$SNAP will eventually snap...I am not claiming this will be the exact outcome, but I can say I surly believe Snapchat is once again over-valued and it will continue to fall into the end of the year.

I expect to see $12 again even towards $10. They had their little recovery and hype, but the truth still lies ahead and people are not using Snapchat like they did before and it has gotten worse...

Snapchat

What type of company has 190m customers & cant make moneyRiddle me this Batman...

You have money to invest and some turtle necked thick circular rimmed glass wearing hipster meets you in starbucks for a triple mocha frappe Mexican soy bean decaf expresso with cream and pitches you his great investment opportunity...

"We are a company that IPO'd last year and our share price has fallen by over half since IPO, we have never made a profit since we IPO's and are still making over $1m a month loss, but the loss quarter on quarter are reducing (almost in a perfect example of special cause variation we started with an estimate of -16c per share loss and achieved -14c, next quarter was -14c and we achieved -12c, next quarter was -12c and well you guessed it -10c, I wonder what the next quarter will be anyway lets get back to it)

"The more users we allow onto the platform the more expensive it is to run (Just work out cost per user versus profit per user) so we cant ever really go above the 200m user level and we are going to fundamentally have to change the user experience to actually make real money so we can be profitable, but we don't know how this will inpact our user experience".

WOULD YOU INVEST IN THIS

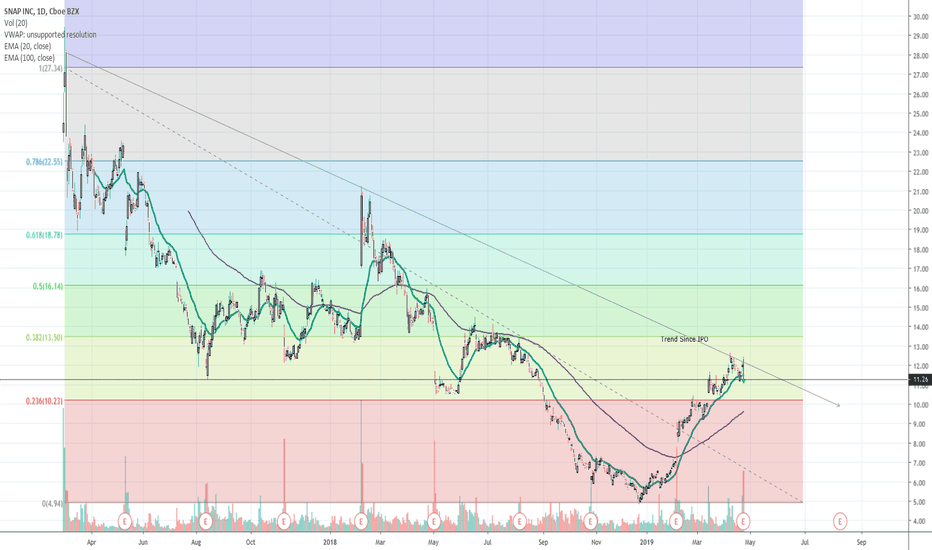

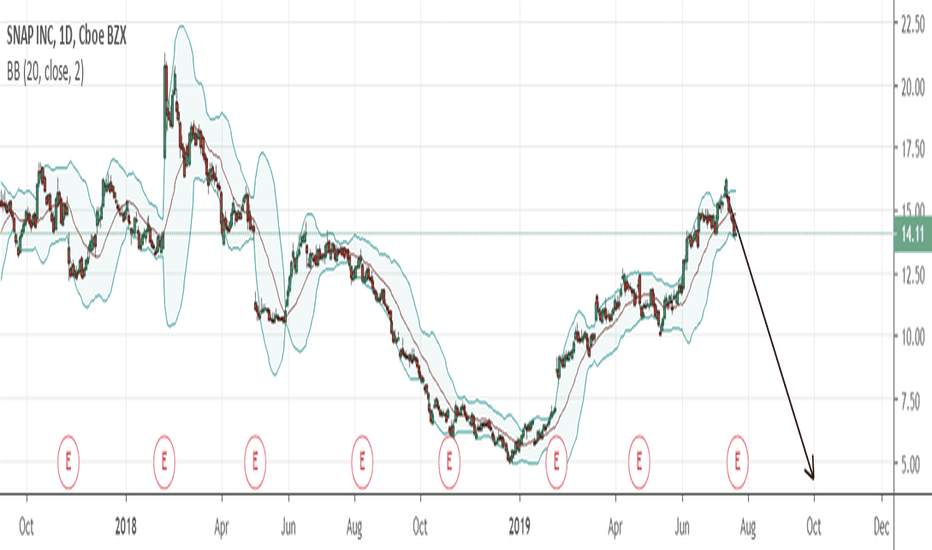

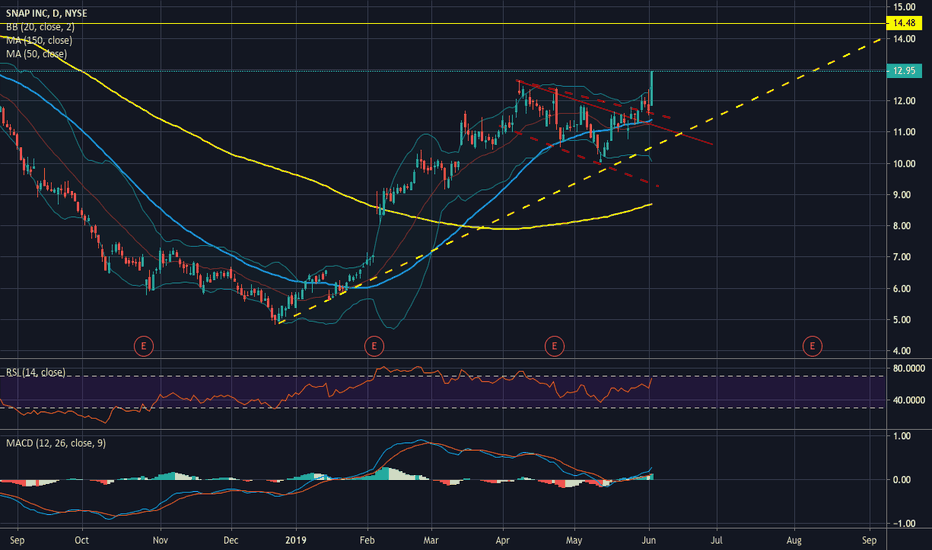

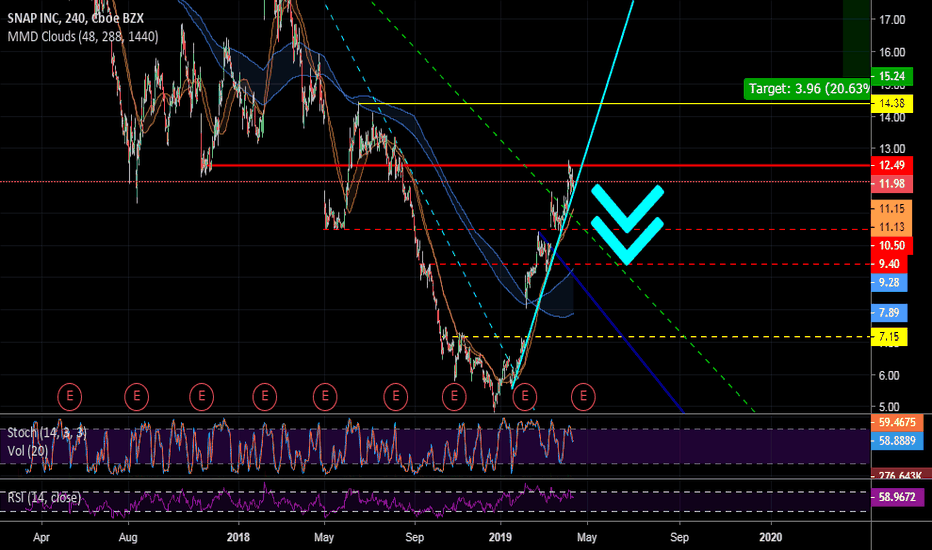

Technical

Long term downwards trend could not break with recent pop and even with "An earnings beat", Jesus it should only be an earnings beat if it actually has so profit to talk about for fuck sake. Its showing signs of weakness, but its up over 100% this year - IDIOTS, well its down over 100% since IPO fucktards.

It also could not break the 20day EMA with this earnings announcement.

My overall view is this period is a critical one for SNAP, it needs to at least hold its 100day ema or even break the 20day and the down trend if it can do this then its a buy all day, however its not now I would not be surprised to see this back at $6 before the end of Q3. lol what company has 190m customers and cant turn a profit lol.

SNAP really needs to fix its cost per customer, however the signs are its focused on revenue per customer which essentially means its margins are small so growth will be small, unfortunately if SNAP announces it turned $1 profit in the next quarter idiot investors means SNAP will be a $100 stock in days.

The issue with focusing on revenue per customer is that your essentially trying to change customer behaviour which for a large part is outwith your control and initially focusing on cost per customer is 100% within your control and is essentially easier to change, plus this gives you a great foundation is formed for growth. Until I see signs around reducing cost per customer unfortunately SNAP is a main stay on my short list

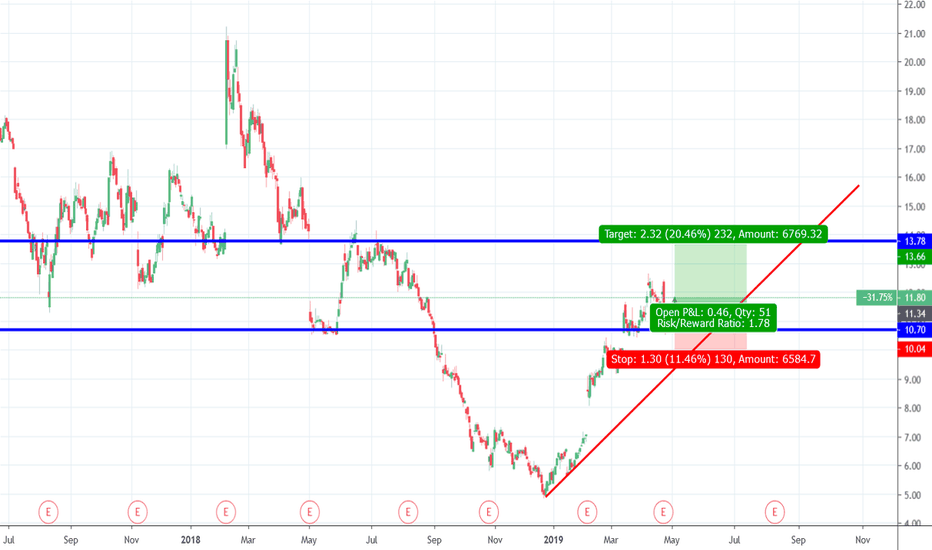

SWING SHORT Target $10 test (Ideally would be back to $6/7 area) Risk $13 all before next earning,

Prediction: Next Earnings will read -8c per share loss with increased operating costs around 190m users and increased revenue per user

Thanks for reading @D0CT0R__WH0

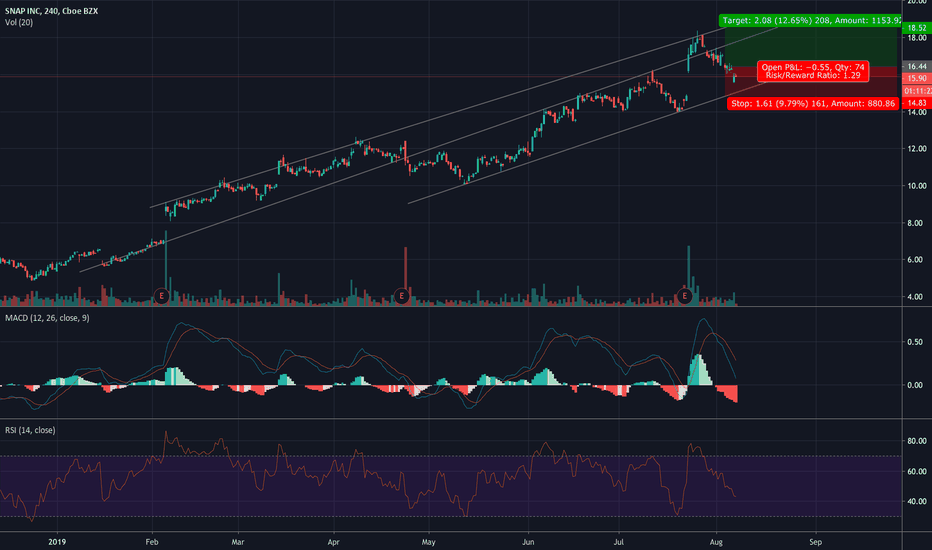

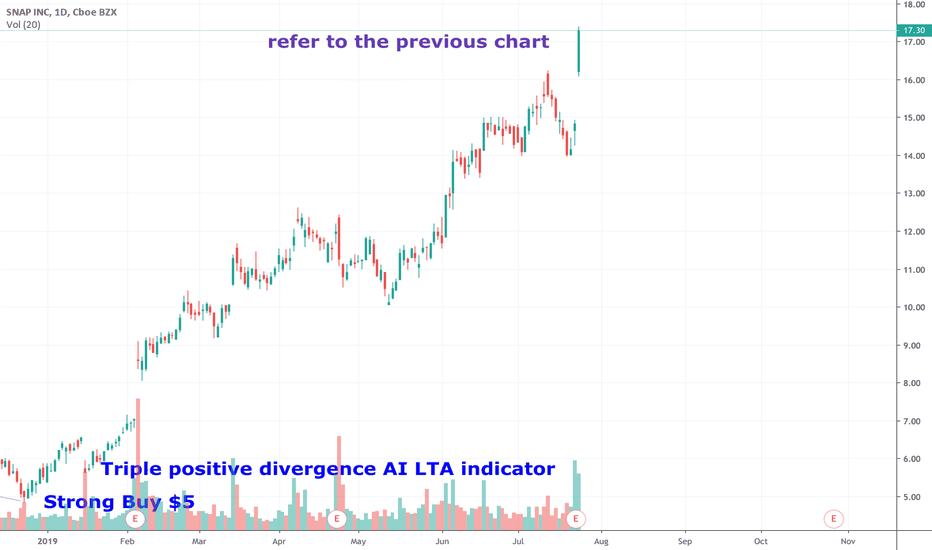

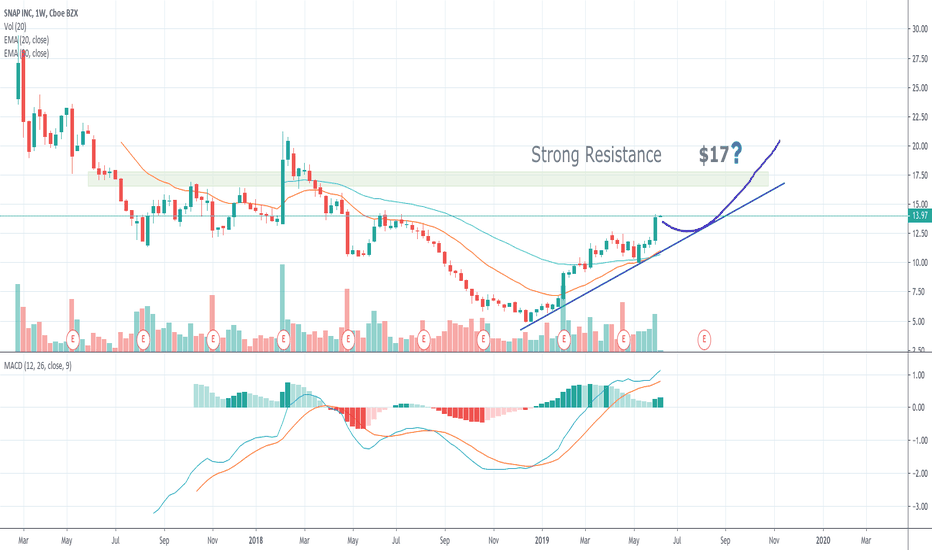

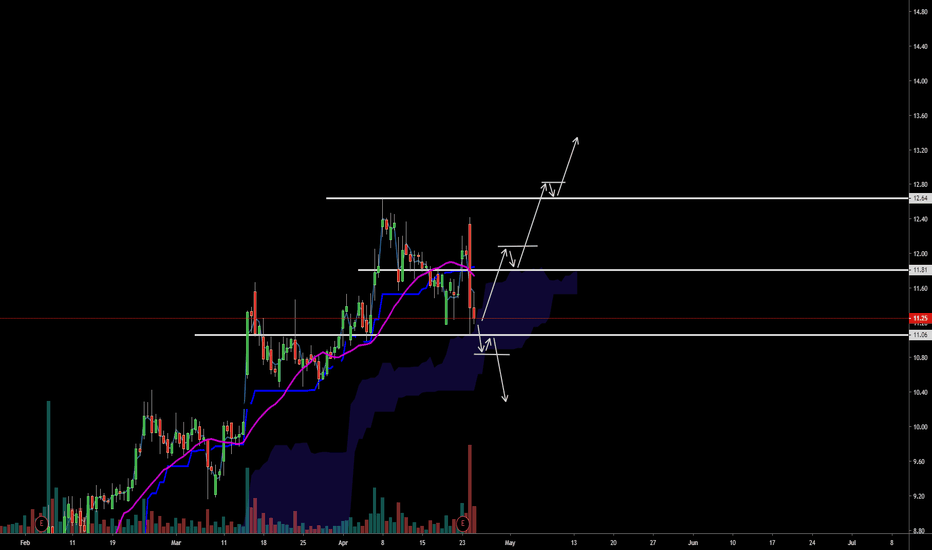

SNAP - slightly scrubby channel, uptrend since late 2018Overall bullish, respectable channel, large swings within it.

Bought Snapchat as it seemed relatively unaffected by the Aug 5th dip which seemed bullish. However, unlike AMD and FSLR this was not already low on the RSI and is now happily swinging low according to the trend, or maybe a more delayed reaction to the overall markets, so perhaps I should have waited for that. This one is another long-term play for swing trading the channel.

Maybe I'm a year too late and the whole financial system is about to implode, who knows?

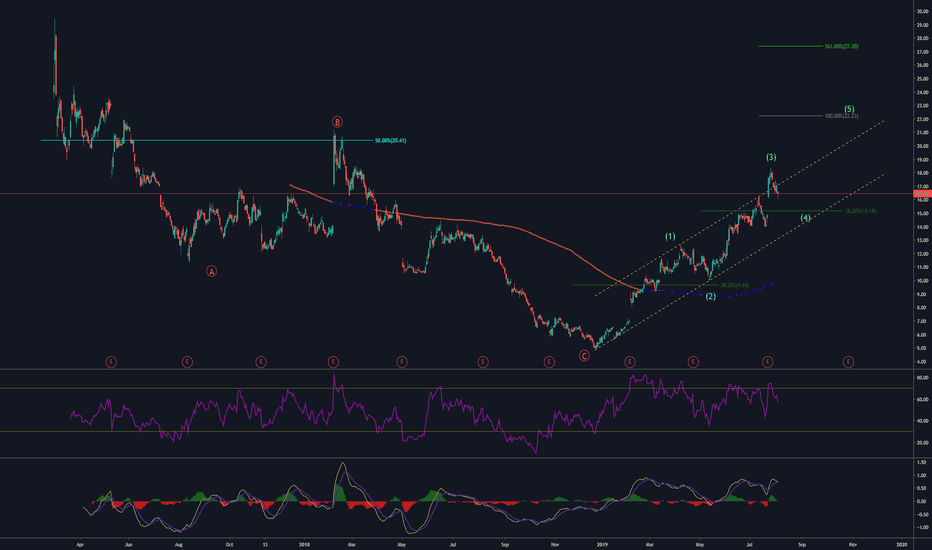

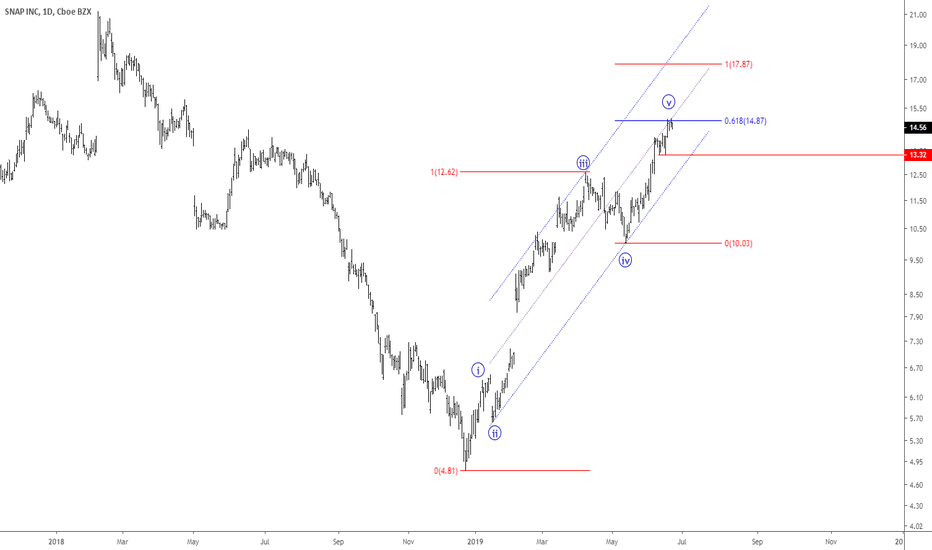

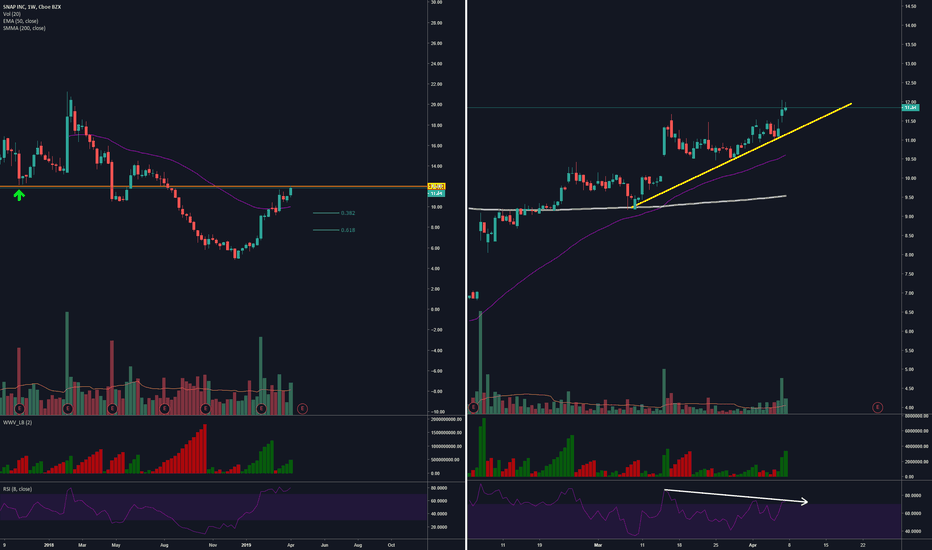

Snapchat updateAfter disappointing IPO, Snapchat fell to $5, practically crossing to penny stocks territory. Investors kicked in to buy cheap stocks and the price rallied. That seems like the end of wave C and now the new wave count started up. Wave 3 seems like over, now waiting for the wave 4 to complete before buying in again to catch the 5th. After very good Q2 earnings and new users added, projections for Snapchat look much better and price is expected to rally further. Good Luck!

Snapchat technicals BULLTwo bullish flags have been raised. We could potentially see another.

Technical analysis

RSI(10) @72 reaching for higher highs.

OBV confirming at its peak for 2019.

CCI(20) @115 - Could potentially reach 240 for bounce

Resistance @$17.8 / Support @11.5

Fundamental analysis

On a fundamental basis, I don't think Snapchat will do well long term.

They're getting into gaming with Zynga (ZNGA). That might help short term though.

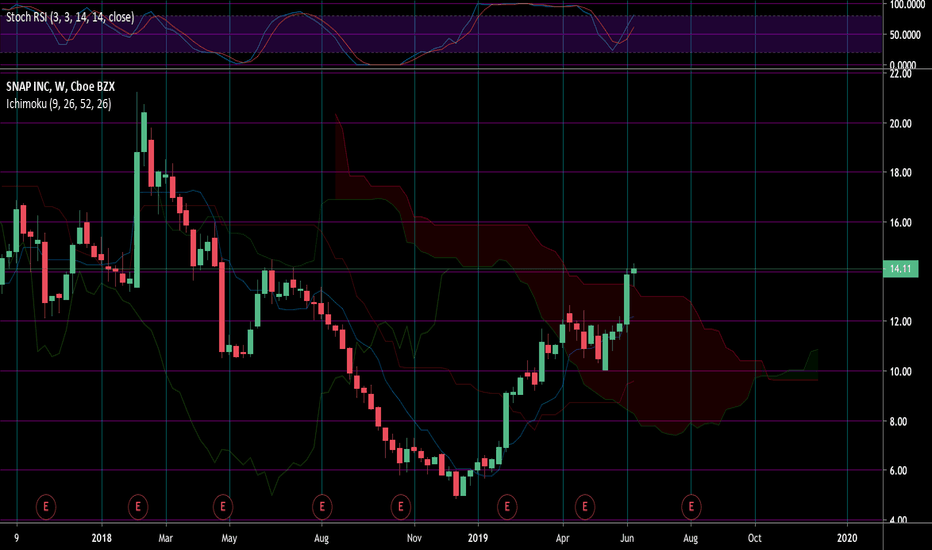

Snapchat's run is just beginning Bullish Kumo Twist on 5 year view. price is now above cloud. Once the Tekken and Kegan (or however you spell it) break cloud its is official.

Fundamental analysis:

I dont know one person my age (22) who does not use snapchat on a daily basis

Legit companies have begun spending more with snapchat ads

Snapchat is seen as less saturated for businesses looking to advertise than competitors like facebook

some new game came out that apparently awesome.

For you guisers that say Instagram has stories too.. they both have their place. Its hard to describe. People post super random shit on snapchat. Conversely, people post more "professional" stories on instagram. Peoples moms and grandmas have instagram. "sarah," a college student, doesnt want her mom to see her spending the money that was meant for "x" on blacking out at the bars.

Snapchat will go up. just buy it.

SNAP Looking Strong!anticipating a dip sooner than later but the trend is your friend with this one. Posted a little while back the range this found itself in and as we trended closer and closer to the upper resistance - the news of interest rates was the extra fuel we needed...Looking for $14 still.

GLTA

The Famous IPO Cycle. $UBER $LYFT $FB $SNAP // Uber overvalued?The Famous IPO Cycle. $UBER $LYFT $FB $SNAP

The Famous IPO Cycle. $UBER $LYFT $FB $SNAP

$UBER

In 2018, Dara Khosrowshahi's first full year as Uber's CEO, the company narrowed losses and continued to grow revenue, though at a slower pace than in the previous year.

According to the private company's self-reported financials, full-year revenue for 2018 was $11.3 billion, up 43 percent year over year.

Gross bookings, or the amount collected before payouts to drivers, grew to $50 billion for the year, up 45 percent from the prior year. Its adjusted losses decreased 15 percent in 2018 to $1.8 billion, down from $2.2 billion in 2017. The figure excludes the company's sale of its Russia and Southeast Asia businesses. Including those two sales to Yandex and Grab, respectively, Uber actually saw GAAP losses of $370 million. GAAP losses in 2017 were $4.5 billion.

So while the growth rate is strong by most standards, Uber's growth decelerated over 2018. On a quarterly basis, Uber continues to report heavy losses and slowing growth. Uber's revenue for the fourth quarter came in at $3 billion, up 25 percent from the same quarter last year, lower than the 38 percent it grew in Q3.

While that's not viable for most public companies, Uber is expected to go public this year with a rumored valuation of over $120 billion, and investors will have to decide if Uber's slowing growth warrants that valuation.

In the fourth quarter of 2018, Uber also reported an adjusted loss of $768 million. A $358 million benefit from income taxes cut down what would have been a more than $840 million adjusted loss. Gross bookings for Q4 came in at $14.2 billion, up 37 percent from the same quarter a year prior. It's the highest it has ever been, the company told investors.

In the lead-up to its 2019 IPO, Uber is pitching itself as a full platform for transportation and logistics, not just ride-hailing. The company hopes that moonshot projects such as Uber freight, electronic bikes, autonomous driving and its development of flying cars will help it own a piece of every trip across any vehicle. However, these segments are costly for Uber to develop, weighing on Uber's long-term profitability.

Khosrowshahi took over Uber in November 2017 from founder Travis Kalanick. He inherited a company that was growing quickly but losing billions overseas and roiled by controversy and board infighting. One of his first moves was to retreat from Russia. A few months later, he sold Uber's unprofitable Southeast Asia business.

He has hired a CFO and COO, and so far, appears on track to bring the company public this year.

At the same time, Khosrowshahi has made big expensive bets, such as Uber's acquisition of the bike- and scooter-sharing start-up Jump, and doubling down on expanding Uber Eats.

Uber now considers food delivery part of its core business, along with ride-hailing. While it didn't break out UberEats for the fourth quarter, the segment made up 17 percent of its business in Q3. Back in October, Uber said it was expanding its food-delivery business to cover 70 percent of the U.S. by the end of 2018.

Uber's take rate, or the percentage of revenue Uber makes for every gross booking, declined in Q4. The company told investors that the decline is due to continued investment in new lines of business and rising competition.

Uber may be spending more in the lead-up to its IPO to shore up its market share. Research firm Second Measure shows that Lyft, Uber's largest U.S. competitor, has taken 28.9 percent of the market over the last year. Lyft is also gearing up for an IPO this year, and both companies are racing to get out first. Uber and Lyft filed to go public confidentially on the same day.

Uber's CFO, Nelson Chai, called 2018 the company's strongest year yet.

"Q4 set another record for engagement on our platform," Chai said in a statement. "In 2018, our ride sharing business maintained category leadership in all regions we serve, Uber Freight gained exciting traction in the US, JUMP e-bikes and e-scooters are on the road in over a dozen cities, and we believe Uber Eats became the largest online food delivery business outside of China, based on gross bookings."

SOURCE: CNBC

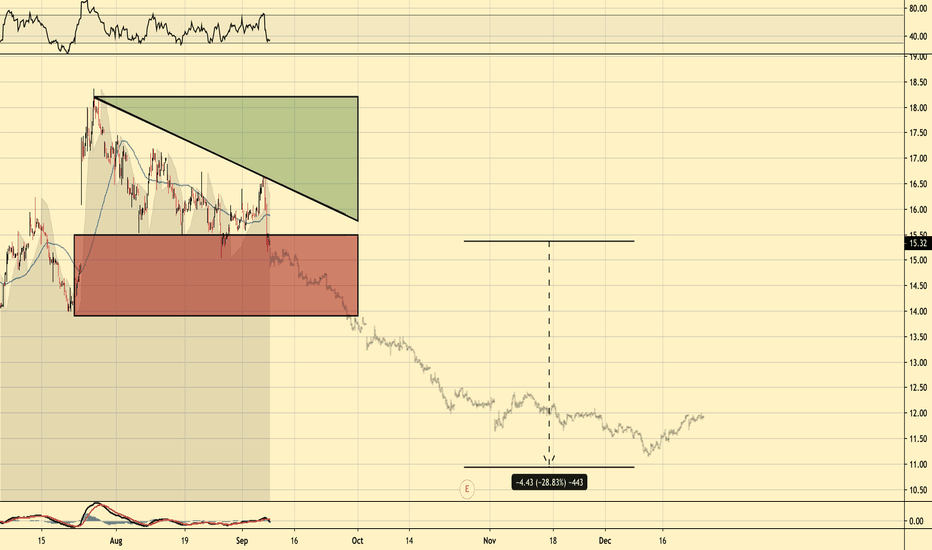

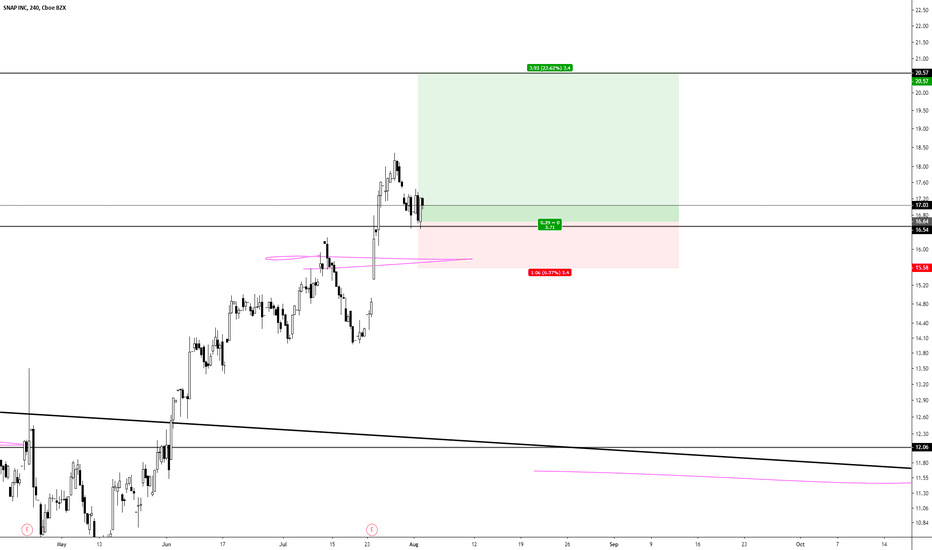

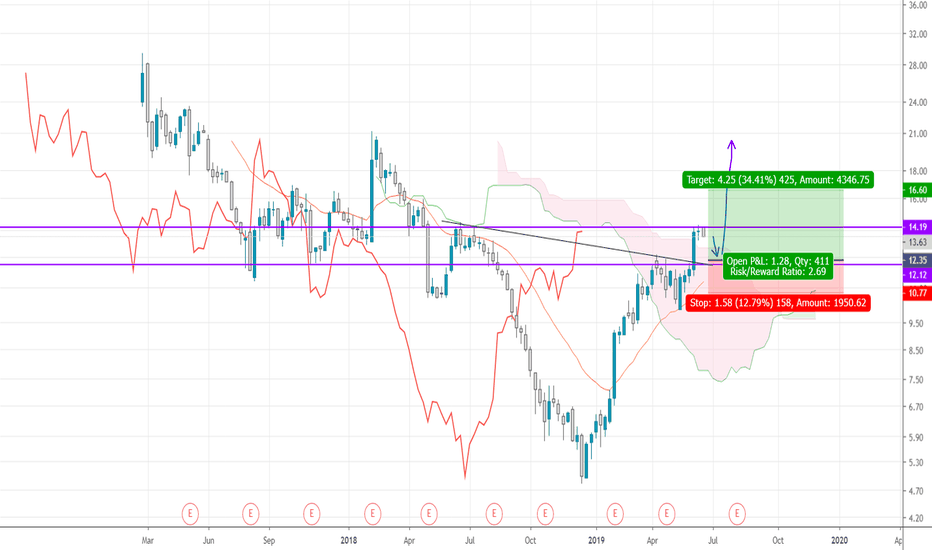

SNAP - Dont fomo it, not yetGood evening everyone,

Snapchat is being a very active stock last week and now we see why,

Price went straight from 20 usd level straight to 5.00 losing 75% of its value in 10 months, now its recovering and people may rush buying it expecting new highs.

Wait!

As we can see 12.0 level was a previous support zone, as demarcated by green arrows and now rsi is overbough (weekly)

On daily chart we can see snap is in a uptrend sure, but what about that huge volume candle spike with high on 12.02, im pretty sure it did trigger a lot of buy-stop orders on the market right? What do we have now? bearish RSI DIVERGENCE (H4 timeframe).

So whats the point? Dont rush buying yet, wait for a good correction close to the yellow uptrend (h4) or our fibonacci retracement zones (weekly) and buy it cheaper, buy it IF price action show bullish behaviour on this zones (i'll update here dont worry).

Too risky to go in right now, at least for my personal strategy and trading plan

Like? Agree? Leave a like, thanks and have a great week.