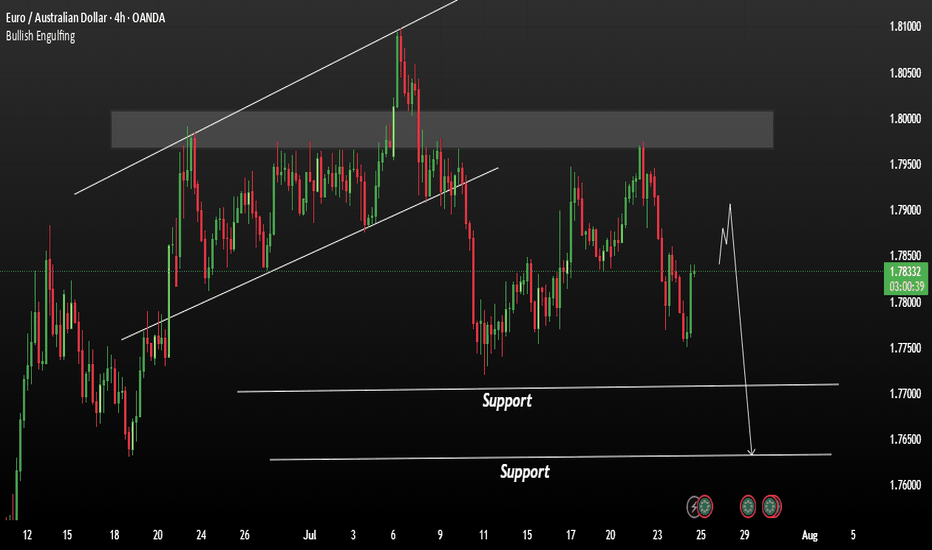

EURAUD is currently showing signs of a bearishEURAUD is currently showing signs of a bearish trend continuation. Despite short-term upward movement driven by optimism around the ECB, the overall structure remains vulnerable to downside pressure.

The European Central Bank (ECB) is expected to keep interest rates unchanged, potentially ending a seven-year streak of cuts. While this could bring temporary strength to the Euro, the technical setup still favours the bears.

Watch for a Break Below the Neckline

If price manages to break below the neckline of the current pattern, it could trigger a strong bearish move. First support: 1.77100 Second support: 1.76300

You May find more details in the chart.

Ps: Support with like and comments for more analysis.

Sroshmayi

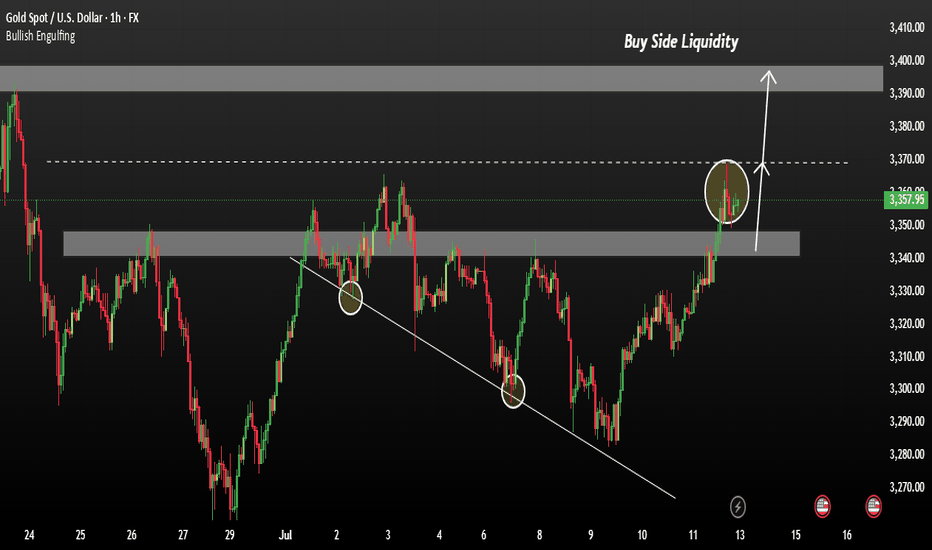

XAUUSD Bullish Trend Fallowing the chart condition Gold continues its bullish trajectory, showing potential for an extension towards the 3400 level, driven by geopolitical concerns and dovish central bank sentiment. Recent tariff related comments from former President Trump have reignited global trade tensions. Fed Chair Powell's recent remarks suggest a cautious stance on future rate hikes, reinforcing bullish sentiment in precious metals.

Technical Overview:

Last Friday, XAUUSD reached the 3368 resistance zone, a critical level where price may consolidate. Momentum remains strong, and if the price breaks above this zone with volume confirmation, the next leg could target 3380–3400 However, caution is advised: if the price falls below 3342, but then regains ground quickly, it may still continue in the bullish trend.

You may find more details in the chart Ps Support with like and comments for more analysis.