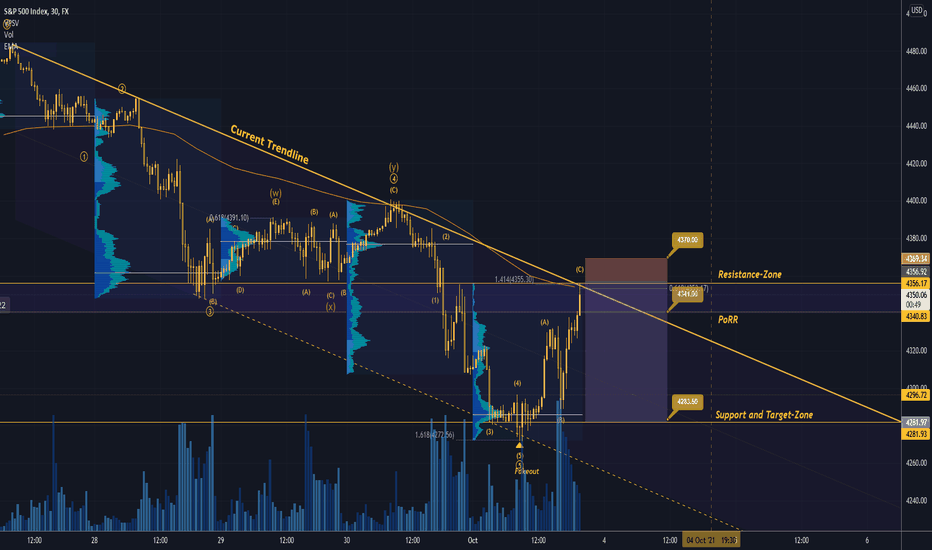

SPX500 SELL IDEAHey tradomaniacs,

welcome to another free trading-setup. After a successfull LONG I`m planning to short this baby for a pullback or to follow the current trend!

SPX500: Daytrade-Preparation

Market-Sell: 4357.00

Stop-Loss: 4370.00

Point of Risk-Reduction: 4341.00

Take-Profit: 4283.50

Stop-Loss: 130 pips (13 points)

Risk: 0,5% -1%

Risk-Reward: 6,0

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

Spx500short

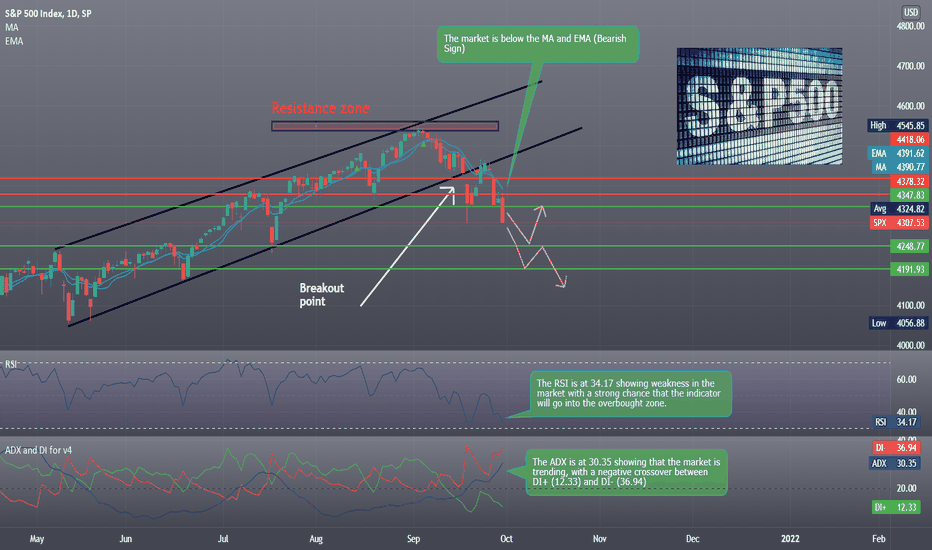

S&P 500 update after the Evergrande crisisHello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

China Evergrande Group has missed a second bond coupon payment in as many weeks, renewing concerns over its ability to repay over $300 billion in liabilities.

This Showed an instant effect on the market, the S&P 500 by dropping almost 2% today it went from 4377.41 to 4301.01 and because Evergrand seems to be heading into default and the grace period of 30 days has started, This could be the start of a big market crash that is similar to the Lehman brothers crises that caused the 2008 crash.

Possible Scenarios for the market :

Scenario 1 :

The markets seem to be heading in a Bearish way that will cause a further drop in the market and the first stop will be the support level located at 4248.77 and from there the market will have a chance to stabilize but for that to happen the Bulls need to step in and gain control over the market in hope to prevent a further drop.

If the Bulls were able to gain control then we will see a bounce of that support level that will lead the price back near the 4347.83 level.

Scenario 2 :

After the market reaches the first support at 4248.77, The bears most likely will not allow the Bulls to gain any control which will lead to a breakout of that level that will lead into a further drop possible leading into the 4191.93 levels which could be an early warning signs for a crash in the Economic world.

Technical indicators show :

1) the market is below the 5 10 20 50 100 MA and EMA indicating a Bearish short/mid trend, and still above the 200 MA and EMA that indicates a Bullish Long-trend.

2) The RSI is at 34.17 showing weakness in the market with a strong chance that the indicator will go into the overbought zone.

3) The ADX is at 30.35 showing that the market is trending, with a negative crossover between DI+ (12.33) and DI- (36.94).

Weekly Support & Resistance points :

support Resistance

1) 4352.12 1) 4512.31

2) 4248.77 2) 4569.15

3) 4191.93 3) 4672.50

Fundamental point of view :

Asian equities followed Wall Street sharply lower and bonds rallied on Friday, as risk sentiment soured amid growing worries that inflation may persist even after global growth has peaked.

U.S. stock futures pointed to a 0.60% decline for the S&P 500, following a 1.19% drop in the index overnight that punctuated its worst month since March of last year.

Federal Reserve Chair Jerome Powell said on Wednesday that resolving "tension" between high inflation and high unemployment is the Fed's most urgent issue, acknowledging a potential conflict between the U.S. central bank's two goals of stable prices and full employment.

China has proved another particular worry for investors: the economy took a hit from regulatory curbs in the tech and property sectors and is now grappling with a power shortage that threatens to push up energy prices globally. According to reuters

Concerns over China Evergrande Group have put investors on edge and added to recent worries over economic growth from the Delta variant.

This is my personal opinion done with technical analysis of the market price and research online from Fundamental Analysts and News for The Fundamental point of view, not financial advice.

If you have any questions please ask and have a great day !!

Thank you for reading.

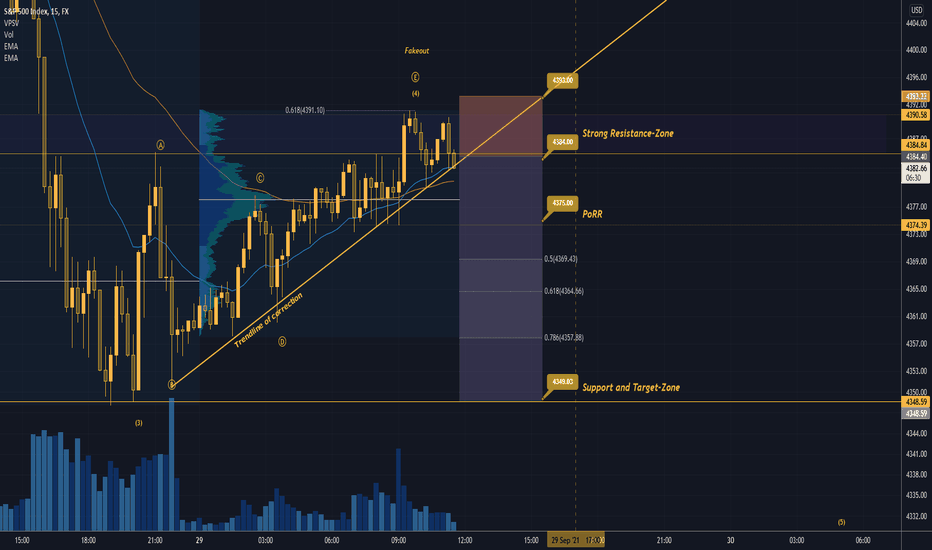

SPX500 SELL IDEAHey tradomaniacs,

welcome to another free trading-setup.

Notice: Volatility during US-Openign very likely. Rather stay out then with tight Stop-Loss!

SPX500: Daytrade-Preparation

Market-Sell: 4390.60

Stop-Loss: 4398.70

Point of Risk-Reduction: 4381.15

Take-Profit: 4358.00

Stop-Loss: 81 pips (8,1 points)

Risk: 0,5% -1%

Risk-Reward: 4,0

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

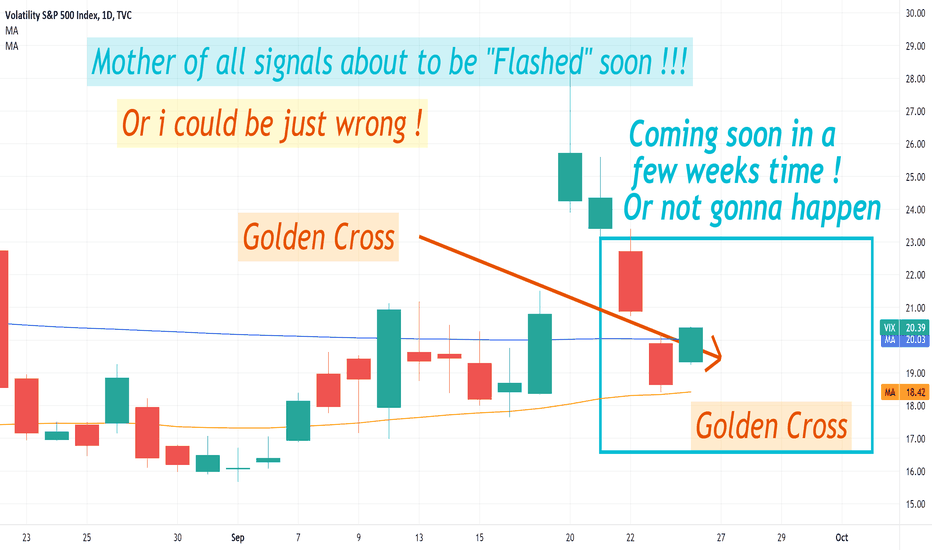

The most important crossing since Covid's low, Golden Cross !!!!What Is the Cboe Volatility Index (VIX)?

The Cboe Volatility Index (VIX) is a real-time index that represents the market's expectations for the relative strength of near-term price changes of the S&P 500 index (SPX). Because it is derived from the prices of SPX index options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is often seen as a way to gauge market sentiment, and in particular the degree of fear among market participants.

The index is more commonly known by its ticker symbol and is often referred to simply as "the VIX." It was created by the Chicago Board Options Exchange (CBOE) and is maintained by Cboe Global Markets. It is an important index in the world of trading and investment because it provides a quantifiable measure of market risk and investors' sentiments.

KEY TAKEAWAYS

The Cboe Volatility Index, or VIX, is a real-time market index representing the market's expectations for volatility over the coming 30 days.

Investors use the VIX to measure the level of risk, fear, or stress in the market when making investment decisions.

Traders can also trade the VIX using a variety of options and exchange-traded products, or use VIX values to price derivatives.

SPX500 ASELL SIGNALHey tradomaniacs,

welcome to another free trading-setup.

SPX500: Daytrade-Execution

Market-Sell: 4384.00

Stop-Loss: 4393.00

Point of Risk-Reduction: 4375.00

Take-Profit: 4349.03

Stop-Loss: 90 pips (9 points)

Risk: 0,5% -1%

Risk-Reward: 4,0

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

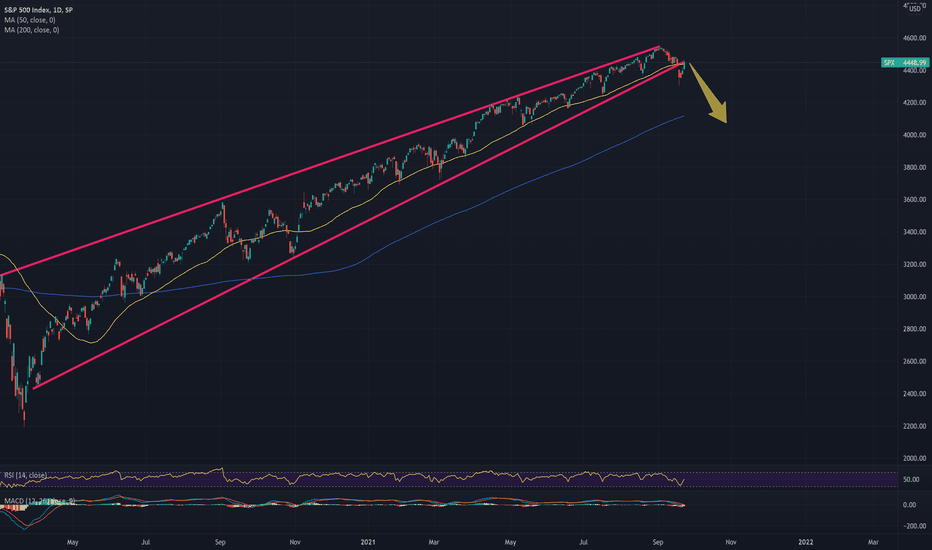

SPX500 2021-2022 PredictionA prediction , or forecast, is a statement about a future event. They are often, but not always, based upon experience or knowledge.

Although future events are necessarily uncertain, so guaranteed accurate information about the future is impossible. Prediction can be useful to assist in making plans about possible

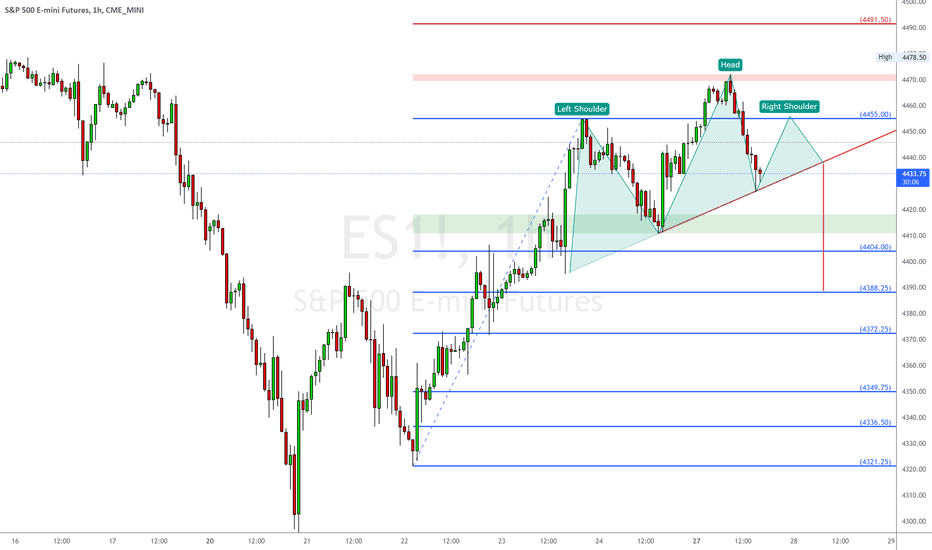

Time to take advantage of the ES_F correction?Greetings traders. Upon viewing the Mini S&P, it seems a few factors have lined up to provide a shorting opportunity! First we have a great test and rejection of structural resistance around the 4475 area which lined up with the retracement zone of the move from 4550 down to 4293. Since then, we have put in an nicely formed impulse that diverges well between wavs 3 and 5. On top of that, price has formed a bat pattern that lends weight to a reversal that seems to be already under way! I am going to try a short with a target zone between 4383 and 4362 with stops above 4440! Good luck!

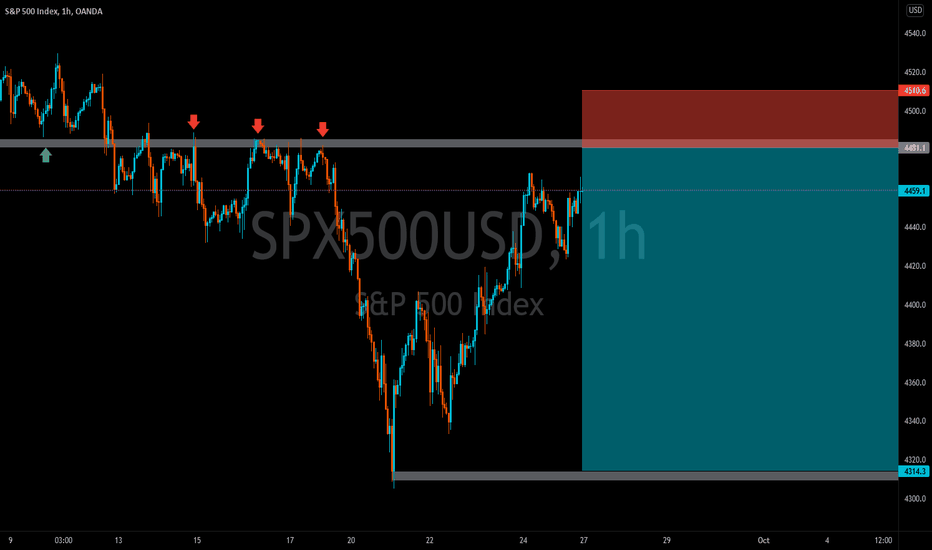

SPX Short | SPX500USD Short| S&P 500 ShortSPX Short| SPX500USD Short| S&P 500 Short

SPX500USD Short Trade Marked On Chart

SPX Short Trade Marked On Chart

GOOD RISK TO REWARD TRADE. LIKELY TO FAIL AS THERE IS A LOT OF SECTOR ROTATION AND NOT VERY CONFIDENT THE TIMING IS RIGHT.

PLEASE DO YOUR OWN DUE DILIGENCE AND ANALYSIS, TRADE AT YOUR OWN RISK

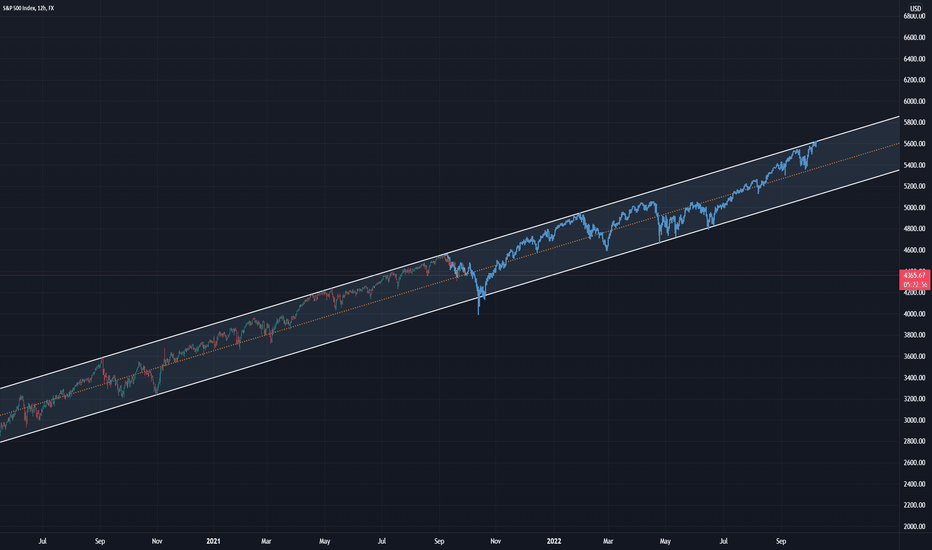

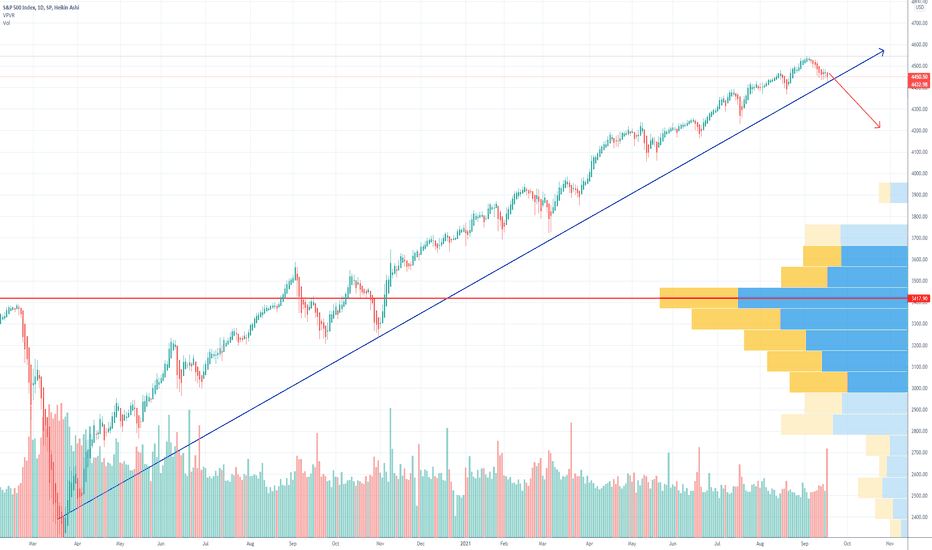

Warning Signals S&P500 SPX500 SPX DJI DJT - Macro Analysis🚨We are nearing a Dow-Sell-Signal acc. to the new Dow-Theory🚨

We had a drop of more than 3% S&P and Dow which is causing a secondary reaction. If the S&P stays below $4400 the secondary reaction is confirmed.

This is the FIRST step acc. to the Dow-Theory system by Jack Schannep!

The economy is still in a major post-pandemic depression and many S&P500 companies are not profitable anymore! FED has pumped up the stock market artificially with free funny money that it has even broken above a resistance trend-line (cyan line) which exists since 1936 and at the same time the Buffet indicator indicates an extreme overvalued sell signal! Also the Wave Trend Oscillator, MACD and StochRSI has crossed bearish at 2W TF & 3W TF recently which means that bullish momentum is exhausted and that we are at a tipping point right now.

Basically it was a bullish signal that the $SPX has broken through the resistance trend-line (cyan line) but I think this was just a so called "overthrow" or "fake out"!

Since May 2021 we have a divergence between the Dow-Jones and the Dow transportation average which is a disconfirmation of the stock bull market. SMI (smart money indicator) shows that smart money is scaling out for months now (not shown on chart). Furthermore, sentiment signals also indicated very rare warning signals. For instance, Jason Goepfert's (sentiment-trader) indicators flashed rare warning signals recently, which means that there is a high spread between bear market probability and macro index models. Last time Jason´s sentiment indicator showed such a high spread was 14 years ago! Also Robert Prechter's Bear Market Prediction (Macro Elliott Wave Analysis with Fibonacci-Cycles) is confirming that we are nearing the end of a major stock bull market soon.

Ray Dalio´s debt cycle model (Short & Long-Term Debt-Cycles) is also indicating that we are on the verge of a serve debt crisis which will cause a major post-pandemic depression similar to 1929.

Currently the consensus (the herd) is thinking that we are currently in a high inflationary environment, but this was just a temporary spike in inflation rate which is currently at a dipping point. A deflationary shock will come sooner or later but an accurate predication when this will happen is impossible. When the debt bubble implodes (credit crunch) there will be high deflation also when it could be short-lived (economic depressions are usually deflationary).

Also smart-money is betting on deflation which is anticipated in the recent raise of bond prices.

At the end of the debt cycle central banks will expand the money supply even further (more money printing) which could cause high inflation but this also depends on factors like velocity of money and on the credit supply. For instance Japan is in a depression for approximately 30 years and there is still no high inflation due to manipulation with negative interest rate policy (NIRP).

However, you should know that in the background the elite has already established plans for the great reset which will force everyone to transition into a new monetary system.

Banks and other financial institutions will use “Ice-Nine freezes” to get your money!

Be prepared and have CASH on the sidelines. This could get very ugly!

Of course these major stock market signals also have negative impact on cryptos as well...

We recommend to accumulate gold and silver during the deflationary shock.

Also US treasury bonds usually are a good investment in a low-interest rate environment (=raising bond prices).

A deflationary shock will be a very good opportunity :-)

Disclaimer!

I´m not a financial adviser. For educational purpose only!

You can use the information from the post to make your own trading decisions.

Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

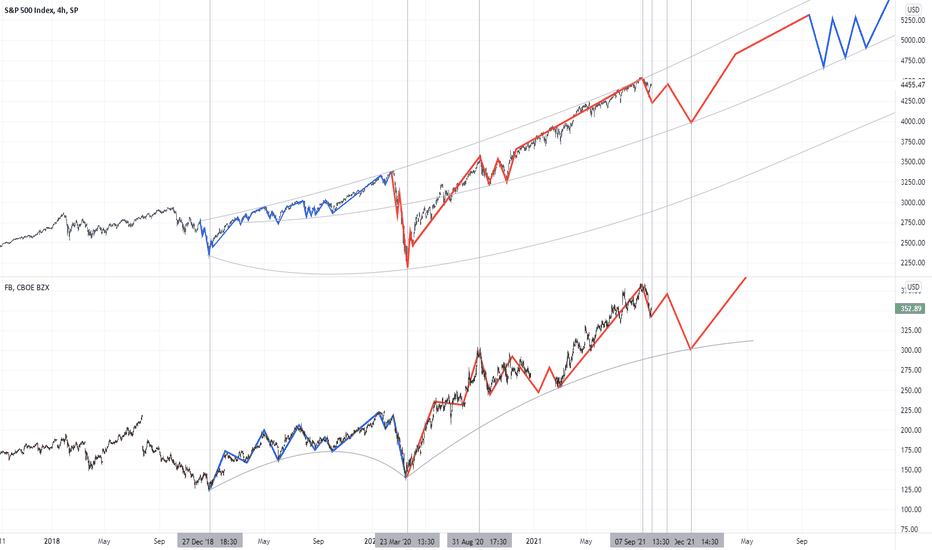

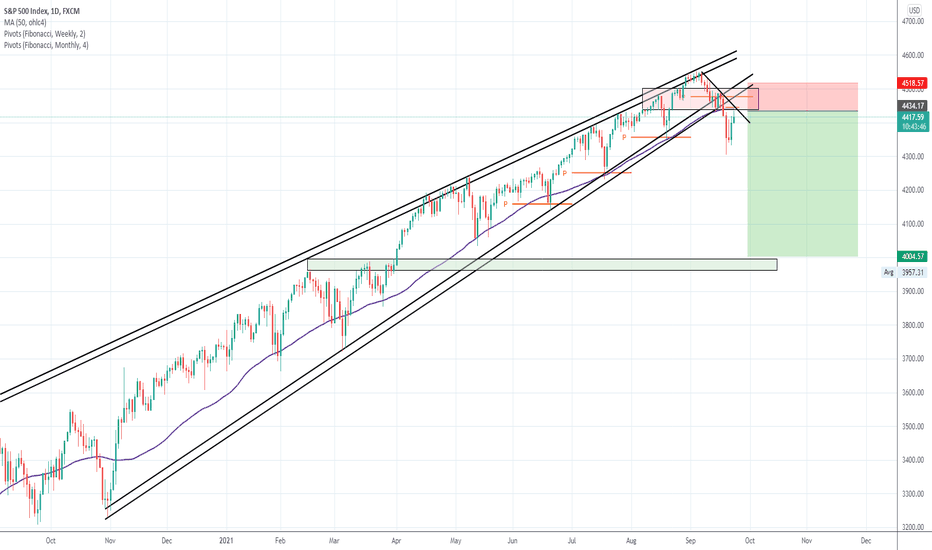

Perfect Risk to Reward trade for SPXDespite the fact that the S&P is still largely bullish and a lot of data point to the upside, the truth is that currently the SPX has broken a very key trend that was tested many many times. It hasn't had a 10% correction since September 2020, while it has gone up 42% since its September 2020 low and 109% since its March 2020 lows. The truth is that it could keep going and I think it will go higher medium to long term, but I just feel that it will go to test 3900-4000 before going even more parabolic.

Up until now most were going long on this very obvious trend. Too many perfect bounces on the Monthly Pivots + Diagonal + 50 DMA. Now all these are lost and they could turn into resistance after being support for so long. Of course the really long term trend is bullish and this might just be a trap. A trap to make everyone think the big trend is broken, only to send it higher.

Essentially even if we don't win this trade, the R/R is very attractive. It is 5:1 and I think this trade has at least a 30-35% chance of winning. So if we consider the odds of this trade being a winner and the R/R we can clearly see that his trade is worth it.

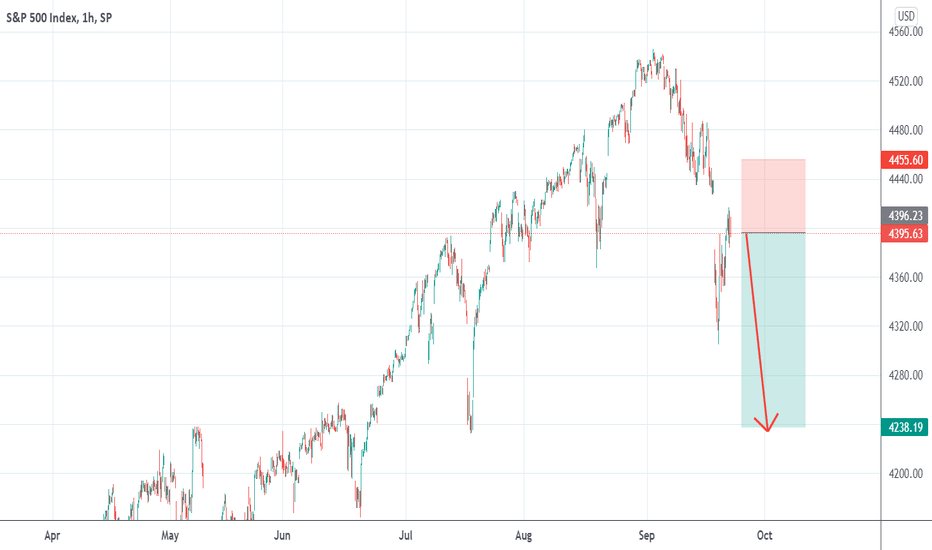

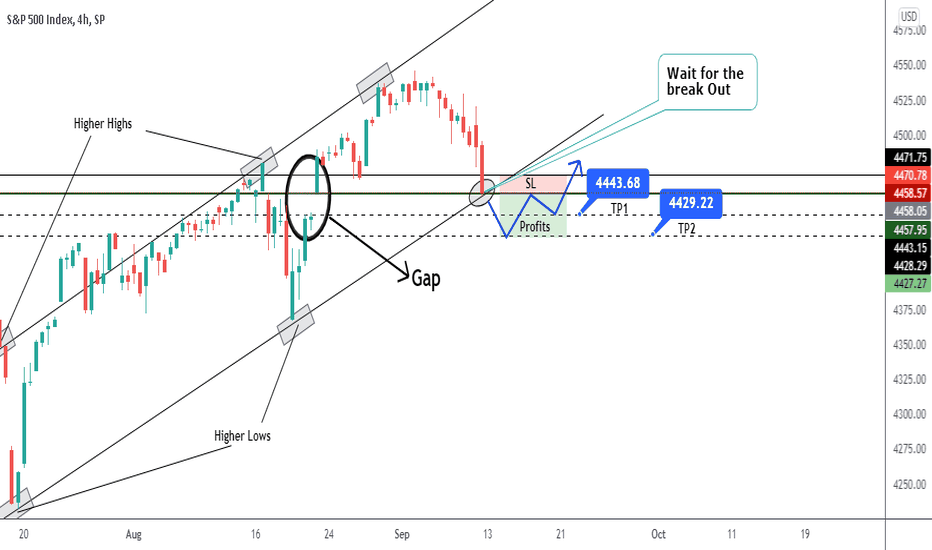

SP500- A new drop is just around the cornerOn Monday, the index has opened with a huge gap and in the next 3 trading days was trying to fill this gap.

However, the bulls are very weak, and this is more of a technical rebound, not buying pressure.

I expect a new leg down, and 4240 support can be the short term target

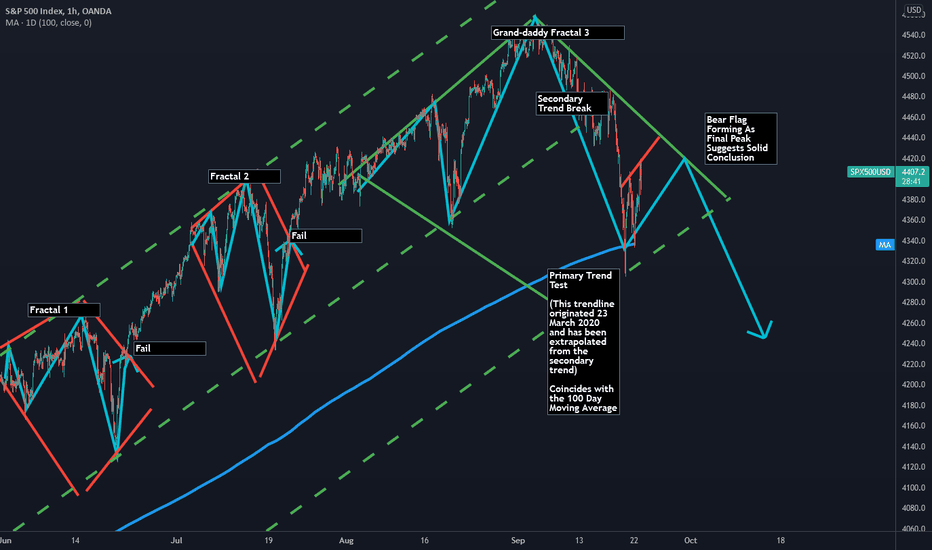

Possible Diamond Reversal Part 2This is an update of the "Possible Diamond Reversal" idea.

This is clearly a fractal diamond regression.

The same setup occurred recently on Bitcoin.

I added the 100 Day Moving Average as this seems to coincide where I placed the lower bounding trendline which I extrapolated from the secondary trend.

This trendline goes back to the March 2020 recovery.

Most significantly we have almost every important feature of a very large diamond reversal taking place and, most importantly, a bear flag appears to be forming which could validate the third peak and the associated downmove.

Watch carefully here. This could be invalidated as Fractal 1 and Fractal 2 were. However, the bear flag type form is particularly interesting here and if that form concludes this could bring the broader large diamond form to a successful conclusion where the previous 2 failed.

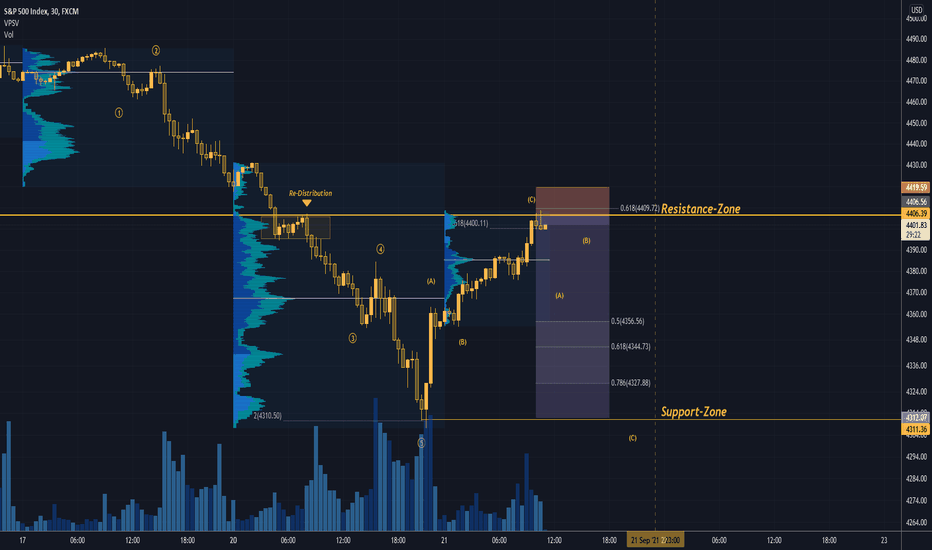

SPX500 with a nice short-chance!Hey tradomaniacs,

SPX500 has just retested a nice distribution-zone and could continue to move down after the recent rejection.

Nice- Risk-Reward worth for a try! What do you think?

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

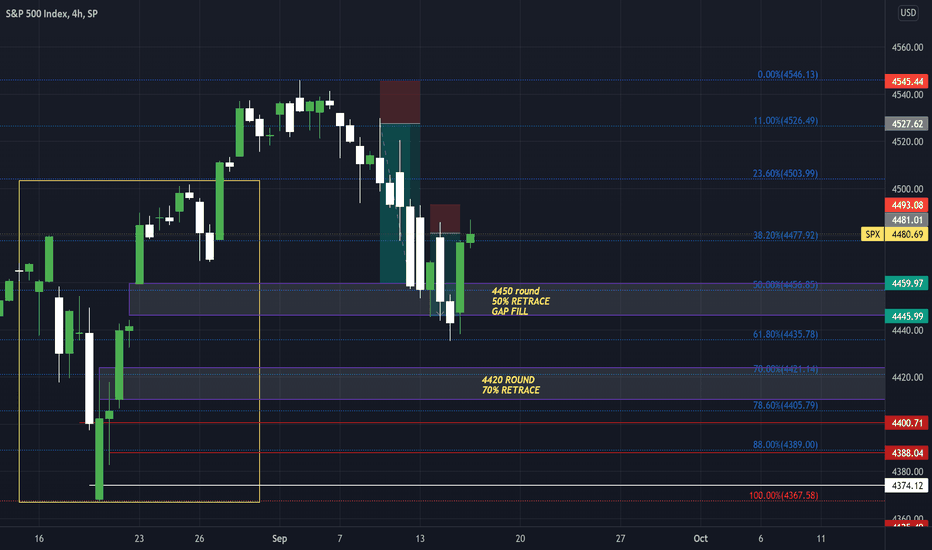

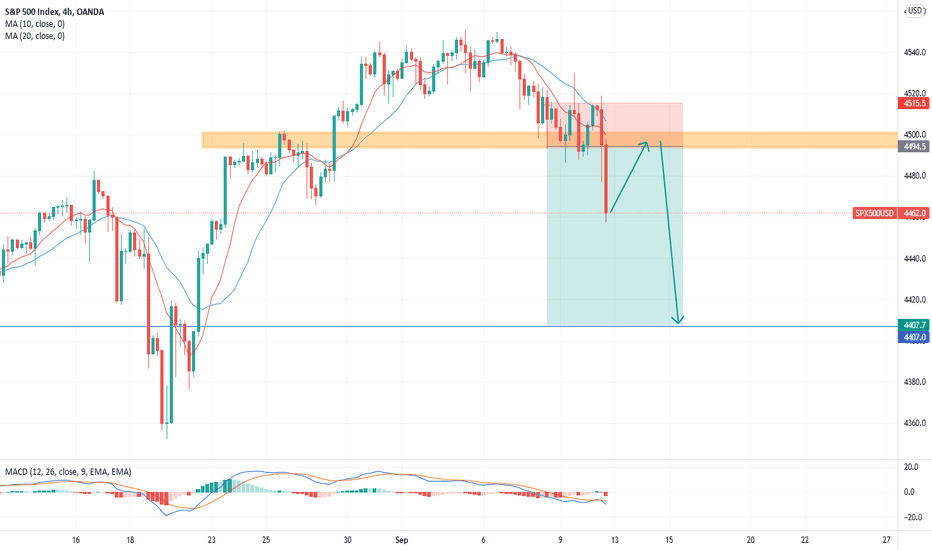

SPX S&P500 Key Support to be tested todayAfter multiple days of trending downwards, the S&P500 reached a key support level at 4450usd that it needs to hold in order to continue the overall upside trend.

If it breaks lower, the target is -7%, so 4138usd.

I`m looking forward to read your opinions on it.

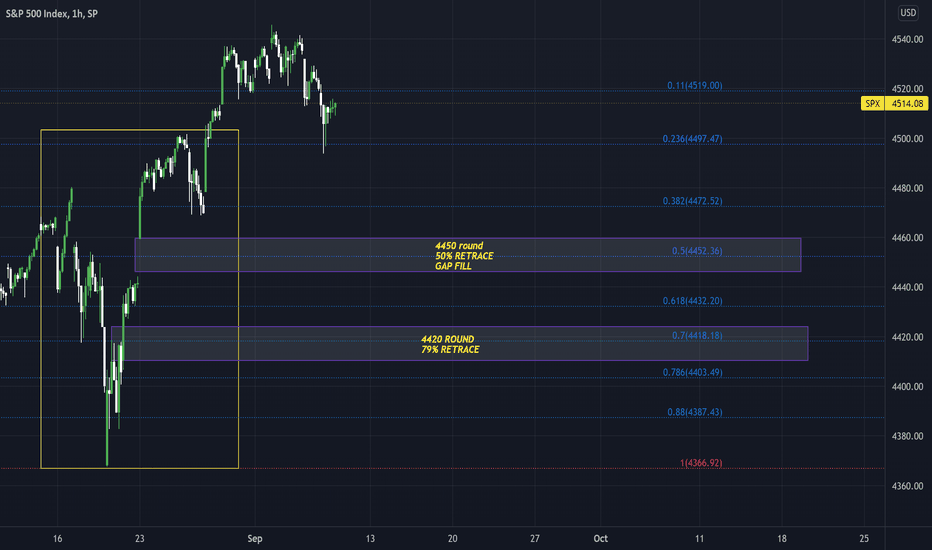

SPX Leading the wayAs SPX has been leading the way this week, today was no different. Starting off with some downward pressure seaking liquidity it found some @61.8 level and gave a really nice reaction pushing towards the previous 2 day highs but not closing above. this leads me to believe were going into a bit of a range so im looking for this rally to be short lived and possible downside Thursday. watch for a positive retail sales number as this could drive the price higher.

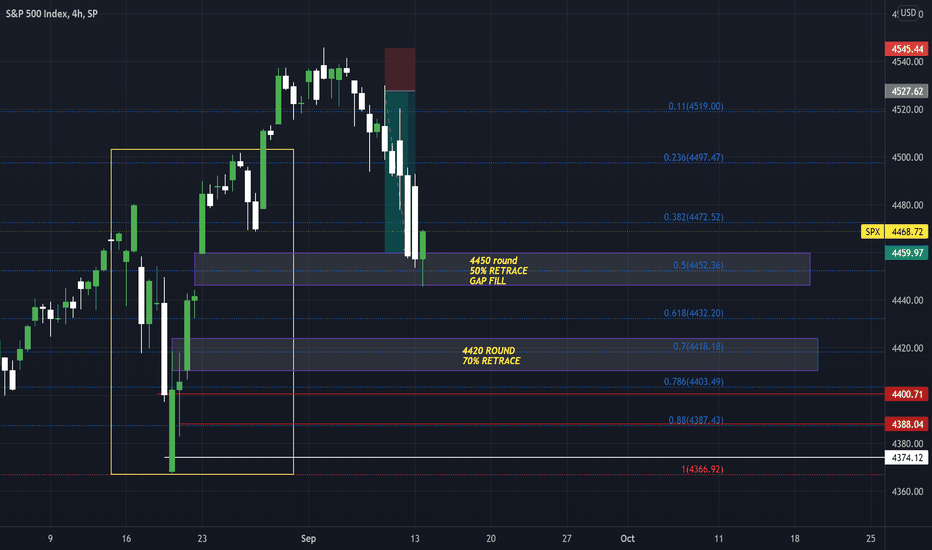

S&P500 textbook Price action and GAP fillS&P as predicted gave some pre market push up before some strong downward force to fill the gap to perfection and giving a beautiful reaction to the 4450 zone 50% level. Im still bearish for the moment looking at the 4420 zone 70% level but main focus is on the 4400-4375 area with the 79%and88% levels where ill be looking for a structured momentum switch.

S&P 500 Short The Dow Jones Industrial Average and S&P 500 Index just suffered five straight days of losses and their worst weekly performance since wait for it June.

www.cnbc.com

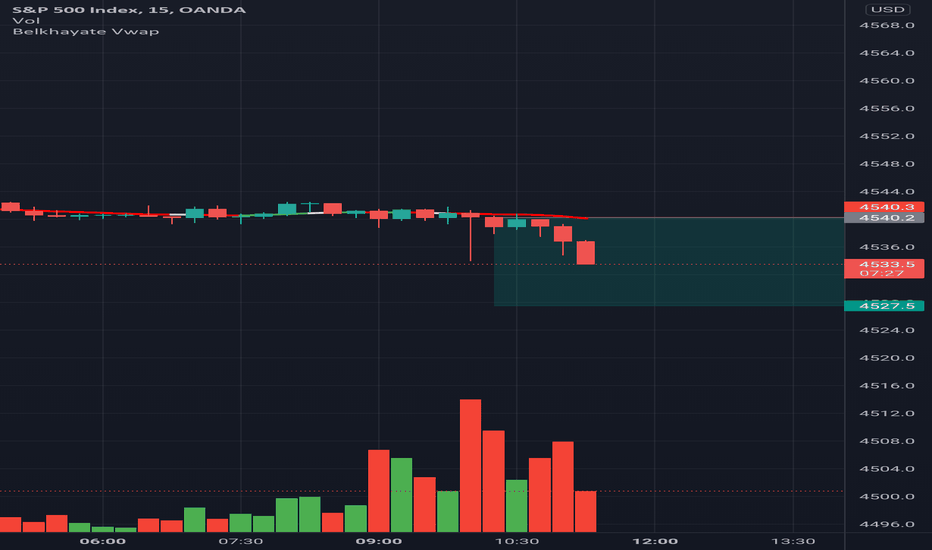

We taking this trade based on TECHNICAL ANAYSIS and FUNAMENTAL ANALYSIS, We expecting the pair to CLOSE the GAP before a Bullish continuation.

Please use proper risk management depending on your account size, Use lot sizes based on these calculations.

Here is a break down of your pip value in ZAR and Dollars

0, 01 = R1,43 / $0,10c

0. 05 = R 7,15 / $ 0.50

0.10 = R 14,3 / $1.00

1 Lot size = R 146,26

How to calculate Margin = (Lot Size * Contract Size)/Leverage, Lets say your broker gives you 1:500, and you open 0,2 size, How much are you exposing ? calculations : (0.2 * 10 000) / 500 = $4 (R58) also (1 Lot * 100 000) / 500 = $200 (R2 960)

So, each time I open (1 Lot size, am exposing R2960 (Down payment)

Remember, These are long term trades, It is advisable to have enough margin to handle the fluctuation of the markets.

Please like, follow and share for more useful content