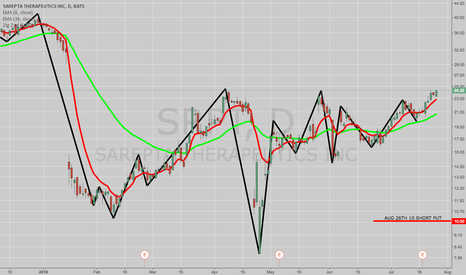

BOUGHT TO COVER SRPT SEPT 16TH 8/40 SHORT STRANGLEMmm. Must have gotten busy and not posted this one. In any event, I legged into these two sides separately, the 8 first and then the 40 after it ripped somewhat higher.

The whole burrito was worth 5.82 in credito. Closing out here for a 4.60 debit nets me $122/contract in profit. This thing is "wicked illiquid", so I figured I get while the gettin' was good ... .

SRPT

PREMIUM SELLING: SOLD SRPT AUG 26TH 10 SHORT PUT... for a 1.30 ($130)/contract credit. I probably could have worked for a better fill by $5-$10, but wanted to get this last trade on before the close.

Metrics:

Probability of Profit: 86%

Max Profit: $130/contract

Max Loss: Undefined

Buying Power Effect: $100/contract

Break Even: 8.70

Notes: I'll look to take this off at 50% max. It's a trade, not an investment ... .

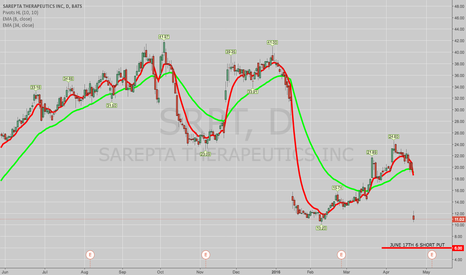

SOLD SRPT JUNE 17TH 6 SHORT PUTAlthough there are some warts on this particular trade (namely, the reason why SRPT tanked today) and the fact that liquidity in the options is not that great, I couldn't resist getting over $100 credit on a short 6 .... .

Metrics:

Probability of Profit: 65%

Max Profit: $125/contract

Max Loss: $475 (the strike price minus the credit received).

Notes: Some price discovery may be worthwhile here. I got filled for $118, but if I'd been slightly more patient, I probably could have gotten a few more bucks out of it. I'll look to take it off at 50% max profit.