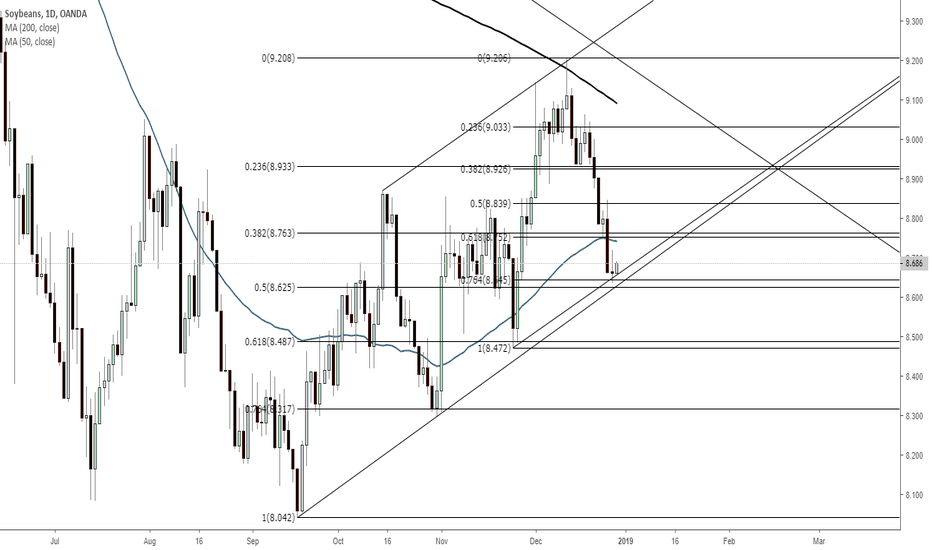

Soybeans Mar 2019 equilibrium patternDaily soybeans futures chart tightening up nicely and should give a good signal in either direction when it breaks. Purple line is 200MA; Yellow line is 100MA.

Soybeans

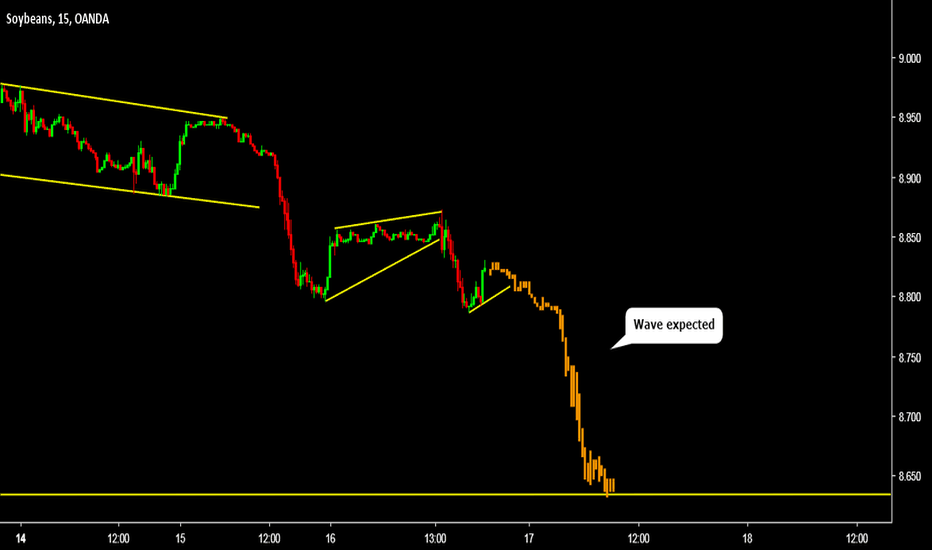

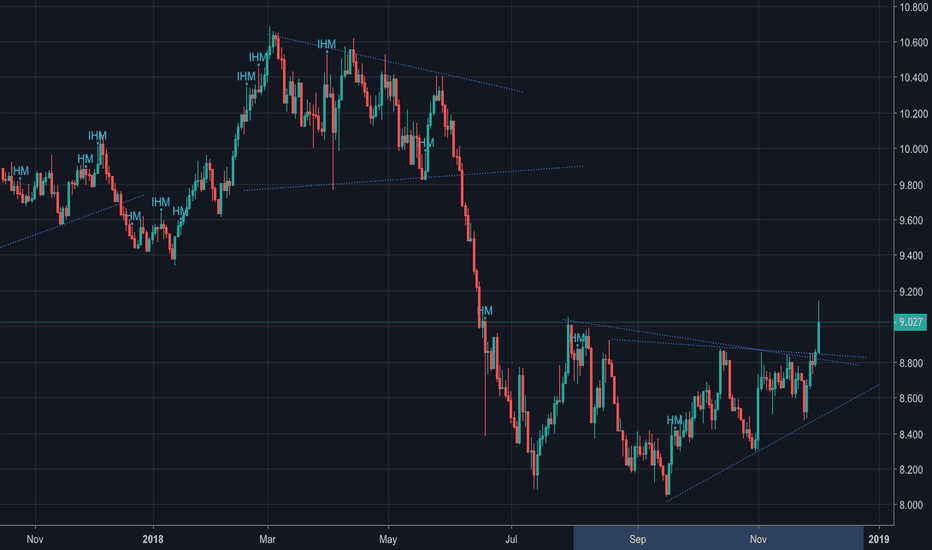

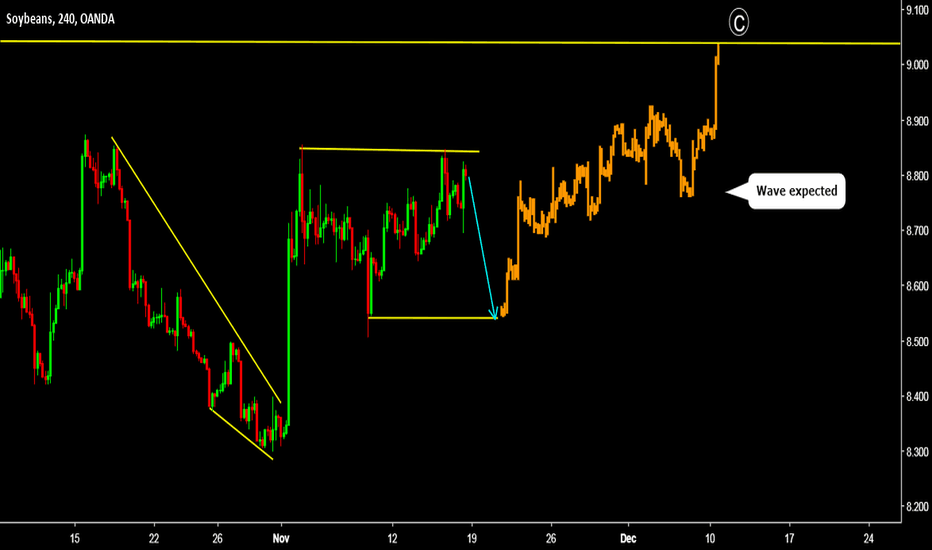

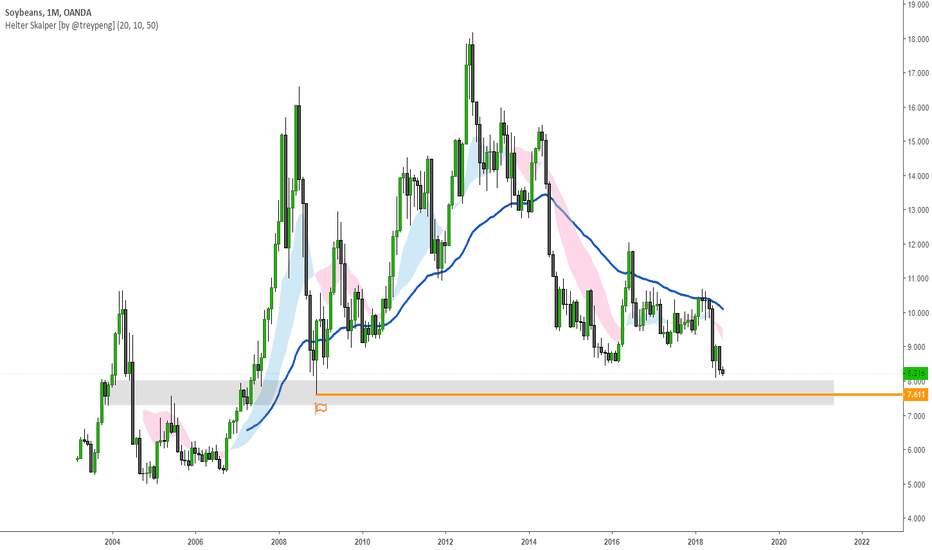

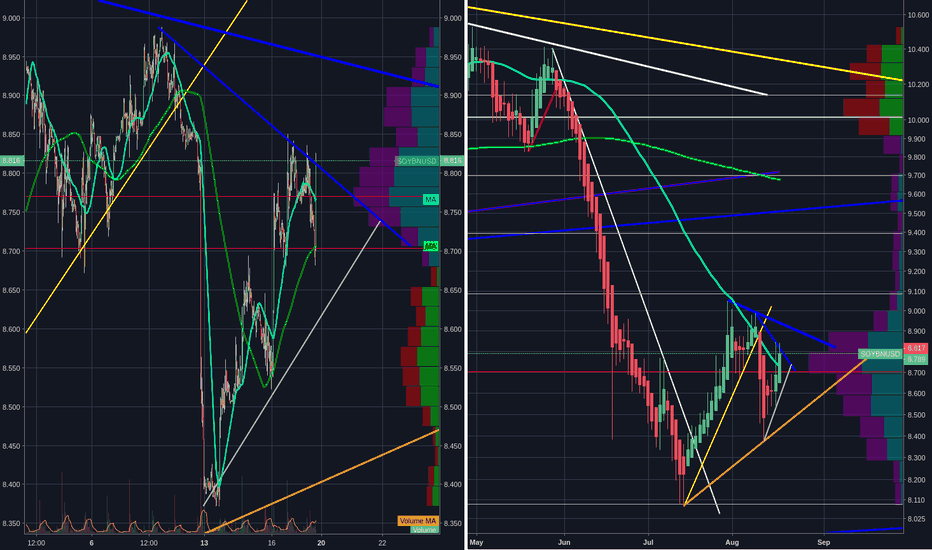

SOYBNUSD SELL FOR SHORT TERM, BUY FOR MEDIUM TERM.Hi there. Price is forming a continuation pattern to the upside. Wait for the price to complete the pattern and watch strong price action for sell. On bigger time frame, price is forming a continuation pattern to the upside. Wait for the price to hit the bottom of the pattern and watch strong price action for buy.

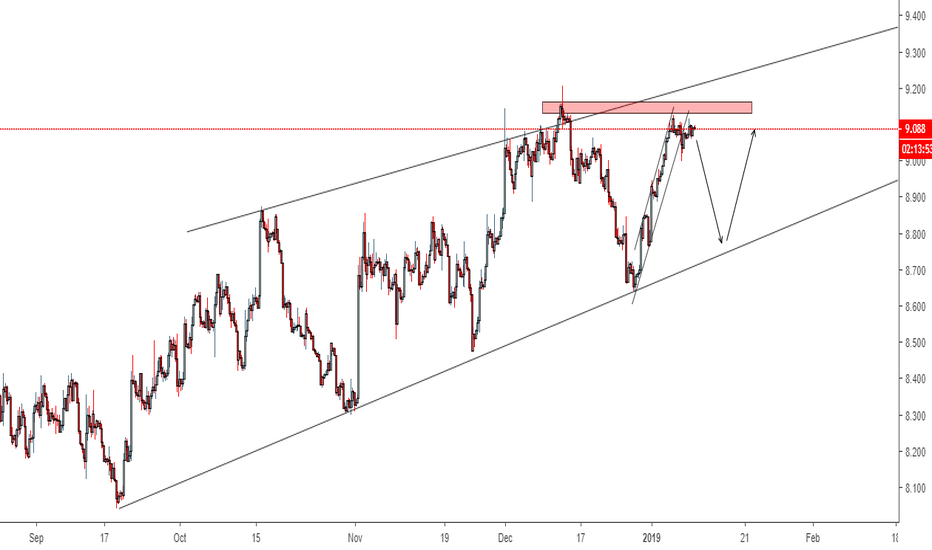

SOYBEAN (SOY/USD)The soybean market is moving in a gradual uptrend and forming a channel. However, there is an opportunity for a short position because of a bearish flag pattern forming and the fact that the price is nearing the channel resistance. Also, the price could form a double top pattern as suggested by the red rectangle forming a horizontal resistance zone.

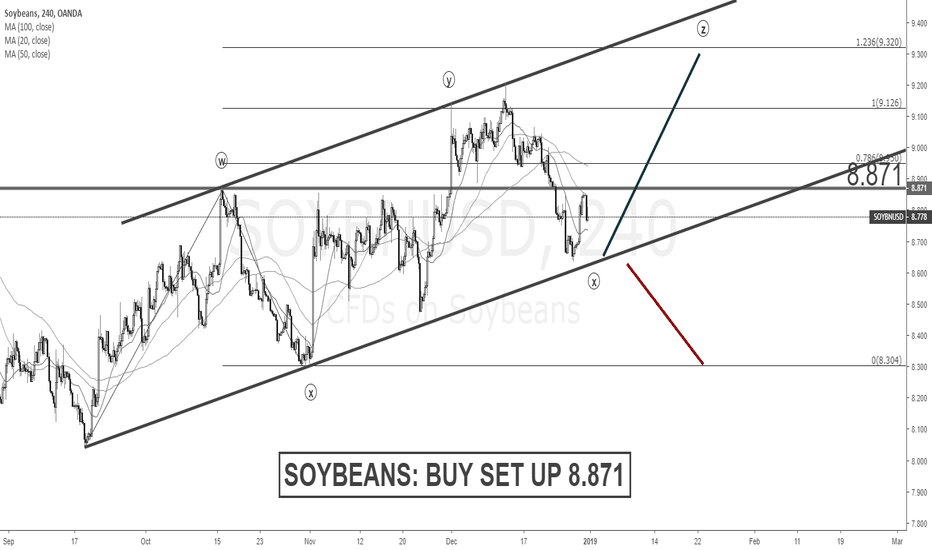

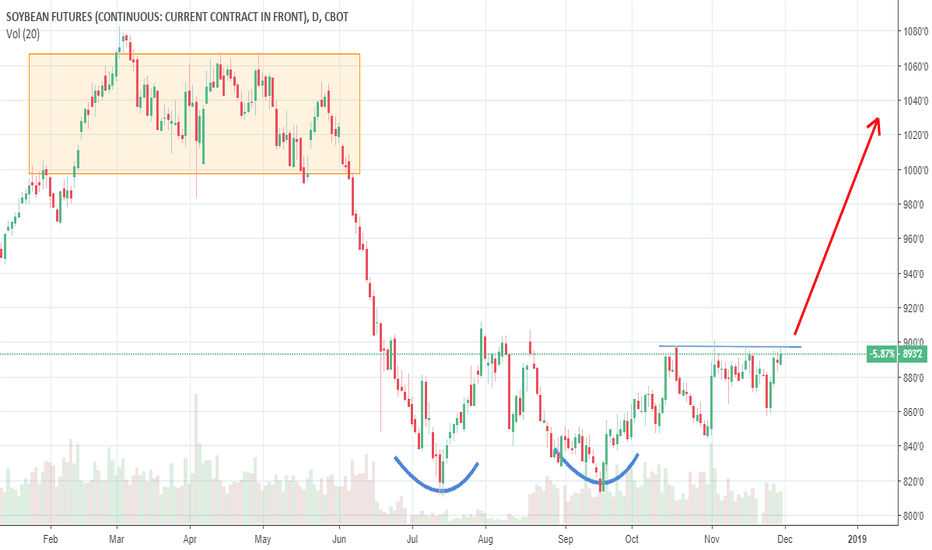

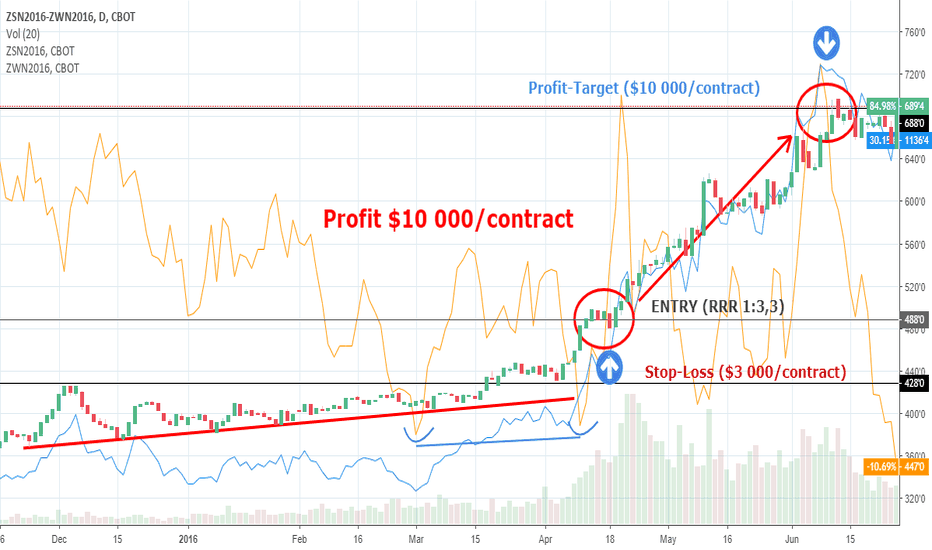

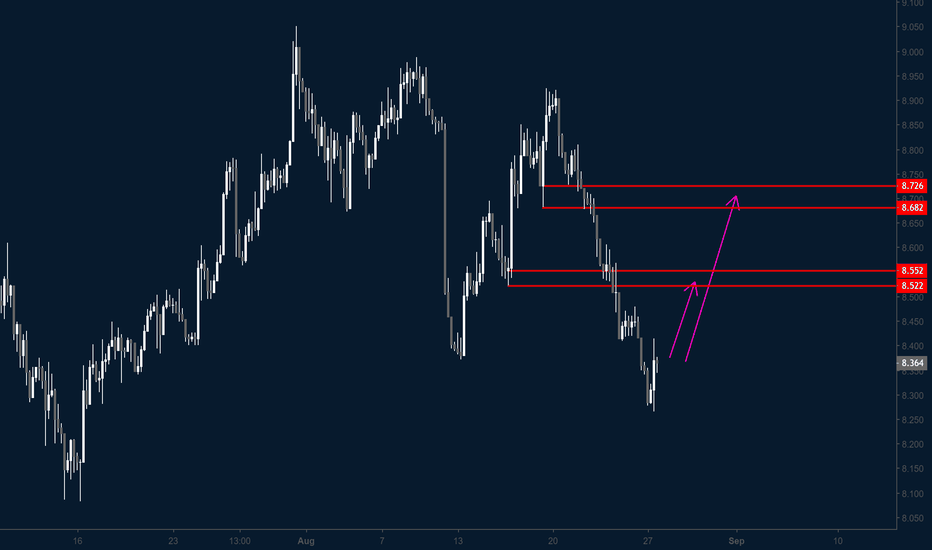

Soybeans Buy setup developing

Soybeans recently broke out to a new high and managed to spend some time above the 9.00 mark before the 200 day moving average and the top of an ascending channel forced price back down. It is now stalled at confluence fibonacci support and a parallel of the lower trendline of the ascending channel, with the bottom of the channel very close below. An aggressive approach would be to buy in at the appearance of a positive closing candle. Otherwise a more conservative approach would be to wait for a daily close above the 50 day moving average. Given the time of year the conservative approach seems to be the more appropriate option. Initial target will be 9.00 and a break below the channels lower trendline would invalidate the bullish bias.

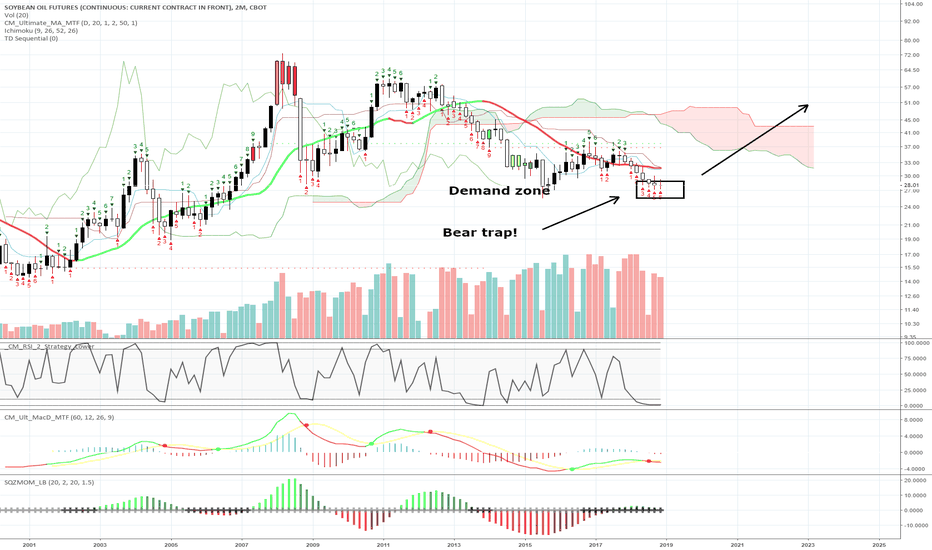

SOYBEAN OIL FUTURES LONGHey friends!

Doing these for fun. Soybean oil futures have bullish signals!

Good luck!

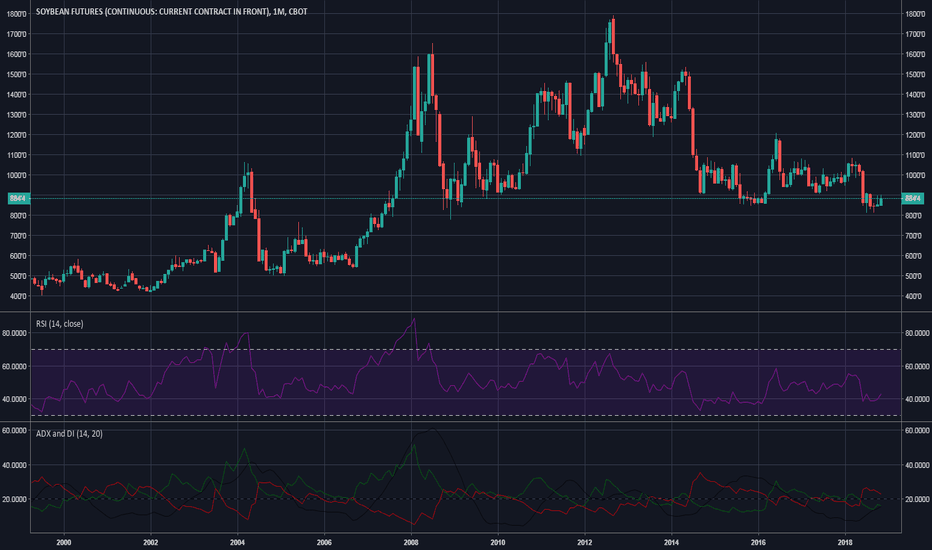

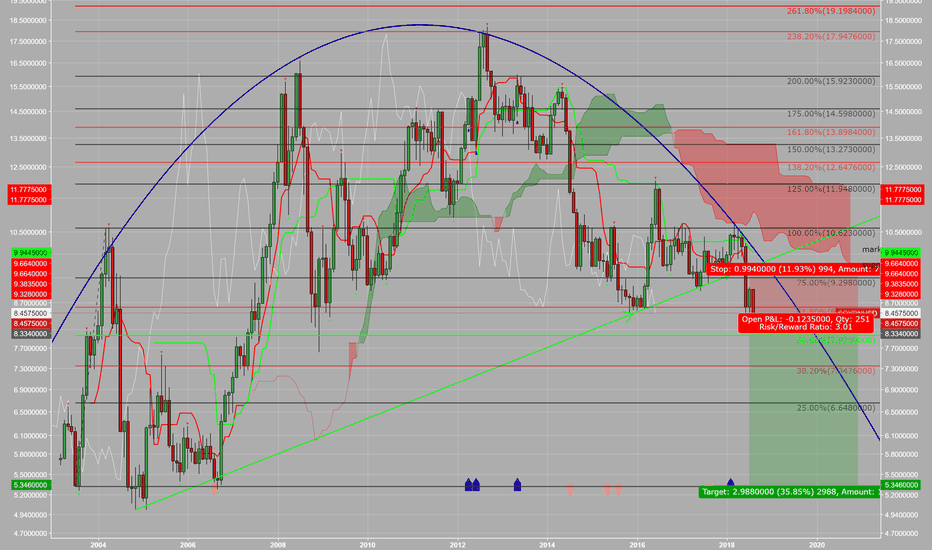

Long SoybeansHi guys ! I post a trading idea for long positions at ZS1! . Recent WASDE report had a price projection for soybeans for 2019 about 900-910. As wee see also in the recent political scene trade war talks at G20 there is a good possibility to go far beyond as from 910. From technical analysis view at the monthly chart is long with target 1056 , RSI is tend to swing to upper levels so I think is a good long signal and ADX now is tending to get a direction which is a further high price. Hope you find it usefull !

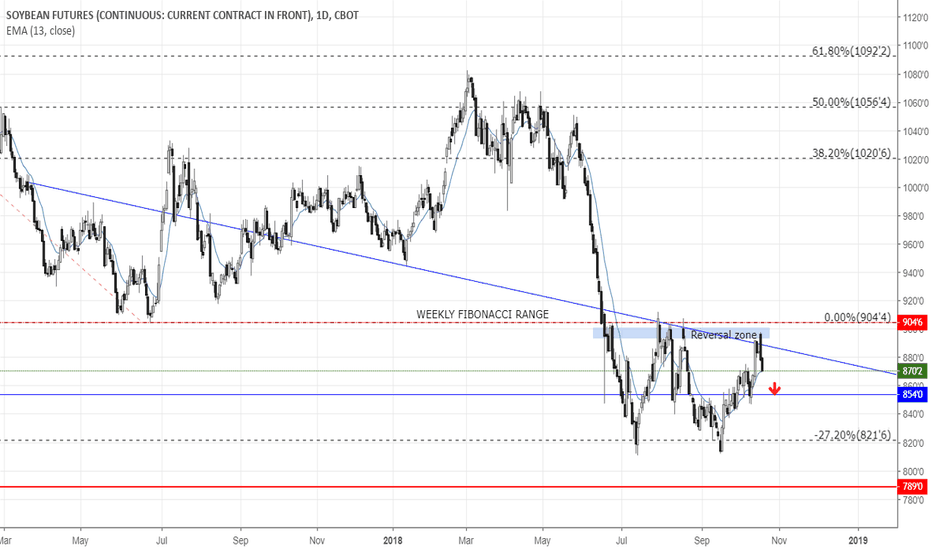

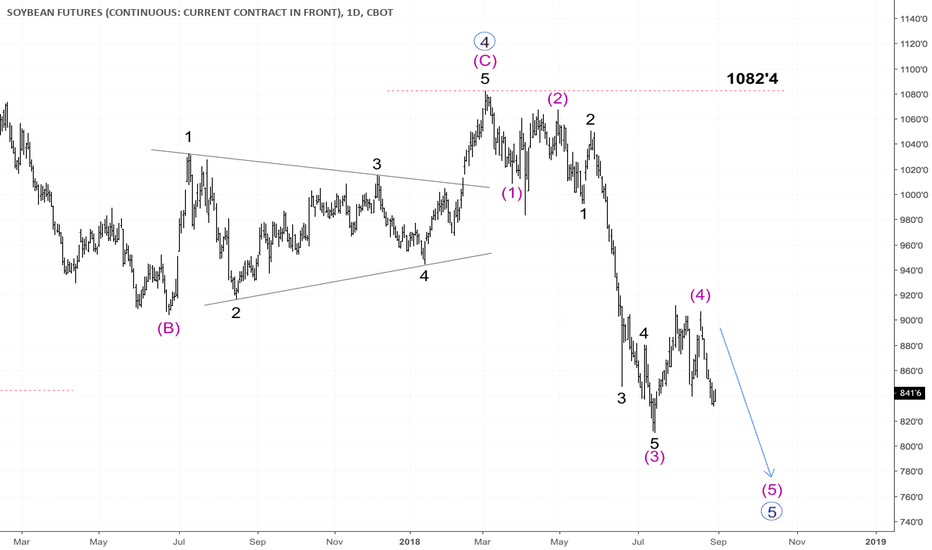

Soybean Futures Momentum BearishThis week price closed with strong bearish momentum after hitting the reversal zone.

With production estimated up, and uncertainty with China trade, the bearish momentum may push further to 854 - 820 level in coming weeks.

Looking to complete the downward range to -27.2% level of the weekly Fibonacci retracement range.

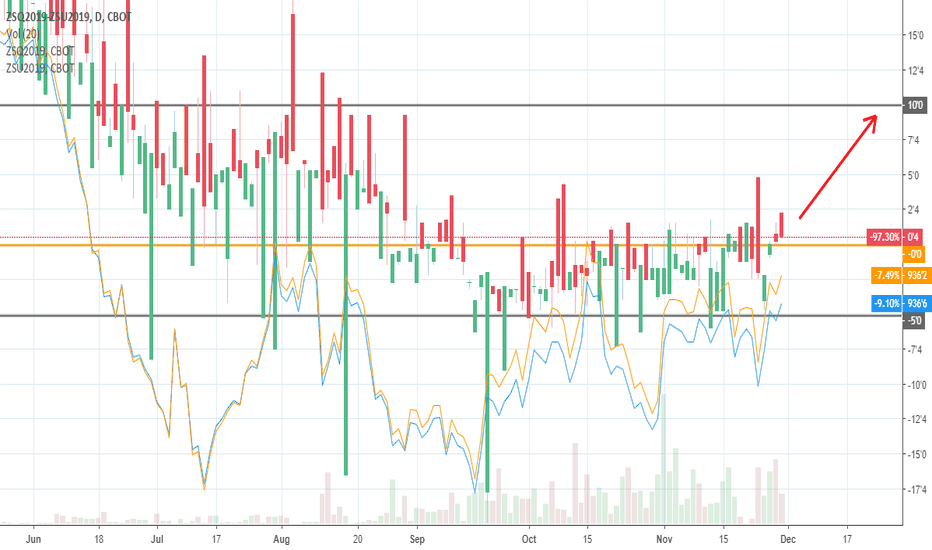

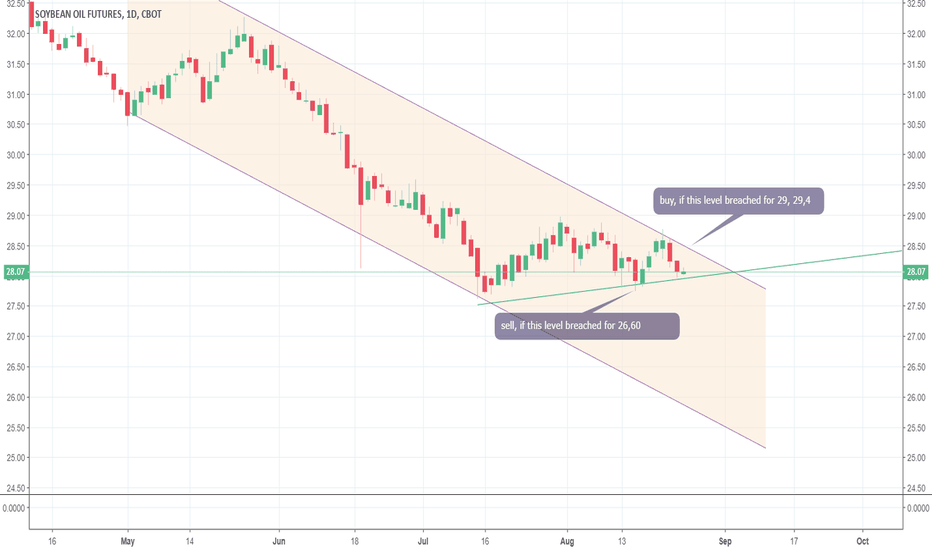

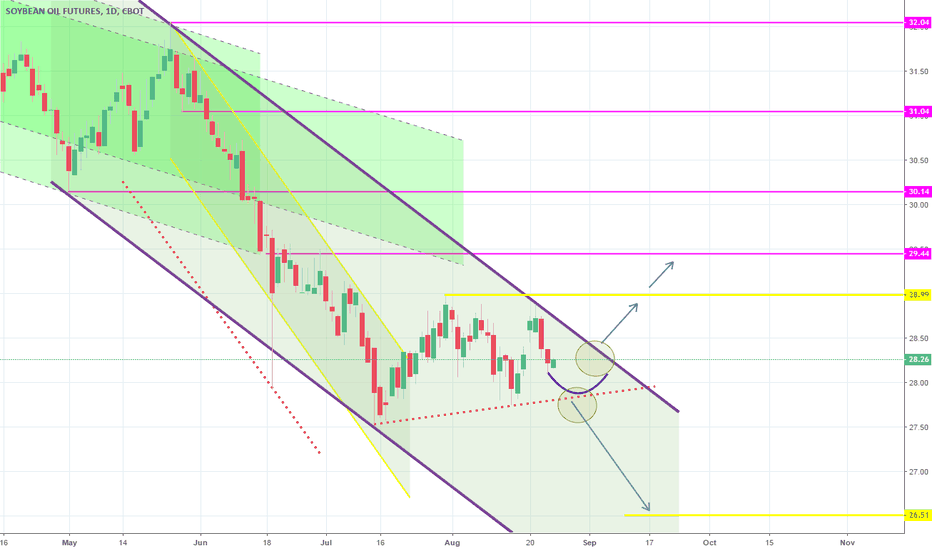

Targest hit. Wait for confirmation on breakout points.Both TP = 30.14 and 29.44 hit as the previous bearish Channel aggressively broke earlier and met the targets much earlier than I expected. Soybean Oil has now entered a new Channel Down on 1D, which is coming off a Lower High (hence Highs/Lows = 0, RSI = 51.334). We now need to wait for confirmation from the two break-out points (illustrated by the circles). If the upper point breaks then we will go long (TP = 28.99 and 29.44). If the lower point breaks then we will go short (TP = 26.51).