Meta Platforms (META) Shares Decline Amid AI ConcernsMeta Platforms (META) Shares Decline Amid AI Concerns

Shares of US tech giant Meta Platforms (META) fell by around 3% after media reports revealed that the company plans to reorganise its artificial intelligence operations for the fourth time in six months. The news has raised investor concerns over whether Meta’s AI strategy is on the right track.

Meanwhile, Bloomberg reports that Meta intends to begin selling its first smart glasses with a built-in display next month. However, the price may come in lower than expected — at $800 — as the company is willing to accept slimmer margins to stimulate demand (and, consequently, lower its profit outlook).

Technical Analysis of META Stock

In our previous analysis of META’s chart, we outlined an ascending channel and suggested that the bulls might attempt to push the price higher within this structure, supported by strong fundamentals following the company’s quarterly earnings release.

Since then, the price has climbed to new record highs (with the all-time peak now above $790). However, the technical outlook appears uncertain, with several bearish signals emerging:

→ Selling pressure may arise around the psychological $800 level.

→ The upper boundary of the channel is acting as resistance, and the price has formed a bearish double top pattern (as indicated by the arrows).

→ A bearish gap (highlighted in orange) may also act as an obstacle to further upward movement.

Additionally, adding an intermediate ascending trendline to the chart reveals the formation of a bearish rising wedge pattern.

At present, the price is hovering around the channel’s median line, but given the above factors, we could assume that the balance could shift in favour of the bears. In this case, META’s share price may undergo a significant correction.

Should this scenario unfold, the bulls could become active again around the support level at $747 or at the lower boundary of the channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stocknews

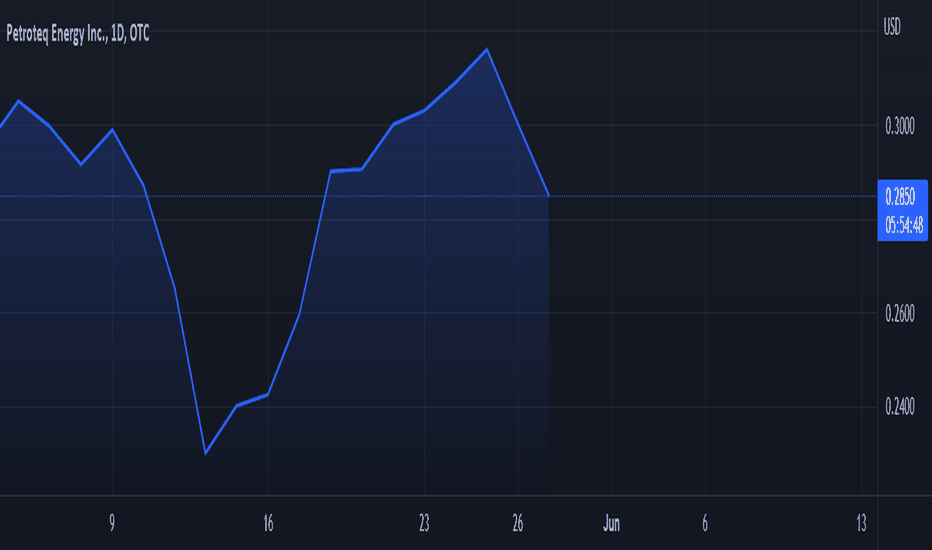

Petroteq $PQEFF continuously emphasizes the importance of develo

Petroteq Energy Inc. is highly engaged in fostering oil sands and expanding production capacity. It is especially focused on its proprietary technologies for environmentally protected oil extraction, particularly heavy oil from oil sands, shale stores, and shallow oil deposits.

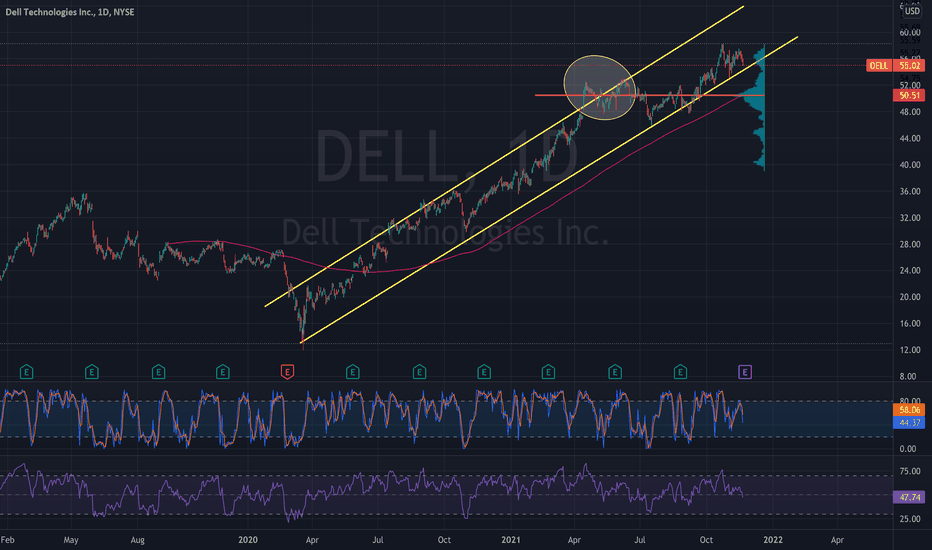

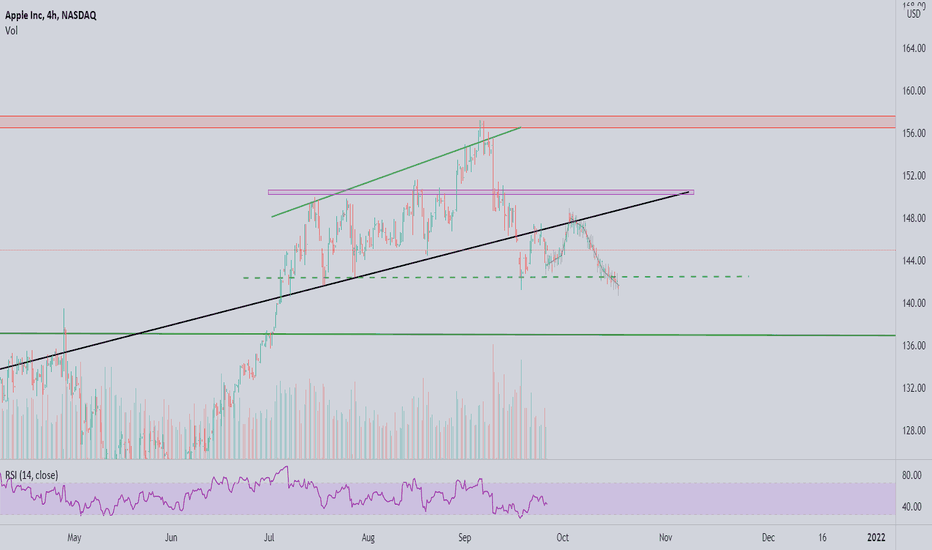

DELL Opportunity to Ride and Nice Push UPDell as you can see from COVID DIP March 17 2020 has been on a tear recently shedding VMWare to do it's own thing it allowed DELL to focus back on what it does best. As you can see it has been on a constant tear VERTICALLY. It will be facinating to see if it will keep this going or if it will break trend. To me basing on the indicators i would bank on it bouncing off the lower trend line and pushing to the top side as it normally has it has not had many breaks on the bottom trend line and it does to the top side circled in yellow. Pay attention to your indicators showing you neutral signs i would much rather wait for a good entry point on the Stochastic or RSI before throwing my money in the hat, but with the holidays it is a good bet to think they will run.

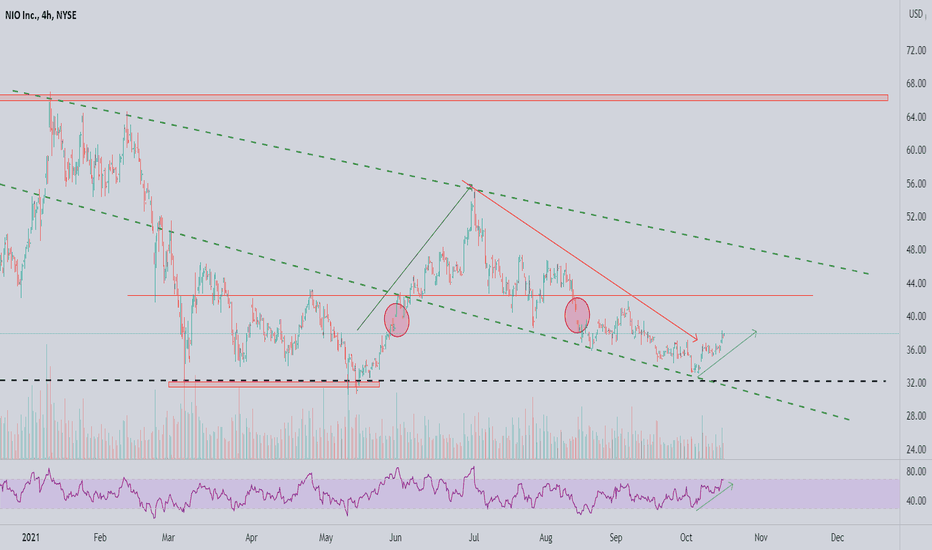

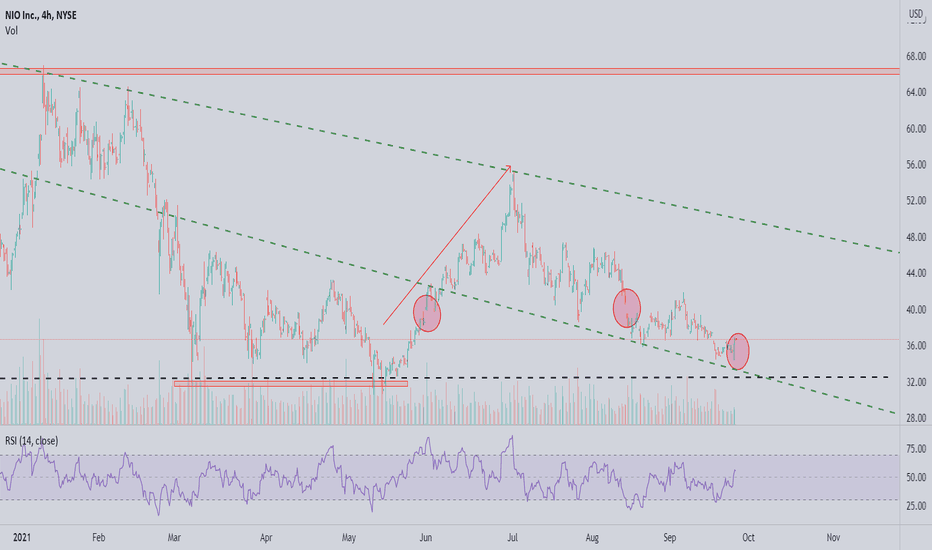

NIO:Up GearFrom last couple of months NIO Down Gear is in charge but now finally NIO Up Gear come in action and break that trend line. If things work for NIO like that we see a major Uptrend and we 42$ mark as over first checkpoint.

Previous Analysis.

If you agree then like idea and support me.

Mention your ideas in comment :)

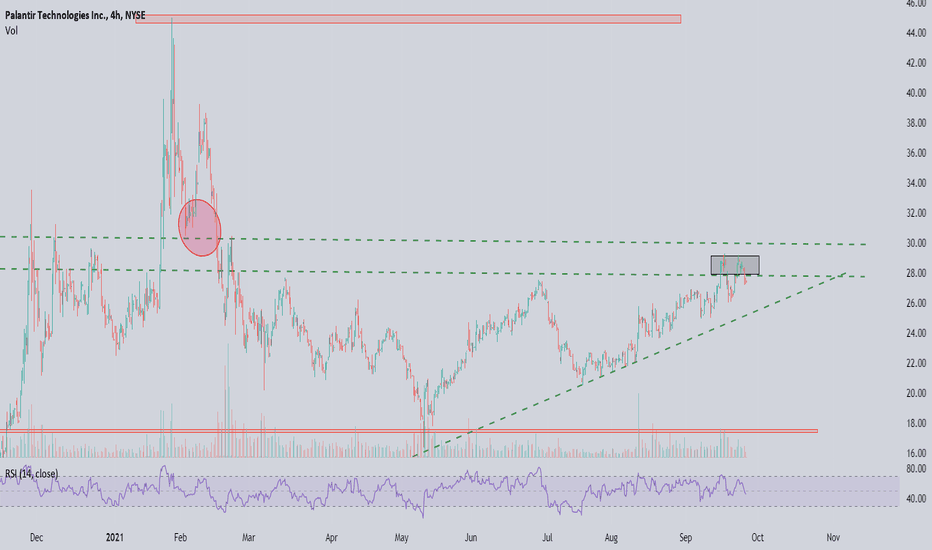

PLTR : Palantir doing rock crawling. Palantir doing rock crawling but as we seeing in chart 29$ is becoming a challenge and it already roll down two time if it break this time we see a up trend and our first target is 30$ mark to fill the gap. but if it fail this time again it can make a bearish trend.

If you agree then like idea and support me.

Mention your ideas in comment :)

NIO: HopeNIO do some consolidation inside that bubble due to Sept markets swoons, chip shortages happened and Evergrande debacle which is the current hot topic of market can affect it in future.

Suggestion for NIO is wait for some clarifications before taking any step.

If you agree then like idea and support me.

Mention your ideas in comment :)

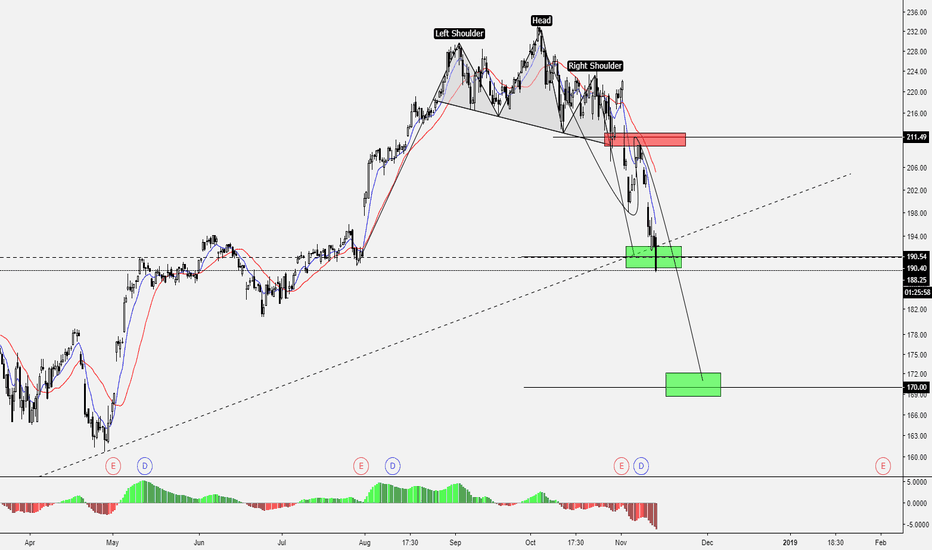

BIG Phase Data Out ACRS BUTBut keep in mind this is Phase 1 for ACRS . Still a long road ahead. I'm not taking anything away from the company at all. Congrats on the win and I hope the momo continues but I've seen so many of these go parabolic. Needless to say, could be something to watch over the next few days

"This time around, Aclaris Therapeutics Inc. has caught attention after announcing positive phase trial results. In the company’s Phase 1 Single and Multiple Ascending Dose Trial of its ATI-450 showed favorable results from dosing and tolerability."

SOUCE: 4 Penny Stocks To Buy Or Sell Ahead Of Employment Data?