Cardano stablecoins: USDA and DjedCardano stablecoins: USDA and Djed

Introduction

In recent years, stablecoins have come under increased scrutiny of regulators. The main concerns are the principles of operation of algorithmic stablecoins, the transparency of reserves, and the adequacy of the centralized stablecoins provision.

Incredibly often, the problems were discussed after the collapse of one of the most significant algorithmic stablecoins – TerraUSD (UST) that caused the fall of the entire cryptocurrency market. As a result, many stablecoins faced a temporary rate unpeg.

But the issue of reserves remains the main subject of discussion of their reliability. And the key concern here is that most of the reserves of centralized stablecoins are a complex mixture of stocks, secured loans, corporate bonds, precious metals, and other assets. And most typically, companies are criticized for the lack of proper audits to confirm reserves. In addition, these issuers need to be appropriately regulated, which increases the risks for investors.

Cardano is currently working on releasing two new stablecoins, which are tasked with solving critical issues inherent in most stablecoins.

The Cardano development team plans to release the first fully regulated stablecoin, USDA, backed by fiat and pegged to the US dollar in 2023. As well as an over-collateralized algorithmic stablecoin issued by the COTI platform called Djed.

The principle of operation of centralized and algorithmic stablecoins is different, and in this article, we will briefly describe the features of each of them.

USDA

On November 18, 2022, in Singapore, Emurgo announced the launch of a new stablecoin on the Cardano blockchain – USDA. This stablecoin will be fully regulated, backed by the US dollar, and pegged 1 to 1.

Emurgo is one of the co-founders of the Cardano project. Its mission is to develop and support businesses and help integrate businesses into the Cardano ecosystem.

One of the Cardano’s global goals is to provide access to banking products to every person in the world. The company has been successfully developing its products for a long time in the markets of Africa and Asia. People there have no access to banking services, and the country's national currency is depreciating too quickly to act as a store of value.

To achieve this goal, the Cardano developers are introducing a set of products called “Anzens”, designed to connect traditional financial services to cryptocurrency. USDA will be the first product to help bridge the gap between TradFi (traditional finance) and DeFi (decentralized finance).

“The Cardano ecosystem was built on the ethos of bringing real world applications to crypto and creating the foundation to build the economy of the future. The introduction of a fully fiat-backed, regulatory compliant stablecoin is the next step in realizing the future for our community. This stablecoin not only offers stability to investors conducting financial transactions on the blockchain but advances a path forward for the Cardano ecosystem to address a problem we are uniquely positioned to solve — banking the underbanked,” says EMURGO Fintech Managing Director Vineeth Bhuvanagiri.

Users can tokenize their USD to USDA via credit cards, wire transfers, direct deposits or payments, and native ADA token conversion. USDA is scheduled to launch in the first quarter of 2023 on the Anzens platform. It will be followed by implementing plans to provide a secure and convenient conversion of other stablecoins to USDA (for example, USDC and USDT), as well as cryptocurrencies such as Bitcoin, Ethereum, and others.

To fully comply with regulatory requirements and ensure compliance with oversight rules, Emurgo has partnered up with an as-yet-unnamed regulated US financial services company to act as the banking partner responsible for issuing USDA tokens and holding deposits.

By relying on regulation and the provision of tangible assets, the USDA can guarantee reliable long-term price stability, ultimately opening more global financial services to the Cardano ecosystem.

Djed

Unlike fiat-backed stablecoins, algorithmic stablecoins are regulated by specific algorithms that manage the balance between supply and demand, thus ensuring exchange rate stability.

Djed is an algorithmic, overcollateralized stablecoin backed by the Cardano (ADA) token and SHEN.

Algorithmic stablecoins, backed by a single currency, have some vulnerabilities. To solve this problem, Djed has a reserve asset – the SHEN token.

The concept of “over-collateralization” means that the stablecoin is backed by excess collateral in the form of a cryptocurrency held in reserve. And, if ADA falls too quickly, the underlying smart contracts include a reserve SHEN token that will be used to balance price fluctuations, helping to ensure a 400% to 800% over collateral level.

This stablecoin has been developed for more than two years in partnership with the COTI platform and IOG (please see the document describing all the technological features and operation of the stablecoin)

COTI is a first-level blockchain payment network that provides a throughput of up to 100,000 transactions per second through the Proof-of-Trust consensus mechanism. COTI provides the infrastructure needed to create and issue stablecoins that are highly secure, scalable, and have low transaction fees.

Input Output Global is an engineering and technology company engaged in cryptocurrency development and research activities.

On January 31, 2023, after completing a series of audits and stress tests, the developers of the COTI blockchain platform, in collaboration with Input Output, announced that Djed had successfully launched on the Cardano mainnet.

During the Cardano Summit in November, COTI CEO Shahaf Bar-Geffen stated, “Recent market events have proven again that we need a safe haven from volatility, and Djed will serve as this safe haven in the Cardano network. Not only do we need a stablecoin, but we need one that is decentralized, and has on chain proof of reserves.”

Conclusion:

The primary mission of Cardano is to bring blockchain technologies into real life and provide access to them to anyone in the world. It is much work from a technological point of view, but the Cardano team is making good progress in this direction.

Providing economic identification is a crucial component in countries where people do not have an identity card or access to the banking sector. For example, in developing countries in Africa and Asia, digital services and decentralized identity will give people access to education, banking services, and the employment market. And Cardano is already addressing some of these issues by developing projects like Atala Scan, Atala Trace, and Atala Prism.

Cardano-powered stablecoins that share these values will help bring stability to the broader ecosystem and restore trust by acting as a trusted channel between TradFi and DeFi. It can bring cryptocurrencies closer to their original goals: provide access to digital financial for every person and ensure independence from centralized issuers.

Stablecoin

Spot vs Ampl

Will be interesting to see how these two will attract towards same price over time.

Current target price is CPI $1.14 for both $ampl and $spot

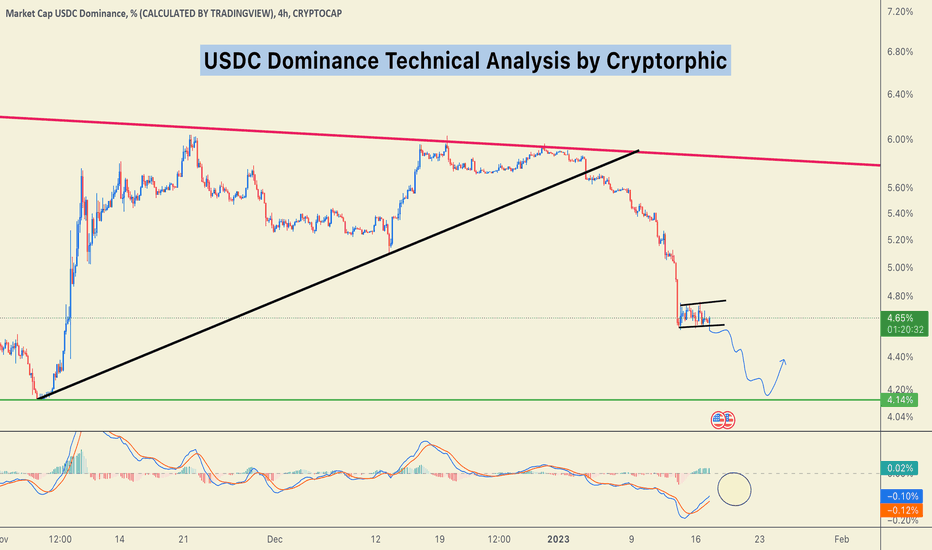

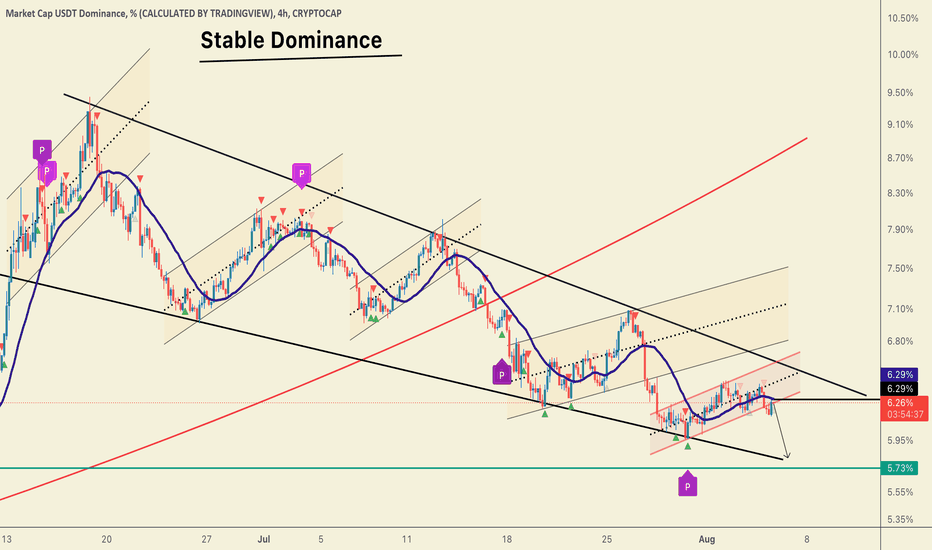

#Stable Dominance , Dump will Continue, Here's Why!Once this pennant breaks below BTC is likely to hit $22.5k+.

Is it likely? I think Yes.

Lower support is around 4.14%

Once this level hits expect some correction in the market.

The charts show the possibility of the continuation of this uptrend.

Invalidation:- Break and close above 4.85%

Let me know what. you think.

Please hit the like button if you like it and share your views in the comment section.

Stay safe

#PEACE

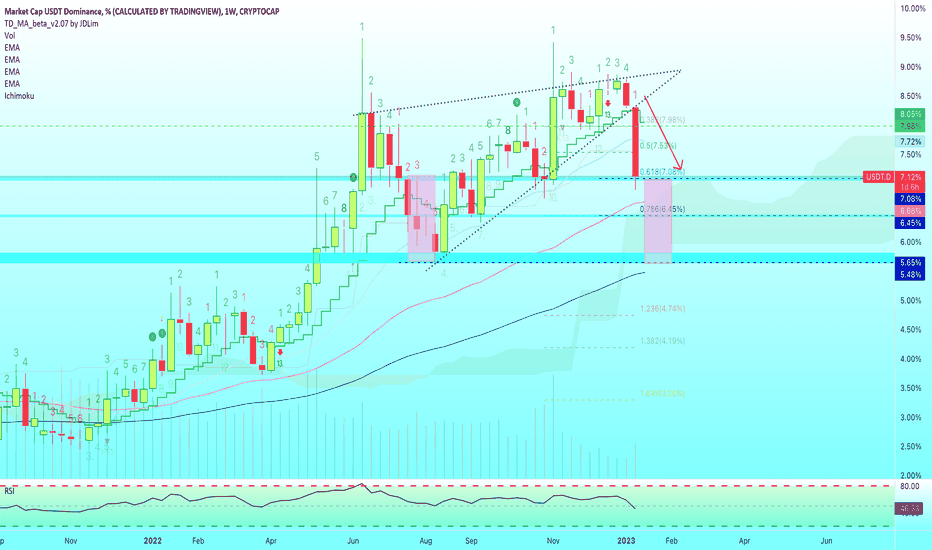

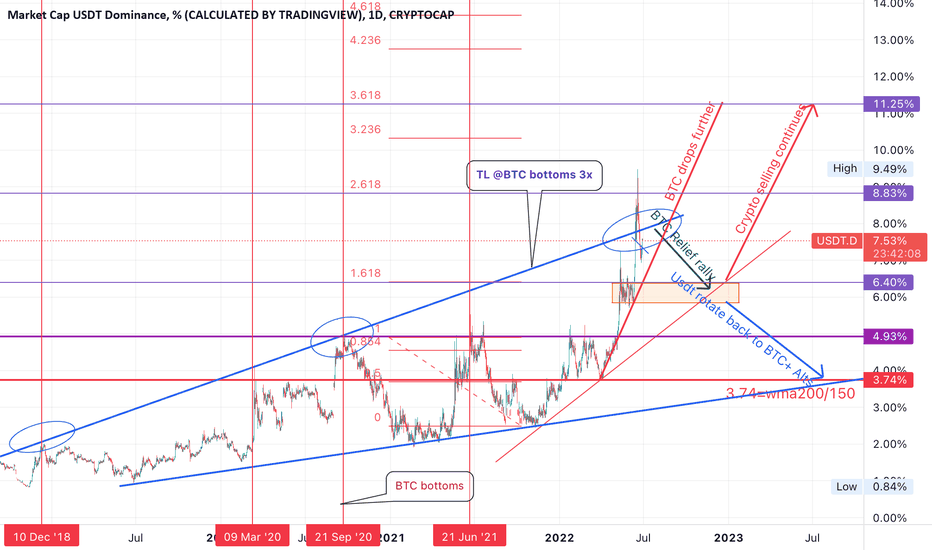

📈 Tether Dominance Weekly | July 2022 RepeatThe weekly candle is full bearish for USDT.D and we have some interesting data to analyze.

Tether Dominance is staying right above support in the form of a 0.618 Fib. retracement level.

The weekly candle closes in about 30 hours.

Looking back at July 2022, this exact same level was tested. As USDT.D broke below it, what followed were four red weekly candles (28 days) that ended up testing the 1 Fib. retracement.

We have the same scenario now.

The weekly session is about to close right above support, this happened last time but only to be followed by strong bearish action.

The RSI is in scuba diving mode and we have a volume breakout on the bearish side.

A bounce can happen at support, this is normal... But the signals are pointing lower, clear and strong.

The next targets are 6.45% and 5.65% which would mean a Bitcoin price of $23,000 to $25,000.

Namaste.

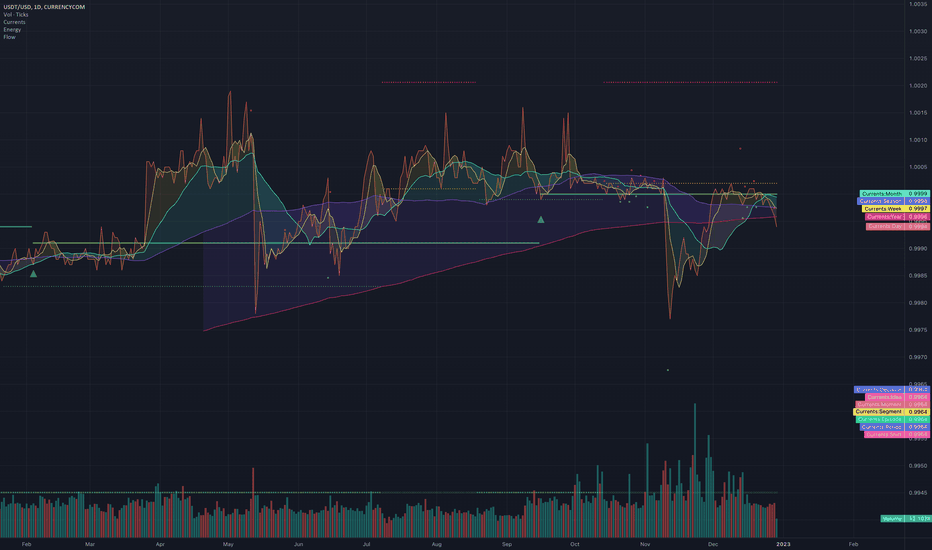

Exploring the Near-Term Risks for the Tether (USDT) PegTether isn't looking too hot right now. I haven't calibrated Cycles to work with stablecoins, but I'd assume that the seasonal current (purple) crossing the yearly current (fuchsia) is... problematic.

Maybe don't keep all your funds in $USDT.

The clustering of energy confirmations is also a very poor sign for $USDT. (Not enough historical data to say what comes after, though.)

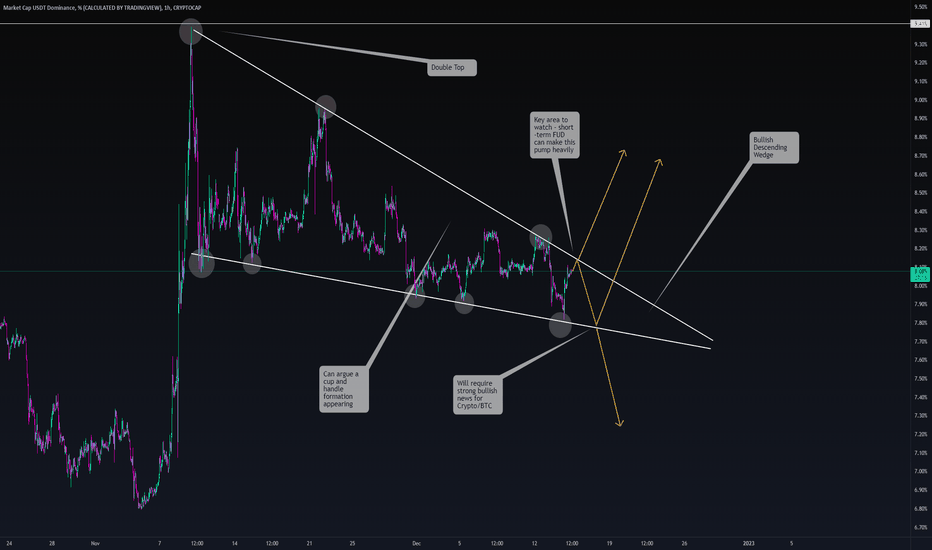

#USDT Dominance looking strong#USDT Dominance looking strong

#USDT DOMINANCE

Keep an eye here as we are in a very bullish pattern atm. Just a reminder that this is very bearish for BTC is USDT dominance increases and even more so for ALT's.

That being said it does mean if there is not a decrease in overall market cap then money is remaining in Crypto so essentially there will be a sentiment of waiting to buy the dip and not complete exodus from the Crypto market.

So this usually means short term pain, long term gain when it pumps.

Key Factors:

- Bullish descending wedge

- Testing upper trendline line

- Can argue a cup and handle formation appearing

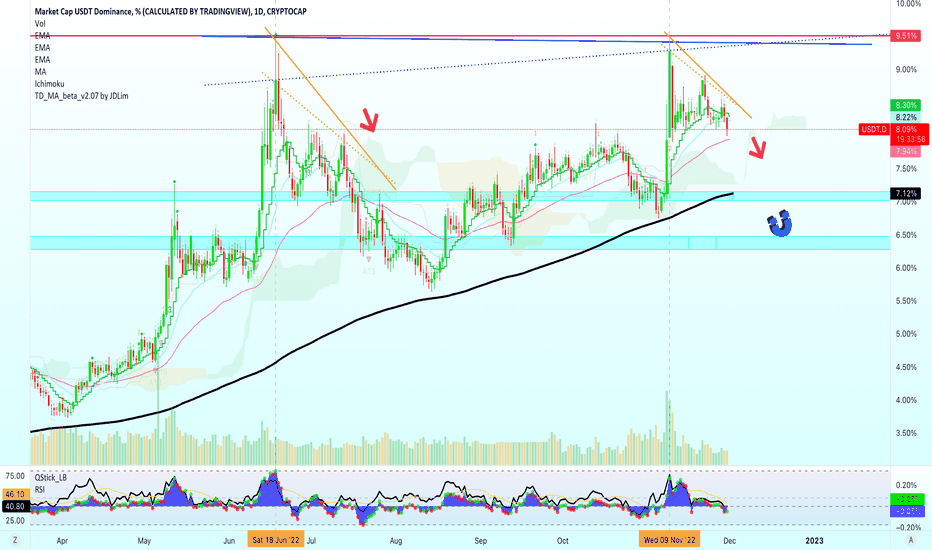

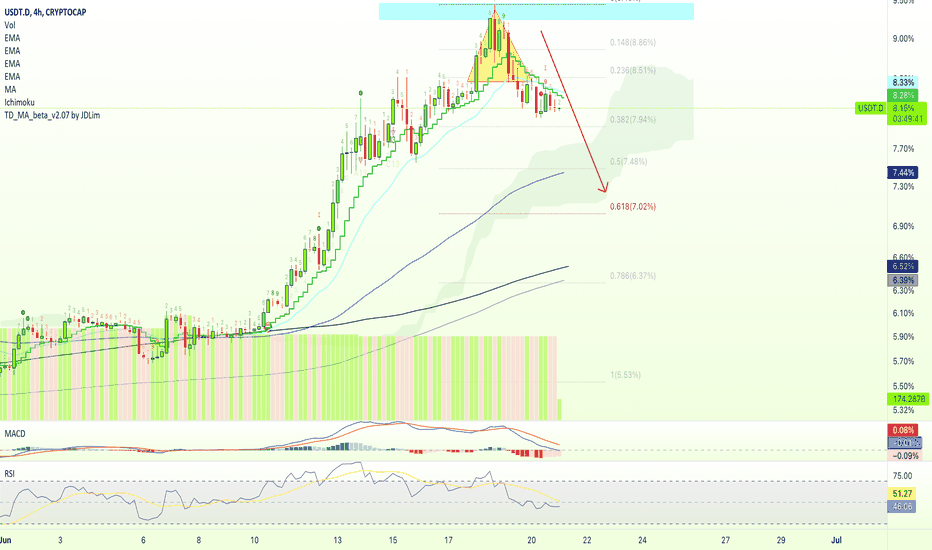

Tether Dominance Aims Down At 7.12% (10% Drop)Yesterday Tether Dominance (USDT.D) closed below EMA10 and today we have a full bearish candle.

The drop is about to speed up.

We see EMA50 as the next support line at 7.94%, but looking back this line is always pierced and MA200 has been the main support.

MA200 is sitting at 7.12%, this is where we think stands the first/main support.

As Tether Dominance goes down, Bitcoin goes up.

We can see at least 1 week bearish, 7 days, to start...

As this move develop, we can gain more data and figure out for how much longer this correction will go.

Namaste.

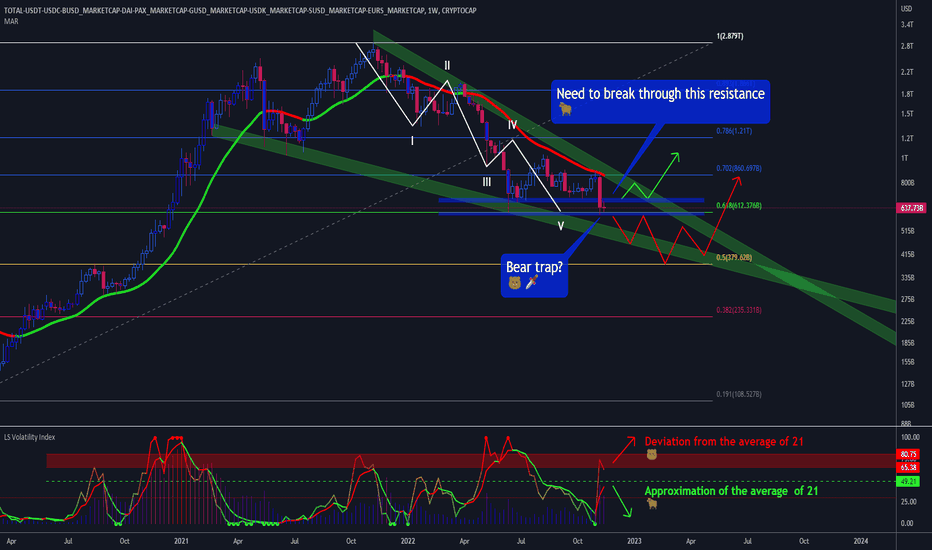

MarketCap of Cryptocurrencies except stable coins (TOTAL-USD)ℹ️ This is the total market capitalization of cryptocurrencies, excluding major stable coins (USDT, USDC, BUSD, DAI, GUSD, PAX, SUSD, USDK, EURS).

🟢The chart indicates a possible bear trap.

However, to be confirmed, the index needs to break through the resistance shown in the blue region above to have an upward confirmation.

If that happens, the LS Volatility Index is expected to drop to zero, indicating an approximation to the 21 moving average.

🔴In a bad scenario, the marketcap can reach new lows, possibly reaching the next Fibonacci level.

In that case, the LS Volatility Index would rise to 100, indicating an even greater deviation from the 21 average.

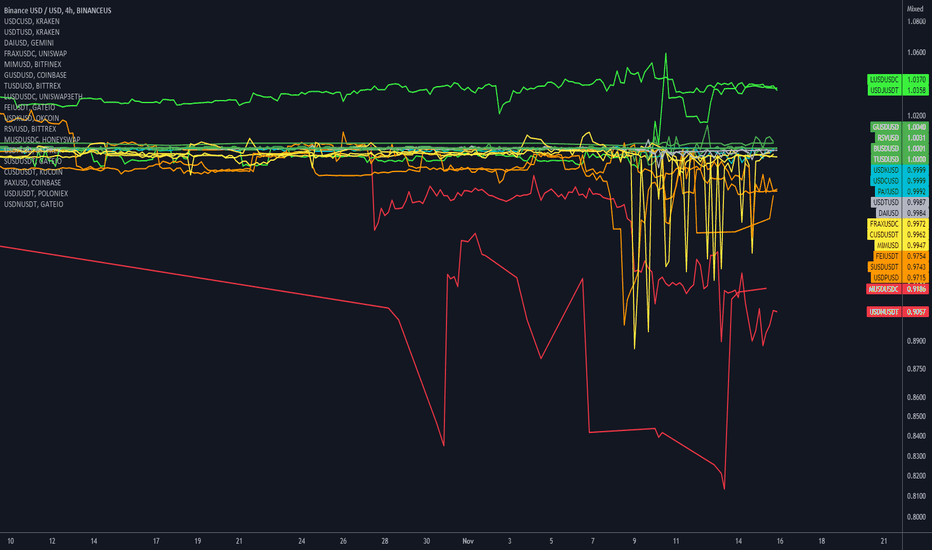

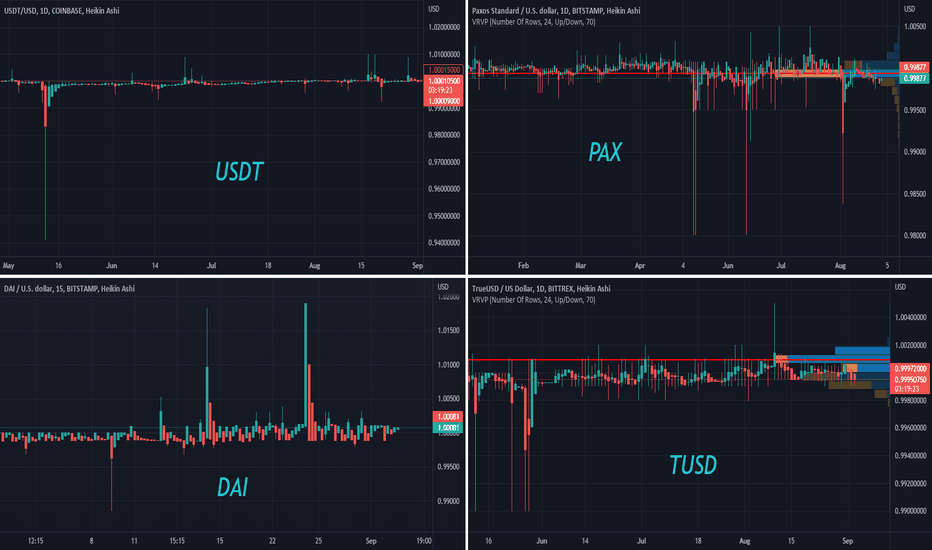

Peg of Stable CoinsStablecoins are cryptocurrencies whose value is pegged, or tied, to that of another currency, commodity, or financial instrument.

Stablecoins aim to provide an alternative to the high volatility of the most popular cryptocurrencies, including Bitcoin (BTC), which has made crypto investments less suitable for common transactions.

(Investopedia)

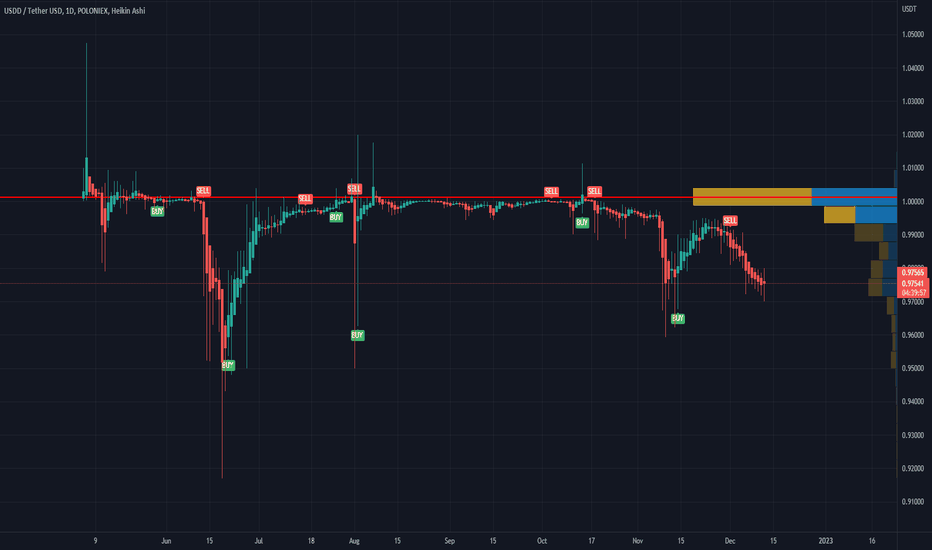

This graph shows the pegged value of the main stable coins.

Ideally, the value should be 1:1.

In this crash scenario, I will stay alert on these values.

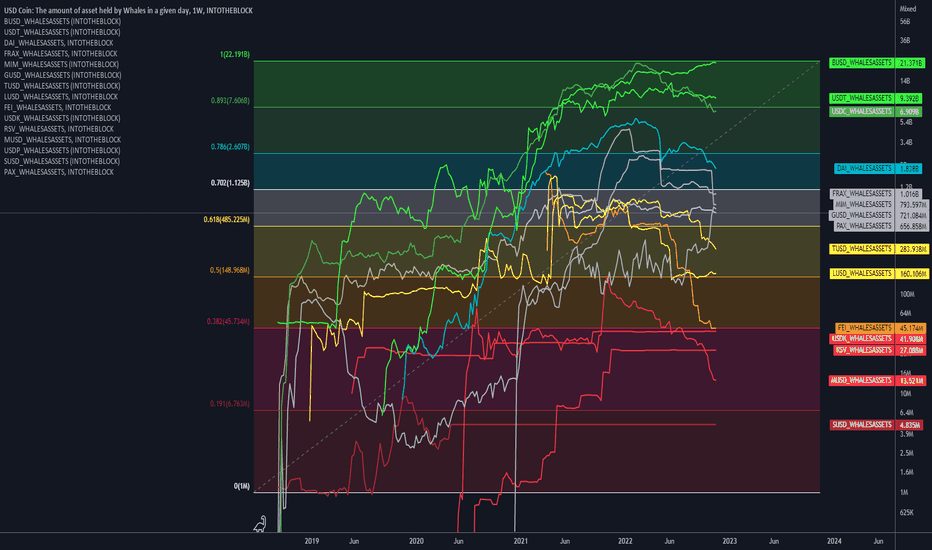

Stable Coins: Amount of Assets Held by WhalesThis graph shows the ranking of stable coins, according to the Amount of Assets Held by Whales (some stable coins don't have this information here).

Since May 02, 2022, BUSD has surpassed USDC in this indicator.

USDT remains relatively stable, and DAI was below $2 billion.

The PEG of these stable coins can be seen in this other analysis:

🔥THIS PATTERN INDICATES THE BULL MARKET WITH 99% PROBABILITY!🔥 Hi friends! I think not a lot of experts told you about this pattern, so support this educational idea with your BOOST🚀 to make it more visible for many traders!

Today I explain you the VERY USEFUL method, which help you to identify the beginning of the bull market with the 99% probability. There is the point where you can open the biggest long trades and get the BIGGEST profit without much effort.

✅HOW TO IDENTIFY THE BULL MARKET BEGINNING WITH 99% PROBABILITY?

📊 The instrtuments that we need:

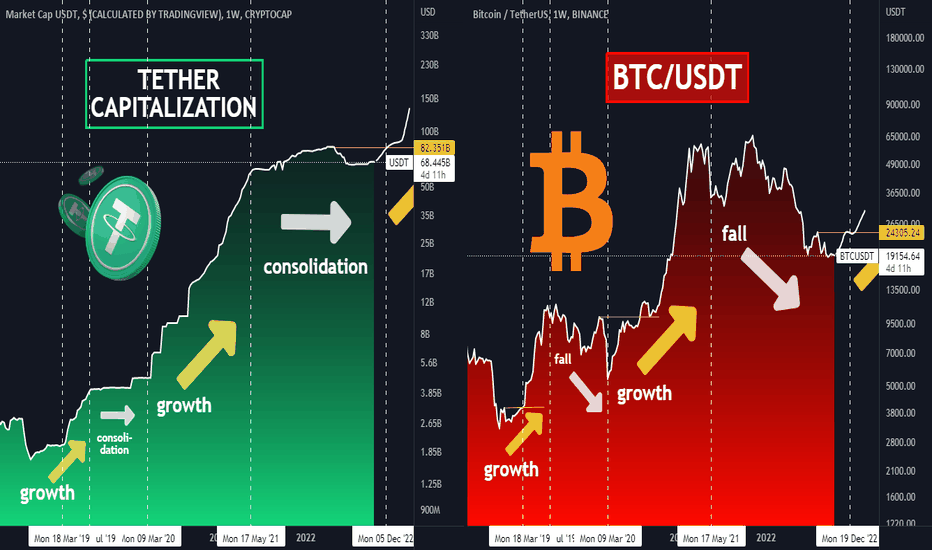

1. Tether (USDT) capitalization growth after the accumulation.

2. Bitcoin price with new Higher Highs (HH).

Look at the USDT cycles. As a rule, the growth of its capitalization coincides with the beginning of a STRONG growth of BTC.

The fall of Bitocoin and entire crypto market coincides with the consolidation of the USDT capitalization.

🚩 The simple formulas:

1. growth of USDT cap = growth of Bitcoin

2. consolidation of the USDT cap = Bitcoin fall

Additionally, I recommend you to wait until the BTC price make Higher highs (yellow line):

1. $4000 - 2019

2. $10200 - 2020

3. $24200 - 2022-2023(?)

As you can see, the most strongest growth beginning with the new HH on BTC chart.

So now you have TWO clear preconditions to open a long trade on BTC and any other crypto.

✅WHY IS THIS PATTERN SO SUCCESSFUL?

🔥 First of all , large players who have cash and do not have crypto want to quickly enter the market, but need a large number of stablecoins. The largest in terms of capitalization and the most liquid of all stablecoins is still Tether, so large players apply to this company and make an exchange from their cash to new printed USDT.

🔥 Secondly , a large number of beginners come to the market at the moments of growth, which also have a large amount of cash, but do not have crypto dollars.

These 2 cases force Tether to "print" more stablecoins.

🚩 The growth of Tether's capitalization stops at the very BTC ATH, when the demand for stablecoins falls. Despite the fact that the majority of altcoins will gain 300-400% for some time, there is no longer a need for new stablecoins. The bear market begins.

✅ HOW TO USE THIS PATTERN IN YOU TRADING STRATEGY?

LONG. With the update of Bicoin's local highs (now 24-25 thousand dollars) and the growth of Tether's capitalization, there is a chance to buy the crypto before the start of the "parabolic growth".

The further decision is up to you:

🔥 buy altcoins with a possible profit of up to 500-2000%, but with a higher risk

🔥 buy Bitcoin with a possible profit of 200-500%, but with less risk

🔥 or at least close your short trades :)

SHORT. The most dangerous signal for crypto is when the USDT cap not grow. You can use this "signal" with others to confirm your short ideas. For example, false breakout of the ATH at 69k back at 2021. After this, the price of BTC fall for -70-75%.

✅ Traders, Let me know if this idea was useful for you! Is it worth continuing to write such educational ideas? It is very important for me!

💻Friends, press the "boost"🚀 button, write comments and share with your friends - it will be the best THANK YOU.

P.S. Personally, I open an entry if the price shows it according to my strategy.

Always do your analysis before making a trade.

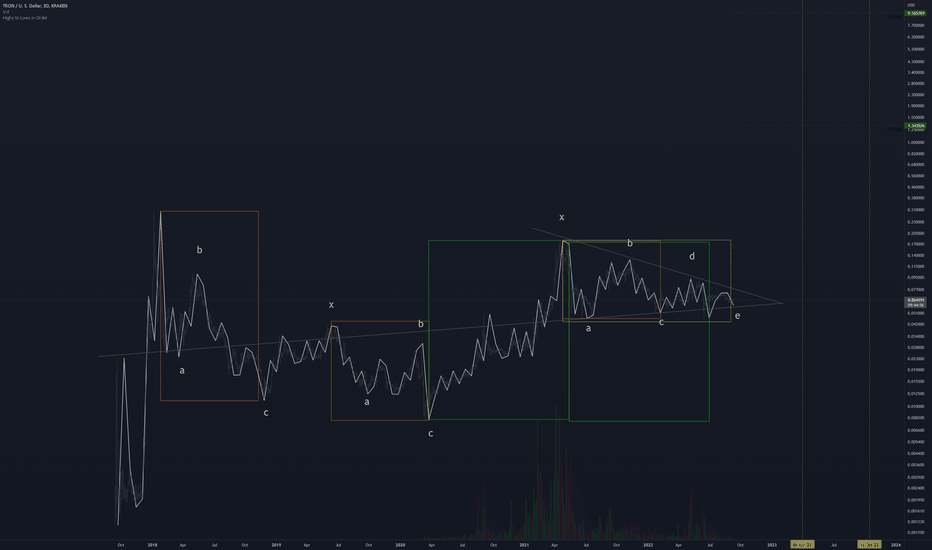

TRX Year-Long Triangle Concluding (Elliott Wave/Neowave)TRX has been trading in a relatively tight range since last year, that range is coming to a point now and it seems like, based on EW structure, that this triangle should break up within the next few weeks. If it doesn't break up in the next few weeks then we'll probably see it continue to consolidate into the tip of the triangle until the end of the year, before breaking up.

If this is the end of a pattern which began in 2018, as shown on my chart, we should see a explosive and near vertical move out of this range. Typically, when volatility reaches a very low point, it is often followed by a massive increase in volatility. This combined with USDD potentially burning a huge amount of the supply of TRX in the future could lead to prices in the double or even triple digits over the next year.

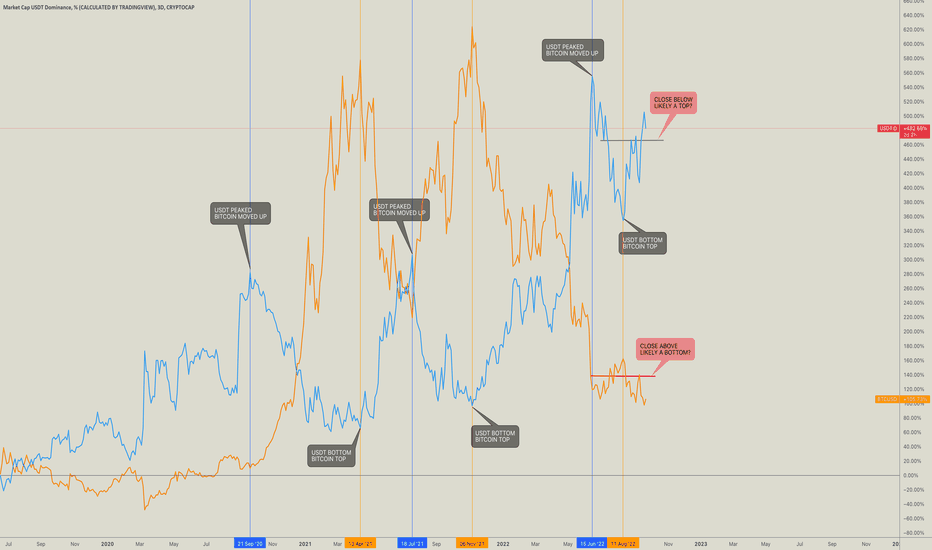

Bitcoin vs Tether 🥷⚔️Bitcoin laid over top of the Tether-USDT Market Cap Dominance Chart.

Pretty self explanatory as they have an inverse relationship up to this point.

USDT peaks when Bitcoin is at or near a bottom.

As USDT Cap works it's way down the money thats sitting Stable Coins starts moving back into Bitcoin.

Once Bitcoin makes a top, USDT is close or near a bottom. As traders start to sell the USDT Dominance starts to climb.

USTC/BUSDwe did together more than 3x before and hit our Target . FA : ON-CHAIN coming for Terra Stablecoin soon today or tomorrow . check link in 18 sep twitter.com

TA : Super Bullish . moon coming . Target is on the chart

USDT warn! only the tokens on the PoS network will be redeemableGrayscale warning ahead of the Ethereum Merge: “issuers like Tether and CirclePay have stated that post-fork, only the tokens on the PoS (proof of stake) network will be redeemable”, so if the PoS-based Ethereum fork goes “live with a parallel DeFi ecosystem, collateralized with unredeemable stablecoins, users and smart contracts may attempt to liquidate positions on the new chain, contributing to sell pressure on the new token.”

The worst case scenario of the Merge is the collapse of Ethereum based stablecoins, so be careful with those.

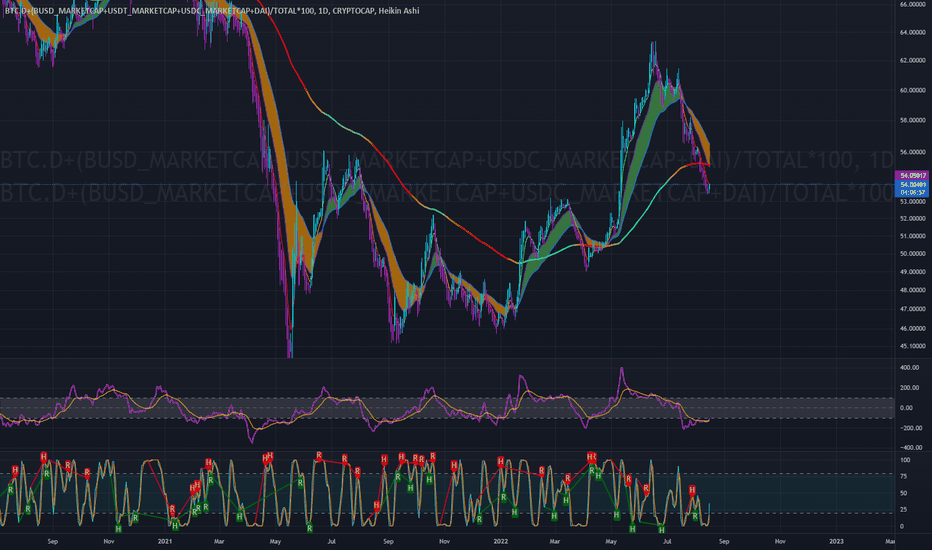

BTC.D+Stablecoin DominanceI think the days of just looking at BTC dominance are nearing its' end now that we have more stable (generally) crypto options to "cash out" to. Before USDT/USDC, bitcoin was the safest to cash out to. I calculated dominance of top 50 overall market cap stablecoins BUSD, USDC, USDT and DAI and then added BTC.D. This way we can paint a picture of overall market risk on vs off, removing the impact trading between BTC and stablecoins has on BTC.D alone.

Equation plugged into TradingView: BTC.D+(GLASSNODE:BUSD_MARKETCAP+GLASSNODE:USDT_MARKETCAP+GLASSNODE:USDC_MARKETCAP+CRYPTOCAP:DAI)/CRYPTOCAP:TOTAL*100

Any comments, questions/concerns are more than welcome!

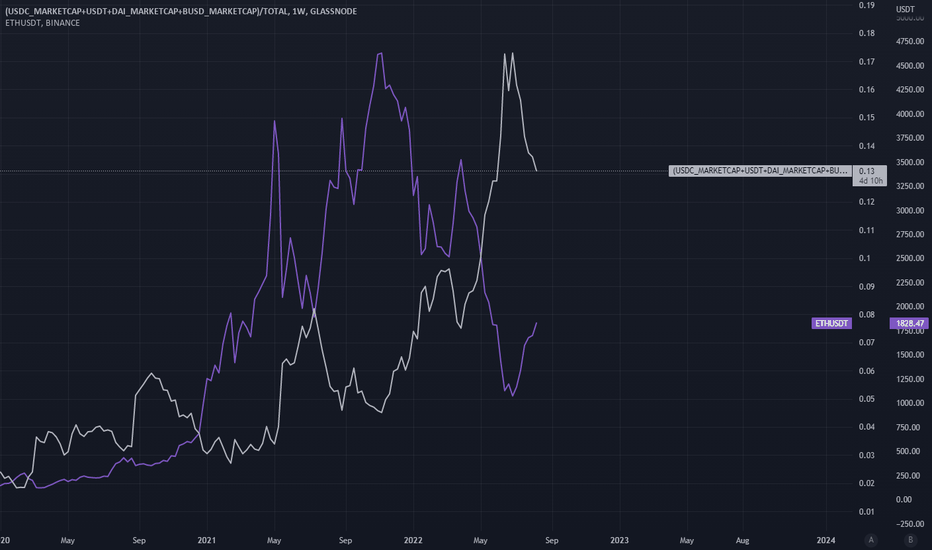

Stablecoin DominanceStablecoin Dominance is a measure of crypto market sentiment. It is calculated as the percentage of the total crypto market cap that is comprised of stablecoins. A decreasing value signals a risk-on market while an increasing value is a sign of risk-off conditions. USDT, USDC, BUSD, and DAI are the stablecoins selected for the calculation.

#Stable Dominance giving us a hint for a green weekend!!USDT Dominance is in play.

Testing the blue EMA right now after the breakdown.Although this is a 4 hour chart but most of the people trade on leverage so keep in mind an hourly full candle close above the 6.28% followed by a confirmation candle would mean I will close my long positions manually and this chart will be invalidated.

Unlikely, but you never know. Always be prepared for the worst.

I am holding Long positions right now.

Let me know what you think. Do hit the like button and share your views in the comment section.

Thank you

#PEACE

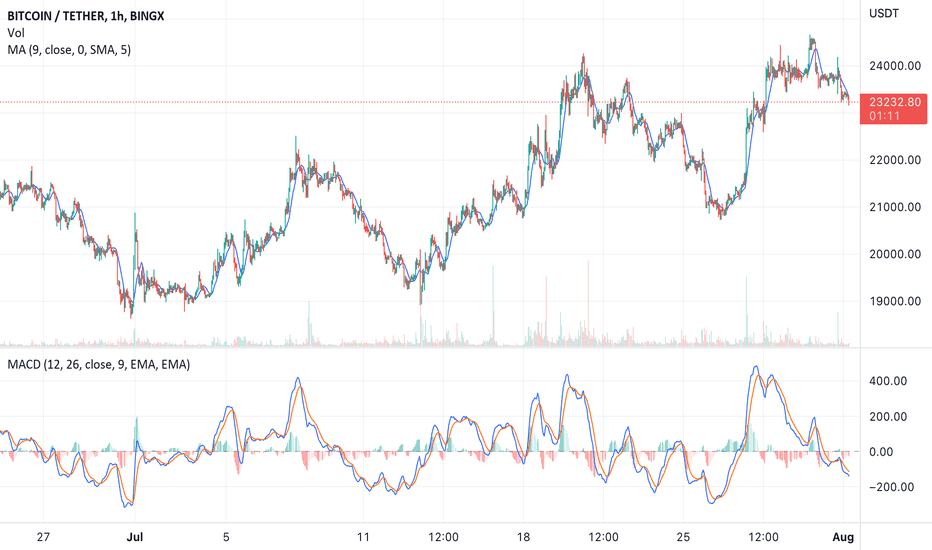

August 1 BTCUSD BingX Chart Analysis and Today's Headline BingX’s Bitcoin Chart

According to Glassnode, the number of addresses holding 1+ Bitcoin just reached an ATH of 890,993. Bitcoin is down 1.32% over the last 24 hours and fell to an intraday low of $23,238.04. The largest cryptocurrency failed to sustain above the $24,000 price level during the weekend, suggesting the sellers remain active at this level. If the BTC/USDT pair breaks and closes above $24,000, the pair could rally to $28,000. Conversely, if the Bears pull the price below the 20-day exponential moving (EMA) ($22,521), the pair could find support around the 50-day moving average (MA) ($21,985).

Today’s Cryptocurrency Headline

Aave DAO Approves Launch of Algorithmic Stablecoin GHO

DeFi protocol Aave’s proposal for the creation of the algorithmic stablecoin GHO has been approved by the Aave DAO, with an approval rate of 99.99% (501,000 AAVE). Aave will enable the creation of GHO stablecoins through an Aave improvement protocol (AIP), with the Aave DAO in charge of supervising the stablecoin’s distribution once its creation has been vetted. Users looking to mint GHO will deposit cryptocurrencies accepted by Aave as collateral. Apart from acting as collateral, these deposits will also earn yield on Aave. The lending protocol will also charge interest on loans taken out in GHO, with payments going back to the Aave DAO.

Disclaimer: BingX does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to the company. BingX is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned in the article.

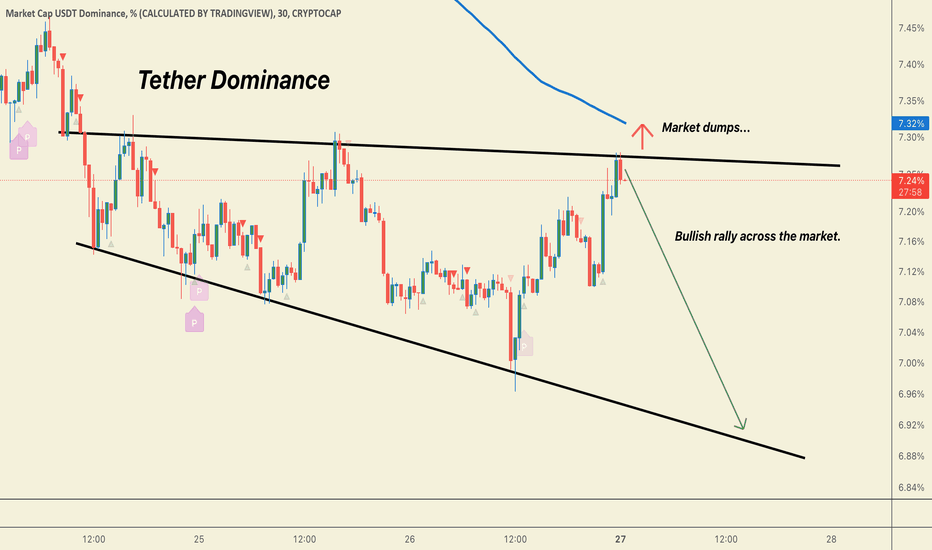

Long or Short? Update for Leverage traders...USDT Dominance is at a decisive point. Multiple

Rejection candles will lead to a rally across the market.

BTC could hit $23k+ and alts will follow, probably a green week.

However, a close above the resistance will lead to a correction.

Important area, stay vigilant.

CONCLUSION:- Close above 7.28% will trigger short entries across the market.

Close below 7.23% enter long position with SL.

Let me know what you think in the comment section and hit the like button if you find this update helpful.

DYOR

Thank you

#PEACE

Tether Dominance Index Top PatternWe have this triangle on the chart which is a "top pattern"; when you see this pattern or an inverted cup you have high probability of dealing with a top.

If prices topped, then we drop.

Just a quick update to let you know that we continue bearish on USDT.D.

The indicators are now also turning bearish, MACD and RSI.

It is likely to speed up, fast, if/when support breaks.

Namaste.