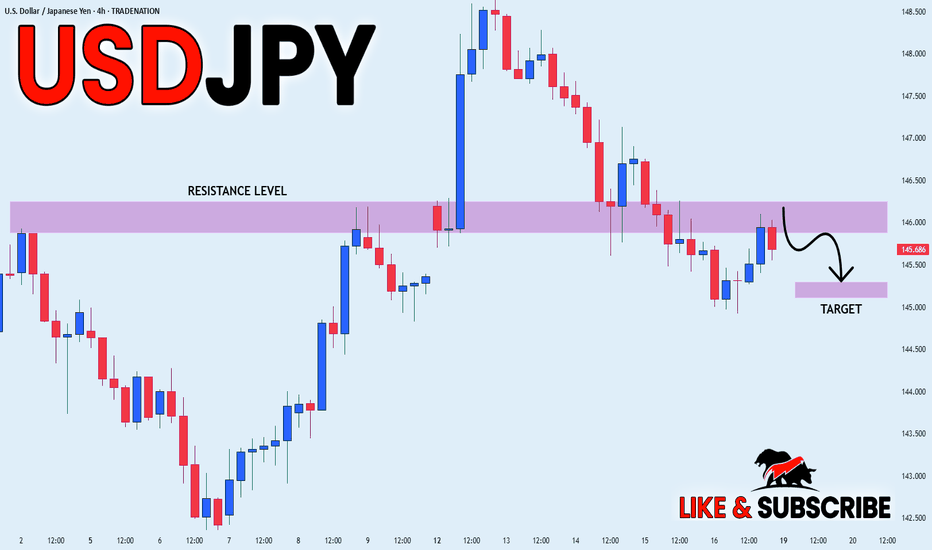

USD_JPY RISKY SHORT|

✅USD_JPY made a bearish

Breakout of the key horizontal

Level of 146.133 which is a

Resistance now and the pair

Is now making a pullback

But as we are bearish biased

We will be expecting a move

Down after the pair retests

The new resistance

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Smartmoneyconcepts

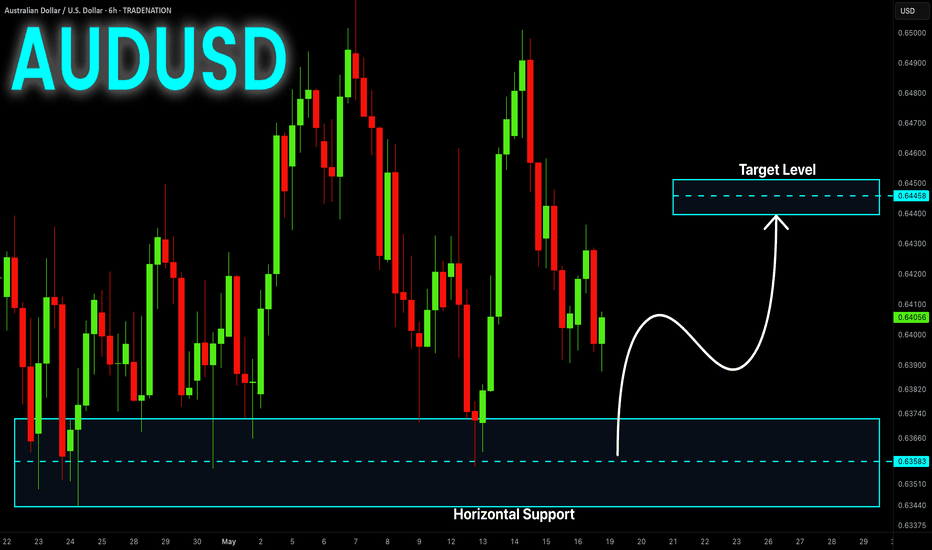

AUD-USD Potential Long! Buy!

Hello,Traders!

AUD-USD is making a local

Bearish correction but the

Pair will soon hit a horizontal

Support level of 0.6358 from

Where we will be expecting

A local rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

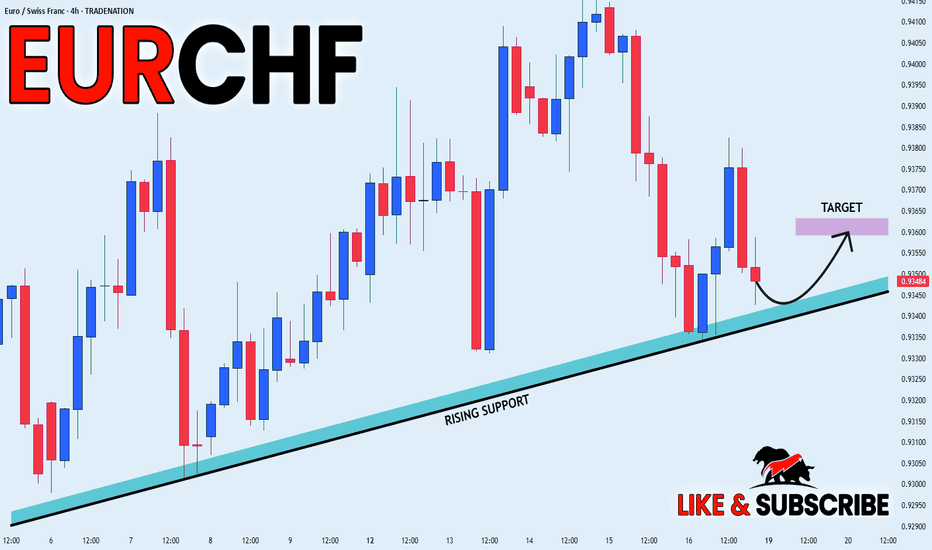

EUR_CHF LOCAL LONG|

✅EUR_CHF is trading along the rising support

And as the pair will soon retest it

I am expecting the price to go up

To retest the supply levels above of 0.9360

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

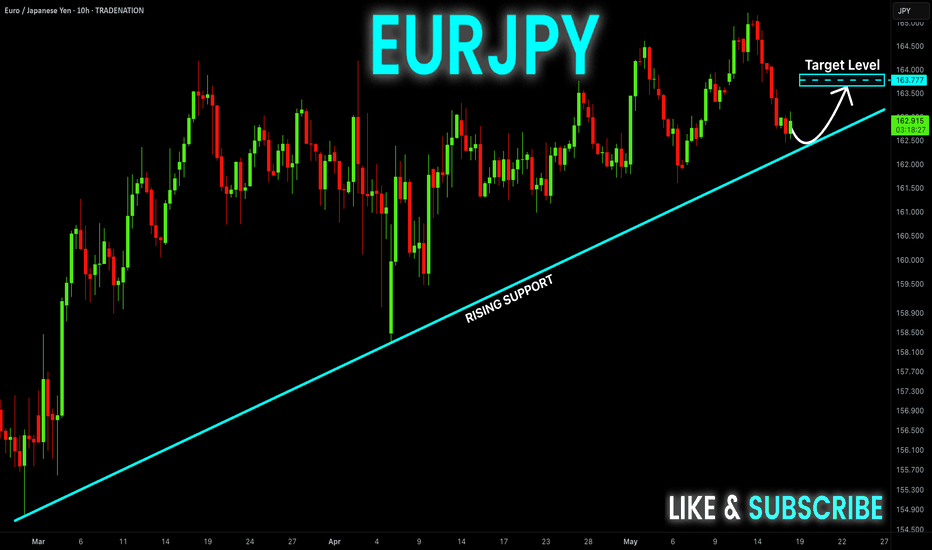

EUR-JPY Risky Long! Buy!

Hello,Traders!

EUR-JPY is trading along the

Rising support line and the

Pair will soon retest the

Support from where we will

Be expecting a bullish rebound

And a local move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

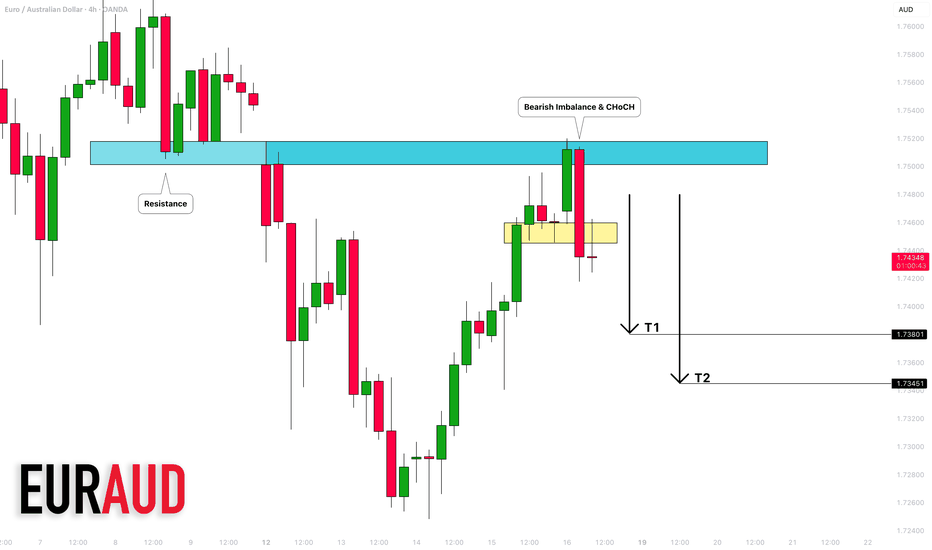

EURAUD: Bearish Movement Confirmed?! 🇪🇺 🇦🇺

Sellers demonstrate a clear strength after a test

of the underlined blue resistance cluster.

A formation of a bearish imbalance candle and a confirmed

intraday CHoCH leave strong reversal clues.

I think that EURAUD will likely retrace today, at least to 1.738 level.

❤️Please, support my work with like, thank you!❤️

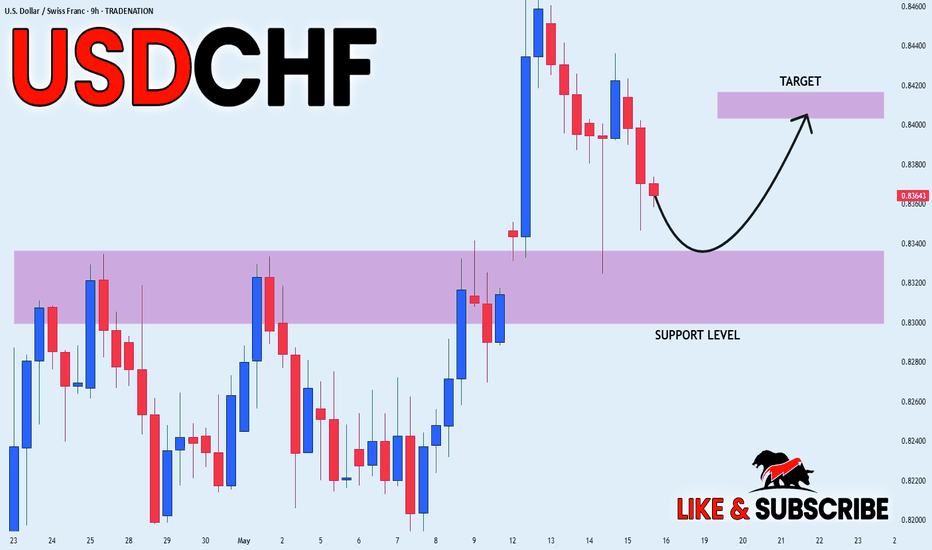

USD_CHF LOCAL BULLISH BIAS|LONG|

✅USD_CHF is making a local

Bearish correction and will

Soon retest a horizontal

Support of 0.8320 from where

We will be expecting a

Local bullish rebound

And a move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

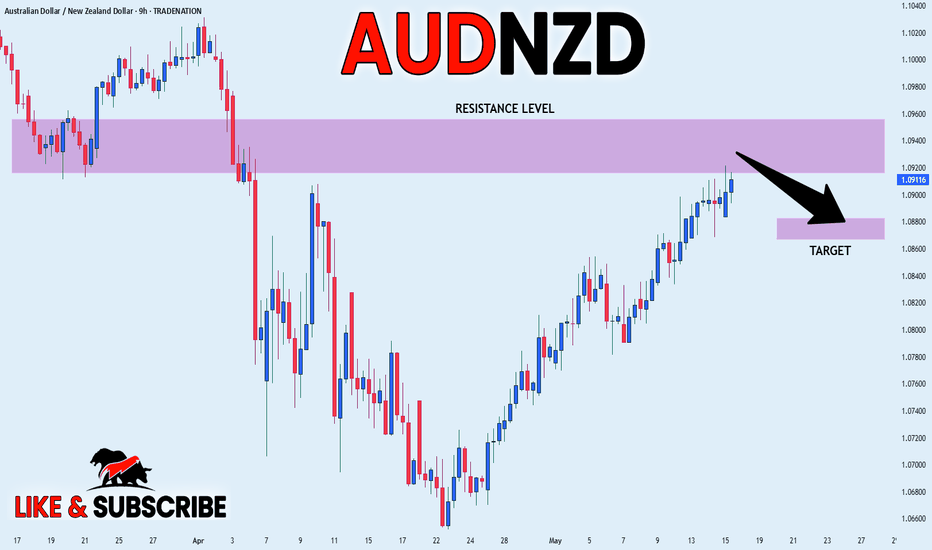

AUD_NZD STRONG RESISTANCE AEHAD|SHORT|

✅AUD_NZD is going up now

But a strong resistance level is ahead around 1.0940

Thus I am expecting a pullback

And a move down towards the target of 1.0880

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

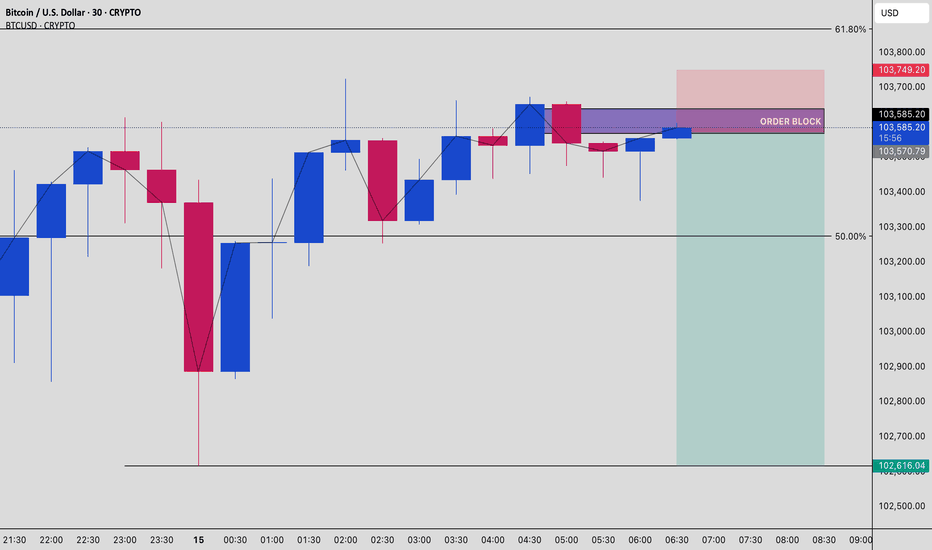

BTCUSD Smart Money Play: Order Block Trap Before the Dump?🚨 Bitcoin (BTCUSD) is flashing a textbook Smart Money setup — are you positioned before the move unfolds?

This chart reveals a juicy opportunity for traders who understand how to follow Smart Money footprints. Let’s break it down:

📊 Chart Context (30m Timeframe):

BTCUSD recently tapped into a significant Order Block (highlighted in purple) — this is where Smart Money typically loads up.

Notice how price showed a fake push into the premium zone, but failed to break higher — signaling potential distribution.

📉 Bearish Reaction + Fib Confluence:

Price kissed the 61.8% Fibonacci retracement, then sharply rejected — classic sign of mitigation before continuation.

The red zone (above 103,700) served as a perfect liquidity trap, where late buyers got baited.

📍 Order Block Zone (OB):

Price is stalling just beneath the OB at 103,577, showing signs of rejection.

Smart Money often uses this pattern to “tap and trap” — tapping into resting orders before driving price down.

🧠 What’s Really Happening?

Retail longs are trapped inside the red box, expecting a breakout.

Meanwhile, Smart Money is distributing into that demand before driving price toward the discount zone (marked in green).

🎯 Target Objectives:

Immediate target: 103,200 (50% Fib level)

Extended target: 102,616 — which aligns with the liquidity void below.

⚡ Risk-Reward Setup:

Entry near 103,577 with SL above 103,749

Targeting 102,616 gives an excellent R:R profile

You don’t chase Smart Money — you follow their traps, and react with precision.

📌 Trading Plan:

Wait for clear rejection or bearish engulfing on lower timeframes at OB

Manage risk wisely — even clean setups can be invalidated.

Don’t guess. React. Let the market show you intent.

💡 Final Take:

This BTCUSD setup is textbook Smart Money Concept in motion:

Order Block ➡️ Trap ➡️ Liquidity Grab ➡️ Expansion

Whether you short this retracement or wait for confirmation, this is a move you’ll want on your radar. Weekly close could reveal major direction.

✅ Comment “OB READY” if you’re watching this setup!

✅ Save this post for future reference. Smart Money always leaves clues.

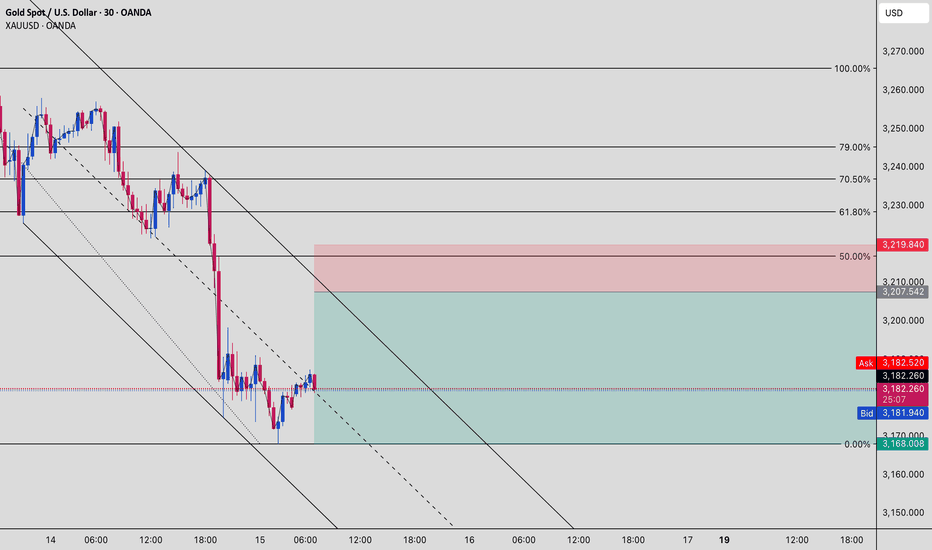

XAUUSD Bearish Setup: Retracement Trap Before the Next Sell-Off?🚨 Gold (XAUUSD) is showing signs of a classic Smart Money retracement trap!

If you're trading gold this week, this is the kind of setup that separates the retail guessers from the Smart Money followers.

📉 The Setup Breakdown (30m Chart):

After a violent sell-off, XAUUSD found temporary support near $3,168, marking a key liquidity zone.

Current price is rebounding, but not randomly — it's heading straight toward the 50% - 61.8% Fibonacci retracement zone, which aligns perfectly with previous imbalance.

📍 Supply Zone (Red Box):

The red area marks a likely Smart Money sell zone — between $3,207 and $3,219.

This zone aligns with the 50% - 61.8% retracement and broken structure area — a classic point for redistribution.

🧠 What Smart Money Might Be Doing:

They're not buying this bounce — they’re setting the trap.

Price is retracing into a premium zone, tempting late buyers, while institutions prepare to re-enter shorts.

📉 Bearish Confluence:

The down-sloping channel supports the current bearish momentum.

Any rejection from the red zone could be the start of another impulsive leg down toward $3,170, then $3,168 and possibly lower.

🎯 Key Target Zones:

TP1: $3,170 — minor liquidity shelf

TP2: $3,168 — Fibonacci 0% level and key support

TP3 (extension): Below $3,160 if structure breaks aggressively

⚠️ Risk Management Strategy:

Entry near $3,207–$3,219

SL just above $3,219 for safety

RR on this play is highly favorable, but only if price respects the supply zone

⚡ Execution Plan:

Wait for bearish signs inside the red zone (engulfing candles, momentum shift)

Avoid early entries — Smart Money often pushes a few pips beyond equilibrium before reversing

Manage trade in segments, partial out at TP1 and trail stop into deeper targets

🧠 Pro Trader Tip:

This is not a breakout play — it’s a liquidity engineering setup.

Smart Money thrives on fake reversals, and this current bounce could be one of them. Watch the supply zone reaction closely.

✅ Comment "GOLD SETUP" if you’re watching this play unfold

✅ Save this analysis to sharpen your Smart Money trading edge

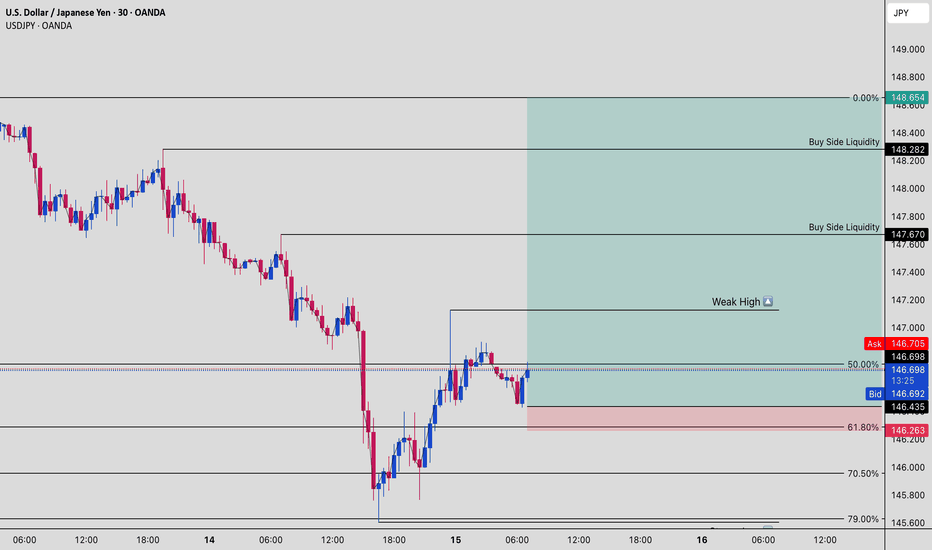

USDJPY Setup: Weak Highs, Smart Money Buys Liquidity!!📊 USDJPY is showing signs of a Smart Money reversal from the discount zone.

This 30-minute chart reveals institutional intentions hiding in plain sight — with clear signs of engineered liquidity grabs and the potential for a strong bullish continuation.

🧠 What’s Happening on the Chart:

✅ Price has swept sell-side liquidity below the recent lows

✅ Retraced cleanly to the 61.8% Fibonacci level at 146.26, a classic Smart Money entry zone

✅ The current price is hovering around the 50% retracement, forming a potential higher low structure

📈 Bullish Confluence:

Price is rebounding from a discount zone (golden ratio: 61.8% Fib)

There’s a clearly defined "weak high" marked around 147.00 — Smart Money typically targets these areas

Above that, there are two stacked buy-side liquidity levels:

147.670

148.282

Final target? The liquidity pool near 148.654 — a clean magnet for price

🎯 Trade Idea:

Long Bias from 146.26–146.43 zone (Smart Money re-entry)

Targets:

TP1: 147.00 (Weak High)

TP2: 147.670 (Buy Side Liquidity)

TP3: 148.282 – 148.654 (Full Liquidity Sweep)

Invalidation: Clean break below 146.20 with strong bearish volume

📌 Why This Setup Works:

This setup uses Smart Money Concepts (SMC):

Weak Highs often signal institutional targets

Fair Value Gap (FVG) + Fib confluence adds strong bullish probability

Retail shorts get trapped, thinking the rally was a pullback — while institutions accumulate at discount

🧠 Pro Tip:

Watch for confirmation with a bullish engulfing candle or break of short-term structure before full entry.

Front-running the Smart Money leads to losses. Let them move first.

💬 Comment "USDJPY MOVE" if you're planning to trade this setup

💾 Save this chart for later — this is how the big players trade FX.

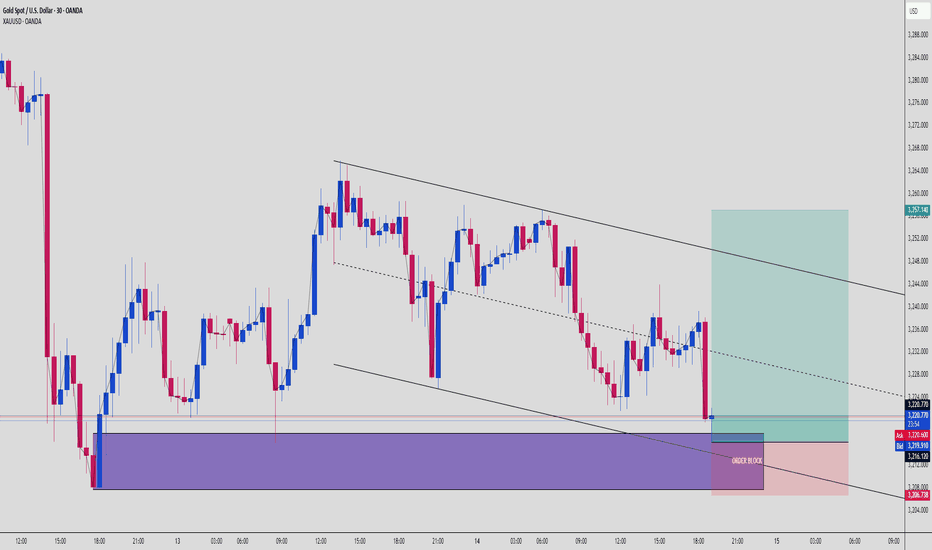

Gold's Fakeout Into The Trap — Smart Money is Loading Up🟡 GOLD 30-Min Chart Breakdown — May 14, 2025

Gold just gave us a masterclass in Smart Money Concepts (SMC). Let’s dissect the juicy bits of this long setup:

🧩 1. Structure Overview

Market in a defined downward channel

Price taps the order block from previous accumulation zone

A liquidity sweep wick pierces just below the OB (classic SMC trap)

🛠 2. Key Confluences

🔵 Order Block: Held strong, respected on multiple timeframes

🔴 Liquidity Sweep: Deep wick hunts stops below OB, then bullish reaction

📉 Descending Channel: Price bounced off the bottom trendline

✅ Clean RRR Long: Setup has 1:5+ potential if targeting the upper channel

📈 3. Trade Idea

Entry: Around $3,220

Stop: Under $3,206 (below liquidity sweep)

TP: Zone near $3,257

Expecting breakout attempt if momentum breaks structure above $3,240

📉 4. Risk Notes & Management

Keep an eye on Asian session volume — fakeouts are common

Trail stop as price pushes past mid-channel

Rejection at $3,240 = consider partial close

📌 Gold loves a dramatic reversal — this one is no different. Smart money doesn’t chase — they accumulate in fear. This setup screams institutional entry zone.

💬 Drop a “💎” if you caught this with us!

🎥 Follow @ChartNinjas88 for clean SMC breakdowns like this every day!

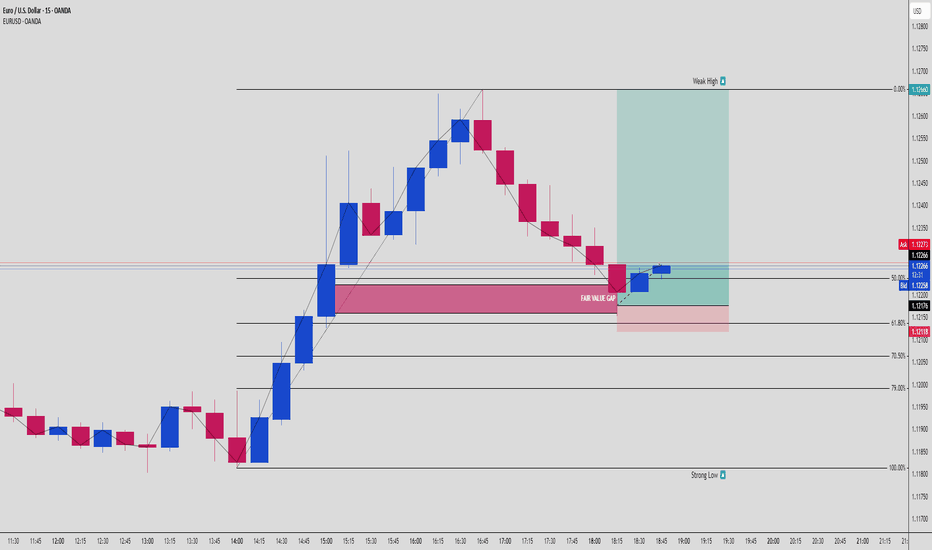

EURUSD Just Landed in the Killzone — Bounce or Breakdown?🔥 EURUSD 15-Min SMC Precision Play — May 14, 2025

Here’s a sweet Smart Money sniper entry on EURUSD, caught right as price tagged a powerful triple confluence zone:

📊 1. Structure & Momentum

Recent bullish momentum created a weak high around 1.12660

Retracement follows with strong bearish pressure

Price lands exactly at a previous OB, Fair Value Gap, and the 61.8% fib retracement

🧱 2. Confluence Breakdown

🔴 Fair Value Gap (FVG): Unfilled imbalance tapped

🟣 Order Block (OB): The last down candle before bullish rally

🟡 61.8% Fibonacci Level: Price kissed the golden pocket

This stacking creates a high-probability reversal zone

🎯 3. Trade Plan

Entry: Around 1.12160

SL: Below 1.12090 (under 70.5% fib)

TP: At 1.12660 targeting previous weak high

RRR ≈ 1:6 — optimal asymmetric reward play

🔄 4. Management & Outlook

Watch for reaction on the 50% level at 1.12300

Break of market structure above 1.12400 = confirmation

Scaling out advised at midline levels with stop-loss trailed manually

🧠 Smart Money knows this is where the liquidity pools live. You're not late — you're patiently positioned where the institutions hunt.

🎯 Drop a “📍” in the comments if you're watching EURUSD

🎥 Follow for more sniper setups like this one — @ChartNinjas88

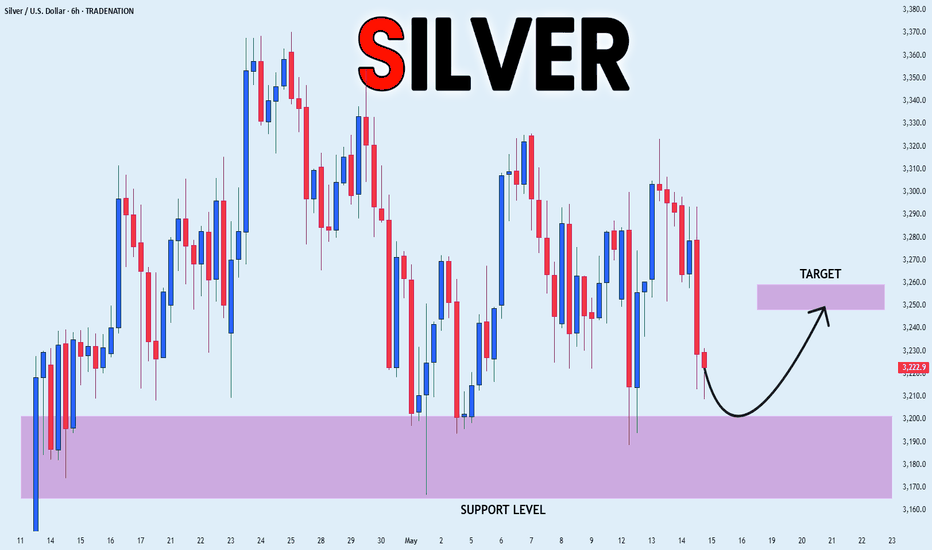

SILVER SUPPORT AHEAD|LONG|

✅SILVER will soon retest a key support level of 3170$

So I think that the pair will make a rebound

And go up to retest the supply level above at 3250$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Rising Support Ahead! Buy!

Hello,Traders!

GOLD is making a nice bearish

Correction and will soon hit

A rising support line at which point

Gold will be trading at a 10% discount

Giving us a great entry point

To ride the coming bullish wave

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

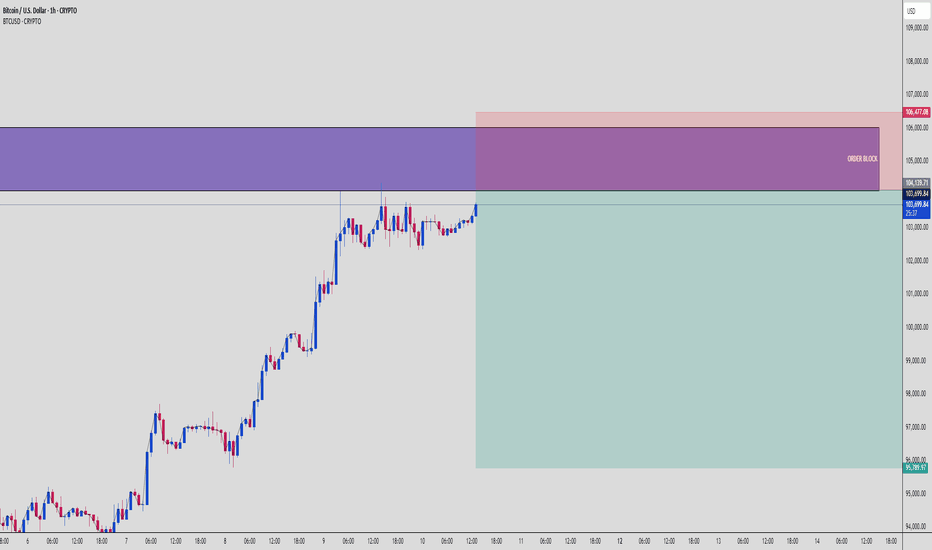

BTCUSD 1H Short Setup | Order Block + Premium Rejection⚠️ BTCUSD | 1H Rejection at Supply Zone | May 10, 2025

Bitcoin is showing signs of exhaustion after a sharp rally into a high-value Supply Zone marked by a bearish Order Block at ~$104.1k–$106.4k. Price tapped right into premium levels, triggering potential Smart Money distribution.

🔍 KEY CONFLUENCES:

🧱 1H Bearish Order Block at 104,139–106,477

⚖️ Price in premium zone (>50% range)

🧠 Clean liquidity grab from prior swing high

🚫 Signs of buying weakness inside OB

📉 Anticipated move down toward imbalance and demand zone near $96k

📊 Setup Specs:

Pair: BTCUSD

Timeframe: 1H

Entry Zone: 104,139 – 106,477

SL: 106,477

TP: 95,789

RR: Approx. 1:4+

📌 Smart Money Breakdown:

After explosive rallies, institutions often offload in supply-rich OB zones while retail buys the top. This setup shows textbook SMC signs of distribution, imbalance below, and a clean trade idea toward unmitigated demand.

🧠 Chart Ninjas Tip:

“Never short early — wait for price to enter the OB and show weakness. That’s where smart entries live.”

GBPJPY Just Hit the Sweet Spot — High RRR or Fakeout Trap?💷 GBPJPY 30-Min Chart Breakdown — May 14, 2025

This setup is a banger for traders following structure, zones, and risk-reward logic. Let’s dissect the trade logic:

🔍 1. Market Structure

Price has been moving within a well-respected ascending channel (see black trendlines).

We just printed a short-term bearish pullback, with price dipping into a refined demand zone (highlighted pink/red).

The most recent bearish impulse looked like a liquidity sweep, not a structure break.

🧱 2. Smart Money Zone

Demand zone aligns with:

✅ Previous OB (order block)

✅ Mid-channel support

✅ Equal lows & trendline liquidity just below

Dark gray box = the exact entry block

Bulls stepped in right on time — classic mitigation + reaction setup

🎯 3. Risk-Reward

Entry: Around 195.380

SL: 195.110 (tight below the block)

TP: 196.575

RRR ≈ 1:5 — beautiful sniper entry with minimal exposure and max gain

🧠 4. What to Watch Next

Break above 195.900 = confirmation of bullish continuation

If price stalls again below midline, re-entry could come after another liquidity push

Clean break of 195.100 = invalidation (watch for potential short setups below)

🔁 Trade Management Tips:

Trail stops aggressively above 195.900

Scale out partials every 50 pips if you're trading it like a swing

Add confluence from DXY/Yen strength for better context

This one checks all the boxes: structure, zone, confirmation, and a clean RRR.

🚀 Tag a trader who loves tight stop, high-RR plays.

📲 Follow @ChartNinjas88 for more Smart Money scalps & swing setups!

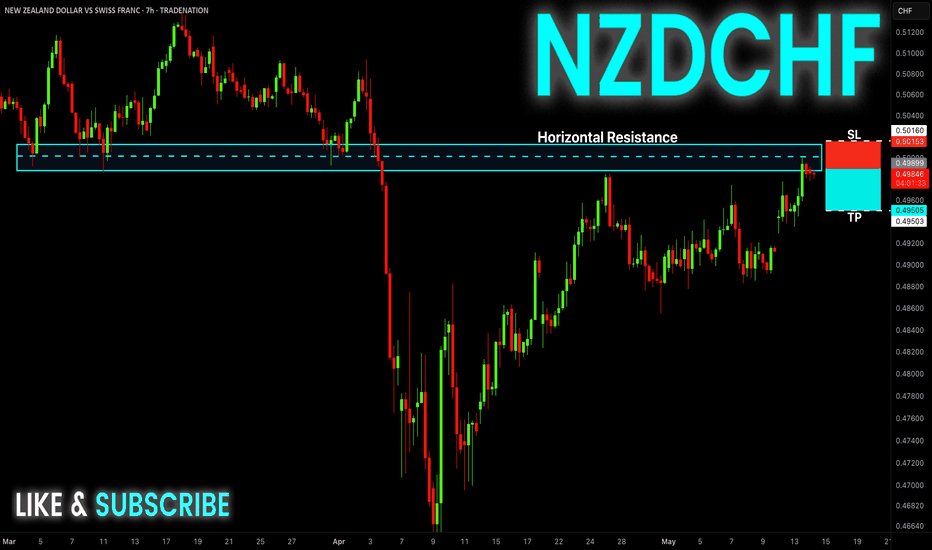

NZD-CHF Free Signal! Sell!

Hello,Traders!

NZD-CHF hit a horizontal

Resistance of 0.5002 and

Its a strong supply area so

We will be expecting a local

Pullback, which means we

Can enter a short trade

With the Take Profit of 0.4950

And the Stop Loss of 0.5016

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

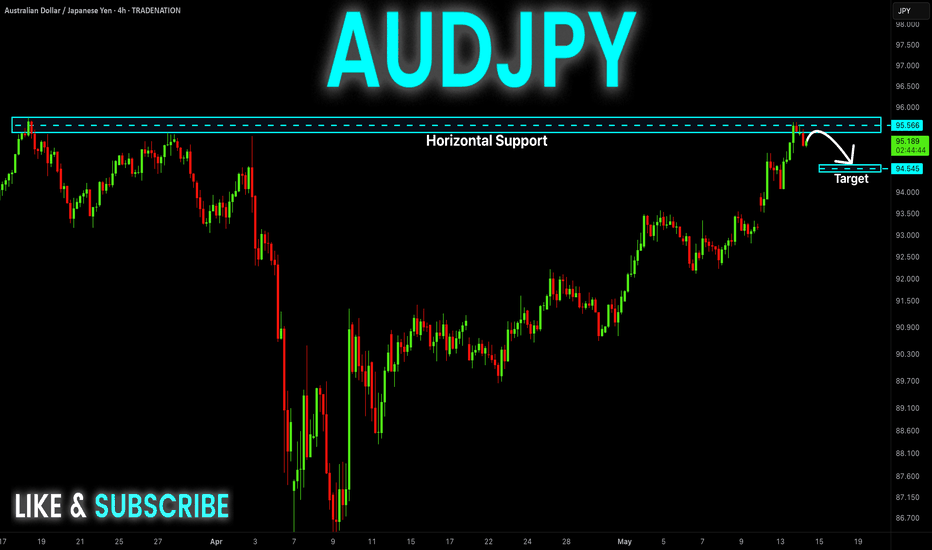

AUD-JPY Risky Short! Sell!

Hello,Traders!

AUD-JPY grew up fast

But then hit a horizontal

Resistance level of 95.750

From where we are already

Seeing a nice pullback

And we will be expecting

A further local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

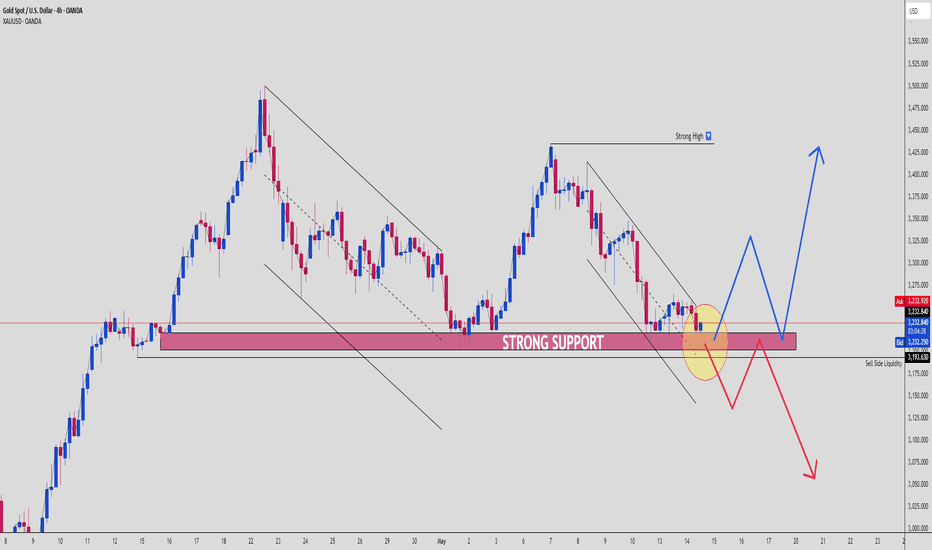

XAUUSD 4H | Strong Support in Play — Breakout or Bounce?🪙 Gold (XAUUSD) 4H Analysis — May 14, 2025

Gold is tapping into a critical support zone, where multiple SMC elements are aligning for either a massive bullish reversal or a stop-hunt breakdown. Let’s break it down:

🔻 1. Context & Price Action

Price has been in a down-channel, respecting structure and forming LHs (lower highs).

We're now tapping into a historically respected demand zone, clearly marked on the chart.

A large compression move into this level increases the probability of a volatile reaction.

🧱 2. Key Zones

✅ Support Zone: ~3,193 to 3,229 — highlighted in pink

💧 Sell Side Liquidity: rests just below support

🔼 Strong High: visible around 3,450 (target if bulls step in)

This is a textbook “liquidity trap or launch” zone.

📈 3. Possible Scenarios

🔵 Bullish Scenario:

If we see a fakeout and recovery from the yellow highlighted area:

Expect a sharp reversal, targeting the mid-channel and eventually the Strong High at 3,450+.

Smart Money may defend this level to grab external liquidity later.

🔴 Bearish Scenario:

If price closes strongly below support and holds beneath:

Sell-side liquidity sweep triggers, targeting deeper zones like 3,100 or even 3,025.

Trendline break + structure shift = full bearish continuation.

🎯 What to Watch For:

Rejection candlestick patterns near the yellow circle

Volume spikes on the bounce

Clean break + retest if bearish

This is a must-watch area for day traders and swing traders alike.

Stay reactive, not predictive!

🔁 Drop a 🔔 if you want to see how this plays out.

🧠 Follow @ChartNinjas88 for Smart Money insights on Gold and more!

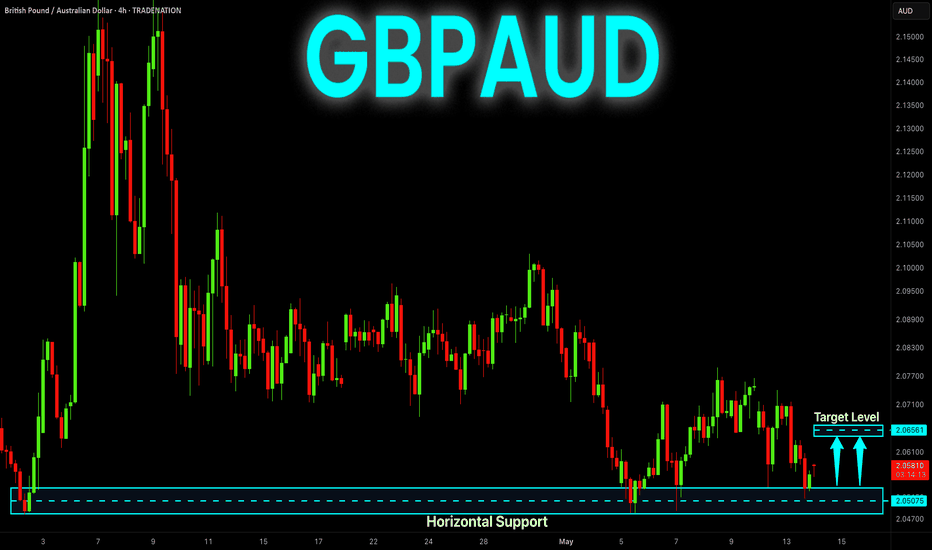

GBP-AUD Will Grow! Buy!

Hello,Traders!

GBP-AUD made a retest

Of the horizontal support

Level of 2.0480 and we are

Already seeing a local bullish

Rebound so we are locally

Bullish biased and we will be

Expecting a further move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

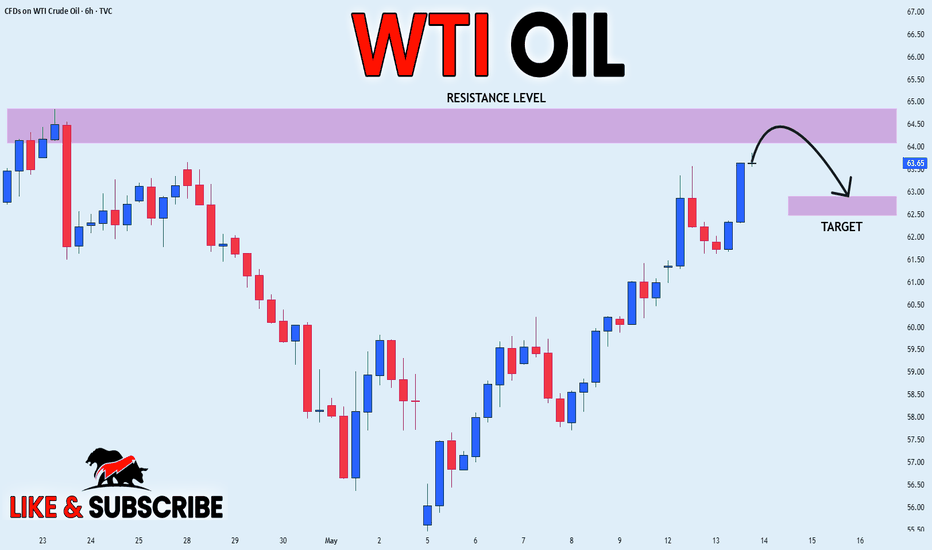

USOIL POTENTIAL SHORT|

✅CRUDE OIL has been growing recently

And Oil seems locally overbought

So as the pair is approaching a horizontal resistance of 64.82$

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

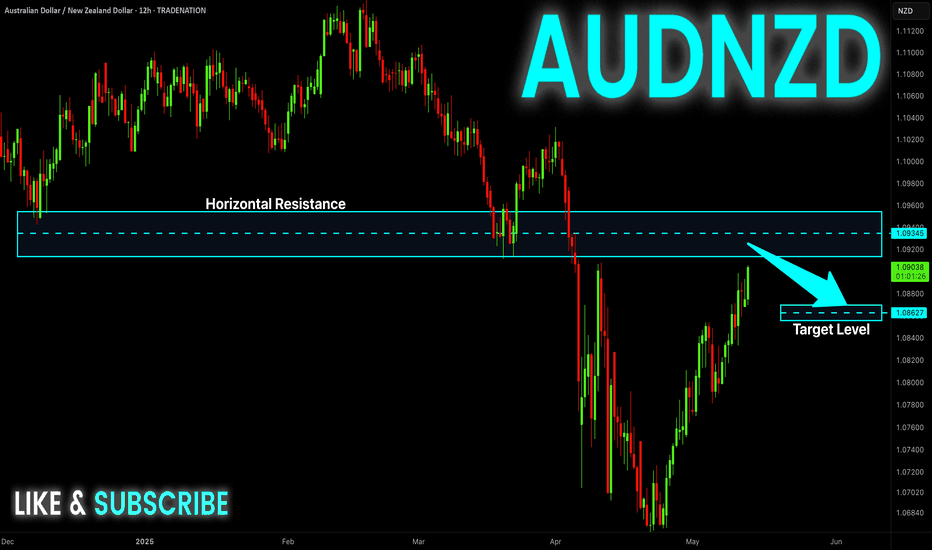

AUD-NZD Correction Ahead! Sell!

Hello,Traders!

AUD-NZD is growing strongly

And the pair looks locally

Overbought so after it

Hits the horizontal resistance

Area around 1.0934 we will

Be expecting a local bearish

Correction and a move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

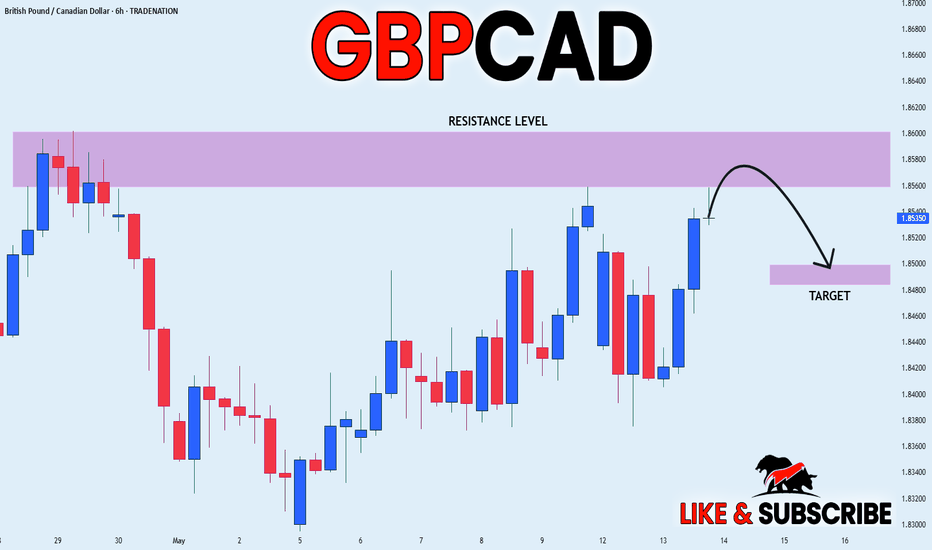

GBP_CAD RESISTANCE AHEAD|SHORT|

✅GBP_CAD is going up now

But a strong resistance level is ahead at 1.8600

Thus I am expecting a pullback

And a move down towards the target of 1.8500

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.