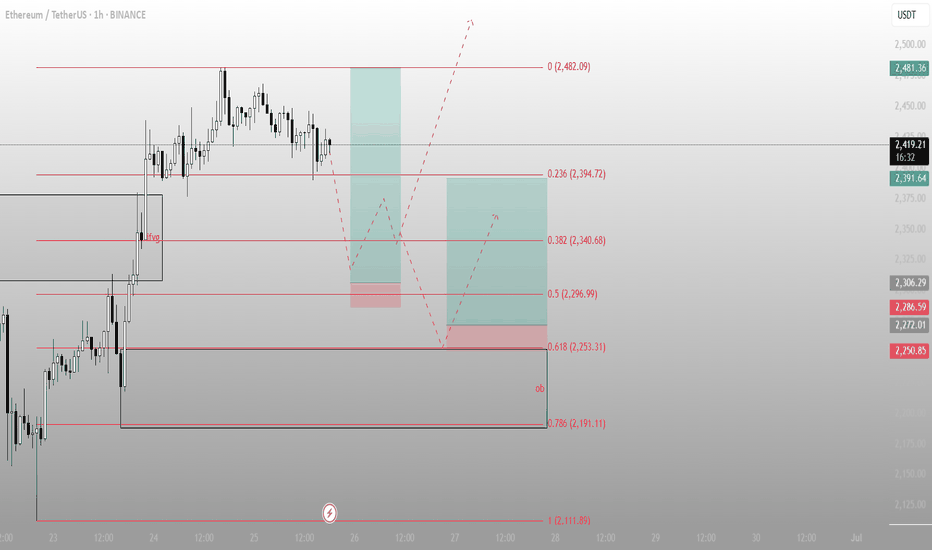

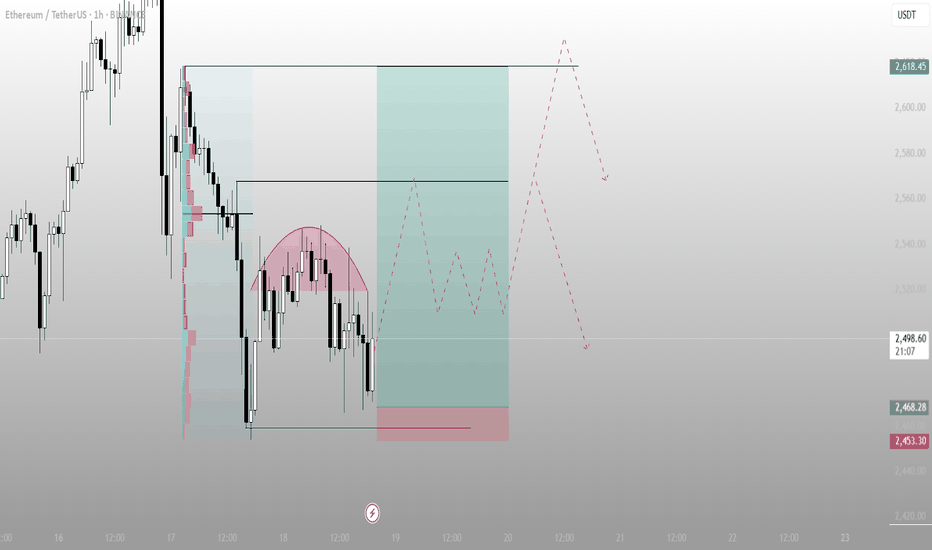

Everyone sees consolidation. I see positioningETH is holding just above a key fib cluster, showing signs of controlled distribution, not weakness. Smart Money doesn’t chase — they build positions while the crowd second-guesses.

The Structure:

Current Price: ~2,419

Local High (Premium): 2,482.09

Fib Retracements:

0.236 → 2,394.72 (mild correction)

0.382 → 2,340.68 (initial re-entry zone)

0.5 → 2,296.99 (ideal discount)

0.618 → 2,253.31 (deep entry, high confluence)

0.786 → 2,191.11 (structure last line)

Key Zones:

FVG already filled during the move up — imbalance mitigated

Order block (OB) at 2,191.11: high-probability reaction zone

Strategy Outlook:

Scenario A (Shallow pullback):

ETH tests 2,394 → 2,340, then continues the push to 2,482

→ Aggressive buyers step in early

Scenario B (Deeper sweep):

A drop to 2,296 → 2,253 opens the door for reaccumulation

→ Classic Smart Money trap before the next rally

Invalidation:

A break below 2,191 (and OB failure) kills this bullish narrative

Execution Logic:

Accumulation Zones:

Light: 2,340–2,296

Strong: 2,253–2,191 (discount reload)

Target:

2,482

Extension optional if momentum builds above recent highs

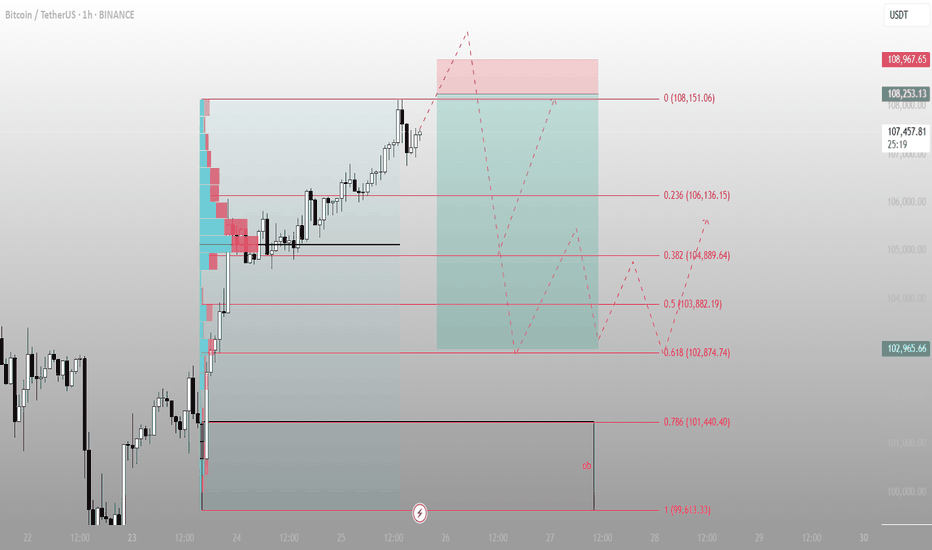

Premium zone tagged — now we watch how the Smart Money reactsBitcoin just tapped into the 108,151 level — the top of a measured premium range and a likely area where profit-taking begins and fresh distribution footprints form.

This run-up wasn’t random. Price surged from inefficiency, cleanly filled the fair value gap (FVG), and is now flirting with a key liquidity pocket.

Here's what the structure says:

Premium reached: 108,151 (0% fib)

If rejection holds, Smart Money looks to discount entries:

0.236: 106,136

0.382: 104,889

0.5: 103,882

Deep retracement zone: 0.618 at 102,874

Final defense for bulls? The unmitigated FVG block between 101,440 → 99,613

Possible Playbook Scenarios:

Quick retrace → higher high:

Bounce off 104,889 or 103,882 before attacking 108,967+

Deeper sweep:

Into 102,874 (0.618) before Smart Money steps in again

Invalidation:

Break below 99,613 closes this bullish narrative and confirms a structural break

TL;DR Execution Logic:

Wait for retracement into 0.5–0.618 fibs

Look for bullish reaction (engulfing or SFP)

Upside targets:

108,151 (retest)

108,967 (liquidity sweep)

Further upside if momentum sustains

Where Most See Resistance, Smart Money Sees OpportunityDOGE is currently hovering around the 0.382–0.5 Fibonacci retracement zone after a reactive bounce from 0.618 (0.16784) — a critical discount level. Most traders panic at these levels, but experienced participants know this is the zone where price builds intention.

Here's the breakdown of the structure:

Price tapped into the 0.618 Fibonacci level (0.16784) and began showing signs of recovery — a typical Smart Money accumulation zone.

The next target is 0.17042, aligning with the 0.236 retracement level, followed by 0.17151, where previous supply might get mitigated.

Potential retracements are possible, but as long as price holds above 0.16670 (0.786), the bullish structure remains intact.

Execution strategy:

Entry (Accumulation Zone): Between 0.16784 and 0.16864

Invalidation: Break below 0.16600 would weaken the bullish case

Upside targets:

• TP1 → 0.17042

• TP2 → 0.17151

• Extension possibility beyond 0.17204

This move appears to be a classic premium-delivery setup — a structural reset, not a collapse. Smart Money steps in quietly when retail panic takes over. If you're trading DOGE like a pro, focus on levels, not emotions.

Let me know if you'd like this converted into a tweet format or turned into a technical newsletter paragraph.

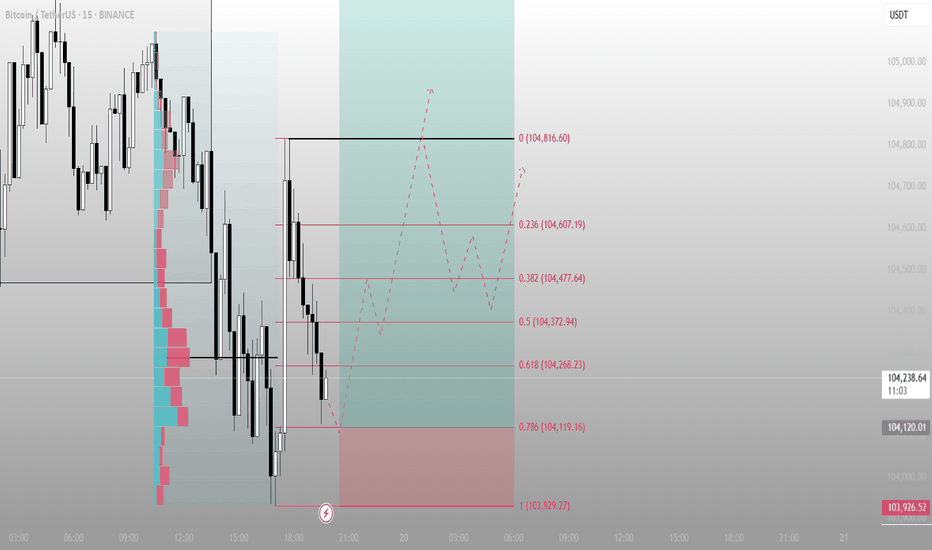

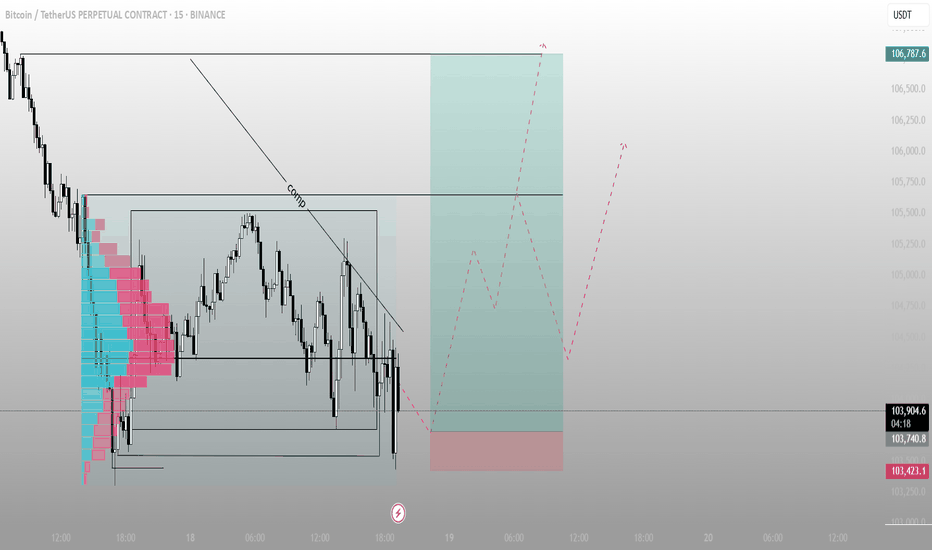

BTC – 15min Reversal Structure & Fibonacci ReclaimWe’re currently witnessing a potential short-term reversal on BTC’s lower timeframe after a volume-supported breakdown and sweep of local lows.

🔍 Key Observations:

Price swept liquidity at local lows (~103,929.27)

Entered into a clear reaccumulation box with responsive buyers

Volume profile shows prior POC just above – room for fill

Fibonacci retracement aligns with key structure:

0.5 = 104,372.94

0.618 = 104,268.23

1.0 = 104,816.60 (final high target for this impulse)

📈 Potential Play:

Entry Zone: Just above the sweep candle (104,100–104,200)

Target 1: 0.382 at 104,477

Target 2: 104,816.60

Invalidation: Close below 103,926

🧠 Mindset:

This is a classic liquidity sweep → reaction → reclaim pattern. If BTC flips the 0.5 level with strong momentum, a short squeeze toward the 104.8K area becomes likely.

Great opportunity for scalpers or day traders.

Let me know if you want this turned into a long-form breakdown or sent in another format.

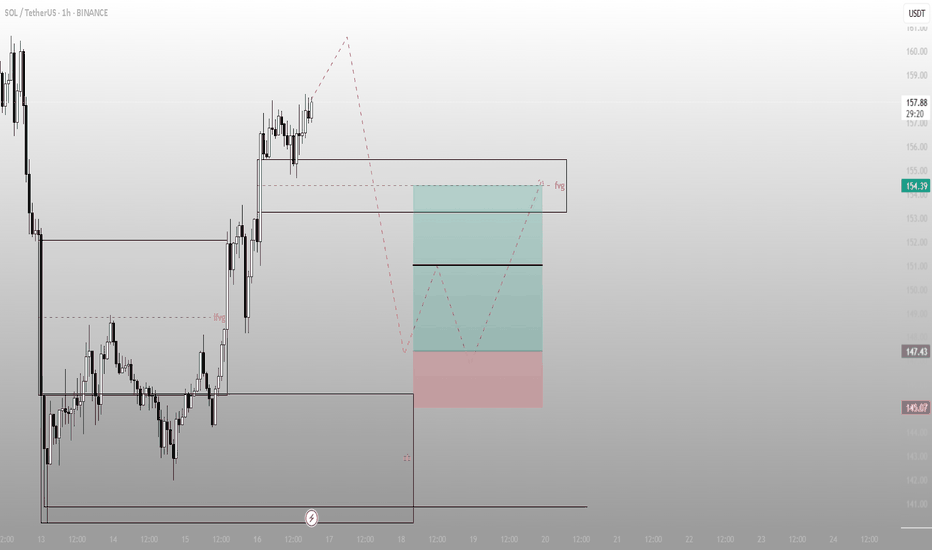

SOL – Sweep & Spring Play at Local DemandWe’ve got a clean rounded top → breakdown → demand sweep setup.

Current price action suggests a potential reversal is brewing.

🔍 What’s happening on this chart?

Rounded top marks a local distribution — aggressive short entries

Price broke lower, swept the demand zone (gray box), and now shows rejection wick + bullish reaction

Fibonacci levels mapped out the structure

0.5 = 154.51

0.618 = 157.76 = key resistance liquidity zone

🎯 Trade idea:

Entry: inside demand zone (OB marked on chart)

Target 1: 151.25

Target 2: 157.76 (0.618)

Full fill: 162.40 – 168.30 (complete inefficiency sweep)

🧠 Mindset:

This setup is classic spring + reclaim. If price consolidates and flips 147.2, upside becomes favorable.

If you like clean trade setups with logic and clear invalidation, check the account bio for more updates and live breakdowns.

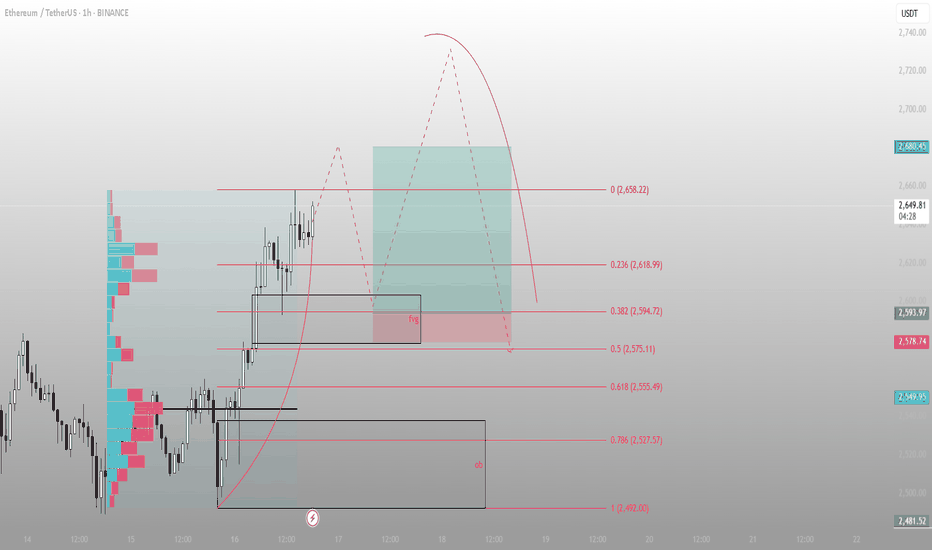

ETH – Rounded Distribution Before the Punch Higher?What we’re seeing here is a potential fakeout setup within a value zone.

Notice the rounded top formation — looks bearish — but price refuses to break the low. This often sets the stage for a sharp reversal.

Structure Breakdown:

Volume profile shows acceptance in current range

Rounded top shape implies weakness — but no breakdown = trap potential

Price holds a higher low inside the range = absorption

Green box marks ideal long entry area — well-defined invalidation below

Bullish case:

We’re watching for that reclaim of the mid-level → quick push into the upper range

Target zone = 2,618 (clean inefficiency fill + local top)

Bearish trap scenario invalidated if price closes below red box (stop hunt level)

Strategy bias:

This is a compression-reversal trap — fake weakness to trap shorts, then launch.

Patience pays here — if it reclaims and consolidates at the mid, it’s time to ride.

📊 More setups like this, early in structure, are shared inside the account description. Tap in for the breakdowns.

BTC – Stop Hunt at the Edge of ValueThis is what a liquidity raid looks like.

Price just swept the bottom of the range, tapped into the low-volume zone (as seen on the volume profile), and reclaimed — classic sign of a trap sprung.

Key points:

The downtrend line labeled “comp” = compression — bulls forced to capitulate into a thin zone

High probability deviation with stop run and reclaim — this fuels the next move up

The green box shows risk-defined entry off the sweep low

Targeting the prior high: 106,787

Volume imbalance filled = no inefficiency above — price can now move cleanly

Execution mindset:

Trap spring → retrace into structure → expansion

Risk is clear, liquidity is engineered, structure remains

Late shorts just became the fuel.

Watch the reclaim of the box top. If that flips support, we ride momentum.

📈 For more setups like this — including pre-breakout traps — check the description in the profile.

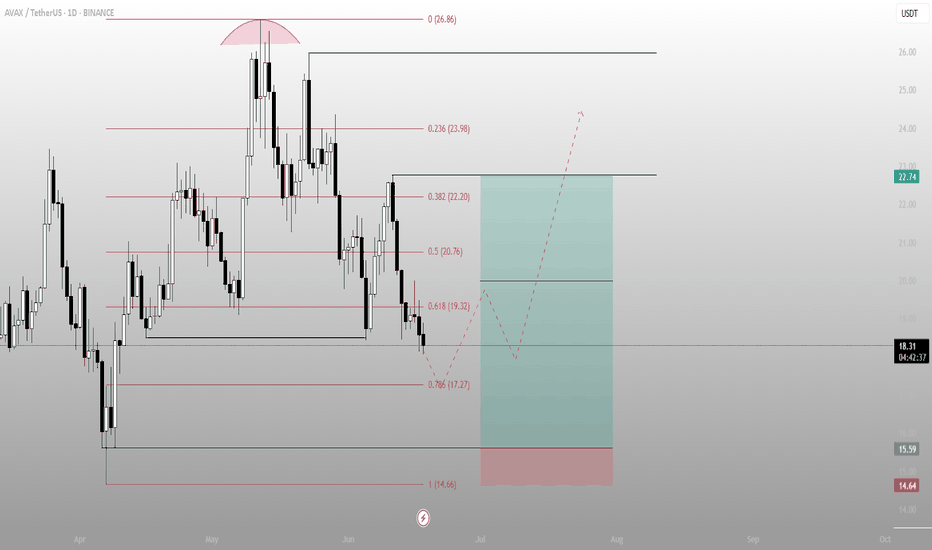

They want AVAX to look weak down here Everyone’s staring at the recent drop like it’s collapse. I see rotation into discount. AVAX is tagging the 0.786 retracement (17.27) — the same level that Smart Money builds into before it reclaims value.

Breakdown of the move:

The range top at 26.86 marked the premium; we’ve now delivered deep into the 0.786

No displacement through the previous swing low — yet

Structure remains intact if 14.66 holds — anything above that is deliberate discount rebalancing, not failure

This is where liquidity collects before decisions are made.

Execution lens:

Accumulation zone: 17.27–14.66

If bulls defend this pocket, 20.76 (0.5 fib) is the first draw, then 22.20

Final delivery window sits between 22.20–23.98 — where late buyers chase

AVAX doesn’t need a narrative. Price is the narrative.

Watch this base. And if it holds — don’t act surprised when it’s 20+.

For more setups that map where, not when — check the profile description.

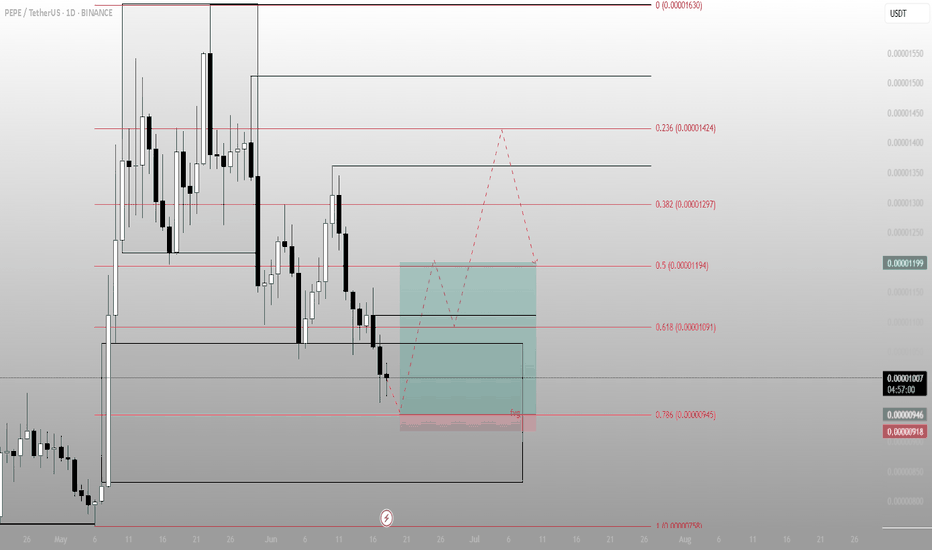

Most see capitulation. I see clean premium-to-discount deliveryPEPE just swept deep into the 0.786 retracement — right where most fear sets in. But Smart Money? This is where they reaccumulate. The structure isn't broken — it's resetting.

Here’s what the chart tells me:

Price dipped straight into the FVG + 0.786 (0.00000945) zone

That's the deepest discount before structural invalidation — exactly where Smart Money looks for reversal footprints

The upside draw sits cleanly at 0.00001194 (0.5 fib), with an extension possible toward 0.00001297 and even 0.00001424

This move down didn’t violate anything. It rebalanced prior inefficiency and opened the door for premium delivery.

Execution logic:

Accumulate within 0.00000945–0.00000918 (discount zone)

Invalidation: break below 0.00000758 closes the book on this setup

Targets: 0.00001194 → 0.00001297 → 0.00001424

The biggest moves don’t start when it feels safe. They start when it feels late.

For setups like this — built on logic, not luck — check the profile description. I trade where Smart Money trades.

ETH didn’t rally — it cleared inefficiency and pausedThis isn’t the move. This is the setup for the move.

ETH tagged 2658.22 — premium — and stalled right where Smart Money pauses before redistributing or rotating.

Here’s how this lines up:

Price swept into the 0 fib (2658.22), then hesitated — that’s not weakness, that’s precision

Just below sits a clean FVG at 2594–2575, right between the 0.382–0.5 fibs

Below that: OB near 2527–2492 — last line of defense before momentum flips

Right now, ETH is offering a reactive pullback opportunity. If bulls hold 2594–2575 with a bounce, we rotate higher again. But if they don’t — 2527 becomes the decision zone.

Execution lens:

Ideal re-entry zone: 2594–2575

Invalidation: sustained close below 2555 = expect OB tap

If FVG holds, expect revisit of 2658 → extension toward 2680s

This setup isn’t done. It’s developing. Wait for price to speak — not hope.

For more plays built like this — mapped in advance, not after the fact — check the profile description

Impulse without purpose? Not in Smart Money termsSOL didn’t just break structure — it filled inefficiency and positioned above. Now price is sitting in the upper FVG, where decisions are made — not guesses.

What just happened:

Price rallied from the OB below and left an IFVG in its wake

Current price is hovering at the edge of a higher FVG, right where liquidity rests from trapped shorts

The move is complete — now it’s about what price does next in this zone of intent

From here, two paths:

Sweep into FVG, reject, and rotate back down toward the 154–147.4 range

React bullishly from mid-FVG, reclaim structure → break to new internal high and keep running

The OB down at 145 is still valid if price unwinds — that’s where Smart Money bids.

Execution view:

Rejection from 158–159 = short bias down to 147–145

Clean invalidation above FVG high

If price consolidates at 154 and reclaims → setup flips bullish

The setup isn’t about what price did — it’s about what it’s preparing for.

You want more trades like this — precision zones, mapped logic — check the profile description.

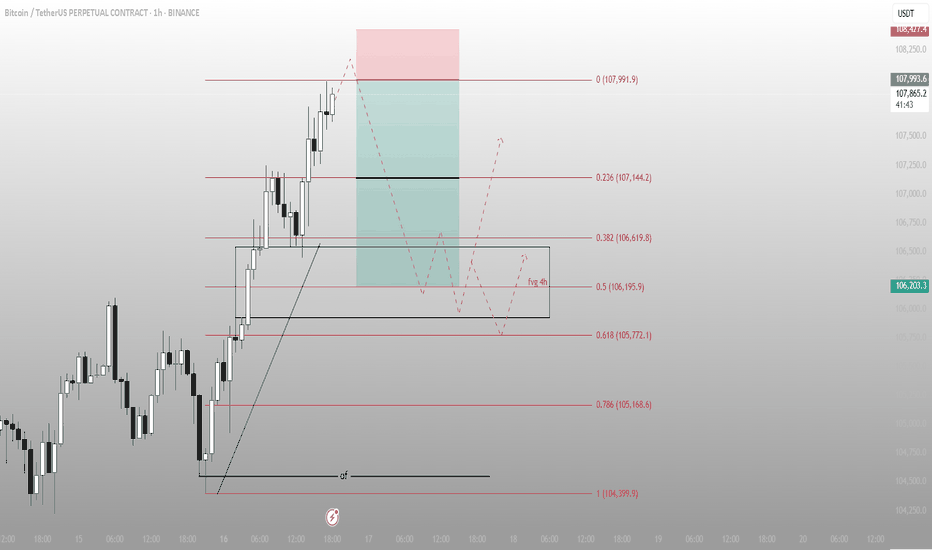

That wasn’t a breakout. That was the stop runBTC swept the high into 107,991 — precision tap of the premium fib. Now the delivery shifts. Price has already done its job: take liquidity, trigger late longs, and set up the real move.

Here’s the execution breakdown:

Price tagged the 0 level of the fib extension — 107,991 — and rejected

A clean 4H FVG sits just below around 106,195.9 (0.5), aligned with 0.382 and 0.618 fib levels (106,619.8 to 105,772.1)

This is the re-entry zone for Smart Money — not the top chasers

Expectations from here:

→ Rebalance into the 106.6–105.7k region

→ If that zone holds and price shifts structure bullish again, we retest 107.1 → 107.9 → break higher

→ If we lose 105.7 cleanly, I’m watching 104,399.9 — the deeper inefficiency magnet

This isn’t about confirmation. It’s about preparation.

More trades like this — clean, controlled, conviction-based — live in the profile description.

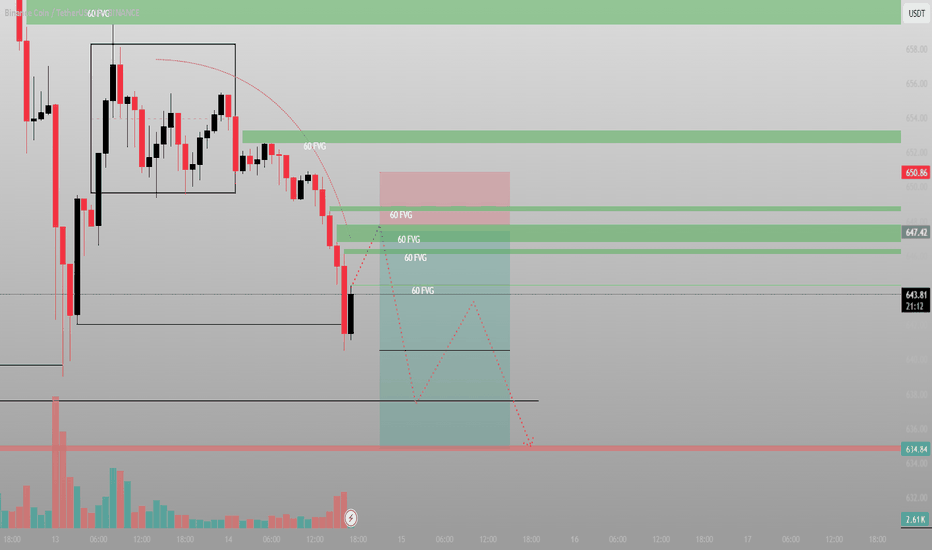

This isn’t a dump. It’s a delivery systemBNB sold off fast — but not irrationally. Look closer, and you’ll see the system at work: rejection from inefficiency, compression, and now a retest of where the last real buyers were found.

The structure:

Price swept short-term demand and wicked below local range lows with a high-volume rejection. That low was engineered — not failed.

Above us? A neatly layered series of 60-minute FVGs from 646.5 to 652.0. Every candle into that zone is a test. But the true objective is to reload short once that imbalance is filled.

Playbook:

We’re in a reactive zone now. Here’s what I’m watching:

Price pushes into the FVG cluster (646–650)

Volume dries → rejection wick → return to discounted re-entry

Aggressive scalpers might long the bounce into the FVG, but the higher-probability play is fading the inefficiency once it’s filled.

Execution:

Scalp long (optional): 643.5 → TP into 648–650

Main setup: short entry from 647.4–650.5

SL above 652.2

TP1: 640.5

TP2: 634.8

Final draw: 630.0 if structure accelerates

Patience is what separates the move from the moment.

Final thought:

“This move didn’t break structure. It exposed the next one.”

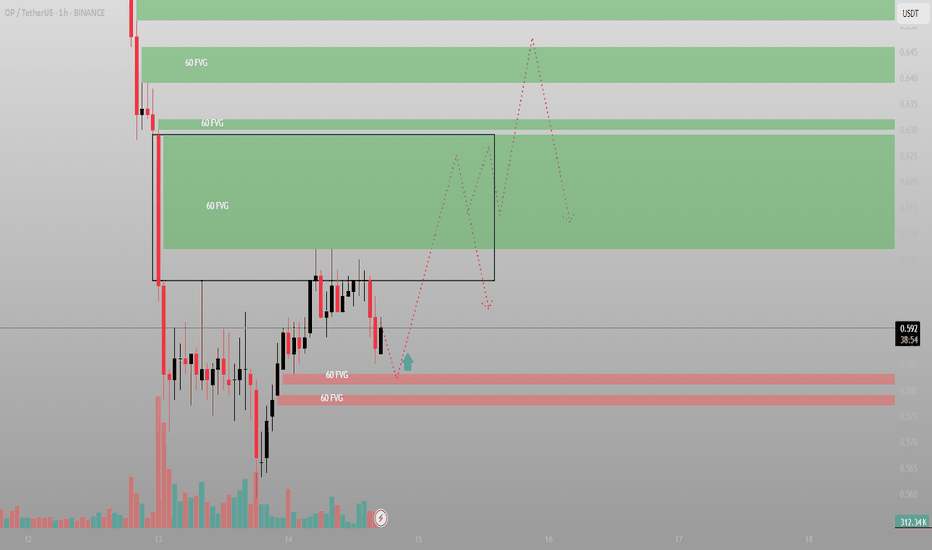

Everyone saw the drop. I saw the gapPrice nuked — but it didn’t break structure. It filled imbalance, paused, and now it's reloading beneath a stack of untouched FVGs. This isn't capitulation. It's orchestration.

The setup:

We’ve got layered 60-minute FVGs stacked from 0.61 to 0.66. That’s the destination — not the mystery. What matters is the origin. The rejection block around 0.58–0.59 has held clean, and we now have two bullish rejection wicks off that base.

Volume surged during the sweep — and fell on the retrace. That’s not distribution. That’s Smart Money filling.

Two entries — one outcome:

Entry 1: Tap into the red demand zone, wick the 0.58–0.579 region

Entry 2: Break and retest above minor FVG (0.60 reclaim confirmation)

Either way, the draw is the inefficiency stack above.

Execution Map:

Long from 0.579–0.583

SL: Below the base at 0.574

TP1: 0.615 (lower FVG)

TP2: 0.645 (full sweep)

Final: 0.660 liquidity run

Don’t fear the compression. That’s where the trap is set.

Final thought:

“Most traders fear price going sideways. I see it as silence before the algorithm speaks.”

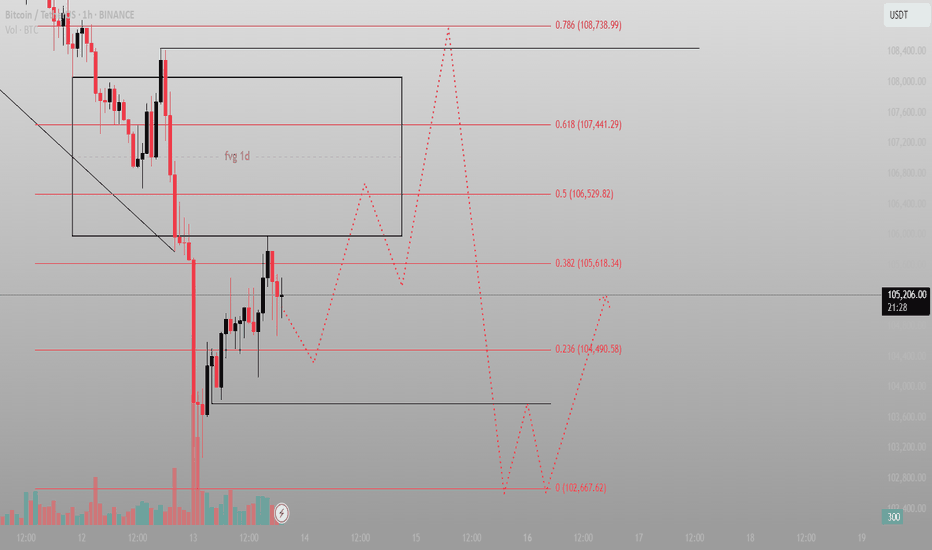

The FVG above isn’t the target. It’s the bait.This is a classic Smart Money sequence. Most are watching the imbalance at 106.5k–108.7k and expecting immediate delivery. But that’s not how this game works.

The setup:

Price broke down violently, then reversed with momentum — stopping right beneath the daily FVG block. That alone tells me it’s not ready. It’s gathering.

Below? Multiple fib levels that haven’t been tested — 104.4k (0.236), 102.6k (0.0), and a volume-backed rejection wick that still holds weight.

The market is likely to dip again — pull into deeper discount, reset the low timeframe narrative — and only then attack the FVG and upper sweep zones.

What I expect:

Sweep of 102.6k (final liquidity run)

Reaction → reclaim 104.4k

Push into the FVG toward 106.5k (0.5) and possibly 107.4k (0.618)

No emotional reaction to the red candles — this is structure playing out, not weakness unfolding.

Plan:

Ideal Entry: 102.8k–103.2k range

SL: Below 102.6k

TP1: 105.6k

TP2: 107.4k

Final: 108.7k clean inefficiency fill

Let it dip. Let it breathe. That’s where conviction is built.

Final thought:

“The real move starts when they convince you it’s done.”

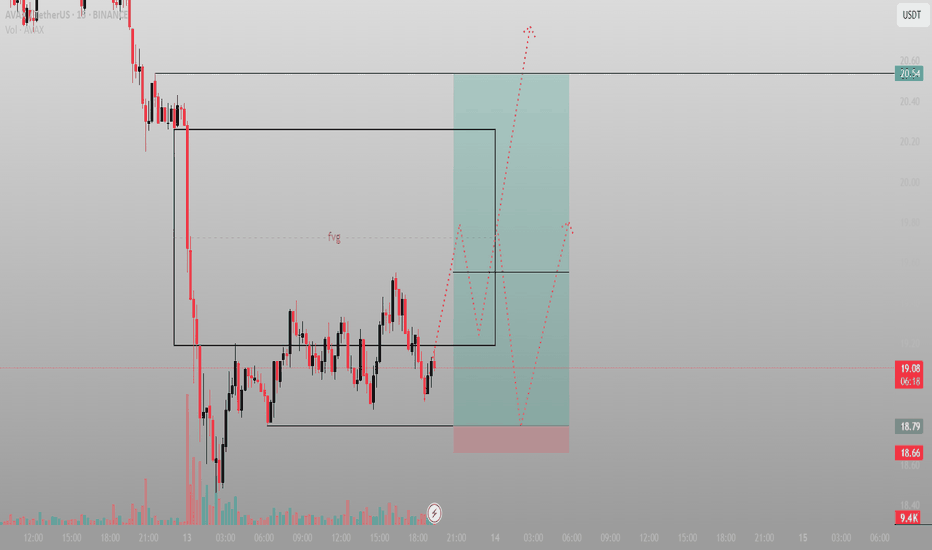

When the range compresses, the breakout doesn’t ask — it takesThis isn’t a chop. It’s a setup. AVAX just printed the kind of consolidation Smart Money wants to see before delivery.

The setup:

After the impulsive drop, price carved out a micro-range with well-defined boundaries — compression structure nested inside inefficiency. The FVG above (marked in purple) hasn’t been mitigated, and price is now pressing upward into that void with rising volume.

But that’s not where the trade is. The real trade is in the retracement.

I’m watching for one of two entries:

Either we drive into the FVG first, then sweep back into the range floor to trap late longs

Or we sweep range low one more time, then rip straight into the imbalance

Either way, the invalidation is clean — below the swing low, under 18.66.

Execution plan:

Entry: 18.70–18.90 zone (post-sweep or reaction)

TP1: 19.80 fill (FVG midpoint)

TP2: 20.54 clean inefficiency clearance

Nothing about this is forced. Price is telling the story. I’m just listening.

Final thought:

“The range isn’t random. It’s the disguise Smart Money uses before they move size.”

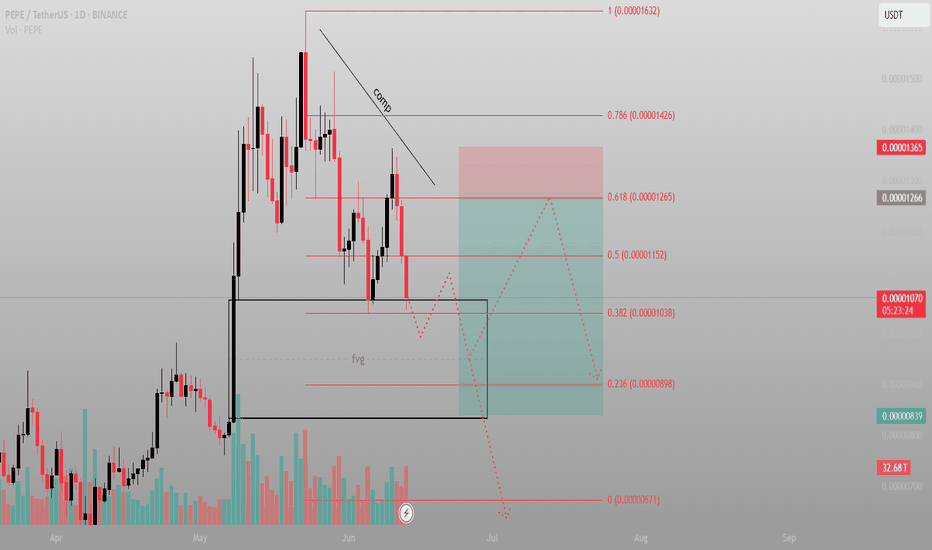

Compression, rejection, and the trap belowPEPE isn’t random here — it’s in a calculated drawdown. Not a dump — a design. What looks like weakness is really compression into a reactive pocket.

The logic:

Price is descending inside a compression channel. But the real interest lies lower — specifically around the FVG and the untouched demand range down to 0.0000089. That’s the key.

The 0.0000103 zone is a surface-level fib level (0.382), but the deeper intention is beneath it — where Smart Money will want to accumulate before running it back into inefficiency.

Above us? There’s a massive void sitting between 0.0000115 and 0.0000126. That’s the draw — but not before a deeper sweep to fuel it.

Two key paths:

Ideal: Full sweep of 0.0000089 demand → strong reversal → drive back into the .5/.618 fib cluster near 0.0000115–0.0000126

If front-run: Hold near current level (0.0000103) and deliver into the FVG gap above

Anything below 0.0000083? That’s your invalidation. Until then, compression is the setup.

Final thought:

“Smart Money doesn’t chase the wick. It sets the trap — then steps in with size.”