Snapchat

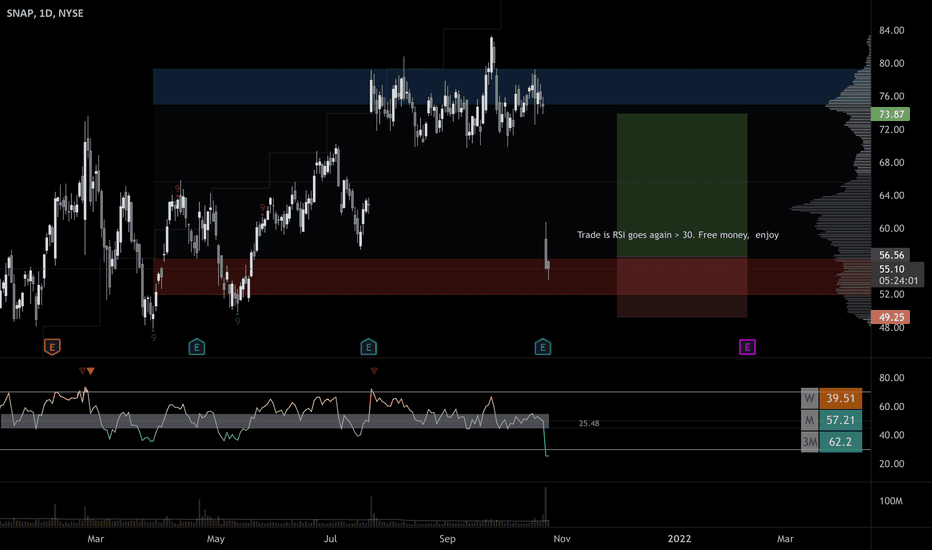

OH $SNAP Baby!!!-Snap has been taking some serious hits but investors see this as an opportunity to buy in while its low bc they realize that snap has a short term problem that can be dealt with

-While many companies face labor shortages and supply-chain issues, pressuring the short-term marketing efforts, it is necessary to reflect on why Snap is so susceptible to these changes.

-Not too much info on how low she's gonna go but when she does bounce she'll bounce hard.

$SNAP Snap stock plunged Friday after the social-networking firm posted disappointing revenue growth and guidance that fell shy of estimates on Thursday.

The parent of Snapchat said its advertising revenue was hurt more than expected by Apple ‘s change in the rules surrounding advertising on mobile apps.

The miss weighed heavy on shares of other major social-media companies.

Snap (ticker: SNAP) stock was down 25% in Friday trading. Facebook (FB) was down 6% on the news, while Twitter (TWTR) was off 5%, Pinterest (PINS) had fallen 4.4%, and Alphabet (GOOGL) had slipped 3.4%. Snap is the first of the companies to report September quarter results.

For the third quarter, Snap posted revenue of $1.067 billion, up 57% from a year ago, and below the company’s guidance range of $1.07 billion to $1.085 billion. Adjusted Ebitda, or earnings before interest, taxes, depreciation, and amortization, was $174 million, well above its guidance range of $110 million to $120 million. On a non-GAAP basis, the company earned 17 cents a share in the quarter, beating the Street consensus of 8 cents a share.

The company said it grew daily average users in the quarter by more than 20% to 306 million.

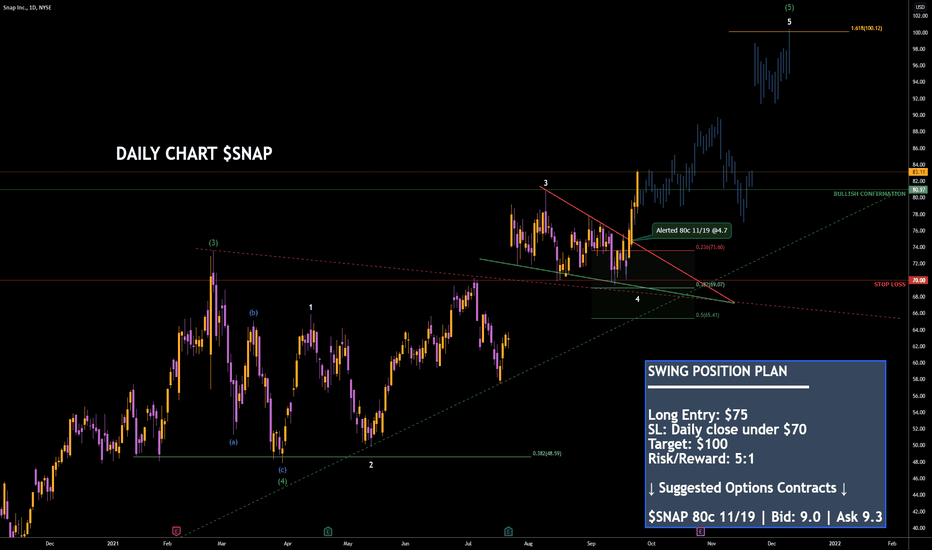

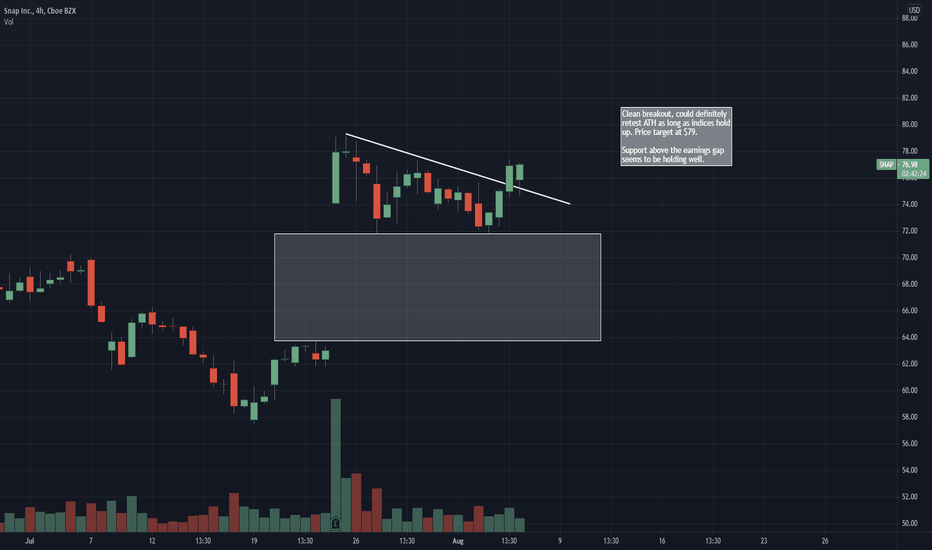

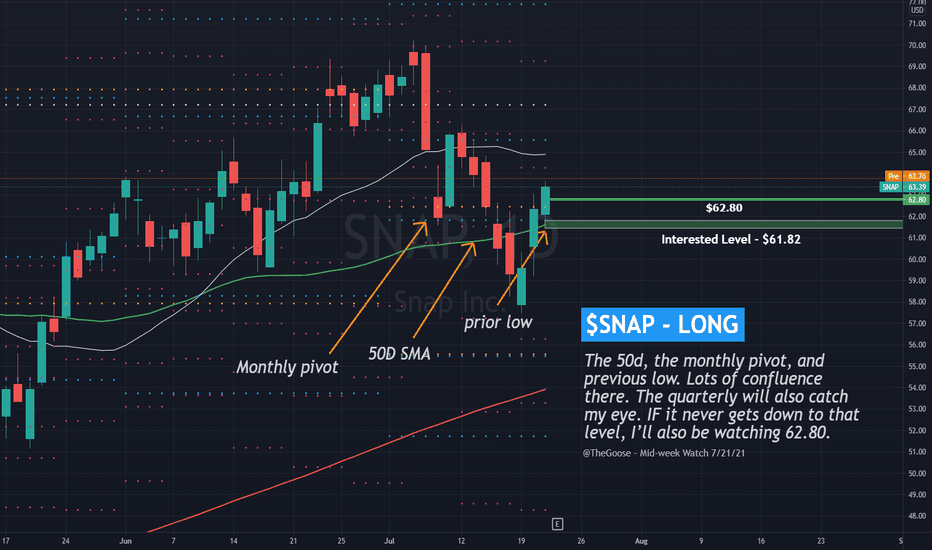

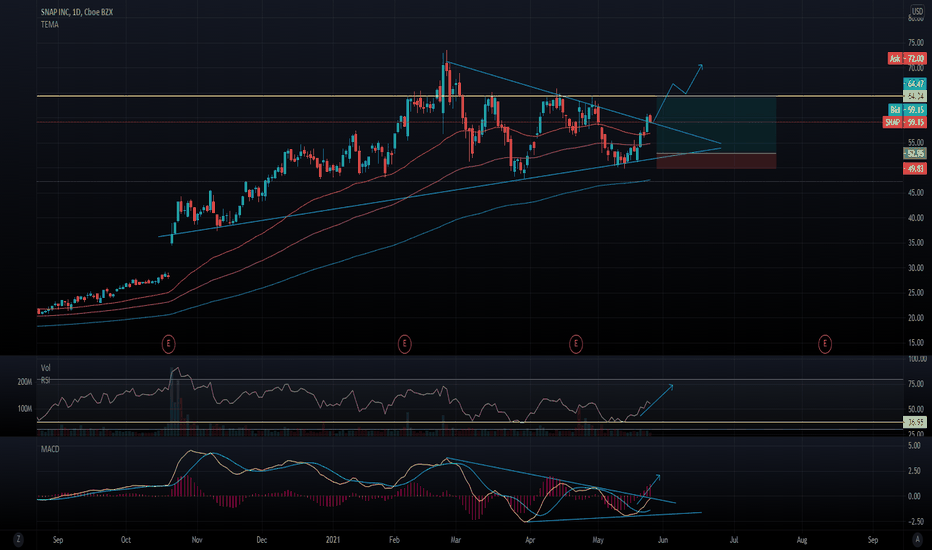

$SNAP Blue Sky BreakoutShould be an exciting week for Snapchat with blue sky breakout and ATHs last Friday.

100 PT magnet. I think it gets there, just a matter of when.

I'm long 10/15 85C letting these profits run.

Highly recommend the book by Nicolas Darvas who made $2M trading stocks just by buying box breakout stocks or "Darvas Box Strategy".

We may see a retest of the box ($83 zone) before a further move up, if you're bullish and not yet long, it may be a good idea to enter at the retest (if we get one).

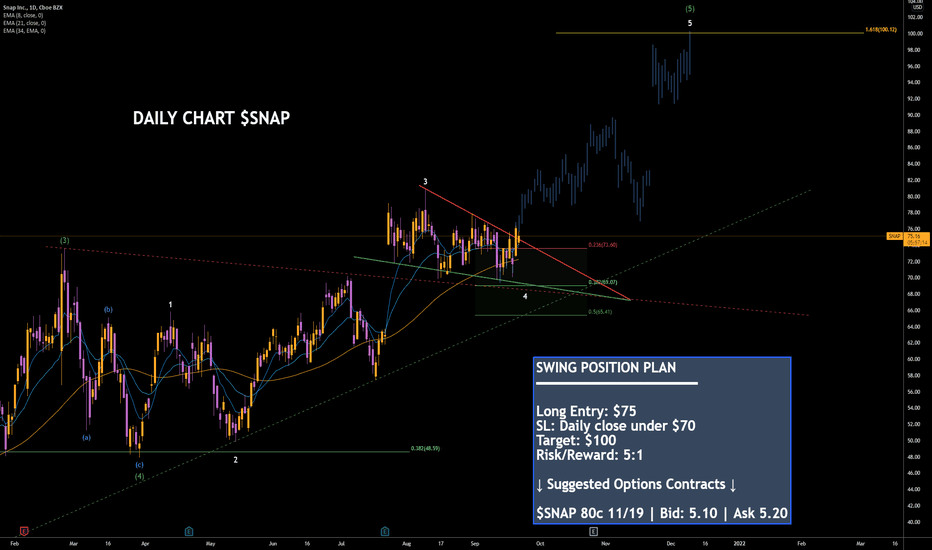

$SNAP | WEEKLY WATCHLIST 9/27Absolutely TEXTBOOK example of how powerful my charts can be. Entered long the 80c 11/19 @4.7 on 9/22. Contracts are currently worth 9+!! Congrats if you played and please be sure to trim.

Although a monster move already, I see more to come. Possible we slow down and consolidate in this $80-84 region to build a base and explode higher to the $90 region. If we get a larger pull, I will take profits on my remaining position and look to re-enter in the future.

Ultimately looking for $100 target by the end of the year!

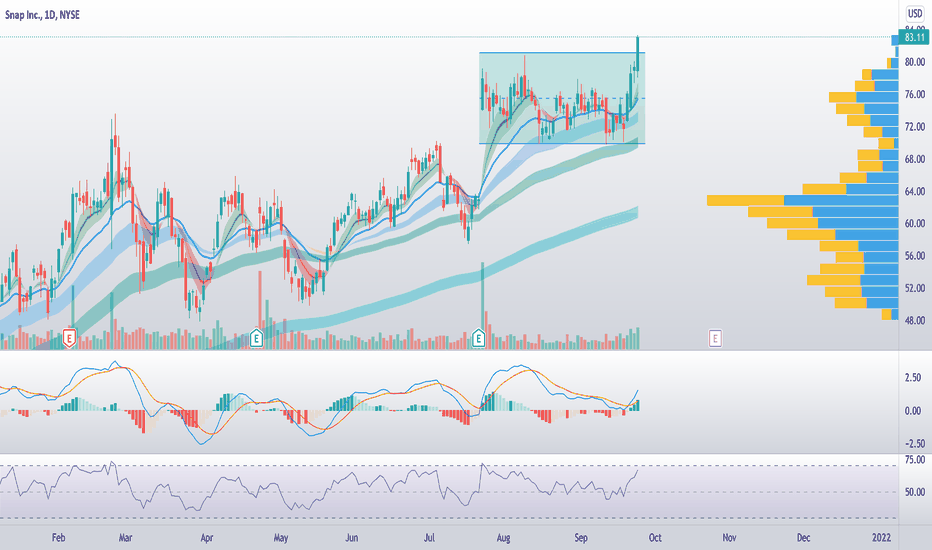

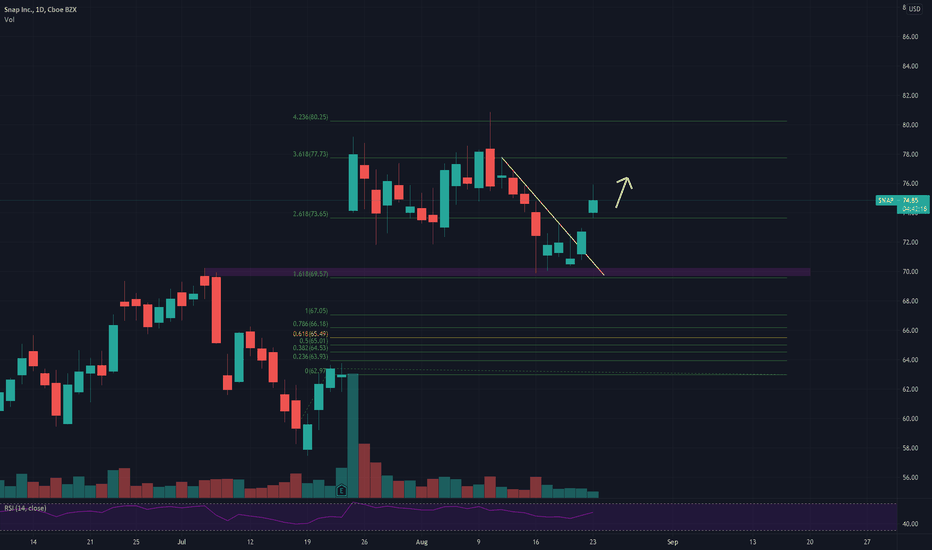

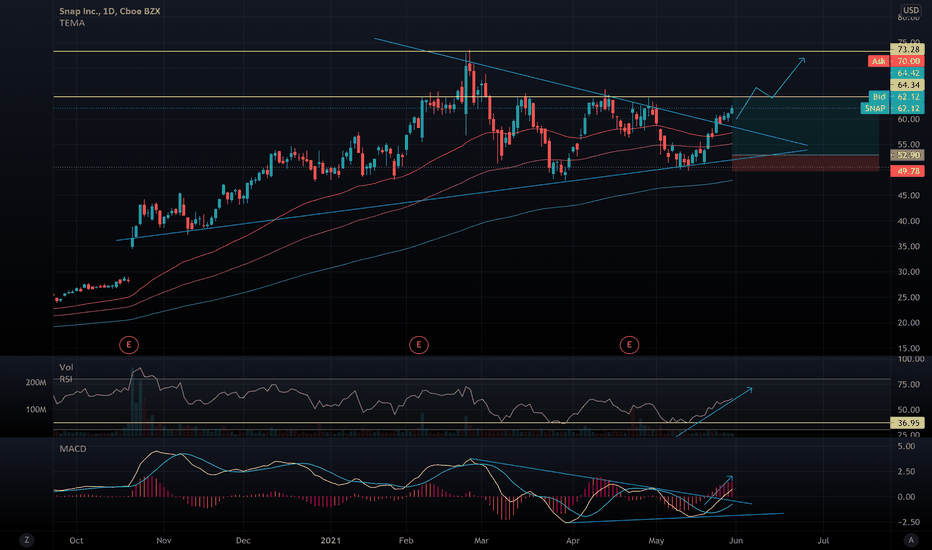

SNAP Breakout Long (8/5/21)Clean breakout on 4h/daily chart with double bottom forming around support levels. Could definitely retest ATH with volume and as long as major indices hold up, current price target around $79.

Support above the earnings gap up seems to have held up well, wouldn't consider puts/short unless we breach the level with volume.

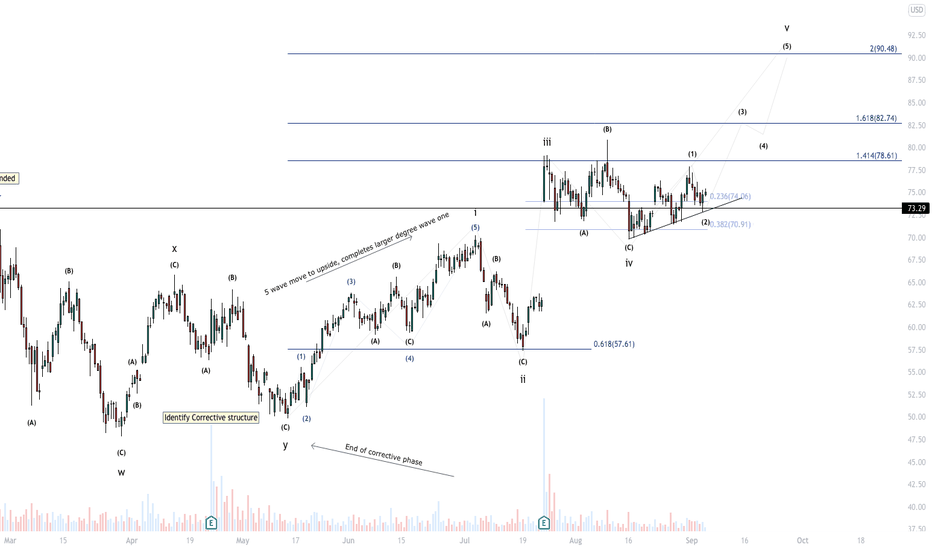

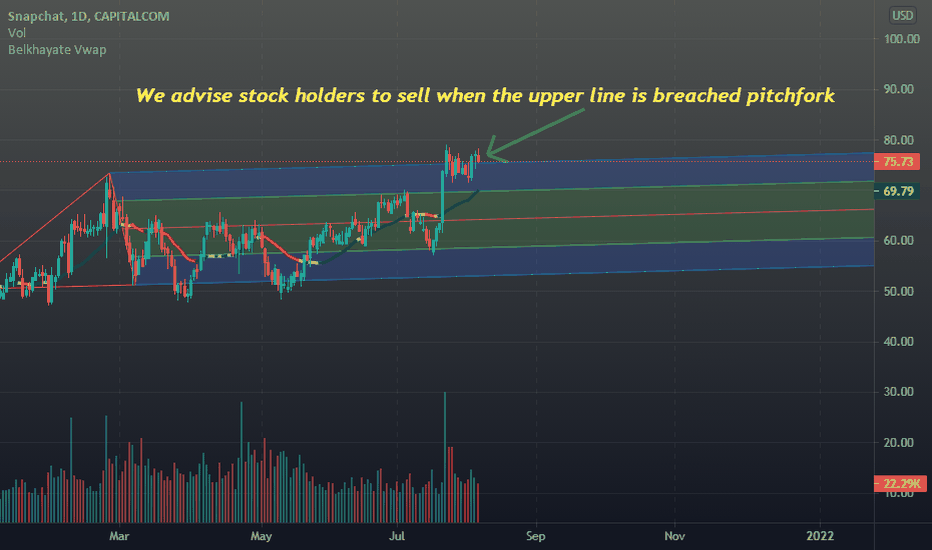

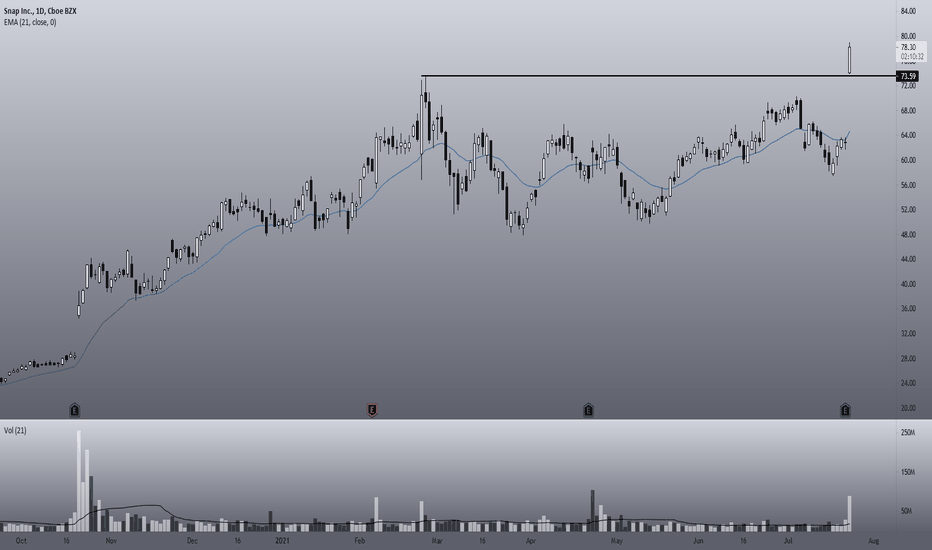

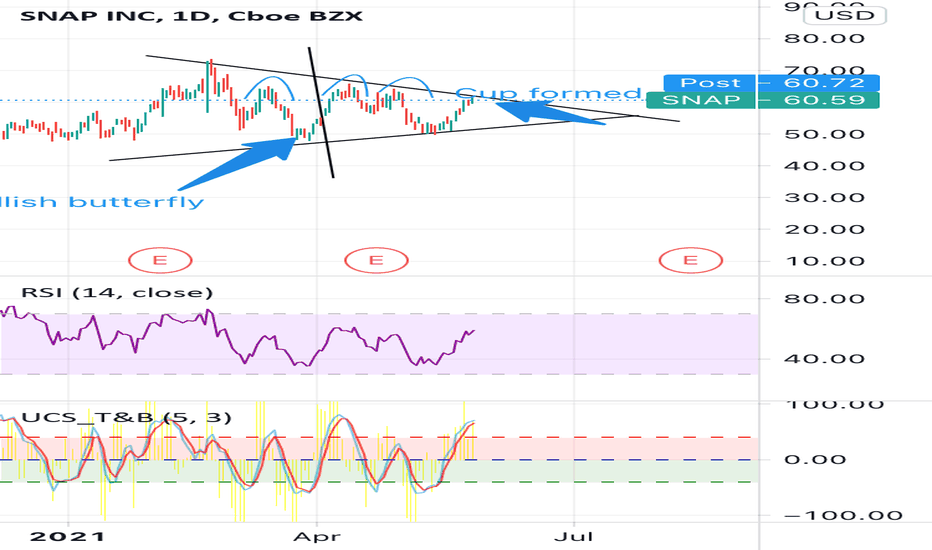

SNAP: How to proceed in this post-earnings?Hello traders and investors! Thanks to the earnings report , SNAP is flying today. But how to proceed when this happens? Is it time to buy, to sell, to go short, or just do nothing? The charts will give us an answer.

If you are in SNAP, I always advise to book at least half of your profits in a day like today, just in case, and then set a technical stop-gain . On SNAP, the technical stop-gain is below the $ 73.59, as this point was the previous All-Time High, and it is supposed to work as a support in the future.

In the next week I would just set a trailing stop-gain under the previous day’s low. If SNAP keeps going up, that’s great. If it drops, then ok, time to exit.

Is there any chance that it’ll fill this gap? Yes, but I find this unlikely, at least for now. This is a Breakaway Gap enhanced by the earnings report, and SNAP did a breakout from the ATH by doing this gap (I like to call this Monster Gap ). The last time this happened on SNAP the momentum was so strong that it prevented even a pullback. Let’s remind SNAP on October 2020:

What could happen on SNAP right now, if it can’t keep pushing up, is a sideways correction , until the 21 ema catches up with the price again in a few weeks, to offer us a new support level on SNAP.

If I were out and wanted to buy SNAP, I wouldn’t count on a pullback, but I would wait for it to cool down a little bit more, and for the Risk/Reward ratio to make sense again. If I buy right now, it would feel like I would be buying from someone who bought at the last dip, and will use me to book profits.

Eventually, the 21 ema will get closer to the price, and we’ll see a good opportunity then. For now, as someone who’s out, I’ll just stay out. There are many more interesting stocks around.

Remember to follow me to keep in touch with my daily studies, and if you liked this idea, please, support it!

Have a good weekend!

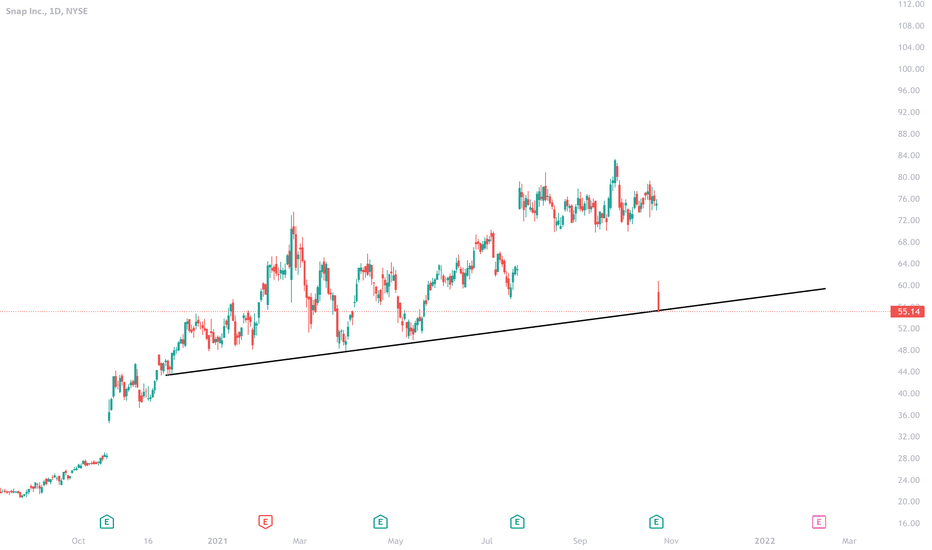

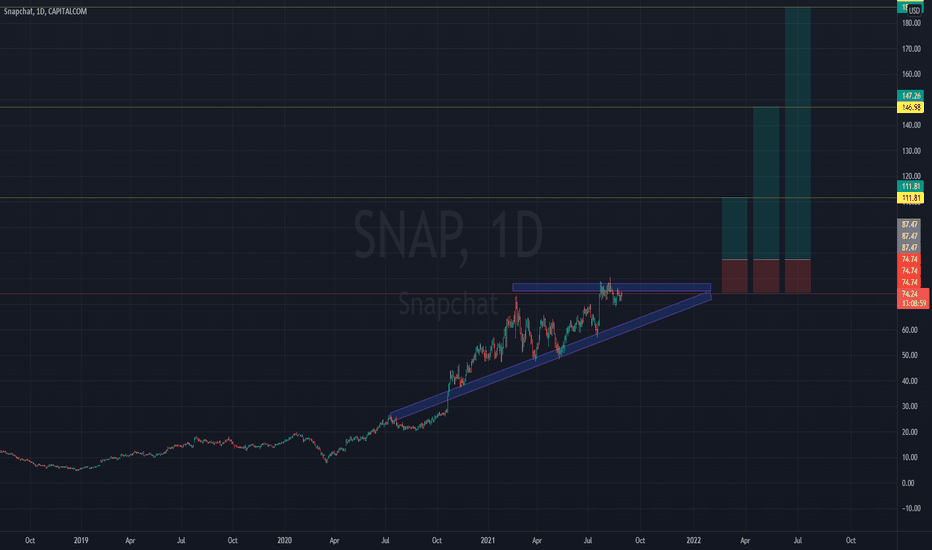

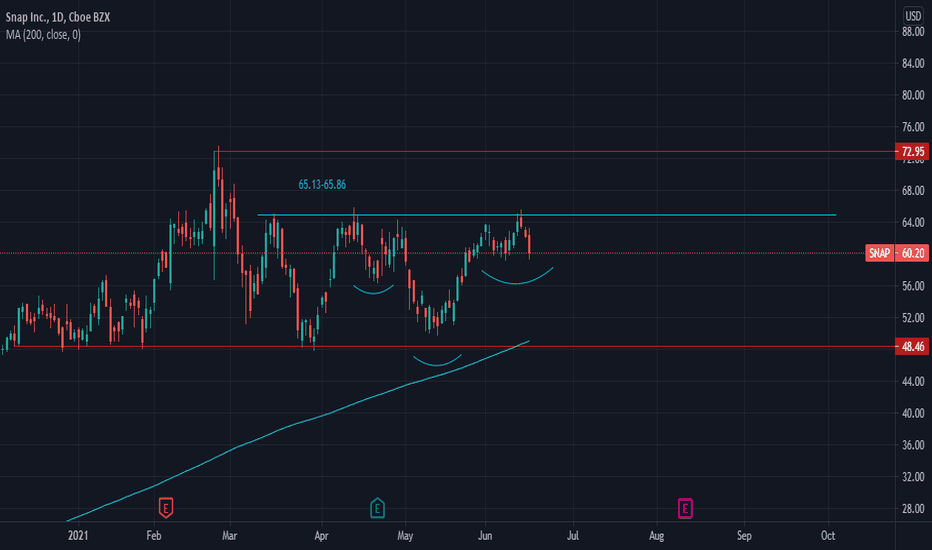

$SNAP Breakout

Snap expects its revenue to rise 81%-85% year over year in the second quarter, buoyed by an easy comparison to its slower ad sales during the start of the pandemic a year ago.

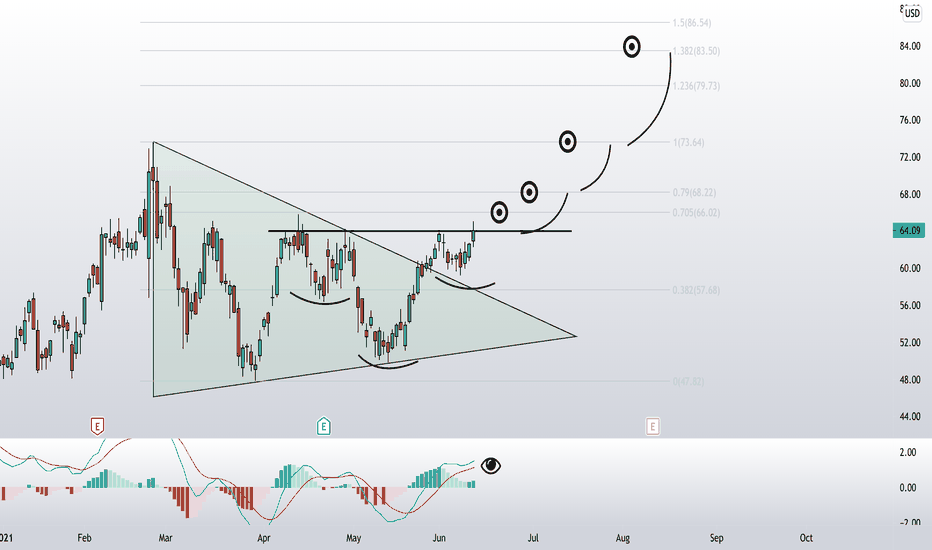

The Technicals are pointing to a breakout to all time highs out of this symmetrical triangle and inverse head & shoulder. A measured move from this pattern gives a target of 83.50 with an extended target of 94 on runners.

-Daniel Betancourt, OptionsSwing Analyst

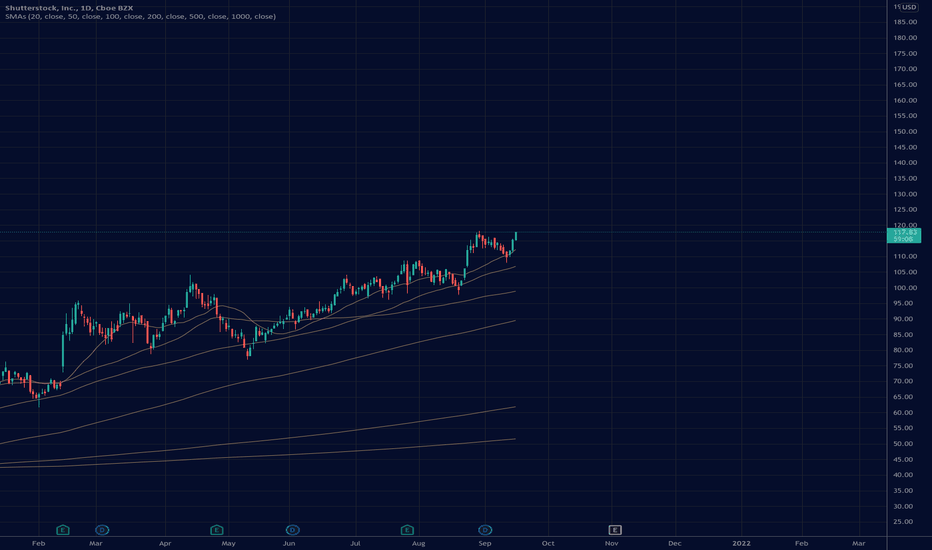

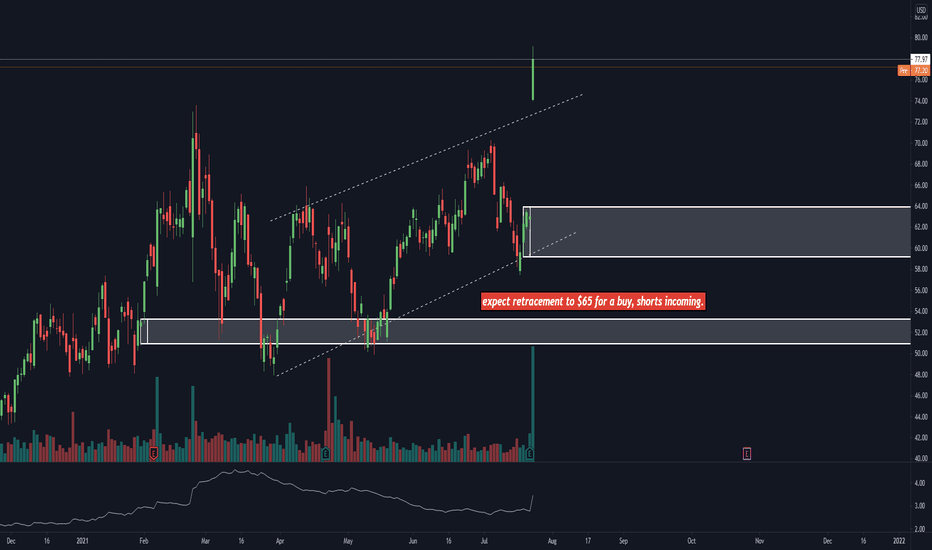

$SNAP Update, 65$ IncomingThis has been a really great snapchat trade, approaching my first 65$ price target in the near term, most likely sometime this week. Passing the 65$ level would then give me a second target near the ATH of 74$+. Obviously this cant go vertical to 74$, but look for some resistance near 68$ and then a bounce off 65$ as old resistance acts as support for the run in the 70's. If tech shows continued momentum, this easily goes to those levels.

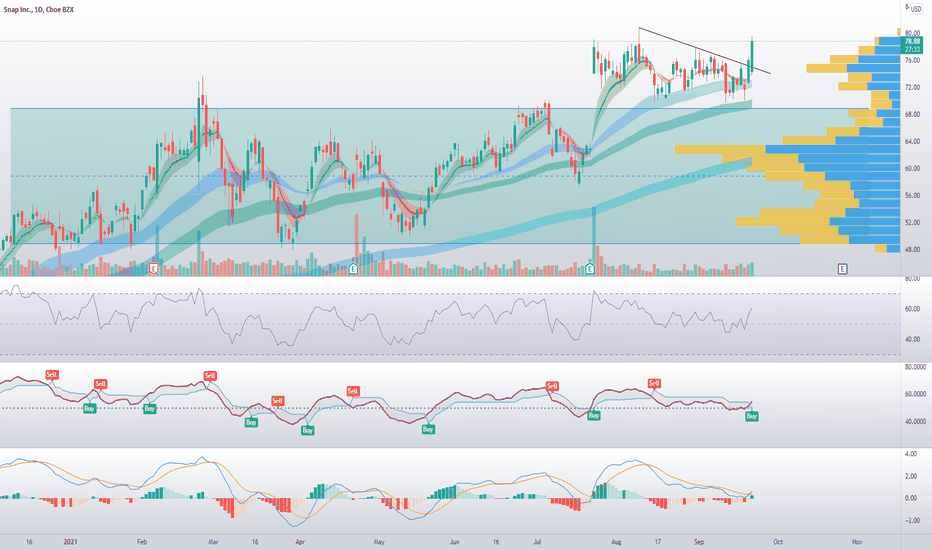

$SNAP Update - Looking for Support Snapchat cleared through its channel range the other day, topping nearly $61, a pullback today seems healthy with an almost 7% move the previous day. What I am looking for next is some support on top of this ascending triangle, if price can hold above approximately $58.50 for the week, I think it will give traders yet another opportunity to enter for a move towards $70. Watch tomorrow as the closing candle green will give this further strength in the near term.