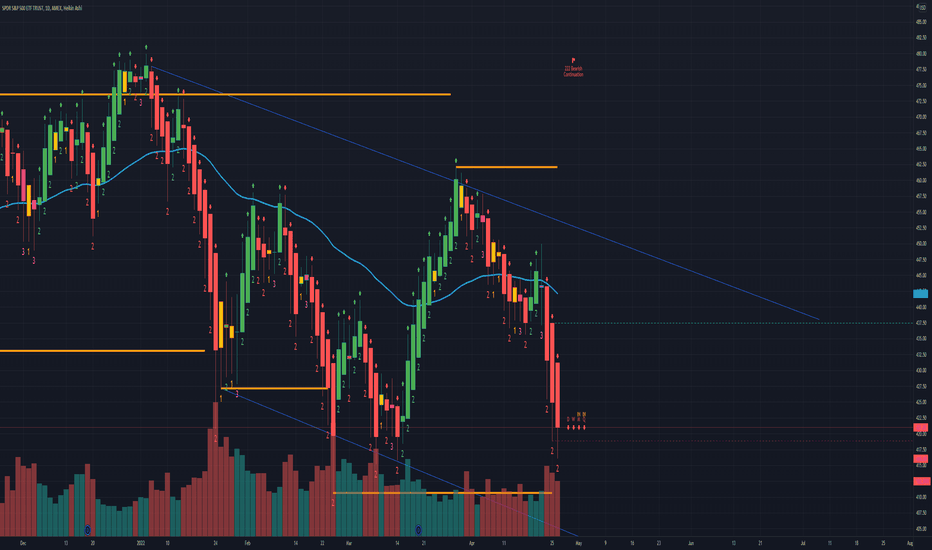

$SPY welcome to bear market? $SPY trading below 100 & 200 moving average and sitting just above the previous level of support around 411-412 where it previously bounces. As the earning week continues, #SPY still struggles to climb back up to break out the resistance level. Also, the market sentiment plays a major role in overall market.

Below is my strategy for day trading or scalp play for SPY

STY: Day trade or scalp target play: 04/227/22

Buy call above 418.90 sell at 4.28 or above.

Buy puts below 413 sell at 405.95 or below.

option open interest: ideal expiration date: (risky) 5/06/22, 5/20/22, 6/17/22

Hello everyone,

Welcome to this free technical analysis . ( mostly momentum play )

I am going to explain where I think this stock might possibly going the next day or week play and where I would look for trading opportunities

for day trades or scalp play.

If you have any questions or suggestions on which stock I should analyze, please leave a comment below.

If you enjoyed this analysis, I would appreciate it if you smash that LIKE button and maybe consider following my channel.

Thank you for stopping by and stay tune for more.

My technical analysis is not to be regarded as investment advice. but for general informational proposes only.