Smcilong

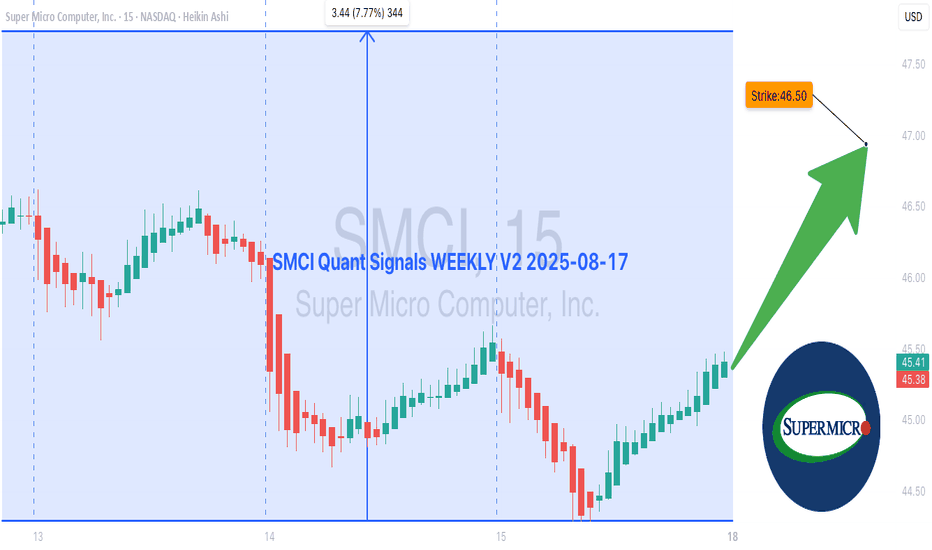

SMCI $46.50 Calls Poised for Explosive Move – Don’t Miss Out! 🚀 SMCI Weekly Options Analysis (2025-08-17) – Don’t Miss Out!

### 🔎 Model Insights Recap

**Grok/xAI Report**

* 📊 Daily RSI: 35.2 → short-term bearish pressure

* 📊 Weekly RSI: 55 → moderate bullish trend

* 📈 Call/Put Ratio: Strong bullish flow

* 🔊 Volume: Weak institutional support

* ✅ Decision: Moderate bullish → **\$47.00 Call**

**DeepSeek Report**

* 📈 Call/Put Ratio: 2.47 → bullish

* ⚠️ Conflicting daily/weekly signals

* 🛑 Decision: **No trade**

**Gemini/Google Report**

* 📊 Daily RSI bearish, Weekly RSI bullish

* ✅ Decision: Moderate bullish → **\$46.50 Call**

**Llama/Meta Report**

* 📊 Mixed sentiment, weak volume

* ✅ Decision: Moderate bullish → **\$46.50 Call**

**Claude/Anthropic Report**

* ⚠️ Daily momentum weak, weekly bullish potential

* 🛑 Decision: **No trade**

---

### 📌 Key Agreements & Disagreements

* **Agreements:** Call/put ratio bullish, daily RSI weak, volume declining → caution

* **Disagreements:**

* Bullish call recommendation: Grok/xAI, Gemini/Google, Llama/Meta

* No trade: DeepSeek, Claude/Anthropic due to conflicting signals

---

### 📊 Recommended Trade

* **Direction:** CALL (Long)

* **Strike:** \$46.50

* **Expiry:** 2025-08-22

* **Entry Price:** \$0.88 (bid/ask midpoint)

* **Stop Loss:** \$0.44 (50% of premium)

* **Profit Target:** \$1.32 (50–100% gain)

* **Entry Timing:** Market Open

* **Confidence:** 65%

---

### ⚠️ Key Risks

* Weak volume → insufficient institutional backing

* Daily RSI weak → short-term reversals possible

* Maintain exit strategy if price breaks support or fails to reach targets

---

📊 **TRADE DETAILS JSON**

```json

{

"instrument": "SMCI",

"direction": "call",

"strike": 46.50,

"expiry": "2025-08-22",

"confidence": 0.65,

"profit_target": 1.32,

"stop_loss": 0.44,

"size": 1,

"entry_price": 0.88,

"entry_timing": "open",

"signal_publish_time": "2025-08-17 12:07:47 EDT"

}

```