The importance of sticking to the plan 👊👌As traders we are our own worst enemies!

A common theory with trading is as follows. 10% is having a good strategy, 30% is having good risk management and the final 60% is psychology.

If we as traders fail to address the final psychology part of the sentence above then we as traders will fail in the markets.

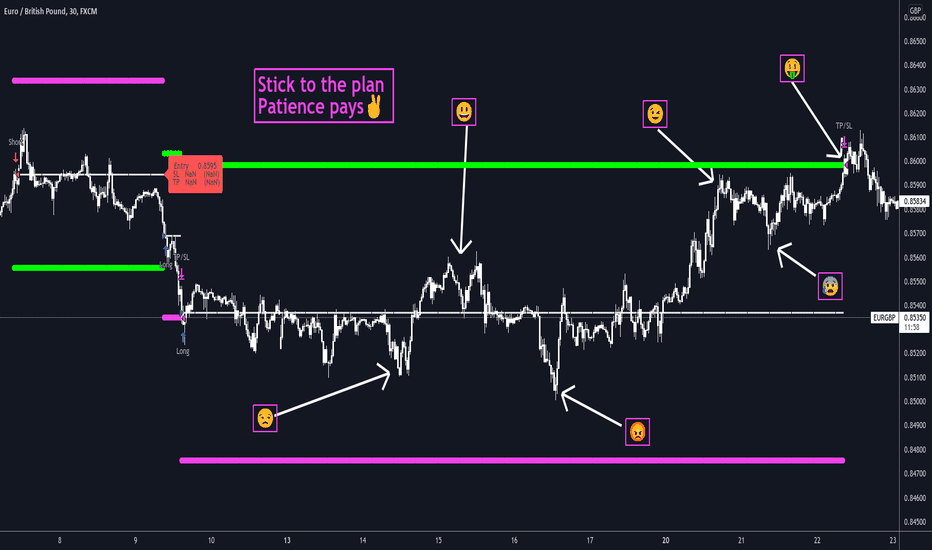

The chart shown in this idea is EURGBP working the 30 minute time frame.

The strategy is a rules based mechanical approach working a 1:1 RR to fixed stop loss and take profit targets.

I know I have a proven edge with this strategy as with all my ideas the built strategy tester report is at the foot of this idea shows the strategies credentials.

Position sizing is correct I trade this strategy on a stand alone account for this pair and I'm happy to risk 2% per trade of my capital from said account.

So where does the psychology part come in to all this?

The emojis on screen show the emotions I would of been feeling with this trade once upon a time! An emotional roller coaster!

The chart shows three trades. A short which hit TP followed by a long which hit SL.

Then the trade I'm using for this idea which lasted a full 13 days!

But this is where sticking to the plan and the rules I set help remove that emotional roller coaster.

Not sticking to that plan could of created many outcomes.

I could of closed for less profit than intended as part of the plan or worse still could of cut my losses only for the trade to go on and hit TP target.

The above would of then led to more emotions thus effecting my future trading decisions and choices.

With each trade I enter I am comfortable with said outcome whatever that maybe.

That comes from trading a proven strategy, having correct risk management and then by sticking to the rules of the trading plan for the strategy.

Sticking to a plan removes any subjectivity and helps take care of the psychological side of trading.

I even automate my strategies now and not checking trades every minute of the day has helped removed all those up and down feelings the emojis on the chart represent.

I'll end with one final thought patience has to be part of your plan. The markets take from the impatient and give to the patient ones among us.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

Darren

Sticktoyourplan

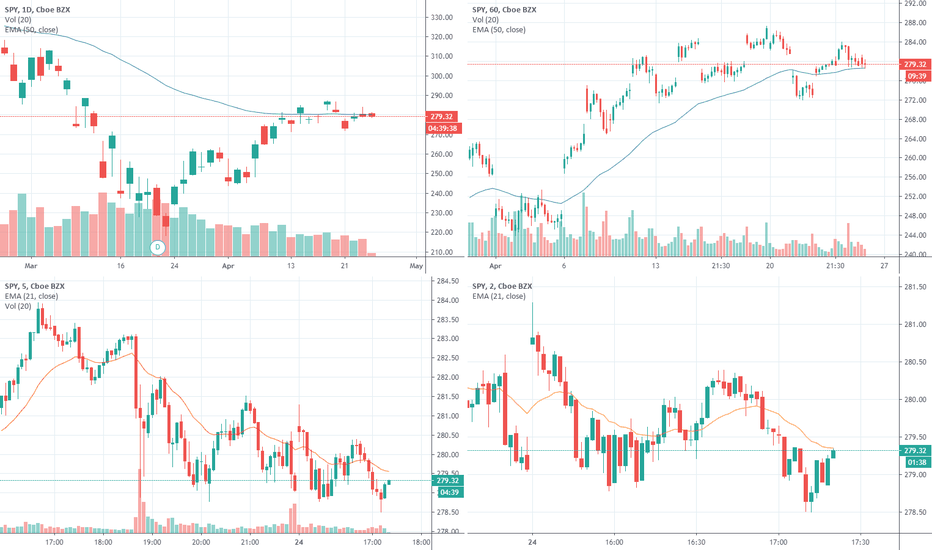

BORING But According To Plan - DT RECAP 04/23/20 (& Today's WL)Hi traders,

Thursday was really boring for me since I'm still on my "recovery" plan I discussed in yesterday's recap. So I only trade the best shots and try to stay green at the end of each day albeit very little. Thursday could be a prime example of this approach. Just one, slow-moving trade that I had to get early from due to massive SPY spike down.

Half a percent, but still up!

Just one lonely trade:

1) NYSE:HAL - LONG @8.68, it lost steam and I exited prematurely when SPY dropped 4 points. +0.5%

*In my ID trades, I risk 1% of the account per trade and go for 2% (2:1 RRR ). Sometimes I adapt a little bit as you can see in the trades' description.*

Total PnL for the day: +0.5%

Total PnL for the week: +2.94%

Good trades,

Tom | FINEIGHT

Half way in a 10 day ALT Coin Consolidaashiooon Looks to me that we are about half way through this Alt coin consolidation, ALTs are looking prime being over sold on the Weekly, consolidating on the Daily and Bitcoin needing a possible pull back to 6k. I'll be looking for a couple positions this week, diversity, stop losses, target resistances, make a plan, good luck.

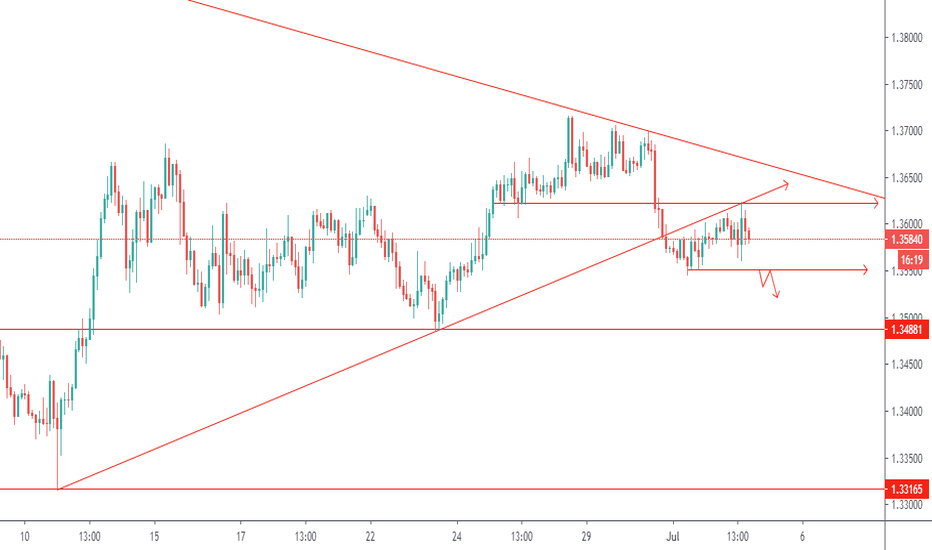

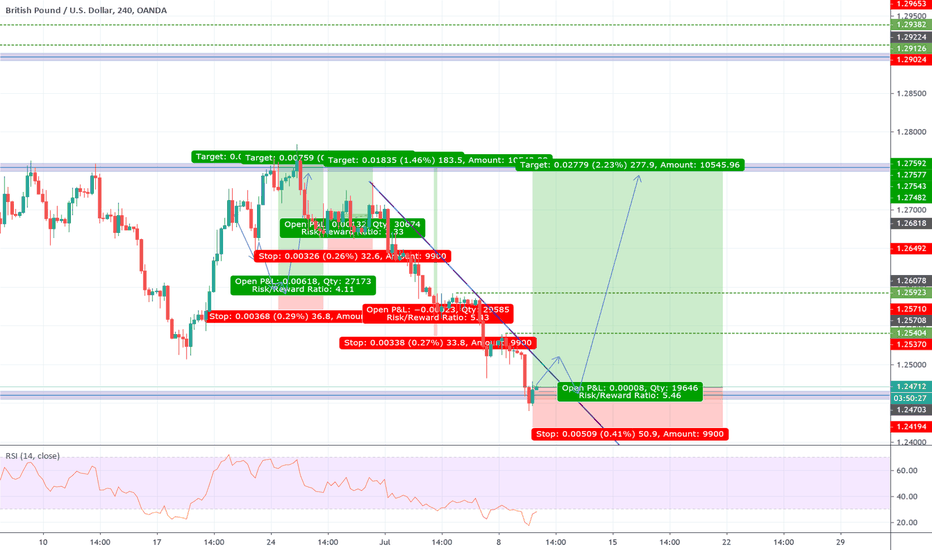

GBPUSD - potential long trade in the coming dayHello all - DuncanForex with another trade idea.

With NFP coming in strong on Friday and USD gaining strength - the question is:

Is this short term sentiment and will the FED support further USD strength or will the FED still suggest a rate cut and in turn will USD weaken,?

Therefore, the recent price action being a stop loss hunt before heading higher quite quickly

I have not been able to publish all my trade ideas this week - however I am currently long gold at 1393 and I expect USD weakness to now continue on other pairs.

I am looking to go long GBPUSD after reviewing my support levels - where I previously think I got in too high on the recent down move.

\I am looking for a break of the trend line and a retest prior to it heading higher

This trade may end up going through FED news tomorrow and I will review prior to the news coming out if I have open trades.

Thanks for looking

Duncan