SPCE is a Goldmine in 2021 www.virgingalactic.com

Dec 11th is a major deal! This is the 1st of two test flights until they "Have a go!" and send real passengers into space. The list is long with a lot of Billionaires :) at I think $250K a head WOW!

"Before passengers climb aboard the suborbital space plane SpaceShipTwo, the space tourism firm will send at least two powered test spaceflights aloft from New Mexico's Spaceport America, where the company moved earlier this year."

Space

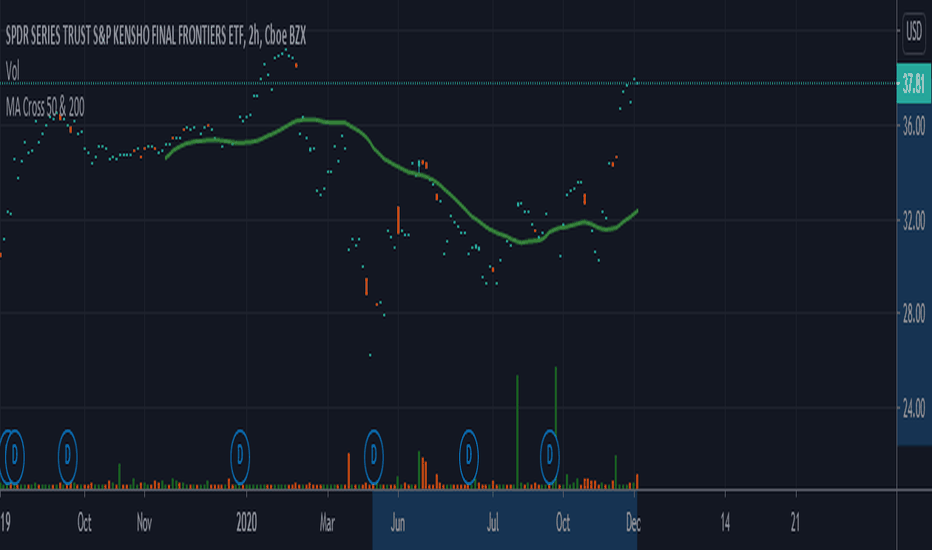

Mr. West on ETF of the day The Exchange Traded Funds (ETF) are a combination of other traded public companies that are gathered together based on sector, industry, and performance. The SPDR S&P Kensho Final Frontiers ETF, ticker symbol (ROKT) has been performing at a high rate. For the past several months, ROKT has grown 70% since it's sharp drop in March. (See image link below)

The ETF total net assets consist of top companies like; Maxar Technologies Inc, Virgin Galactic Holdings Inc, Honeywell International Inc, Heico Corp, Lockheed Martin Corp and many more companies that reflect the Industrial and Technology industries. According to Watch Market, ROKT has a strong portfolio that focuses more on Industry market which is at 86%, Technology at 10%, and Oil & Gas at 3%. Majority of these Industry companies are looking to push the envelope of space and space materials like Northrop and Grumman and Virgin Galactic.

It is trading at 38.59 a share and has a low of 38.53.

My prediction that this will continue to perform over the next 30 years as space exploration will tend to be a mission for many top Space companies.

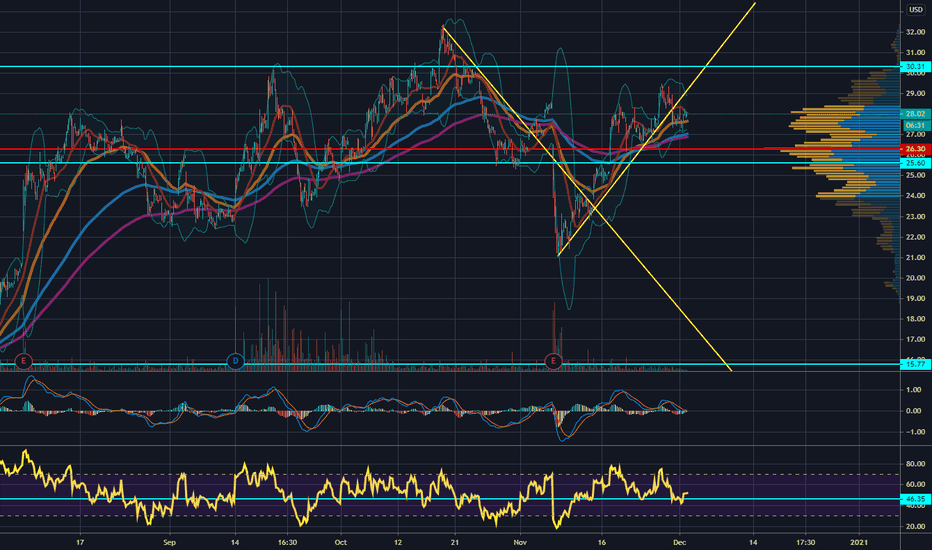

MAXAR about to give backMAXAR is one of my fav stocks, but today I've decided to enter a put position for January at the $20 mark. Will it get that far? Probably not, but there is strong evidence to show its cooling off creating a massive head and shoulders as you can see in the graph. This could make some nice solid gains in the short term. Theres nothing else to really to say besides arkq dumped a large spce position, so space stocks may need time to cool off.

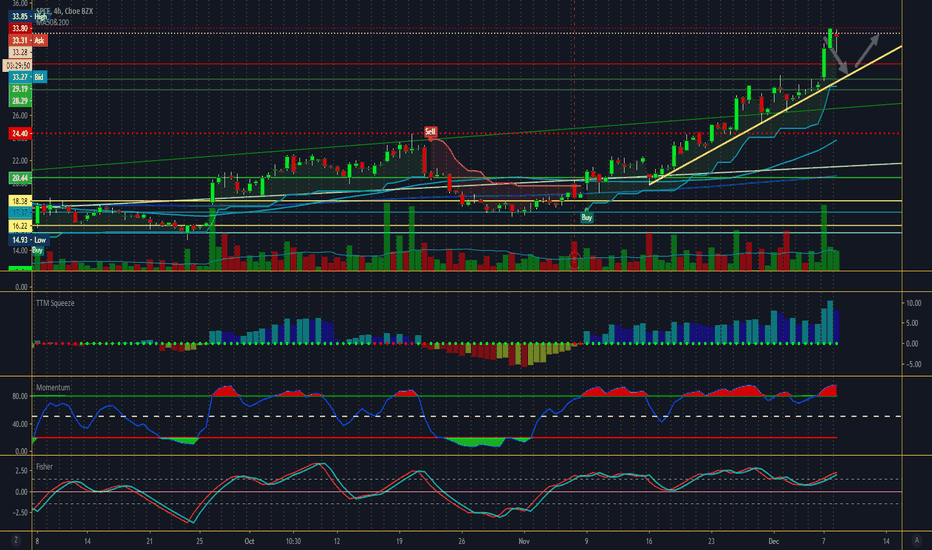

SPCE Life is probably better in Space...The wealthy Might need to go to space to make up for all the traveling they missed can't see this doing bad even in a economic downturn the rich have even more money now then before Covid. Like The Cup and Hope for A consolidation Reset to Form handle Then Break with Enough Power to get Through the Resistance on volume.. Depth of cup is about 7.50 so look for a move up to the 30's

NNDM almost hit our targetHello my friends and long time no see. I have personally sold out of nndm and didn't catch our move to the upside with is almost hitting our target in our last TA. This TA/Idea is going based on what the graph shows, so no news.

News

Well I'm not lieing about any news cause I'm not gonna read it, but ark has invested into NNDM , which caused it to almost hit our target. Ark is probably the best company to follow and them investing in a penny stock shows its not a penny stock to them and has potential.

-Earnings coming up, so it will be interesting to see. If you have any news that might come out it will be great. Again I suspect them to beat earnings, but a pull back before will be a buy imo

-elections results still going on with recount, but won't hurt nndm since space is going private

TA

-MACD is bullish, but can turn over

-RSI is overbought

-A retracement to 3.54-3.64 is on the table before moving higher. Also if we break above 4.10-4.20 we could suspect to go create higher highs with 4.09 being our resistance point.

-High vpvr from 3.80 and up, which is bullish

Final Thoughts

I personaly did sell and been leveraging on bybit for bitcoin, but I did buy the 7.5 may 2021 call and up 44% and also some shares. I would buy more shares, but my RH account is locked cause I accidentally used the wrong bank to deposit money, so I have to wait till funds are settled. Till then I'll watch for a pull back hoping I can buy.

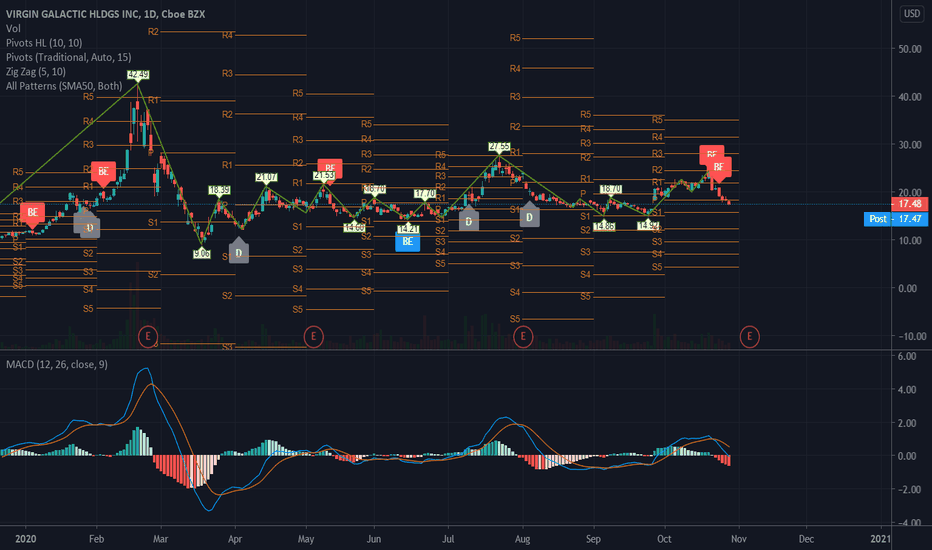

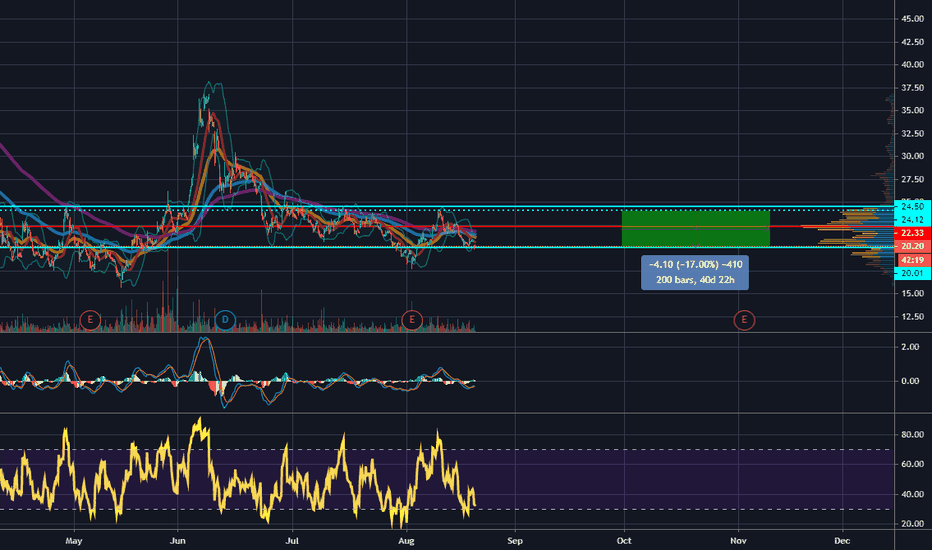

Trade setup in the worksLooks like this goes to support level 1 (S1) then a likely bounce back to at least Resistance 1 (R1), MAYBE higher.

Should reach R1 by end of Nov, maybe sooner based on pattern here.

My alert is @ 16.5 and will jump in around there once I catch the bounce.

No bounce and I recommend holding off until a sign of change in direction.

* Template & indicators used*

*Zig Zag

*Pivots

*Vol

*All Patterns SMA50 Both

*MACD

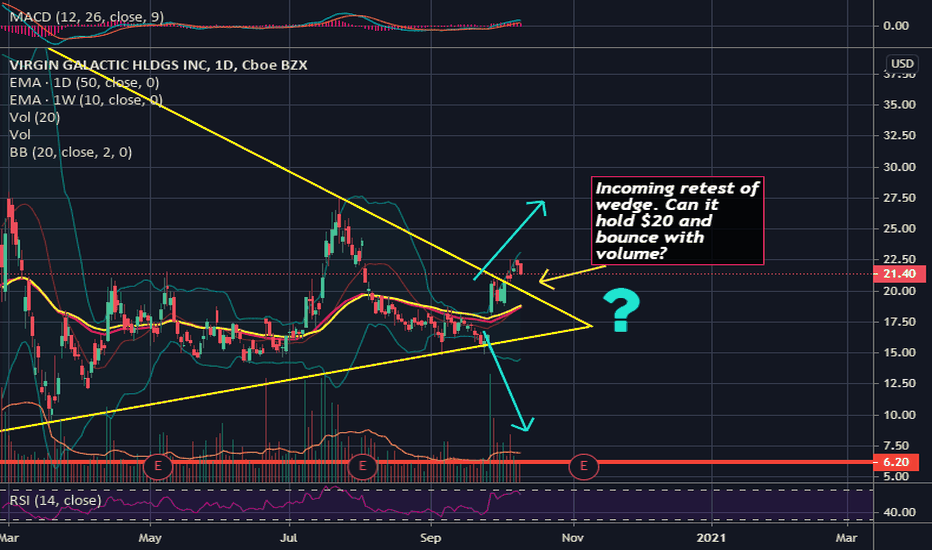

SPCE has broken the wedge. Retest and a bounce needed to confirmPlease see my previous analysis linked to this update. We see SPCE has already broken the wedge ahead of schedule, indicating very bullish sentiment. Some are calling it "the only pure-play" in the future of Space. Who wouldn't want to take a ride?

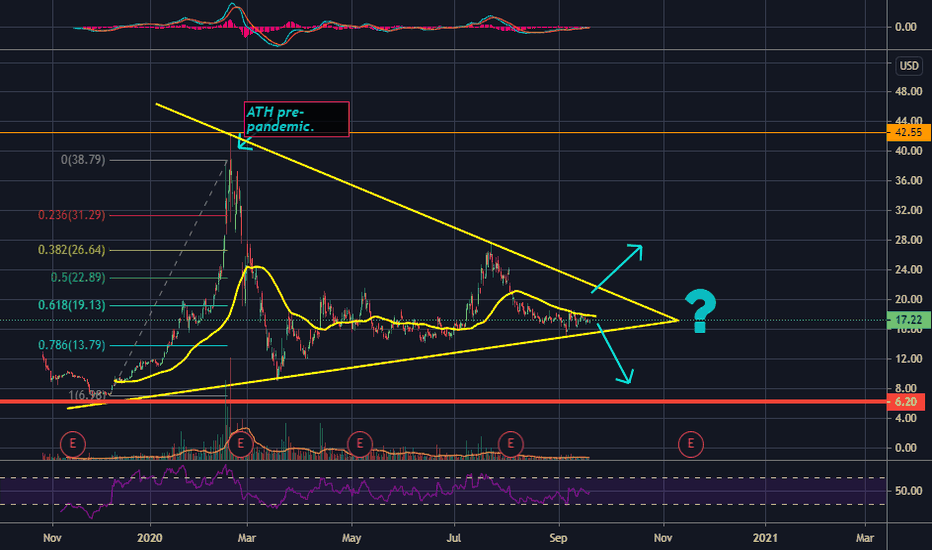

SPCE VIRGIN GALACTICGood afternoon, I hope you're all right. Today we present our analysis of SPCE until the end of this (terrible year 2020) MEDIUM TERM. To see this idea I recommend you move around the chart to see medium and short term.

Currently it is in a flat structure, without movements of interest in the last days and without showing possible movements, create a new trend:

SHORT TERM WILL TOUCH THE FIRST SUPPORT, Red OR GO TO POINT A

MEDIUM TERM LEVEL B : BULLISH OR LEVEL C : BEARISH

Sincerely L.E.D Thank you very much for your time and your support.

In Spain at 3/10/2020.

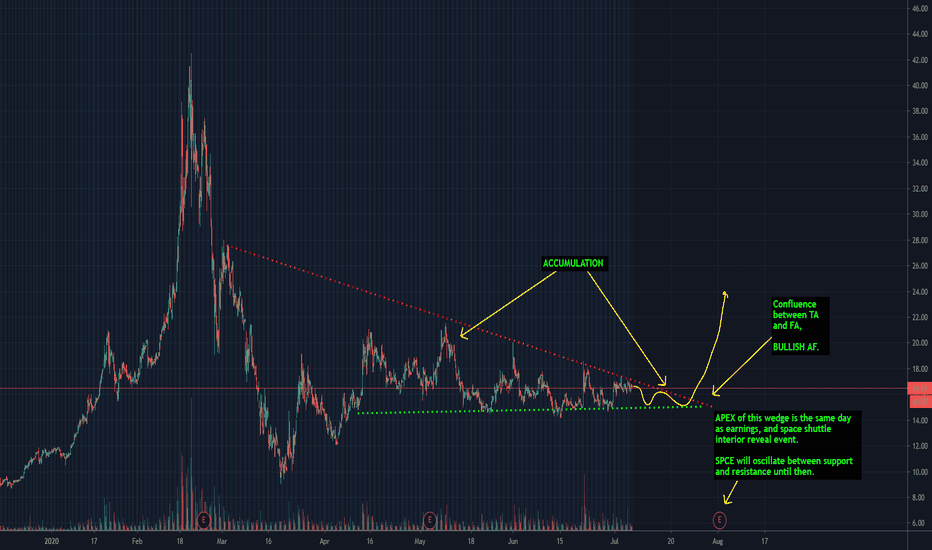

VIRGIN GALACTIC aka SPCE is reaching an apex, will it launch?Hey everyone, today we're looking at a longer-term stock that has the potential to get exciting very quickly. I'm really liking how the fundamentals and the technicals are lining up on this wedge I've drawn, what do you think?

Note the end of this Wedge is targeted by November 2020. Meanwhile, there is a strong catalyst that will have this stock either moving higher or lower, and one should be watching this wedge pattern alongside the news:

4 days ago this report came out:

The flight will be the first of two that the space tourism company has planned to complete testing of its SpaceShipTwo spacecraft system and should have just two test pilots on board," CNBC's Michael Sheetz wrote.

"Virgin Galactic said last month that the second test spaceflight will then have four 'mission specialists' inside the cabin," Sheetz added. "If both test flights succeed, Virgin Galactic expects to fly founder Sir Richard Branson in the first quarter of 2021."

If you aren't watching SPCE right now, it's probably a good time to buy and then watch your indicators. I'd hate to miss this, but it's a high risk, high reward trade and so one should set a stop-loss according the the wedge and use the fundamental news as an indicator to match against the future candlestick pattern.

Good luck and happy trading.

Disclaimer: I am not a professional, nor do I claim to know what I am doing. I chart for my own education and revealing potential trade setups. I am always open to constructive feedback and resources that you can recommend to "up" my game. Thank you!

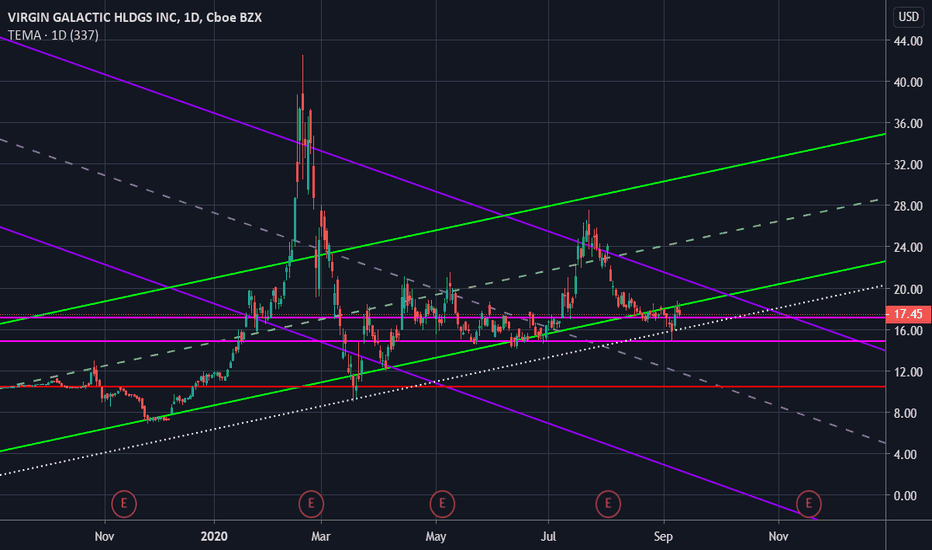

[SPCE] Launching to the MOON: Follow the Dashed GREEN Road!Mostly cosmetic updates for funzies and some bigger picture on this for you all.

Never gonna close below $10.50 on the 1W again.

Under white dotted line Price is likely to bounce back quickly... fantastic value.

Magenta is the current Value Zone.

There is what looks to be a decent fractal from the end of 2019 that may be playing out here at about 4x the scale. If that does come true, it would mean we drop down to the red line soon for a few weeks before we skyrocket again. That would align with an ensuing market crash and earnings FOMO blast off.

Lets see if it plays out! B)

Spirit Aerosystems a play or not?Spirit Aerosystems isn't spirit airlines. It's own by boeing and makes parts for boeing and inovates in the aerospace sector and from its website is also into space with a virgin galactic partnership. Now I've been watching this for awhile, yet I'm still not sure if i should go in but heres some levels I'm looking at.

Current findings

-Their earnings is they are losing money, yet they are tied into boeing and if boeing isn't making money they aren't either

-They have ties to the space sector, which comparing it to the other space stocks, they are underperforming

-They pay divends, so you could become a long term holder and get paid while hoping this company can recover after COVID

-Boeing has had a 34% drop in its price around June, yet SPR has had about a 50% drop giving this stock a potentional upside of 20% to go side by side with boeing. This reflects that SPR is struggling and can be shown as this company wants to layoff over 1400 people. From a quick search they have just over 5k people working from them. Big hit on their workforce short term.

Buy In

-Now I've market that you may take a position at this level with a 20% bounce back, yet I'll be watching for two key levels.

1: Sub 20 dollars since to be a fair value and has gone down as low as 16.70 (with dropping lower, yet springing back). Sub 20 dollar since like a good start if you want to dip your toes in.

2: An optmistic bull and don't mind gambling is taking a position in when it gets too 24.12-24.5 hoping for a breakout. Now this same level could be profit takers, yet around May 27th when it hit this level it broke out and giving a $12 high profit per a share. Roughly 30% return.

Final Thoughts

Its interesting stock and will just wait if it goes sub 20 and you could be worried if boeing would cut this company to cut boeing's loses, yet thats the doom mindset and don't think that will happen. I'll remain Neutral on this stock

Expanding On My Last Idea: I LOVE EVERYTHING ABOUT SPCEJust expanding on what I just said. I love the idea of this company and like Tesla, it could be the first of it's kind. 10 years ago people laughed at Tesla, now they're singing a different tune as Tesla is the most valuable car manufacturer in the world. Mark my words... 20 years ago it was the internet boom, right now and the last 10 years it's the tech boom, 4G/5G, streaming.... the next 10-20 years will be a space industry boom. I want to be in at only $20 a share.

-Aaron

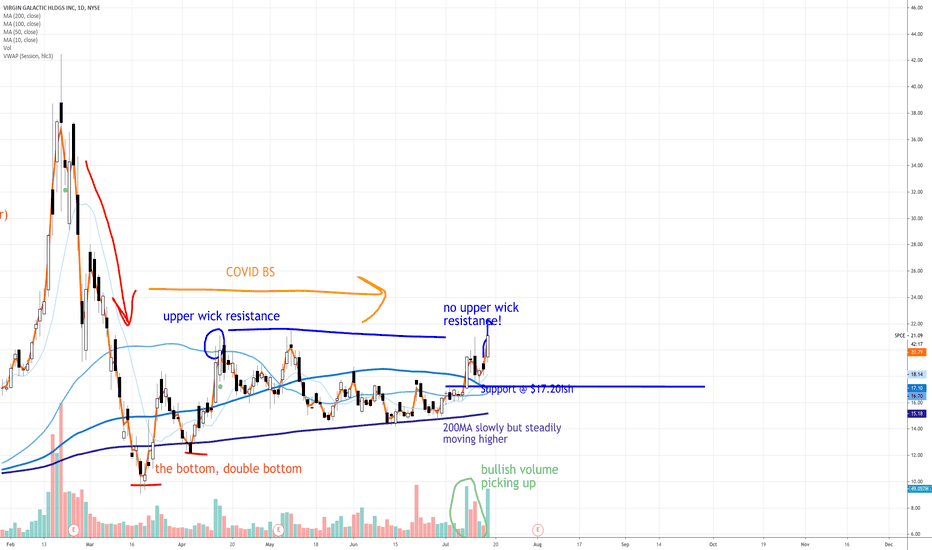

SPCE Bullish Breakout: The Beginning To New Highs (IMO)In my opinion, SPCE is a lifetime stock. I'm just happy to be young and alive at it's IPO. I'm holding shares and I believe in this company. I DO believe we're bullish from here, no reason to fall back to $10-$15 again.

• Disney executive appointed new CEO is legitimizing the company as "this is real"

• Ships are almost ready to go

• Branson is first in line to go to space (I'd be second if I could)

• We're on the backside of COVID - this stock could held highs and already moved higher if we didn't have the market crash

• NEW bullish activity happening now and VOLUME is picking up

• Cabin reveal is coming up at the end of month

• Hundreds of preordered tickets confirmed and thousands in reservation mode (over 100 million in possible sales already)

THE FUTURE POSSIBILITIES

• tickets get cheaper

• Disney creates a "space world" in partnership with Virgin Galactic (zero G simulation rides, education/inspiration rides, best planetarium you've ever seen)

• interplanetary travel made much faster - Atlanta to Tokyo in 2 hours with new ships (this is actually already being planned)

• VG ships are already compatible with current international airports (no special runway or launch pad needed)

• other space and research partnerships with medical companies, NASA/government, satellite companies, etc

Buy and hold forever!!! This company could be the only stock you'd ever need to own. Imagine, $1000 price point in 10 years, with 1000 shares = $100,000 average profit a year. If you want to go to space, like I do, hold at least 250 shares and in 10 years they might be worth $250,000 and you can easily buy a ticket then. Bless!

Friendly reminder: All of this is my opinion. I do hold shares. Please invest wisely.

Virgin Secures Financial Package of $1.5 Billion - Huge Win!Just an FYI...

If anyone missed this today...

At approx. 1:59 PM today, news was announced that Richard Branson Secured a financial package for Virgin Atlantic of about $1.5 Billion.

www.barrons.com

This is also great news for Virgin Galactic Holdings, Inc. because it takes financial pressure off all the Richard Branson companies as a whole.

Also, on another note...

I've heard rumors the FAA gave Virgin Galactic the long awaited license it needs for space travel.

So we should have some great news forthcoming!

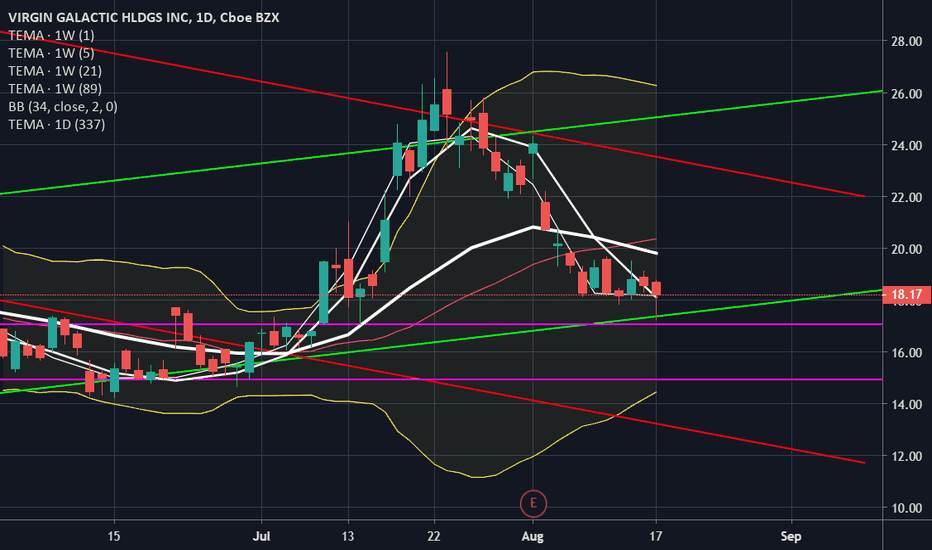

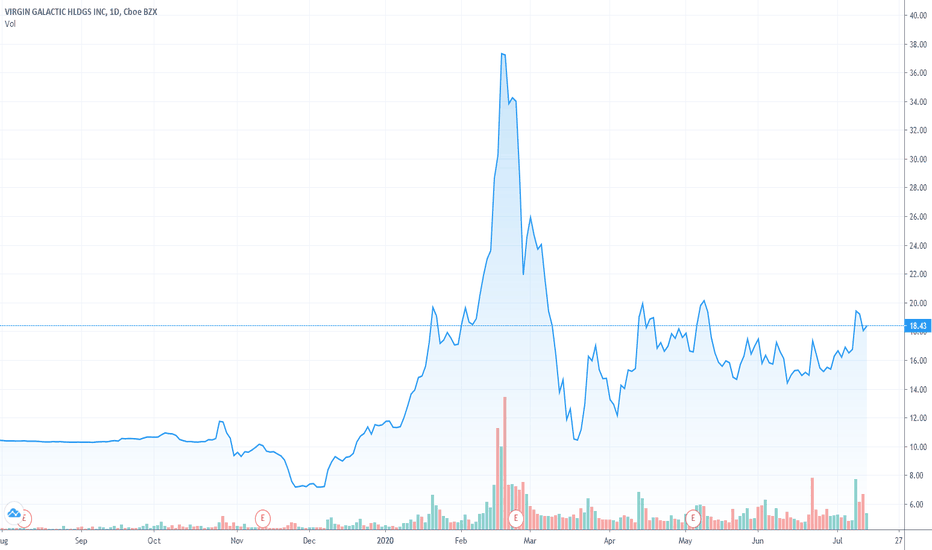

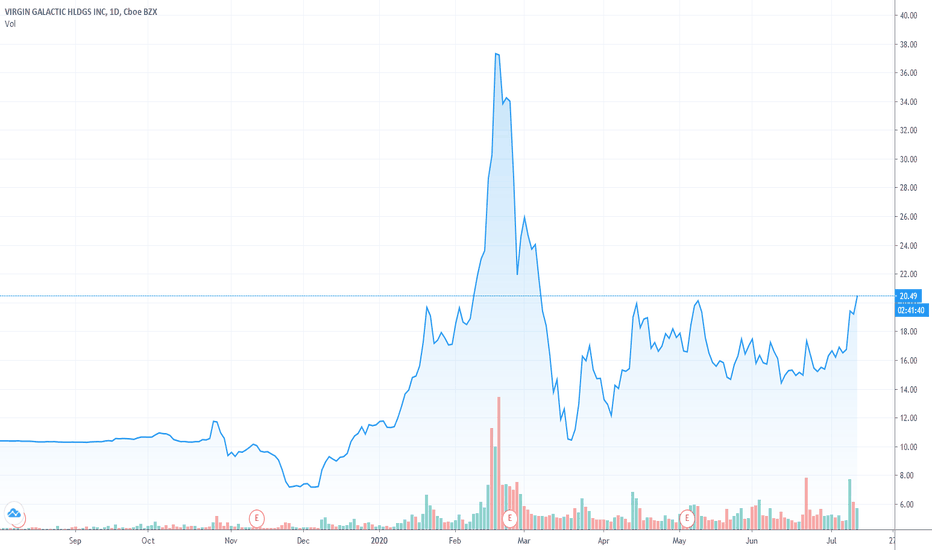

Daily Chart

SPCE is trading above the cloud and bounced up off support today to close up for the day, +0.33 at $18.43.

PMO is Bullish

RSI is Bullish

OBV is Bullish

Accumulation is Bullish

Where's the stock going from here? My guess...to the moon!

Best of luck longs!

DISCLAIMER

The Content herein is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Bullish Charts - The Space Force, News ForthcomingVirgin Galactic Holdings, Inc., an integrated aerospace company, develops human spaceflight for private individuals and researchers. It also manufactures air and space vehicles. The company's spaceship operations include commercial human spaceflight, flying commercial research, and development payloads into space. In addition, it designs, develops, and manufactures ground and flight testing systems, as well as provides post-flight maintenance services for spaceflight vehicles. Virgin Galactic Holdings, Inc. was founded in 2007 and is based in Las Cruces, New Mexico.

SPCE was upgraded a few minutes ago to a BUY

On 07/02/20, Virgin announced it will reveal the design of SpaceShipTwo's Cabin Interior via Livestream on July 28, 2020.

On 07/01/20, Virgin announced it is getting closer to obtaining an FAA License for Space Travel. (This alone should make the stock spike upon approval of the license)

On 06/23/20, NASA announced it is stepping up support for Space Tourism.

Virgin could be the Tesla of Space Travel.

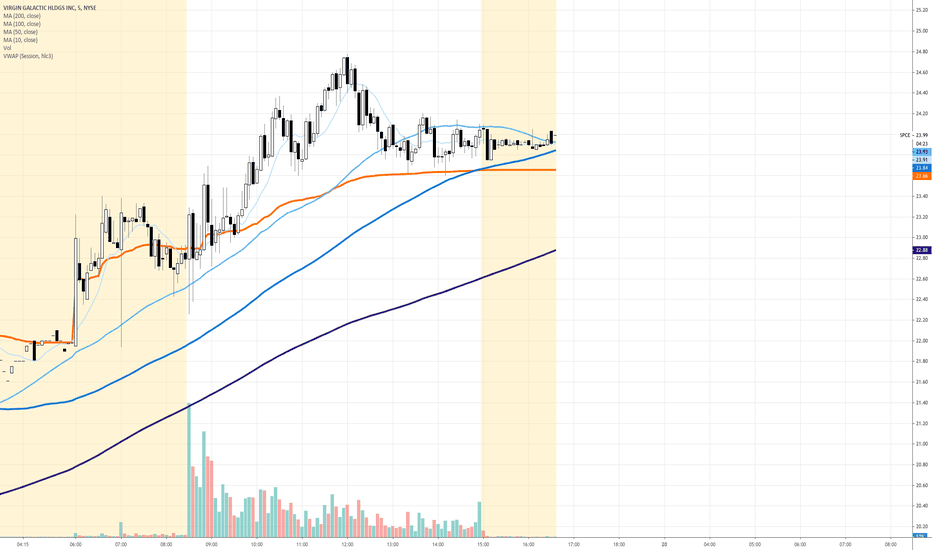

Daily Chart is Bullish

Volume is Bullish

PMO is Bullish

MACD is Bullish

RSI is Bullish

Stochastic is Bullish

Long!

DISCLAIMER

The Content herein is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

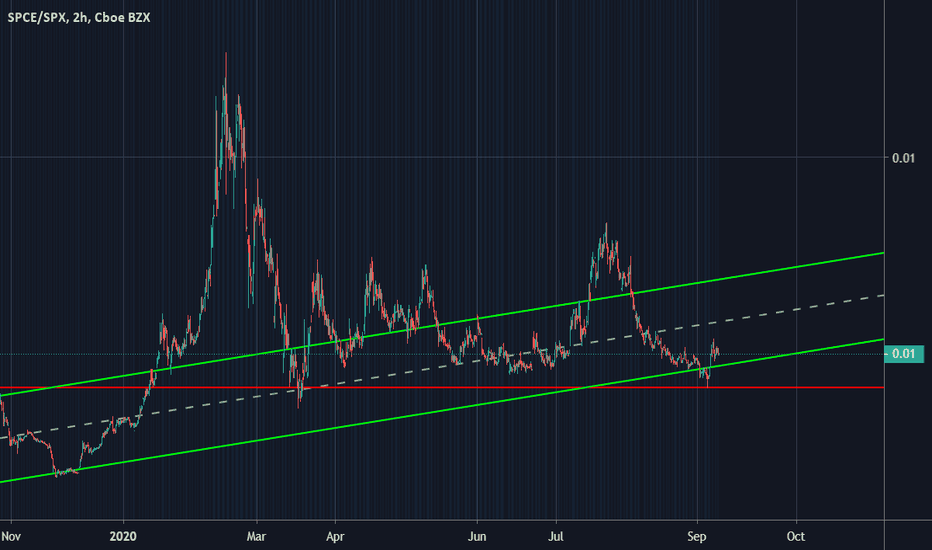

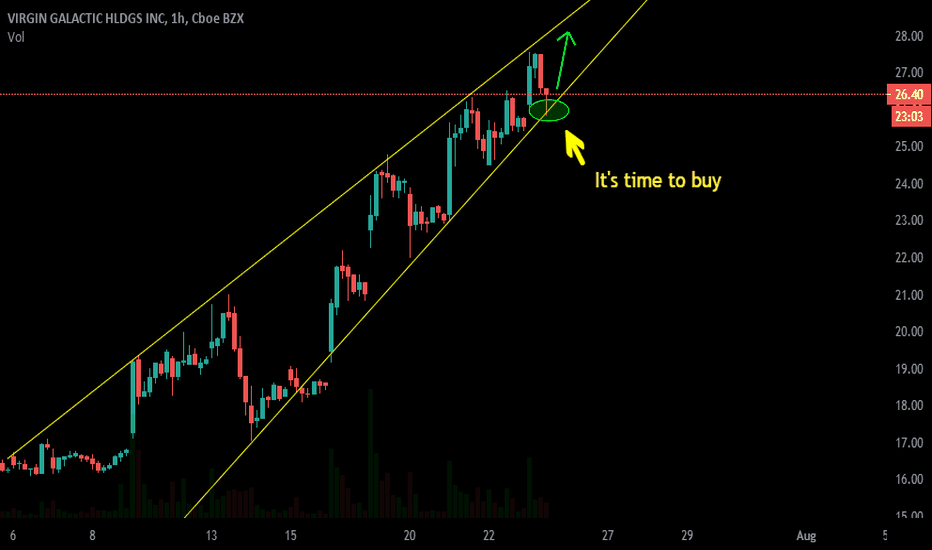

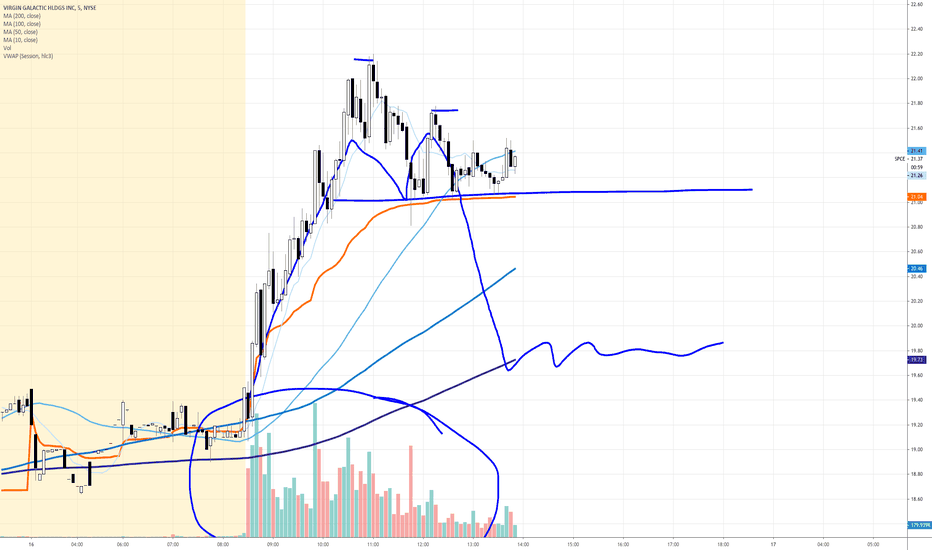

$SPCE testing its breakout resistance, big test coming!!SPCE is coming down to test the the previous resistance of the breakout trendline. This is typical of breakouts, and if it bounces from this point, I'd say we are cleared for higher.

If it gives up the range in the oval, this will turn into a failed breakout and SPCE could see much lower prices unfortunately.

FWIW, SPCE moves with the indices pretty aggressively, so I'm going to say everything will be dependent on the markets for the next 48hrs.

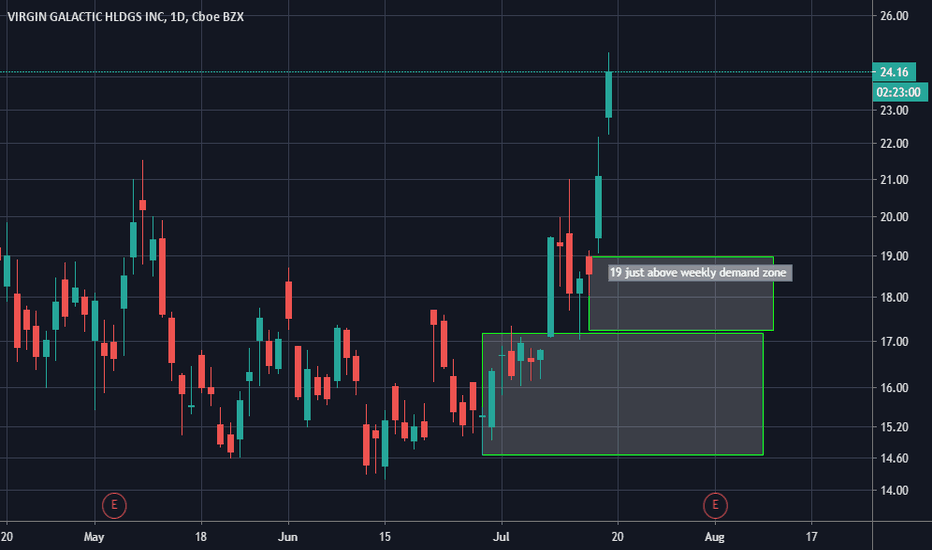

HUGE ACCUMULATION, TA and FA CONFLUENCE! HOLD ON FOR THE RIDE. Huge accumulation happening for the past 3 months. July 31st is the reveal of the interior of the space ship, and Aug 2nd is their earnings report, where they will more than likely announce they have received FAA certification, AND have scheduled date for getting RB into space.

This confluence is extremely rare to see in an asset.