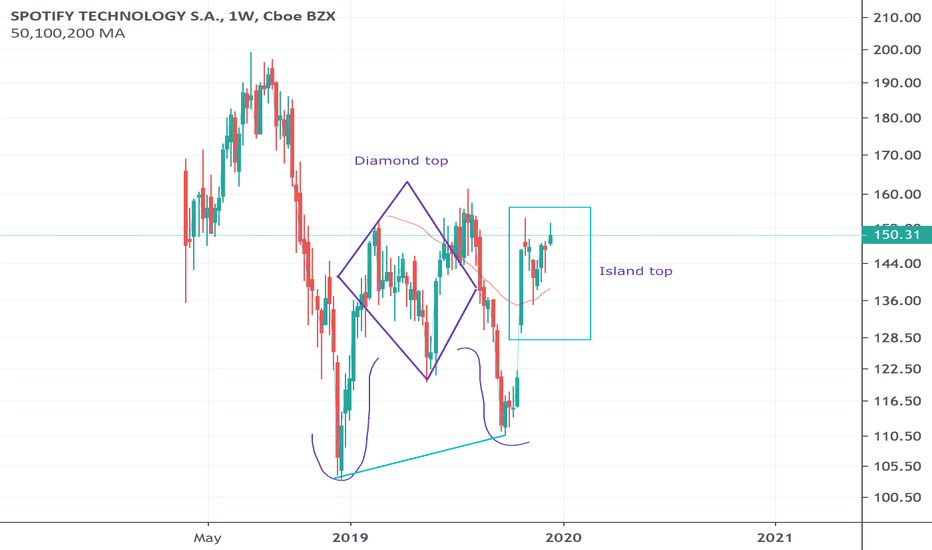

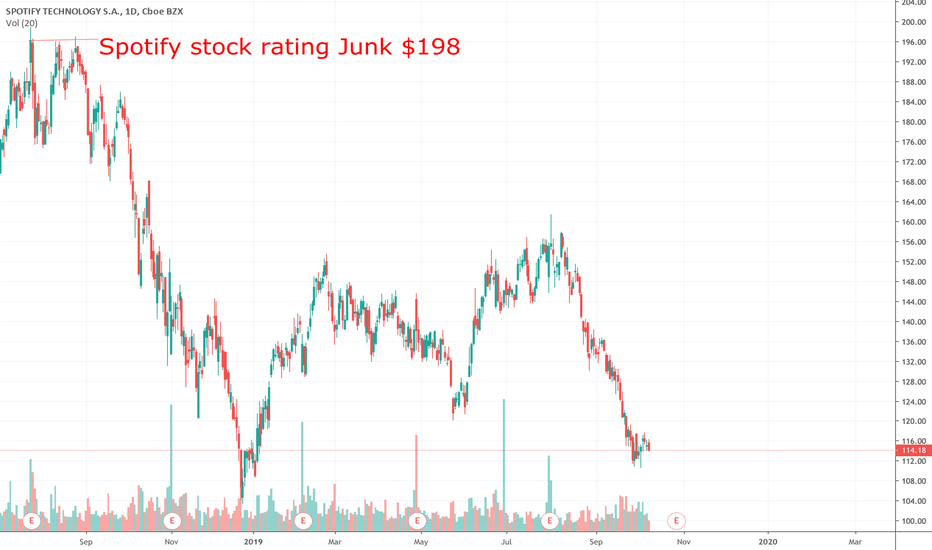

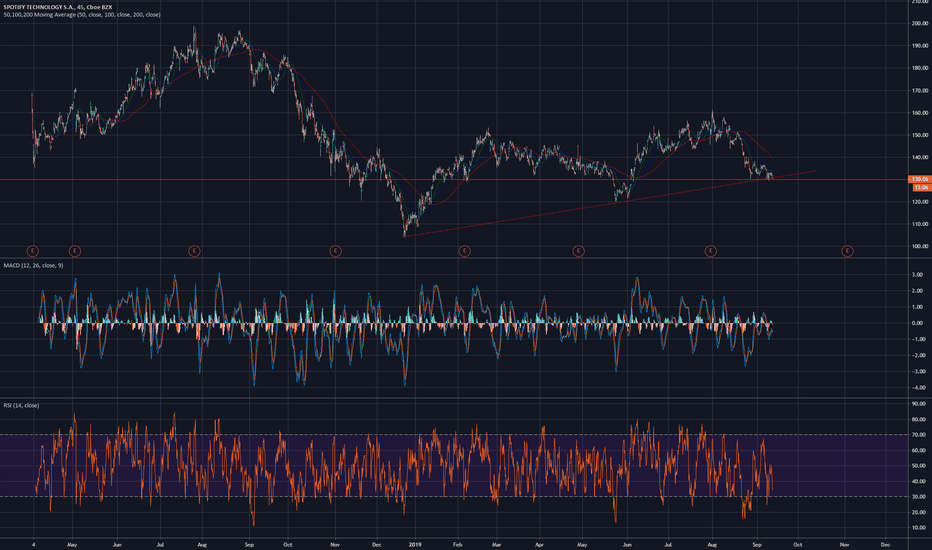

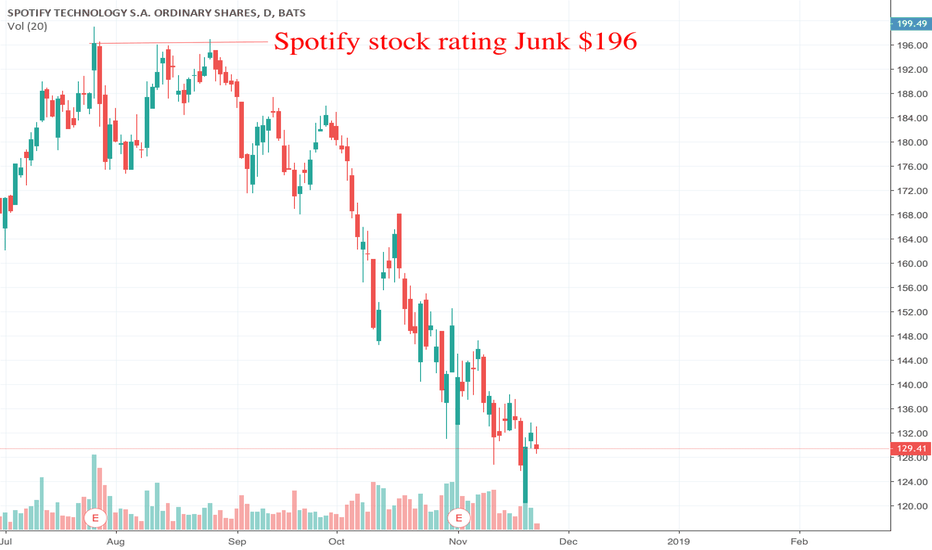

Spotify diamond topSpotify is showing mixed signals with the formation of a diamond top which is indicative of a bearish reversal, evident on the chart. Also, formation of an island top which are a quite reliable bearish reversal chart pattern. The uncertainty in this chart may be evident to investors which choose to capitalise on this or sit out.

Personally I use Spotify myself..

Spotify

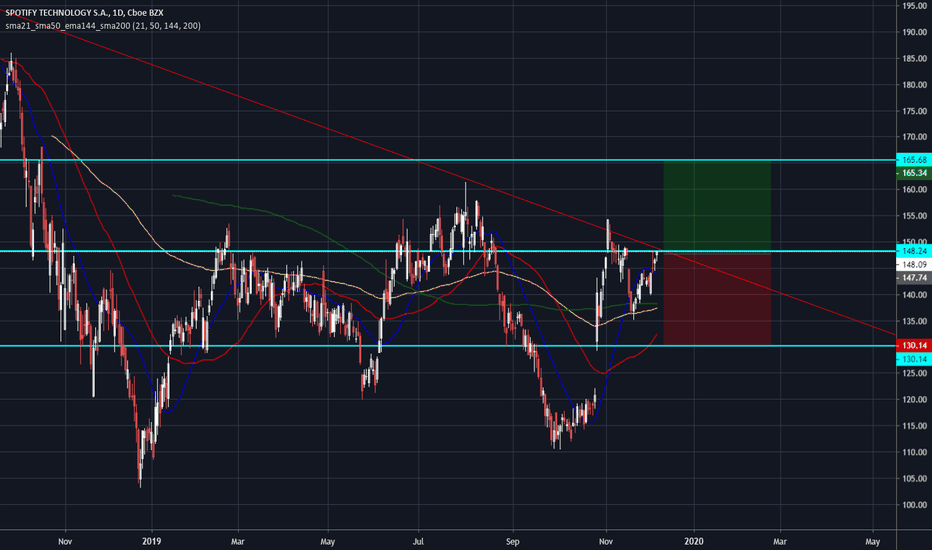

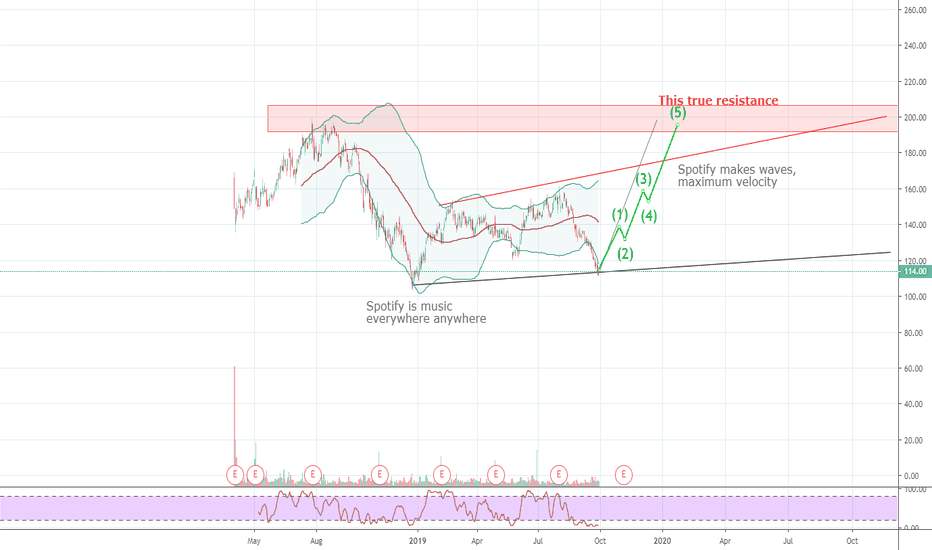

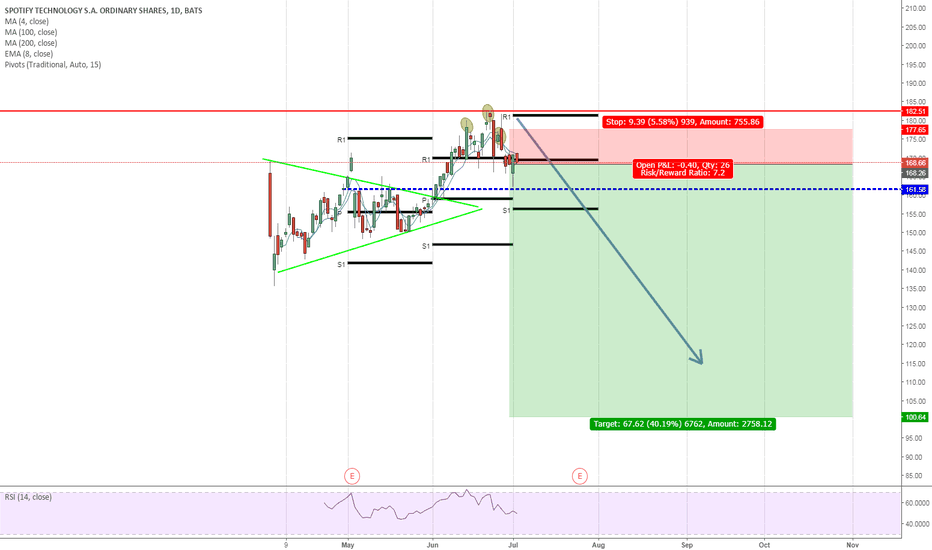

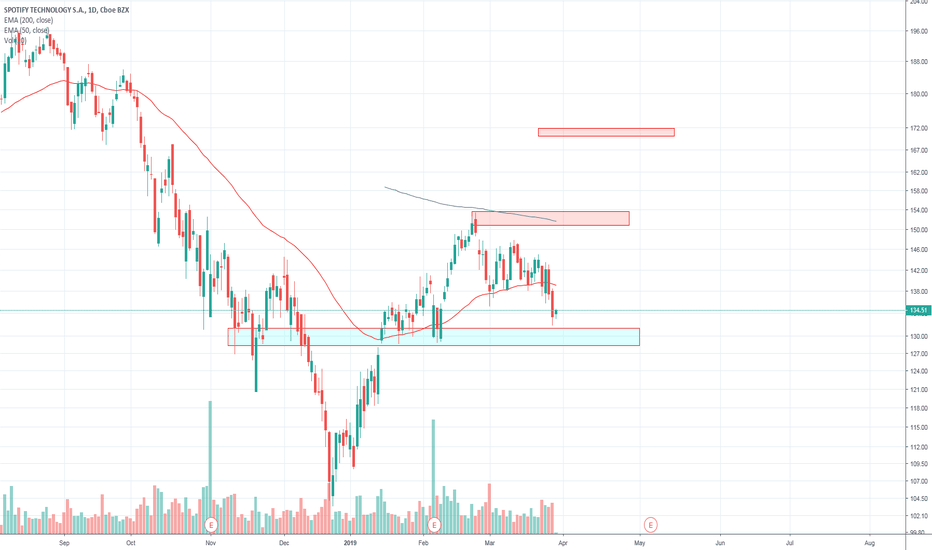

LONG SPOTIFYCompany showing solid Y/Y growth. We are testing long time overhead resistance. Wait for a break and long to $168. 13-15% upside. Coming off a good ER and bouncing off critical support.

Y/Y

Revenue 1.73B 28.03%

Net income 241M 460.47%

Diluted EPS 0.36 56.52%

Net profit margin 13.92% 337.74%

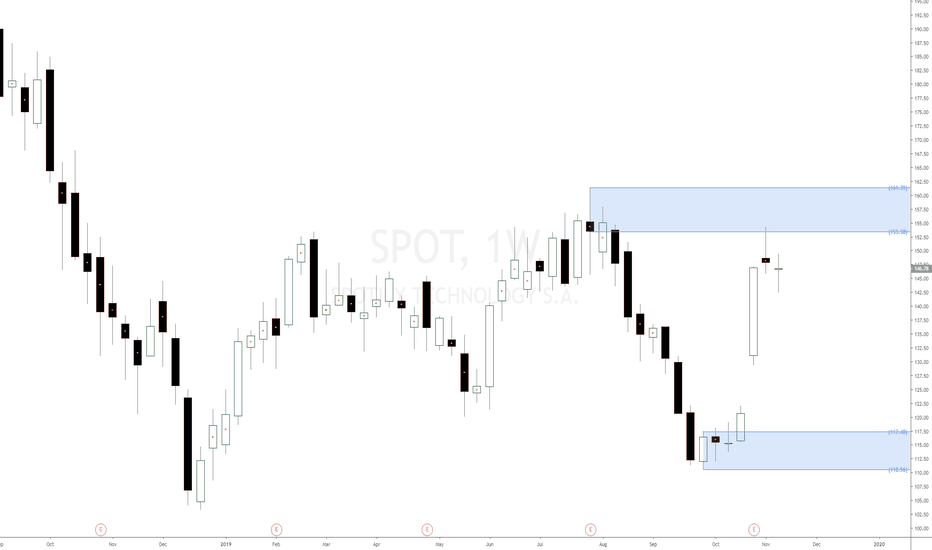

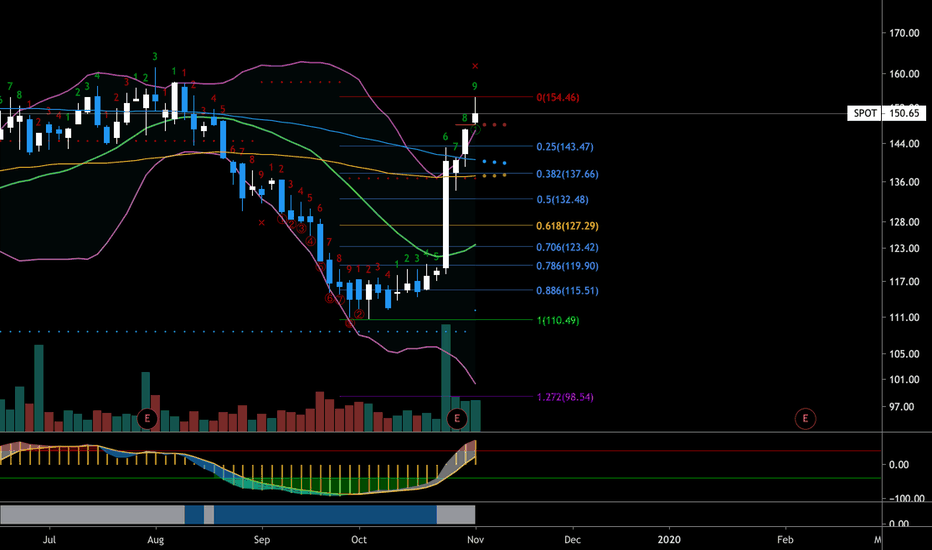

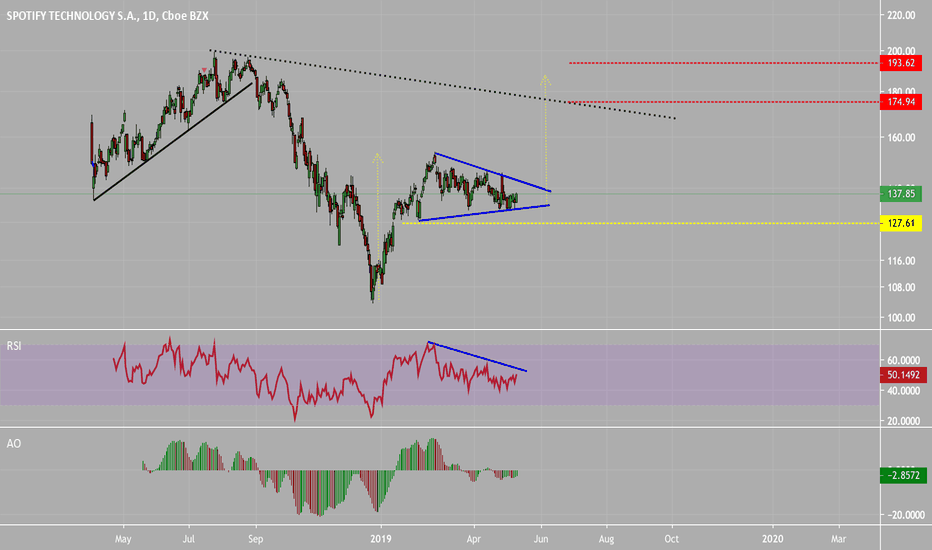

Spotify buy opportunities created with new imbalance createdA very strong weekly demand imbalance has been created on the weekly timeframe around $117 per share for a long term buy opportunity on this stock. Currently we have a pretty strong weekly supply level that has gained control, buying Spotify stock is not possible now. Remember this is a long term analysis, short term and intraday stock trading is a different story but this can help you decide which bias you can trade on your stock trading strategy.

When Spotify Technology #SPOT stock is analysed with the glasses of a supply and demand strategy, we can see that strong impulses and created providing new demand to lean on for long term buy opportunities.

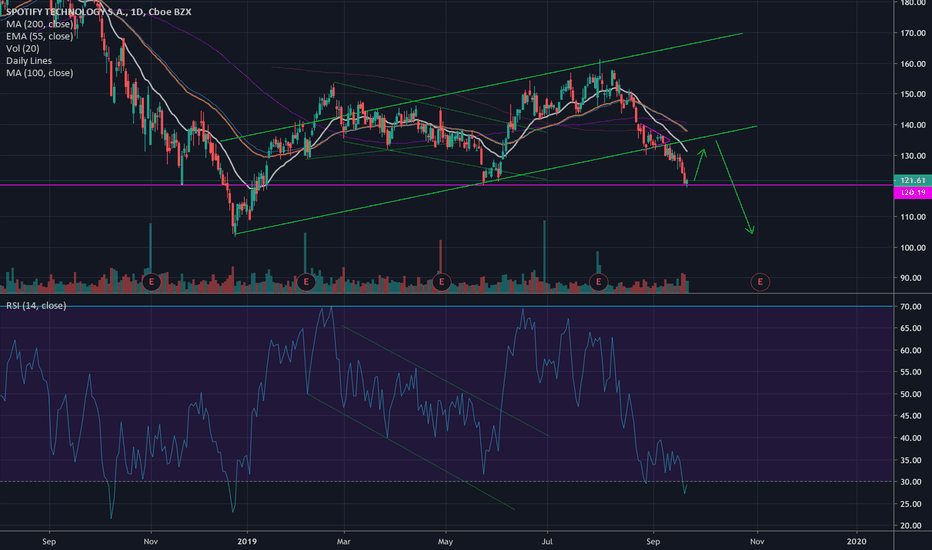

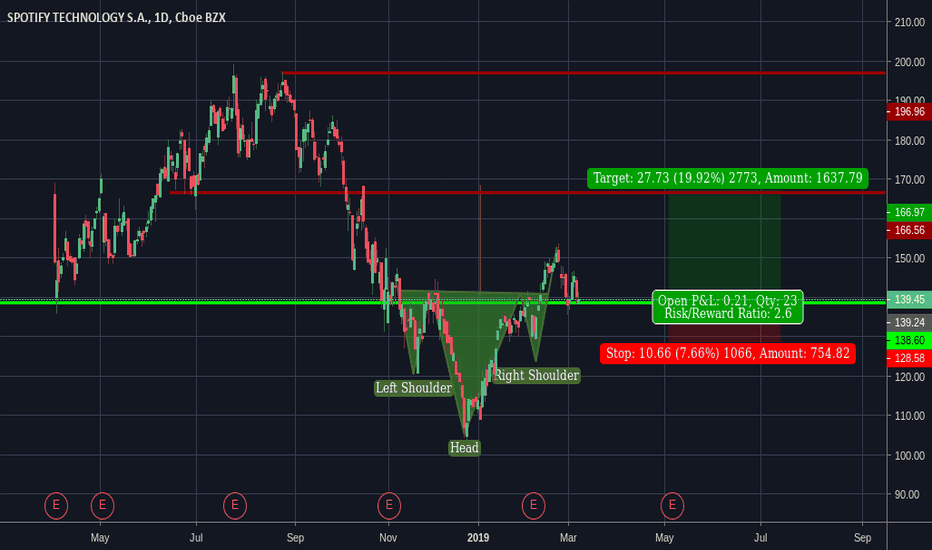

Spotify BOTTOM SaR Entry Setup of Beeskneessteell™

StopManagement by RuChezRu™

Wait and Watch for TriceBarGain™ Setup/Confirmation

If I purchase today:

W/ Leverage 1:5

Long: MarginLevel 250%

2% in Margin

(126.75 last bottom)

StopLoss: MarginLevel 245.30%

(≈quote 124.36)

Loss ≈–1.93% of position ≈–0.03‰

Loss $2.39/Lot + StopLoss

1Lot Spotify w/ ≈$6300 Account and 2% (1Lot) in Mingin

If Longterm Outright:

40% Account in Purchase,

—10% StopLoss (-4% Account)

StopLoss

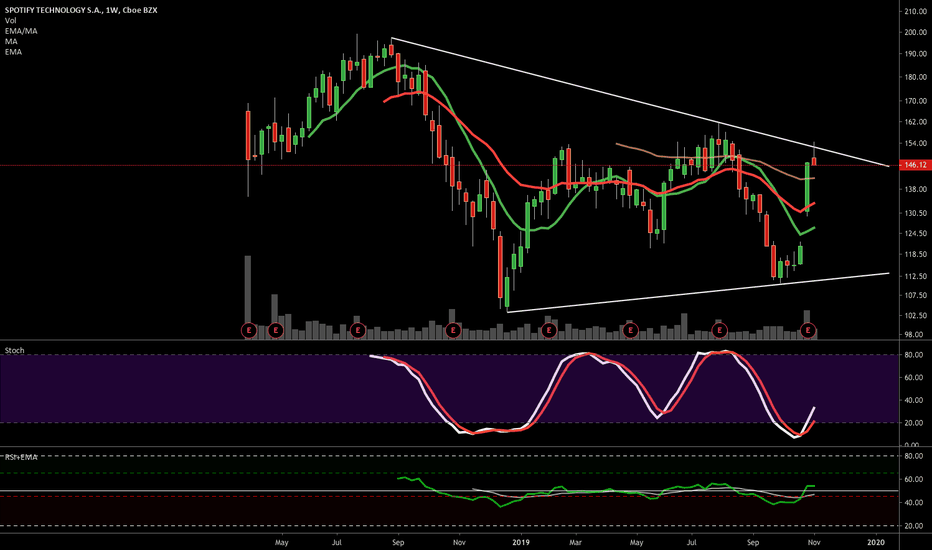

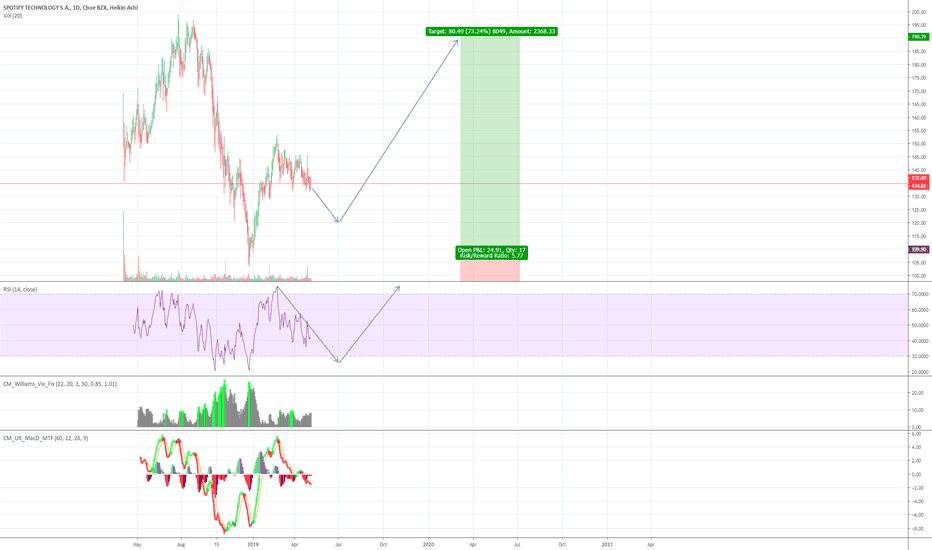

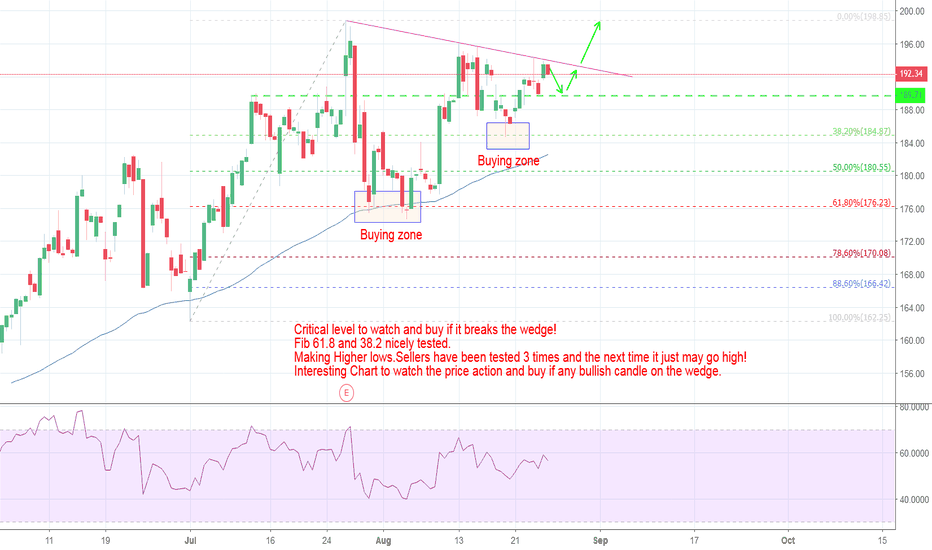

Uncertainty brings best opportunitiesAs it always happens. It has been a rough time since IPO for the renowned music streaming service. It’s hard to estimate the “true” value for a company like that. While everyone was ecstatic when it only become listed. The biggest and only one music service on the market.

Now what we see is when people realize that it also should bring profit. And now what we see is the opposite of that euphoria. People are just not certain how to evaluate.

It was long introductory to my thought that it’s the best opportunity to find dysbalance. As uncertain as profits for them were they are growing strong. Consequently growing revenues and in the last quarter they managed to get net profits.

Don’t let twitter feed to mislead you.

Strong buy (but risky)