Sniperentry

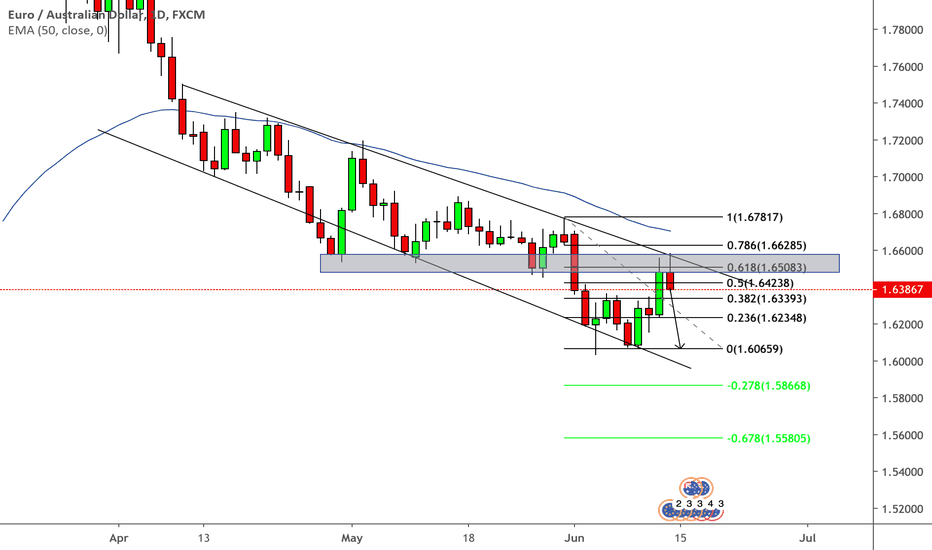

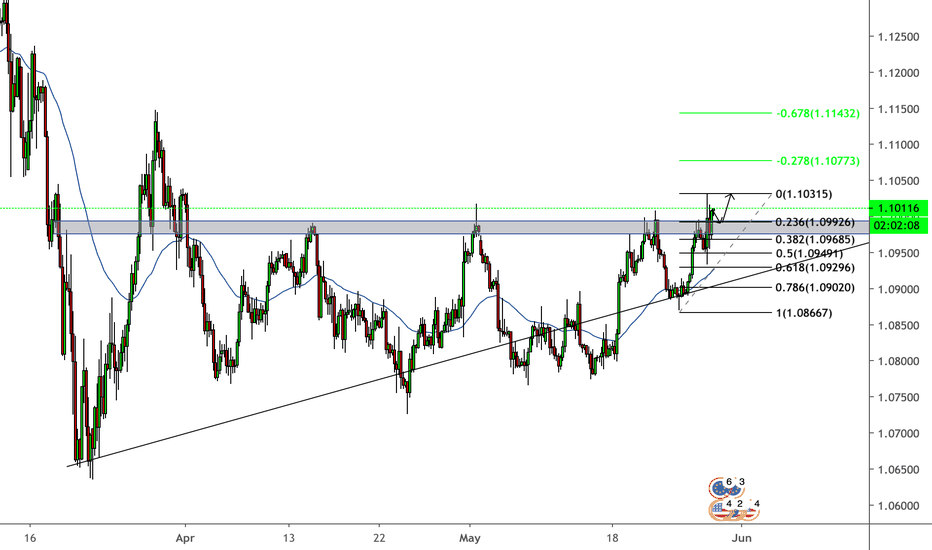

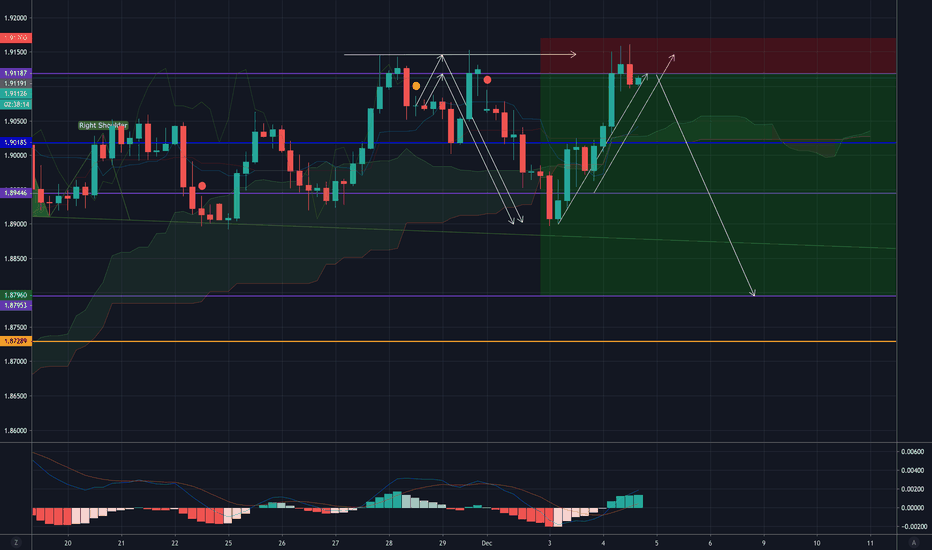

EURAUD- Sell Opportunity On The retracement of 61.8% Fib level!!- A very decent set up for the coming week.

- We can see how price as reacted to the 61.8% fib level and we see a strong bearish candle confirmation that bears are in control.

-A Confluence for this pair is that the supply zone is line with the 61.8% level which shows that price reacts well to the level and more confirmation that price would retrace once it has reached.

- Another confluence is the 50EMA which is above price indicates that this pair is in bearish territory and we are looking for bearish signals.

Drop down to the lower time frame and enter at a strong bearish candle to enter.

This should be a very good set up with a possible to risk to reward of 1:3 or higher when price hits TP.

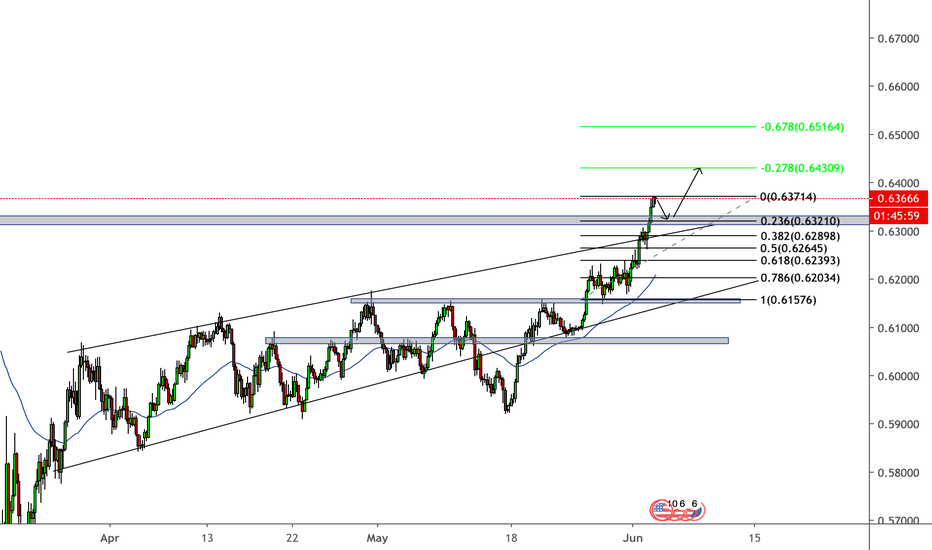

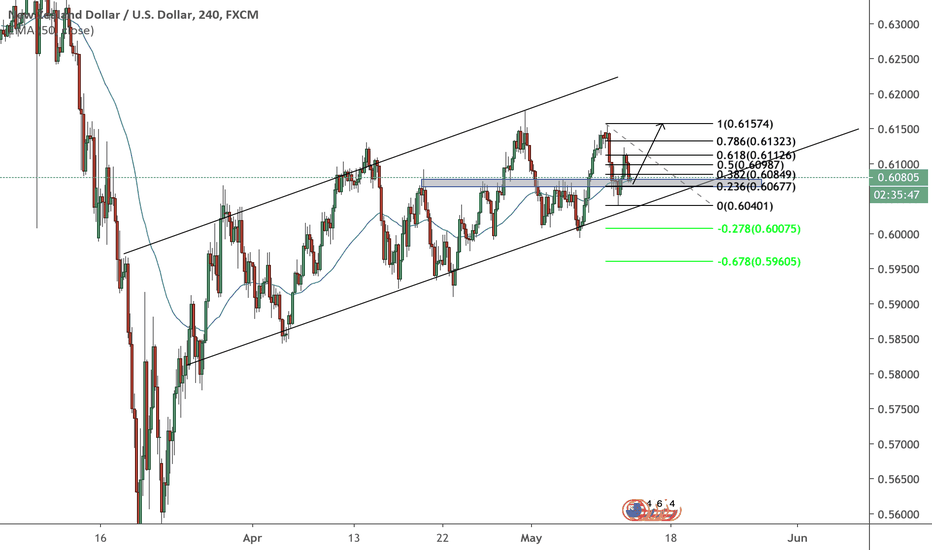

NZDUSD Long -Ascending Channel/Retracement of 23.8% Fib Level!-This is a really good buy opportunity on the reversal of the 23.8% fib level.

-A confluence in the higher timeframe we see ascending channel which indicates a bullish trend.

-Another confluence is that 50EMA is below price which shows that we should be looking for bullish signals for this pair.

-The supply turned demand zone is in line with the 23.8% fib level which price could potentially retrace from.

-Look for a strong bullish candle confirmation around the 23.8% level to buy this pair.

Let's see how price will react during the week!

Make sure to like and comment your ideas/opinions on this pair!

EURUSD- Long Opportunity On The Reversal of Ascending Triangle!!-Very decent long opportunity on the reversal on top of the ascending triangle.

-There is a confluence as the resistance of the triangle is in line with my supple zone.

-Another confluence is that the supply zone is in line with my 23.6 fib level which could indicate that price could potentially reversal from that zone.

-An extra confluence is the EMA as it is below price which indicates medium term bullish trend for this pair.

-I will wait until price reaches the significant level and look for strong bullish confirmation to enter the trade.

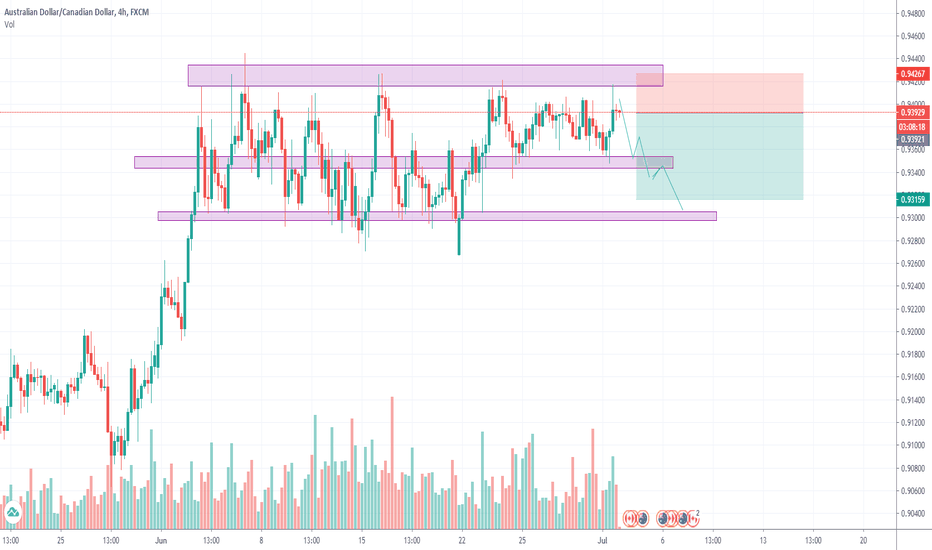

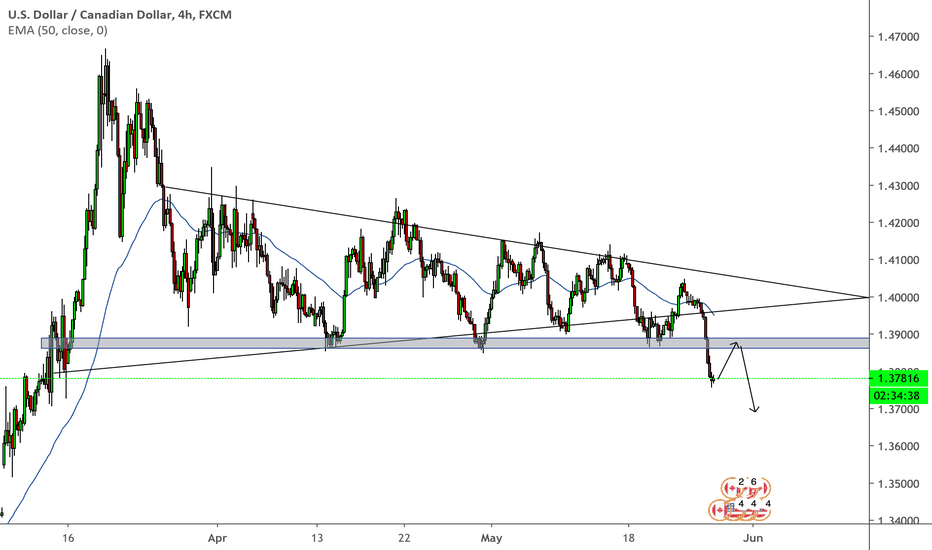

USDCAD- Descending Triangle Breakout and Enter At Reversal!- Very good opportunity to go for a short position on this pair at the reversal of the supply zone.

-Another confluences is the EMA is above price which shows bearish trend of the pair.

-Wait for a strong bearish candle at the supply zone and enter the trade.

Let's see what happens during the week!

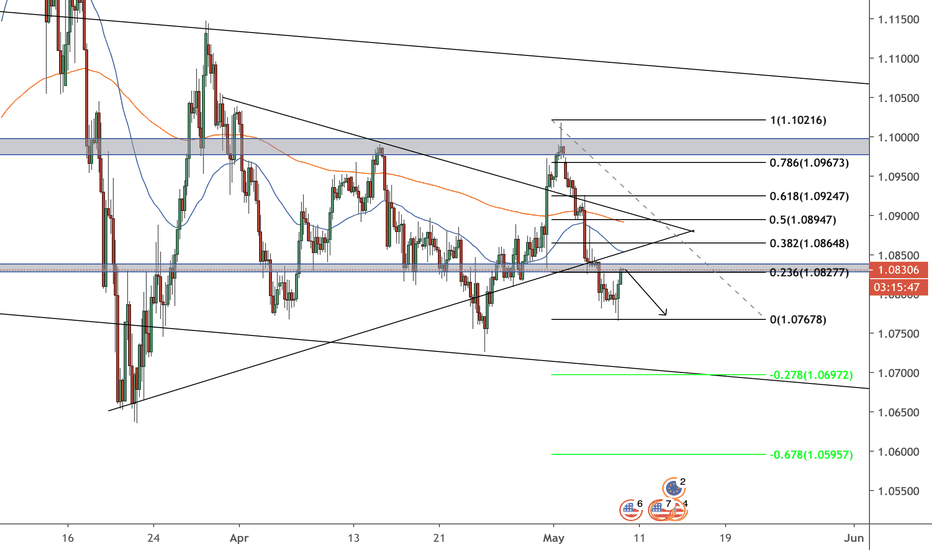

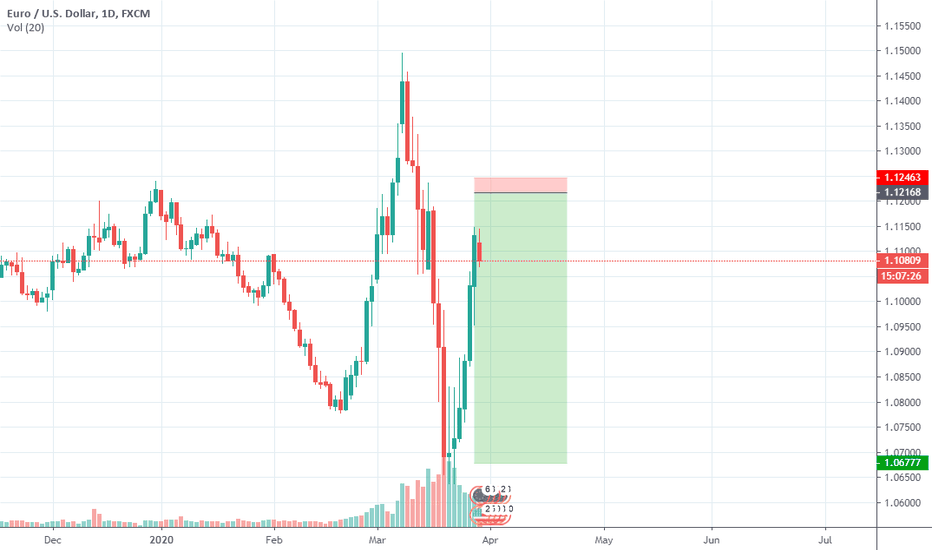

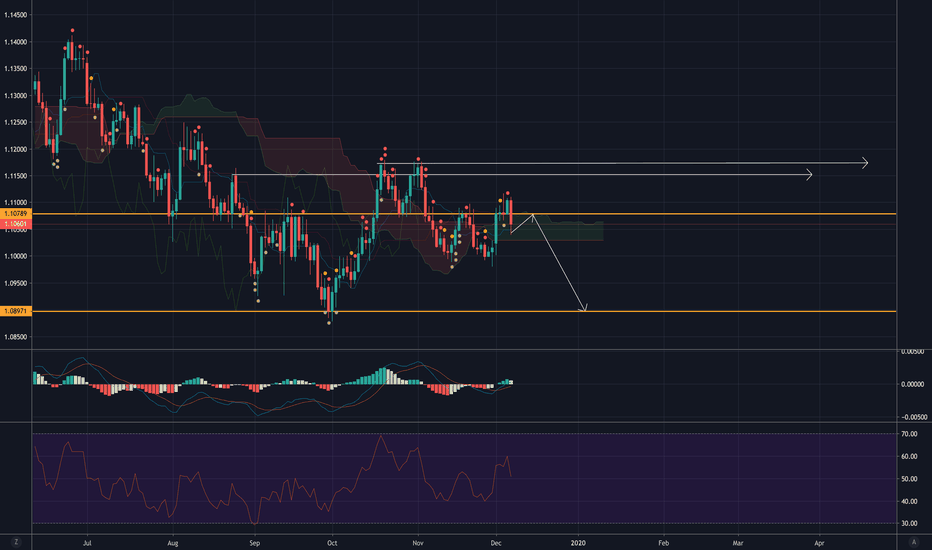

EURUSD- Bearish Reversal on 23.6% Fib Level-Very good opportunity to enter a short position on the retest of the supply zone which is in confluence with the 23.6% fib level.

-Another confluence is the EMA's which show bearish signals as price is below both EMA's.

-Top down analysis from the weekly and daily show bearish signals which gives me confidence the bears are in control of this pair.

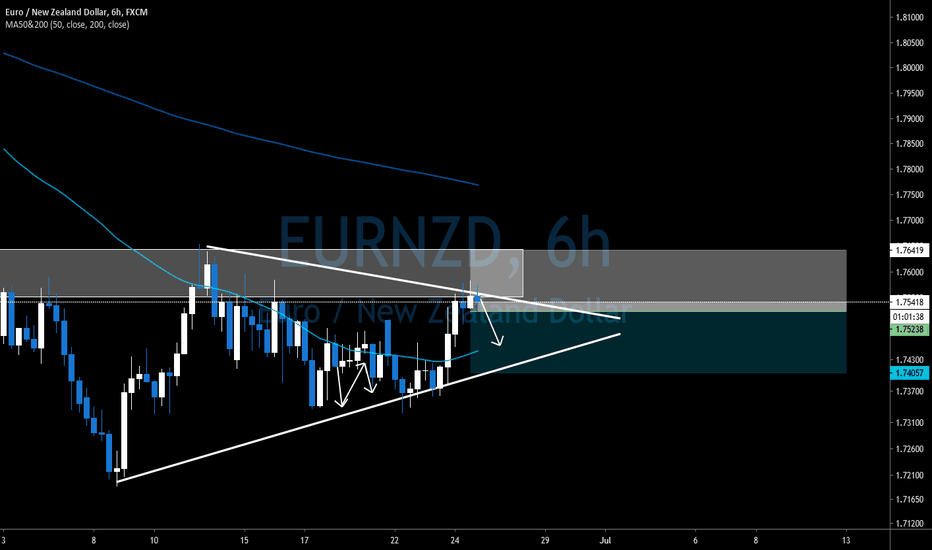

NZDCAD- Bearish Momentum On The Reversal Of The Supply Zone!-Very good opportunity to sell at the supply zone which is in confluences with the 38.2% level.

-The Ema is above price suggests Medium term bearish momentum on the pair.

-Price previously broke the ascending channel which is also another indication that price could retest the supply zone and then we could start to see bearish momentum for this pair.

Wait for price to reach the zone and look for bearish candlestick formation to enter this pair.

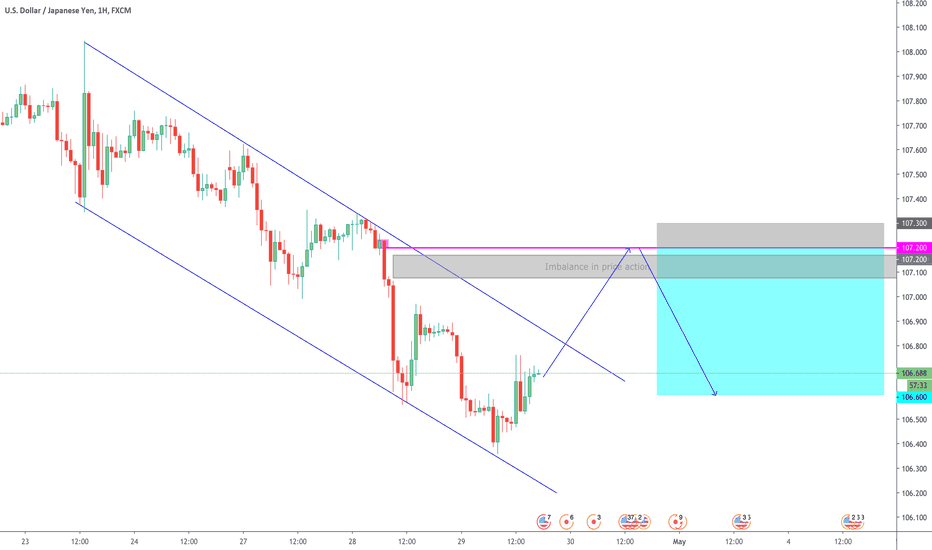

usdjpy market overviewThe liquidity pool that was created at around 107.4 mark finally got cleared and we can see a quick bullish move back to the key structure level. Retailer would be looking to sell at this zone but institutionalist on the other hand would be looking for buy entries. I still see price going to the supply zone (green zone) before the final sell.

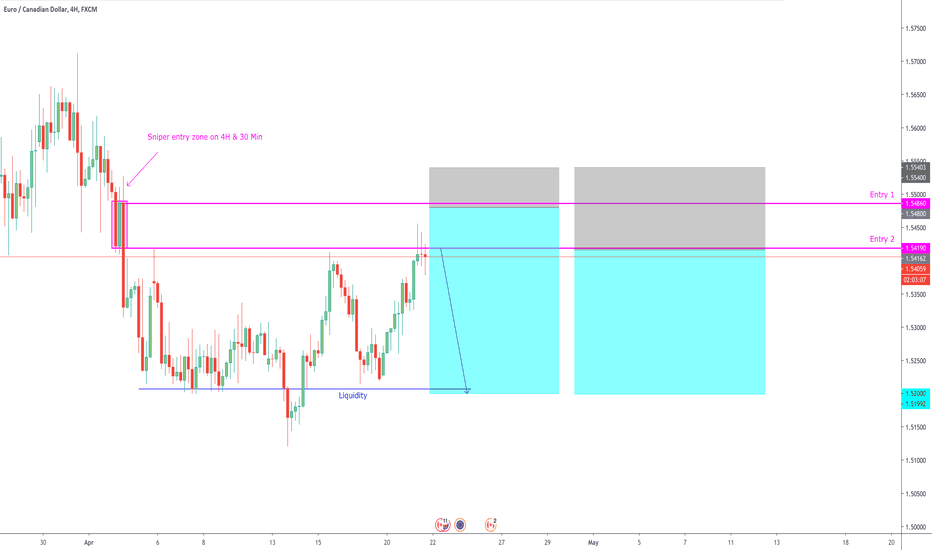

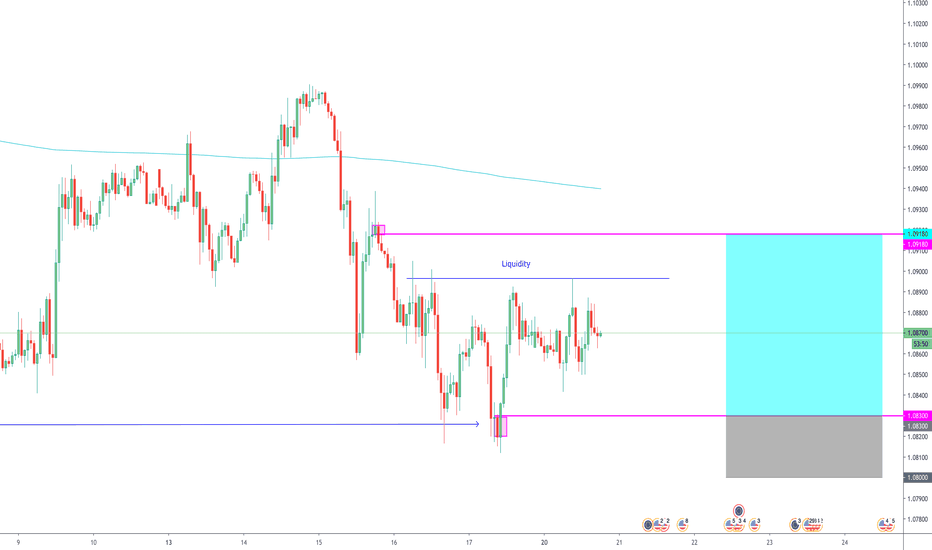

EURCAD Short ideaWe have a Sell limit placed at our entry 1 point, but we do have 2 possible entries, just make sure you use correct risk managment. We expect price to head up to our entry 1 point and then head down to take out them equal lows (Marked "Liquidity")

where price could keep pushing down or reverse.

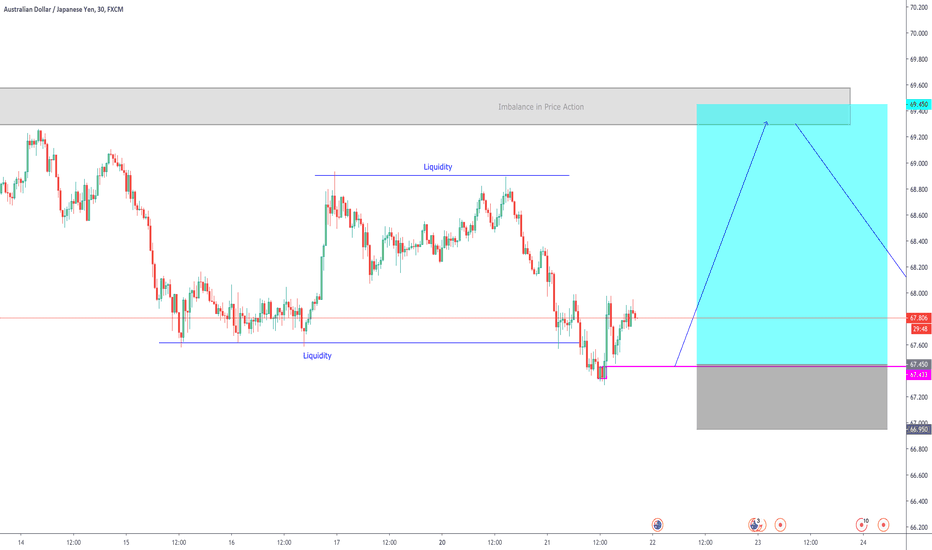

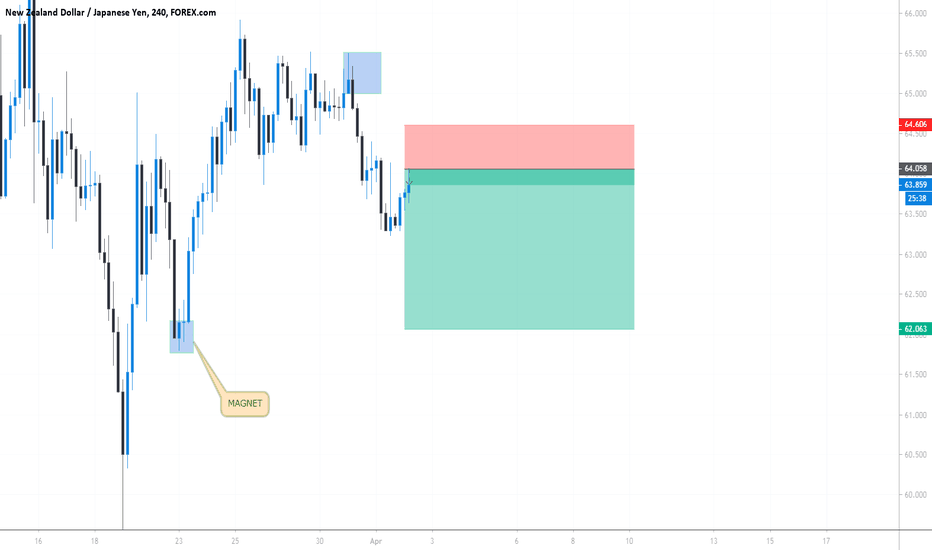

AN Long IdeaOn the monthly time frame we can see the Orange line (Retial Support) has been respected more than 3 times. Price has broken through this support level to take out retial trader that entered Long posoitons at the support area. We could see price head back down to the sniper zone (Marked in purple) to take out any eary retial long traders and then head up in the inteded direction.

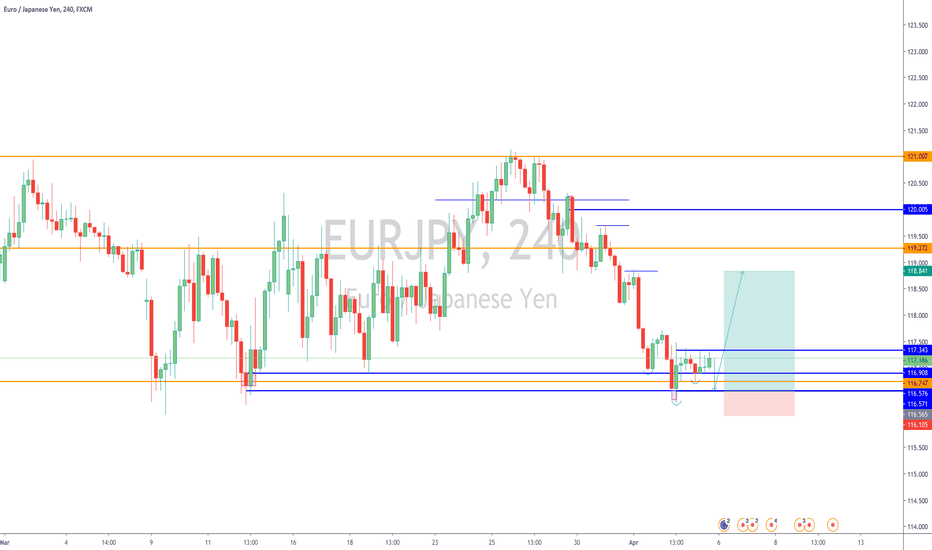

EJ LongWe have this retail support zone where price broke through previously. We have this retail head and shoulders pattern forming on the lower time frames which retail traders will be watching. Price should come down towards to he sniper block (Marked in pink) and then in the intended direction. This will be grabbing retail liquidity so the institutions can get in at better price.