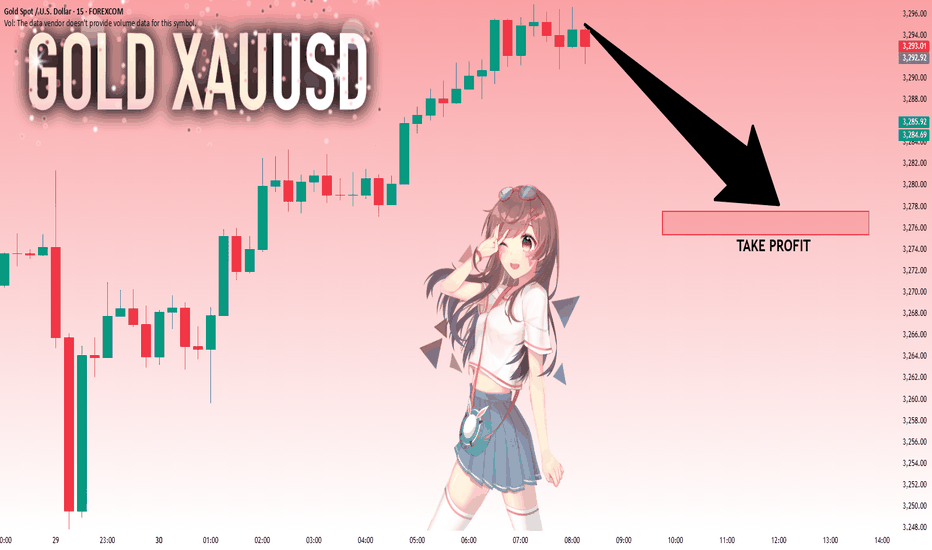

GOLD: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse GOLD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 3,295.36 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

SMC

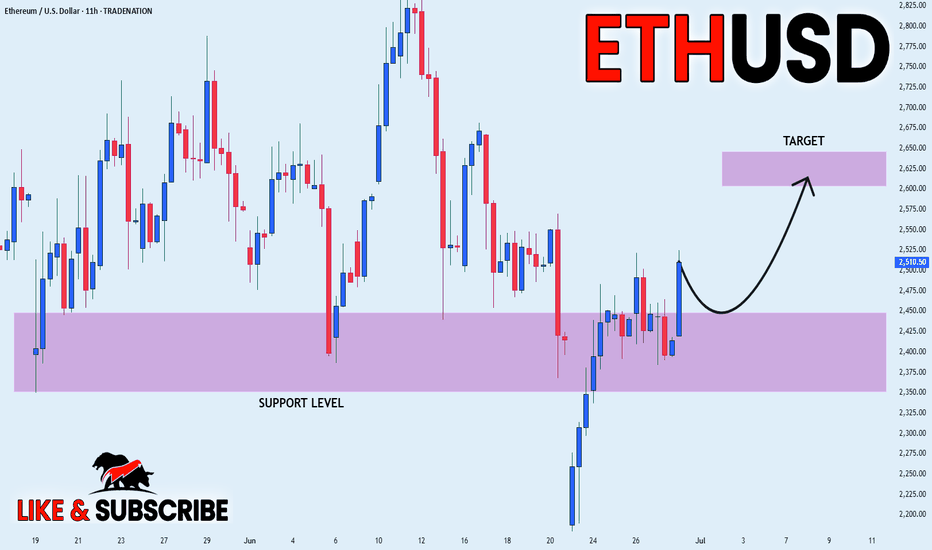

ETHEREUM WILL GROW|LONG|

✅ETHEREUM consolidated

Above the horizontal support

Around 2400$ and now we are

Finally seeing a bullish rebound

So we are bullish biased and

We will be expecting a

Further move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Support Ahead! Buy!

Hello,Traders!

GOLD keeps falling just

As I predicted but the price

Will soon hit a horizontal support

Around 3235$ from where we

Will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

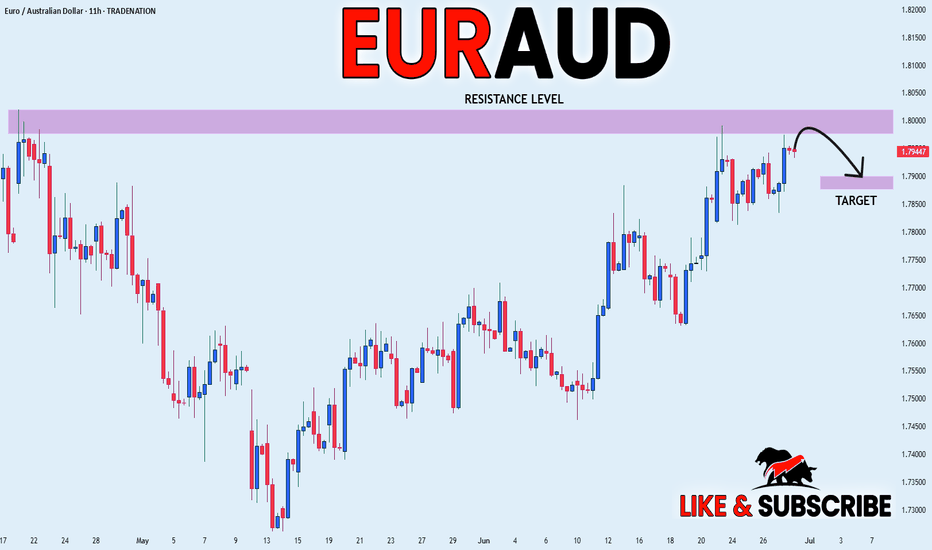

EUR_AUD LOCAL SHORT|

✅EUR_AUD is going up now

But a strong resistance level is ahead at 1.8018

Thus I am expecting a pullback

And a move down towards the target of 1.7900

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

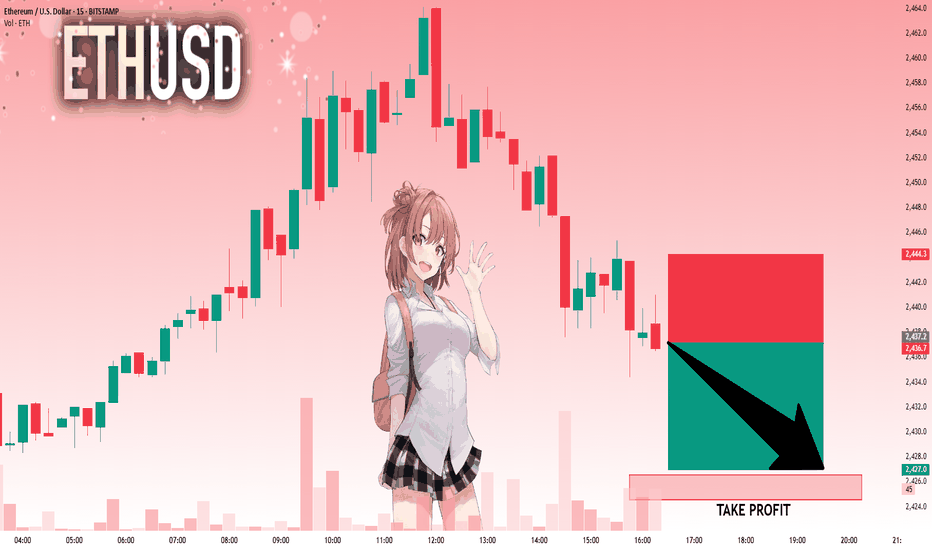

ETHUSD: Strong Bearish Sentiment! Short!

My dear friends,

Today we will analyse ETHUSD together☺️

The market is at an inflection zone and price has now reached an area around 2,437.2 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 2,426.5..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

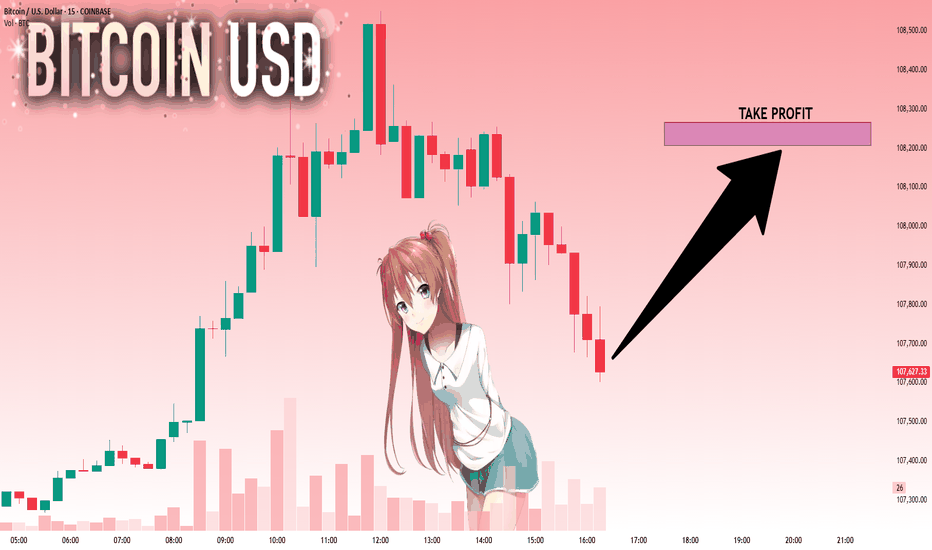

BTCUSD: Bulls Are Winning! Long!

My dear friends,

Today we will analyse BTCUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 107,630.73 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 108,207.06.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

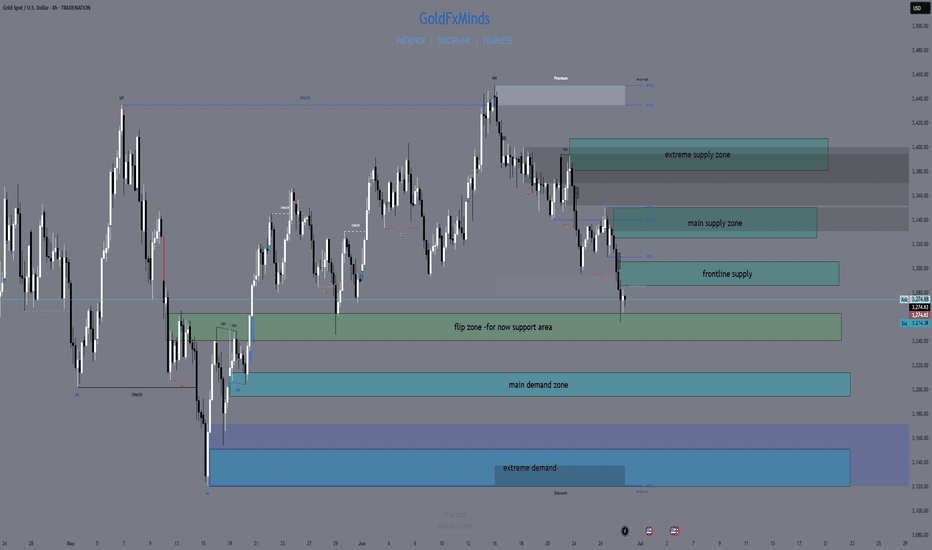

H4 Outlook | XAUUSD Monday • June 30 • 2025Hey fam,

Fresh week on gold — clean structure, clean levels, clean execution ahead. Forget the noise. We trade price, we trust precision.

🔍 Market Flow & Bias

Gold remains bearish on the H4 timeframe.

Lower highs, lower lows, clean rejection from supply, and all EMAs (21/50/200) aligned down. RSI hovers near 30, showing heavy momentum — not exhaustion yet.

Price is coiled, not crushed. If structure holds, we follow the short flow into deeper zones.

📌 Bias: Bearish below 3325. Pullbacks into supply = opportunity.

—

🧱 Zones of Interest (Clean & Confluent)

🔺 Zone 1 – 3380–3405 | Extreme Supply

Top OB zone with resting liquidity above. If price sweeps this level and fails, expect a sharp reversal. Only valid with reaction (CHoCH or bearish engulfing).

🔺 Zone 2 – 3325–3350 | Main Supply

Strong H4 breaker block. Origin of the last major selloff. Already defended once — if it holds again, look for sniper shorts from within.

🔺 Zone 3 – 3285–3305 | Frontline Supply

First inducement zone. Clean micro-OB that could give early fade trades. If bulls break through, Zone 2 becomes magnet.

⚖️ Zone 4 – 3260–3240 | Flip Shelf

Range base. If price holds, bulls might step in short-term. But a clean break below shifts momentum fully toward lower demand.

🟢 Zone 5 – 3215–3195 | Main Demand

Unmitigated OB with imbalance. If gold drops here with momentum and forms rejection wicks or CHoCH on LTF → long opportunity for bounce.

🟢 Zone 6 – 3150–3120 | Extreme Demand

Macro swing demand. Deepest discount level on the chart. Valid only if market flushes — this is the “last stand” for buyers.

—

🎯 Key Levels Zone Cheat-Sheet

Above

• 3380–3405 → Extreme Supply (trap zone)

• 3325–3350 → Main Supply block

• 3285–3305 → Micro OB inducement

Below

• 3260–3240 → Flip shelf (structural pivot)

• 3215–3195 → Main buy zone

• 3150–3120 → Deep macro demand

—

⚔️ Execution Plan

We sell from reaction zones, not assumptions.

We buy from confluence, not hope.

Every zone above comes with condition: no confirmation, no entry.

—

📣 Found this useful?

Drop a ⚔️ in the comments, tag your bias, 🚀and follow GoldFxMinds for sniper-level execution.

This isn’t guessing. This is structure. This is clarity.

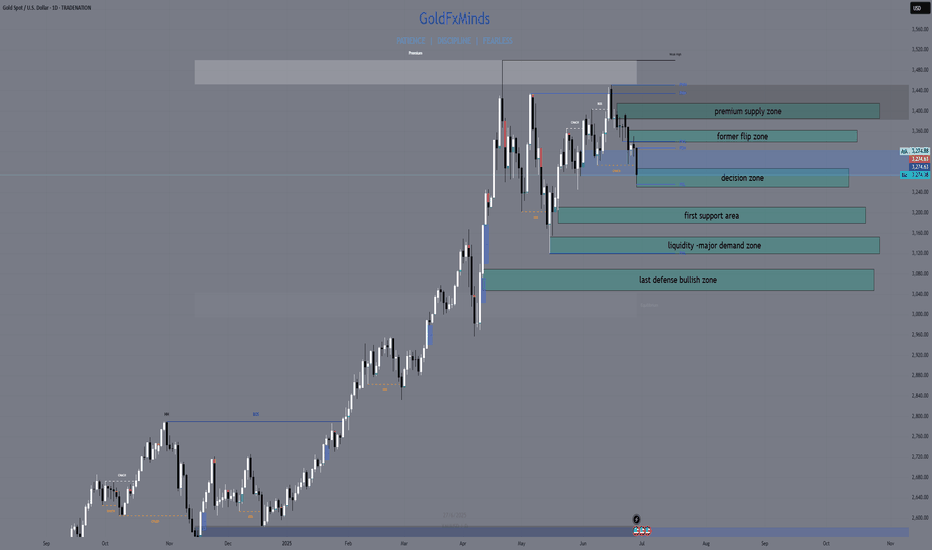

Daily Outlook | XAUUSD June 30, 2025Hey traders,

Fresh week, clean structure. Let’s lock in the key levels and let price do the talking.

🌐 Macro Context

It’s a heavy week for USD – all major data drops before Friday:

Tuesday: ISM Manufacturing + Powell speaks

Wednesday: ADP Employment

Thursday: NFP, Unemployment Rate, ISM Services

Friday: US holiday – markets closed

📌 This means liquidity will build into Thursday, then fade. Expect gold to stay range-bound early in the week, unless momentum shifts hard today. Volatility should peak around NFP.

🧭 Daily Structure & Bias

Gold opened weak under 3287, still below 21EMA and 50EMA. The structure shows lower highs, bearish control, and no signs of strength reclaiming ground. RSI is at 42 — momentum down, but not oversold yet. Unless price breaks back above 3340, sellers stay in control.

✅ D1 Bias: Bearish while under 3340

📌 Key D1 Zones to Watch

🔺 D1 Breaker Block – 3340–3355

Former support, now clean resistance. Includes 50EMA and last failed closes. If price rejects again here, bearish continuation likely. A daily close above 3355 flips short bias.

🔺 D1 Supply + FVG – 3385–3405

Unmitigated imbalance from early June. If price pushes through 3355, this is the next upside magnet. Good spot for first reaction.

⚖️ D1 Decision Zone – 3287–3265

Current price zone. Multiple past reactions. A daily close below 3265 confirms breakdown. Holding above = more choppy range.

🟢 D1 Reaction Shelf – 3210–3180

Minor support zone from April candle bodies. Can slow price, but not strong enough for reversal on its own.

🟢 D1 Demand Block – 3155–3120

First major HTF demand. Includes 200EMA, strong structure, and previous breakout base. If price sells into it fast, watch for rejection — but only with confirmation.

🟢 D1 Macro Demand – 3090–3055

Final line of macro defense. Clean imbalance + demand from February. Valid only if sentiment breaks post-NFP.

✅ Final Summary

• Below 3265 = structure breaks → opens 3180

• 3155–3120 = real support zone

• Below 3120 = macro shift risk

• Reclaiming 3340 = short bias invalid

• Break above 3385 = continuation possible

📌 Today is all about the close. No confirmation = no trade. Thursday is the real trigger — be positioned, not exposed.

—

📣 If this gave you clarity and structure, drop a 🔥, share your bias, and follow GoldFxMinds for sniper plans with zero fluff — only clean, confirmed price action.

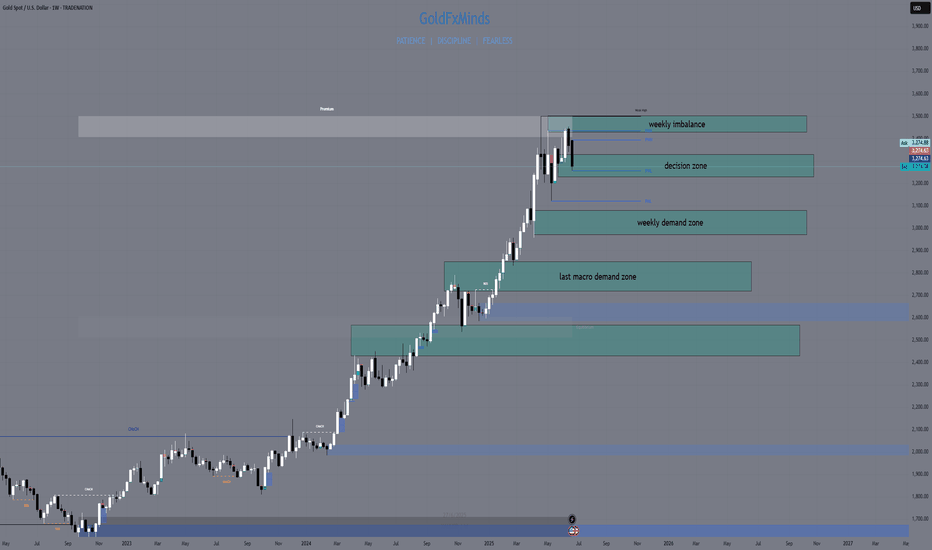

Weekly Outlook | XAUUSD June 30 – July 4, 2025Welcome to a new trading week. Let’s break down the gold chart from a clean, high-timeframe perspective. No setups, no noise – just structure, momentum, and zones that matter.

🌐 Macro Overview

This week concentrates all key USD events into one tight window:

Tuesday: ISM Manufacturing + Fed Chair Powell speech

Wednesday: ADP Employment

Thursday: NFP, Unemployment Rate, ISM Services PMI

Friday: US holiday – markets closed

📌 This means liquidity and momentum will peak by Thursday, then fade into the weekend.

Expect gold to stay in range until macro data breaks direction.

🧠 Weekly Structure & Momentum

Gold remains in a bullish macro structure, but price is hesitating below 3300.

Last two weekly candles printed long upper wicks with no body follow-through – clear sign of distribution, not continuation.

We’re still trading above the 21EMA Weekly, which maintains the uptrend’s integrity.

RSI (14): sitting at ~59 → no real momentum breakout, just consolidation.

📌 The chart is not reversing, but it’s also not trending anymore. We’re in a decision zone.

📍 Key Weekly Areas of Interest

3430 – 3500 → W1 Imbalance + March High Sweep

This is a wide weekly imbalance left unfilled since March, paired with the prior 2024 swing high. 3500 is also a psychological round number. If price pushes into this area, it becomes a liquidity target, not an entry – unless a clear rejection forms.

3330 – 3230 → Weekly Decision Block

This is the current consolidation range. It includes multiple W1 candle bodies, wick highs/lows, and volume cluster.

– Weekly close above 3330 = likely bullish continuation toward 3430+

– Weekly close below 3230 = confirms weakness and opens path to the next major support

3080 – 2970 → Weekly Demand + Fib 38%

Clean block of accumulation from April–May, aligned with the 38.2% retracement of the 2024 rally. This is where we’d expect institutional buying interest on a deeper pullback.

A weekly candle with a long wick into this zone + strong close would reset bullish structure.

2850 – 2720 → Last Macro Demand Zone

This zone includes the 50EMA weekly, a weekly FVG from late 2023, and unmitigated demand before the full 2024 breakout. If price ever gets here, we’re no longer in a healthy uptrend – we’re correcting structurally. But this zone will matter if that happens.

🧭 Summary & Expectations

Gold is still inside a large weekly range.

Until we break above 3330 or below 3230, it’s just consolidation on the HTF.

Thursday’s data will decide the candle.

Don’t predict direction — let the W1 close speak.

📌 Final Notes:

Above 3330 = room toward 3430–3500

Below 3230 = risk opens toward 3080–2970

Inside = no directional edge — stay reactive, not biased

🔥 If you enjoy this clean breakdown: hit that 🚀, follow & drop your thoughts below!

Stay sharp traders — we execute with precision.

— GoldFxMinds

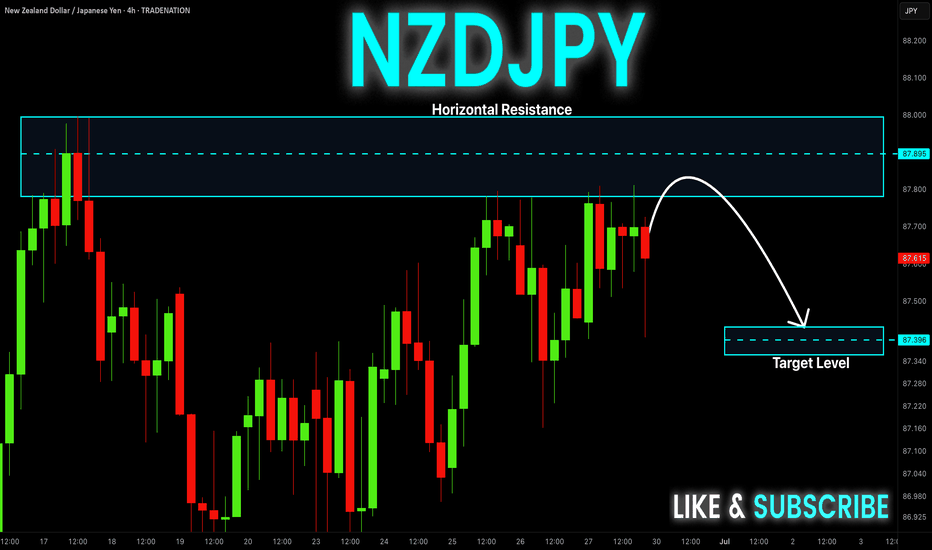

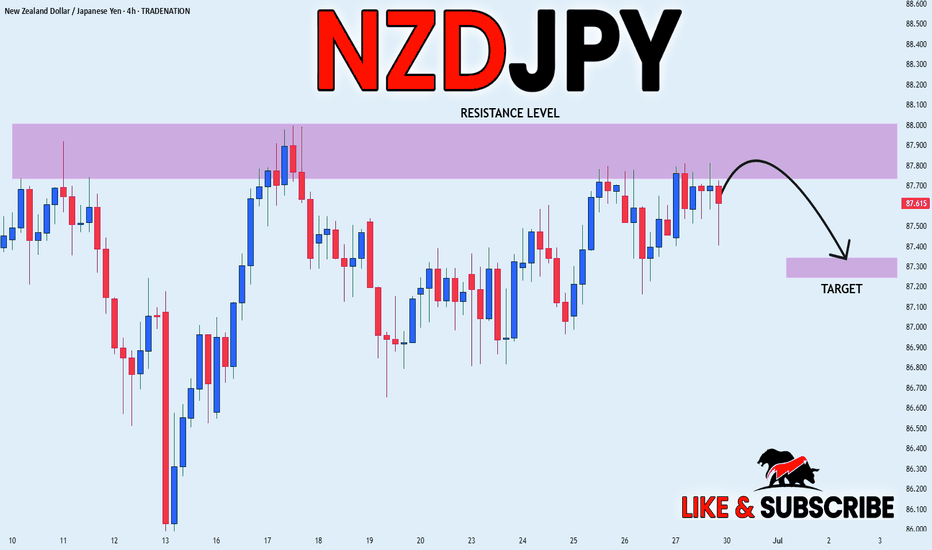

NZD-JPY Potential Short! Sell!

Hello,Traders!

NZD-JPY is slowly approaching

A horizontal resistance level

Around 87.994 so despite

The strong uptrend

We will be expecting a

Local bearish pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

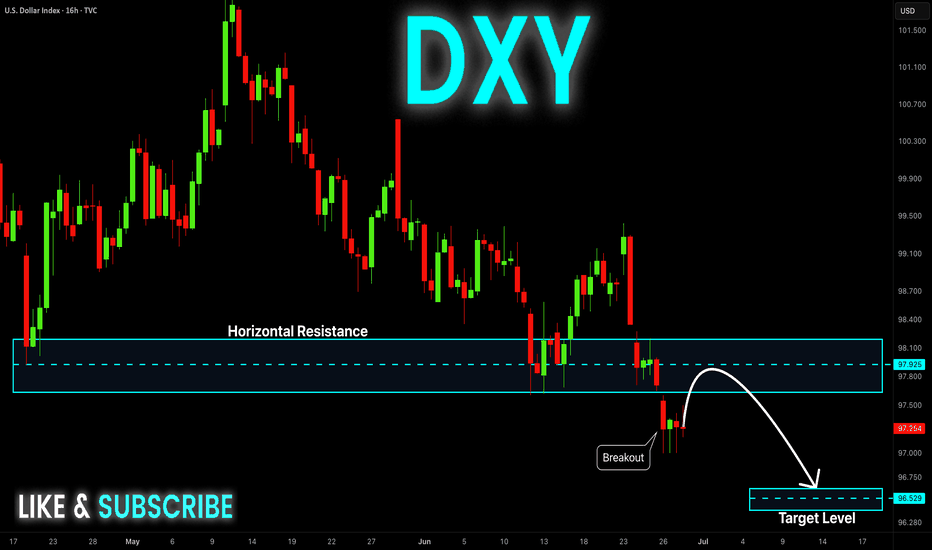

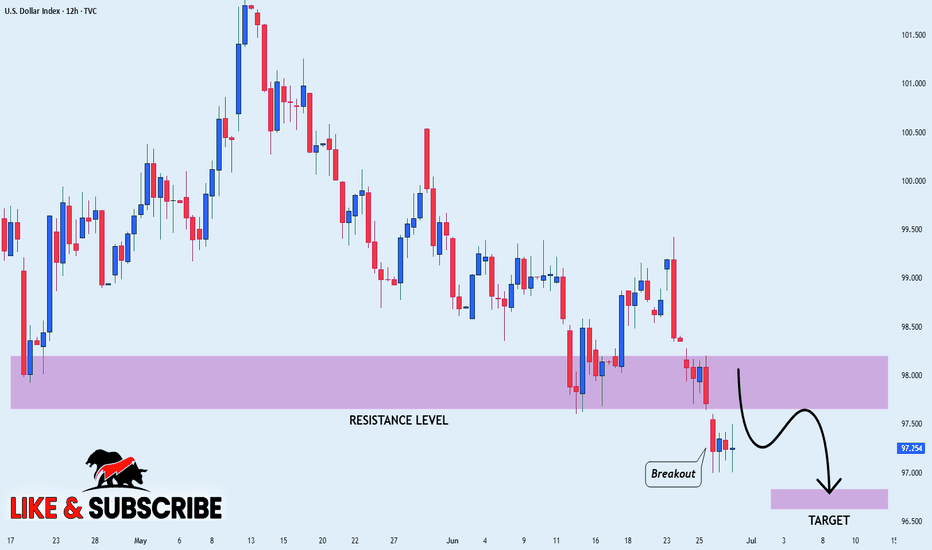

DXY Swing Short! Sell!

Hello,Traders!

DXY keeps falling down

And the index broke the

Key wide horizontal level

Around 97.800 which is now

A resistance and the breakout

Is confirmed so we are very

Bearish biased and we will

Be expecting a bearish

Continuation on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

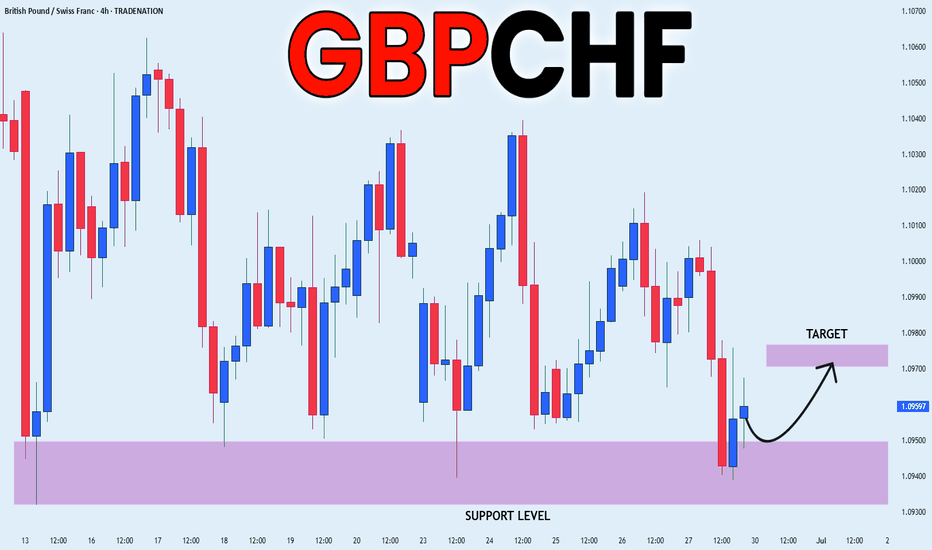

GBP_CHF RISKY LONG|

✅GBP_CHF fell down sharply

But a strong support level was hit at 1.0932

Thus as a rebound is already happening

A move up towards the target of 1.0970 shall follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_JPY SHORT FROM RESISTANCE|

✅NZD_JPY is set to retest a

Strong resistance level above at 88.000

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 87.341

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

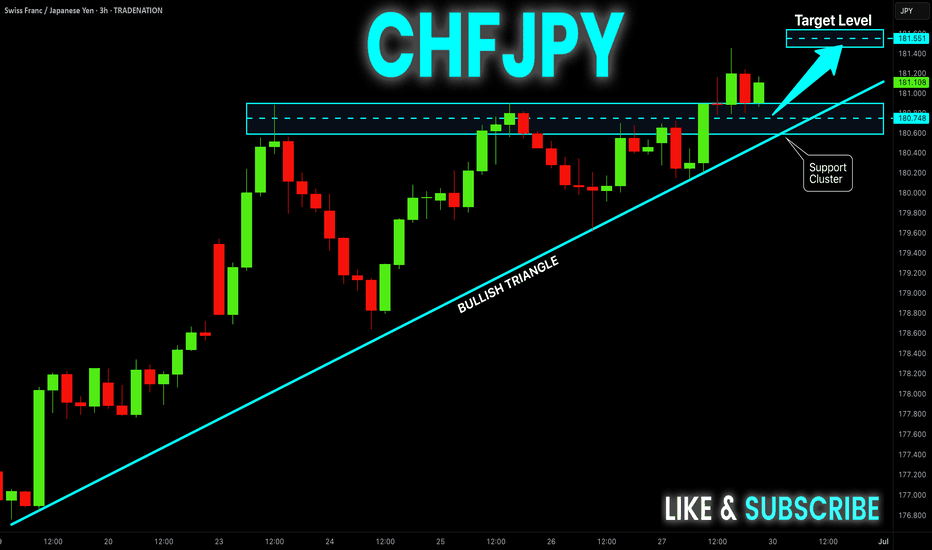

CHF-JPY Local Long! Buy!

Hello,Traders!

CHF-JPY is trading in a strong

Uptrend and the pair made a

Bullish breakout from the bullish

Triangle pattern and is now seems

To be consolidating above the

Support cluster around 180.740

So we are bullish biased and

We will be expecting a further

Bullish move up on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

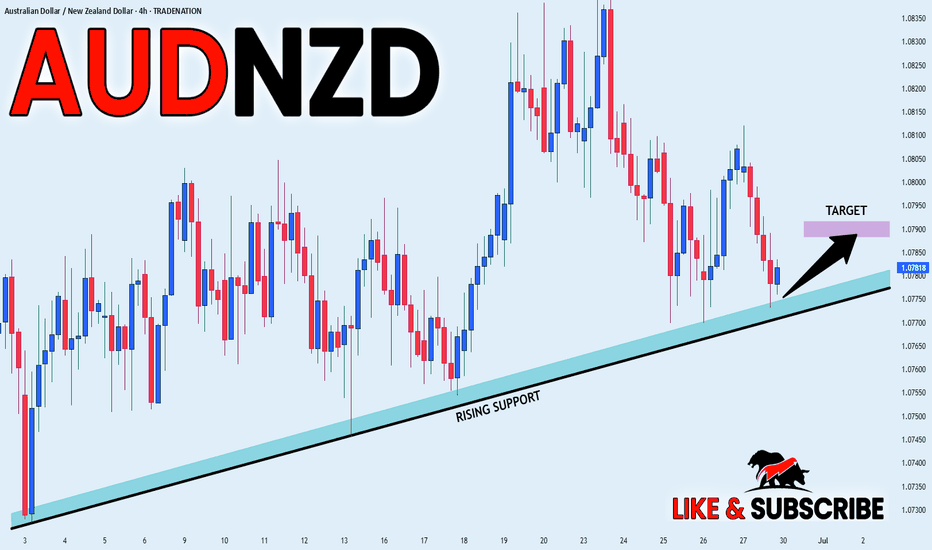

AUD_NZD LOCAL LONG|

✅AUD_NZD is trading along the rising support line

And as the pair is going up now

After the retest of the line

I am expecting the price to keep growing

To retest the supply levels above at 1.0789

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

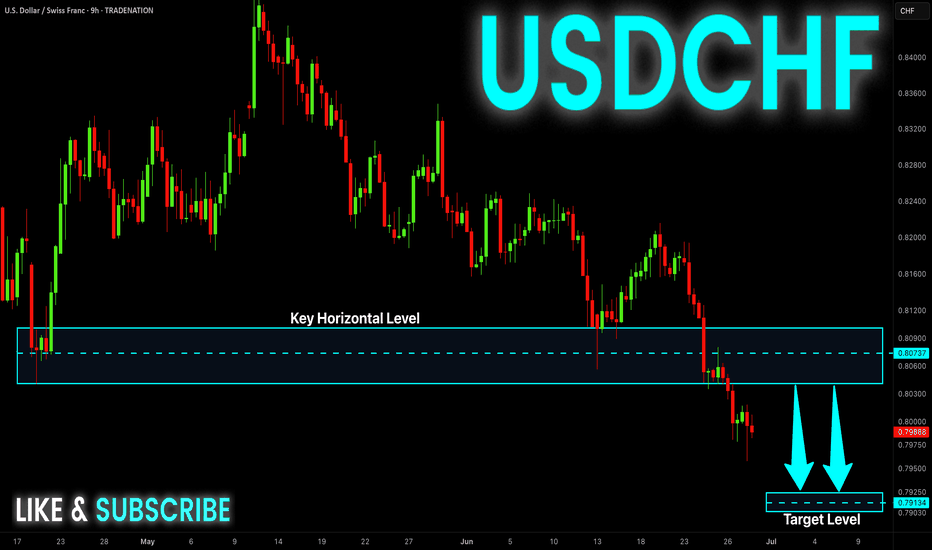

USD-CHF Will Fall! Sell!

Hello,Traders!

USD-CHF keeps falling down

And the pair broke the key

Horizontal level of 0.8090

Decisively so we are bearish

Biased and we will be expecting

A further move down next week

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

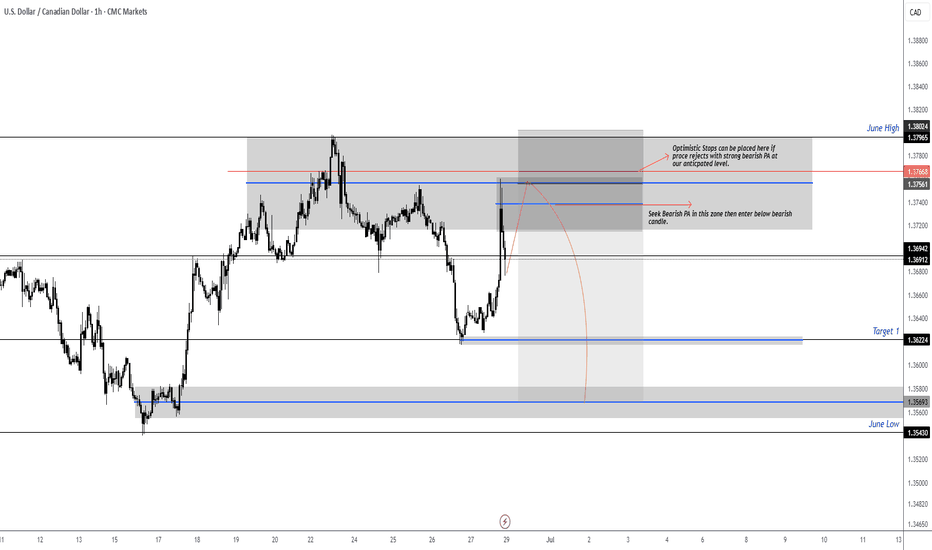

USDCAD RT of Supply Zone then ShortPrice has retraced back into a key supply zone just under the June High. We are now watching for strong bearish price action (PA) to confirm a potential short entry from this area.

Key Zone to Watch:

Supply Zone: 1.3756 – 1.3796

Optimistic stops can be placed above the zone if strong rejection occurs

Plan:

Seek bearish PA within the highlighted supply zone

Wait for confirmation via a bearish candle close

Enter below the trigger candle once setup forms

Targets:

Target 1: 1.3622

Extended Target / June Low: 1.3543

If no rejection occurs and price breaks above the zone with conviction, the setup becomes invalid and we reassess.

Execution will be reactive, not predictive — we trade confirmation, not speculation.

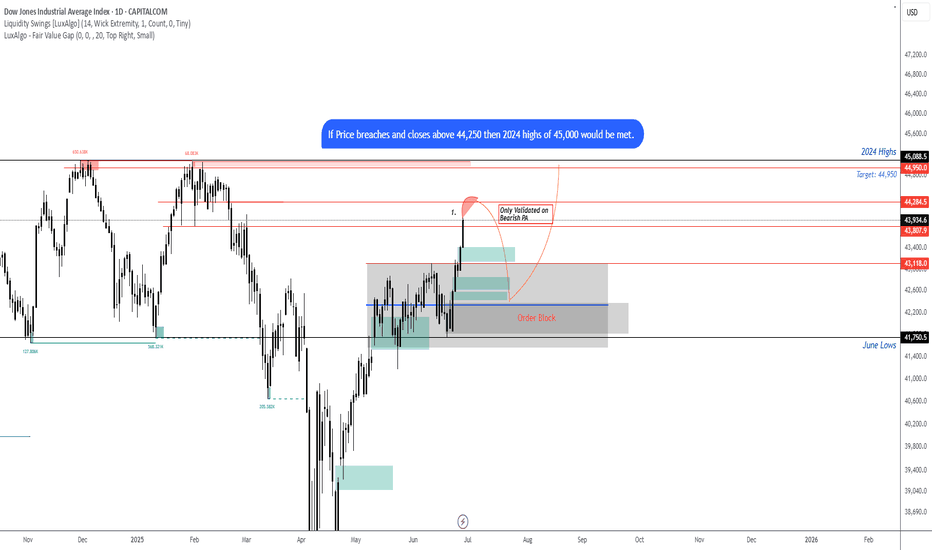

US30 looking for the short on Bearish PAI believe we can expect a pull back down to JuBias: Short-term Bearish (Contingent Setup)

Context: Price is currently trading just below a high-probability supply zone between 44,048 – 44,277. This area aligns with prior highs and liquidity, making it a prime zone to look for a short-term rejection if strong bearish price action (PA) appears on the 4H or Daily timeframes.

We are currently seeing strong bullish momentum on the Weekly, Daily, and H4 candles. Any short positions from this zone must be reactive — not anticipatory. A clear bearish signal (e.g., engulfing, structure break, supply confirmation) is required to consider entry.

Key Zone:

Seek bearish PA between 44,048 – 44,277

Contingency: If price breaks and closes above 44,250 (2024 highs), expect continuation toward 45,000

Short Targets if Rejection Occurs:

Target 1: 43,350

Target 2: 42,500

Extended Target: 41,734 (June Low)

Post-Rejection Bullish Scenario:

If we do get a rejection and targets are met, we will then look for bullish PA in the demand zones (42,500 or 41,700) to consider long setups back toward the 2024 highs and potentially beyond.

Breakout Scenario:

If price breaks and closes above the 44,277 zone early this week, we anticipate the next leg to 45,000 before any meaningful reversal.

At this stage, it’s a waiting game — let price action lead. We don’t predict, we react.ne lows before an

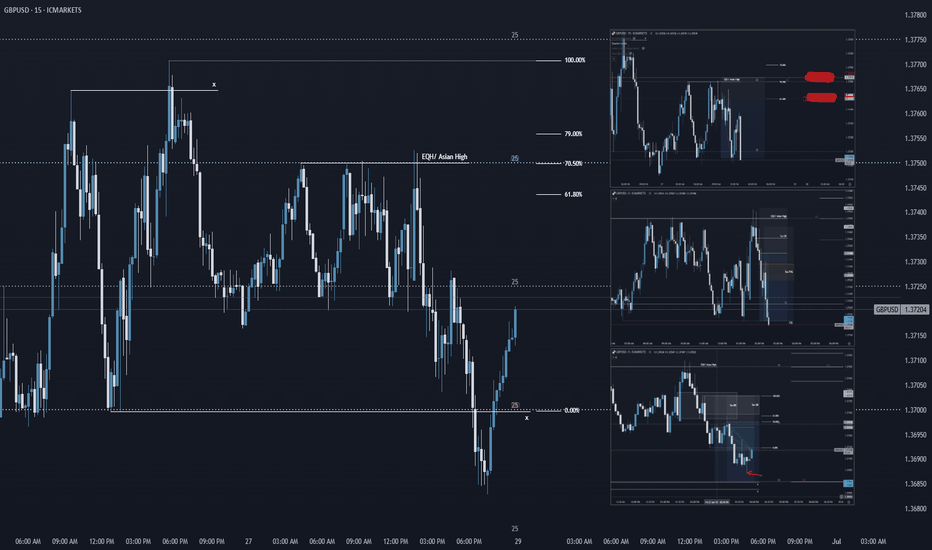

GU Friday Bearish ReviewHi everyone,

GBP/USD played out exactly as per forecast (link below if you'd like to revisit):

It was fairly simple price action to forecast, price sweeped 1.375 initially, taking out the Asian highs and the similar equal highs (liquidity)

Before then creating its bearish leg towards the next liquidity zone of 1.37.

I was able to jump onto a few moves throughout both London & NY (have thrown in those screenshots onto the chart for you guys)

Regards,

Aman | SMC Wolf FX

1-1 student onboarding is currently open (website in my signature & profile)

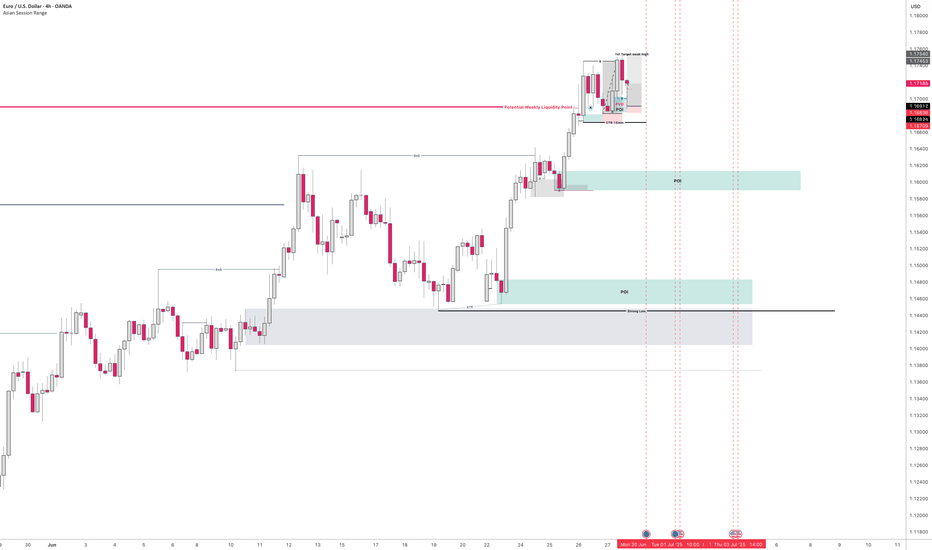

Market Re-Cap and Outlook for NEXT WEEKHere I am giving you a little insight as to what trades I am currently in, taken & looking to take for the week just gone and the week coming.

1 Winning trade on EU

1 Current open position on EU

EURGPB - Breakdown

AUDUSD - Breakdown

NZDUSD - Breakdown

Gold - Breakdown

If there are any pairs you would like me to share my feedback on give me a message and I will be happy to try and do so.

Thanks

Happy Hunting

DXY STRONG DOWNTREND CONTINUES|SHORT|

✅DXY is going down currently

In a strong downtrend and the index

Broke the key structure level of 98.000

Which is now a resistance,

And after the pullback

And retest, I think the price

Will go further down next week

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

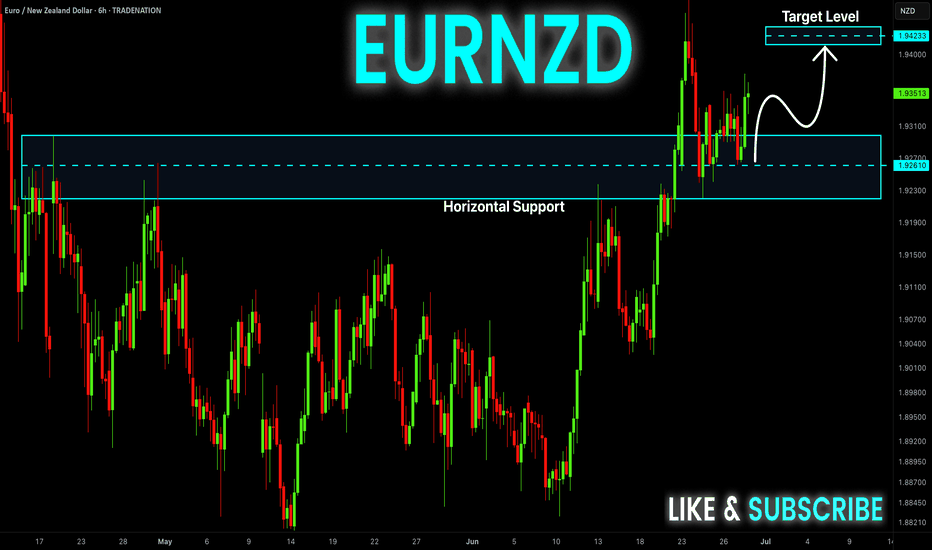

EUR-NZD Bullish Bias! Buy!

Hello,Traders!

EUR-NZD is trading in a

Strong uptrend and the pair

Is printing higher highs and

Higher lows while breaking

Important key levels such

As 1.9270 which is now

A support and the pair

Is consolidating above the

New support so we are

Bullish biased and we will

Be expecting a further move

Further up on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.