SMCI Earnings Setup: Big Miss Incoming? Put Flow Exploding

### 🧨 SMCI Earnings Setup: Big Miss Incoming? Put Flow Exploding 🚨

📆 **Earnings Date:** Aug 5, 2025 (After Market Close)

💣 **Sentiment:** **Moderate Bearish** — 72% conviction

💬 **Why?**: Weak margins, cash burn, heavy put activity, and bearish technicals.

---

### 🔍 Quick Breakdown:

📉 **Fundamentals:**

* Profit margin only 5.34%

* Free cash flow: **–\$272M**

* Historical EPS beats? Just 50%

* Analyst consensus is turning **bearish**

🧾 **Options Flow:**

* Heavy \$58 & \$56 **Put Accumulation**

* Cautious positioning into earnings

* Skewed toward **defensive hedging**

📉 **Technicals:**

* Weak RSI (\~48), poor volume

* Price drifting with no conviction

* 🔑 Key Support: \$53.66

* 🔼 Resistance: \$60.00

---

### 💼 Trade Setup: SMCI PUT ⚠️

* 📍 **Strike:** \$56.00

* 📆 **Expiry:** Aug 8, 2025

* 💵 **Entry Price:** \$2.23

* 🎯 **Profit Target:** \$6.69

* 🛑 **Stop Loss:** \$1.11

* 🧠 **Size:** 2% Portfolio

**Expected Move:** 10–15% ⚠️ (based on IV and past reactions)

**Exit Plan:** Take profits within 2 hours post-earnings to avoid IV crush!

---

### 📈 TradingView Tags:

```

#SMCI #PutOptions #EarningsPlay #BearishSetup

#OptionsFlow #TechnicalAnalysis #SwingTrade #HighConviction

#NASDAQ #AIStocks #MarketVolatility #DarkPoolData

```

---

### 💬 Hook for Comments:

> SMCI bulls better hope for a miracle… or this earnings could trigger a 15% flush. Are you hedged? 😬

Smciearnings

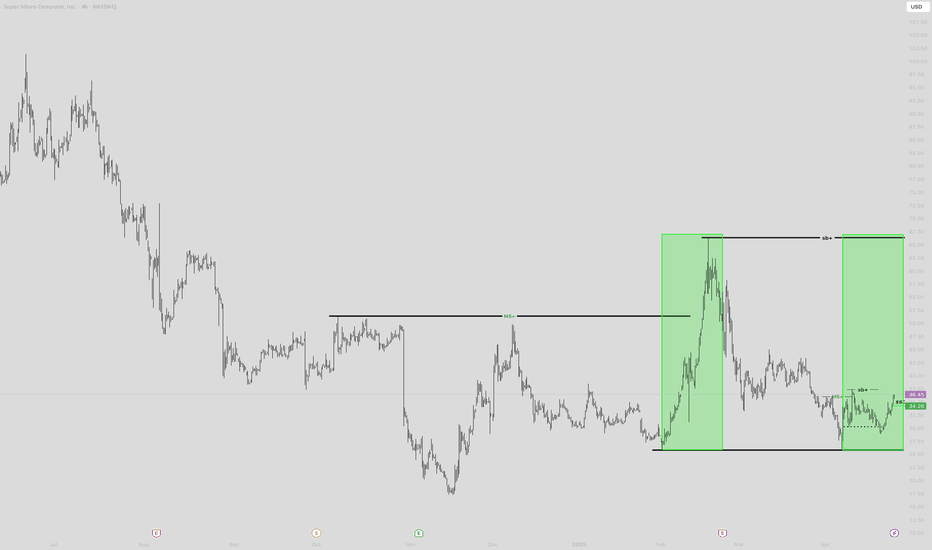

SMCI ONCE IN A LIFETIME DIP BUY!!!Ive taken a $600 position on SMCI I will be looking to size into as it works. You can clearly see what happened last time we were at this price area. I have less than a $1 stop loss if price were to return below the green line. This will be a LONGGGGGGGGGGG hold into the future.

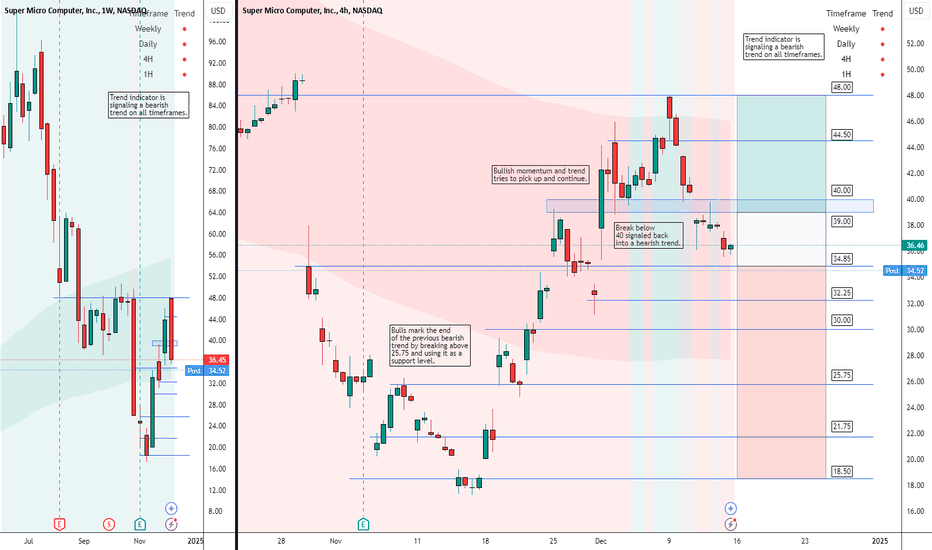

SUPERMICRO COMPUTERS $SMCI |SUPERMICRO TO SUPER BEARISH Dec13'24SUPERMICRO COMPUTERS NASDAQ:SMCI | SUPERMICRO TO SUPER BEARISH Dec13'24

When to enter NASDAQ:SMCI :

NASDAQ:SMCI BUY/LONG ZONE (GREEN): $39.00 - $48.00

NASDAQ:SMCI DO NOT TRADE/DNT ZONE (WHITE): $34.85 - $39.00

NASDAQ:SMCI SELL/SHORT ZONE (RED): $18.50 - $34.85

NASDAQ:SMCI Trends:

NASDAQ:SMCI Weekly Trend: Bearish

NASDAQ:SMCI Daily Trend: Bearish

NASDAQ:SMCI 4H Trend: Bearish

NASDAQ:SMCI 1H Trend: Bearish

NASDAQ:SMCI has been spiraling downwards for weeks. We finally saw price come to life just this past month, but the bearish trend has continued. The break below 40.00 confirmed the bearish trend for me, and I will look to see price either continue below 34.85 or try to create some type of support here. Bulls should be eyeing a break above the 39 - 40 level to try to gain some momentum. My trend indicators are also all pointing to the downside.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, smci, supermicro, supermicrocomputers, audit, failedaudit, passedaudit, smciearnings, smciaudit, smciearningsreport, smcianalysis, smcitrend, smcipattern, smciprice, smcitrade, smciidea, supermicrotrend,