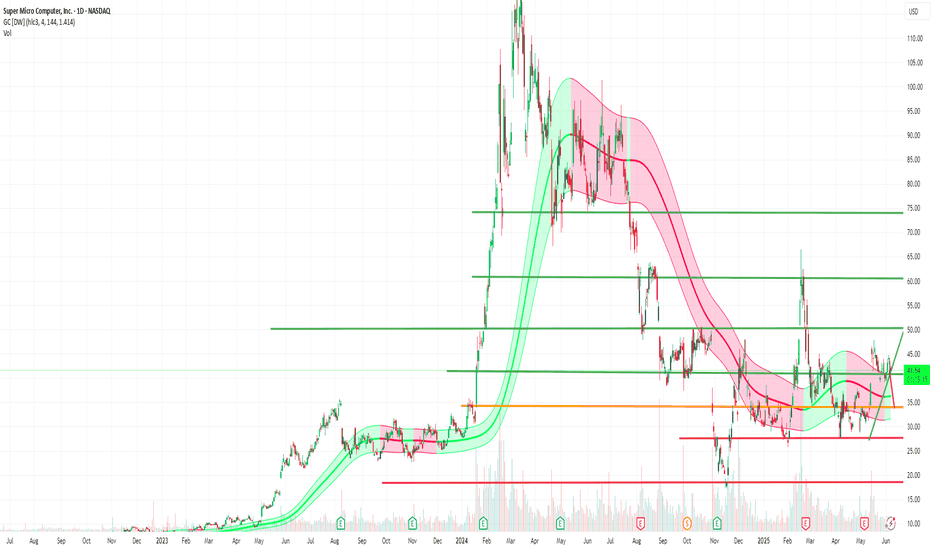

Bearish or bullish SMCI Stock USD. Breakpoint coming.Technical and Fundamental Analysis for SMCI 🚀

The current stock price of Super Micro Computer, Inc. (SMCI) is $41.87 USD . The target sell point is set at $73 USD, indicating a potential upward movement. The s upport level for buying is $34 USD , suggesting that if the stock price drops to this level, it may be a good opportunity to purchase.

It is crucial to maintain the resistance level at $41 USD ; otherwise, the stock may decline further to the support level of $34 USD.

Technical indicators on the chart include moving averages and volume data, which help in understanding the stock's price trends and market sentiment. The green and red bands represent different moving averages, showing the stock's volatility and potential price movements.The annotations on the chart highlight key support and resistance levels, providing a visual guide for trading decisions.

Fundamentally , Super Micro Computer, Inc. is a company listed on NASDAQ, and its stock performance is influenced by various factors such as market conditions, company earnings, and industry trends. Investors should consider both technical and fundamental aspects before making trading decisions.

Conclusion: 🚀

The analysis suggests monitoring the resistance level at $41 USD closely. If the stock price maintains above this level, it may move towards the target sell point of $73 USD. However, if it fails to hold this resistance, it could drop to the support level of $34 USD, presenting a potential buying opportunity.

If you want to refine this analysis or explore other scenarios, I'm here to dive deeper into key points! 🚀 Subscribe! TSXGanG

I hold a CCVM and MNC (Certificate of Competence to become a securities broker anywhere in Canada) and have been working as a trader for five years.

It’s a pleasure for me to help people optimize their trading strategies and make informed financial market decisions. 🚀

Smcisretail

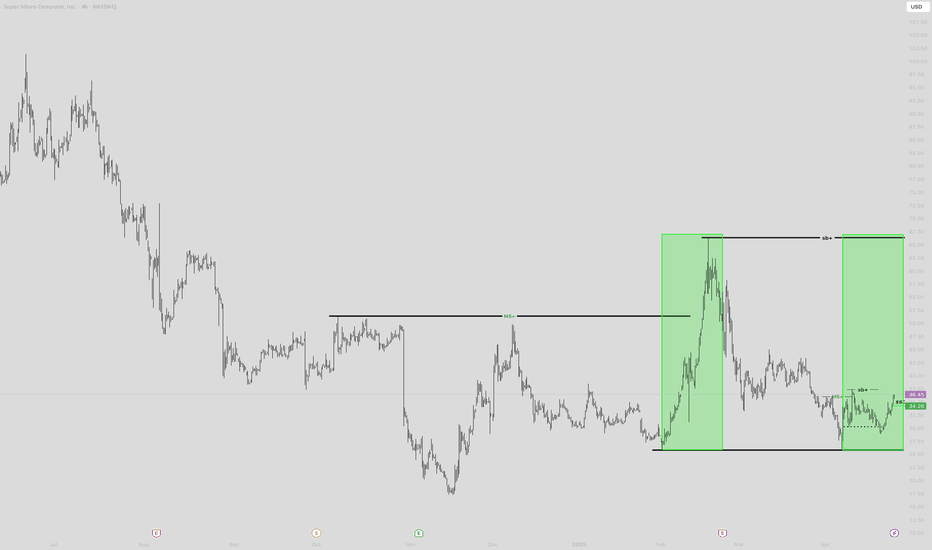

SMCI ONCE IN A LIFETIME DIP BUY!!!Ive taken a $600 position on SMCI I will be looking to size into as it works. You can clearly see what happened last time we were at this price area. I have less than a $1 stop loss if price were to return below the green line. This will be a LONGGGGGGGGGGG hold into the future.

IS SUPER MICRO COMPUTERS ($SMCI) FINALLY BOTTOMING?! IS SUPER MICRO COMPUTERS ( NASDAQ:SMCI ) FINALLY BOTTOMING?!

3 REASONS WHY:

1⃣ We have DIVERGENCE on the Weekly Chart

2⃣ It's almost a "High Five Setup"

3⃣ Take a BREAK and find out by watching. 👇

Stay tuned for more!🔔

Like ❤️ Follow 🤳 Share 🔂

Will Super Micro finally get back on track after the insane negative sentiment and news articles?!

Not financial advice.

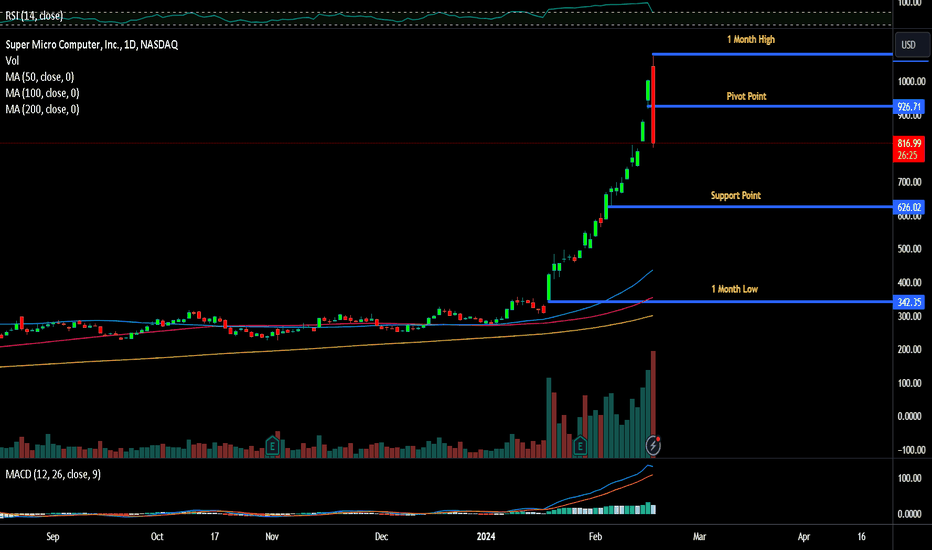

SMCI Experiences Rollercoaster Week Amid AI BoomThe stock market is often a whirlwind of ups and downs, but few stocks exemplify this volatility as much as Super Micro Computer ( NASDAQ:SMCI ) in recent days. With its shares soaring to unprecedented heights before tumbling back down, NASDAQ:SMCI 's journey reflects both the excitement and unpredictability surrounding the artificial intelligence (AI) sector.

Unveiling the Rollercoaster Ride:

In a week marked by dizzying swings, NASDAQ:SMCI 's stock embarked on a wild ride that left investors both exhilarated and apprehensive. Following a remarkable surge that propelled the stock above the remarkable milestone of $1,000 per share on Thursday, NASDAQ:SMCI experienced a dramatic reversal, plunging by over 12% to $880.64 just a day later. This rollercoaster trajectory underscores the volatile nature of the market, particularly in sectors driven by transformative technologies like AI.

The Driving Force:

Fueling SMCI's meteoric rise is the ever-expanding landscape of artificial intelligence. Analysts and investors alike have been captivated by the potential of AI to revolutionize industries ranging from healthcare to finance. With NASDAQ:SMCI positioned as a key player within the AI ecosystem, bolstered by strategic partnerships with industry giants such as NVIDIA, Advanced Micro Devices (AMD), and Intel, the company has emerged as a focal point for those seeking exposure to this lucrative market.

Analyst Insights:

Barclays analysts have recalibrated their outlook on NASDAQ:SMCI , raising their price target to $961, citing the company's adeptness in navigating the complexities of AI architecture. They highlight NASDAQ:SMCI 's agility in customizing solutions to meet the evolving demands of AI applications, underpinned by its flexible manufacturing capabilities.

Meanwhile, Bank of America analysts echo this sentiment, initiating coverage with a bullish "buy" rating. They emphasize NASDAQ:SMCI 's potential to capitalize on the burgeoning demand for AI servers, emphasizing the company's adaptability in integrating new designs and technologies as the AI landscape continues to evolve.

Looking Ahead:

As NASDAQ:SMCI navigates the turbulent waters of the stock market, the company remains firmly positioned at the forefront of the AI revolution. With analysts bullish on its prospects and investors eyeing the potential for further growth, NASDAQ:SMCI 's trajectory serves as a compelling narrative of the opportunities and challenges inherent in investing in transformative technologies.

Conclusion:

SMCI's rollercoaster week encapsulates the excitement, uncertainty, and potential inherent in the AI sector. As investors continue to grapple with the implications of AI-driven innovation, NASDAQ:SMCI stands poised to carve out a significant role in shaping the future of technology and finance alike.

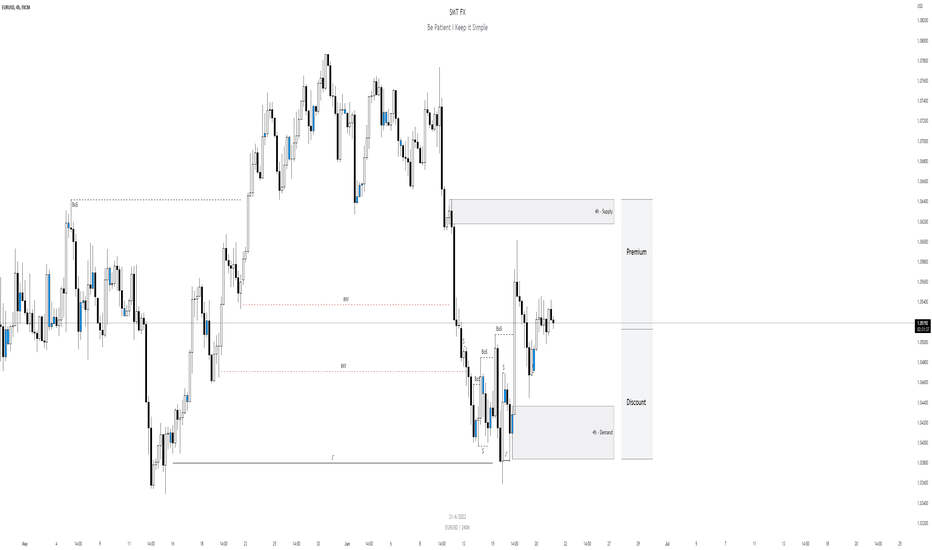

EURUSD stuck in the middle of a 4h trading rangeEURUSD seems to be sat between 2x POIs on the 4h.

I have no issue scalping between these zone, however the higher probability trades will be more likely in or around the 4h zones.

Usual story, once we see a mitigation of either of these zone, we'll wait to see if there's a lower time frame entry that meets our rules.