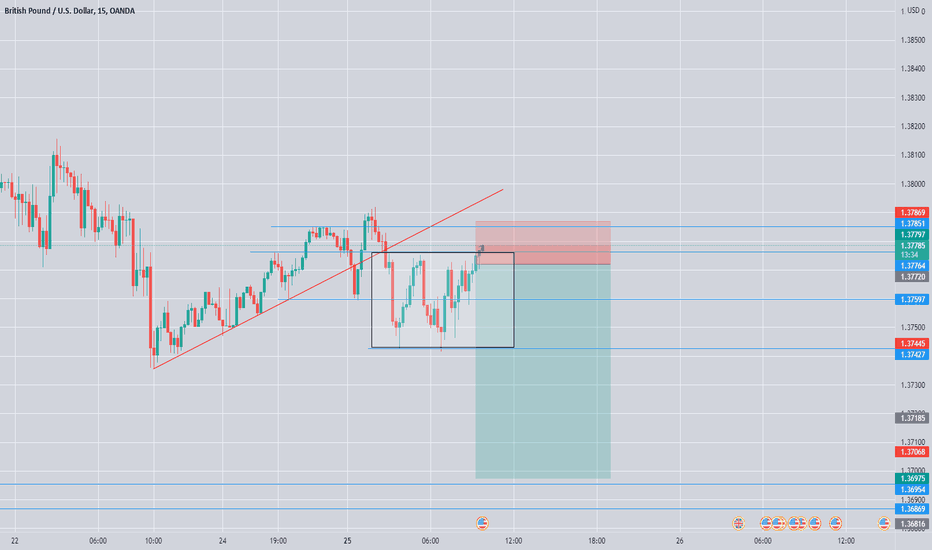

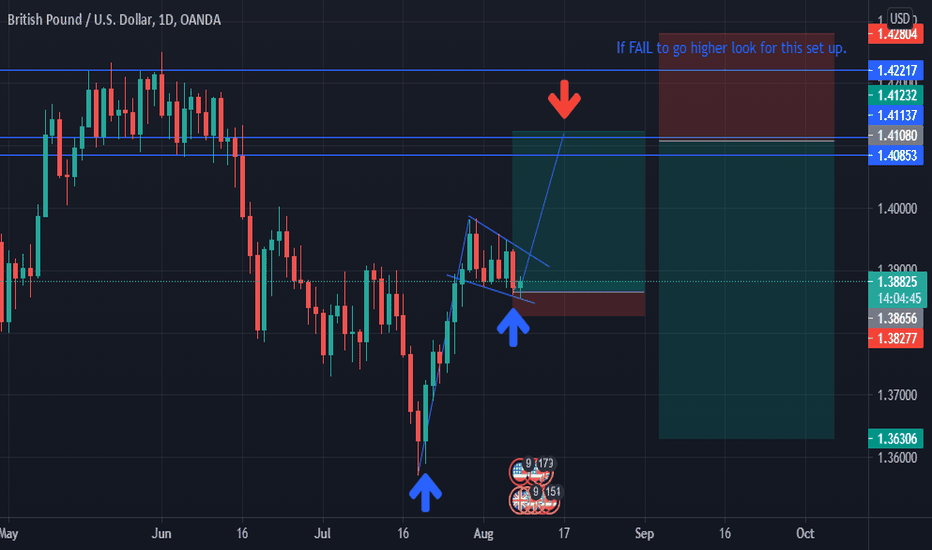

GBPUSD analysis - Third touch of trend line. Hope the markets are treating you all well.

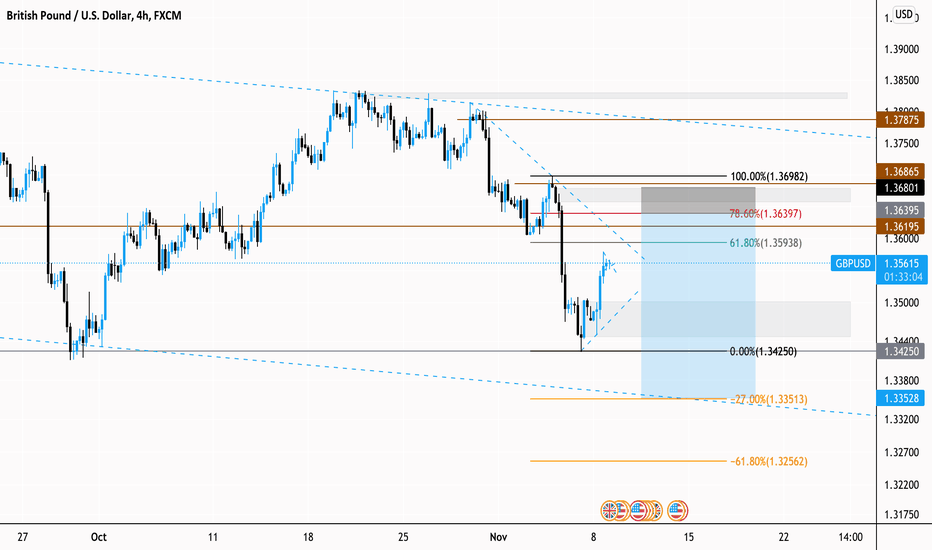

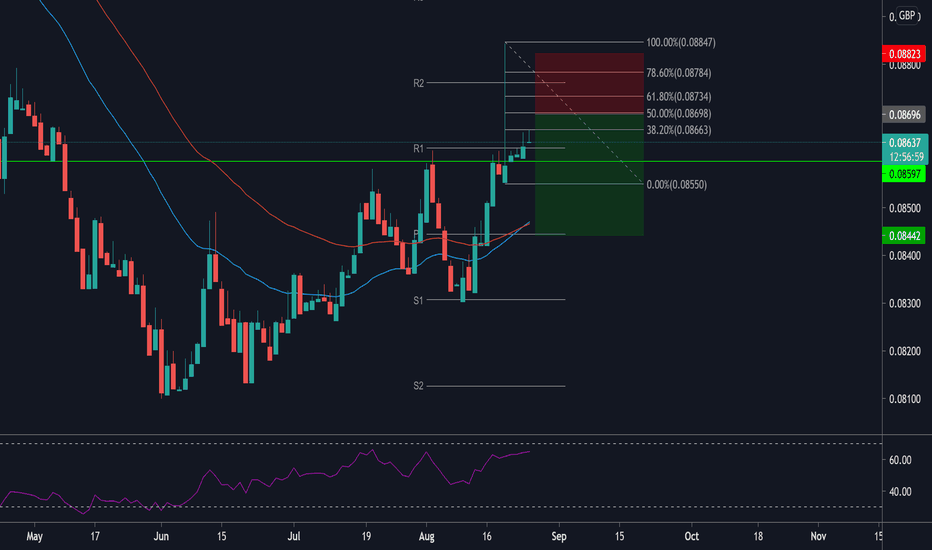

Here's my analysis for GBPUSD, price action has rejected the weekly support. I believe we can see a little bullish push up towards the daily resistance and 78.6% Fibonacci level; before price, action follows market structure.

I have shown my risk management on this trade, I only risk 1% per trade.

Please comment below your ideas and please like and follow!

Sterling

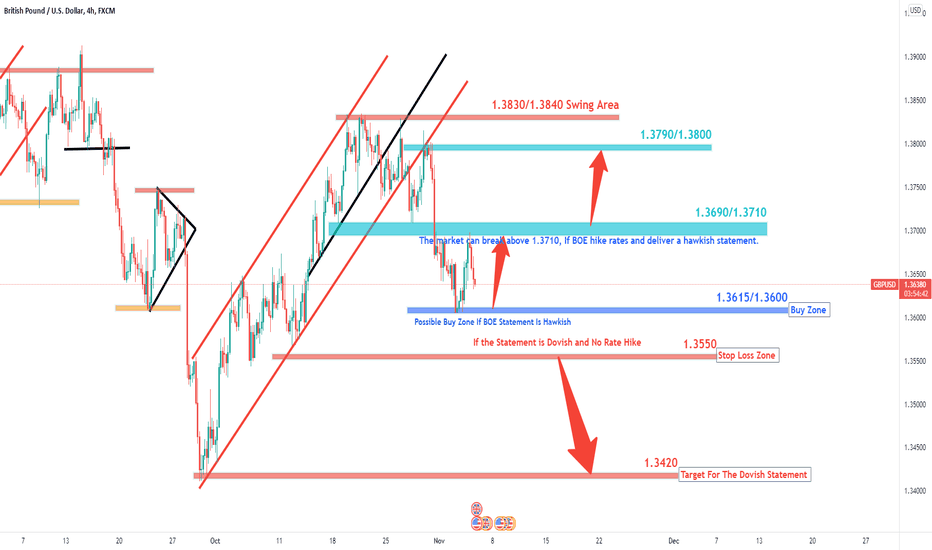

GBP/USD Analysis Ahead Of BOE Monetary Policy And Rate Decision The Pound is getting a boost from traders who expect the Bank of England (BOE) to hike their interest rates on Thursday.

Markets are split, with most expecting no change at this time, but CME Group's BOE Watch Tool shows that markets have priced in a 55% chance for 15 basis point rate hikes.

It might be enough alone, even without any other actions taken by policymakers like buying stocks or bonds.

The GBP/USD exchange had some relief yesterday after reaching on nearly 1.3600 price zone. But yesterday, it formed a nice bullish candle.

The BOE could also opt-out to make a "dovish rate hike" and reassure markets that they will wait and see how inflation reacts to the policy before deciding what are next.

BOE governor remarks on the outlook for CPI should be taken into consideration. If BOE adopts a cautious tone, many investors may believe it is good news about GBP from a long-term perspective. But since economists think his comments will dampen market expectation of Bank Rate hikes any time soon.

The Pound is getting a little bit better against the Dollar. It's still going down, but at least it's not declining as fast. So there are some positive signs that we may be seeing an end in sight.

A few days ago, we saw how GBP has been suffering lately due to uncertainty over Brexit negotiations. However, things seem like they're starting to turn around after comments made by FOMC Chairman Jerome Powell yesterday.

He said he doesn't think policymakers will hike rates until 2022 (instead of 2021) if economic conditions continue on their current path without any significant disruptions or shocks hitting markets first before then announcing another rate cut once QE ends).

So, if we see BOE keeps their policy unchanged, that will hurt GBP/USD, and it may test 1.3420 very soon.

The Bank of England is a hot potato right now. The new Chief Economist Huw Pill and external member Catherine Mann have expressed concerns over earlier monetary policy tightening.

At the same time, according to some economists, Dave Ramsden and Michael Saunders cheered hawks at the previous meeting's policy discussion with an eye on future rate increases and increasing inflation expectations ahead of possible hikes later this year or early 2022' predictions.

It could be good news for those heavily invested in stocks but could hurt those living off their savings accounts once more interest rates start climbing again from here on out.

We all know current BOE governor Bailey is a hawkish member, so if he delivers his speech as usual, what we saw before GBP/USD may test 1.3690/1.3710 immediately.

If the BOE hike rates today or hints they will hike rates this year or early in the next year, it is not hard for GBP/USD to test 1.2790/1.3800 or above.

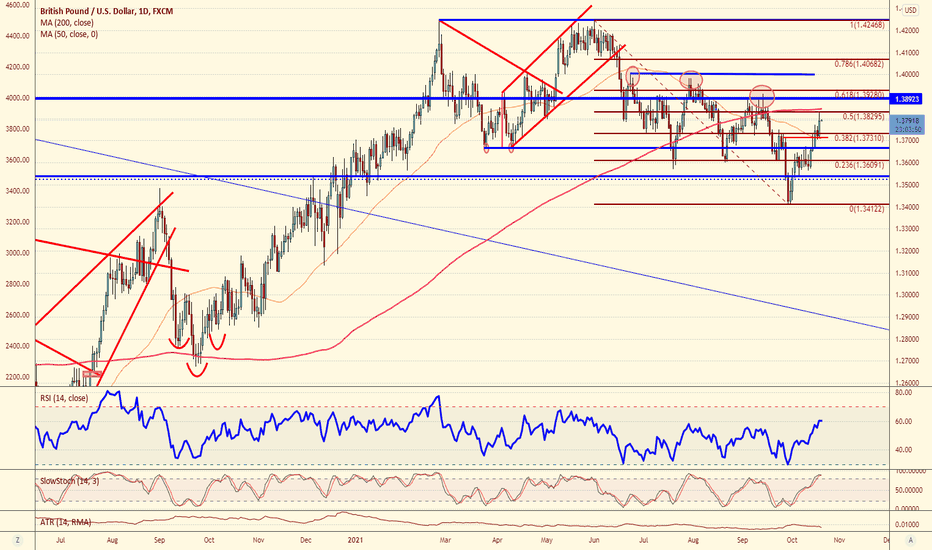

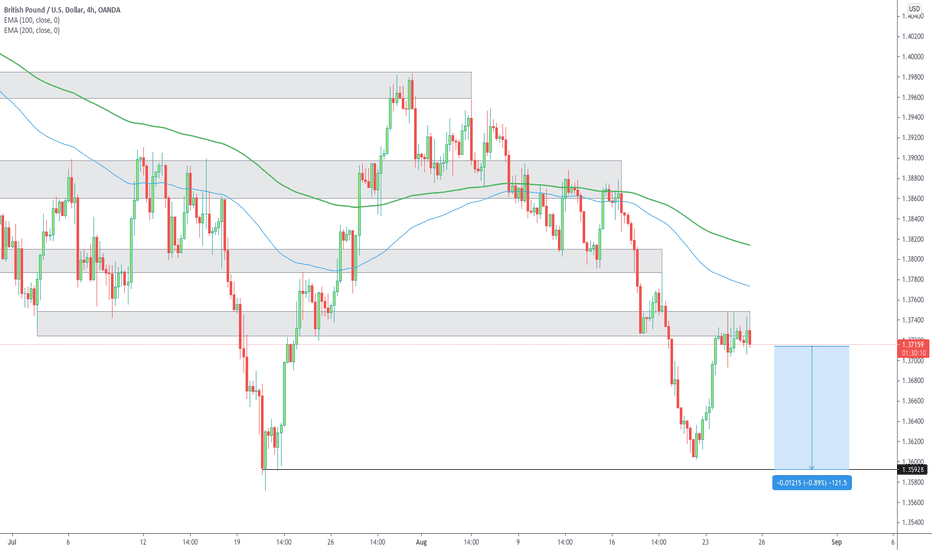

Technical Analysis

GBP/USD closed the candle yesterday with a full-body bullish candle. However, the market dropped nearly 60 pips from the recent high now. From the present rate, strong support is identified at the 1.3600 price zone.

If BOE doesn't deliver a hawkish statement, GBP/USD may break below 1.3600 will test 1.3550/1.3500 very soon.

Another scenario is, BOE may deliver a dovish statement, but they will hike rates 15 bp. in that case, GBP/USD may drop nearly 1.3550 initially but will bounce about 1.3690 price zone.

Or GBP/USD will spike to the 1.3690/1.3710 price zone and back towards the 1.3550 price zone.

To break above 1.3710, We need a hawkish statement as well as a 15Bps rate hike. On the other side, to break below 1.3550, we need dovish information with no rate hikes.

Keep in touch with us to get more updates.

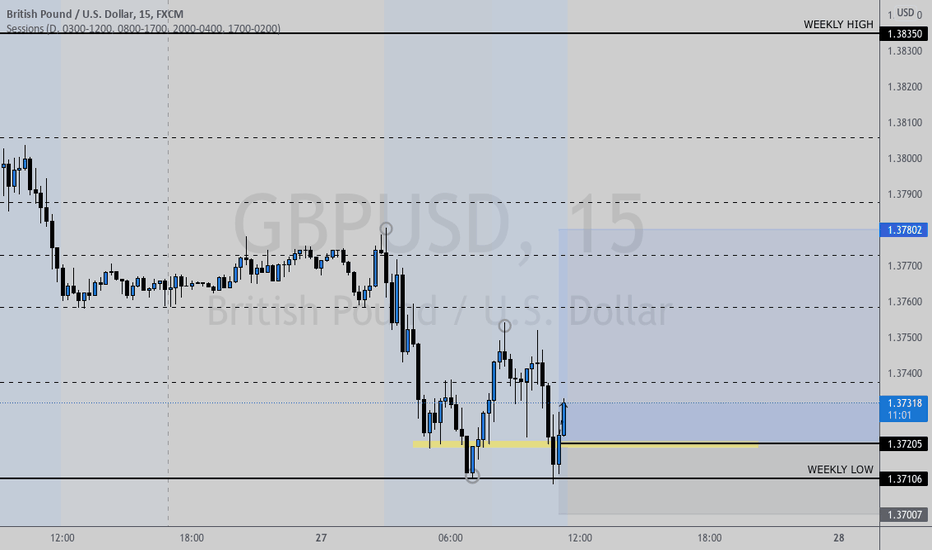

GBPUSD running into a lot of resistance The GBPUSD is within close proximity of the 200dma, and just below that was today's highs at the 50% retracement at the 1.3829 level. Overnight, the risk may be for a probe into the 200dma, but the bears may attempt to hold the 200dma to keep the Sterling holding lower highs, which is essence is keeping the bearish trend in tact near term. A move below the 1.3700 level would mean the corrective bounce is now over.

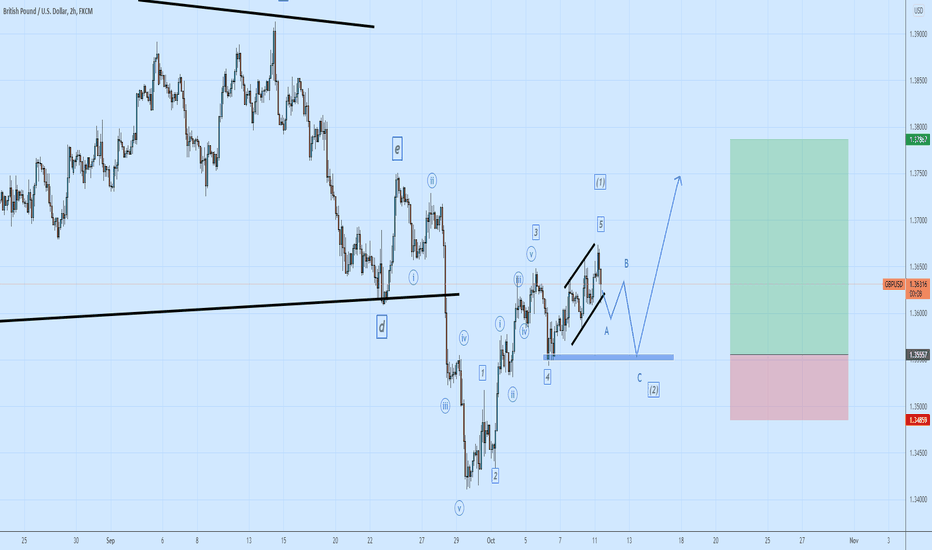

Sterling to Find Supportany pullback on the pair GBPUSD will be a good opportunity to long.

if you are a risk taker you can start buying from current levels however do a correct risk management because we might see a 3 waves pullback as wave (2) before the surge can happen.

will look closely into this trade because if we completed the corrective cycle the upside potential is hugeee!!!

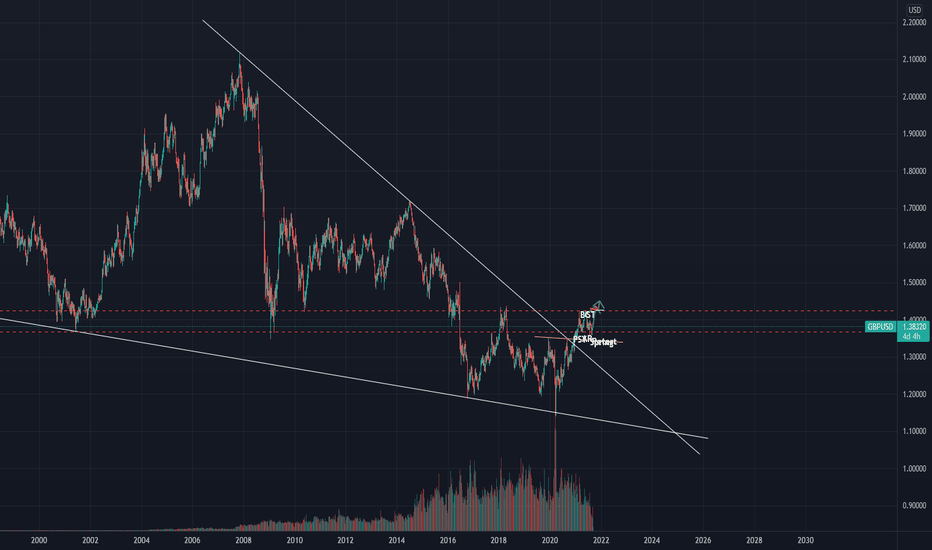

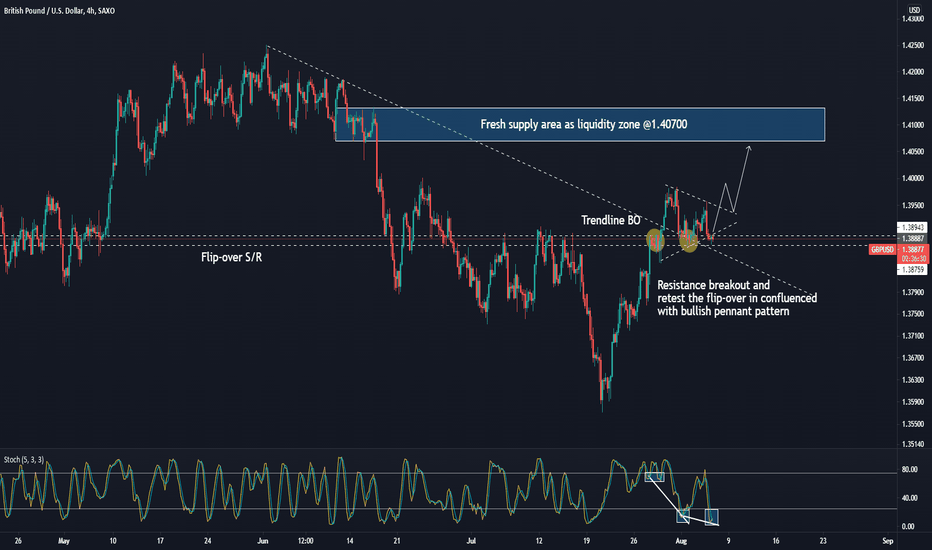

HAS ANYONE ELSE NOTICED THIS MASSIVE FALLING WEDGE ON GBP/USD?Hello my beauties.

I think that the cable has just broken a massive falling wedge. I believe it might kiss the trendline goodbye before leaving for good.

If the pattern is set to complete, the opportunity could be massive.

If you find this idea to be helpful like, follow, and drop a comment below if you'd want me to analyse a different pair.

Consider supporting me if you think I am providing you with value.

Peace.

Luca, TrickleDownFX

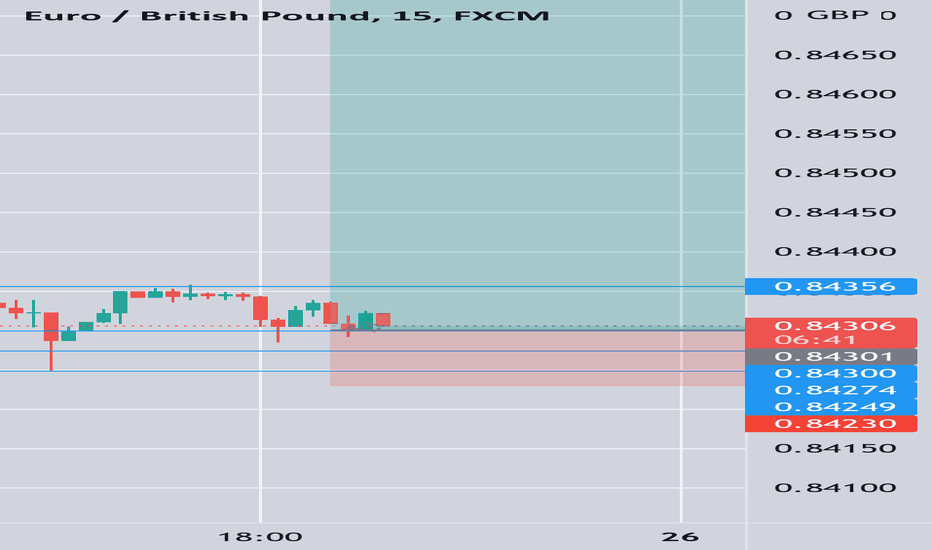

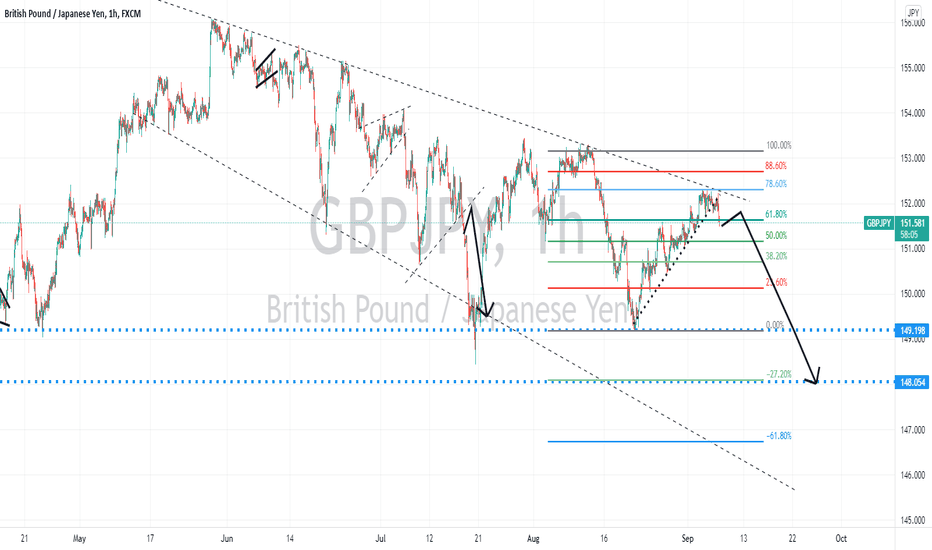

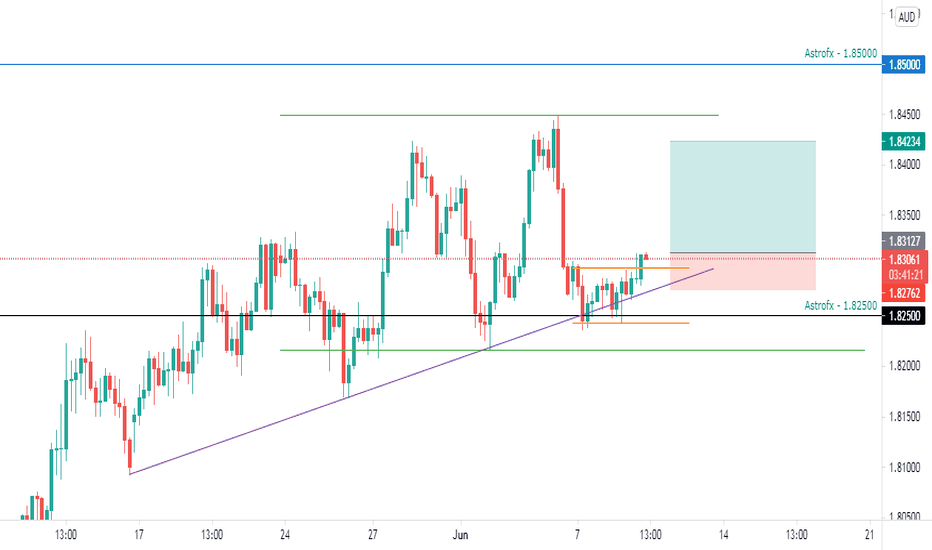

EURGBP may setup for another bullish move with a bull flag. The EURGBP has held recent gains well coming out of a "false breakdown" a few weeks ago on the break of the .8470 support and reversal out of the descending wedge. Since then, the EURGBP rallied to test the 61.8% Fibonacci retracement of the July high to August low at .8584. From here, dips to the .8525 level could find support as a bull flag is setting up. Whenever you get a sharp reversal, then a shallow pullback, the risk builds for a continuation move.

GBPUSD - Respecting LevelsAs we can see from the chart, GBPUSD has been respecting the highlighted zones well.

I am expecting GBPUSD to reverse off its current level of support turned resistance, to revisit the June lows at the 1.36 region. Price has tried to break upward several times over the past couple of days, and for that reason my bias is short.

GBPUSD Plan of action.GBPUSD Potential price movements heading into this week, I expect price to reach that contraction we saw at the top in GU, I would expect to see a reaction here, if we are going to see strong $, if we get to this block, we can look to short weakness down to new lots, for the time being I believe we are in a continuation pattern and we can look to trade GBPUSD up before a demise, with a big 4h pinbar in DXY right now, it could be a good time to find an entry.

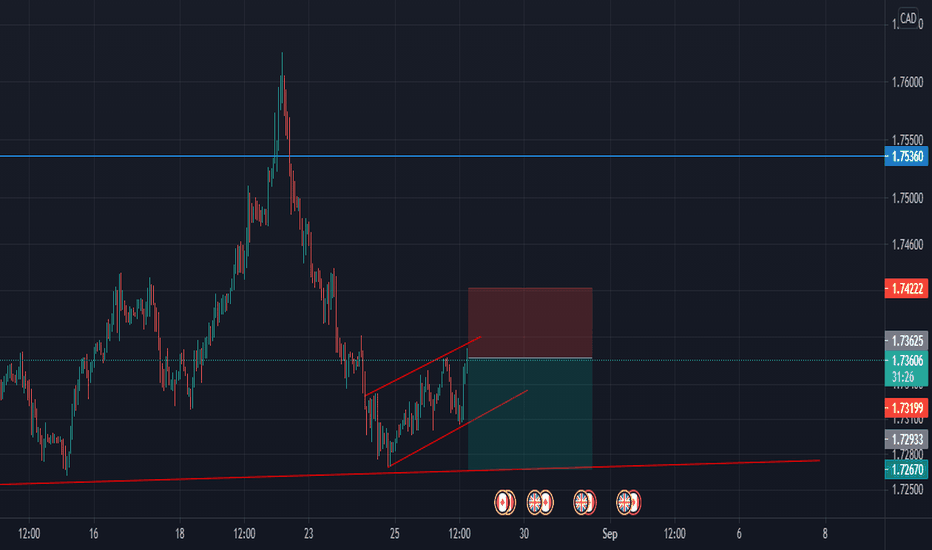

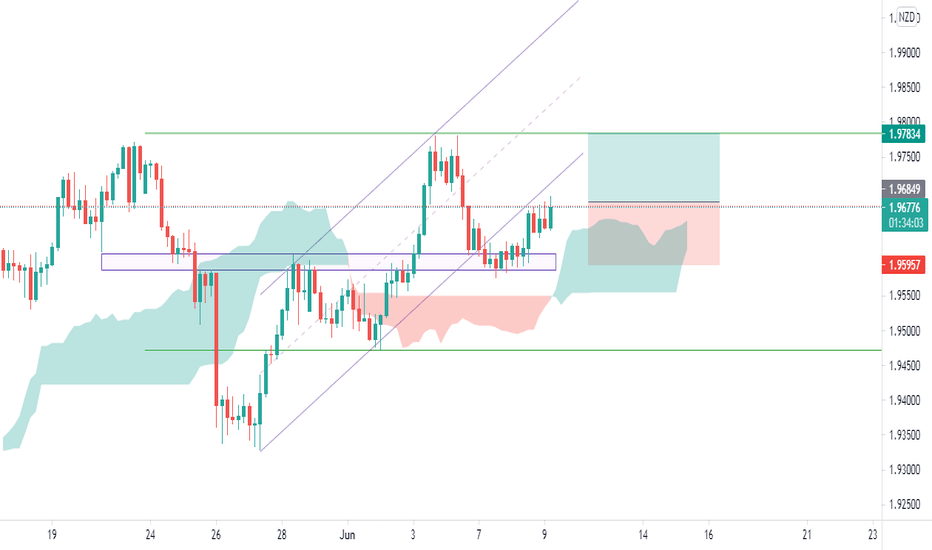

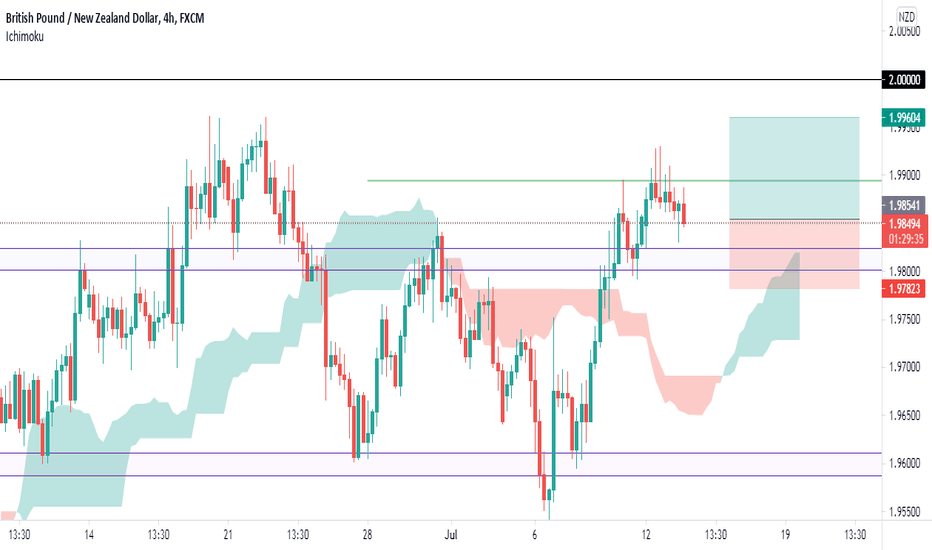

GBP_NZD_4H_LongThe long position is taken – 4H -Daily timeframe I checked and last day candle barriers are HL and HH, in 4H also I see the start of a movement from a 4H demand zone, although price broke an ascending channel it was above a fat ascending komu. Also in lower timeframes, I see HL and HH. I enter the long position and the TP is last week High.

R/R = 1:1.1

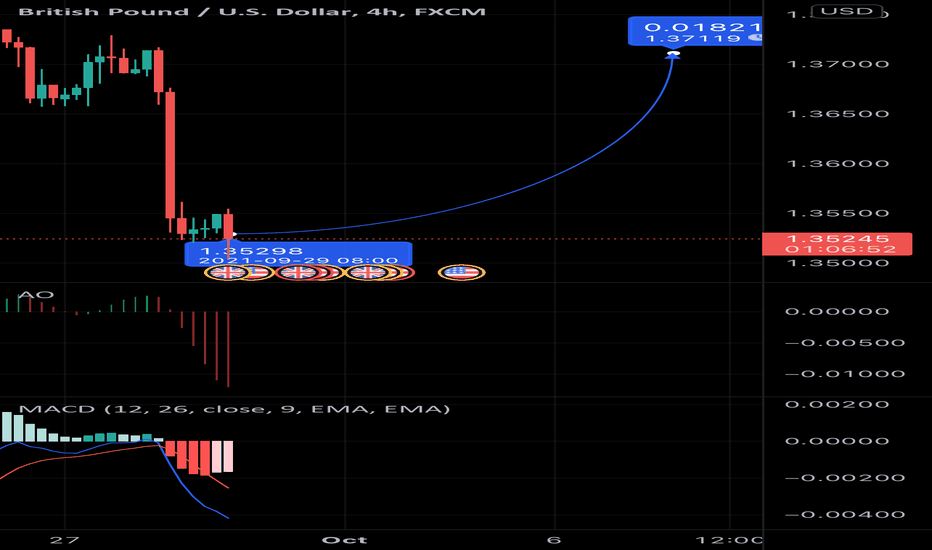

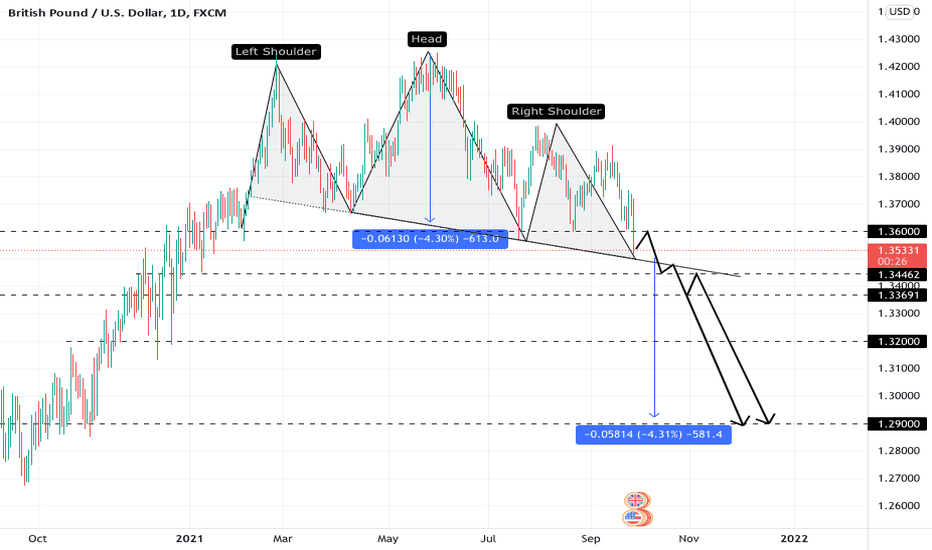

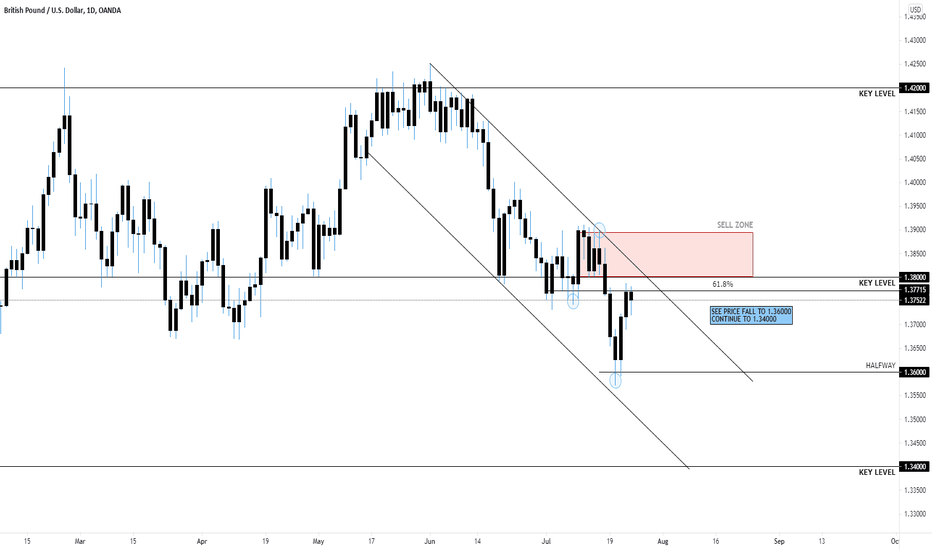

26th July- 30th July GBP/USD BIASSHORTING GBP/USD from 1.38000 to 1.36000 - 1.34000.

CONFLUENCES:

- Sterling Sentiment overall bearish

- Down trend continuation

- 68.1% FIB

- TRENDLINE BOUNCE

- SUPPLY ZONE

Waiting for confirmation of markdown. Currently in distribution phase of Wyckoff. (Lower timeframes)

Entering shorts week ahead unless trendline has been broken - Bias change.