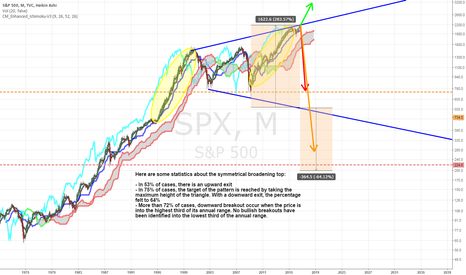

Spx500at2400short

S&P 500 CrashAfter reading an article, I decided to try some TA to figure out what they were seeing and why. Had to move out to the Monthly charts to really get a clear picture.

We know it's coming.. Question is, when.. sometime in 2016, Oct-1st estimated here?

We'll have to break above 2400 to fall within the 53% that will exit upwards.

"Here are some statistics about the symmetrical broadening top:

- In 53% of cases, there is an upward exit

- In 75% of cases, the target of the pattern is reached by taking the maximum height of the triangle. With a downward exit, the percentage felt to 64%

- More than 72% of cases, downward breakout occur when the price is into the highest third of its annual range. No bullish breakouts have been identified into the lowest third of the annual range."