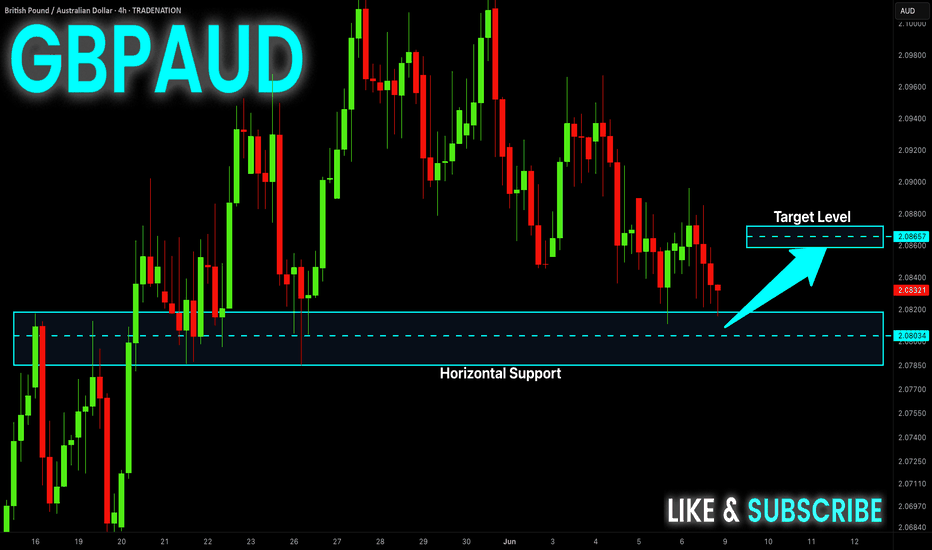

GBP-AUD Local Long! Buy!

Hello,Traders!

GBP-AUD will soon hit

A horizontal support

Of 2.0780 and as it is

A strong level we will

Be expecting a bullish

Rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

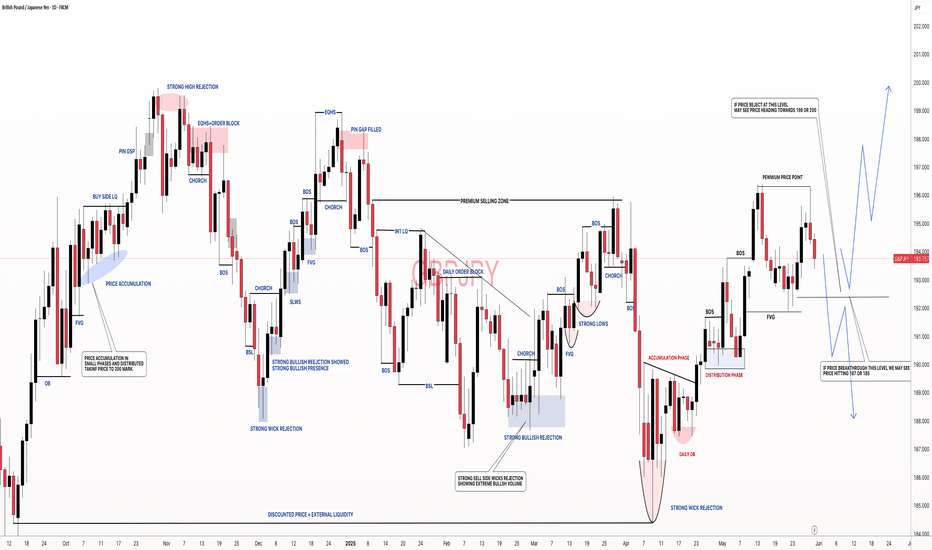

Smartmoneyconcept

#GBPJPY: Buyers and Sellers Both Has Equal Chances! Hey there! So, GBPJPY is at a pivotal moment, and we might see a mix of buying and selling activity in the market. Since the bulls aren’t exactly sure what to do next, here’s what we think:

- The GBPJPY pair is having a tough time breaking through the 194 region. The Japanese yen (JPY) is holding steady, making it hard to predict what will happen next. This has made trading JPY pairs a real challenge.

- Looking back at how prices have behaved in similar situations can give us some clues about what might happen in the future. But it’s important to do thorough research before we start trading. Just because something happened in the past doesn’t mean it will happen again.

- The Japanese yen (JPY) also tends to go down when the US dollar (USD) goes up. Since we’re bullish on the DXY index in the coming days, we think the JPY will probably take a hit, and it could go down a lot. It’s also worth keeping an eye on the GBP, which has been one of the most popular currencies since the market opened earlier today.

- In the meantime, we suggest setting two take-profit targets: one at 197 and another at 199. These levels are likely to see a lot of selling activity.

Now, let’s talk about what sellers should do:

- The price is currently in favour of sellers since it dropped from 195.50 to 193.50. And since the last two daily candles closed with strong bearish volume, it looks like the price is going to keep going down.

- If the price breaks below 190.50, that would be a great opportunity for sellers to make some money.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

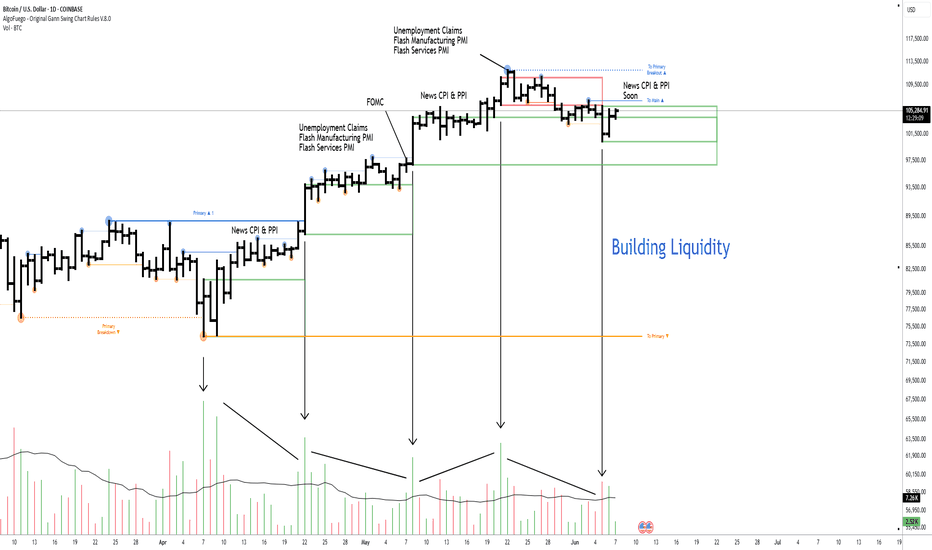

Building Liquidity: What It Really Means🔵 Building Liquidity: What it really means

Professional traders often need liquidity (buyers and sellers) to enter/exit large positions without moving the market too much.

This means manipulating the market within a pre-determined range, which serves as the operating center for everything that follows.

🔹 How is liquidity built

Price Ranging: Sideways consolidation before big moves attracts both buyers and sellers.

False Breakouts (Stop hunts): Price may briefly break support/resistance to trigger retail stop-losses and fill institutional orders.

News Timing: Pro traders often execute during or just before major news when volatility brings liquidity.

🔹 How can you spot a Liquidity-building zone

🔸 Volume

Unusual spikes in volume: Often indicate institutional activity.

Volume clusters at ranges or breakouts: Suggest accumulation/distribution zones.

Volume with price divergence: Price rises but volume falls = possible exhaustion. Volume rises and price consolidates = potential accumulation.

🔸 Price Action

Order Blocks / Imbalance zones: Sharp moves followed by consolidations are often pro trader footprints.

Break of Structure (BoS): Institutions often reverse trends by breaking previous highs/lows.

Liquidity sweeps: Price moves aggressively above resistance or below support then reverses = stop-loss hunting.

🔸 News Reaction

Watch pre-news volume spikes.

Look for contrarian moves after news — when price moves opposite to expected direction, it often reveals smart money traps.

Analyze price stability post-news — slow movement shows absorption by pros.

Wick traps and reversals around news events = stop hunting.

🔸 Narrative is Everything

Higher timeframe trends show intent.

Lower timeframes show execution zones.

Look for alignment between timeframes in a specific direction.

🔹 Why do whales move the market in an orderly manner

To fill large positions at optimal prices.

To create liquidity where there is none.

To trap retail on the wrong side of the move.

To trap other whales on the wrong side of this move.

To rebalance portfolios around economic cycles/news.

🔹 Professionals never forget what they've built

When you track price, volume, and news, you’ll find specific bars that form areas that are the foundation for the short-term direction.

This is pure VPA/VSA logic, the interplay of Price Analysis ,Volume Analysis and News, where each bar is not just a bar , but a clue in the story that professionals are writing.

When you monitor volume, price, and news together and perform multi-timeframe analysis, it becomes clear what the whales are doing, and why.

🔹 From the chart above

The market reached a weekly resistance level and then pulled back slightly after whales triggered the stop-losses of breakout traders.

Prior to the breakout, whales had accumulated positions by creating a series of liquidity-rich buying zones on the daily timeframe.

It's essential to understand the broader context before choosing to participate alongside them—whether you're planning to buy or sell.

🔴 Tips

Use volume and price analysis together, not separately.

Monitor any unusual volume bars before economic market news.

Monitor news and volatility spikes to detect traps and entries.

Combine this with liquidity zones (support/resistance clusters).

Build a "narrative" per week: What is smart money trying to do?

A smart trader understands the tactics whales use, and knows how to navigate around them.

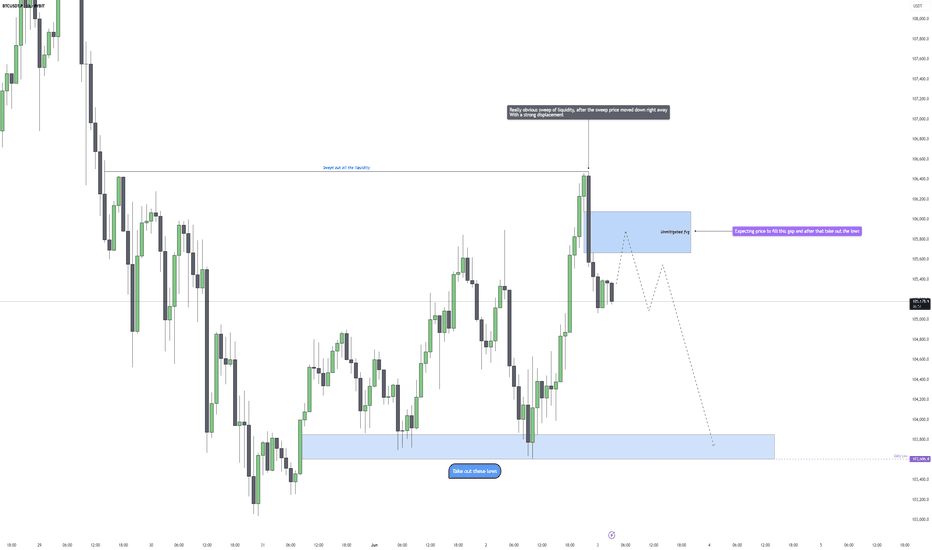

Bitcoin - Reclaim or Reject? Key 4H FVG Levels in FocusAfter an extended move lower, Bitcoin has just swept the major 4H lows and immediately bounced back with strength. This aggressive reaction suggests the sweep was likely a liquidity grab rather than a continuation. Price is now trading back inside a large 4H fair value gap, which could serve as a short-term magnet while market participants reassess direction.

Key Price Reaction and Fair Value Gap Context

The current rebound into the 4H FVG is notable. This zone holds significance because it's the last inefficiency left unfilled before the final leg down. If buyers manage to push through and close above this imbalance, it would indicate a short-term reclaim and open the door to a bullish liquidity sweep higher. The clean highs just above are marked by the $$ label, which align with a key inducement zone and should attract price if bullish momentum sustains.

Upside Scenario – Targeting the Liquidity Sweep

If we do see a clean move and close above the fair value gap, I’ll be looking for price to extend toward the highs just above it. These highs are likely to be the next target for liquidity collection, especially if short-term traders begin chasing strength. However, I’m not expecting price to trade beyond that zone. There’s a protected high resting above, and unless a significant fundamental shift occurs, it’s unlikely we break that structure.

Downside Risk – Failure to Hold Could Lead to 99K

If the market fails to close above the FVG or quickly gets rejected on a wick into it, the bullish scenario becomes invalid. That would confirm the move back up was simply a retracement after the sweep, setting the stage for further downside continuation. In that case, I expect the market to break lower and move toward 99K, which remains my downside target under bearish conditions.

Conclusion

Bitcoin just swept key 4H lows and is now testing a large imbalance. A close above could trigger a run on the $$ liquidity, but I do not expect price to move beyond that due to the presence of protected highs. On the other hand, failure to break and hold above the FVG opens the door for a deeper flush toward 99K.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

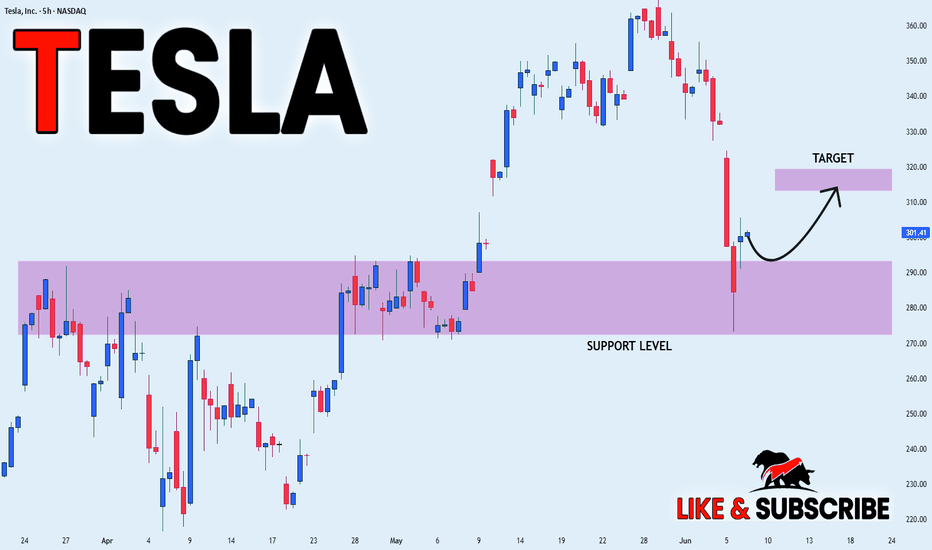

TESLA RECOVERY AHEAD|LONG|

✅TESLA lost more than 25%

On the Elon VS Trump fallout

In less than a week which is

Seen by many as an excellent

Opportunity to add TESLA stocks

To their portfolios with a great

Discount which is why we are

Already seeing a nice rebound

From the wide strong horizontal

Support just above 270$ level

And as we are locally bullish

Biased we will be expecting

Further growth on Monday

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Long From Rising Support! Buy!

Hello,Traders!

GOLD is trading in an

Uptrend and the price is

Making a local pullback

But as we are bullish

Biased we will be expecting

A rebound from the rising

Support line and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

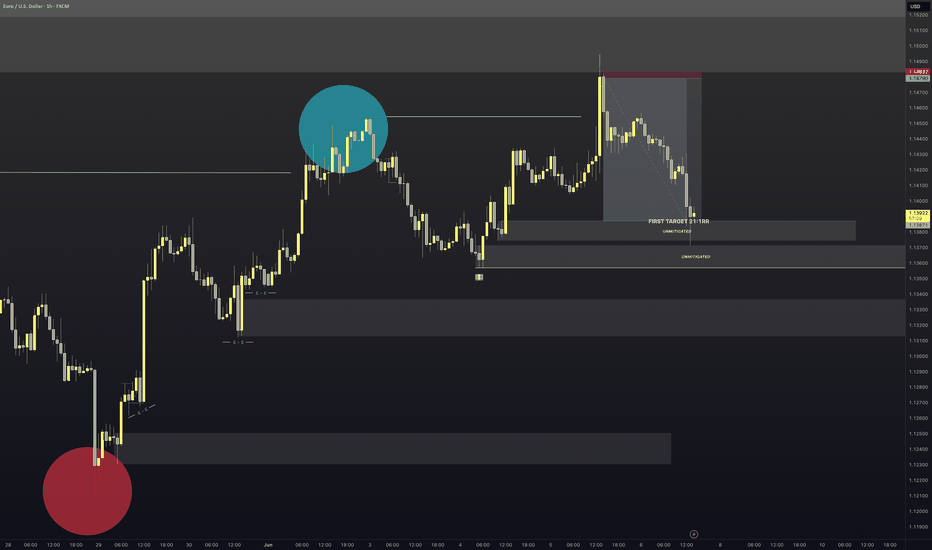

EURUSD - SellEntered this earlier on the 1min TF

Target will be the first Order Block which is 21:RR.

The reason I am targeting here is the 4H order flow is still bullish. So if we can hit the target I close 50% of the position and let the rest ride and manage accordingly to price.

Lets see how it plays out

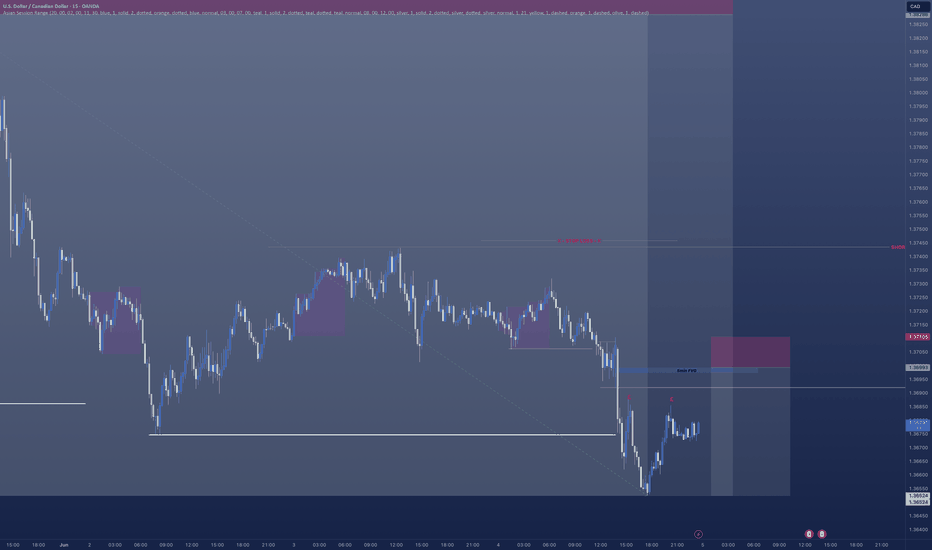

USDCAD - Short ContinuationHave a really nice short currently open on USDCAD

However I am looking to get a further position opened which come in the morning.

There's a clear break of structure.

- A nice FVG left behind.

- We are creating liquidity / inducement

- All pointing towards a nice further sell off in the morning.

Ideal situation is we sweep Asian session highs in the morning in the hope we move lower

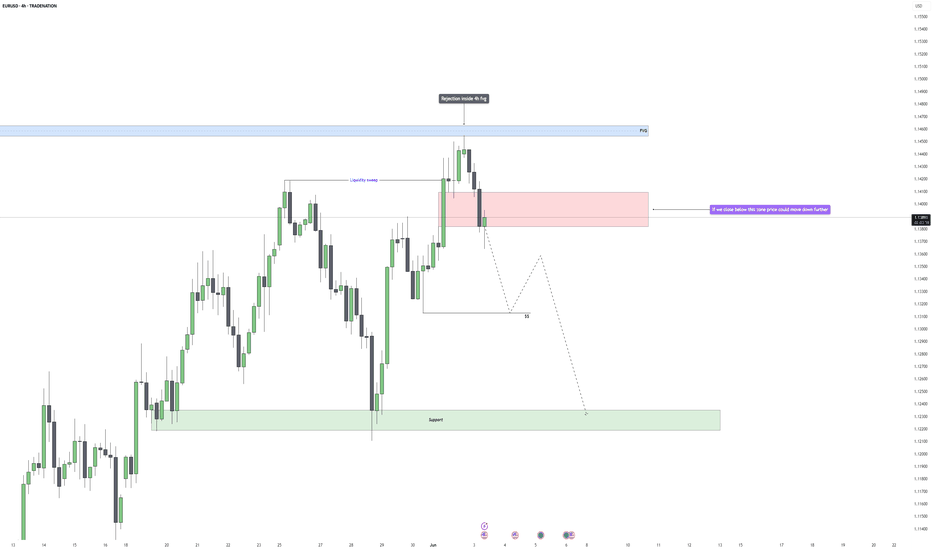

EURUSD - Potential Bearish ContinuationEURUSD recently tapped into a 4-hour Fair Value Gap, aligning perfectly with a prior liquidity sweep just above the recent swing high. This zone acted as a magnet for buy-side liquidity, and price reacted sharply once that liquidity was taken out. The rejection confirms this area was used by larger players to offload positions rather than push higher.

Rejection and Structure Shift

After the sweep and tap into the FVG, we saw an immediate and aggressive bearish reaction, signaling a clear rejection of higher prices. Momentum flipped decisively, breaking smaller structural points on the way down. The rejection is not just technical, it’s reactive, showing that the intent was never to sustain the breakout.

Break of Support Zone and Bearish Setup

Price is now testing the critical mid-range structure marked in red. This zone previously held as support multiple times, but it is now under pressure. If we get a clean 4H close below this area, it confirms a market structure shift and opens the door for further downside.

Bearish Target and Liquidity Zone Below

If the break confirms, the next logical move would be a push down into the broader support area below. That zone holds untapped liquidity and marks the base of the recent rally. A sweep of those lows would align perfectly with the narrative of a failed breakout, followed by a deeper correction.

Conclusion

The rejection from the 4H Fair Value Gap, combined with a liquidity sweep and a pending structure break, builds a clean bearish case. A confirmed close below the marked zone would shift this into a continuation setup, with expectations for a move toward the lower support and a potential sweep of the lows.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

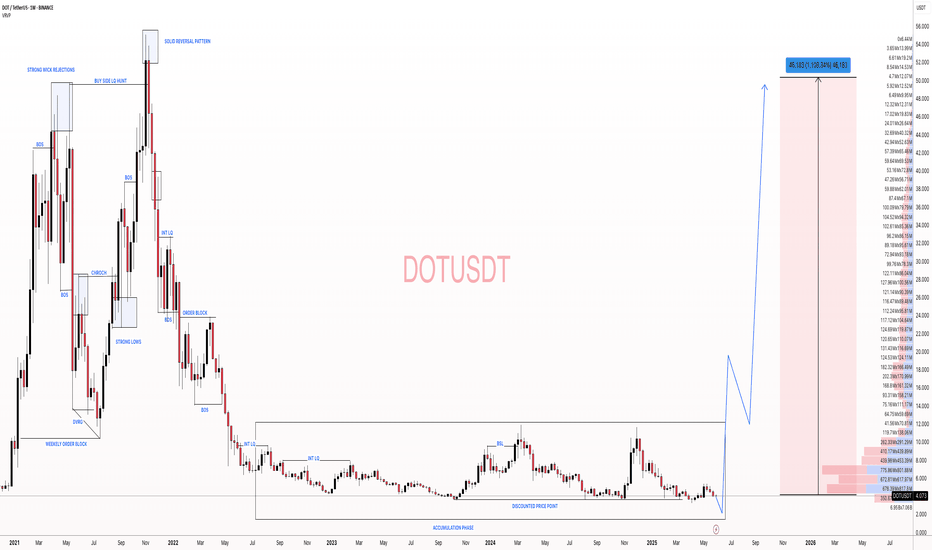

#DOTUSDT: Targeting $50 By End Of The Year! Wait For Volume ? Hey everyone!

So, about DOTUSDT, it’s been trading sideways at $4 lately. However, it has the potential to break through and hit new highs in the coming weeks or months. We’re not sure exactly what will happen next, but once it does, we expect it to start distributing its value. If this happens, we could see it reach our $50 mark by the end of the year.

I know this is just our speculative view, and we can’t rely solely on technical analysis to make this happen. We also need strong fundamental support. But hey, it’s worth a shot, right?

If you like our work, please give it a like and let us know what you think in the comments. We’d love to hear your thoughts!

Wishing you all the best and happy trading! 😊

We really appreciate your unwavering support! ❤️🚀

And if you’d like to lend a hand, here are a few ways you can contribute:

- Give our ideas a like

- Share your thoughts in the comments

- Spread the word about our ideas

Cheers,

Team Setupsfx_

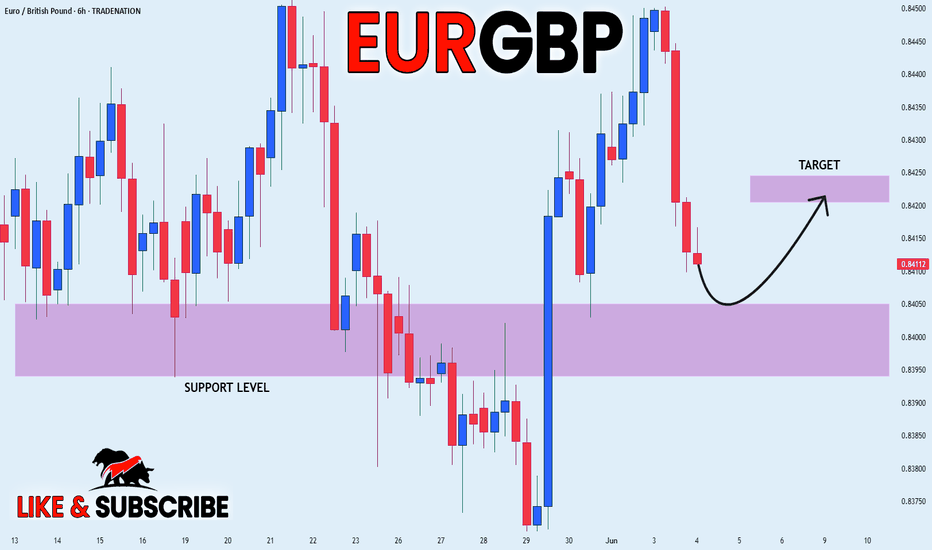

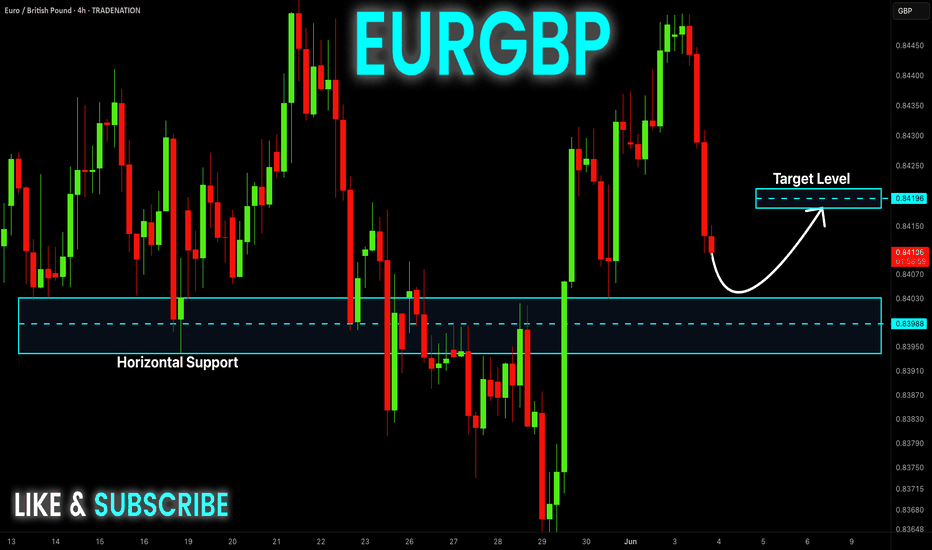

EUR_GBP POTENTIAL LONG|

✅EUR_GBP will be retesting a support level soon at 0.8400

From where I am expecting a bullish reaction

With the price going up but we need

To wait for a reversal pattern to form

Before entering the trade, so that we

Get a higher success probability of the trade

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

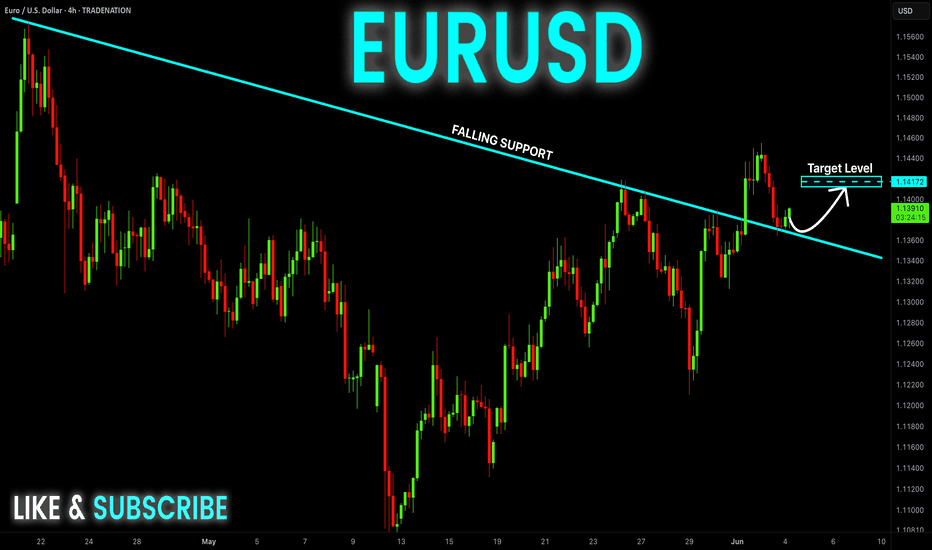

EUR-USD Bullish Rebound! Buy!

Hello,Traders!

EUR-USD made a retest of

The falling support line

While trading in a local

Uptrend and we are already

Seeing a bullish reaction

So we are locally bullish

Biased and we will be

Expecting a further move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

EUR-GBP Support Ahead! Buy!

Hello,Traders!

EUR-GBP made a pullback

From the horizontal resistance

Above just as we predicted

In our previous analysis

But a local horizontal support

Level is ahead at 0.8398

So after the retest we

Will be expecting a

Bullish rebound and a

Local bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bitcoin - Bears in control: Back to $103kPrice just swept the 1-hour and 4-hour swing highs, grabbing liquidity from anyone who had stops above the high. This was followed by an immediate and aggressive selloff, showing a clear bearish displacement. That move confirms smart money was unloading into retail longs, and we now have a shift in momentum pointing down.

Liquidity Sweep and Displacement Context

The sweep of the high was immediately followed by a strong bearish displacement. There was no hesitation after the breakout, which confirms this wasn’t a real breakout but a stop hunt. The reaction tells us that price was tapping into a key supply area or simply running out of buying interest above the high. This kind of rejection usually signals that smart money is positioning for a move lower.

Fair Value Gap and Pullback Zone

The drop left behind a clear 1-hour Fair Value Gap, sitting just below the swept high, between roughly $105,600 and $106,000. Price hasn’t returned to it yet, which opens the possibility for a short-term retracement back into that imbalance before continuation. That FVG becomes the main short entry zone, if price trades back into it, it’s likely to reject again.

Bearish Target and Market Structure Outlook

If we retrace into the FVG and reject, I expect a break of the recent short-term low around $104,300. That level will act as the first sign of bearish continuation. If that goes, there’s clean liquidity sitting below near the higher-timeframe low in the $103,600 zone. That’s the larger target for this setup, sweeping those lows would complete the move.

Conclusion

This is a clean high sweep followed by strong displacement and an unfilled FVG. If price trades back into that imbalance and shows rejection, I’m expecting continuation lower, with targets at $104,300 and ultimately down to $103,600.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

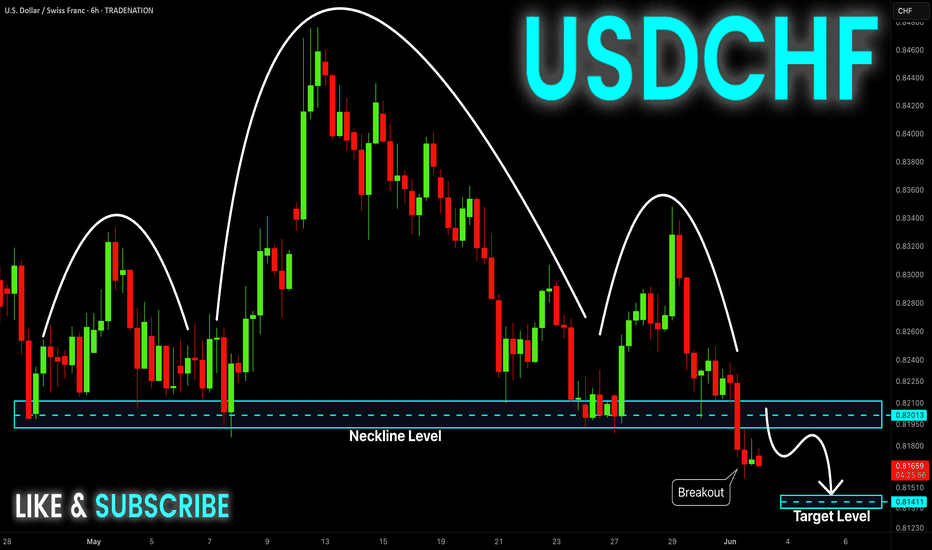

USD-CHF Head And Shoulders Breakout! Sell!

Hello,Traders!

USD-CHF formed a H&S

Pattern and then made a

Bearish breakout which is

Confirmed so we are bearish

Biased and we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

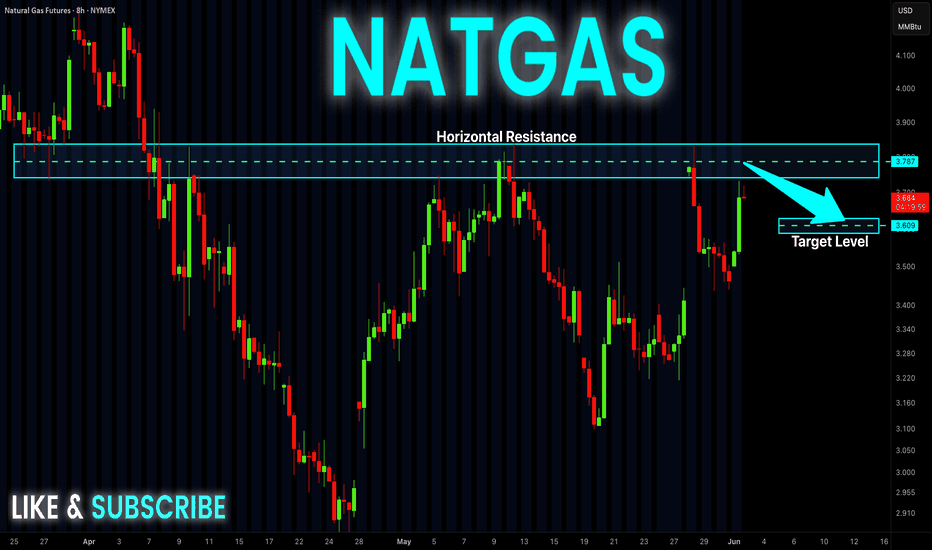

NATGAS Short From Resistance! Sell!

Hello,Traders!

NATGAS went up sharply

But the price will soon hit

A wide horizontal resistance

Of 3.809$ from where we will

Be expecting a pullback and

A local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Massive Bullish Breakout! Buy!

Hello,Traders!

GOLD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

"Demand Zone Play – Targeting Fresh Highs!"Clean Buy Setup | Reaction in Demand Zone

- Price has touched a well-defined demand zone.

- Confirmed bullish reaction with good wick rejections.

- Placed entry just above the zone, stop loss below structural low.

- Targeting more liquidity zones as TP1 and TP2.

Entry: 3356.50

SL: 3344.50

TP1: 3367.20

TP2: 3374.97

This concept draws on a blend of Smart Money Ideas and Demand/Supply Zones

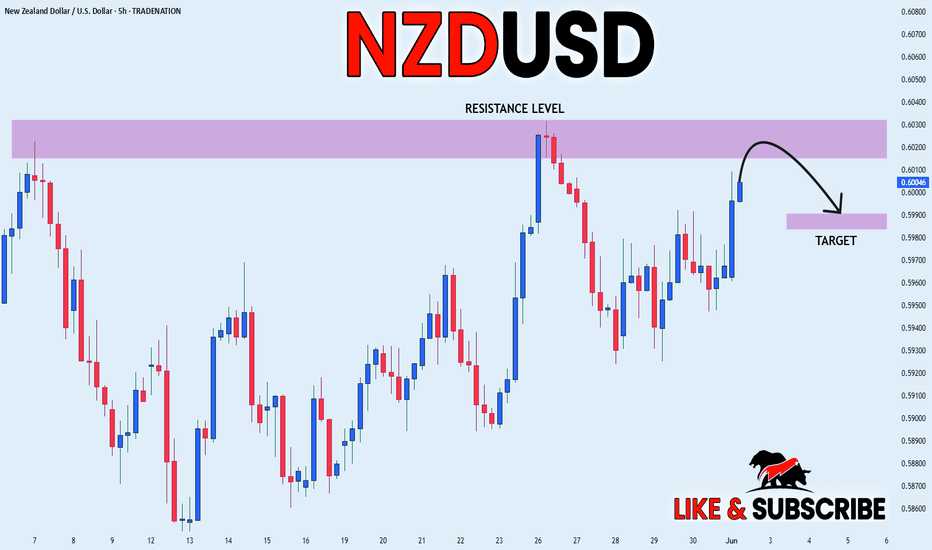

NZD_USD RISKY SHORT FROM RESISTANCE|

✅NZD_USD has been growing recently

And the pair seems locally overbought

So as the pair is approaching a horizontal resistance of 0.6030

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

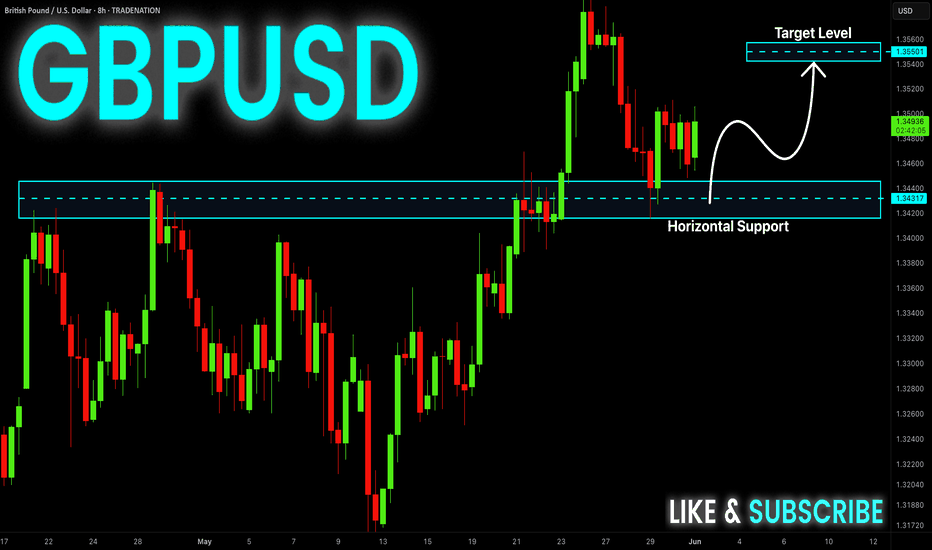

GBP-USD Will Go UP! Buy!

Hello,Traders!

GBP-USD is trading in an

Uptrend and the pair already

Made a rebound from the

Horizontal support level

Around 1.3431 from where

So we are bullish biased

And we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

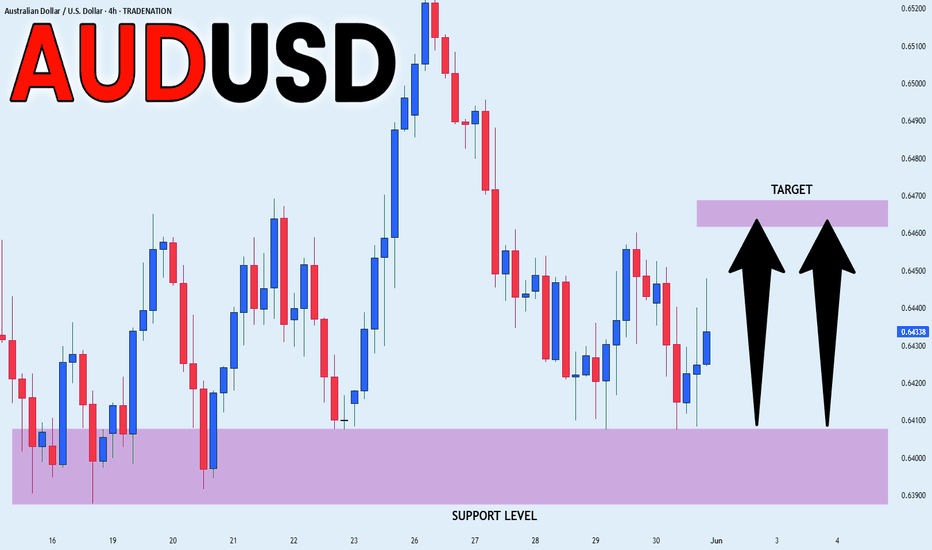

AUD_USD POTENTIAL LONG|

✅AUD_USD fell down sharply

But a strong support level was hit around 0.6400

Thus as a rebound is already happening

A move up towards the target of 0.6463 shall follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

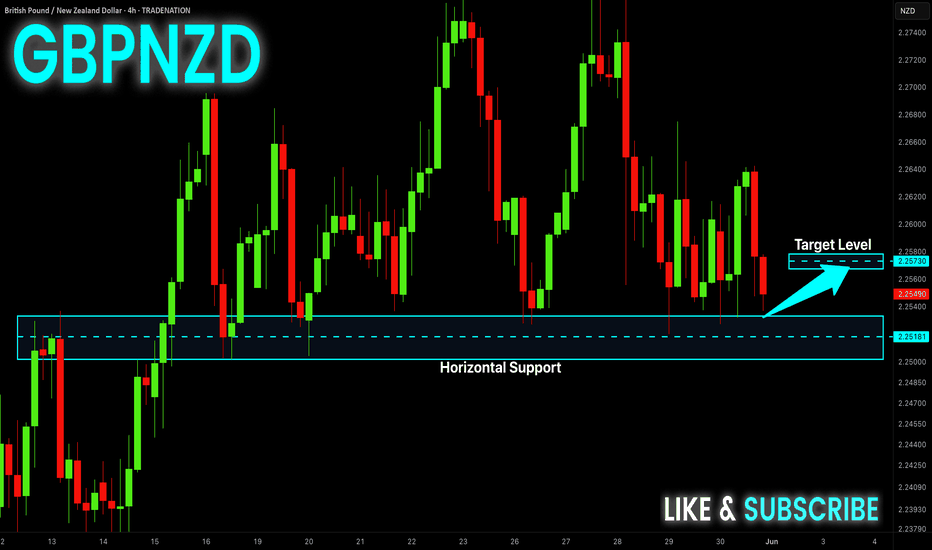

GBP-NZD Local Long! Buy!

Hello,Traders!

GBP-NZD will soon hit a

Horizontal support level

Of 2.0518 and as we have

Seem multiple rebounds

From the level we can

Bet on a one more rebound

And go long from the level

On Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.