SPX500 at New ATH – Will NFP Fuel the Next Leg Up? SPX500 Outlook: Trade Optimism Fades as Focus Shifts to U.S. Jobs Data

Caution prevails ahead of today’s high-impact U.S. Nonfarm Payrolls report, which could be pivotal for the July rate cut narrative. A weaker print may support risk assets and push SPX500 higher, while a strong report could dampen momentum.

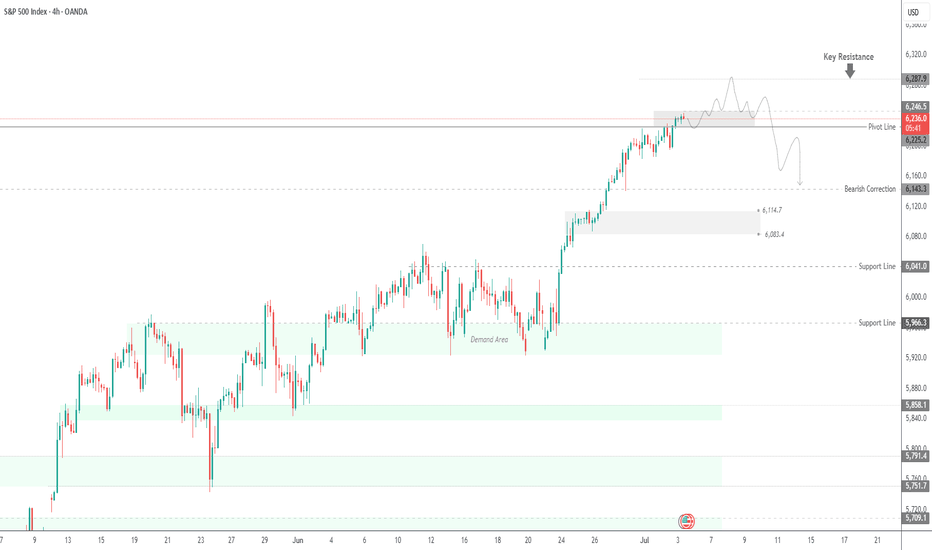

Technical Analysis (SPX500):

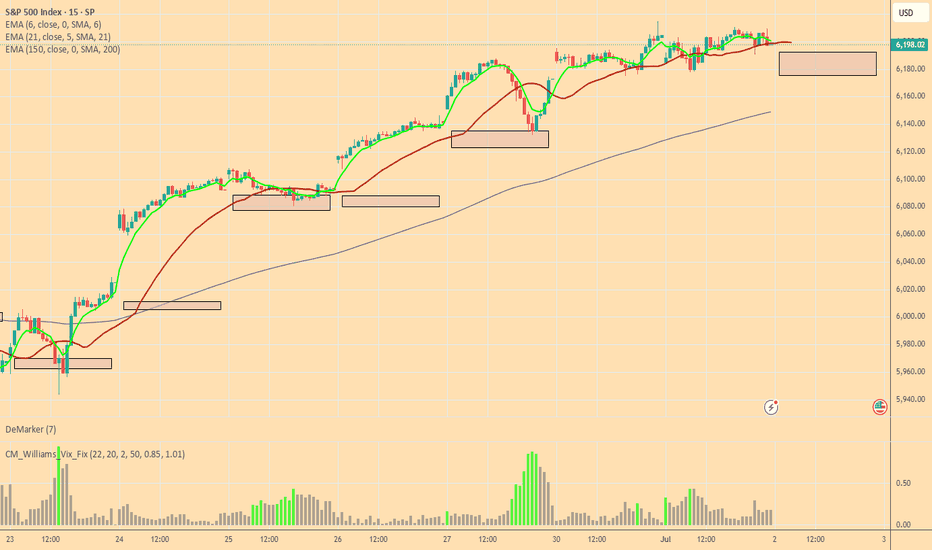

SPX500 has printed a new all-time high and is now targeting 6287, especially if the index closes above 6246 on the 1H chart.

As long as price holds above 6225 (pivot), the bias remains bullish, with potential upside targets: 6287 & 6325

However, a 4H close below 6213 would suggest a correction toward: 6190 & 6143

Key Levels:

• Resistance: 6287 / 6325

• Support: 6190 / 6143

Stay alert — today's NFP report could trigger major moves across indices and FX.

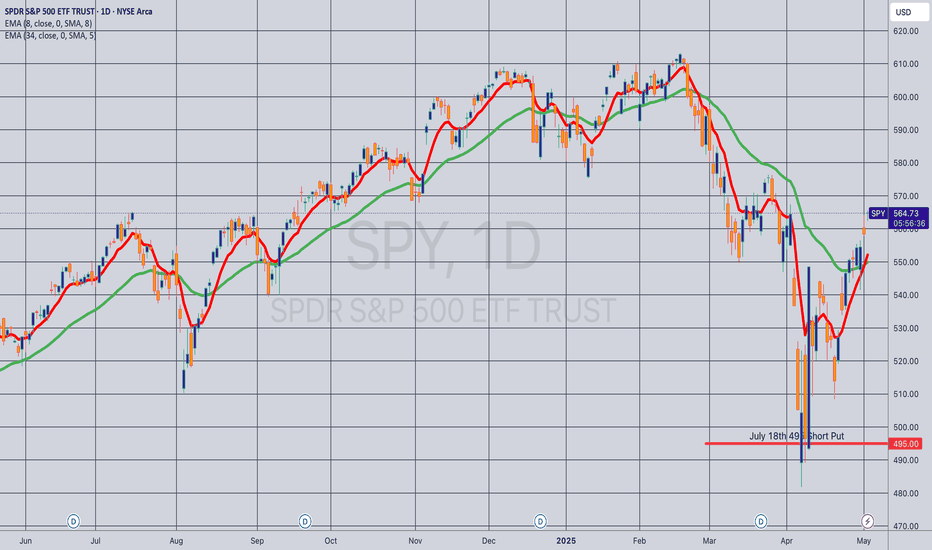

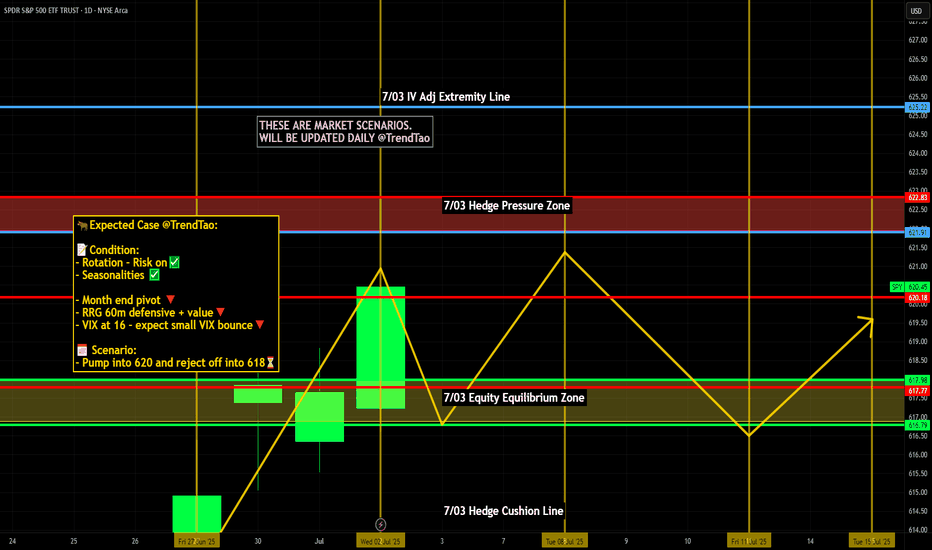

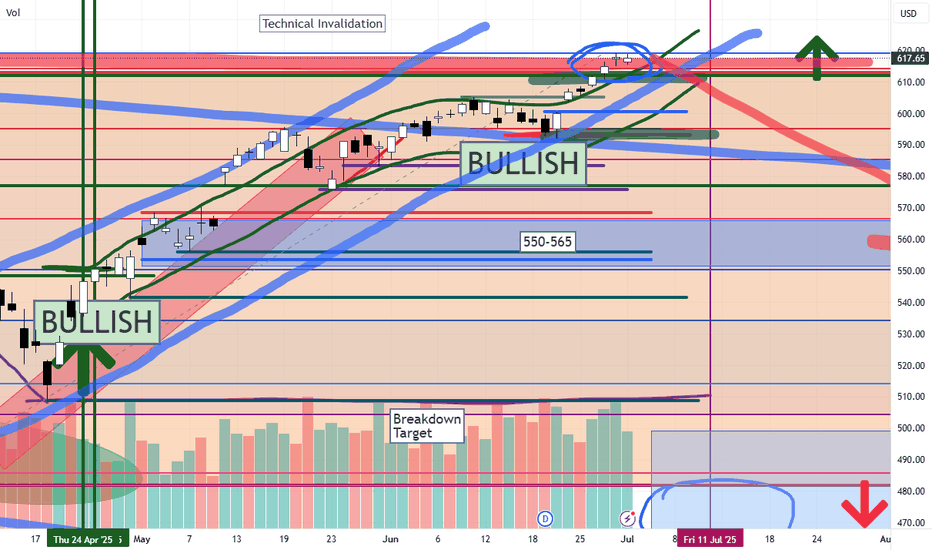

SPDR S&P 500 ETF (SPY)

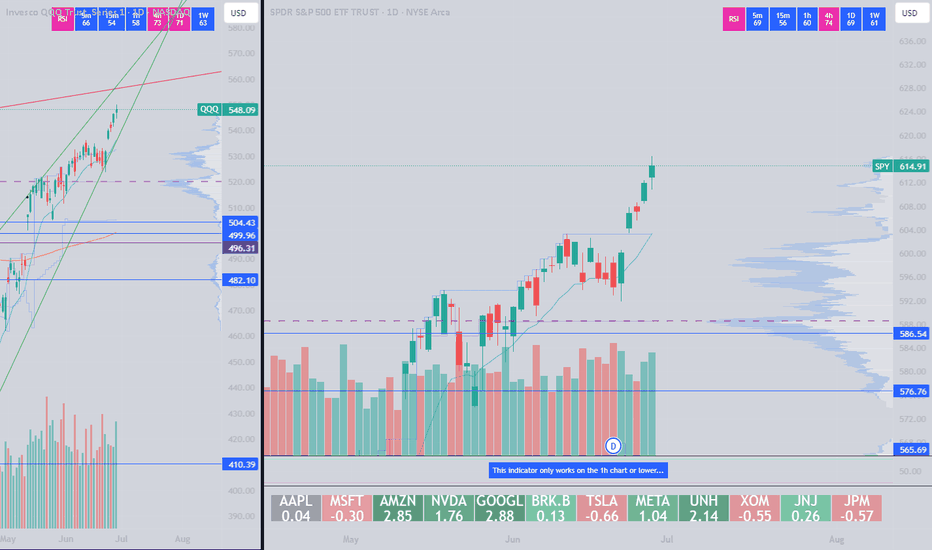

July Doesn't Disappoint - S&P Nasdaq Dow Russell All RunningS&P All Time Highs

Nasdaq All Time Highs

Dow Jones closing in on All-Time Highs (and outperforming both S&P and Nasdaq recently)

Russell 2000 playing catch up and moving higher

This is melt-up at its finest

Since US/China Trade Agreement and Middle East Ceasefire Agreement, markets have used

these two events as further catalysts to continue the upside runs

Stochastic Cycle with 9 candles suggesting a brief pause or pullback in the near-term, but

a 3-5-10% pullback is still an opportunity to position bullish for these markets

I'm only bearish if the markets show that they care with price action. The US Consumer isn't breaking. Corporate Profits aren't breaking. Guidance remains upbeat. Trump is Pro Growth and trolling Powell on the regular to run this economy and market HOT demanding cuts (history says that's a BUBBLE in the making if it's the case)

Like many, I wish I was more aggressive into this June/July run thus far, but I'm doing just fine with steady gains and income trades to move the needle and still having plenty of dry powder

on the sidelines for pullbacks

Markets close @ 1pm ET Thursday / Closed Friday for 4th of July

Enjoy the nice long weekend - back at it next week - thanks for watching!!!

Opening (IRA): SPY July 18th 495 Short Put... for a 5.13 credit.

Comments: Targeting the <16 delta strike paying around 1% of the strike price in credit.

Max Profit: 5.13

ROC at Max as a Function of Strike Price: 1.04%

Will generally look to roll up if the short put is in profit at 45 DTE or greater, add at intervals if I can get in at strikes better than what I currently have on at the June 513's and July 495's, and/or consider a "window dressing" roll (i.e., a roll down to a strike that is paying about the same in credit) to milk the last drops out of the position.

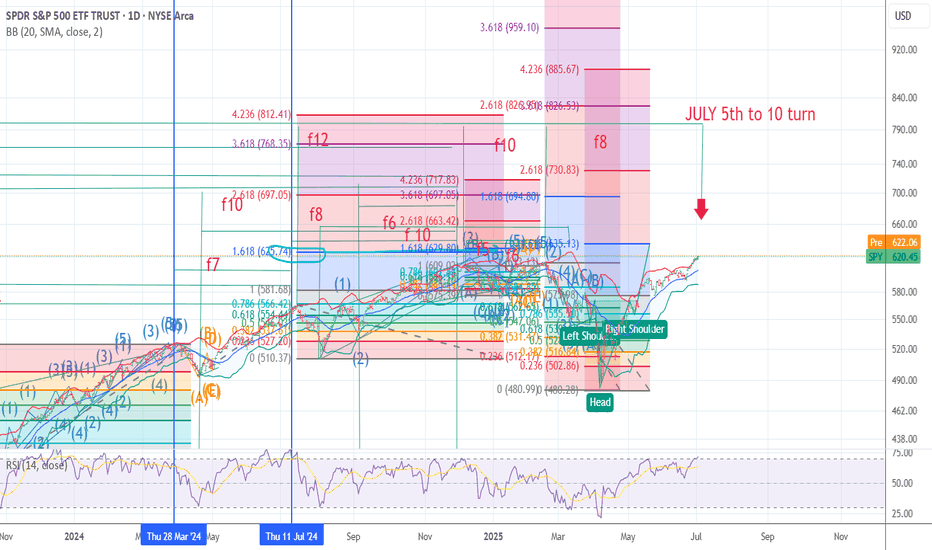

SPRIAL TURN MAJOR JULY 5to the 10th TOP 4 spiral and one FIBThe chart posted is the updated chary for SPY SPIRAL calendar TURN Notice f12 is a spiral from July 16th 2024 top F 10 is from 11/2024 DJI The SPY was 12/5 th TOP F8 is from Feb 19th Top They ALL have a focus point on JULY 5th to 10th 2025 it is also 89 days since the print low. I Am looking for a MAJOR World event into this date . This time I feel it will be something with JAPAN . As to the markets here The put/call is now at the same level as july 2023 top and july 2024 . I have had fib targets in cash sp 500 from 6181 to as high as 6331 we are now in the middle of the targets But Time still has 3 to 5 days .So if we close strong today I will be buying deep in the money puts once again . The QQQ have entered the min target 551/553 But I tend to think {HOPE] we can reach 562 plus or minus 1.5 to move to a full short . But now in cash BTW the SMH target 283/285 is also a target .for its TOP Bitcoin is now setup for the next TOP I just need a new high .Best of trades WAVETIMER

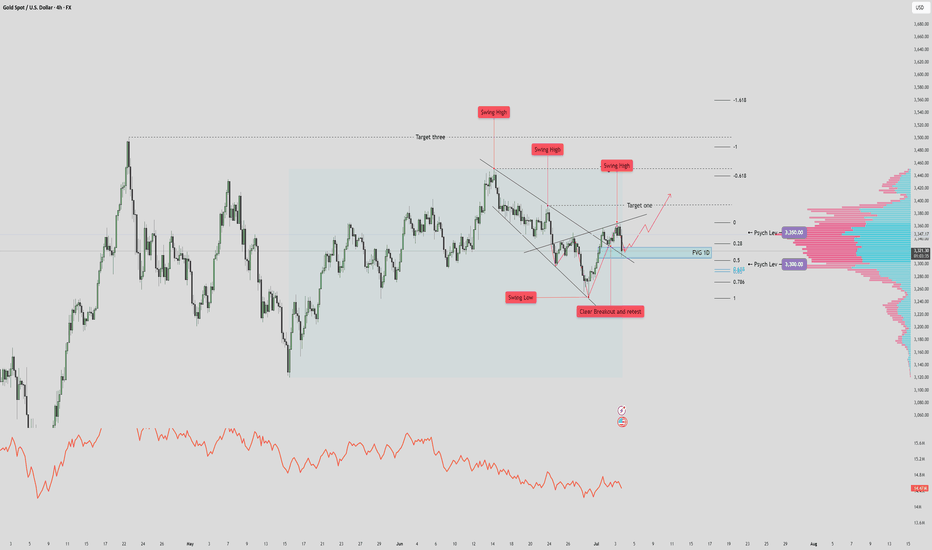

XAUUSD $3500 Recovery? Reverse Heads and Shoulders? 🔎 STRUCTURE & TECHNICAL ELEMENTS

1. Pattern:

A falling wedge was formed and broken cleanly to the upside → bullish reversal structure.

Breakout was followed by a successful retest at prior structure lows (marked “Clear Breakout and Retest”).

2. Fair Value Gap (FVG 1D) Zone:

Currently being tested. This zone coincides with:

Minor support from prior consolidation

Fib retracement (0.5 level)

Potential demand area (watch for bullish reaction/candle structure here)

3. Volume Profile:

3,350 = POC (Point of Control) → heavy resistance.

3,300 = Secondary HVN → strong support below current price.

Low-volume nodes just under current price → if broken, price likely accelerates into the GP zone.

4. Fibonacci & Liquidity Confluence:

Golden Pocket (3287) just below 3,300 = ideal liquidity draw if FVG fails.

Target 1 / 2 / 3 above are Fibonacci-based projections + historical swing zones.

✅ SCENARIO 1: Bullish Case – FVG Holds

If price respects the FVG 1D zone, expect:

Continuation up toward Target One (~3,430)

Extension to Target Two (~3,470) and even Target Three (~3,540+) possible

Confirmation: Bullish engulfing / high-volume bounce / sweep of intraday lows without close below FVG

Bias: Bullish continuation as long as price holds above FVG/0.5 Fib

🚨 SCENARIO 2: Bearish Case – FVG Breaks Down

If price closes below FVG zone, particularly below 3,312:

High probability drop toward 3,300 (psych level)

Liquidity sweep and deeper correction into Golden Pocket (~3,287) likely

This area can act as a high-probability long re-entry zone

Bias: Short-term bearish if close below FVG + swing structure invalidation

⚖️ REFINED SUMMARY

Price rejects off FVG - we can expect target 1 and 2 tagged.

Price breaks & closes below FVG zone - we can expect it to drop/wick to 3,300

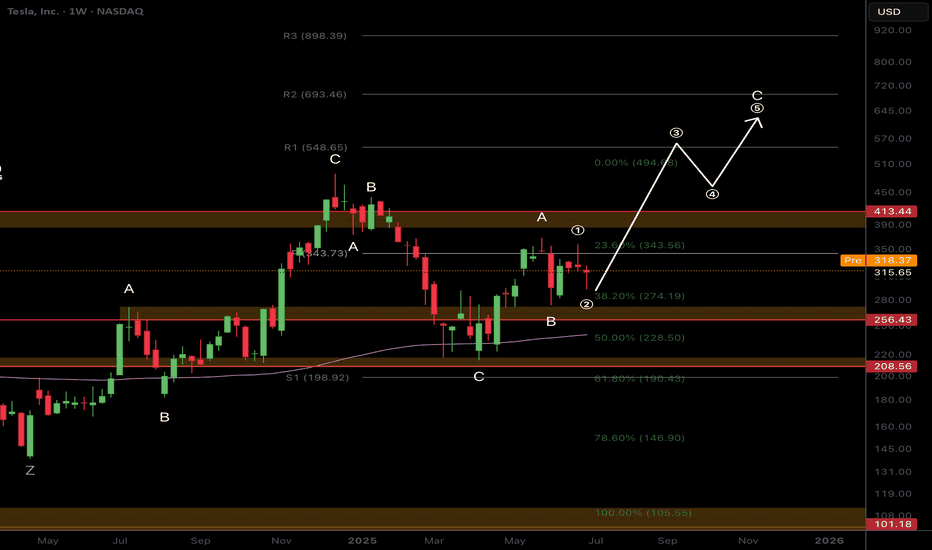

$TSLA Time to Fade or..?NASDAQ:TSLA (like NASDAQ:GOOG ) is standing out to me as bullish, yet, corrective Elliot Waves a higher degree series of ABCs appear to be underway.

A final wave C appears to be underway which would take price too all time highs in an expanded flat correction pattern. My count could be wrong and the interference could be from the increase it sentiment volatility connected to the US headlines lately and Trump posting on socials. Things may get back to normal after the summer and a clearer pattern may emerge.

Price is struggling to get past the weekly pivot point bullishly or the weekly 200EMS bearishly and is trapped within that range.

For now long term target is the R2 daily pivot at $693 as the higher probability is continued upside

Safe trading

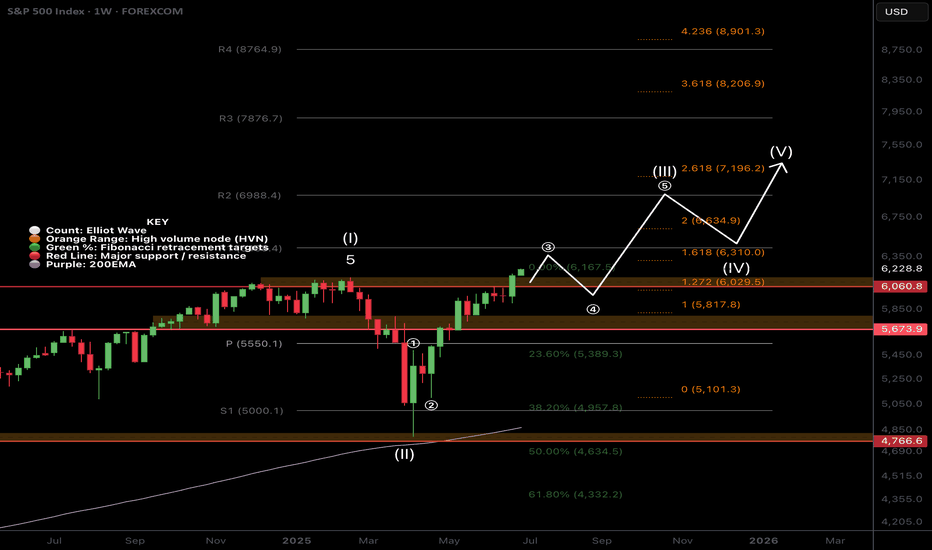

$SPX500 Most Hated Rally to Continue?FOREXCOM:SPX500 continues into price discovery suggesting a wave (3) is still underway but nearing a its minimum target of the 1.618 Fibonacci extension target $6310. Overextension of this target will demonstrate an even stronger bullish outlook.

Long term terminal targets remains above $7000 for me.

A short term pull back is a high probability but markets can stay irrational longer than participants can stay liquid.

Safe trading

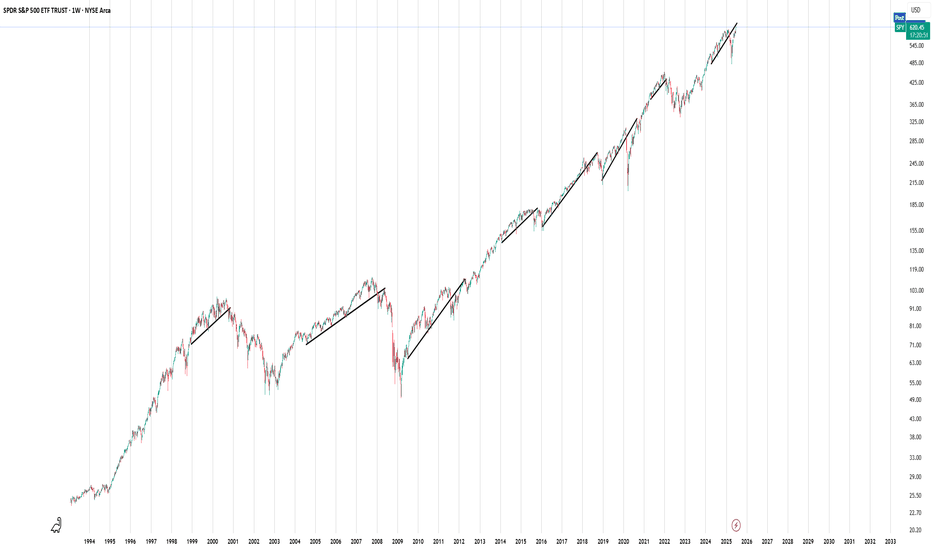

SP500 approaching rising trendline from belowThere has always been some correction when the market approaches the rising trendline from below. AMEX:SPY has about 10 point and SP:SPX about 100 points to go still. The volume is still on the buy side. I expect that to fade before a correction. Some market leaders like AMZN have already touched that trendline

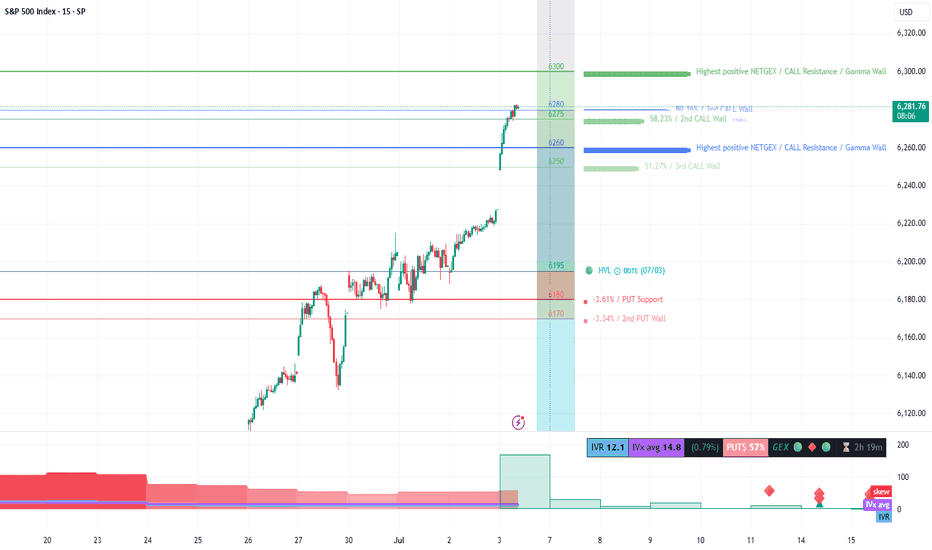

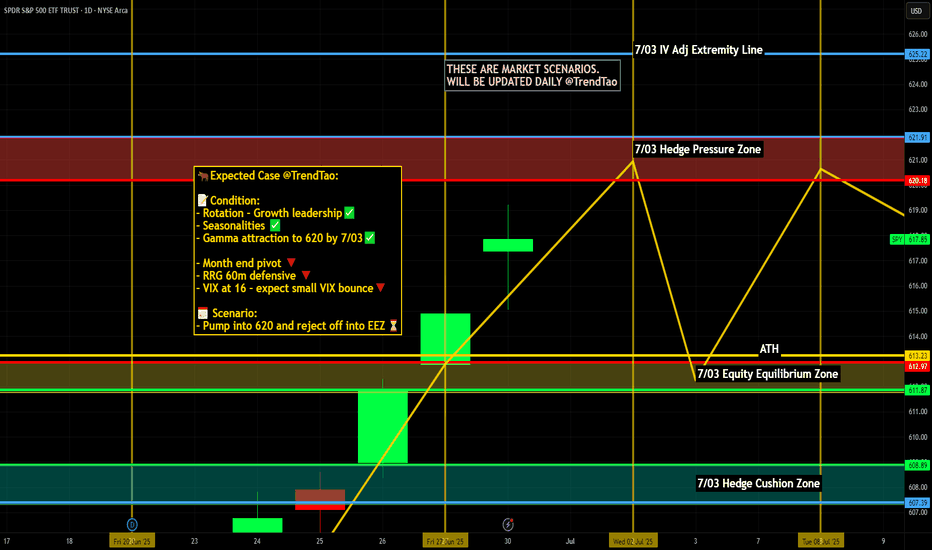

Nightly $SPY / $SPX Scenarios for July 3, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 3, 2025 🔮

🌍 Market-Moving News 🌍

📉 U.S. Private Payrolls Surround Weakness

The ADP report showed a drop of 33,000 private-sector jobs in June, the first decline in over two years, reflecting businesses holding back hiring amid trade uncertainty. However, layoffs remain low, signaling no acute stress yet

📊 Markets Braced for NFP Caution

Markets are wary ahead of this morning’s Non‑Farm Payroll (NFP) release—currently projected at +115,000 jobs and 4.3% unemployment—based on indications of labor-market cooling from weak ADP numbers

💵 Canadian Dollar Strengthens

The loonie jumped 0.4% as investors adjust expectations for broader central-bank dovishness, driven by the weak U.S. jobs signals and optimism over a revived U.S.–Canada trade dialogue

📊 Key Data Releases 📊

📅 Thursday, July 3:

8:30 AM ET – Non‑Farm Payrolls (June):

Forecast: +115,000; Previous: +139,000 (May). Watching for signs of sustained job-growth slowdown.

8:30 AM ET – Unemployment Rate:

Forecast: 4.3%, up from 4.2% in May. A rise may increase odds of rate cuts.

8:30 AM ET – Average Hourly Earnings (MoM):

Forecast: +0.3%; prior: +0.4%. Cooling wages would ease inflation pressures.

8:30 AM ET – Initial & Continuing Jobless Claims:

Track week-to-week stability or worsening of labor-market conditions.

9:45 AM ET – Services PMI (June, flash):

Monitor for signs of slowing in U.S. service-sector activity.

10:00 AM ET – ISM Non-Manufacturing PMI (June, flash):

Forecast: 50.8. A reading below 50 suggests contraction in services.

⚠️ Disclaimer:

For informational and educational purposes only. It does not constitute financial advice. Consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #jobs #Fed #labor #technicalanalysis

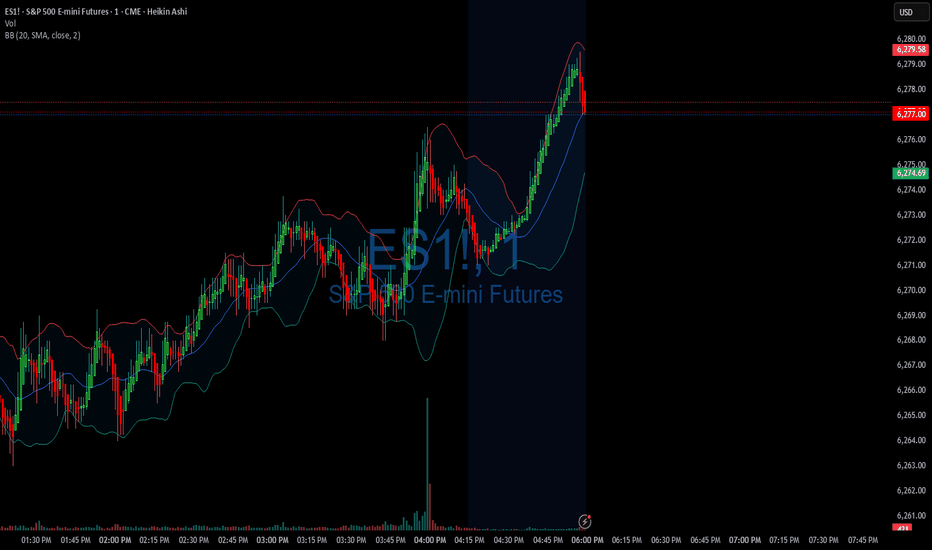

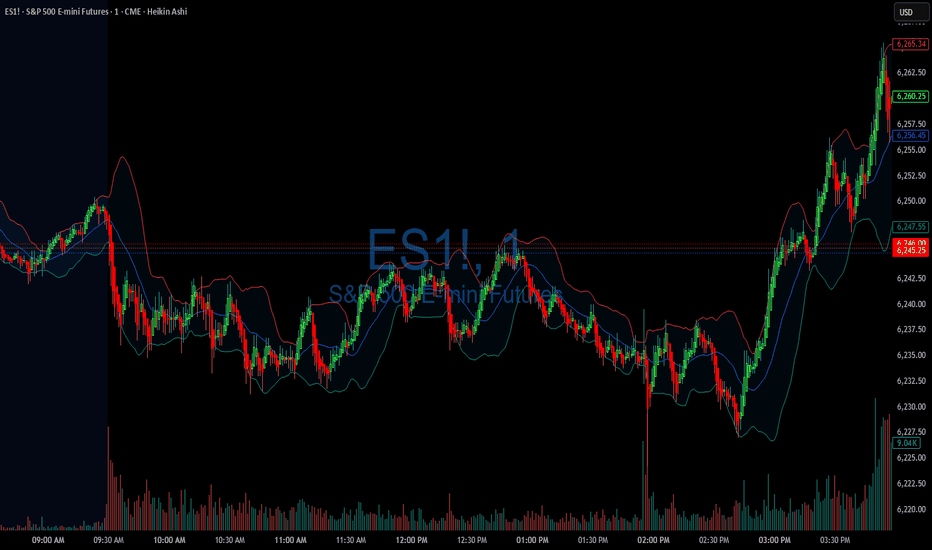

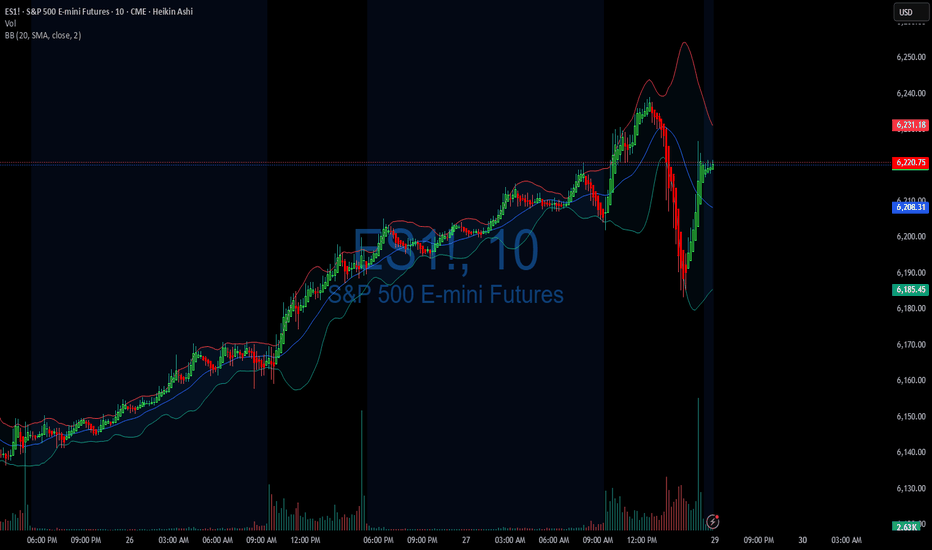

DIYWallSt Trade Journal: Why Price Action Beats News **07/02/25 Trade Journal, and ES_F Stock Market analysis **

EOD accountability report: +763

Sleep: 4.5 hours

Overall health: sleep deprived

** VX Algo System Signals from (9:30am to 2pm) 4/4 success**

— 9:57 AM Market Structure flipped bullish on VX Algo X3! :check:

— 10:30 AM Market Structure flipped bullish on VX Algo X3! :check:

— 11:10 AM VXAlgo ES X1 Sell Signal :x:

**What’s are some news or takeaway from today? and What major news or event impacted the market today? **

You can't trade on news, the only thing that matters in day trading is price action.

Bad news can still make the market go up.

News

The U.S. economy lost 33,000 jobs in June, as per ADP, badly missing forecasts for a gain of 99,000.

MICROSOFT TO LAY OFF AS MANY AS 9,000 EMPLOYEES

Tesla’s NASDAQ:TSLA Q2 deliveries miss consensus expectations

**What are the critical support levels to watch?**

--> Above 6250= Bullish, Under 6240= Bearish

Video Recaps -->https://tradingview.sweetlogin.com/u/WallSt007/#published-charts

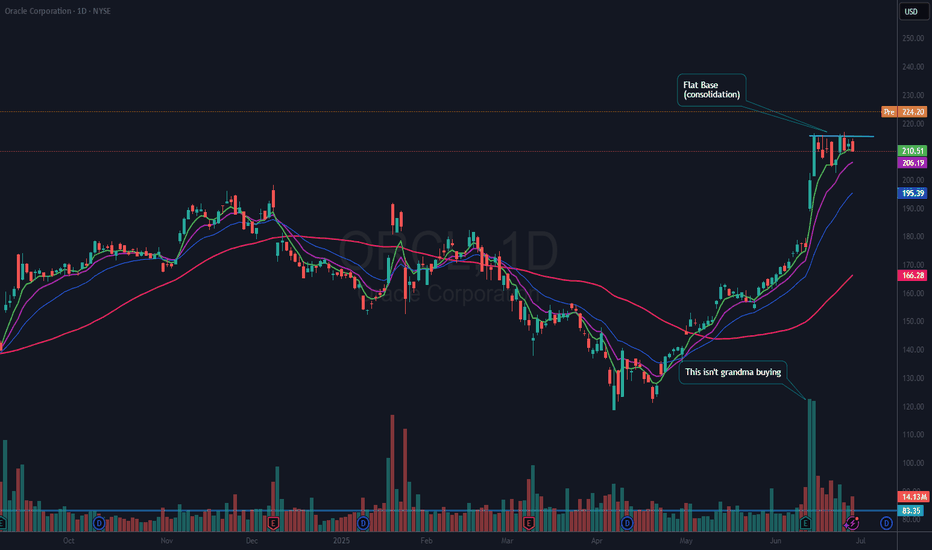

$ORCL Beats Earnings – Flat Base Breakout?There is a lot to like about NYSE:ORCL both on the chart and fundamentals. Not only did they beat earnings and now get an upgrade (see below), but the stock has also now formed a flat base after earnings. What that means to me is that buyers have pushed the stock up and there are not enough sellers to bring it back down.

I have an alert set at 215.01. If that triggers, I plan to open a full-sized position with a stop just under the most recent low (202.54). That is a 6% risk. Although, if it does not perform well right off the bat, I may close it on whatever day I open if it falls below the day low. All TBD.

If you like this idea, please make it your own and follow your trading plan. Remember, it is your money at risk.

Oracle rises as Stifel upgrades to 'buy'

** Stifel upgrades stock to "buy" from "hold", citing strong momentum in its Cloud business and disciplined cost management

** Increases PT to $250 from $180, implying an 18.91% upside to stock's last close

** "We believe Oracle is well positioned to accelerate total Application Cloud growth to the low teens range in FY26" - brokerage

Oracle Beat Expectations

Wednesday, June 11, 2025 at 4:05 PM ET

Oracle (ORCL) reported earnings of $1.69 per share on revenue of $15.90 billion for the fiscal fourth quarter ended May 2025. The consensus earnings estimate was $1.64 per share on revenue of $15.54 billion. The Earnings Whisper number was $1.66 per share. The company beat expectations by 1.81% while revenue grew 11.31% on a year-over-year basis.

SPY/QQQ Plan Your Trade For 7-1 : Post Market UpdateToday was a very powerful day for the Cycle Patterns - particularly for Gold and BTCUSD.

Gold rallied as the Cycle Pattern predicted a RALLY in TREND mode.

BTCUSD collapsed on a CRUSH Cycle Pattern.

The SPY Cycle Pattern predicted a Gap Reversal pattern. We did see the Gap today and a moderate reversal in price. But the SPY, as usual, continued to try to melt upward.

I highlighted a very interesting TWINNING pattern in Bitcoin in this video. Pay attention.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

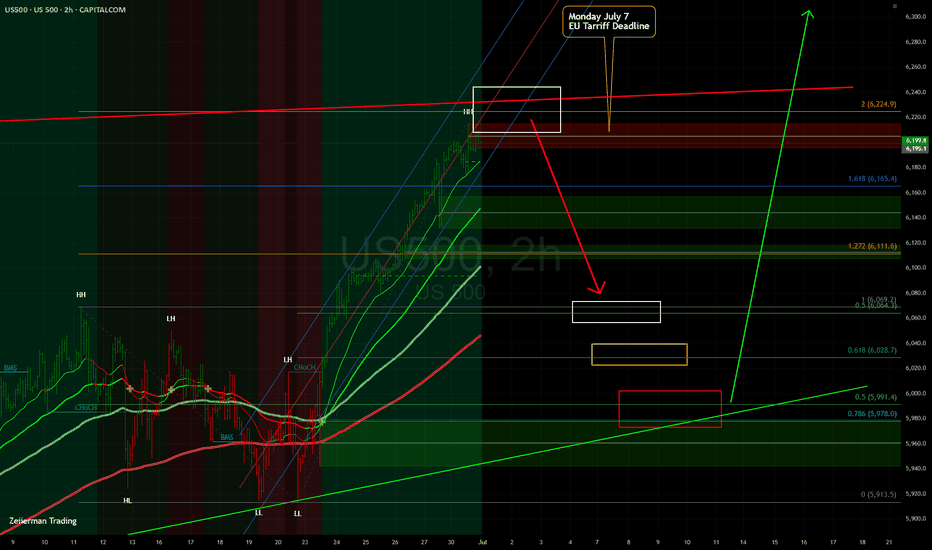

Possible "DIP" into Monday July 7 Tarrif DeadlineHello everyone,

Well we made it. ATH! Well all things must eventually dip. I see a good possibility into next Monday July 7 Tarif deadline plus we are hitting the ATH's prior tops trendline (Red Line)....

I highlight with colored boxes 3 different price targets I think it could dip to before resuming its march higher.

Let's see what happens!

SPY S&P 500 ETF Potential W-Shaped Recovery Forming We may be witnessing the formation of a W-shaped recovery on the SPY (S&P 500 ETF) – a classic double-bottom structure that often signals a strong reversal after a period of correction or volatility. Let’s dive into the technicals and what this could mean in the sessions ahead.

🔍 The Technical Setup:

SPY recently tested key support around the $485-$500 zone, bouncing off that area twice in the past few weeks. This gives us the left leg of the W and the first bottom. After a modest relief rally to ~$520, we saw another pullback – but this second dip failed to break below the first bottom, a hallmark of the W-pattern.

As of today, SPY is starting to reclaim ground toward the $517-$520 resistance zone. If bulls can push through this neckline area, especially with volume confirmation, we could see a breakout that targets the $530-$535 area in the short term.

🔑 Key Levels to Watch:

Support: $490-$500 (double-bottom support zone)

Neckline/Resistance: $530

Breakout Target: $550 (previous highs)

Invalidation: A break below $490 with volume could invalidate the W-recovery idea and shift bias bearish.

📊 Momentum & Volume:

RSI is climbing back above the 50 level – bullish momentum building.

MACD shows a potential crossover forming, hinting at a shift in trend.

Watch for increasing buy volume as SPY approaches the neckline – that’s where the bulls will need to step up.

🧠 Macro & Earnings Angle:

Don’t forget – we’re entering a heavy earnings season and rate cut expectations are still a wildcard. A dovish tone from the Fed and strong corporate results could be the fuel that sends SPY higher to complete this W-shaped recovery.

🧭 Final Thoughts:

This is a high-probability setup if neckline resistance is broken cleanly. Wait for confirmation before going heavy – fakeouts are common in double-bottom scenarios. If we do get the breakout, we may be looking at a broader market rebound going into summer.

🔔 Set alerts near $525. A confirmed breakout could mean the bulls are back in charge.

Nightly $SPY / $SPX Scenarios for July 1, 2025 🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 1, 2025 🔮

🌍 Market-Moving News 🌍

📊 Core Inflation Edges Higher

May’s core inflation rose unexpectedly to 2.7% year-over-year, up from 2.6%, casting uncertainty over the Fed’s timeline for rate cuts. While headline CPI sits at 2.3%, the resilience in underlying prices complicates policymakers’ projections for later this year

💵 Weak Dollar, Rising Rate-Cut Bets

Markets are reacting to “summertime data”—like the core CPI uptick—with renewed optimism. Traders now see up to 75 bps in Fed rate cuts later this year, while the dollar remains near 3½-year lows on concerns about Powell’s independence and trade developments

🇨🇦 U.S.–Canada Trade Talks Resume

Trade talks between the U.S. and Canada restarted today, following Ottawa’s suspension of its digital-services tax. Progress toward a broader agreement could reduce tariff risk and offer further relief to risk assets

📊 Key Data Releases & Events 📊

📅 Tuesday, July 1:

All Day – U.S.–Canada Trade Talks

Markets will watch for updates on tariff resolution and broader trade deals. Any breakthrough could notably boost equities and improve trade sentiment.

10:00 AM ET – ISM Manufacturing PMI (June)

A below-50 reading again would reinforce the narrative of industrial weakness. A rebound could support equities and temper recession concerns

10:00 AM ET – JOLTS Job Openings (May)

Still at elevated levels (~7.39 million in April), this metric assesses labor-market resilience. A decline could shift rate-cut expectations.

⚠️ Disclaimer:

This is for educational and informational purposes only. It does not constitute financial advice. Consult a licensed financial advisor before investing.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

06/30/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +212

Sleep: 7 hours

Overall health: Good, caught up on workout and sleep over the weekend.

** VX Algo System Signals from (9:30am to 2pm) 2/4 success**

— 12:20 PM VXAlgo NQ X1 Sell Signal :x:

— 12:30 PM Market Structure flipped bullish on VX Algo X3!:check:

— 1:55 PM VXAlgo NQ X1 Buy Signal :x:

— 2:00 PM Market Structure flipped bearish on VX Algo X3! :check:

**What’s are some news or takeaway from today?

and What major news or event impacted the market today?

**

The X1 Signals today has been happening after market structure signals and usally that means MM is going to change the direction to the opposite way to scam us. Based on that, I decided to lock out my account after making $200 today so i don't get caught in the scam.

News

EU TO ACCEPT TRUMP’S UNIVERSAL TARIFF BUT SEEKS KEY EXEMPTIONS — 2:07 PM

What are the critical support levels to watch?

--> Above 6240= Bullish, Under 6210= Bearish

Video Recaps -->https://tradingview.sweetlogin.com/u/WallSt007/#published-charts

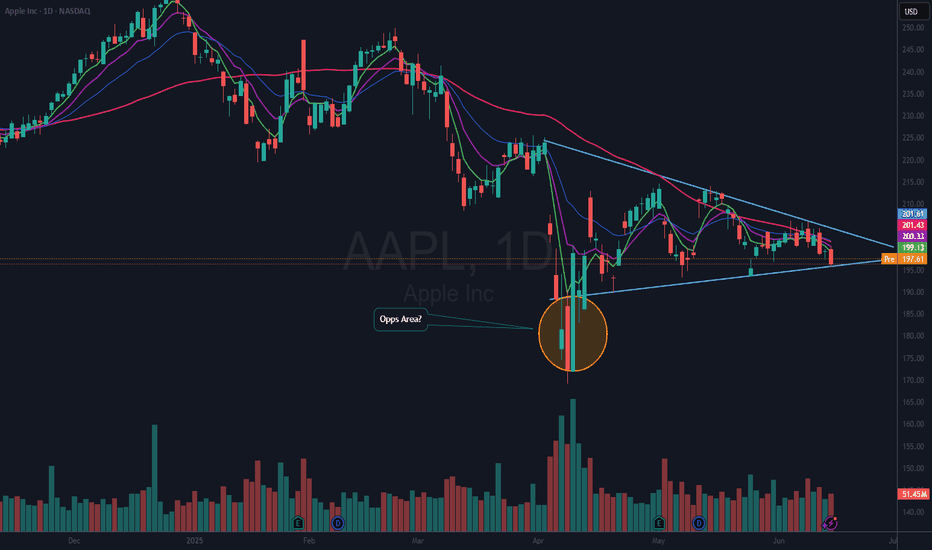

$AAPL In ConsolidationNASDAQ:AAPL is consolidating here in a wedging pattern. I do not know which way this will resolve. But, since I rarely if ever short, I am looking on the long side of a trade. The thing I like about a consolidation pattern like this is, you know when you are wrong very quickly. My plan is to take a ¼ size long position if / when it moves above the 50 DMA (red) with a stop just below the most recent low (which would also correspond to dropping below the lower wedging trendline.

Then if it can break out over the upper downtrend line, I will look to build out my position. I thought this would be a good one to put on your watchlist. If you like the idea, please make it your own so that it fits within your trading plan.

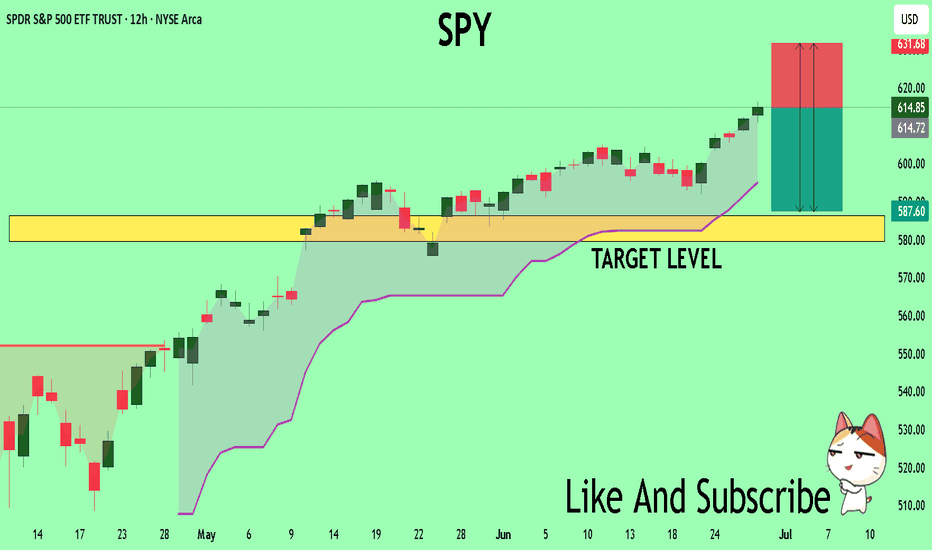

SPY Technical Analysis! SELL!

My dear followers,

I analysed this chart on SPY and concluded the following:

The market is trading on 614.85 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 586.37

Safe Stop Loss - 631.68

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

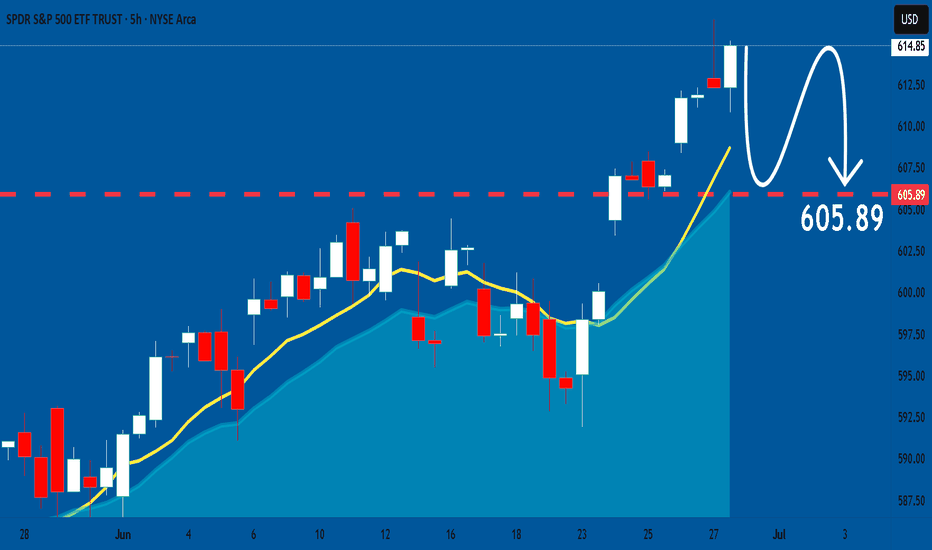

SPY: Bearish Continuation is Expected! Here is Why:

Looking at the chart of SPY right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

06/27/25 Trade Journal, and ES_F Stock Market analysis 06/27/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +915

Sleep: 6 hours

Overall health: edgy from sleep

** VX Algo System Signals from (9:30am to 2pm) 3/4 success**

9:37 AM VXAlgo ES X1 Buy signal :check:

9:55 AM Market Structure flipped bullish on VX Algo X3! :check:

10:31 AM VXAlgo ES X1 Sell Signal (double sell) iffy

1:43 PM Market Structure flipped bearish on VX Algo X3! :check:

**What’s are some news or takeaway from today?

and What major news or event impacted the market today?

**

Early on in the market, I noticed that there was heavy manipulate by the MM with violent buy and sell. This somewhat warns that today's market could be tough to trade and you have to be very patient.

News

PRES TRUMP: ENDING ALL TRADE TALKS WITH CANADA; WILL TELL CANADA ITS TARIFF LEVEL IN COMING DAYS - around 1 :40pm est

What are the critical support levels to watch?

--> Above 6200= Bullish, Under 6185= Bearish

Video Recaps -->https://tradingview.sweetlogin.com/u/WallSt007/#published-charts

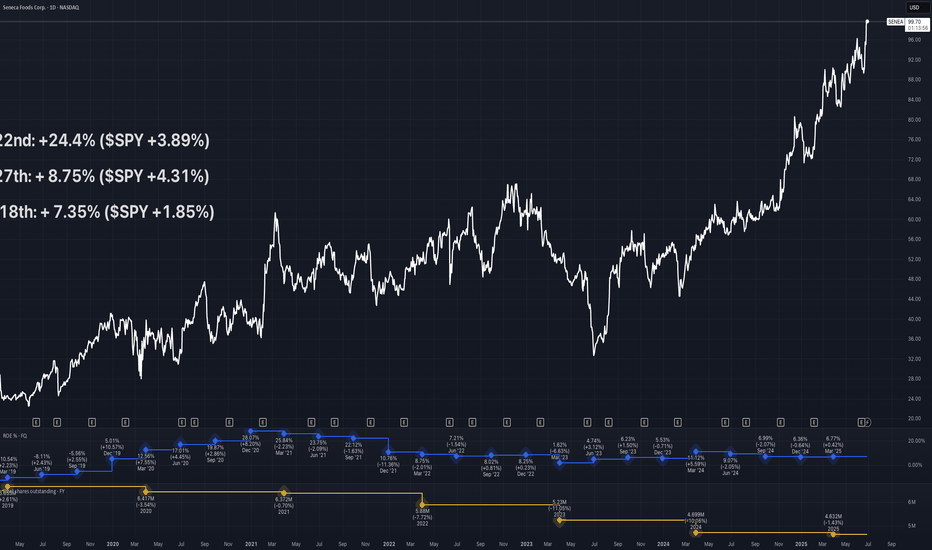

Beating the S&P 500 with TradingView's Stock ScreenerThis is Mo from MWRIGHT TRADING. The date is Friday, June 27th, 2025.

This video is about selecting stocks that collectively have the potential to consistently beat the S&P 500

I look for smooth and consistent long-, mid-, and short-term performance. For that we need

Building a Screener

What I look for

- Liquidity - that means money, or trading volume.

- Room to move - no overhead resistance

- Favorable trends - stable moving averages

- Good short term signals - a good intraday chart

Filters

- Market Cap 300M to 2B

Not too big, and not too small

- Perf 10Y > Perf 5Y

No long term dips in performance

- Perf 5Y > Perf 1Y

No short term dips in performance

- SMA(300) < Price

Price above moving average

- SMA(200) < Price

Price above moving average

- Avg Volume 10D > 100K

No lightly traded stocks. Liquidity needed

- + SMA(200) >= SMA(300)

Stacked long-term SMAs

- + SMA(50 >= SMA(200)

Stacked short-term SMAs

- + ROE, Trailing 12 Months > 0% (Chris Mayer)

Improving ROE

Examples

- SENEA

- DGII

Review the charts

- Verify short term performance

- Multi-VWAP (1 hr Chart) - Free Indicator

- Above a rising 5-Day AVWAP

- Magic Order Blocks (5 min Chart) - Free Indicator

- No major overhead resistance

- Verify fundamentals and long term performance

- ROE (Quarterly) - TV Indicator

- Rising ROE

- Float Shares Outstanding - TV Indicator

- Lower float means lower supply. When high demand occurs, this can act as a price catalyst.

- Multi VWAP from Gaps - Free Indicator

- Stacked is good

- 3 SMA Ladies - Custom Indicator

- Stacked is good