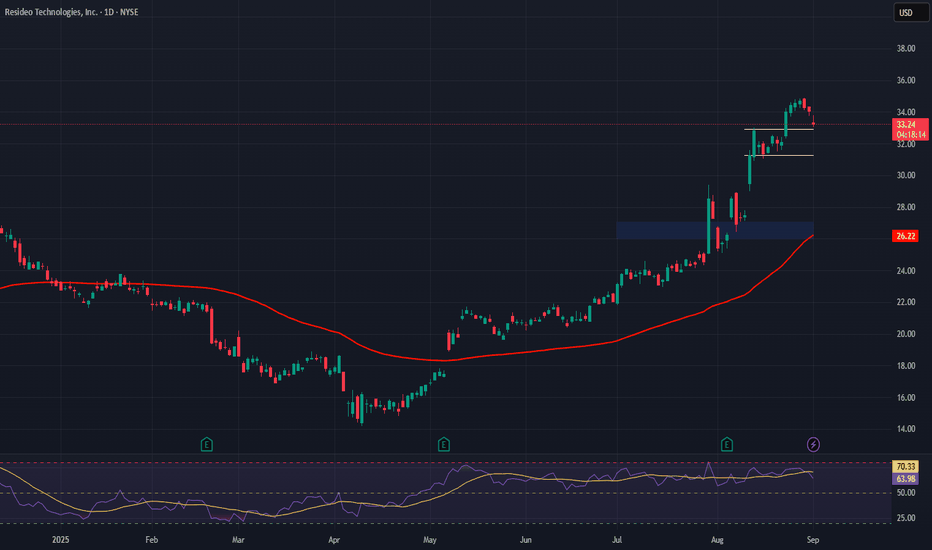

Resideo Technologies (REZI) AnalysisCompany Overview:

Resideo Technologies NYSE:REZI is a smart home & security solutions provider, positioned to benefit from the fast-growing residential technology sector.

Key Catalysts:

Spin-off ahead: Plans to separate ADI Global Distribution in 2H 2026, unlocking shareholder value and sharpening strategic focus.

Honeywell indemnity resolved: Settled $1.59B liability in Q3 2025, removing a long-standing earnings overhang and improving financial clarity.

Product momentum: Strong adoption of Honeywell Home FocusPRO thermostats and First Alert smart alarms, expanding market penetration.

Investment Outlook:

Bullish above: $26.00–$27.00

Upside target: $40.00–$42.00, supported by spin-off potential, liability resolution, and product strength.

📢 REZI — unlocking value with spin-off, clarity, and smart-home growth.

#REZI #SmartHome #Security #Honeywell #SpinOff #GrowthStocks #ResidentialTech

Smarthome

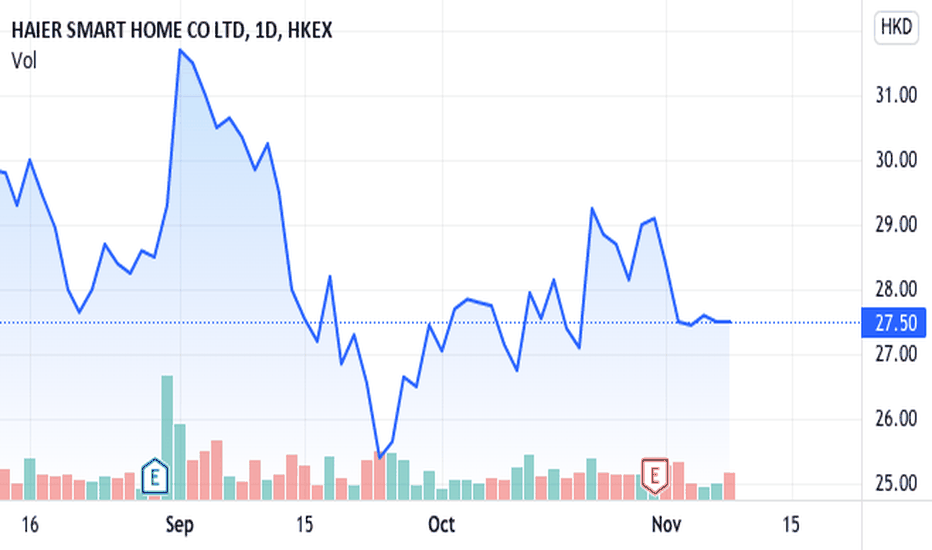

Haier Founder Zhang Ruimin Steps Down as ChairmanZhang volunteered not to participate in the nomination of new directors. Zhou Yunjie was elected as the new chairman of the board and appointed as CEO. Liang Haishan was appointed as president.

During Zhang’s 37-year stint at Haier, the firm has grown from a Qingdao refrigerator factory with a sale revenue of only CNY 3.48 million but a deficit of CNY 1.47 million in 1984 to a global enterprise with a worldwide sale of more than CNY 300 billion and a pre-tax profit of more than CNY 40 billion in 2020.

According to the Qingdao-based firm, Zhang proposed a management model called Rendanheyi in 2005, which has 'become a trend during the era of Internet of things.'

As a legend in China's household appliance industry, Zhang, known as the 'godfather of Chinese management,' has been selected as one of the 50 most influential global management philosophers. In September 2021, Zhang and Eric Cornell, president of the European management development foundation, jointly signed the first international certification of innovative management, signifying that the Chinese enterprises have created the first international standard of management mode.

Consequently, Haier pioneered a new inheritance mechanism, enabling the company to keep evolving after transforming from its bureaucratic model into a self-driven enterprise.

Zhang was also among the 100 Chinese who were awarded the medals of reform pioneers during a grand gathering in December 2018 to mark the 40th anniversary of the country's reform and opening-up.

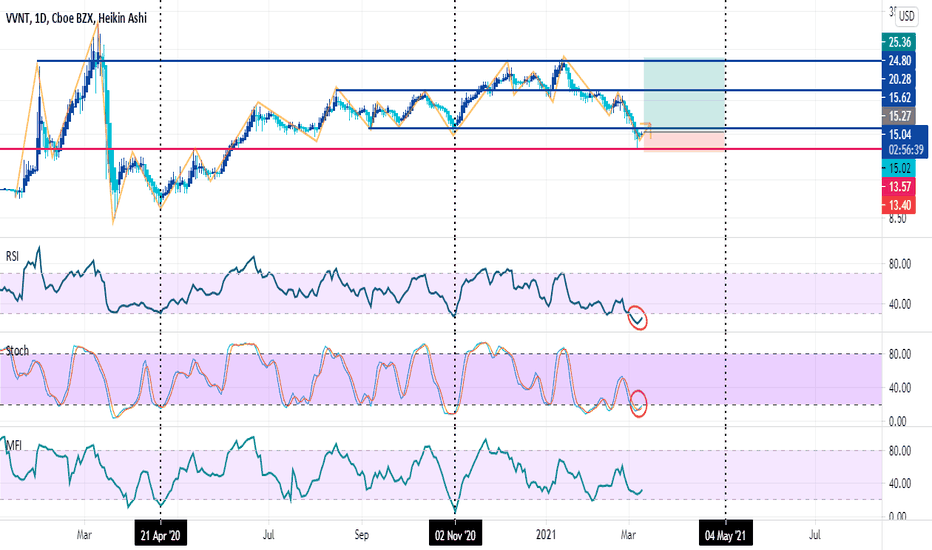

Vivint Smart Home is on saleAt relevant support at $ 15, the next level is at $ 13.5.

It has the potential to go up to $ 20 and a maximum of $ 25 in the medium term.

50% below the peak of March last year.

Stochastic and RSI at the oversold point.

It is a company that has struggled to be profitable, although I highly doubt that it will disappear, on the contrary, I see that its technology is part of a growing sector, so it still has to keep going.

"Vivint Smart Home, Inc. is a public smart home company in the United States and Canada. Vivint delivers an integrated smart home system with in-home consultation, professional installation and support delivered by its Smart Home Pros, as well as 24/7 customer care and monitoring."

NYSE:VVNT