IS SUPER MICRO COMPUTERS ($SMCI) FINALLY BOTTOMING?! IS SUPER MICRO COMPUTERS ( NASDAQ:SMCI ) FINALLY BOTTOMING?!

3 REASONS WHY:

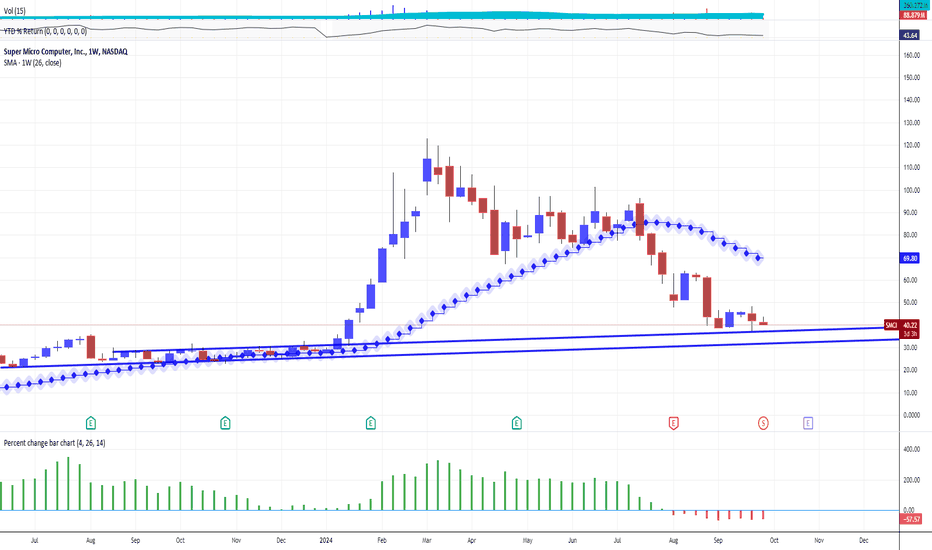

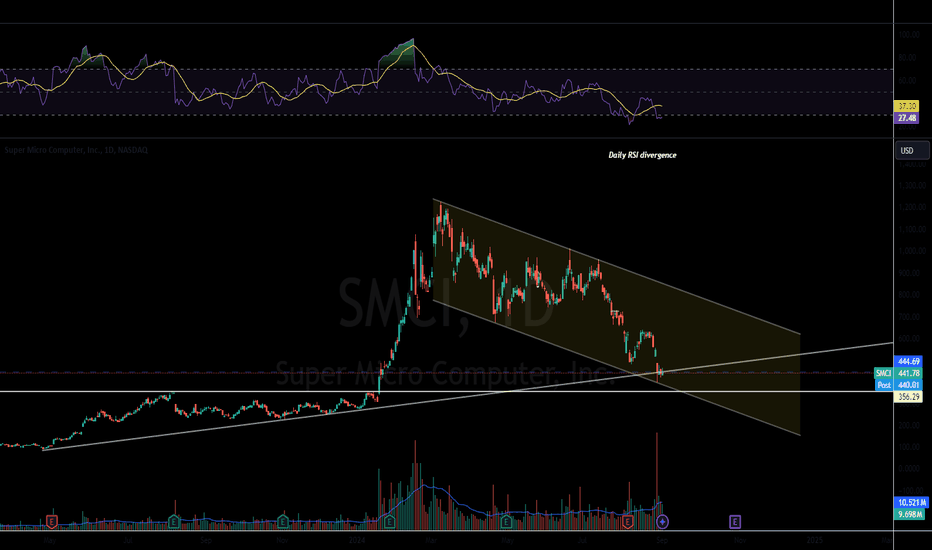

1⃣ We have DIVERGENCE on the Weekly Chart

2⃣ It's almost a "High Five Setup"

3⃣ Take a BREAK and find out by watching. 👇

Stay tuned for more!🔔

Like ❤️ Follow 🤳 Share 🔂

Will Super Micro finally get back on track after the insane negative sentiment and news articles?!

Not financial advice.

SMCI

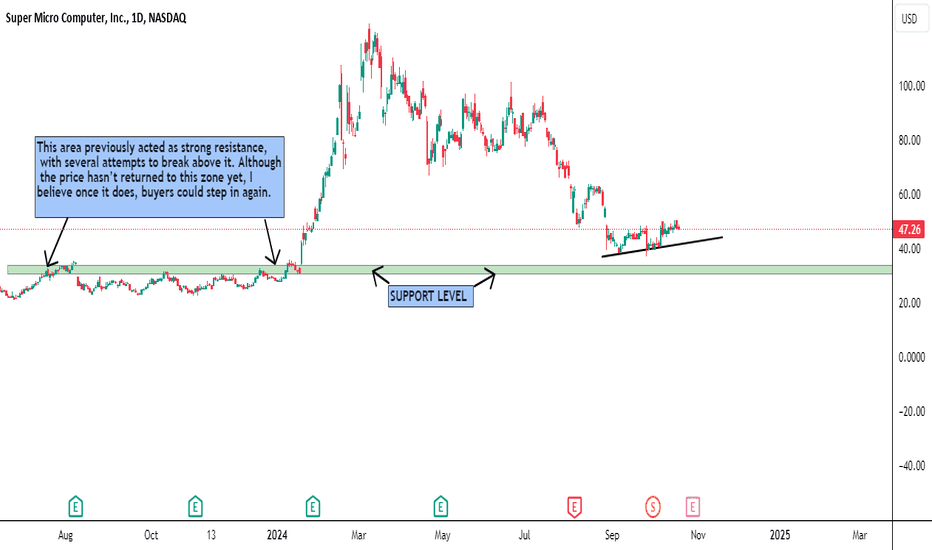

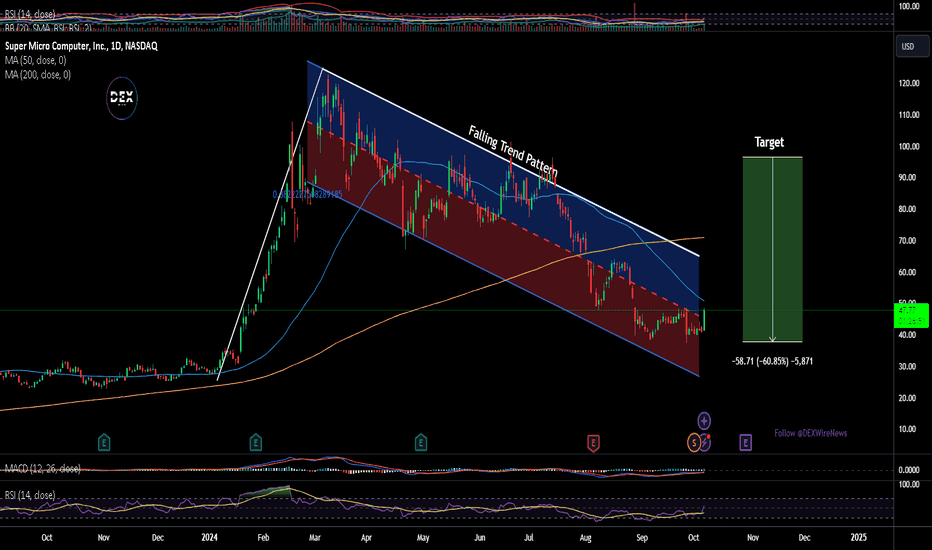

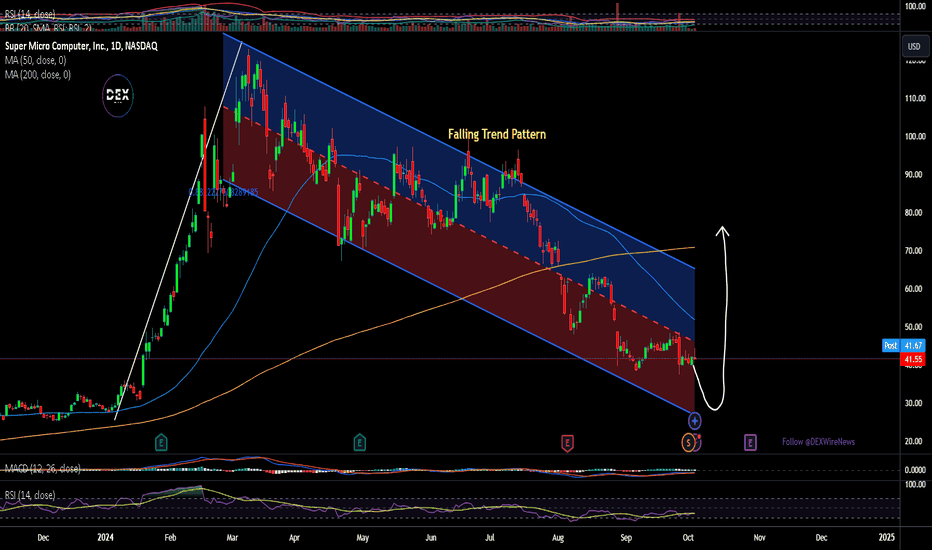

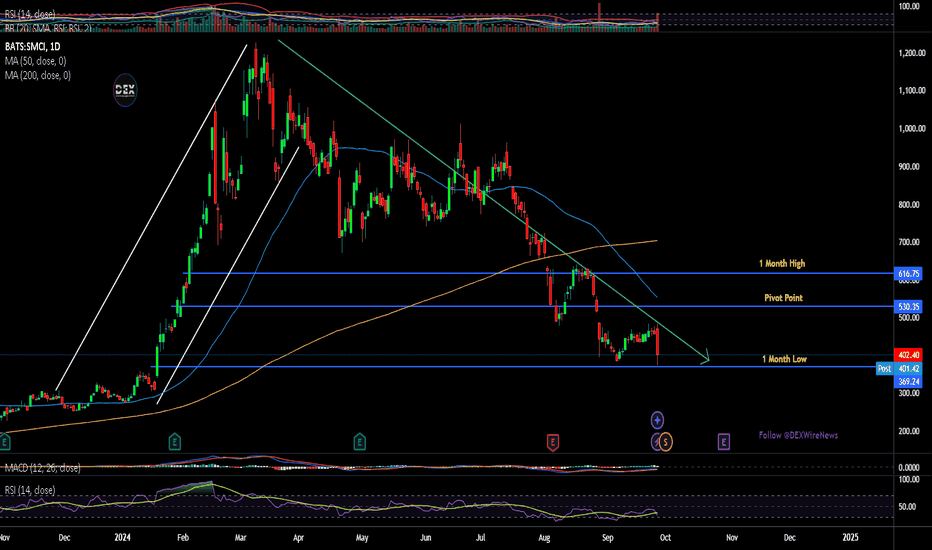

SMCI at a Critical Support: Will Buyers Return?In the daily time frame, SMCI is approaching a key support zone, highlighted in green. This area previously acted as strong resistance, with several attempts to break above it. Although the price hasn’t returned to this zone yet, I believe once it does, buyers could step in again. This level has proven significant before, and if the price revisits this support, it could present a potential buying opportunity. Keep an eye on this zone, as it may signal a shift in momentum if buyers come back. This version reflects that the price hasn’t yet revisited the support zone.

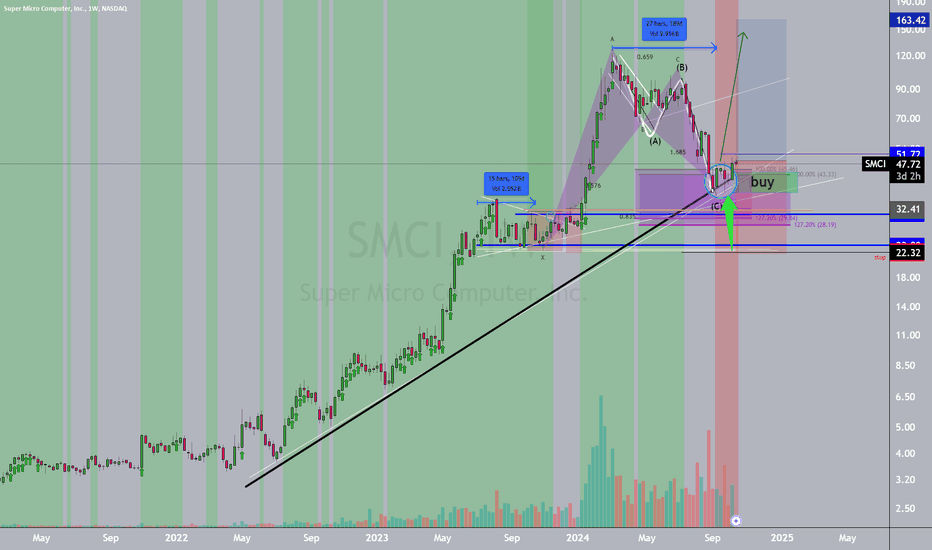

SMCI: Stock Split with Chart UpdateSMCI had a stock split, so I have to update this chart.

Light Fundamental:

It is a stock called SMCI (or Super Mico Computer). It is a US company that makes super powerful computers and servers. The world needs servers to help run things like big websites, apps, and AI. The stock price fell by half. So, it is selling at a discount for what it is really worth. So, it is a good chance to buy it.

Technicals:

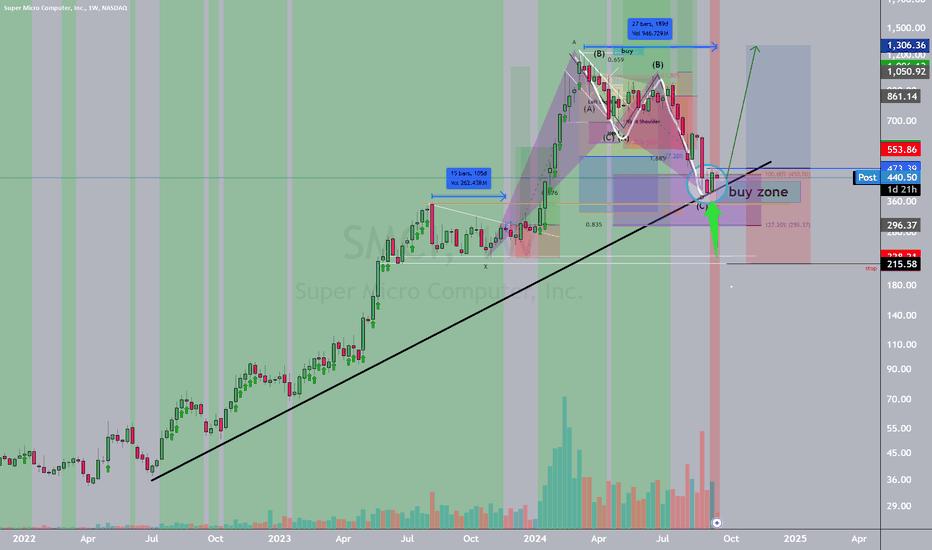

Gartley-like pattern

diagonal support

engulfing bullish pattern with d3 volume and volume confirmation

a-b-c completion at a 78.2% fib pullback

Entry is above the weekly engulfing bullish candle at 475.44.

Target is, tentatively, 1500.

Note: preparing for either an election rally or a Christmas rally in stocks

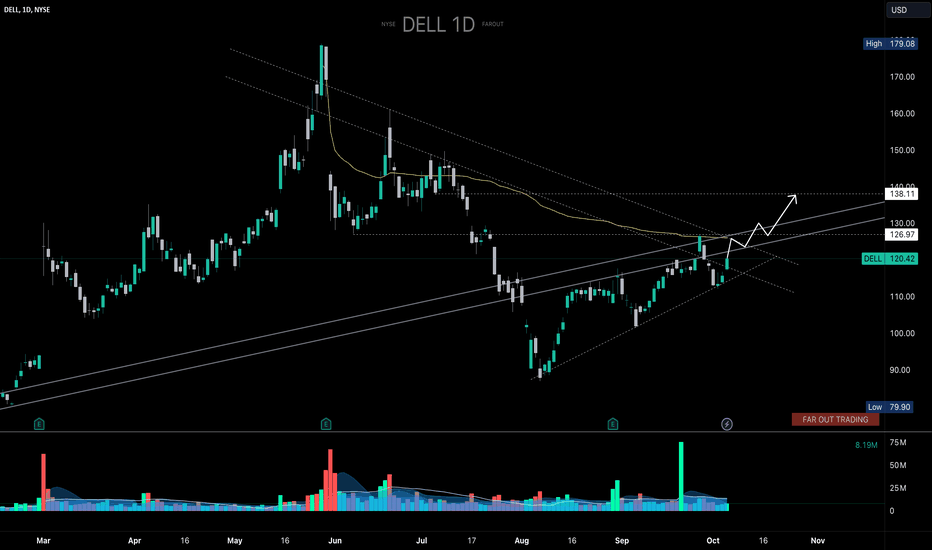

Shorts Trapped Into Insider Selling | DELL I've been actively trading DELL with my private community members and I believe the company is gearing up for another positive run. Despite the news about Michael Dell selling more shares, which may have trapped some short-sellers, DELL is making strategic moves such as reducing costs, rejoining the S&P500, and aiming to capture market share from SMCI.

With this in mind, I see two potential entry points:

a. Enter the trade above $121.50, aiming for $127.

b. Enter the trade once it breaks $127, targeting $138.

Personally, I prefer the second option. DM me with any questions!

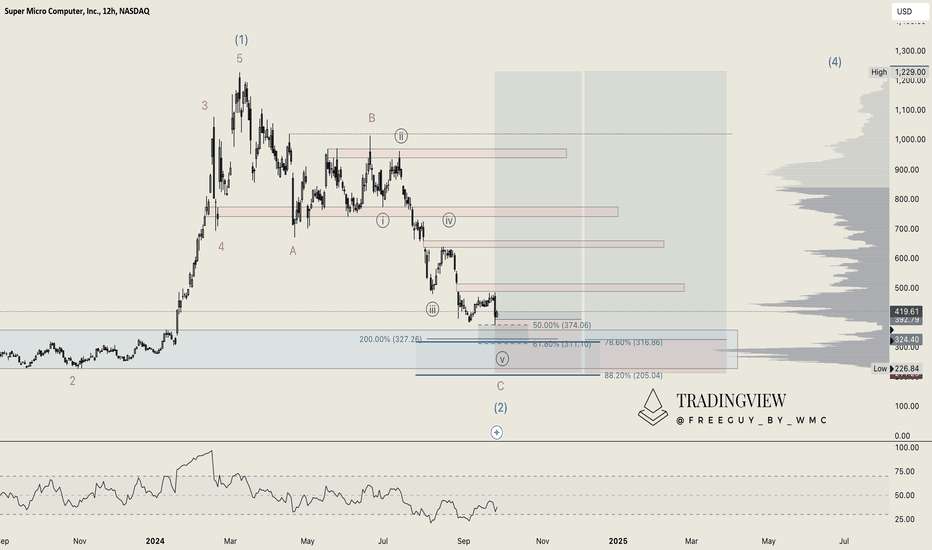

Super Micro Computer (SMCI): Time to buy in after a -70% drop!Since our first analysis a while ago, we've been inching closer and closer to our target area on $SMCI. Since then, we've seen a price drop of 40%, which is far from irrelevant, with the stock retracing nearly 70% from its peak. We're witnessing a clear and recurring pattern here—what we call the "staircase to hell." Each push to a level has been met with rejection, which is exactly why we see a buying opportunity forming.

We are now making our first bid here as a market entry. This is intended to be a swing trade that we plan to carry into 2025, with a target of reaching previous highs again. Therefore, we're not worried about getting a "perfect" entry within 1-2% but instead setting a DCA bid a bit lower for an optimal position if NASDAQ:SMCI comes down further.

Below the market entry, there's an important Fibonacci cluster that combines the 200% target of Wave C, the 78.6% retracement of Wave (2), and a target for Wave ((v)), all aligning well. With these multiple levels coinciding, there's a strong possibility we will see the price reach this zone. If so, we’ll place another bid to buy more shares.

If NASDAQ:SMCI manages to flip the first resistance, we expect it to move up quickly. As we always say, patience is the key to successful swing trading—don’t let greed or fear cloud your decisions 🤝.

SUPERMICRO. BUY WHEN THERE'S BLOOD IN THE STREETS.The worse the market - the greater the opportunity to profit it gives.

This seems to be the credo of contrarian, or counter investing.

Nathan Rothschild, a 19th-century British financier and member of the Rothschild banking family, is credited with saying:

“The time to buy is when there’s blood in the streets.”

Whether or not Rothschild actually uttered this famous line, it reveals an important truth about betting against market psychology. When prices are falling and markets are shaky, bold contrarian investing can yield big returns.

Key Takeaways

👉 Contrarian investing is a strategy that goes against prevailing market trends or sentiment.

👉 The idea is that markets are subject to herd behavior, fueled by fear and greed, which causes markets to periodically overprice or underprice.

👉 “Be fearful when others are greedy, and be greedy when others are fearful,” said Warren Buffett. This phrase embodies a similar philosophy, perhaps just in a slightly more succinct form.

Historically, market panics can be a great opportunity for cheap investing.

Most d̶u̶m̶b̶a̶s̶s̶ ̶ people want to have ONLY WINNERS in their portfolios, but as Warren Buffett warned, “In the stock market, you pay a very high price for a happy consensus.”

In other words, if the crowd is unanimous in agreeing on an investment decision, it’s probably NOT A GOOD ONE.

Going Against the dumbass Crowd

Contrarians, as the name suggests, try to do the opposite of the crowd. They get excited when a good company’s stock price drops sharply and unfairly. They swim against the tide and assume that the market is usually wrong at both extreme lows and highs. The more prices fluctuate, the more delusional they think the rest of the market is.

Contrarian investors believe that people say the market is going up when and why they are fully invested and have no further buying power.

At that point, the market is peaking and should be going down. When people predict a decline, they are already sold out, and at that point, the market can only go up.

For this reason, contrarian thinking is great for figuring out whether a particular stock has actually bottomed.

Bad times build wealth

😬 Contrarian investors have historically made their best investments during times of market turmoil. During the 1987 crash (also known as Black Monday), the Dow Jones Industrial Average in the US fell 22% in one day.

😬 During the 1973–74 bear market, the market lost 45% in about 22 months.

😬 The September 11, 2001 attacks also caused the market to fall significantly.

I AM CERTAINLY NOT AN ADVOCATE OF VIOLANCE

But the list of facts goes on and on. And these were the times when contrarians found their best investments.

😬 The 1973–1974 bear market gave Warren Buffett the opportunity to buy a stake in the Washington Post Company, an investment that subsequently rose more than 100 times its purchase price. That’s before dividends.

Buffett said at the time that he was buying the company’s shares at a deep discount, as evidenced by the fact that the company could “sell (the Post’s) assets to any of 10 buyers for at least $400 million, probably considerably more.” more." Meanwhile, the Washington Post's market cap at the time was just $80 million. In 2013, the company was sold to Amazon CEO and founder Jeff Bezos for $250 million in cash.

😬 After the 9/11 attacks, the world stopped moving for a while. Let's say you were investing in Boeing (BA), one of the world's largest commercial aircraft makers, during that time. Boeing's stock bottomed out just a year after 9/11, but since then, it has more than quadrupled in the next five years. Clearly, while 9/11 may have temporarily soured market sentiment on the airline industry, those who had done their research and were willing to bet on Boeing's survival were well rewarded.

😬 Sir John Templeton ran the Templeton Growth Fund from 1954 to 1992, when he sold it. For every $10,000 invested, into an A-share fund in 1954 would have grown to $2 million by 1992 with dividends reinvested, or an annual return of about 14.5%.

Templeton was a pioneer of international investing. He was also a serious contrarian investor, buying into countries and companies when, according to his principle, they reached their "POINT OF MAX. PESSIMISM."

Four years later, he sold the stock for a huge profit.

The Risks of Contrarian Investing

While the most famous contrarian investors bet big money, went against the grain, and succeeded, they also did a lot of research to make sure the crowd was wrong.

So when a stock takes a big dive, it doesn't prompt the contrarian to place an immediate buy order, but to figure out what caused the stock to fall and whether the price drop is justified.

Knowing which distressed stocks to buy and sell once the company recovers is a major concern for contrarian investors. This can lead to stocks that deliver much higher returns than usual. However, being overly optimistic about hyped stocks can have the opposite effect.

Final Points.

👉 While each of these successful contrarian investors has their own strategy for evaluating potential investments, they all have one thing in common: they let the market give them deals instead of chasing them.

👉 What's next for Supermicro stock? Who knows, who knows..

It's very individual and depends on what you're looking for... opportunity or denial.

👉 The current 6-month return on investment in Supermicro stock is -58.44% - a pretty rare occurrence for SMCI.

This has never happened before.. even in times of WFC, Covid-19 or smth else.

Indeed, several times 6-months returns were quite negative for SMCI. Then Supermicro shares doubled or even tripled in price in just several next years.

What principle and style of investing do you adhere to?! Please share your comments and feedback in the box below! 👇👇

SMCI: Are we back in business??Super Micro Computer just broke over the LH 1 trendline holding since July 15th and is about to turn bullish again on the 1D technical outlook (RSI = 54.296, MACD = -2.380, ADX = 24.033). Coming off a double bottom (DB), the only resistance left before the bullish trend is resumed, is the 1D MA50 (untested since July 17th). The 1D RSI already made its breakout over its own R level. When the 1D MA50 breaks, target the LH2 trendline (TP = 78.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Super Micro Computer Stock up 16% Amidst AI DemandSuper Micro Computer Inc. (NASDAQ: NASDAQ:SMCI ) has recently been thrust back into the spotlight after announcing a surge in shipments of its advanced graphics processing units (GPUs). These GPUs, driven by the ongoing artificial intelligence (AI) revolution, are powering some of the largest AI factories globally. The company revealed that it has deployed over 100,000 GPUs utilizing its proprietary liquid cooling technology, designed to help AI data centers cut down on energy costs while improving operational performance. The news has given NASDAQ:SMCI a fresh momentum, with the stock soaring 16.37% as of Monday’s trading.

AI Boom Fueling Growth

The ongoing boom in AI is playing a pivotal role in NASDAQ:SMCI ’s resurgence. The company, which supplies critical server infrastructure used for AI model training, data storage, and large-scale cloud operations, has been a significant beneficiary of the rising demand for GPU-powered AI systems. Partnering with Nvidia (NVDA), NASDAQ:SMCI leverages Nvidia’s cutting-edge $30,000 chips to service the growing AI sector. The company's ability to deploy more than 100,000 GPUs per quarter could translate into billions of dollars in potential revenue.

Additionally, NASDAQ:SMCI 's latest innovation—its direct liquid cooling products—has opened new avenues for reducing the overall energy footprint of data centers. CEO Charles Liang noted that these solutions are already being adopted by "state-of-the-art" AI factories, further solidifying the company’s standing in the green technology landscape.

Despite this growth, NASDAQ:SMCI has faced its share of challenges. The company is currently about nine weeks behind on filing its annual report, citing ongoing assessments of its internal controls over financial reporting. Furthermore, a recent investigation by the Department of Justice, following allegations of accounting manipulation by Hindenburg Research, caused shares to drop 12% last month. Still, with AI demand continuing to fuel orders, NASDAQ:SMCI ’s fundamentals remain strong.

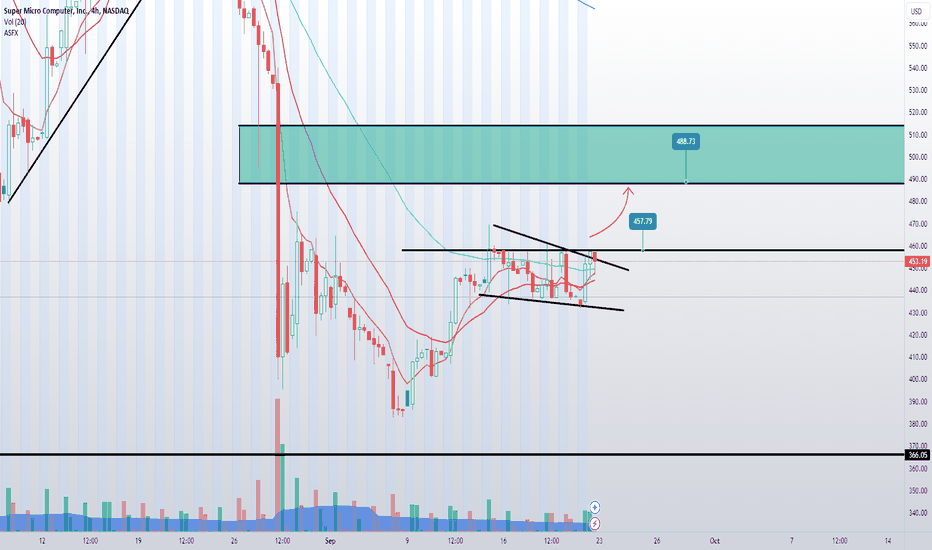

Technical Outlook: A Bullish Flag in the Making?

From a technical standpoint, NASDAQ:SMCI is showing signs of a potential rebound after weeks of decline. The stock's 16% jump on Monday suggests that investors are starting to recognize the company’s growth potential once again. Currently, NASDAQ:SMCI is trading within a presumed falling trend channel, but with the latest bullish momentum, it appears ready to break out of this bearish pattern.

One of the most encouraging signs on the daily price chart is the early formation of a bullish flag pattern, a signal typically associated with the continuation of an upward trend. The stock has also avoided hitting overbought or oversold territory, as reflected in the Relative Strength Index (RSI), which is primed for further gains.

However, NASDAQ:SMCI is still trading below key moving averages (MAs), which serves as a point of caution for traders. A sustained move above these MAs could indicate a more stable reversal, suggesting that the stock might migrate from its current bearish trend into a more balanced state.

Outlook: Hope in the Midst of Uncertainty

While the stock remains down by over 50% from its March highs, the recent surge and new product innovations offer a glimmer of hope. If NASDAQ:SMCI can clear its regulatory hurdles and capitalize on the ongoing demand for AI infrastructure, the stock may continue to rise. The combination of fundamental strength in AI growth and the promising technical setup offers a compelling case for long-term investors.

The next key for investors to watch will be NASDAQ:SMCI 's ability to regain ground above its moving averages, solidifying the bullish reversal. If the bullish flag pattern plays out, the stock could see further gains as AI demand and liquid cooling innovation continue to drive its growth.

Supermicro and Fujitsu Collaborate on Green AI ComputingSupermicro stock (NASDAQ: NASDAQ:SMCI ) Shows Bullish Potential Despite Stock Dip

Supermicro, Inc. (NASDAQ: NASDAQ:SMCI ) and Fujitsu have recently announced a long-term strategic collaboration to develop cutting-edge green AI computing technology and liquid-cooled datacenter solutions. This partnership, which will focus on future AI, HPC, and next-generation data centers, aims to provide more energy-efficient solutions for the growing demand in AI and data infrastructure while minimizing environmental impact.

Strategic Collaboration Overview

The collaboration includes developing platforms using Fujitsu's upcoming **Arm-based “FUJITSU-MONAKA” processor**, targeted for release in 2027. This processor will be designed for high-performance computing while also being energy-efficient. Supermicro’s liquid-cooling technology will play a vital role, helping to address the challenge of rising data center power consumption and environmental concerns. Together, the companies aim to create green IT architectures that align with global sustainability goals.

Supermicro CEO Charles Liang stated, “These systems will be optimized to support a broad range of workloads in AI, HPC, cloud, and edge environments.” The companies’ combined technical capabilities are expected to enhance performance across several industries while reducing the ecological footprint of data centers.

The liquid-cooled systems, which Supermicro is already leading in, will be central to this effort. The companies aim to bring rack-scale liquid cooling solutions that offer not just high-performance processing, but also **green AI infrastructure** that meets the global demand for scalable, energy-efficient AI and computing platforms.

Strengths and Future Outlook

Supermicro has continued to position itself as a leader in IT infrastructure. The company's focus on energy efficiency and green computing aligns with broader market trends, especially as environmental concerns become central in technology development. The new FUJITSU-MONAKA processor promises to deliver excellent performance and power efficiency, crucial for AI workloads and data centers of the future. This processor, using cutting-edge 2-nanometer technology, will strengthen Supermicro’s competitive edge in both the AI and broader HPC market.

In addition, the partnership will extend globally with the inclusion of Fsas Technologies Inc., a subsidiary of Fujitsu, providing AI platforms based on Supermicro's GPU servers. This move will allow both companies to offer top-tier AI solutions on a global scale, aiding enterprises and data center operators in leveraging AI-driven digital transformation (DX).

Technical Analysis

As of the time of writing, NASDAQ:SMCI stock is down 1.07%, but the technical indicators point to a potential bullish reversal. The daily chart reveals the formation of a bullish flag pattern, which signals a potential upward breakout. A move above the $75 pivot would confirm this bullish momentum and could trigger a substantial rally in the stock, given the broader AI and tech stock trends this year.

The RSI (Relative Strength Index) currently sits at 38, which indicates that the stock may be in oversold territory. This could present an excellent buying opportunity for investors who believe in the long-term potential of Supermicro (NASDAQ: NASDAQ:SMCI ), especially with its involvement in green AI and liquid-cooling technologies.

Conclusion

Supermicro’s collaboration with Fujitsu marks an important step forward in creating a sustainable and high-performance AI infrastructure, essential for the future of data centers. Despite the stock’s current dip, the technical analysis suggests a potential bullish reversal on the horizon, fueled by favorable industry conditions and the company’s focus on innovative, green technologies. Investors might view the RSI level as an opportunity to enter or accumulate positions, given the long-term promise of this partnership and the growing demand for AI-driven solutions.

Supermicro is well-positioned to benefit from both its focus on sustainability and the growing demand for AI infrastructure, making it a stock to watch closely in the near term and beyond.

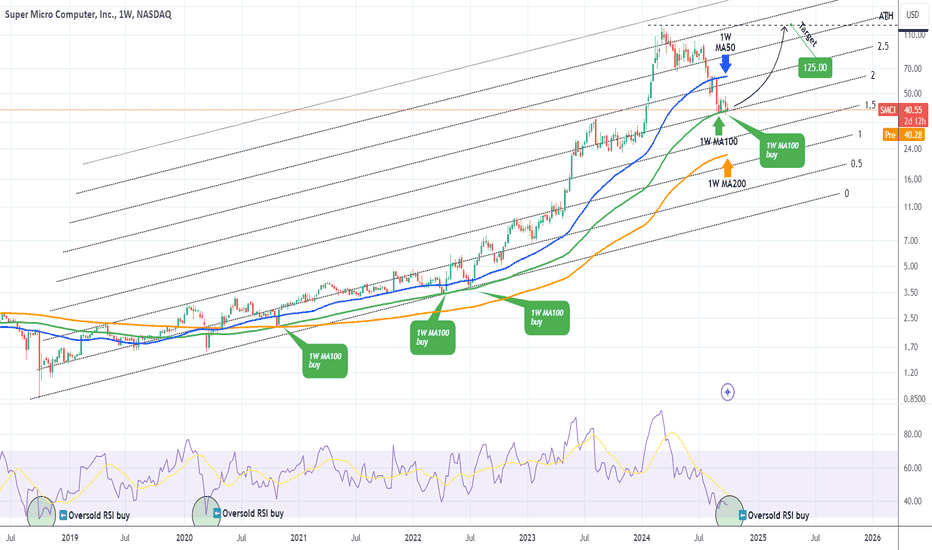

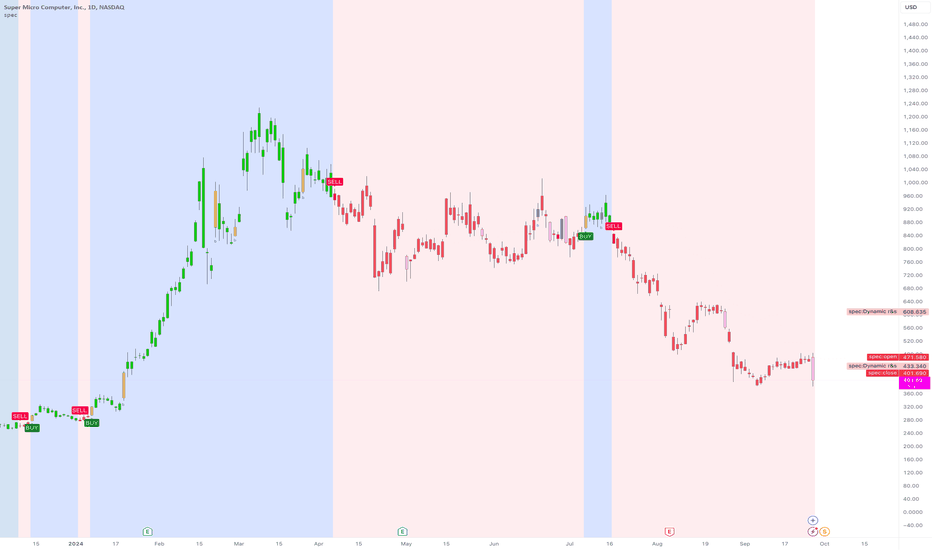

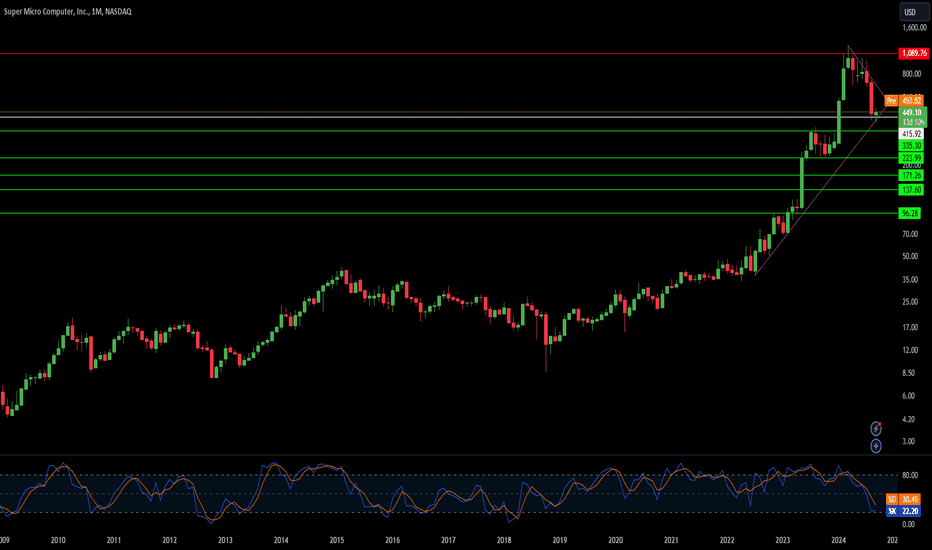

SMCI Is it a by after the stock split??Super Micro Computer Inc (SMCI) just had their 10-for-1 stock split and what's on everyone's mind now is this: Is it a buy? Well after a fresh 8-month Low last Thursday, the market certainly doesn't look at its best, quite the contrary, it is on the worst position it could be after the July 15 High and the start of a Channel Down with series of Lower Highs and Lower Lows.

There is a certain level though, where all of SMCI corrections came to an end since the March 23 2020 bullish break-out during the COVID flash crash, and that is the 1W MA100 (green trend-line).

As you can see, before the stock turned completely parabolic in May 2023, it was trading within a Channel Up since the October 01 2018 market bottom. With the use of the Fibonacci Channel levels, we can accurately put into context the subsequent parabolic move too, which extended all the way to almost the 4.0 Fibonacci extension on the week of March 04 2024 and the All Time High (ATH), before starting its correction.

In the meantime, notice the excellent Buy Signal that the 1W RSI is giving in the last 6 years, every time it approaches the 30.00 oversold barrier.

So as long as the 1W MA100 keeps closing the stocks weekly candles above it, we will be bullish, targeting $125.00 (the ATH). If that fails to support though, expect further downside to the 1W MA200 (orange trend-line), where we will place a second long-term buy.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Super Micro Computer Stock Plunges Amid Federal Accounting ProbeSuper Micro Computer Inc. (NASDAQ: NASDAQ:SMCI ), a prominent player in the AI hardware space, saw its stock tumble by 15% on Thursday after reports surfaced that the U.S. Department of Justice (DOJ) has opened a federal investigation into the company. The probe, sparked by allegations of accounting manipulation and other improprieties, has sent shockwaves through the market. For a company that had been riding high on the back of the AI boom, this investigation poses serious questions about its future trajectory.

The Backstory: Short-Seller Allegations and Federal Involvement

The DOJ's investigation follows a damning report by Hindenburg Research, a well-known short-seller, which was released in August. In the report, Hindenburg alleged that Super Micro Computer engaged in accounting manipulation, sibling self-dealing, and sanctions evasion. The short-seller also pointed to undisclosed related-party transactions, export control violations, and suspicious customer issues.

The allegations didn’t just arise from external analysis—internal turmoil has also surfaced. A former employee of Super Micro filed a whistleblower lawsuit earlier this year, accusing the company of improper accounting practices. The lawsuit also names Charles Liang, the CEO of Super Micro, who has been a central figure in the company's rise during the AI boom. These combined factors appear to have prompted federal officials to begin looking into the server manufacturer’s business practices.

According to reports from *The Wall Street Journal*, prosecutors from the U.S. Attorney’s Office in San Francisco are now involved, and early-stage inquiries have been made regarding the whistleblower’s accusations. While Super Micro has declined to comment on these developments, the stock market reacted swiftly to the news, with NASDAQ:SMCI leading the day's decliners in the S&P 500.

Delayed Annual Report and Market Fallout

This isn't the first time Super Micro’s accounting practices have raised concerns. In August, the company announced that it would be delaying the filing of its annual report, citing the need to assess its internal controls over financial reporting. That announcement caused the stock to fall nearly 20%, hinting that investors were already skittish about the company’s financial transparency.

Super Micro’s inability to file its annual report with the U.S. Securities and Exchange Commission (SEC) on time coincided with Hindenburg's allegations, further fueling speculation that all may not be well behind the scenes. While the company has not provided clear explanations for the delay, the timing raises questions about whether the two events are linked.

The Impact on Super Micro: From AI Boom to Uncertainty

Super Micro (NASDAQ: NASDAQ:SMCI ) had been one of the major beneficiaries of the artificial intelligence boom, with its server technology being a critical component for companies such as Nvidia, AMD, and Intel, all of whom are at the forefront of AI development. The company specializes in manufacturing high-performance servers used for data storage, website hosting, and AI-driven applications.

Earlier this year, NASDAQ:SMCI shares hit an all-time high, having quadrupled in value thanks to the skyrocketing demand for AI hardware. As a key supplier to some of the biggest names in the tech world, Super Micro positioned itself as a crucial cog in the AI machine. The company's meteoric rise seemed unstoppable, with shares still up by 38% in 2024, even after recent setbacks.

However, this latest development puts the company in a precarious position. With a federal probe underway, the future looks uncertain. Even if the company manages to clear its name, the mere specter of an accounting scandal is enough to dent investor confidence.

A Look Ahead: Can Super Micro Rebound?

As the federal probe unfolds, the critical question for investors is whether Super Micro can recover from this blow. While the company’s technological prowess and strategic positioning within the AI sector remain intact, the financial and legal challenges could significantly impact its future performance.

Analysts are likely to keep a close watch on how the company handles the accounting investigation and whether it can restore trust with its shareholders. For now, the stock’s sharp decline serves as a reminder that even the most promising companies can face turbulence when financial transparency is called into question.

With no comment from either the company or the DOJ, much remains unknown about the exact scope of the investigation or how long it will last. Super Micro's success has largely been built on its reputation as a reliable provider of server technology in the booming AI market. However, if the allegations prove to be true, the fallout could be severe, leading to deeper market losses and potentially legal consequences.

Conclusion

Super Micro Computer (NASDAQ: NASDAQ:SMCI ) now finds itself at a critical juncture. After riding high on the AI boom, the company must now contend with a federal investigation that could unravel the confidence investors have placed in it. While Super Micro’s role in the AI revolution is undisputed, the outcome of the DOJ probe will likely determine the company's future trajectory.

Investors should brace for continued volatility as the investigation progresses. For those considering a stake in NASDAQ:SMCI , caution is advisable until more information is available about the probe's findings and Super Micro’s financial health. Until then, the company remains in a precarious position, teetering between its past AI-driven success and an uncertain legal future.

SMCI DROPSuper Micro Computer (SMCI) is currently under scrutiny as it faces multiple probes and class-action lawsuits. These legal issues primarily stem from allegations of accounting manipulation and concerns over corporate governance. The investigation has been sparked by a report from Hindenburg Research, which raised serious questions about the company's financial reporting, including accusations of overstating sales, understating expenses, and engaging in "round-tripping" practices to inflate revenues

Super Micro Computer (SMCI) Faces Securities Fraud LawsuitSuper Micro Computer Inc. (NASDAQ: NASDAQ:SMCI ) is navigating turbulent waters as the company faces a class action lawsuit alleging violations of federal securities laws. The Schall Law Firm, a national shareholder rights litigation firm, has filed a lawsuit against Super Micro for potential violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as well as Rule 10b-5. The litigation involves accusations of misleading investors and possibly inflating financial figures. Shareholders who purchased SMCI securities between August 10, 2021, and August 26, 2024, are urged to contact the law firm before the October 29, 2024, deadline.

Despite the legal headwinds, Super Micro’s stock is making waves ahead of a highly anticipated 10-for-1 stock split, which is scheduled to take effect after the closing bell on September 30, 2024. On the technical side, the stock has rebounded by 4% in recent trading, signaling renewed investor interest. However, the company has lost nearly half of its value over the past three months, weighed down by disappointing fiscal Q4 earnings and allegations of “accounting manipulation” by short seller Hindenburg Research.

Legal Troubles and Market Sentiment

The class action lawsuit represents a major challenge for Super Micro Computer as it grapples with accusations that could severely damage investor confidence. Violations of securities law can lead to significant penalties, reputational damage, and a prolonged legal battle, all of which could negatively affect the company’s stock price.

Adding to these troubles is Hindenburg Research’s scathing report, which alleges that the company engaged in improper accounting practices, contributing to the stock's volatility in recent months. This report has stirred skepticism among some investors, although others remain focused on Super Micro’s long-term potential, particularly in the fast-growing artificial intelligence (AI) server market.

Technical Analysis: Key Levels to Watch

Despite these setbacks, NASDAQ:SMCI stock is attempting to recover from its sharp decline and has recently shown some signs of life. On Monday, the stock rose by 1.78%, trading at a relative strength index (RSI) of 43, indicating that it is emerging from an oversold condition, but still showing some weakness. The RSI remains below 50, suggesting that NASDAQ:SMCI is still working to overcome bearish momentum.

SMCI’s price movement has been oscillating within a descending broadening wedge formation since reaching its all-time high in March 2024. This pattern is often viewed as a bullish reversal signal once a breakout occurs, but so far, the stock has struggled to maintain upward momentum. The lower trendline of the wedge around $357 has held as key support in recent weeks, and a failure to defend this level could send shares tumbling toward $230, where previous troughs were established between August and October of last year.

On the upside, the stock faces significant resistance around $700, a level that aligns with the 200-day moving average. A breakout above this resistance could trigger a rally toward $975, a price level that corresponds with several swing highs from earlier in the year.

AI Server Demand and Innovation

While Super Micro (NASDAQ: NASDAQ:SMCI ) grapples with its legal issues, the company still holds substantial promise as a first mover in AI server infrastructure. The demand for AI server technology, particularly liquid cooling rack systems, is expected to surge as artificial intelligence applications grow. This market opportunity has led analysts at Needham to issue a “buy” rating for SMCI, with a price target of $600, which represents a potential upside of 31% from the stock's current price of $457.27.

Super Micro’s expertise in high-performance computing solutions positions it well to capitalize on the rising demand for AI servers. The company's AI-focused products, including its liquid cooling rack systems, are seen as cutting-edge technology that could play a crucial role in addressing the growing data needs of AI workloads.

The Path Forward: Legal Risks vs. Market Potential

As SMCI prepares for its stock split and navigates its legal battles, investors will be watching closely to see how the company balances the risks of the lawsuit with its promising opportunities in the AI server market. The ongoing legal challenges could weigh on the stock in the short term, but the company’s innovative technology and growing demand for AI infrastructure offer long-term growth potential.

For investors, key technical levels such as $357 and $700 will be important markers for determining whether the stock can regain its footing or continue to slide. With the stock split and lawsuit on the horizon, Super Micro Computer remains a stock to watch closely in the coming weeks.

Conclusion

Super Micro Computer Inc. (NASDAQ: NASDAQ:SMCI ) finds itself at a critical juncture. The class action lawsuit for potential securities fraud, coupled with accusations from Hindenburg Research, presents significant risks. However, the company’s forward-looking focus on AI servers and liquid cooling systems provides a compelling case for long-term growth. As the stock split nears and legal proceedings unfold, investors should keep a close eye on both the technical price levels and any updates on the lawsuit, as these factors will heavily influence SMCI’s trajectory in the near future.

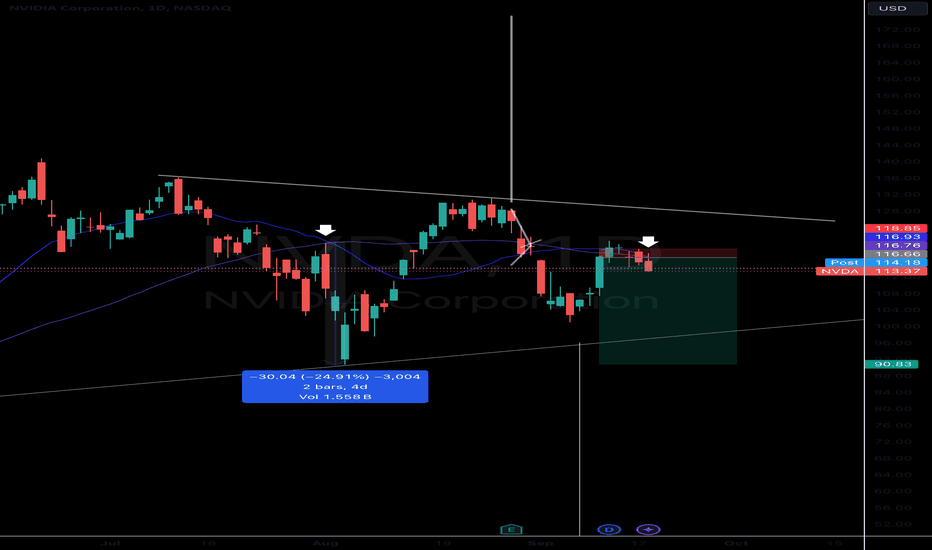

Is NVDA the catalyst for the market?NVDA just had a bearish crossover of the 20 & 50 MA (Daily chart)

Last time we saw this bearish moving average formation was in early August.

NVDA proceeded to fall sharply in the coming days.

All eyes on the market leader. All eyes on the QQQ.

Will the Q’s be the demise of SPY?

If Nvidia sees anymore weakness you can be sure it will have other semis following suit.

Risk to reward in the near term is clear.

SMCI Bottom and Christmas Rally To ComeLight Fundamental:

It is a stock called SMCI (or Super Mico Computer). It is a US company that makes super powerful computers and servers. The world needs servers to help run things like big websites, apps, and AI. The stock price fell by half. So, it is selling at a discount for what it is really worth. So, it is a good chance to buy it.

Technicals:

Gartley-like pattern

diagonal support

engulfing bullish pattern with d3 volume and volume confirmation

a-b-c completion at a 78.2% fib pullback

Entry is above the weekly engulfing bullish candle at 475.44.

Target is, tentatively, 1500.

Note: preparing for either an election rally or a Christmas rally in stocks

Article Title: Is AI Just Hype?In the whirlwind of AI's rapid ascent, a critical question emerges: Is the hype surrounding AI justified, or are we witnessing a bubble fueled by inflated valuations and limited innovation? Let's delve deep into the AI industry, separating the signal from the noise and providing a sobering reality check.

The Super Micro Cautionary Tale

The financial woes of Super Micro Computer serve as a stark warning. Despite the soaring demand for AI hardware, the company's internal challenges highlight the risks of investing solely in market enthusiasm. This case underscores the importance of **industry openness** and **due diligence** in the face of AI's allure.

A Landscape of Contrasts

The broader AI landscape is a tapestry of contrasting narratives. While pioneers like DeepMind and Tesla are pushing the boundaries of AI applications, a multitude of companies are capitalizing on the hype with products lacking substance. This proliferation of **AI hype** has created a toxic environment characterized by inflated valuations and a lack of substantive innovation.

Market Dynamics and Future Prospects

As the market for AI hardware matures, saturation and potential price drops loom. NVIDIA's dominance may be challenged by competitors, reshaping the industry landscape. The future of AI, however, lies in the development of more sophisticated systems capable of collaboration and learning. The integration of **quantum computing** could revolutionize AI, unlocking solutions to complex problems that are currently beyond our reach.

Conclusion

The AI industry is a complex landscape, filled with both promise and peril. While the hype surrounding AI may be tempting, it's imperative to scrutinize each company's core innovation and value. As the market matures and competition intensifies, those who can deliver **real value** and **technological advancements** will ultimately prevail. The Super Micro case serves as a stark reminder that in the realm of AI, substance, not hype, is the true currency of success.

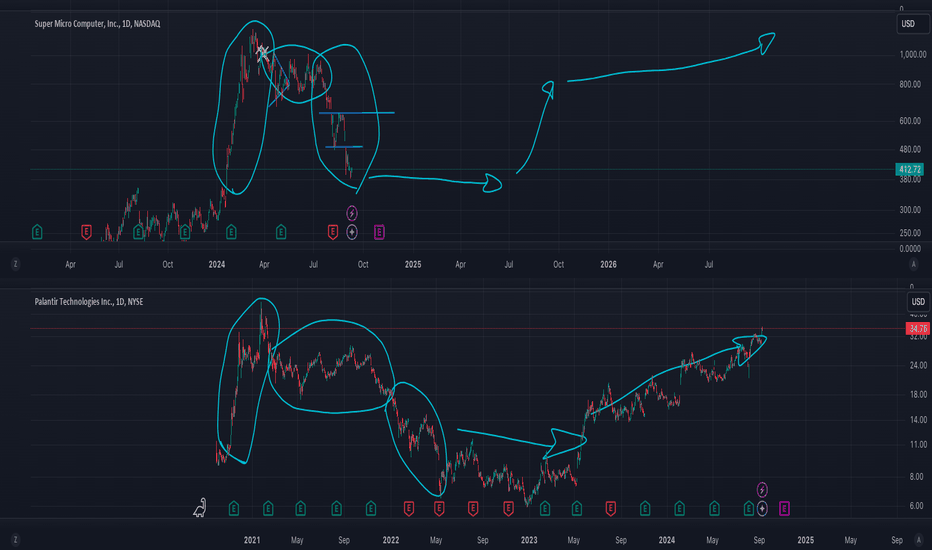

SMCI to get back up to 1000$ ?SMCI has an awfully similar chart to PLTR, both of them hit all time highs, and then crashed. Smci is now at its all time lows and is going to stay there for a bit. PLTR on the other hand, did hit an all time high and also fell. But, it has recovered and is on track to hit all time highs again. I think that SMCI is going to trace the chart of PLTR and go back to around 1000$-900$. Both companies had a big boom and at the top, were overvalued, and came crashing down. NVDA might be experiencing the same.

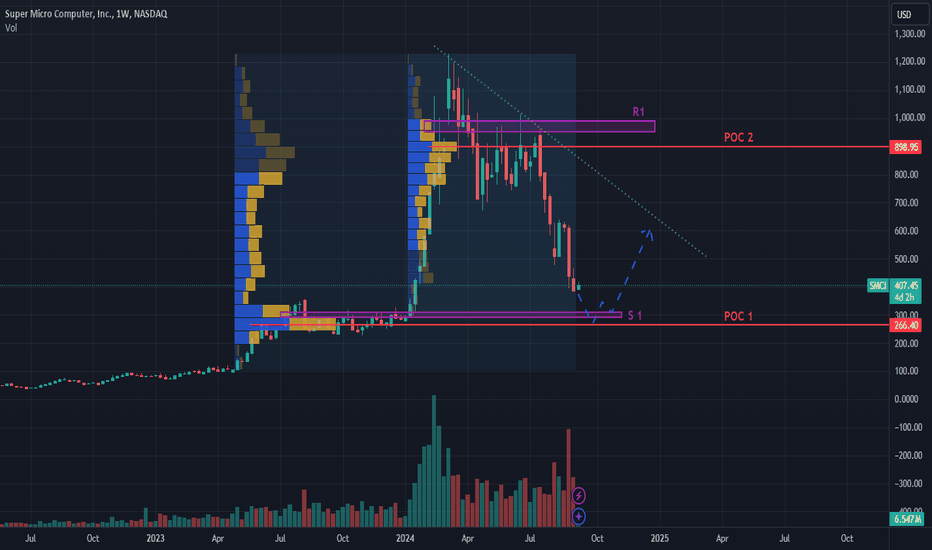

Technical Analysis of Super Micro Computer Inc (SMCI)Upon analyzing the stock SMCI , we observe a significant turning point starting in 2022, following a long period of sideways movement where the stock struggled to break above the $40 level.

After this prolonged sideways phase, the stock broke out with a clear upward trend, highlighted by the ascending trendline (green), characterized by higher highs and higher lows.

Following a year of gains, the stock entered a consolidation phase but then broke out again to the upside with strength, accompanied by a substantial increase in volume.

After reaching a peak in March 2024, the stock began a downward phase that is still ongoing.

Potential long entry points, where the stock might bounce or change trend direction, are found in the following two support areas:

Support area S1;

The POC 1 area.

If the stock begins to rally again, it will be crucial to monitor its behavior as it approaches the descending trendline (green), which could serve as a more conservative initial target.

More ambitious targets are POC 2 and resistance R1, both within a price range of $900 to $1,000.

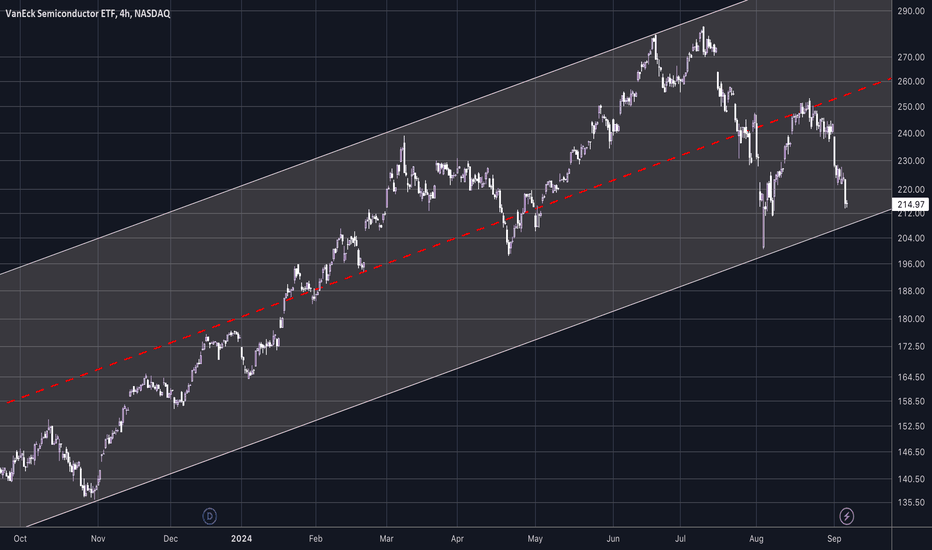

Is there an AI bubble around the corner?Are semi conductors forming a rounded top or will they bounce on the trend support line? If you are even asking yourself if this is a serious question you are probably already late. get your calls asap. don't wait for the trend line support bc semi conductors are leading the way into AI. looking at the 265 calls sept 27 at the open on monday...

Is SMCI a buy? SMCI has lagged NVDA and many other semis.

Were now approaching a critical area...its make or break!

positive Daily divergence provides some hopes that were close to a near term bounce however after today semiconductor selloff the whole complex was shattered.

The fact that SMCI remained green while NVDA was down 10% should be a small win in itself...

The question is can it hold and build on this?

I do think its better positioned for a long than most semis.

No confirmed technical breakdown has occurred yet

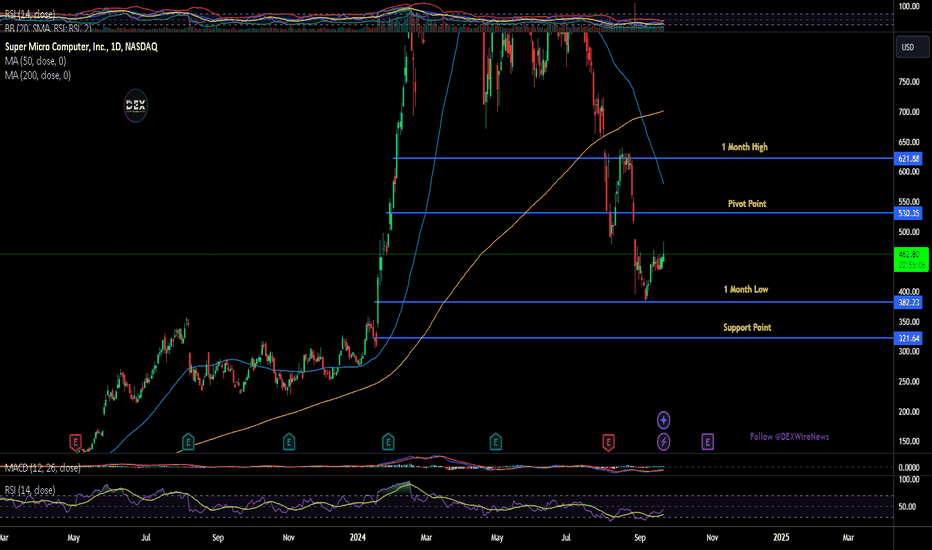

SMCI This is honestly the last stand.Super Micro Computer Inc. (SMCI) suffered yet another brutal sell-off following the announcement of a delay in filing its 10-K annual report. This may prove to be a catastrophic one as technically not only did it fail exactly on its 1W MA50 (blue trend-line) but also saw the stock test the bottom of its multi-year parabolic support, the Higher Lows Zone since the week of July 05 2022.

This was basically the last time the 1W MA100 (green trend-line) got tested with the current week coming the closest since then. The 1W MA100 last broke during the unexpected COVID flash crash in March 2020, so technically it is the stock's longest Support. If it fails to hold and SMCI closes a 1W candle below it, the long-term parabolic growth pattern is invalidated and we will risk testing the 1W MA200 (orange trend-line) at a price potentially around $250.00.

If on the other hand the 1W MA100 holds (and we will need the news sentiment to drastically reverse in order to achieve that, something that currently can't be seen on the horizon), then we can see another +400% long-term rally, in which case we estimate a Target around $2000, the stock's next critical psychological growth level.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇