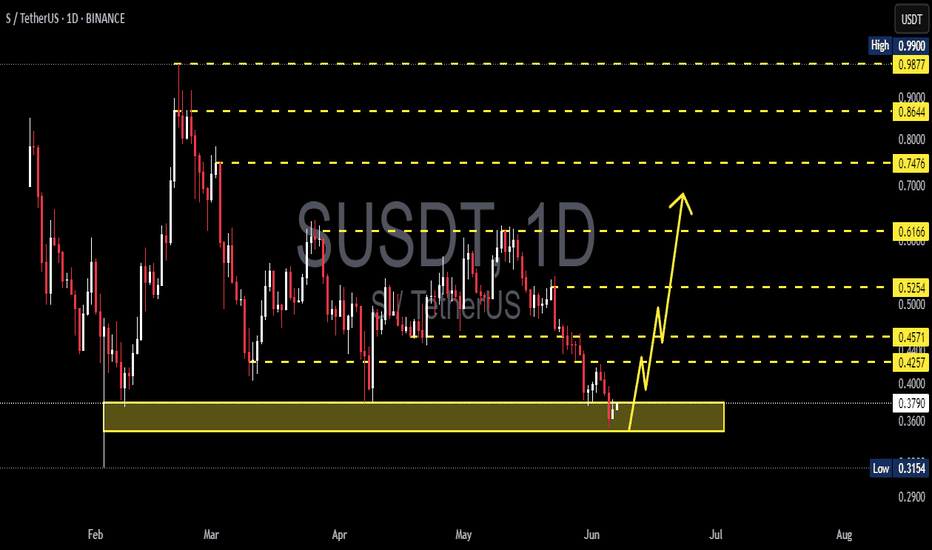

SONIC/USDT — Descending Triangle at Key Support!Overview

The daily chart shows a clear medium-term downtrend (well-defined descending trendline) meeting a strong horizontal support zone around 0.25–0.31 USDT (yellow box). Current price ≈ 0.3059 USDT. This structure forms a descending triangle or accumulation range, signaling that the market is in a decision phase — either a bullish breakout or a bearish continuation.

---

Key Levels

Current Price: 0.3059

Support Zone: 0.2494 – 0.305 (historical low at 0.2494)

Descending Trendline Resistance: ~0.33–0.35 (dynamic)

Next Resistances: 0.3891, 0.5278, 0.6067, 0.7461, 0.8654, 1.0453

Breakdown Measured Target: ~0.11 (if 0.2494 breaks)

Potential % moves from current price:

To 0.3891 ≈ +27.2%

To 0.5278 ≈ +72.5%

To 0.2494 ≈ −18.5%

To 0.11 ≈ −64%

---

Pattern & Interpretation

Main Pattern: Descending trendline + horizontal support = descending triangle (bearish bias unless broken to the upside).

Bearish Signal: Lower highs structure, price still under the descending trendline, supply pressure dominant. A daily close below 0.2494 with high volume = breakdown confirmation.

Bullish Signal: Daily close above the trendline (~0.33–0.35) with strong volume, followed by a successful retest = breakout confirmation. Extra confirmation if price breaks and holds above 0.3891.

---

Scenarios

Bullish

1. Break & daily close above trendline (~0.33–0.35) with rising volume.

2. Retest holds as support.

3. Targets: 0.3891 (+~27%), then 0.5278 (+~72%).

4. Stop-loss: below support box (~0.28 or safer < 0.2494).

Bearish

1. Daily close below 0.2494 with strong volume = breakdown.

2. Measured move target ≈ 0.11.

3. Conservative target: psychological zones 0.18–0.15.

4. Stop-loss for shorts: above 0.305–0.33.

---

Trading Notes

Conservative Long: Wait for breakout & retest above trendline.

Aggressive Long: Enter near support (0.26–0.30) with tight stop below 0.2494.

Short: Only after confirmed breakdown below 0.2494.

Always watch daily close + volume to avoid false signals.

---

Conclusion

Current trend is bearish, but the strong 0.25–0.31 support keeps the possibility of a short-term rebound alive.

Decision point: Breakout above 0.35 → bullish rally, Breakdown below 0.2494 → extended sell-off.

Risk management is key — use stop-losses and position sizing.

#SONIC #SONICUSDT #CryptoAnalysis #SupportResistance #DescendingTriangle #Breakout #Altcoin #RiskManagement

Sonicusdc

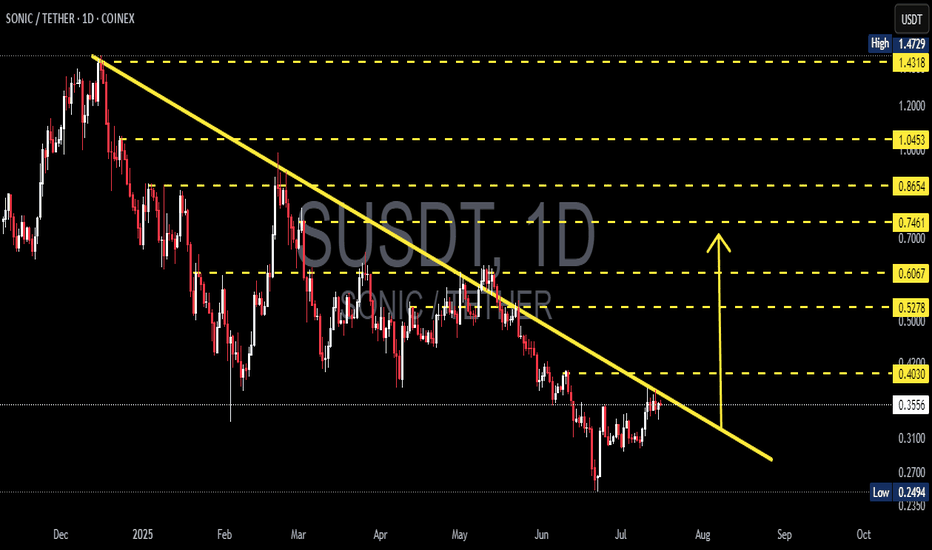

SONIC/USDT Breakout in Progress? Watch This Critical Level Close🧠 Technical Breakdown – Daily Chart (1D, Coinex)

The SONIC/USDT pair is currently exhibiting a textbook descending trendline breakout setup, formed over the past 7+ months. This long-term downtrend has been respected since late November 2024, connecting multiple lower highs and establishing a well-defined bearish structure.

However, recent price action shows a potential trend reversal as the pair consolidates tightly near the apex of the structure, with signs of breakout momentum building.

📐 Pattern Identification:

✅ Falling Wedge / Descending Triangle

✅ Continuous lower highs connected by a descending trendline

✅ Support held above $0.25 (strong demand zone)

✅ Price now testing the upper boundary of the trendline

This is a classic bullish reversal pattern—especially when price breaks out after long-term compression.

🚀 Bullish Scenario:

Should SONIC successfully break and close above the $0.4030 level (trendline + horizontal resistance), it could unlock a wave of bullish momentum. Here are the key upside targets based on Fibonacci retracement from the previous high ($1.4729) to the local low ($0.2494):

🎯 Resistance Level Significance

$0.5278 0.382 Fib – First major target post-breakout

$0.6067 Key confluence level – psychological barrier

$0.7461 0.618 Fib – Bullish continuation zone

$0.8654 High momentum extension

$1.0453 0.786 Fib – Reversal confirmation

$1.4318 Retest of the all-time high

If volume supports the breakout, we could see a sharp move toward these zones.

🧨 Bearish Scenario:

If price fails to break out and gets rejected from the trendline:

It could retrace back toward $0.3100 and $0.2700

A daily close below $0.2494 (previous low) would invalidate the bullish setup, signaling potential continuation of the downtrend

Traders should monitor RSI divergence and volume drop as warning signs

📌 Why This Setup Matters:

This is not just a short-term play. A successful breakout here signals the end of a multi-month downtrend and the potential start of a new macro uptrend. SONIC has been heavily compressed — and the tighter the coil, the bigger the move.

Smart money often enters before the breakout confirmation. Monitor for volume surges, candle structure changes, and key breakout retests.

✅ Summary:

🔄 Trendline breakout imminent

🟢 Watch for breakout confirmation above $0.4030

🔴 Breakdown below $0.2494 invalidates the bullish thesis

🧭 Fibonacci levels offer reliable target zones for profit-taking

This is a critical make-or-break zone for SONIC/USDT. Traders, be ready.

#SONICUSDT #BreakoutSetup #AltcoinAlert #CryptoAnalysis #TrendReversal #TechnicalAnalysis #CryptoTA #Altseason #FibonacciLevels #PriceAction

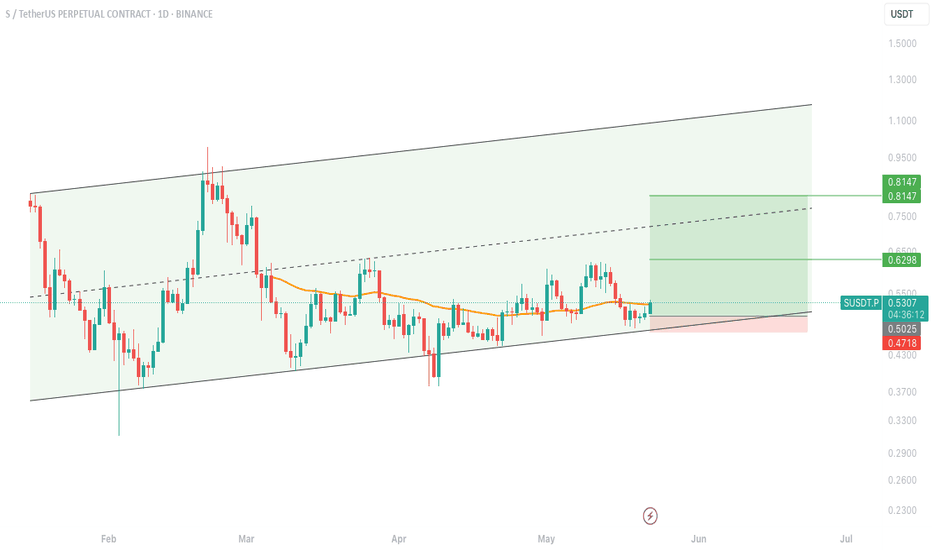

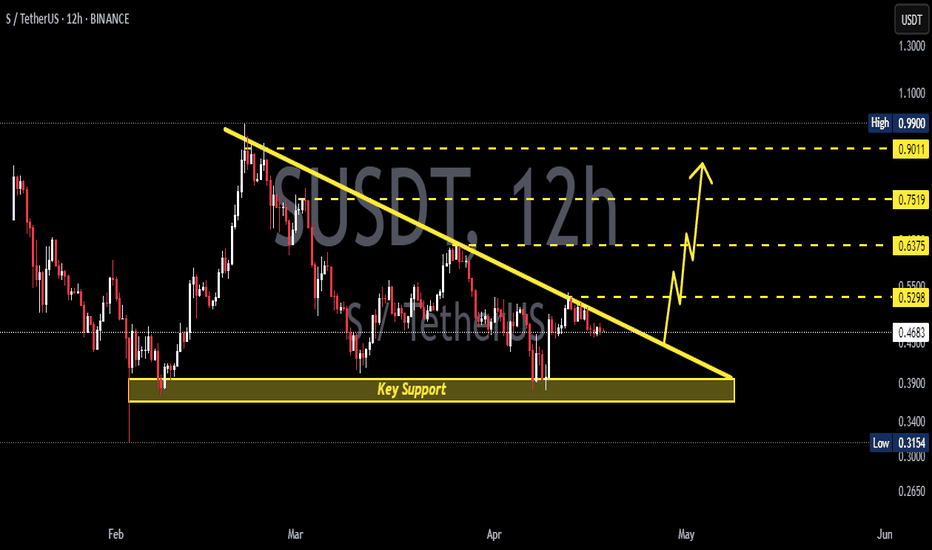

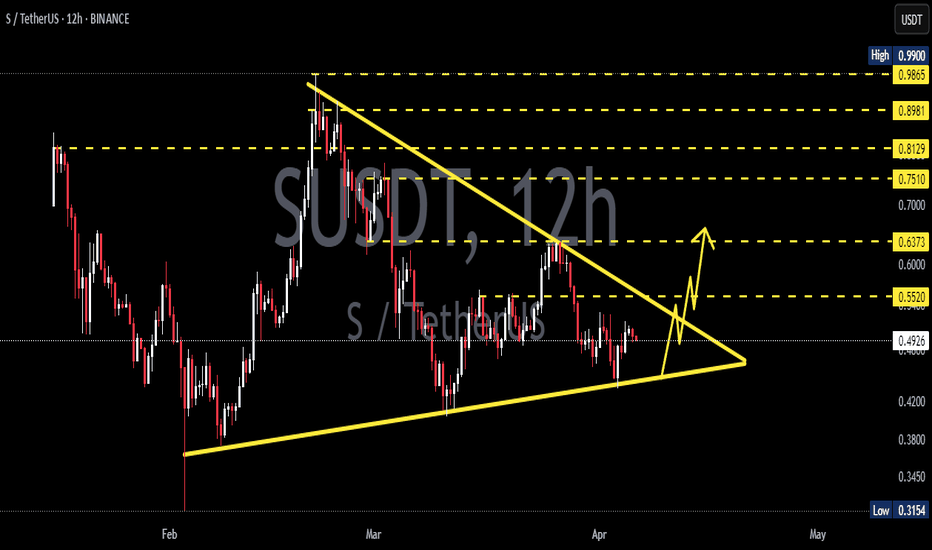

Long Trade set-up SUSDT:SonicUSDT: A clean bounce from the lower trendline of the ascending channel is showing strength! 📈

We’re seeing price reclaim the EMA support with strong structure holding.

🎯 Targets ahead:

• TP1: $0.6298

• TP2: $0.8147

🔒 SL below: $0.4718

Risk-managed and technically sound setup.

✅ Keep this one on your radar — or jump in if price retests near entry!

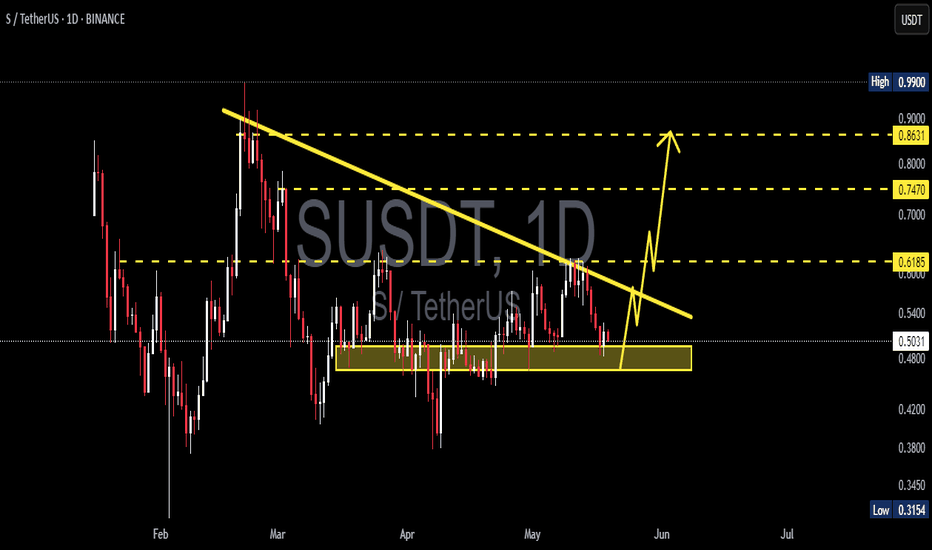

Be careful with SONIC !!!Finally, the price broke the wedge, and the price experienced a significant drop. I think now is the time for SONIC to rise again to 0.27 . STRONG SUPPORT 0.382=0.21 TO 0.23.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!