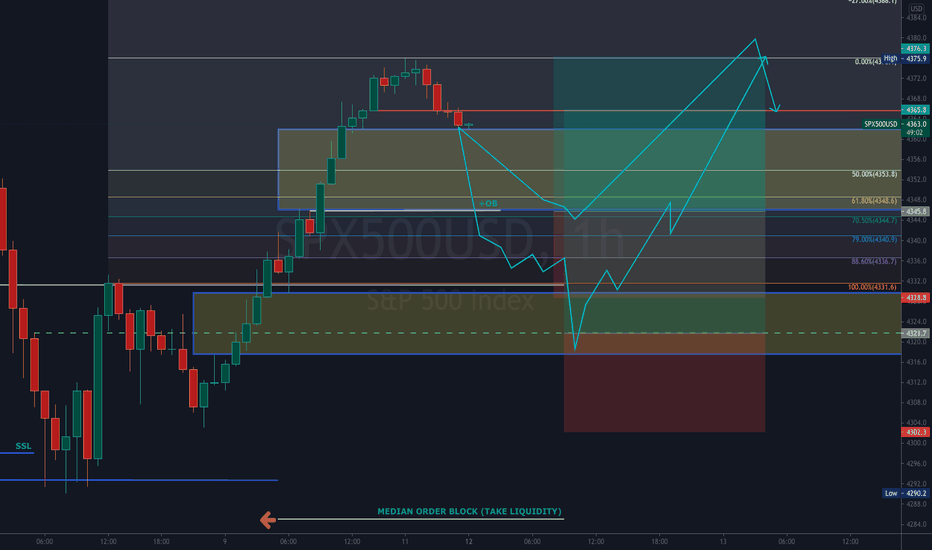

$SPX - Going Long after FOMC Speaker - Two Options It depends on where the price is when I wake up tomorrow. If it's not been below 4345.8, that's at target as if you were to put a fib on top of the current breaker, that price point is just below the 63% retracement level (discount) And I would wait for the FOMC speaker to start and if it's still not below this level after opening then this is where I would look for it to bounce and go long

The second option is that if I wake up and price hs made it way lower than that price point, I would expect it to be hovering around/above the breaker point 4331.2. If you place the fib at the bottom where it hits the previous bullish order block on the 1-hour chart

(

I would expect it to dive past the breaker and hit the Bullish order block on the 4 hr chart at 4321.7 before moving bullish again. The patterns repeat in Smart money, it's just where Institutional order flow wants the price to go is the difference.

The around 2:00 p.m. the 10 yr bond auction happens and I would expect the price to start slipping from there so I would aim for any High that I could and take profits before 1:00 p.m., to be honest.

Even if Either scenario isn't perfect, as long as it stays above 4290, it'll still be bullish.