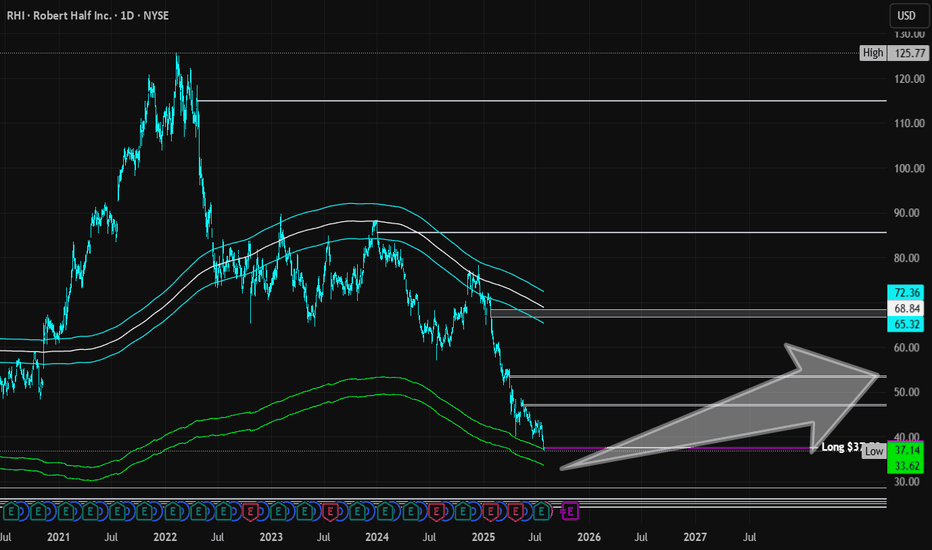

Robert Half | RHI | Long at $37.58Robert Half NYSE:RHI is a company that provides talent solutions and business consulting services in the US and internationally. It's a cyclical stock. Currently, the price has entered my "crash" simple moving average zone ($37-$33) and has historical bounced from this area. This doesn't mean the "major crash" area won't be reached ($26-$21 or below), but the company has been around since 1948 and survived many hurdles along the way.

Earnings are forecast to grow 8% annually and it has a 6.3% dividend. P/E = 21x and financially healthy (low debt-to-equity: .2x, low bankruptcy risk/Altmans Z Score: 5; and enough cash to pay current bills/quick ratio: 1.6).

Regardless of bottom predictions, I think there is a high chance the stock may reach $33 before a slight bounce. If the market flips for a bit, that "major crash" area ($20s) may be hit.

So, a starter position for NYSE:RHI has been created at $37.58 with additional entries near $33 and $25-$26.

Targets into 2028:

$46.00 (+22.4%)

$53.00 (+41.0%)

Staffing

Are you looking for stocks to buy? I am $PCTY $CCRNThe thing is, I'm buying very small positions.

I use the averages like the SP:SPX and NASDAQ:IXIC more like a sentiment measure. The averages are that, averages. They don't account for the whole market.

There will always be stocks rising or falling regardless of what the indexes are doing. But, if the averages are in downtrends I won't buy aggressively.

I like these two stocks, NASDAQ:PCTY and NASDAQ:CCRN . They are both leaders in the outsorcing industry. Coincidence?

Cross Country HealthCare provides market-leading workforce solutions and healthcare staffing services. And Paylocity provides software for payroll solution designed for the employee experience.

I'll buy a close above Friday's high with a stop loss just below the Friday's low. Also I'll be watching volume very closely as in both momentum is still bullish.