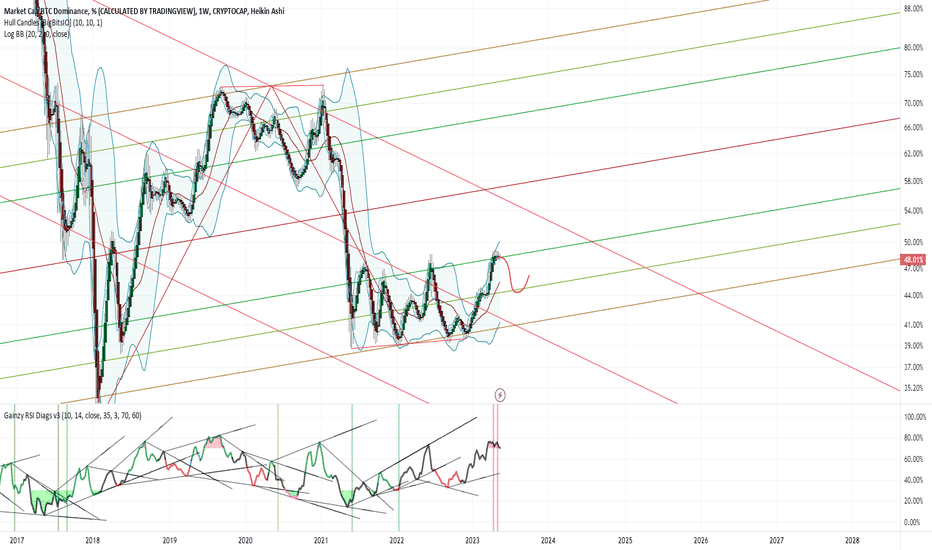

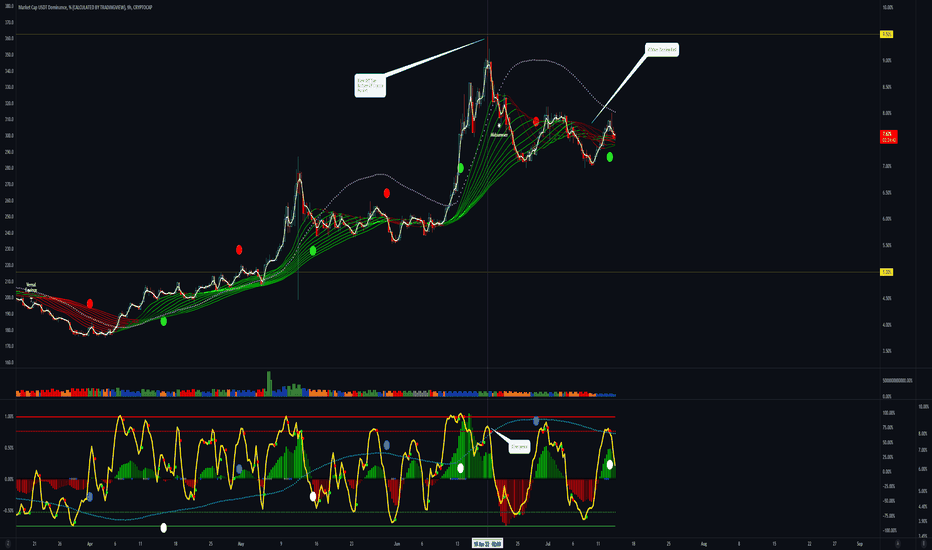

Bitcoin Dominance Likely to Have Peaked for NowHey there!

It seems that Bitcoin dominance has peaked, at least for the time being. A medium-term retracement to 44% in 3-4 months appears likely. While some may view this as the start of alt season, we should consider that increased market volatility may lead to stablecoin dominance rising, which could explain the drop in Bitcoin dominance in a turbulent market scenario.

As always, stay safe and stay liquid.

Stablecoins

Algorithmic Stablecoins: Will They Ever Find Enough Support?Algorithmic stablecoins, as their name implies, are cryptocurrencies that use algorithms to maintain a stable value instead of being backed up by any sort of reserve asset as collateral. However, in reality, some algorithmic stablecoins have struggled to maintain a stable peg, while others have failed catastrophically.

This article examines the major types of algorithmic stablecoins, their design, and shortcomings and then explores how algorithmic stablecoins may develop over time.

In conclusion, we believe algorithmic stablecoins will become the most important type of stablecoins globally and serve as the major currencies for the future’s decentralized financial world. Their creation and transaction will happen on a global scale instead of being subject to the regulation of any jurisdiction.

Stabilization Mechanisms and Challenges

Algorithmic stablecoins have a mechanism like the shadow banking which provides the possibility for offshore money creation. Different from other types of stablecoins, algorithmic stablecoins maintain price stability not by relying on centralized entities but by using algorithms to regulate supply and demand. As a result, algorithmic stablecoins face various challenges, including illiquidity and black swan incidents.

Rebasing: This mechanism adjusts the circulating supply in response to price fluctuation. When the price of a stablecoin is higher than the reference, the protocol will mint more tokens. When the price goes the other way, the protocol will burn or repurchase tokens. Ampleforth is an example of stablecoins using this scheme.

Seigniorage: This mechanism supports a stablecoin’s value by issuing one or more other cryptocurrencies. When the price of a stablecoin is higher than the reference, the protocol will use seigniorage tokens as collaterals to generate more tokens. Conversely, the protocol will buy back or burn seigniorage tokens. Basis Cash is an example of this type of stablecoins.

Besides these two schemes, some new projects are experimenting with other innovative ways to maintain the peg. Take Frax Finance for instance. It introduced a fractional reserve stablecoin, which is partially backed by collateral, i.e. USDC, and partially stabilized algorithmically.

Algorithmic stablecoins have faced various challenges in recent years. The major ones are the following.

Imbalanced supply and demand: When demand drops, the price of an algorithmic stablecoin tend to be lower than the reference, leading to the burning or repurchasing of a part of the circulating supply to regain balance. However, such a move may further dent market confidence or even trigger a vicious circle of selling. Terra is a bloody lesson.

Governance risks: Algorithmic stablecoins are run by smart contracts and decisions are made by the consensus of the majority. Therefore, there may be governance risks such as code defects, hacker attacks, manipulation, or conflict of interests.

Legal and regulatory challenges: As algorithmic stablecoins are not backed up by physical assets, they face more legal and regulatory uncertainties. There may be more countries and regions banning or limiting the use of algorithmic stablecoins in the future.

Mainstream Models: Semi-decentralized and Overcollateralized

There are many subgroups of algorithmic stablecoins based on their design. The collateralized lending model of MakerDAO is representative. The protocol allows users to issue DAI by locking up collateral assets such as ETH and adjusts the supply of the stablecoin according to market demand. Another representative mechanism is the liquidity pool model of Aave, which adjusts the price of a stablecoin in real time based on supply and demand and maintains price stability through arbitrage among multiple stablecoins.

Below are three stablecoins representative of the mainstream models.

GHO

GHO is a multi-collateral stablecoin that pegs its value to the U.S. dollar. Users or borrowers can mint GHO using a diversified set of collateral on Aave. When borrowers borrow GHO, the protocol mint GHO tokens. When the loan is repaid, the previously issued GHO tokens will be destroyed, reducing their circulation. GHO can be used in payment, lending and borrowing, and other use cases. It can also generate yield as the tokens will participate in liquidity mining on Aave automatically.

GHO uses the liquidity pool model of Aave V3 where Aave is the only liquidity pool provider and users can only acquire GHO through Aave V3 using the collateral available. Therefore, all the revenue generated from the GHO stablecoin will go to the Aave Treasury and finally be controlled by the Aave DAO. In the future, more liquidity pool providers may be allowed to make the stablecoin more decentralized.

In summary, GHO is a decentralized multi-collateral yield-generating stablecoin. Its innovative features, especially interoperability with other services on Aave, give it certain competitive advantages. However, as the stability of GHO relies on the value and liquidity of its collateral, if the market fluctuates widely or meets liquidity crises, the stablecoin may depeg and liquidate. GHO’s risk management and degree of decentralization are areas worthy of attention. If more liquidity pool providers join the system, the allocation of risks and interests will be more complicated. Then, more matured decentralized governance mechanisms will be needed to ensure its long-term stability and sustainability.

CrvUSD

CrvUSD is an algorithmic stablecoin using a so-called lending-liquidating AMM algorithm or LLAMMA. The algorithm maintains price stability by converting between the collateral (for example, ETH) and the stablecoin (let’s call it USD). If the price of collateral is high — a user has deposits all in ETH, but as it goes lower, it converts to USD. Users may also use liquidity provider positions (LP tokens) as collateral.

This is very different from traditional AMM designs where one has USD on top and ETH on the bottom instead. The LLAMMA is designed to provide a soft liquidation mechanism that turns collateral into liquidity provider positions, thus avoiding large asset dumps in a short time as in other models.

In a nutshell, Curve’s stablecoin mechanism achieves price stability and liquidity by combining the liquidity of different chains and multiple strategies and leveraging composability with other DeFi projects. The stablecoin can also enable investors to generate returns by participating in transactions, borrowing and lending, and liquidity mining, thus motivating more users to participate in its ecosystem.

FRAX

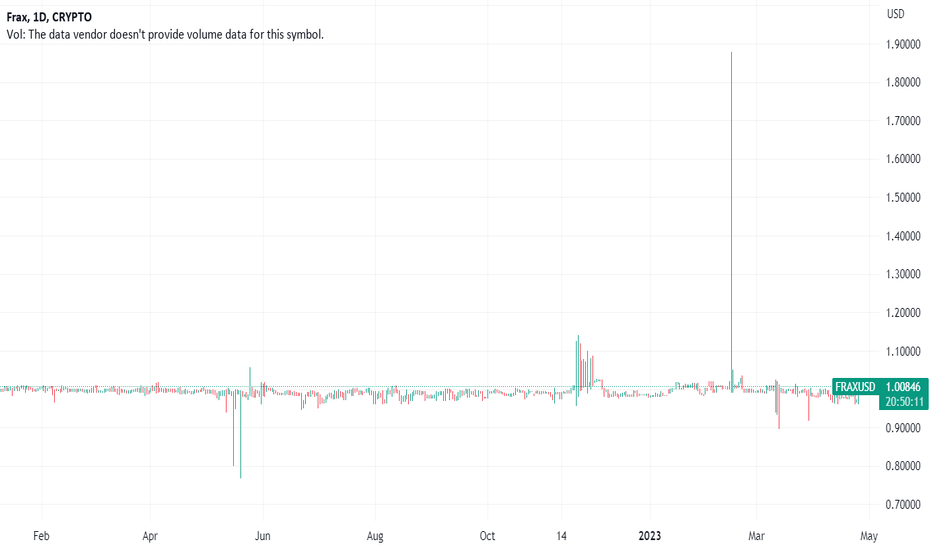

FRAX is partially backed by collateral assets and partially supported by the native token of Frax Finance, FXS. The ratio of these two in the backing of Frax is called the Collateral Ratio (CR) The collateral, in this case, is USDC. The Frax Protocol adjusts CR in accordance with the market price of Frax. When the market price of FRAX goes under HKEX:1 , the Frax algorithm increases the CR, meaning that each FRAX is required to be backed by a higher percentage of hard collateral (USDC). This action increases market confidence that Frax can maintain its backing, causing the price to rise. In this way, the algorithm maintains the balance and ensures Frax does not break its peg.

In Frax V2, a new mechanism called algorithmic market operations controller or AMO was introduced, which reinvests the excess collateral elsewhere to generate additional revenue to support the protocol’s long-term growth. Also, the Frax community has voted to give up on the two-token model and increase the target CR to 100%. This will make Frax more attractive for users looking for a long-term store of value. The target CR will be achieved through AMO instead of selling the FXS token.

The AMO module enables programmable monetary policy as long as it does not change the FRAXT price off its peg or lower the collateral ratio. This means that AMO controllers can perform open market operations algorithmically, but they can not arbitrarily mint FRAX out of thin air and break the peg. This keeps FRAX’s base layer stability mechanism pure and untouched while creating maximum flexibility and opportunity, enabling FRAX to become one of the most powerful stablecoin protocols.

However, the protocol still needs to rely on external stablecoins as its last defense. If external stablecoins go wrong or are frozen, like what recently happened to USDC in its recent de-pegging, the stability, and security of FRAX and its protocol will be affected. What’s more, the protocol also relies on the FXS tokens for its governance and incentivizing users. If FXS tokens suffer price declines or reduced demand, FRAX and its protocol will be influenced too.

In a nutshell, the strengths of GHO and crvUSD are their stable market positions, multiple use cases, and investment value. FRAX is strong in technology, but it has never been through large-scale market turbulences and its use cases and investment value are waiting to be demonstrated. In the future, GHO and crvUSD may continue to deepen their moat by rolling out new products and extending to new use cases.

Current Issues

The above-mentioned stablecoins face the same risk. With the increased complexity of their protocols, they are subject to more diversified attacks which could jeopardize the whole ecosystem out of the blue. In recent years, we’ve already seen many bankruptcies because of loopholes in stablecoins.

In addition, competition in the stablecoin space is getting more and more fierce. A few decentralized stablecoins have built a deep moat in terms of on-chain liquidity and cooperation with other protocols. By contrast, native stablecoins of a single protocol have struggled to get enough liquidity. The cost for them is huge.

Currently, there are two major directions in the development of stablecoins: collateral-based and arithmetic. The former can be considered pseudo-arithmetic stablecoins. The two types both have their issues. Collateral-based stablecoins require a large amount of overcollateralized assets, while algorithmic stablecoins are often faced with illiquidity and unfair incentives.

In comparison, the previously popular “liquidity mining” model has essentially placed protocol-controlled value over algorithmic stability. But in the last two years, it has been proven that such a design that prioritizes liquidity over collateral also has problems. For example, in times of market contraction, there may be insufficient liquidity, and holders and DAOs may be unfairly rewarded. This may lead to situations where whales manipulate the market, which is detrimental to the long-term stability of the ecosystem.

Low acceptance as a store of value

These stablecoins have struggled to be accepted by users. The main reason is that they are not as stable as their mainstream peers that are pegged to fiats such as the U.S. dollar. Algorithmic stablecoins are more often used as rewards rather than being regarded as a store of value. DAI, as a pioneer in this space, has accrued market shares. However, with the rise of fiat-pegged stablecoins like USDC, DAI’s position has been shaken.

In addition, algorithmic stablecoins often have complicated and incomprehensible mechanisms which require holders’ involvement in maintaining their stability. This means increased costs and risks and somewhat reduced experience for users. Algorithmic stablecoins have yet to be widely adopted, their liquidity and market shares are relatively low. This has restrained their use in payments, lending, and cross-border transfers, which in turn affected their attractiveness as a store of value.

In summary, for arthrotomic stablecoins to be more widely accepted, their stability issue will need to be addressed first to enable them to be deemed as better storage of value. Furthermore, more efforts need to be put into understanding users’ needs, such as providing higher yields, to attract more users. Increasing connection to real-world assets is also a promising way to enhance the liquidity and value of algorithmic stablecoins and improve their competitiveness.

Reliance on diversified collaterals

At present, algorithmic stablecoin protocols still need a diversified set of collaterals such as ETH and CRV to operate, and their scalability also relies on the growth of the value of the collaterals. Meanwhile, they face risks of low demand. Some protocols have already run out of their insurance funds due to risk incidents.

We are doubtful about the legitimacy of having multiple collaterals. From a short-term view, support for a diversified set of collaterals will improve the network effects and bring more liquidity to a stablecoin, especially in a bull market. However, from a long-term view, it’s an irresponsible speculative move that endangers the stablecoin’s stability and safety. Obtaining liquidity from centralized exchanges to improve the feasibility of these protocols may be a possible solution.

Take Frax for instance. Although it is algorithmic in its stability mechanism, when faced with strong redemption pressure, its degree of decentralization reduces, leaving holders with more risks. Algorithmic stablecoins should be undercollateralized in nature and they are naturally riskier. However, such a nature makes it difficult for them to be compliant, which in turn is a prerequisite for them to be competitive against centralized stablecoins such as USDC. Therefore, finding a better solution to their reliance on diversified collaterals and expanding to more use cases will be the key to their future potential.

Exploring Decentralized Algorithmic Stablecoins

BTC/ETH Collateralized Crypto-native Stablecoins

LUSD: Liquity’s Crypto Native Stablecoin

LUSD is a stablecoin issued by the decentralized lending protocol Liquity which allows users to pledge ETH to obtain loans with 0% interest. The algorithm of LUSD requires borrowers to maintain over-collateralization, or else their borrowings will be liquidated. LUSD can be redeemed at any time for HKEX:1 of ETH. LUSD also benefits from its strong soft peg mechanism which adjusts the supply and demand of LUSD in line with market expectations to maintain its value within $1.00-$1.10.

LUSD provides interest-free borrowing on Ethereum that allows users to obtain an ETH-backed loan without any recurring costs, making borrowing highly capital efficient. Additionally, it has innovative features such as collateral pools, stabilizations pools, and a liquidation mechanism to ensure its safety and stability. Nevertheless, it faces competition from protocols providing similar services, such as MakerDAO and Compound. In the meantime, regulatory pressures from different countries and regions, such as the U.S. and the European Union, are also a concern.

DLLR: Sovryn’s Sovereign Stablecoin

The Sovryn Dollar (DLLR) is a BTC-backed stablecoin aggregating multiple exclusively BTC-backed “constituent” stablecoins. It aims to maintain a 1:1 peg with the value of USD and provide a great form of payment and a reliable store of value. By aggregating more BTC-backed stablecoins such as ZUSD and DOC which rely on a combination of algorithmic and incentive-based mechanisms to stabilize, DLLR is designed to be more stable and more resilient to market volatility and collateral risks than any of the individual stablecoins backing it. The supply of DLLR is determined by market demand. When the price of DLLR is higher or lower than HKEX:1 , there will be arbitrage opportunities to restore the balance.

Sovryn is a decentralized finance (DeFi) protocol deployed on a Bitcoin sidechain called Rootstock. It supports leveraged trading, perpetual futures, lending, and other DeFi activities and adopts zero-knowledge-proof technologies to protect user privacy. It also has the security assurance of the Bitcoin blockchain. All services on Sovryn are priced in BTC and secured by the Bitcoin network.

Sovryn runs on EVM-compatible smart contracts on Rootstock and is interoperable with the Bitcoin network, lightning network, Ethereum, and the Binance Smart Chain. Most of the features of Rootstock or RSK, are like Ethereum. The uniqueness of the RSK blockchain is that it has 2-way interoperability with the Bitcoin blockchain, and it has a merged mining mechanism that allows it to be mined simultaneously with the Bitcoin blockchain. All Sovryn’s ownable contracts are currently controlled by the Exchequer multisig, an anonymous group of key holders, except Staking and FeeSharingProxy which can be updated according to the votes of SOV stakers. Changes to all contracts and the project’s codebase can be voted on in Bitocracy DAO, with the right to vote given to stakers of SOV tokens.

The potential of DLLR lies in its being a fully transparent, decentralized, and censorship-resistant stablecoin that is exclusively backed by BTC, free from the intervention and risks of any centralized third party. It increases the value and utility of BTC and facilitates the circulation and usage of BTC. DLLR is also a powerful lending tool for the Sovryn platform, enabling users to borrow DLLR against BTC collateral with 0% interest and generate high yields.

Multiassets-backed Stablecoins

sUSD: leveraging the tailwind of synthetic assets

sUSD is a stablecoin issued by Synthetix. It tracks the price of the U.S. dollar and relies on a decentralized oracle network to obtain price feeds. sUSD is baked by crypto-native collateral, i.e., the SNX token issued by Synthetix. sUSD has multiple use cases in the Synthetix ecosystem including trading, lending, saving, and buying other synthetic assets or Synths such as synthetic stocks, commodities, and cryptocurrencies.

The pegging mechanism of sUSD relies mainly on arbitrage and the balance of demand and supply. When the price of sUSD goes below HKEX:1 , arbitragers can buy sUSD at external exchanges using the U.S. dollar or other stablecoins and then use sUSD to buy Synths on the platform or stake sUSD to borrow SNX or ETH. When the price of sUSD goes above HKEX:1 , arbitragers can stake SNX or ETH to borrow sUSD on the Synthetix platform and sell sUSD into the U.S. dollar or other stablecoins on external exchanges. Such arbitrage operations will increase the demand or supply of sUSD accordingly, helping it to restore the peg to $1.

Benefiting from Synthetix’s multichain strategy, the use cases of sUSD have been greatly expanded with the introduction of Atomic Swaps, Curve, and Perps v2. Furthermore, the capital efficiency issue of sUSD will likely be addressed in Synthetix v3 which will support multiple collaterals thus bringing down sUSD’s pledge ratio. In this multichain era, Synthetix has the potential to grow into a super application and sUSD may leverage the tailwind of synthetic assets to find more support from real-world assets.

TiUSD: multi-asset reserves stablecoin

TiUSD is an algorithmic stablecoin issued by the TiTi Protocol that pegs to the value of 1 U.S. dollar. It is decentralized, backed by multi-assets reserves, and has a use-to-earn mechanism to ensure its stability and scalability. As an elastic supply stablecoin, its supply will be automatically adjusted according to market demand and supply and price fluctuation. Its reserve pool consists of multiple crypto assets, such as ETH, BTC, and DAI, which enhances its reserve diversification and risk resilience.

However, TiUSD faces competition and challenges from other algorithmic stablecoins, especially those with more complex or advanced algorithmic designs or governance models, such as MakerDAO, Ampleforth, etc. Additionally, TiUSD needs to ensure its reserve diversification and risk resilience to avoid the risk of reserve depletion or attacks.

Omnichain Stablecoins

USD0: Tapioca-based stablecoin

LayerZero is an innovative cross-chain messaging infrastructure that allows for the secure transfer of tokens between different chains without the need for asset wrapping, intermediate chains, or liquidity pools. Big Bang, an omnichain money market based on Layerzero, allows users to mint an omnichain stablecoin called usd0. It has no borrowing ceiling but a debt ceiling. The collateral that the program accepts for minting usd0 is the native Gas token (or its staked derivative). These include ETH, MATIC, AVAX, wstETH, rETH, stMATIC, and sAVAX.

The pegging mechanism of USD0 is based on an algorithm called Tapioca, which employs a dynamic debt ceiling and a variable borrowing fee to maintain a 1:1 ratio between USD0 and the U.S. dollar. Tapioca adjusts the debt ceiling and borrowing fee in response to market conditions and changes in the value of the collateral. When the price of USD0 is above HKEX:1 , Tapioca increases the debt ceiling and lowers the borrowing fee to encourage users to mint more USD0. When the price of USD0 is below HKEX:1 , Tapioca lowers the debt ceiling and raises the borrowing fee to encourage users to repay or buy more USD0.

In theory, USD0 can be used on any chain. It does not require asset wrapping or intermediate chains, thereby reducing costs. It can also leverage LayerZero for seamless token transfer and trading and can be integrated with other LayerZero-based applications, such as Stargate. However, its risk comes from the security and compatibility of the LayerZero protocol itself and its underlying chain.

IST: enabling cross-chain asset transfer

Inter Protocol’s IST is a fully collateralized, cryptocurrency-backed stable token for use across the Cosmos ecosystem. It’s designed to maintain parity with the US dollar (USD) for broad accessibility and have minimum price fluctuations. IST can be minted through three methods: the Parity Stability Module, Vaults, and BLD Boost. Using the Parity Stability Module, you can mint IST by using specified stablecoins as collateral, such as DAI, USDT, USDC and etc. Vaults allow users to mint IST by locking crypto assets at different pledge ratios set by a DAO. And BLD Boost enables users to mint IST with BLD as collateral against future staking rewards.

IST has stability mechanisms similar to DAI, which consist of liquidations, pledge ratios, debt ceilings, the Reserve Pool for emergent debt reduction, and BLD issuance for debt repayment. These mechanisms are controlled with fine-grained restrictions to create a dynamic stablecoin model that has never existed before. Inter Protocol is built on Agoric, which is a blockchain within the Cosmos ecosystem where smart contracts can be developed using JavaScript. The native token of the Algoric blockchain is $BLD. IST is not only a stablecoin but also the native fee token of the Agoric platform, which adds utility to the stablecoin and enhances the stability of its token economy.

Known as the “Internet of Blockchains”, Cosmos achieves blockchain interconnectivity through the IBC protocol, allowing for asset transfer between different blockchains and improving the interoperability and scalability of blockchains. Within its ecosystem, many projects are eyeing stablecoins. Being a representative, Inter Protocol’s IST has the potential to provide a more stable and reliable medium of value exchange for the whole system.

As interoperability increases within the Cosmos ecosystem, it will have a positive spillover effect on the Inter Protocol. With more and more protocols being built on the Cosmos SDK achieving interoperability through IBC, there will be more protocols that the Inter Protocol can interact with, resulting in increases in the overall liquidity and potential user base. It can be foreseen that applications on Cosmos will be used more actively and so will the stablecoin of Inter Protocol.

Finding Support

Protocols like Curve are leading a new paradigm shift in DeFi. Specifically, DeFi protocols are increasingly realizing the need to control the issuance, circulation, and borrowing of stablecoins. With Frax and Aave following suit, more and more protocols are joining the quest to find solutions to the stablecoin trilemma. Differentiation on the product level alone will not be enough. Compared with MakerDAO, Curve, and Aave have stronger brand awareness and team capability. Therefore, their stablecoins have a relatively brighter prospect.

Currently, demand for algorithmic stablecoins mainly falls into three categories: as a store of value; as a medium of exchange in transactions, and as an alternative to fiat-backed stablecoins. Meanwhile, there exist a lot of issues and challenges when introducing real-world assets into algorithmic stablecoins, for instance, issues related to the scalability and risks of real-world assets. Also, many stablecoin projects pay too much attention to the stabilization mechanism and decentralization to overlook market fitness. This is exactly why many of them struggle.

Through a comprehensive overview of the industry landscape, we believe the following are promising directions of development for algorithmic stablecoins.

Crypto-native stablecoin protocols. BTC and ETH are generating great network effects and they form the cornerstones for trust in cryptocurrencies. Therefore, these stablecoin projects will have a more solid backing in terms of assets. But user experience, size of lock-in assets, and reliable consolidation mechanisms will be key differentiators.

Stablecoins issued by super applications. In essence, these protocols bypass the need for a trust intermediary and issue stablecoins directly to their users. In this scenario, protocols like Curve, Aave, and Synthetix will become super pawnshops enabling their users to enjoy customized financial services that are much faster and more friction-free than the real world. Considering that their user base and innovativeness will determine how far they can go, we are more bullish on Synthetix.

Omnichain deployed stablecoins. They have the potential to realize true decentralization, cross-chain interoperability, and transferability. By issuing, transferring, and trading stablecoins freely on any chain, they will be able to ensure sufficient liquidity. More importantly, an omnichain insurance mechanism will help mitigate liquidity crises when a run happens.

Delta-neutral stablecoins. Delta-neutral stablecoins may become an important trend in the future, but they will need to be supported by futures protocols and a large futures market. Market fitness and risk control are also worth paying attention to.

Is there a possibility that an algorithmic stablecoin protocol could encompass all the features? Unfortunately, we have yet to come across such a project. Algorithmic stablecoins need to have an efficient and reliable algorithmic design that can maintain price stability in various market conditions and prevent collapses in extreme scenarios. They also need a large and loyal user base to support their economic model and provide efficient demand and liquidity. What’s more, a robust and innovative ecosystem will also be needed to bring more use cases and added value to the stablecoin through integration with on-and-off-chain services. When a stablecoin meets all these requirements, then more importance should be placed on the healthiness of its value network and assets used instead of the diversification of collateral.

The rise of algorithmic stablecoins has its reasons and background, but that doesn’t mean they will eventually replace centralized stablecoins, especially in large-scale applications. Therefore, finding a more efficient and scalable solution under the premise of safety should be the focus. Also, stablecoins that are backed by the U.S. dollar such as USDC are still dominating the market because their issuers provide users with more reliable safeguards with their financial strength and compliance capability. For users seeking to avoid centralized risks and legal and regulatory risks, algorithmic stablecoins are a valuable alternative. While admitting their constraints, we hope more innovative solutions can be explored to drive the development of the whole DeFi industry.

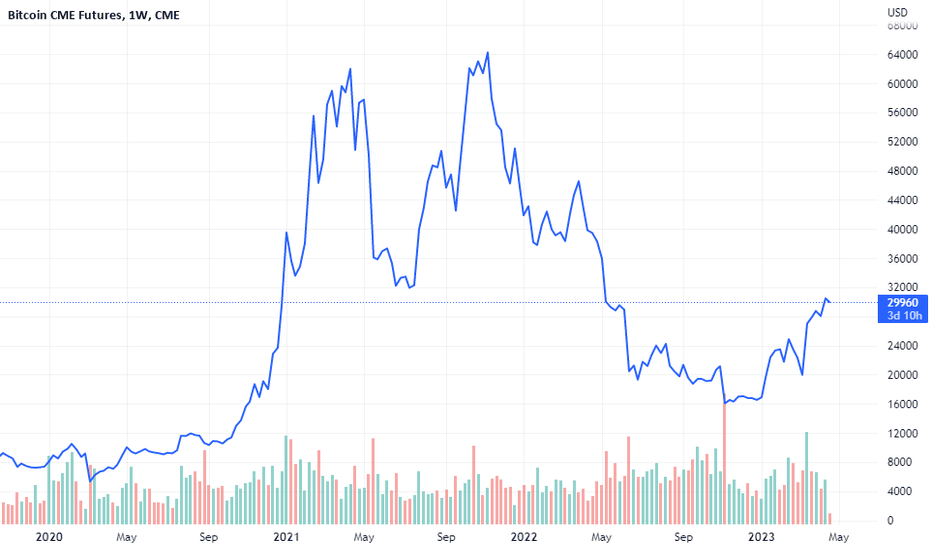

Digital Assets Outlook 2023Digital assets have had a strong early 2023

Digital asset prices, led by Bitcoin, have had a strong 2023 so far. Bitcoin is up by over 70% this year and Ether is up by over 50%1. Together, these two assets still account for over 63% of the total market cap of the digital assets space. While the US Federal Reserve (Fed) is still raising interest rates, the market seems to expect that the recent bank failures (Silvergate Bank, Signature Bank, Silicon Valley Bank, Credit Suisse) will lead to central bank easing. Lower interest rates would benefit long-maturity assets, such as digital assets. Moreover, several traders have been caught off-guard and short-sellers expecting more downside in digital assets have had to liquidate positions leading to higher prices.

We believe we could be on the cusp of the fourth major bull market in crypto, although the exact timing is uncertain. Our belief is that the next bull market will be enabled by advancements in speed and scalability of the blockchain networks, more intuitive user interfaces, and innovations in blockchain wallets, as well as developments in digital identity, which will pave the way for Web3 applications. The critical determinant, of course, will be the user applications that will take the market by storm and we will keep monitoring potential candidates on a continuous basis.

Despite dismal price action last year, digital assets are supported by a healthy and vibrant software developer community. The number of monthly active developers actually rose last year by 5%2, which is significant, and confirms our view that developers remain actively engaged in their respective blockchain ecosystems.

Layer 2 networks finally coming into their own, promising to solve the scalability issue

The main impediment of current Bitcoin and Ethereum networks has been their inability to handle a large volume of transactions. It is estimated that, without a layer 2 solution, Bitcoin can only handle approximately 7-10 transactions per second while Ethereum can only handle approximately 15-30 transactions per second. While it is on Ethereum’s road map to be able to ultimately handle 50,000-100,000 transactions per second, this is not a reality at the moment. As a contrast, Visa is said to handle at least 1,700 transactions per second although there are some estimates that Visa could handle up to 24,000 transactions per second and Visa itself is claiming this number to be as high as 65,000 transactions per second3.

One way to solve the scalability issue of blockchains is to use a layer 2 network, which is built on top of a layer 1 blockchain. Layer 2 networks move transactions off-chain, roll them up and bundle multiple transactions into a single transaction, which can then be secured on the layer 1 blockchain benefiting from underlying blockchain’s security and robustness. This bundling enables faster throughput, faster settlement, and lower prices. For Bitcoin, the most well-known layer 2 solution is the Lightning Network, while for Ethereum there are several options available, including optimistic rollups, zero-knowledge rollups (ZK rollups) and sidechains. It is also worth mentioning that the Ethereum network is expected to go through so called ‘sharding’ later this year, which is expected to split the network into separate ‘shards’ thereby increasing the capacity of the network and reducing the transaction (gas) fees in the process.

Digital USD tokens emerging as a major use case

Stablecoins, digital tokens issued on public blockchains and pegged to an underlying asset, such as a currency or a physical asset, were initially used in trading and interexchange settlement but have become increasingly popular in payments and remittances. Because stablecoins are global and accessible to anyone, they offer an attractive way to cheaply and securely transmit money around the world 24/7 and settle transactions (almost) instantaneously. The world’s largest stablecoin, Tether’s USDT, is particularly popular in Asia, while in the West Circle’s USDC is widely used. Stablecoins are designed to offer stability while an asset like Bitcoin is more volatile.

To give an idea of the magnitude of transaction volumes, last year, Visa settled HKEX:12 trillion worth of payments, mainly related to consumer spending, while stablecoins settled HKEX:8 trillion worth of on-chain transactions, higher than the $2.2 trillion settled by Mastercard or HKEX:1 trillion settled by American Express4. This year, it is possible that the combined amount of stablecoin transactions exceeds the payments settled by Visa. These stablecoin transaction volumes, of course, are not related to consumer spending but rather to payments, trading and decentralised finance, and do not take into account trading volumes on centralised exchanges.

Competition for instant payments heating up

The market for instant settlement of payments seems to be in flux at the moment. Crypto regulation in both Europe and the US are focusing on stablecoins and are expected to set stringent reserve requirements for stablecoin issuers and also forbid interest being paid to stablecoin holders. We view transparency requirements into reserve assets of stablecoin issuers important but also believe that attention should be paid into issuers’ risk management, cybersecurity, and blockchain code testing quality.

In the US, the Federal Reserve is planning to launch an instant payment system called FedNow in July 2023. The network will not be based on blockchain but will be able to settle payments in seconds and can support transactions between consumers, merchants, and banks. Some believe that the closure of Silvergate’s SEN network and Signature Bank’s SigNet network in mid-March 2023, both offering instant settlement service where clients were able to move assets between fiat currencies and crypto exchanges at any time, could have had something to do with the launch of FedNow. Around the world, central bank digital currencies (CBDCs) are also being actively developed. They offer a digital form of a government-issued currency that is not pegged to any physical commodity and these digital currencies will continue to be based on the fractional reserve banking system.

In Europe, the European Commission adopted a legislative proposal in late October 2022 that mandates all banks to offer instant euro payments to any individual with a bank account in the eurozone. At the moment, the EU banking sector, on average, lags behind other major international markets in instant payments, although single-country solutions have been adopted and variations between countries are large. In some European countries, instant payments cover 70% of banks but, in others, only 1% of payments are settled instantly. The European banking sector has stated that they need up to two years to make banks instant-payment ready5.

Europe has its own version of an instant settlement network. BCB Group, regulated in the UK and Switzerland, offers BLINC network that links crypto companies to the banking system and enables business accounts to trade in fiat and digital assets 24/7. The company already offers fiat-to-crypto rails in sterling, euros, Swiss francs, and yen in Europe and plans to add USD fiat-to-crypto rails by early Q2 2023. BCB’s goal is to plug the gaps left by the SEN network. Unlike SEN, BLINC is multicurrency-based and is not tied to any single credit institution. It was designed as a payment institution to provide on-ramps to banks in Europe, the UK and Switzerland. The company emphasises that its funds are always 1:1 backed and are unleveraged and un-rehyphothecated6.

Sources

1 Source: Coingecko.com

2 Source: Electric Capital, 2022 Developer Report

3 Source: Visa Fact Sheet, 2022

4 Source: CoinMetrics

5 Source: Euromoney

6 Source: BCB Group, Coindesk

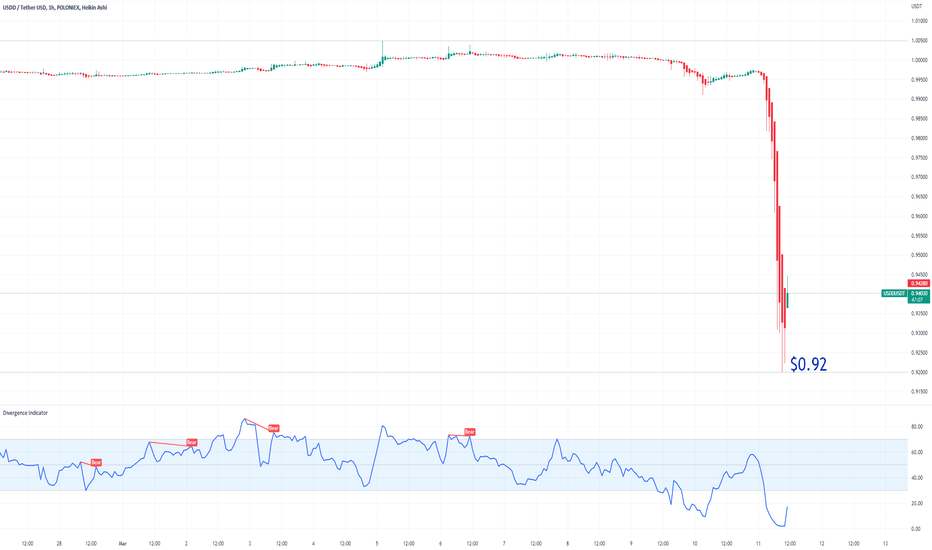

USDD Strablecoin DepeggingAs i warned you in the past article, TRX is about to collapse because of USDD:

According to their website, USDD is secured by the over-collateralization of multiple mainstream digital assets (e.g. TRX , BTC , and USDT). The total value of collateralized assets is significantly higher than that of USDD in circulation with the collateral ratio set at 120%.

This is the USDD collateral:

TRX 10,929,535,279

BTC 14,040.6 = about $313Mil

USDT 29,964,253

USDC 39,719,839

so besides TRX , the total amount of other collateral is $383Mil for a stablecoin that has a mk cap of $724Mil.

Now let`s say TRX drops to the Covid level of $0.0072, which is not unrealistic in my opinion.

Then the TRX collateral of 10,929,535,279 coin will be worth $78,692,654.

Assuming that BTC won`t go lower, then still the liquid collateral of USDD will be around $462Mil for a mk cap now of $724Mil, which will result in a huge depegging od the "stablecoin".

Looking forward to read your opinion about it.

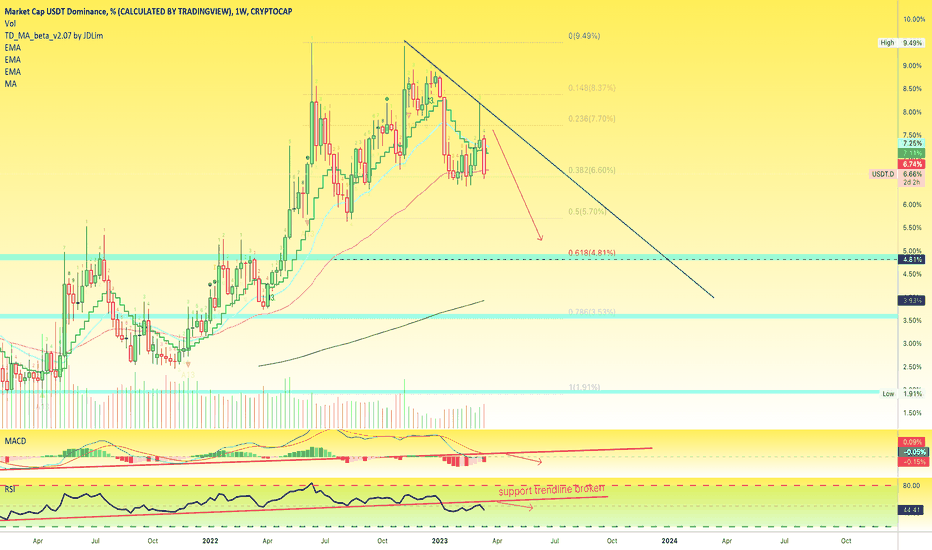

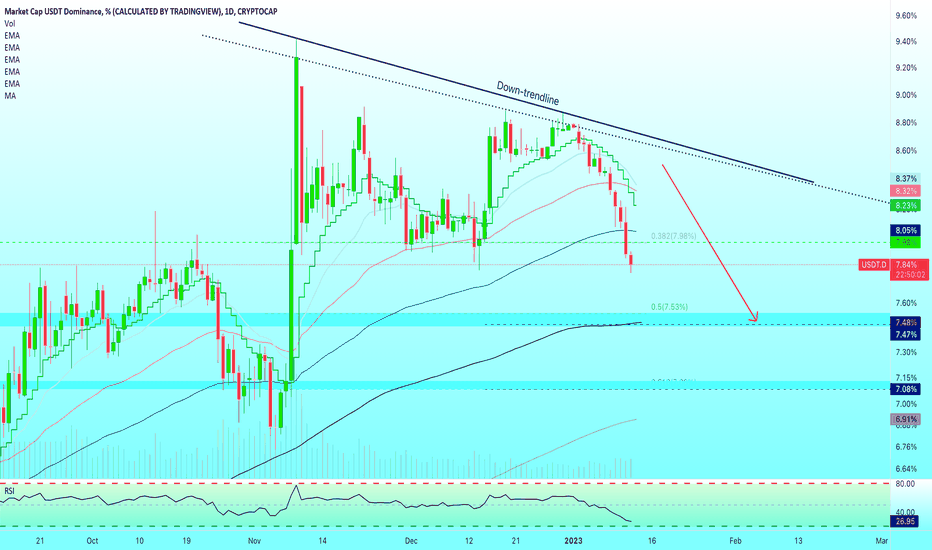

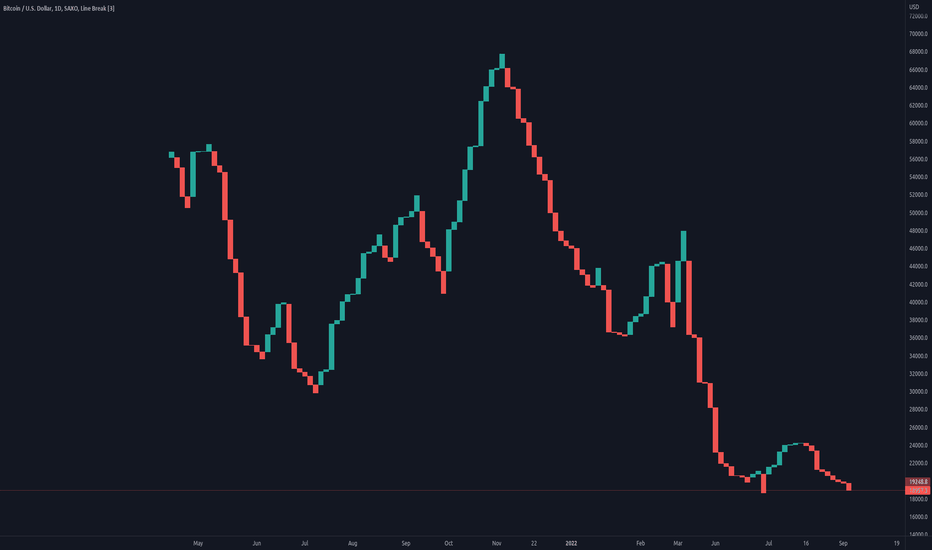

📈 Tether Dominance Long-Term Bearish Trend ConfirmedLast week closed as an inverted hammer and this was the "last hooray".

EMA50 still stands as support but we have multiple lower highs since June 2022.

The weekly MACD just entered the bearish zone:

The weekly RSI is also showing a strong bearish bias:

All the USDT (Tether) will be used to buy Bitcoin and Altcoins.

Here we can see clearly on the daily timeframe how MA200 has been lost as support:

Below this level Tether Dominance is always bearish.

Notice bear volume being at its highest since November 2022 when USDT.D started to decline.

The next drop will send USDT.D to around 4.81%, a major drop.

This is the level it traded at around April 2022, this would mean Bitcoin trading at about $40,000.

There is strong support at this level just as Bitcoin will face strong resistance at $40k.

Everything is pointing in the same direction... Bitcoin will grow like the world is ending... But the world isn't ending, it is just the end of an era where a new financial system will emerge.

✔️ Bitcoin is the future of money.

✔️ Cryptocurrency is the future money.

✔️ Bitcoin is the present of money.

✔️ Bitcoin is very likely to save us from another 2008.

Namaste.

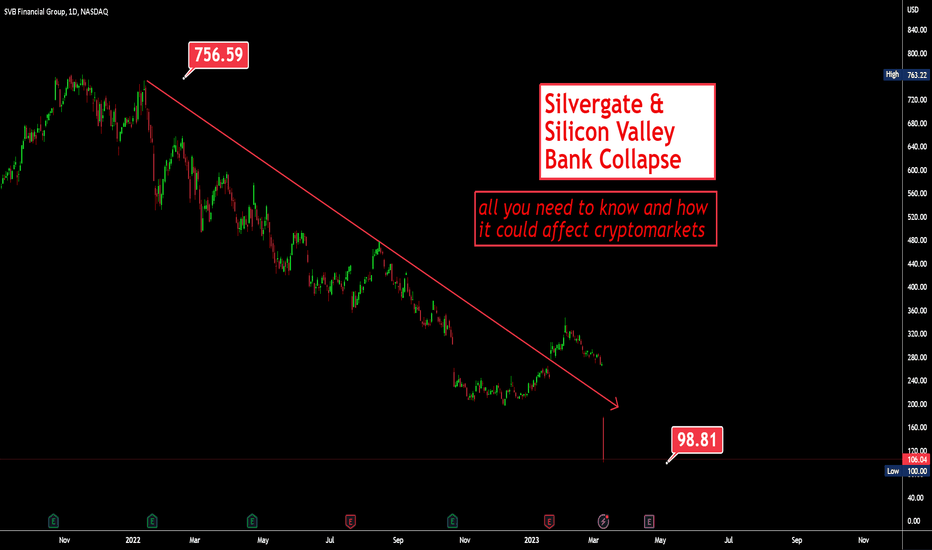

SVB, Silvergate Collapse & Affect on CryptomarketHi Traders, Investors and Speculators of the Charts 📈📉

Ev here. Been trading crypto since 2017 and later got into stocks. I have 3 board exams on financial markets and studied economics from a top tier university for a year.

In a twist of events, an incident that happened within the banking realm created chaos for the crypto realm. I bet you didn't have that on your bingo cards for 2023...

In the past few weeks, there have been two significant bank failures in the United States that have sent shockwaves throughout the financial world. The collapse of Silicon Valley Bank and Silvergate Bank has sparked concerns about the stability of the banking system and the future of the crypto industry. The failure of these banks highlights the fragility of the financial system and the challenges faced by institutions that operate in high-risk sectors like tech and crypto.

Silicon Valley Bank ( SVB ) was closed by the FDIC on March 9 due to its heavy losses caused by the downturn in technology stocks and the U.S. Federal Reserve's aggressive plan to increase interest rates.

The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the US Congress in 1933 to maintain stability and public confidence in the nation's financial system. The FDIC provides deposit insurance that guarantees the safety of deposits in member banks, up to a certain limit. In the event that a member bank fails, the FDIC will step in to insure deposits, provide assistance to depositors, and liquidate the failed bank's assets. The FDIC also regulates and supervises member banks, as well as conducts research and analysis on the banking industry.

Silicon Valley Bank bought bonds using customers' deposits, but the value of those investments fell as interest rates rose. This is usually not a problem for banks, but Silicon Valley Bank's customers were largely startups that needed cash. Venture capital funding was drying up, and companies were tapping their existing funds deposited with Silicon Valley Bank, which was at the center of the tech startup universe. In response to this liquidity crisis, SVB sold a $21bn bond portfolio at a loss of $1.8 billion. The bank attempted to fill the solvency hole with a combined equity offering of $2.25bn on March 8, but the attempt failed. This is the largest failure of a financial institution in the United States since Washington Mutual collapsed more than a decade ago. The closure of SVB had an immediate effect on some startups that had ties to the bank, as they scrambled to pay their workers and feared having to pause projects or lay off employees until they could access their funds. SVB , the 16th largest bank in the US, had assets of $209 billion, with more than 50% of its investments tied up in long-term securities, including exposure to the Silicon Valley tech and health startup world. The bank's sudden collapse has raised questions about its risk management practices, and the impact of its closure on its clients, who are largely startups and wealthy tech workers. The bank's large uninsured deposits and exposure to high-risk sectors like tech and crypto contributed to its downfall.

But SVB isn't the only one... Silvergate Bank, which has been a significant player in the crypto world, has announced that it is closing and returning deposits. The bank's holding company, Silvergate Capital Corporation, stated that the decision was made "in light of recent industry and regulatory developments." The closure follows the loss of one billion dollars in a quarter after customers withdrew $8.1 billion, and a subsequent filing in March revealing even worse financials. The closure of Silvergate Bank is concerning for the crypto industry, as it may lead to companies turning to less regulated institutions for their banking needs, potentially making the space even riskier. Coinbase, Crypto.com, and Paxos have already started moving away from the bank. The collapse of the bank will likely draw scrutiny from lawmakers who are concerned about the crypto contagion affecting the traditional financial sector. The Silvergate Exchange Network, which allowed crypto exchanges like Coinbase, Gemini, and Kraken to move money between themselves and other institutions, has also been shut down. The bank's financial struggles have been ongoing for some time, with some of its high-profile clients like FTX and Genesis also experiencing challenges. Silvergate's collapse raises concerns about the future of the crypto industry, as companies may turn to less regulated institutions for their banking needs, potentially making the space even riskier for everyone involved. The bank's failure is also likely to draw scrutiny from lawmakers concerned about the potential contagion of the crypto industry on the traditional financial sector.

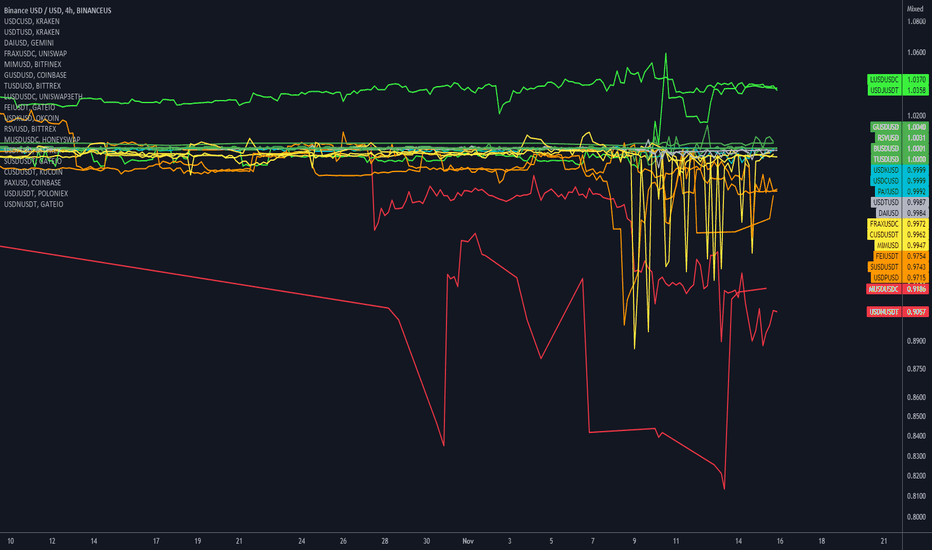

Late Friday night Coinbase, a popular cryptocurrency exchange, announced that it would suspend conversions for the USDC stablecoin. This led to a rush of people trying to sell their USDC holdings, causing it to depeg from its value of $1 and trade as low as $0.87 before recovering to $0.92. Another stablecoin, Dai, also depegged and experienced a high volume of trading. Stablecoins are important in the cryptocurrency market as they provide a way for traders to move funds between different exchanges or cryptocurrencies without having to convert back to fiat currency. They are also used as a store of value by some cryptocurrency investors who prefer a more stable asset compared to the volatility of Bitcoin or other cryptocurrencies. If stablecoins depeg permanently, it could lead to a loss of confidence in their stability and reliability. This could potentially cause a sell-off of stablecoins and a shift towards other assets perceived as more stable, such as traditional fiat currencies.

But before we panic too hard and FUD out, it's important to note that the impact of this crisis on cryptocurrencies such as alts and Bitcoin would depend on the severity and duration of the stablecoin depegging event, as well as other market factors such as investor sentiment and regulatory actions. In the past, there have been instances of stablecoins temporarily depegging from their underlying assets without significant impact on the broader cryptocurrency market. One notable example of a stablecoin depegging in the past is the case of Tether (USDT) in 2018. Tether is a stablecoin that is pegged to the value of the US dollar , with each USDT token representing one US dollar . In October 2018, Tether's price dropped below the $1 peg on several cryptocurrency exchanges, leading to concerns about the stability of the stablecoin. The depegging was attributed to a variety of factors, including regulatory pressures, concerns about Tether's reserves, and a general market downturn. The depegging led to a sell-off of Tether and a shift towards other stablecoins such as USD Coin ( USDC ) and TrueUSD (TUSD), which saw increased demand as traders and investors sought more reliable alternatives. Despite the depegging of Tether, the broader cryptocurrency market did not experience a significant impact, with Bitcoin and other cryptocurrencies largely unaffected. However, the incident highlighted the potential risks and uncertainties associated with stablecoins and their reliance on centralized institutions to maintain their pegs.

In terms of price action for the immediate term, the Tether (USDT) depegging event in 2018 did have some impact on the cryptocurrency market prices, although the impact was relatively limited and short-lived. Following the depegging of USDT, there was a brief sell-off of Tether and a shift towards other stablecoins such as USD Coin ( USDC ) and TrueUSD (TUSD). This led to increased demand for these stablecoins, which helped to maintain their pegs to the US dollar . However, the broader cryptocurrency market, including Bitcoin , was largely unaffected by the Tether depegging. While there was some initial volatility and uncertainty, the market quickly stabilized and resumed its upward trend.

💭The collapse of Silicon Valley Bank is the second-largest bank default in U.S. history and puts the golden trifecta rule of banking (liquidity, solvency, and profitability) into review. This failure reminds us of the unintended consequences of unorthodox monetary policies, pandemic remediation measures, excessive leverage, and democracy eroding rulings. SVB had significant exposure to long-term securities and the Silicon Valley tech and health startup world. The bank's uninsured deposits pose a problem but insured deposits will be available as soon as Monday.

The collapse of Silicon Valley Bank and Silvergate Bank underscores the need for stricter regulatory frameworks and tighter risk management practices in the financial industry. The failures also highlight the importance of diversification and risk mitigation strategies for banks and their clients. As the financial industry continues to evolve, it is essential that institutions keep pace with the changes and adapt their practices to ensure their stability and resilience in the face of future challenges.

_______________________

📢Follow us here on TradingView for daily updates and trade ideas on crypto , stocks and commodities 💎Hit like & Follow 👍

We thank you for your support !

CryptoCheck

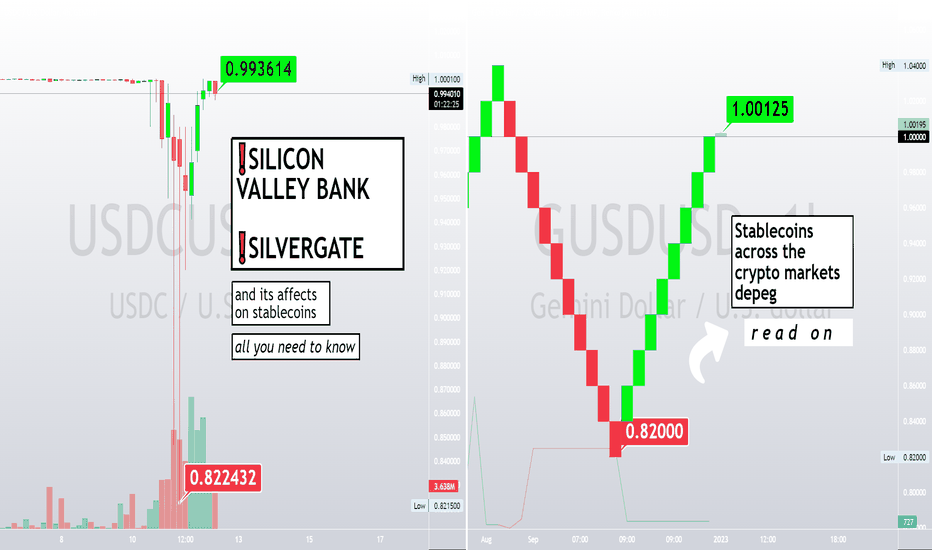

Stablecoins Depeg: Twist of Events, Banking CrisisHi Traders, Investors and Speculators of the Charts 📈📉

Ev here. Been trading crypto since 2017 and later got into stocks. I have 3 board exams on financial markets and studied economics from a top tier university for a year.

In a twist of events, an incident that happened within the banking realm created chaos for the crypto realm. I bet you didn't have that on your bingo cards for 2023...

In the past few weeks, there have been two significant bank failures in the United States that have sent shockwaves throughout the financial world. The collapse of Silicon Valley Bank and Silvergate Bank has sparked concerns about the stability of the banking system and the future of the crypto industry. The failure of these banks highlights the fragility of the financial system and the challenges faced by institutions that operate in high-risk sectors like tech and crypto.

Silicon Valley Bank (SVB) was closed by the FDIC on March 9 due to its heavy losses caused by the downturn in technology stocks and the U.S. Federal Reserve's aggressive plan to increase interest rates.

The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the US Congress in 1933 to maintain stability and public confidence in the nation's financial system. The FDIC provides deposit insurance that guarantees the safety of deposits in member banks, up to a certain limit. In the event that a member bank fails, the FDIC will step in to insure deposits, provide assistance to depositors, and liquidate the failed bank's assets. The FDIC also regulates and supervises member banks, as well as conducts research and analysis on the banking industry.

Silicon Valley Bank bought bonds using customers' deposits, but the value of those investments fell as interest rates rose. This is usually not a problem for banks, but Silicon Valley Bank's customers were largely startups that needed cash. Venture capital funding was drying up, and companies were tapping their existing funds deposited with Silicon Valley Bank, which was at the center of the tech startup universe. In response to this liquidity crisis, SVB sold a $21bn bond portfolio at a loss of $1.8 billion . The bank attempted to fill the solvency hole with a combined equity offering of $2.25bn on March 8, but the attempt failed. This is the largest failure of a financial institution in the United States since Washington Mutual collapsed more than a decade ago. The closure of SVB had an immediate effect on some startups that had ties to the bank, as they scrambled to pay their workers and feared having to pause projects or lay off employees until they could access their funds. SVB, the 16th largest bank in the US, had assets of $209 billion, with more than 50% of its investments tied up in long-term securities, including exposure to the Silicon Valley tech and health startup world. The bank's sudden collapse has raised questions about its risk management practices, and the impact of its closure on its clients, who are largely startups and wealthy tech workers. The bank's large uninsured deposits and exposure to high-risk sectors like tech and crypto contributed to its downfall.

But SVB isn't the only one... Silvergate Bank, which has been a significant player in the crypto world, has announced that it is closing and returning deposits. The bank's holding company, Silvergate Capital Corporation, stated that the decision was made "in light of recent industry and regulatory developments." The closure follows the loss of one billion dollars in a quarter after customers withdrew $8.1 billion, and a subsequent filing in March revealing even worse financials. The closure of Silvergate Bank is concerning for the crypto industry, as it may lead to companies turning to less regulated institutions for their banking needs, potentially making the space even riskier. Coinbase, Crypto.com, and Paxos have already started moving away from the bank. The collapse of the bank will likely draw scrutiny from lawmakers who are concerned about the crypto contagion affecting the traditional financial sector. The Silvergate Exchange Network, which allowed crypto exchanges like Coinbase, Gemini, and Kraken to move money between themselves and other institutions, has also been shut down. The bank's financial struggles have been ongoing for some time, with some of its high-profile clients like FTX and Genesis also experiencing challenges. Silvergate's collapse raises concerns about the future of the crypto industry, as companies may turn to less regulated institutions for their banking needs, potentially making the space even riskier for everyone involved. The bank's failure is also likely to draw scrutiny from lawmakers concerned about the potential contagion of the crypto industry on the traditional financial sector.

Late Friday night Coinbase, a popular cryptocurrency exchange, announced that it would suspend conversions for the USDC stablecoin. This led to a rush of people trying to sell their USDC holdings, causing it to depeg from its value of $1 and trade as low as $0.87 before recovering to $0.92. Another stablecoin, Dai, also depegged and experienced a high volume of trading. Stablecoins are important in the cryptocurrency market as they provide a way for traders to move funds between different exchanges or cryptocurrencies without having to convert back to fiat currency. They are also used as a store of value by some cryptocurrency investors who prefer a more stable asset compared to the volatility of Bitcoin or other cryptocurrencies. If stablecoins depeg permanently, it could lead to a loss of confidence in their stability and reliability. This could potentially cause a sell-off of stablecoins and a shift towards other assets perceived as more stable, such as traditional fiat currencies.

But before we panic too hard and FUD out, it's important to note that the impact of this crisis on cryptocurrencies such as alts and Bitcoin would depend on the severity and duration of the stablecoin depegging event, as well as other market factors such as investor sentiment and regulatory actions. In the past, there have been instances of stablecoins temporarily depegging from their underlying assets without significant impact on the broader cryptocurrency market. One notable example of a stablecoin depegging in the past is the case of Tether (USDT) in 2018. Tether is a stablecoin that is pegged to the value of the US dollar, with each USDT token representing one US dollar. In October 2018, Tether's price dropped below the $1 peg on several cryptocurrency exchanges, leading to concerns about the stability of the stablecoin. The depegging was attributed to a variety of factors, including regulatory pressures, concerns about Tether's reserves, and a general market downturn. The depegging led to a sell-off of Tether and a shift towards other stablecoins such as USD Coin (USDC) and TrueUSD (TUSD), which saw increased demand as traders and investors sought more reliable alternatives. Despite the depegging of Tether, the broader cryptocurrency market did not experience a significant impact, with Bitcoin and other cryptocurrencies largely unaffected. However, the incident highlighted the potential risks and uncertainties associated with stablecoins and their reliance on centralized institutions to maintain their pegs.

In terms of price action for the immediate term, the Tether (USDT) depegging event in 2018 did have some impact on the cryptocurrency market prices, although the impact was relatively limited and short-lived. Following the depegging of USDT, there was a brief sell-off of Tether and a shift towards other stablecoins such as USD Coin (USDC) and TrueUSD (TUSD). This led to increased demand for these stablecoins, which helped to maintain their pegs to the US dollar. However, the broader cryptocurrency market, including Bitcoin, was largely unaffected by the Tether depegging. While there was some initial volatility and uncertainty, the market quickly stabilized and resumed its upward trend.

💭The collapse of Silicon Valley Bank is the second-largest bank default in U.S. history and puts the golden trifecta rule of banking (liquidity, solvency, and profitability) into review. This failure reminds us of the unintended consequences of unorthodox monetary policies, pandemic remediation measures, excessive leverage, and democracy eroding rulings. SVB had significant exposure to long-term securities and the Silicon Valley tech and health startup world. The bank's uninsured deposits pose a problem but insured deposits will be available as soon as Monday.

The collapse of Silicon Valley Bank and Silvergate Bank underscores the need for stricter regulatory frameworks and tighter risk management practices in the financial industry. The failures also highlight the importance of diversification and risk mitigation strategies for banks and their clients. As the financial industry continues to evolve, it is essential that institutions keep pace with the changes and adapt their practices to ensure their stability and resilience in the face of future challenges.

_______________________

📢Follow us here on TradingView for daily updates and trade ideas on crypto , stocks and commodities 💎Hit like & Follow 👍

We thank you for your support !

CryptoCheck

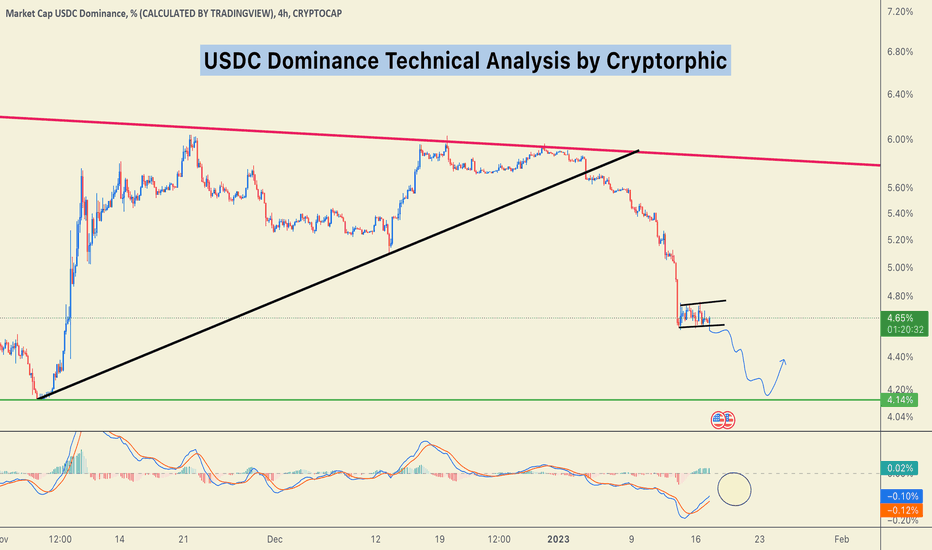

#Stable Dominance , Dump will Continue, Here's Why!Once this pennant breaks below BTC is likely to hit $22.5k+.

Is it likely? I think Yes.

Lower support is around 4.14%

Once this level hits expect some correction in the market.

The charts show the possibility of the continuation of this uptrend.

Invalidation:- Break and close above 4.85%

Let me know what. you think.

Please hit the like button if you like it and share your views in the comment section.

Stay safe

#PEACE

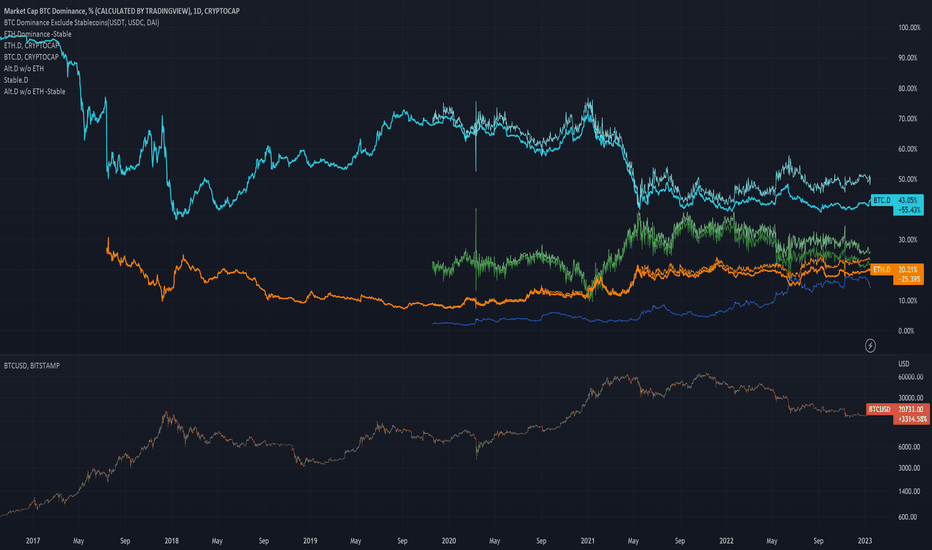

Market Dominance of different assets w and w/o stablecoins1. Bitcoin dominance w/ostablecoins

2. Bitcoin dominance with stablecoins

3. Altcoins dominance w/o ETH w/o Stablecoins

4. Altcoins dominance w/o ETH with stablecoins

5. ETH dominance w/ostablecoins

6. ETH dominance with stablecoins

7. Stablecoin dominance

📈 Tether Dominance, The Final ConfirmationIncredibly enough, some people still have doubt that Bitcoin and the Altcoins will continue to grow.

Here is the final confirmation in the form of a strongly bearish USDT.D chart.

Remember that one mentioning this thing is about "to speed'...

Well, this "thing" has more down to go before it finds support.

At least one more strong red candle, then a small bounce before more lows.

Namaste.

💵USD.Dominance Diverging⛽Fuel For Future Financial Flurry🤺👑

King Dollar Has Been Demonstrating It's

Dominance Over Markets, Especially Crypto Since

Bottoming In Quarter One Of 2021

Holding The Moniker Of The Dollar Prince

Even I've Been Surprised By The

Recent Strength, Though That Seems Set

To Finally Change

🔮

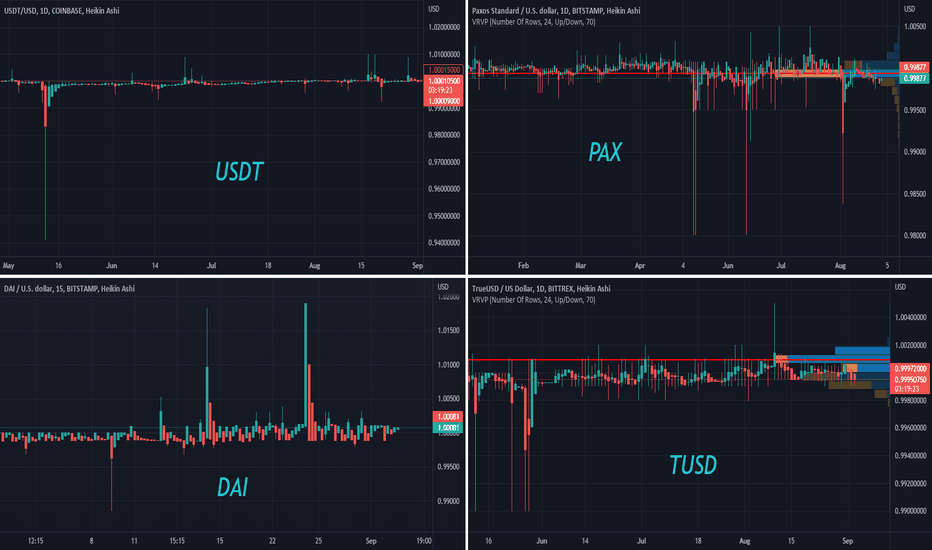

A Collection Of USD.D Stable Coin

Charts For Your Viewing Pleasure Below

Remember US Dollar Dominance Down =

Risky Markets Up

💹

As An Aside, So Much For

The Fed Printing All Dem Dollars

One Would Think QE Isn't Money

Printing After All..

🤔

USDT.D

USDC.D

DAI.D

TUSD.D

CRYPTOCAP:USDT.D

CRYPTOCAP:USDC.D

CRYPTOCAP:DAI.D

CRYPTOCAP:TUSD.D

💸

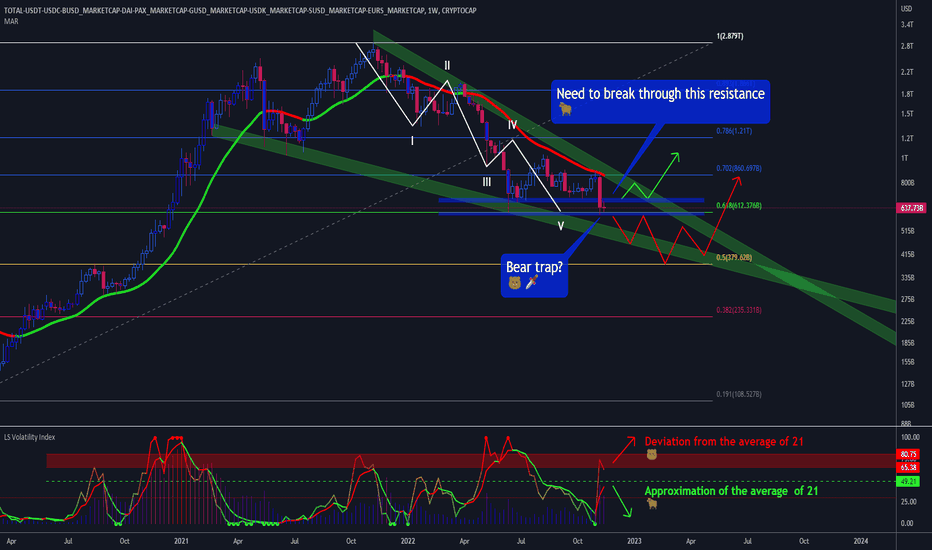

MarketCap of Cryptocurrencies except stable coins (TOTAL-USD)ℹ️ This is the total market capitalization of cryptocurrencies, excluding major stable coins (USDT, USDC, BUSD, DAI, GUSD, PAX, SUSD, USDK, EURS).

🟢The chart indicates a possible bear trap.

However, to be confirmed, the index needs to break through the resistance shown in the blue region above to have an upward confirmation.

If that happens, the LS Volatility Index is expected to drop to zero, indicating an approximation to the 21 moving average.

🔴In a bad scenario, the marketcap can reach new lows, possibly reaching the next Fibonacci level.

In that case, the LS Volatility Index would rise to 100, indicating an even greater deviation from the 21 average.

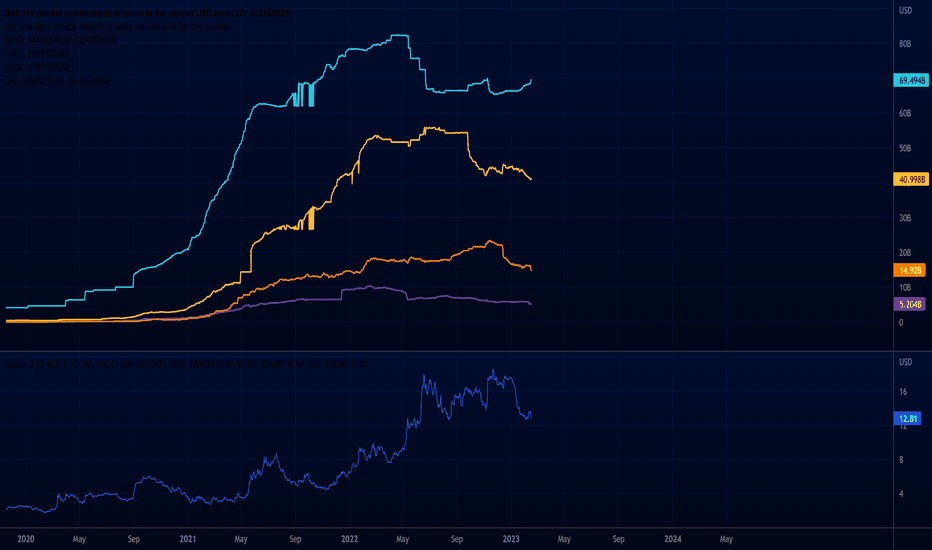

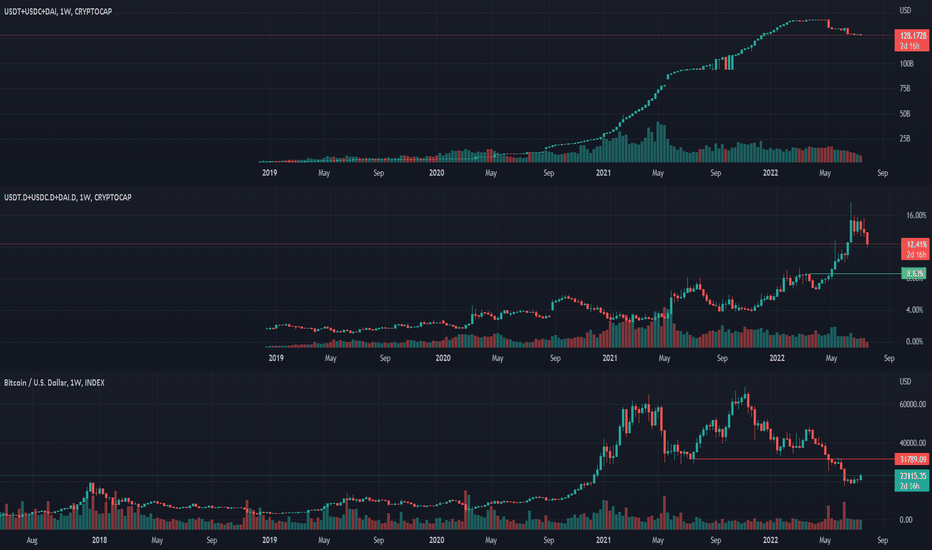

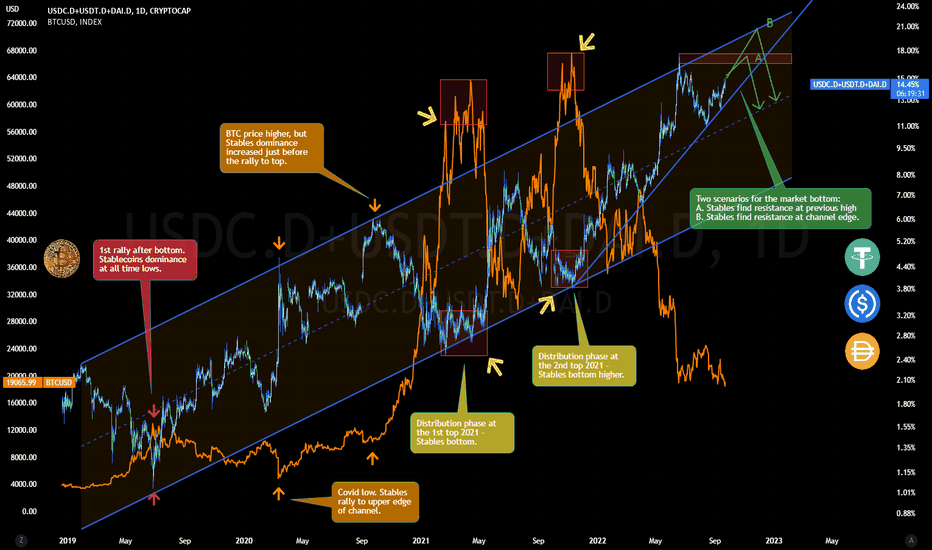

Crypto Market Risk ExposureThis layout is used to understand the level of risk exposure in the crypto market.

There are 3 data, in order from top to bottom:

1. USDT+USDC+DAI: Market Cap main stablecoins.

2. USDT.D+USDC.D+DAI.D: Dominance main stablecoins.

3. Bicoin/Dollar.

The data seen together makes us understand whether investors prefer to go risk-off or risk-on based on the divergence/convergence between the values of USDT.D+USDC.D+DAI.D and Bitcoin/Dollar. The more the two data diverge, the more investors take refuge in stablecoins, while the more the two data converge, the more investors buy BTC using stablecoins. As for the USDT+USDC+DAI data seen together with the other two, it serves to weigh the level of confidence in the crypto market during its phases, eg. the combination of flattening/reduction of the stablecoins market cap with the increase of their dominance makes us understand not only that investors are running away from BTC(and Alts) but also that they are making cash-out in FIAT, effectively removing ready liquidity on the market which will find it more difficult to recover in a short time(eg period from 2022-03-07 to 2022-07-12, historical record red candles on the W). Analyzing the last week instead we are seeing a change of direction, from divergence to convergence, the dominance of the stables has reached the peak and is now reversing heading towards the first support at 8.63%, while BTC is start climbing towards the resistance at 31.7k, in the meantime the market cap of the stables is continuing to fall in a first historical retracement, a sign that the market continues to lose ready liquidity to give a greater boost to BTC, also witnessed by the low trading volumes.

Peg of Stable CoinsStablecoins are cryptocurrencies whose value is pegged, or tied, to that of another currency, commodity, or financial instrument.

Stablecoins aim to provide an alternative to the high volatility of the most popular cryptocurrencies, including Bitcoin (BTC), which has made crypto investments less suitable for common transactions.

(Investopedia)

This graph shows the pegged value of the main stable coins.

Ideally, the value should be 1:1.

In this crash scenario, I will stay alert on these values.

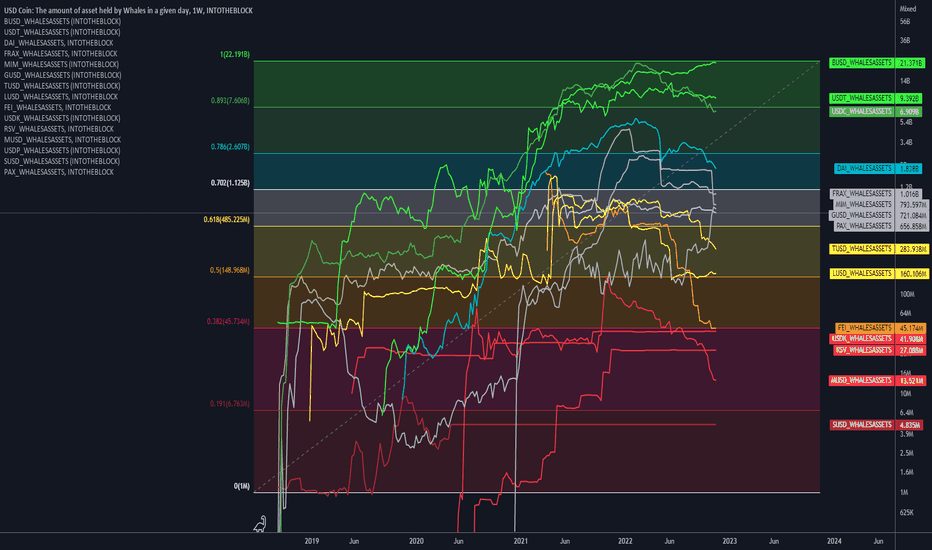

Stable Coins: Amount of Assets Held by WhalesThis graph shows the ranking of stable coins, according to the Amount of Assets Held by Whales (some stable coins don't have this information here).

Since May 02, 2022, BUSD has surpassed USDC in this indicator.

USDT remains relatively stable, and DAI was below $2 billion.

The PEG of these stable coins can be seen in this other analysis:

Dollar losing strength? Correlation with BitcoinThis is the Dollar dominance chart in the cryptocurrency world.

It has an inverse correlation to Bitcoin and other cryptocurrencies that are not stable coins:

The dominance index is exiting the bullish purple channel.

However, it is still above the red support region.

The scenario will be bullish if this dominance does not return to the purple channel, and break the red zone downwards.

If the scenario worsens, it will go back inside the channel and can test the top of 06/18/2022.

Which translates, conversely, to the bottom of the Bitcoin price could be retested.

In DXY, which measures the strength of the Dollar against other FIAT currencies, we have an ascending broadening wedge, the "megaphone" pattern.

To break this uptrend the index needs to first break the purple support region, and then break the lower wedge line downwards.

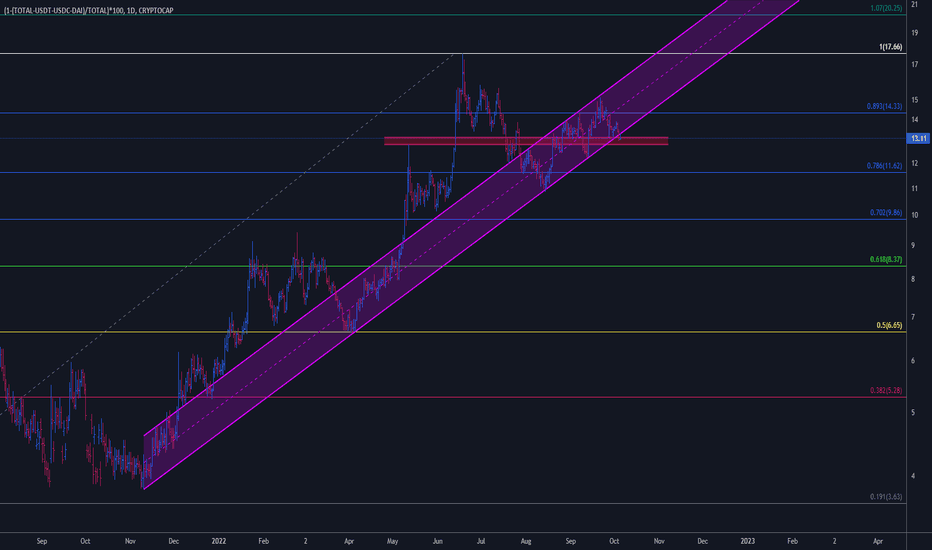

🎯 Stablecoins dominance - the DXY of Cryptoverse🎯 Today we'll have a look at the cumulated dominance of Tether USD, Circle USD and DAI in comparison with Bitcoin's price.

Since 2019 Stables dominance has been ranging inside this channel on the logarithmic chart.

The channel is moving upwards as more funds enter and remain in the cryptoverse.

As such, the dominance of Stables is highly dependent on interest in these assets, so I expect this channel to break at one point (at minimum due to saturation of the market). So far this channel has held.

Touches of the upper band marked bottoms for BTC, while touches of the lower band marked tops.

Thus, I'm looking at their dominance as inversely correlated with Bitcoin's price, similar to how DXY is inversely correlated with the stock market.

We are currently in an up move that's been trending the blue line since the 69k$ top.

Considering the channel holds, we can expect one of the two scenarios to develop and mark a reversal in the market.

This doesn't mean that it is the only way we are ending the bear market. However, I am watching this closely. 🎯

💎 Looking forward for your questions below. If this post provided you value, follow for more.

1 Year Of BTC El Salvador CelebratesEl Salvador has used Bitcoin for a year.

El Salvador started using Bitcoin as a legal tender a year ago after President Nayib Bukele made a contentious choice. The public welcomed the new chance with enthusiasm, but since then, Bitcoin's value has fallen, and some experts believe the initiative was a disaster.

Bitcoin is up 2.72% today, Ethereum is up 8%, and Solana is up nearly 5% as the cryptocurrency markets rebound.

This Thursday morning, cryptocurrency markets are up. Pololu, Polygon, and Ethereum have made gains. Shiba Inu and Dogecoin, two meme coins, have also increased in value over the past 24 hours. Volatility has been seen in stablecoins.

"More CBDC news," the Ripple advisor teases.

According to Ripple, it may soon reveal additional information regarding its central bank digital currency projects.

Advisor to the CBDC Antony Welfare

The last session saw a 3.1% increase in BTC/USD.

The latest session saw a massive 3.1% increase in the Bitcoin-Dollar pair. The MACD is sending a negative signal. Resistance is at 20712.8113, while support is at 17730.3773.

USDT warn! only the tokens on the PoS network will be redeemableGrayscale warning ahead of the Ethereum Merge: “issuers like Tether and CirclePay have stated that post-fork, only the tokens on the PoS (proof of stake) network will be redeemable”, so if the PoS-based Ethereum fork goes “live with a parallel DeFi ecosystem, collateralized with unredeemable stablecoins, users and smart contracts may attempt to liquidate positions on the new chain, contributing to sell pressure on the new token.”

The worst case scenario of the Merge is the collapse of Ethereum based stablecoins, so be careful with those.

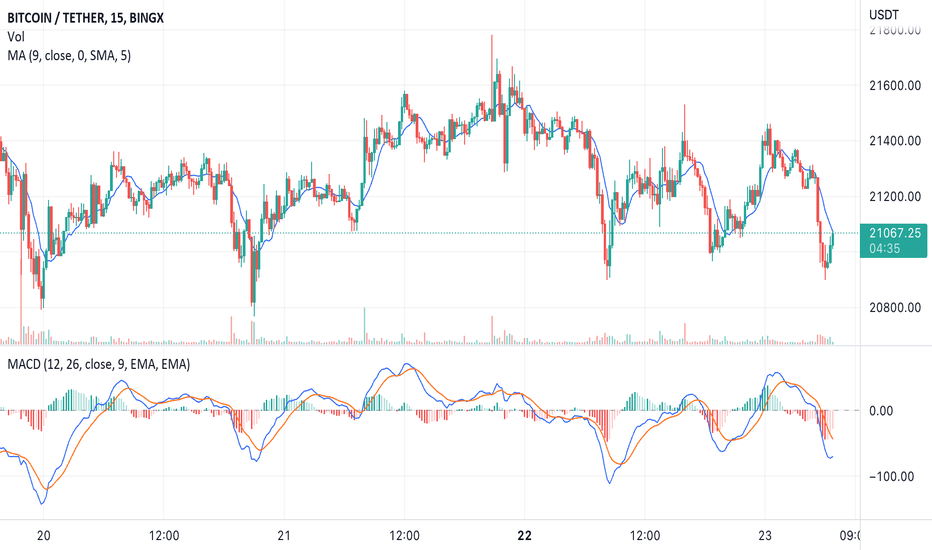

August 23 BTCUSD BingX Chart Analysis and Today's HeadlineBingX’s Bitcoin Chart

According to CoinShare, Digital asset investment products saw minor outflows last week totalling US$9m last week with volumes at US$1bn, 55% off the year average and the 2nd lowest this year. Bitcoin price is almost flat over the past 24 hours. The relative strength index (RSI) is near the oversold zone, indicating that the bears have a significant advantage. For now, the bulls need to push the Bitcoin price above the 50-day simple moving average (SMA) ($22,382) to avoid further decline.

Today’s Cryptocurrency Headline

UK Intends to Bring Stablecoins Under Regulation

A proposed bill could give U.K. regulators new powers over payments-focused crypto assets like stablecoins in September. The bill looks to expand existing financial regulations to cover payments-centric cryptocurrencies such as stablecoins, which are broadly defined as "digital settlement assets" (DSAs), and the bill also puts the UK Treasury in charge of defining what DSA are and gives the Bank of England (BoE), the Financial Conduct Authority (FCA) and the Payments Systems Regulator (PSR) corresponding powers to enforce the rules.

Disclaimer: BingX does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to the company. BingX is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned in the article.