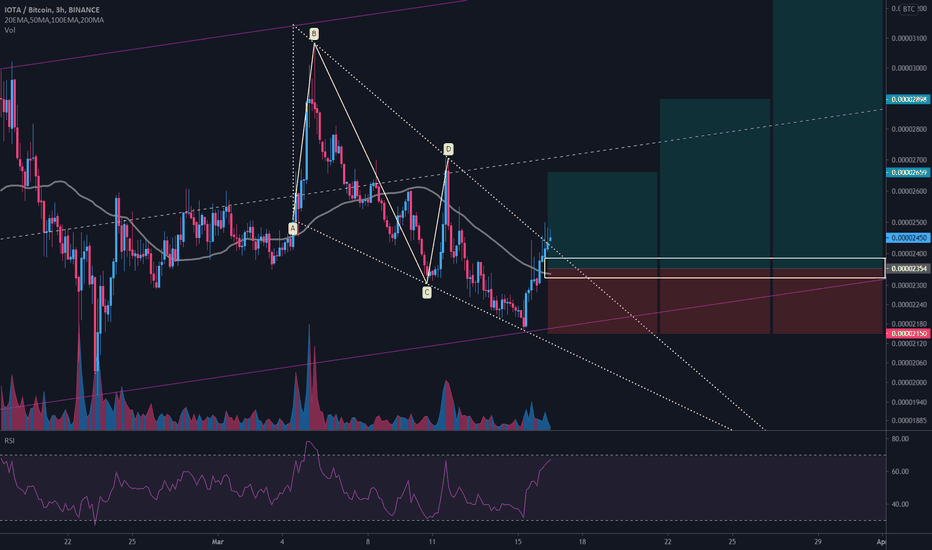

$IOTA/BTC 4h (Binance Spot) Falling wedge breakoutMiota is trending inside an ascending channel and has broken out of that falling wedge.

Let's wait for a pull-back and try to catch it on 50MA support retest, which is also a demand zone!

Current Price= 0.00002450

Buy Entry= 0.00002385 - 0.00002323

Take Profit= 0.00002659 | 0.00002898 | 0.00003316

Stop Loss= 0.00002150

Risk/Reward= 1:1.5 | 1:2.67 | 1:4.72

Expected Profit= +12.96% | +23.11% | +40.87%

Possible Loss= -8.67%

Fib. Retracement= 0.5 | 0.786 | 1.272

Margin Leverage= 1x

Estimated Gain-time= 2 weeks

Spot

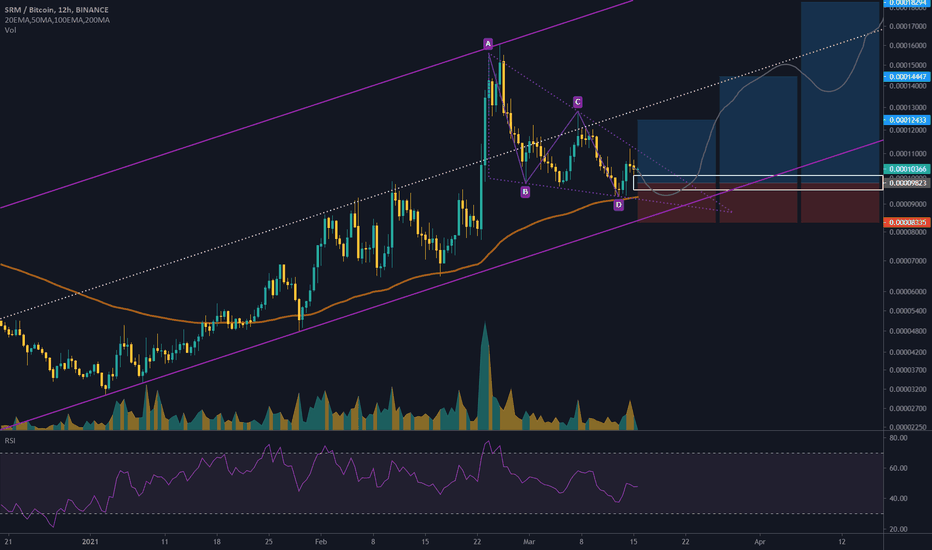

$SRM/BTC 12h (Binance Spot) Ascending channel on supportSerum is up-trending and forming a falling wedge, a break-out would be very bullish!

100EMA seems to be acting as support so let's place some bid down there and be patient enough.

Current Price= 0.00010374

Buy Entry= 0.00010110 - 0.00009536

Take Profit= 0.00012433 | 0.00014447 | 0.00018294

Stop Loss= 0.00008335

Risk/Reward= 1:1.75 | 1:3.11 | 1:5.69

Expected Profit= +26.57% | +47.07% | +86.24%

Possible Loss= -15.15%

Fib. Retracement= 0.5 | 0.786 | 1.272

Margin Leverage= 1x

Estimated Gain-time= 1 month

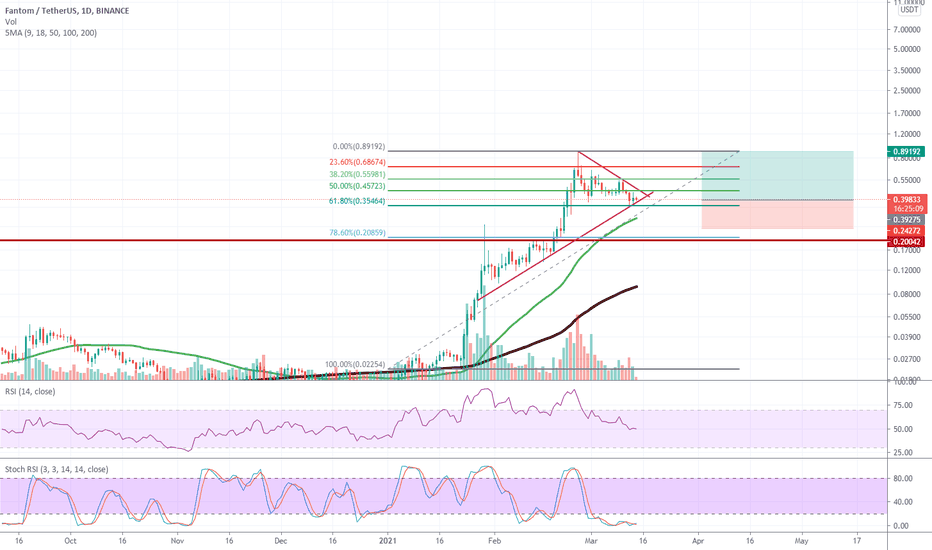

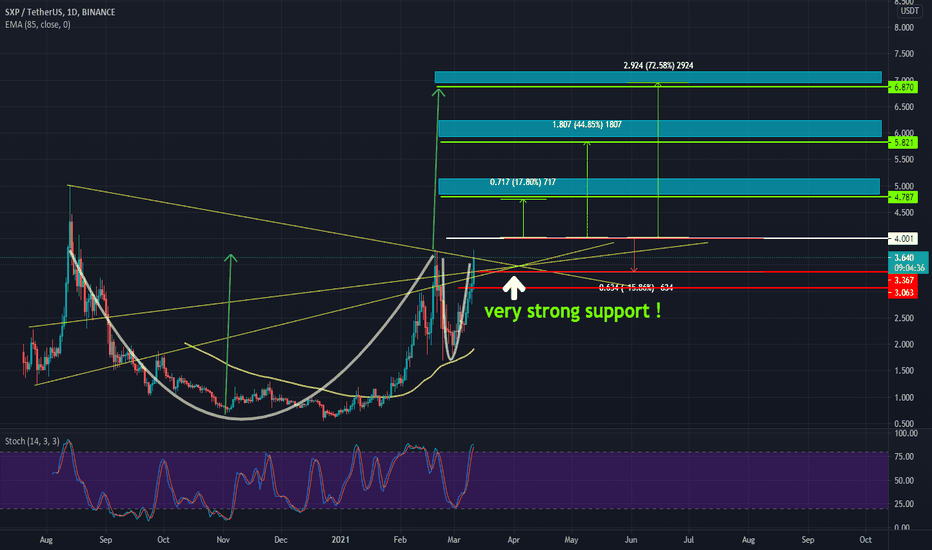

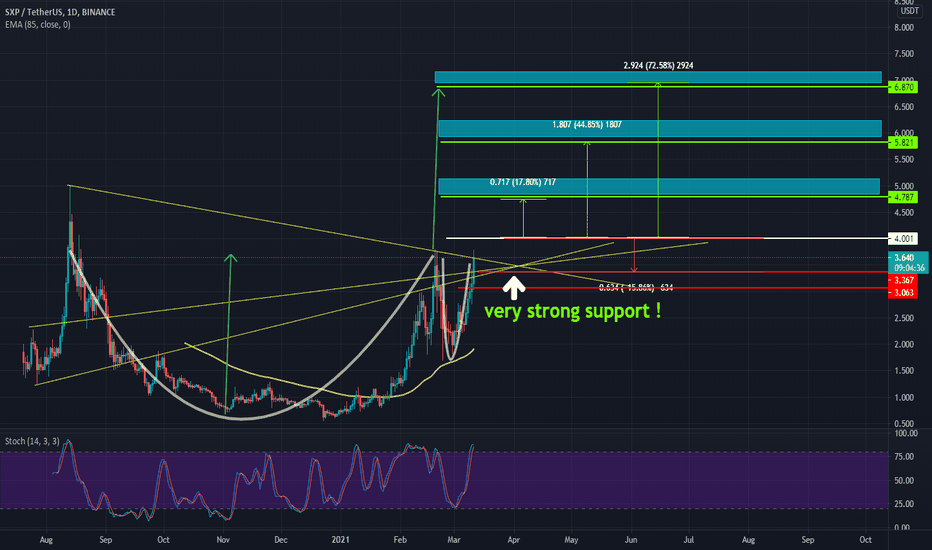

2x Profit with #FTM/USDT LongGreat oppurtunity to buy.Hold it in spot for at least one month.

R/R: 3

Indicators showing a perfect bullish wave coming soon so dont miss it.

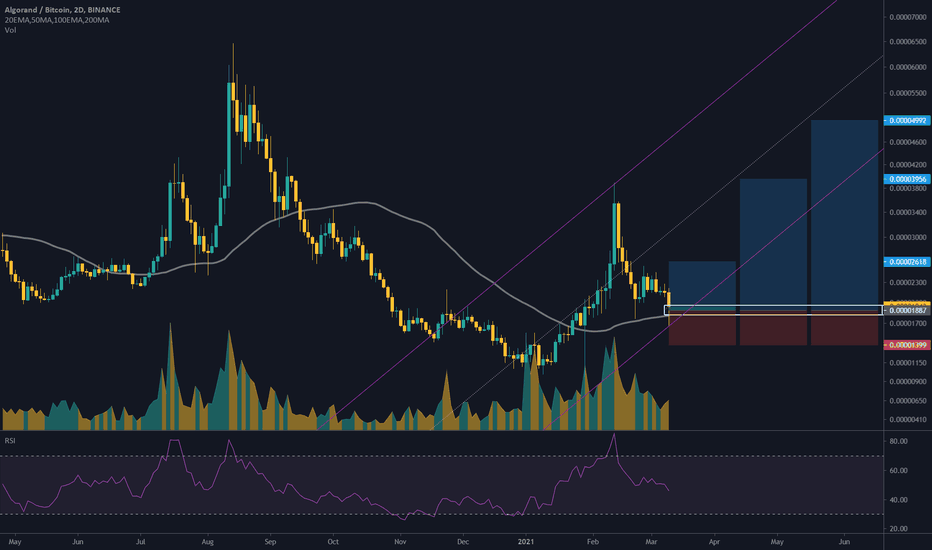

$ALGO/BTC 2D (Binance Spot) Ascending channel on supportAlgorand seems to have retraced enough from last spike, I think It's time to enter a swing!

Current Price= 0.00001943

Buy Entry= 0.00001956 - 0.00001818

Take Profit= 0.00002618 | 0.00003956 | 0.00004992

Stop Loss= 0.00001399

Risk/Reward= 1:1.5 | 1:4.24 | 1:6.36

Expected Profit= +38.74% | +109.64% | +164.55%

Possible Loss= -25.86%

Fib. Retracement= 0.382 | 0.618 | 0.786

Margin Leverage= 1x

Estimated Gain-time= 3 months

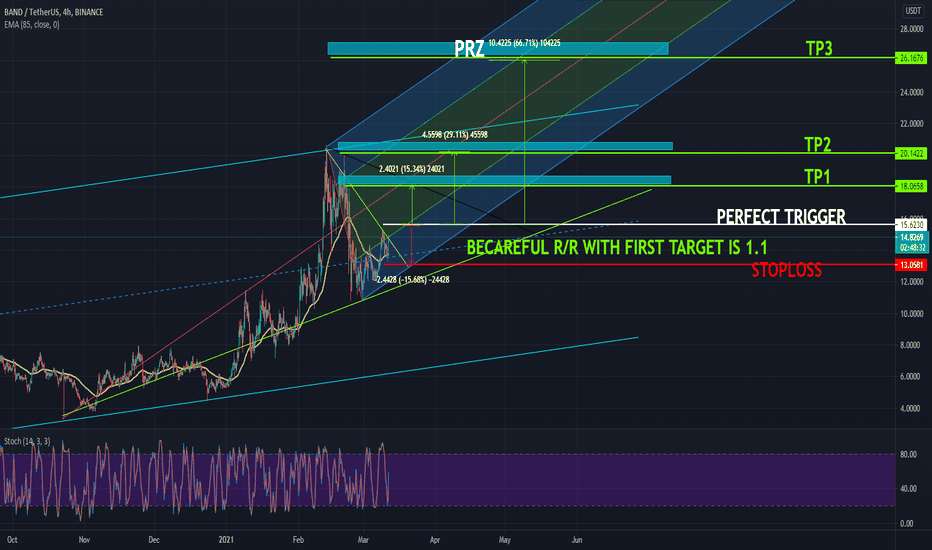

BQX BTC PAIR IN BINANCE SPOT LONG POSITION 8D

BE CAREFUL RISK / REWARD RATIO WITH FIRST TAKE PROFIT IS 1.3

FOLLOW AND LIKE MY ACCOUNT AND POSTS FOR MORE ANALYSIS !!

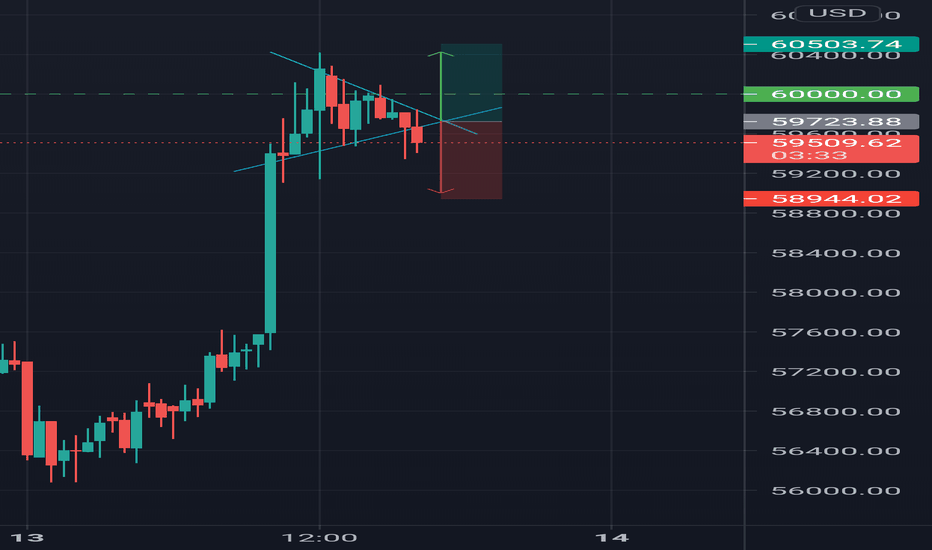

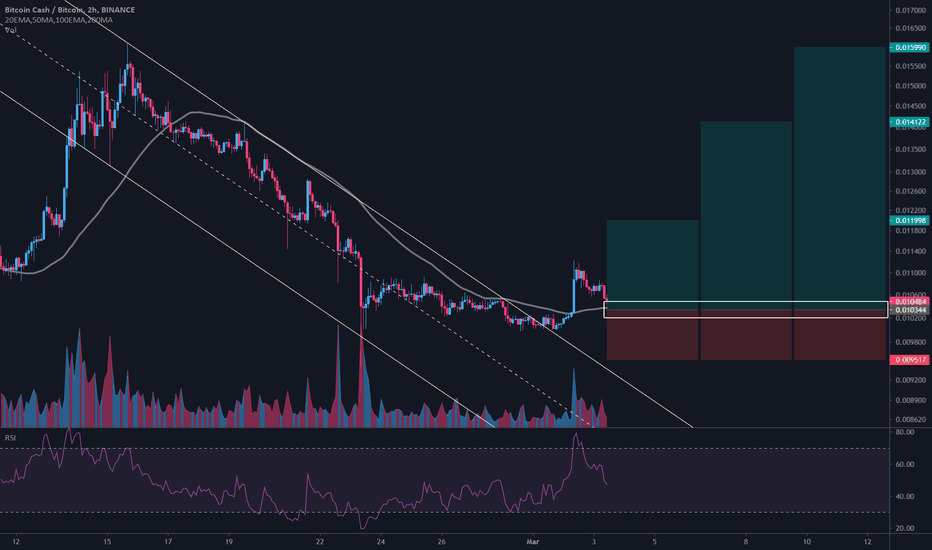

$BCH/BTC 2h (Binance Spot) Descending channel breakoutBitcoinCash is looking ready for reversal here in satoshi, I am adding to my current bag!

Current Price= 0.010484

Buy Entry= 0.010486 - 0.010202

Take Profit= 0.011998 | 0.014122 | 0.015990

Stop Loss= 0.009517

Risk/Reward= 1:2 | 1:4.57 | 1:6.83

Expected Profit= +15.99% | +36.52% | +54.58%

Possible Loss= -7.99%

Fib. Retracement= 0.5 | 0.786 | 1

Margin Leverage= 1x

Estimated Gain-time= 10 days

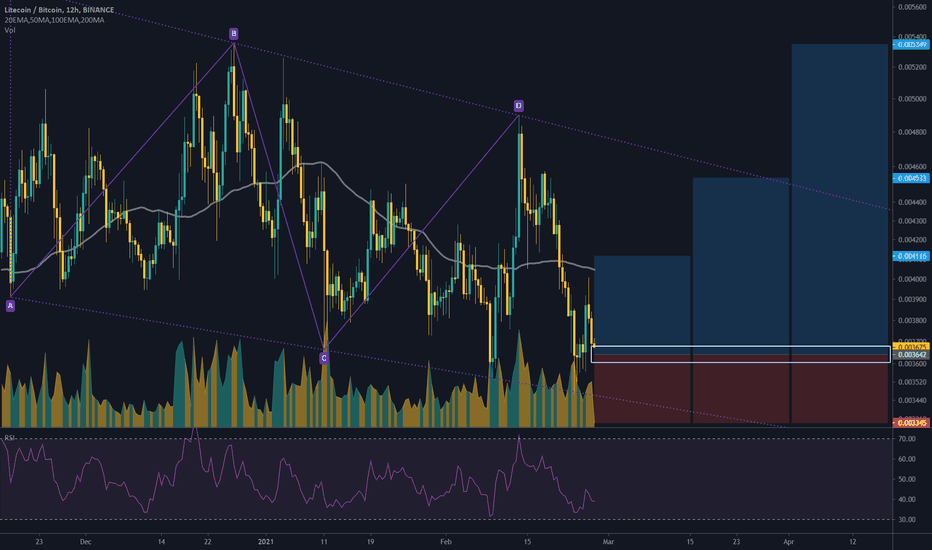

$LTC/BTC 12h (Binance Spot) Descending wedge on supportLitecoin is accumulating in satoshi and could bounce in the weeks to come!

Current Price= 0.003675

Buy Entry= 0.003679 - 0.003605

Take Profit= 0.004116 | 0.004533 | 0.005349

Stop Loss= 0.003345

Risk/Reward= 1:1.6 | 1:3 | 1:5.75

Expected Profit= +13.01% | +24.46% | +46.87%

Possible Loss= -8.15%

Fib. Retracement= 0.5 | 0.786 | 1.272

Margin Leverage= 1x

Estimated Gain-time= 2 months

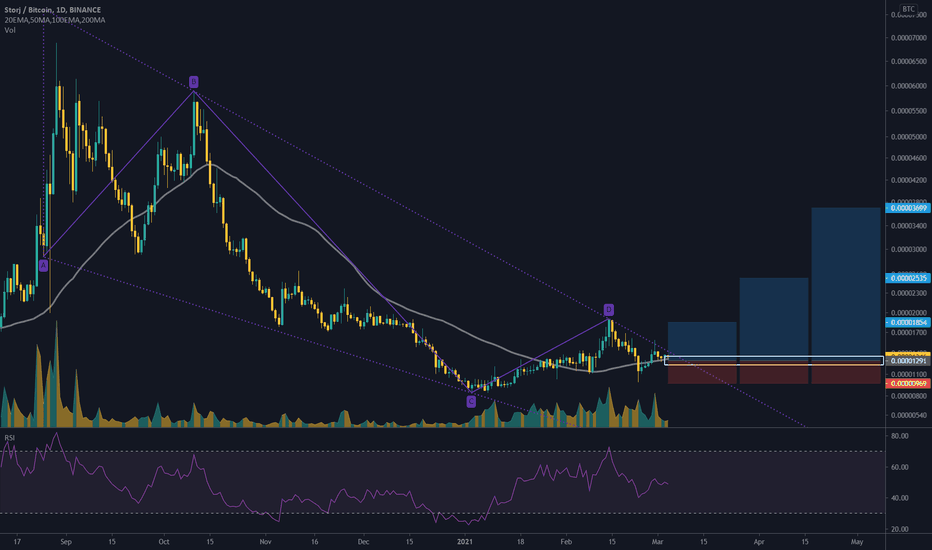

$STORJ/BTC 1D (Binance Spot) Big falling wedge near breakoutStorj is looking ready to reverse the downtrend here, we are grabbing a decent bag!

Current Price= 0.00001346

Buy Entry= 0.00001352 - 0.00001230

Take Profit= 0.00001854 | 0.00002535 | 0.00003699

Stop Loss= 0.00000969

Risk/Reward= 1:1.75 | 1:3.86 | 1:7.48

Expected Profit= +43.61% | +96.36% | +186.52%

Possible Loss= -24.94%

Fib. Retracement= 0.236 | 0.382 | 0.618

Margin Leverage= 1x

Estimated Gain-time= 2 months

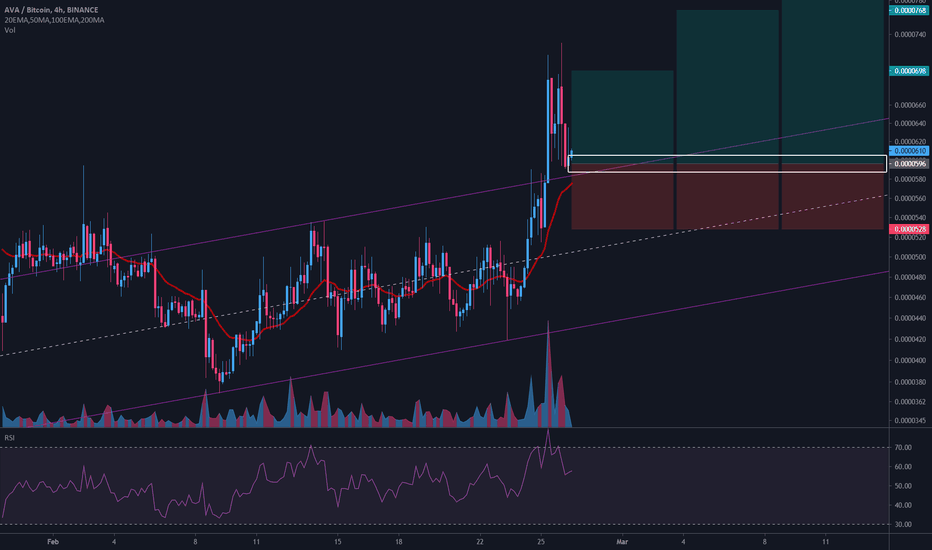

$AVA/BTC 4h (Binance Spot) Ascending channel breakout and retestTravala is looking ready for bullish continuation, let's enter here!

Current Price= 0.0000610

Buy Entry= 0.0000605 - 0.0000587

Take Profit= 0.0000698 | 0.0000768 | 0.0000844

Stop Loss= 0.0000528

Risk/Reward= 1:1.5 | 1:2.53 | 1:3.65

Expected Profit= +17.11% | +28.86% | +41.61%

Possible Loss= -11.41%

Fib. Retracement= 0.786 | 1.272 | 1.786

Margin Leverage= 1x

Estimated Gain-time= 10 days

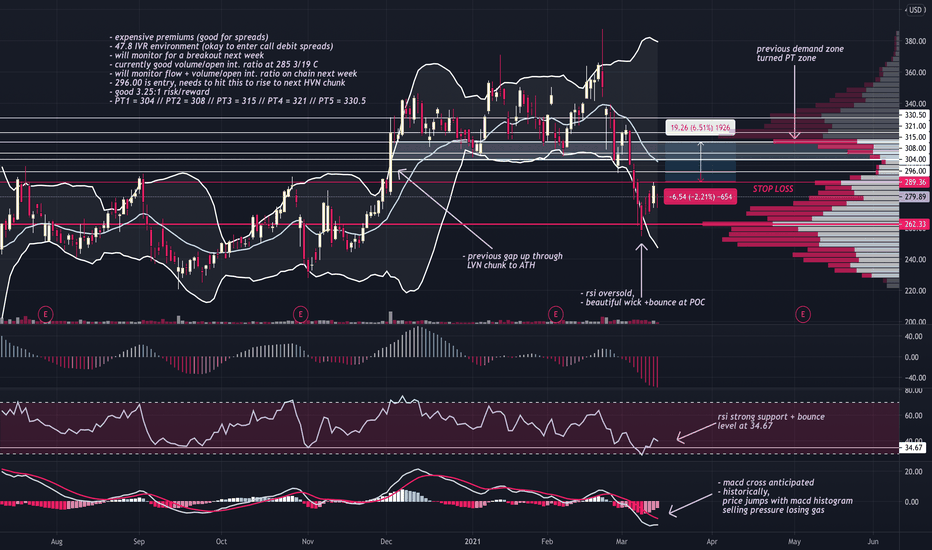

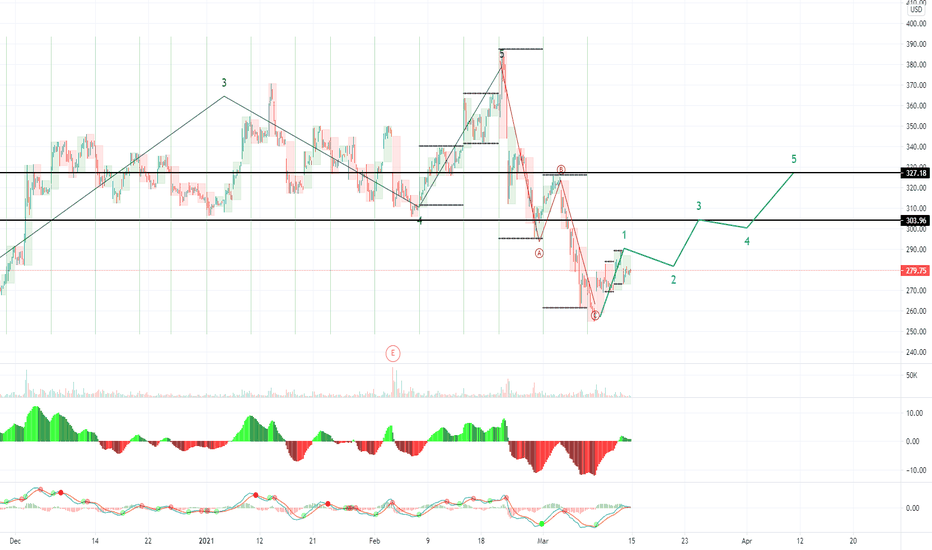

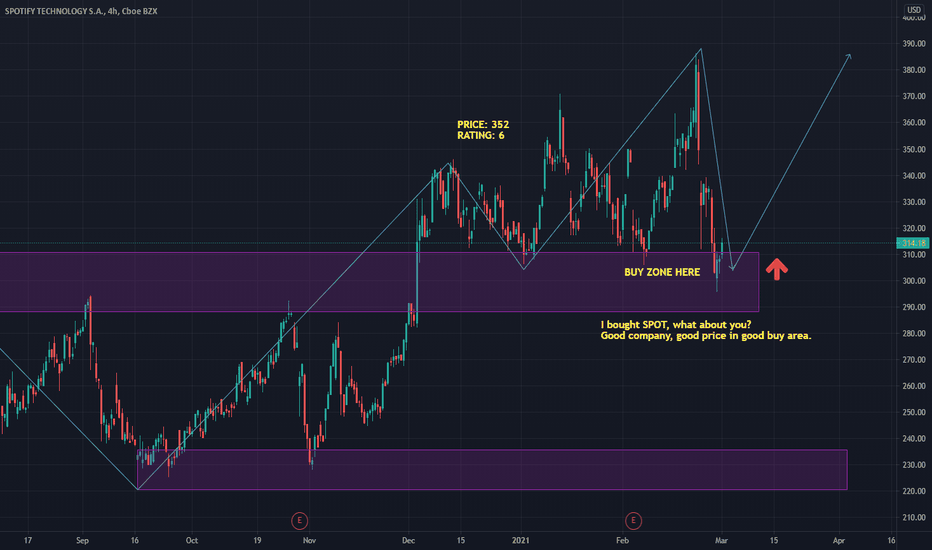

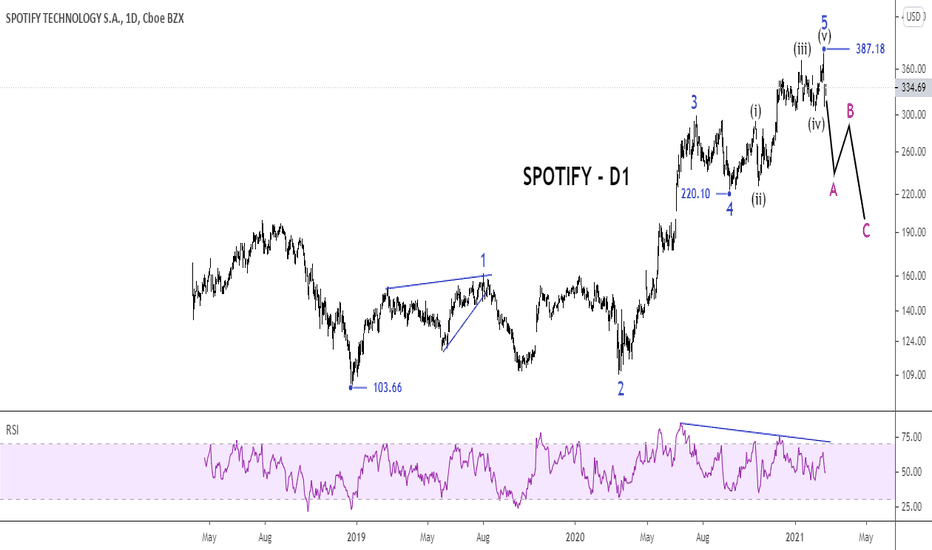

Spotify Stock to Lose Half of its 2020 UptrendIs this a good time to join Spotify bulls? Let’s see how the situation looks like from an Elliott Wave perspective.

The daily chart above puts Spotify advance from its December 2018 low in Elliott Wave context. The chart reveals that the uptrend from the 2018 low at $103.66 is shaped as a complete five-wave impulse. The pattern is labeled 1-2-3-4-5, where the five sub-waves of wave 5 are also visible.

There is also a good alternation between the correction, wave 2 is a time-consuming flat pattern that completed during the coronavirus panic of 2020, and wave 4 is a sharp zigzag move. According to the theory, a three-wave correction follows every impulse.

The corrective phase of the Elliott Wave cycle typically erases the entire progress achieved by the fifth wave. Applying this to SPOT stock makes us expect a decline back to the support of wave 4 near $220 a share . If this count is correct, a ~43% drop from the top at $387 seems to have just begun. The double bearish RSI divergence between waves 3 and 5 also indicates the bulls are running out of steam

What's your view on Spotify Stock? Let me know in the comment section.

Thanks for reading!

Veejahbee.

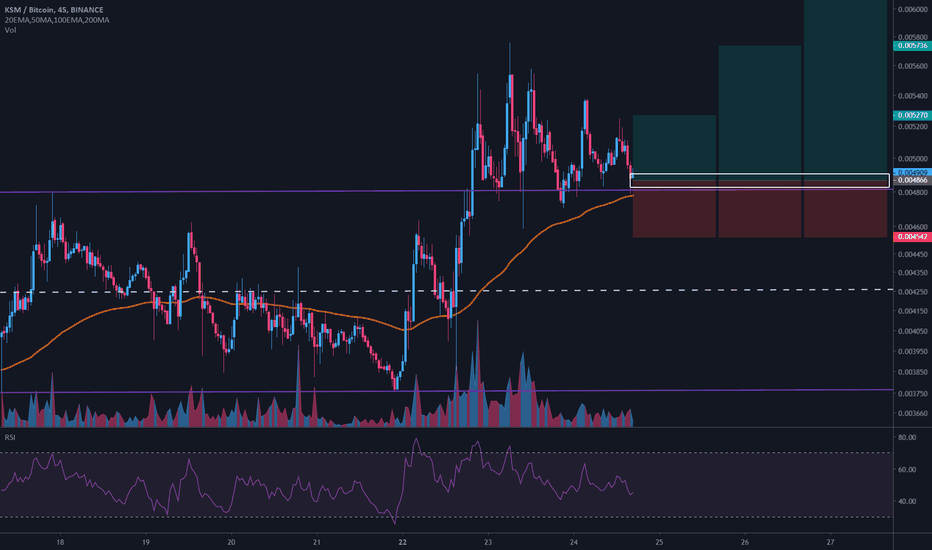

$KSM/BTC 1h (Binance Spot) Rectangle breakout and retestKusama broke bullish and is accumulating above the box, trend continuation is likely.

Current Price= 0.004909

Buy Entry= 0.004906 - 0.004826

Take Profit= 0.005270 | 0.005736 | 0.006289

Stop Loss= 0.004542

Risk/Reward= 1:1.25 | 1:2.69 | 1:4.39

Expected Profit= +8.30% | +17.88% | +29.24%

Possible Loss= -6.66%

Fib. Retracement= 0.618 | 1 | 1.414

Margin Leverage= 1x

Estimated Gain-time= 5 days

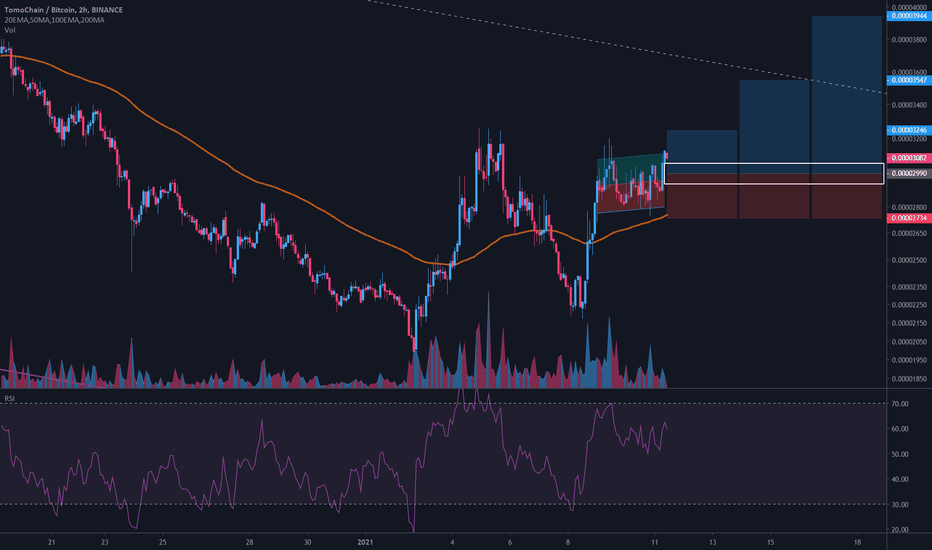

$TOMO/BTC 2h (Binance Spot) Bullish flag near breakout#TomoChain is looking ready to continue the uptrend, let's join it on next dip!

Current Price= 0.00003082

Buy Entry= 0.00003051 - 0.00002929

Take Profit= 0.00003246 | 0.00003547 | 0.00003944

Stop Loss= 0.00002734

Risk/Reward= 1:1 | 1:2.18 | 1:3.73

Expected Profit= +8.56% | +18.63% | +31.91%

Possible Loss= -8.56%

Fib. Retracement= 1 | 1.272 | 1.618

Margin Leverage= 1x

Estimated Gain-time= 180h

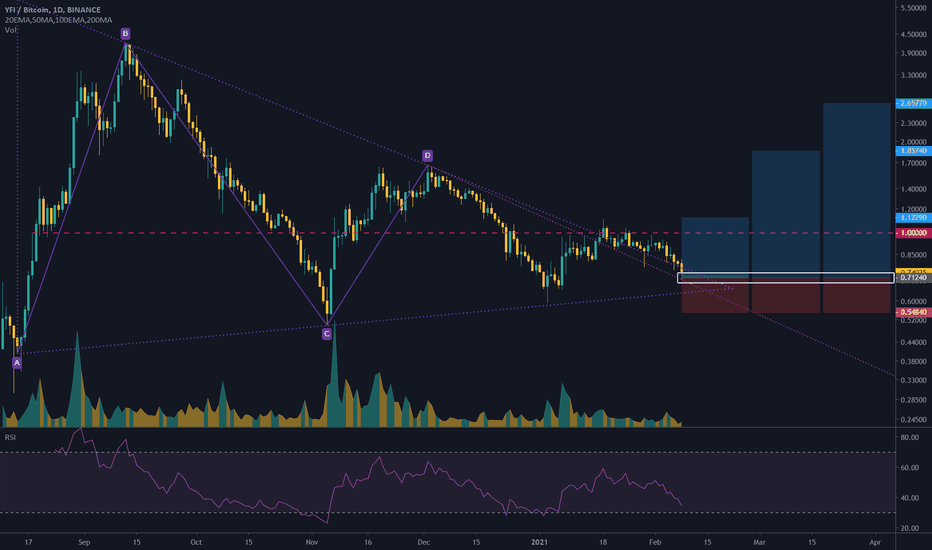

$YFI/BTC 2D (Binance Spot) Symmetrical triangle break and retestYearn.finance is accumulating for next big move upwards I believe, let's start filling a bag here!

Current Price= 0.74025

Buy Entry= 0.74040 - 0.68540

Take Profit= 1.12290 | 1.85740 | 2.65770

Stop Loss= 0.54840

Risk/Reward= 1:2.5 | 1:6.98 | 1:11.86

Expected Profit= +57.62% | +160.72% | +273.06%

Possible Loss= -23.02%

Fib. Retracement= 0.382 | 0.618 | 0.786

Margin Leverage= 1x

Estimated Gain-time= 2880h