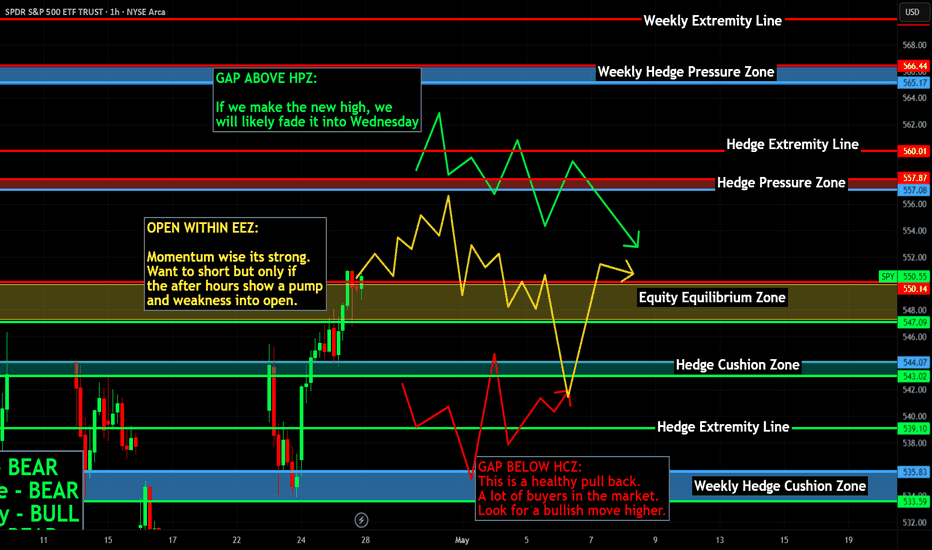

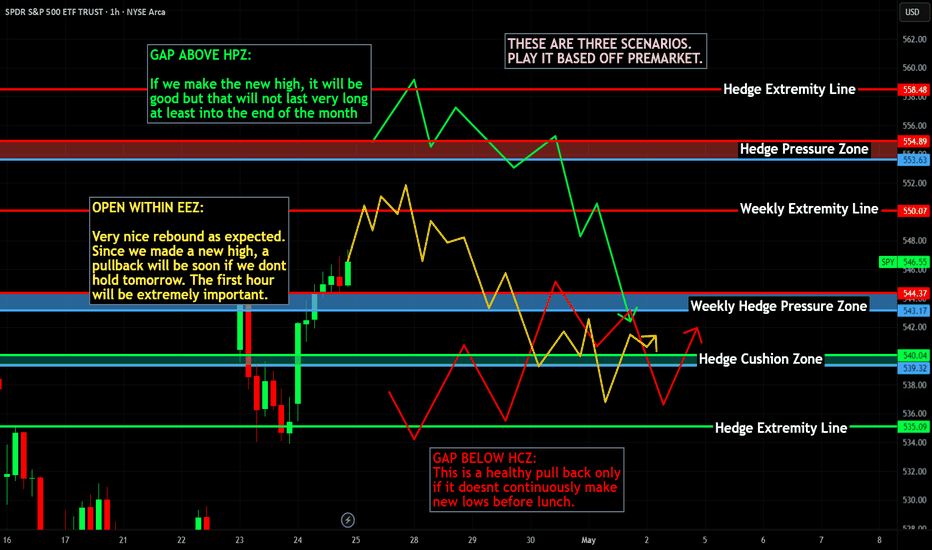

Weekly $SPY / $SPX Scenarios for April 28 – May 2, 2025🔮 🔮

🌍 Market-Moving News 🌍

🇺🇸 President Trump's 100th Day in Office: Wednesday marks President Trump's 100th day of his second term. His administration's protectionist tariffs continue to influence global markets and political landscapes, with notable impacts observed in Canada, Australia, and the UK.

📉 Trade Tensions and Economic Indicators: Investors are closely monitoring the effects of recent U.S. tariffs on economic performance. Key data releases this week, including GDP and employment figures, will provide insights into the economy's resilience amid these trade policies.

💼 Major Corporate Earnings: This week features earnings reports from major companies, including Apple, Amazon, Microsoft, Meta Platforms, ExxonMobil, and McDonald's. These reports will offer a glimpse into how large corporations are navigating current economic challenges.

📊 Key Data Releases 📊

📅 Monday, April 28:

🏠 Housing Vacancies and Homeownership (10:00 AM ET):

Provides data on rental and homeowner vacancy rates, offering insights into housing market dynamics.

📅 Tuesday, April 29:

📈 Advance Economic Indicators (8:30 AM ET):

Includes data on international trade in goods, wholesale inventories, and retail inventories for March.

📊 Consumer Confidence Index (10:00 AM ET):

Measures consumer sentiment regarding current and future economic conditions.

💼 JOLTS Job Openings (10:00 AM ET):

Reports the number of job openings, indicating labor market demand.

📅 Wednesday, April 30:

📈 GDP (Q1 Advance Estimate) (8:30 AM ET):

Provides an early estimate of economic growth for the first quarter.

💳 Personal Income and Outlays (10:00 AM ET):

Includes data on personal income, consumer spending, and the PCE price index, the Fed's preferred inflation measure.

🏭 Chicago PMI (9:45 AM ET):

Assesses business conditions in the Chicago region, reflecting manufacturing sector health.

📅 Thursday, May 1:

🏗️ Construction Spending (10:00 AM ET):

Reports total spending on construction projects, indicating economic activity in the sector.

📉 Initial Jobless Claims (8:30 AM ET):

Measures the number of new filings for unemployment benefits, reflecting labor market

conditions.

🏭 ISM Manufacturing PMI (10:00 AM ET):

Provides insight into the manufacturing sector's health through a survey of purchasing managers.

📅 Friday, May 2:

👷 Nonfarm Payrolls (8:30 AM ET):

Reports the number of jobs added or lost in the economy, excluding the farming sector.

📉 Unemployment Rate (8:30 AM ET):

Indicates the percentage of the labor force that is unemployed and actively seeking

employment.

🏭 Factory Orders (10:00 AM ET):

Measures the dollar level of new orders for both durable and nondurable goods, indicating manufacturing activity.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Stocks!

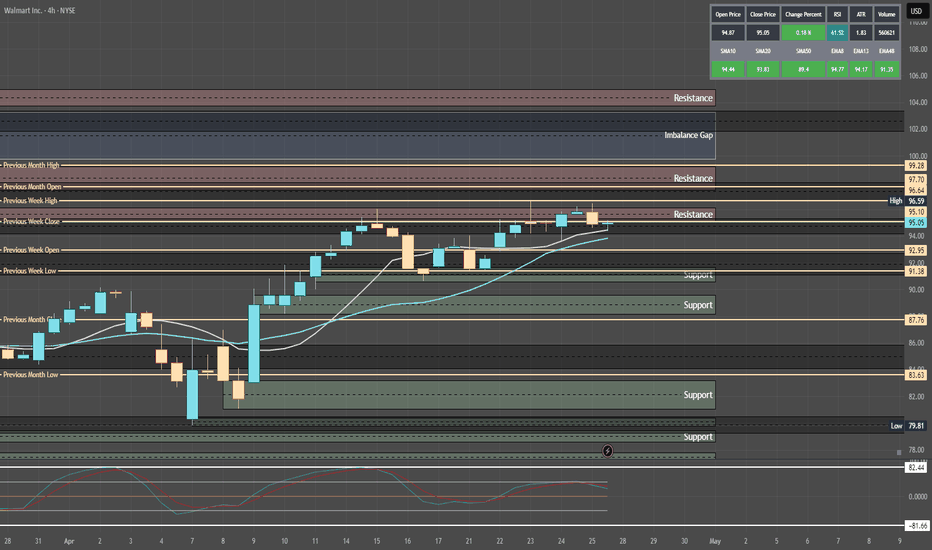

Quantum's Walmart (WMT) Trading Guide 4/28/25WMT’s weekly outlook balances its defensive resilience against macroeconomic headwinds, with a comprehensive synthesis of technical, market, and strategic factors guiding its trajectory for weekly options contracts. The FAME framework underscores WMT’s long-term bullish potential, driven by robust fundamentals (+5% revenue, $0.58 EPS, 21% e-commerce growth) and adaptability (AI, Walmart+), positioning it as a resilient player in a risk-off regime. However, elevated yields (10-year 4.255%, 20-year 4.738%, 30-year 4.721%) and a stable DXY at 99.58 amplify tariff pressures and margin concerns, capping upside and reinforcing a cautious stance. A tactical long bias is favored for weekly contracts, targeting a bounce from $94.36 to $96.47–$98.50, with a short stance viable below $88.50 if support fails.

Technical implications highlight bullish momentum on daily (RSI ~40, Stochastic ~28) and weekly (RSI ~44, Stochastic ~32) timeframes, with oversold conditions signaling a rebound potential for weekly contracts if $94.36 holds. Monthly neutral momentum (RSI ~50) suggests consolidation, requiring a breakout above $96.47 to confirm bullish strength. This supports a short-term bounce but advises monitoring for sustained moves.

Market influence implications reflect a risk-off environment, with high yields and a stable DXY increasing import costs, particularly amid tariff uncertainty from WMT’s upcoming Trump meeting. The VIX at 24.84 amplifies volatility, favoring WMT’s defensive appeal but heightening risks. WMT’s Q3 FY25 strength and e-commerce growth provide stability, supporting resilience near $94.36.

OFD summary and implications reveal bearish pressure from Vanna (-$0.04), Charm (-$0.02), and DEX (-$0.06), driven by put-heavy flow and hedging demand tied to tariff fears. However, GEX (+$0.08) at the $95 strike pins price, stabilizing volatility and supporting a neutral-to-bullish bounce for weekly contracts if $94.36 holds, aligning with oversold technicals.

Edge insights bolster the case for a bounce, with institutional buying at $94–$95 signaling accumulation, defensive retail sector strength outperforming cyclicals, and low short interest (1.4%) offering squeeze potential above $96.47. These factors enhance confidence in a tactical long bias for weekly contracts, provided support holds.

Strategic outlook implications emphasize consolidation near $95.09, with $94.36 as a critical pivot. A break below risks $88.50, driven by tariff fears and bearish options flow, while a move above $96.47 targets $98.50, fueled by oversold signals and institutional support. The VIX at 24.84 and put-heavy options flow underscore volatility, but WMT’s defensive positioning mitigates downside, favoring a bounce in a risk-off regime.

In summary, WMT’s weekly outlook hinges on defending $94.36, with oversold technicals, GEX pinning, and institutional buying supporting a bounce to $96.47–$98.50 for weekly contracts. Tariff risks, high yields, and DXY stability maintain a risk-off backdrop, capping upside and requiring vigilance for a break below support, which could shift bias to bearish. This balanced approach leverages WMT’s defensive strengths while navigating weekly volatility, aligning with Buffett’s preference for resilient businesses with tactical opportunities.

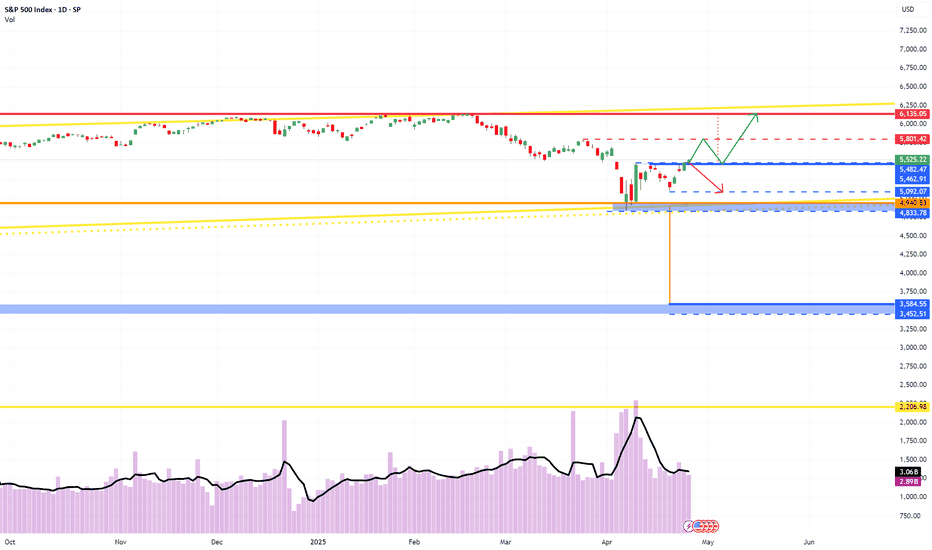

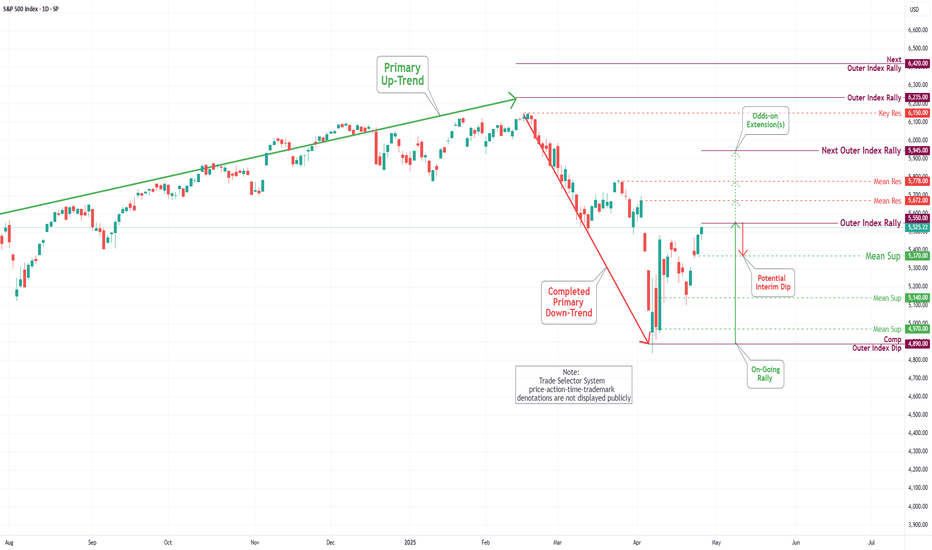

S&P 500: Key Levels and Potential ScenariosThis analysis of S&P500 will explore both bullish and bearish scenarios, incorporating key levels and considering possible market and crowd psychology.

Bullish Scenario: Potential Uptrend Resumption

From a bullish perspective, if the S&P 500 maintains a position above the 5482 level, it could suggest a potential end to the current correction and a resumption of the major uptrend. A hold above 5482 might reinforce bullish sentiment, encouraging further buying activity, as traders may view this as confirmation of renewed strength. The index could then potentially retest the 5801 level, where it's possible that the index may encounter resistance on the first attempt. A successful break above 5801 would then open the path towards the 6135 zone, which represents a key upside target.

Bearish Scenario: Potential Retest of Support Zones

Conversely, if the S&P 500 fails to hold above the 5482 support level might trigger increased selling pressure, as traders liquidate positions. The index could then potentially retest the 5092 to 4833 support zone. This zone represents a critical area where buyers may step in, but a break below it would signal further weakness.

Concluding Remarks

In conclusion, the S&P 500's price action around the identified key levels will be crucial in determining its short- to medium-term direction. A sustained hold above 5482 could favor a bullish continuation towards 5801 and potentially 6135, while a break below 5482 might lead to a retest of the 5092 to 4833 support zone.

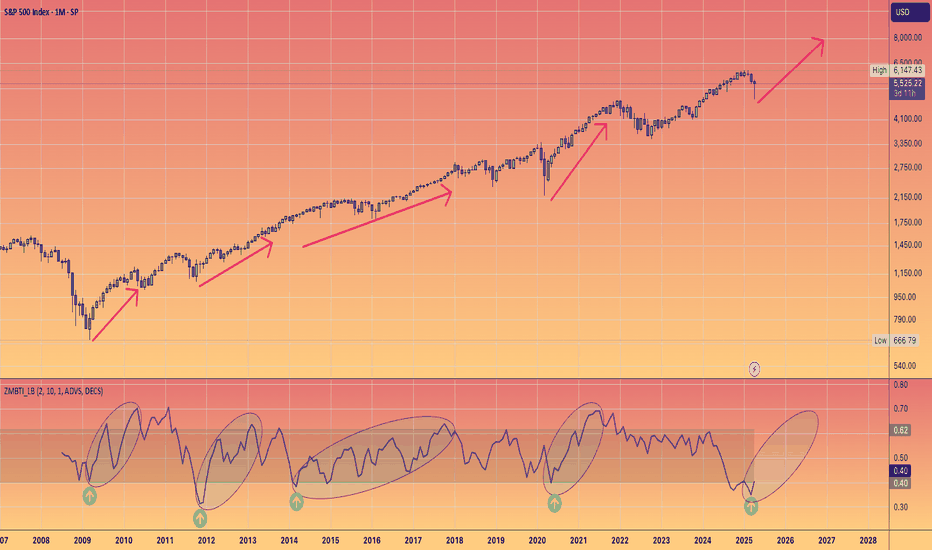

Was this the best buying opportunity since 2011?Sure, here's a rewritten version of your text in an engaging tone:

"Have you ever heard of the Zweig Breadth Thrust? Well, let me tell you, it’s an incredible metric that can really shed some light on the current market situation!

So, what would it take for me to believe that this bounce isn't just another bear market rally? My first step would be to dive into the breadth indicators and look for signs of that elusive breadth thrust.

Think of a breadth thrust like a rocket taking off. You need a strong initial boost to break free of gravity's grip. If the thrust is weak, the rocket can’t escape, and the same applies to stock market reversals. When we see a robust breadth thrust, that's a signal that a significant reversal is underway. Without it, we could be facing another false bounce.

Now, let’s talk numbers! As of Friday, April 25th, the SPX has surged an impressive 14.2% from its recent lows, and while that’s quite a leap, it’s essential to keep it in perspective. Just think back—this index was down 21.35% from its all-time high earlier in February during the panic sell-off. Now, with the recent strength, it’s only 10.75% off its peak.

The Zweig Breadth Thrust is calculated based on the 10-day EMA of NYSE Advances divided by the sum of Advances and Declines. A bullish signal pops up when the ZBT shifts from below 0.40 to above 0.615 within just ten days or less. Keep an eye on that—it might just help us navigate these choppy waters!"

On the monthly chart, it’s clear that what we’ve been seeing in the broader economy (you know, Main Street) is actually showing us some bearish divergence—a concept I've mentioned in my previous ideas.

Since 2009, we've had four notable instances on the Monthly chart where the ZBT dipped below 0.40, only to bounce back up past the 0.6 mark. Remember back in November 2011? That was when we got a significant signal with a low reading of 0.31, which climbed back to 0.62 by February 2013. That surge sparked a bull run that peaked in February 2020!

So, the takeaway here is that this breadth thrust is generating the positive momentum we need to reach new stock market highs this year. Exciting times ahead!

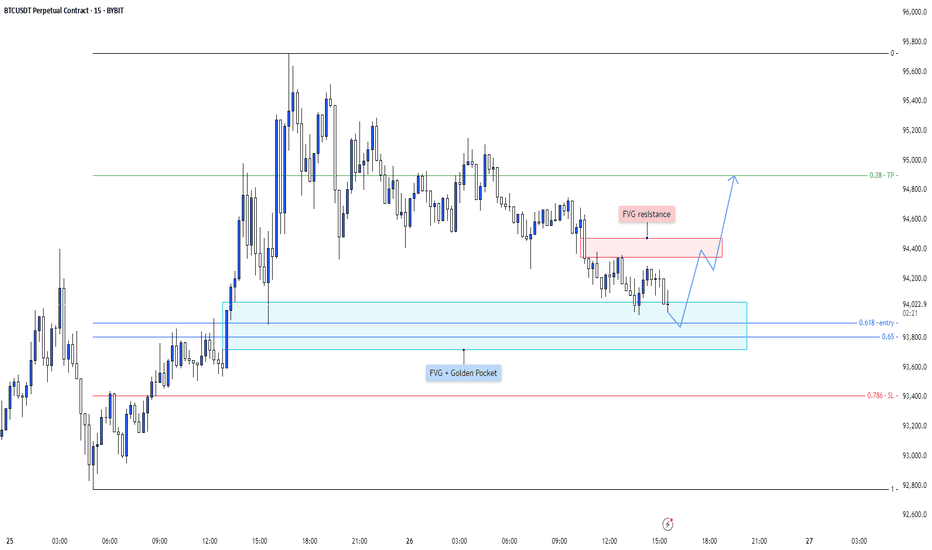

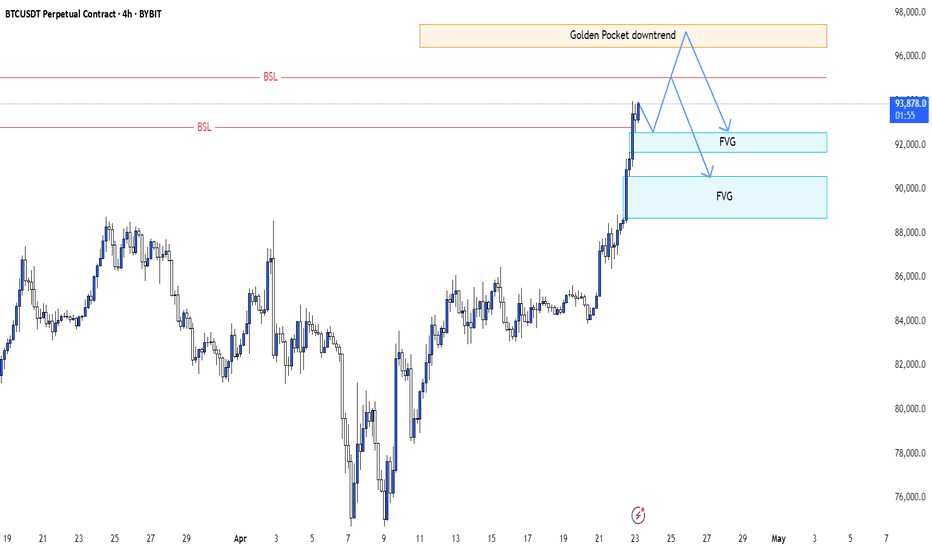

BTC - Golden Pocket Confluence + FVG Sweep = Long SetupA highly refined scenario blending Fibonacci confluence with liquidity principles, setting up a controlled bullish play.

---

1. Golden Pocket + FVG Confluence — Critical Demand Zone

The blue highlighted area represents a strong confluence:

- FVG (Fair Value Gap): Imbalance left by aggressive price movement, likely to attract price for rebalancing.

- Golden Pocket: The 0.618–0.65 Fibonacci retracement zone, statistically favored for deep retracements and high-probability reversals.

Expecting strong buying interest once price taps into this confluence.

---

2. 0.618-0.65 Fib Range — Key Reversal Territory

The Fibonacci zone offers the perfect environment for engineered liquidity sweeps and smart money accumulation.

- This range often acts as a trap for retail shorts while institutions accumulate.

- A clean entry opportunity arises as price dips into this critical golden zone before expansion.

---

3. FVG Resistance Above — Initial Reaction Zone

A notable FVG resistance area is marked around 94,400–94,500:

- Upon reaching this zone, price may face initial selling pressure or short-term consolidation.

- Observing how price interacts here can further confirm bullish strength and continuation.

---

4. Smart Money Liquidity Play

The setup suggests a classic liquidity engineering move:

- Induce shorts through a pullback into the Golden Pocket.

- Absorb liquidity inside the FVG.

- Trigger a sharp bullish reversal aligned with institutional footprints.

This layered setup is clean, logical, and methodical.

---

5. Projected Price Flow

Anticipated price action structure:

- Step 1: Dip into the Golden Pocket + FVG demand zone.

- Step 2: Reversal toward the FVG resistance.

- Step 3: Breakout continuation upon reclaiming resistance, leading to further bullish expansion.

Each leg is mapped to follow high-probability liquidity behavior.

---

6. Summary:

- Golden Pocket + FVG = Prime Reversal Confluence

- Efficient Liquidity Sweep Mechanics

- Structured Bullish Progression Based on Smart Money Concepts

This plan is framed to capitalize on precision entries and liquidity dynamics without chasing price.

EURUSD - Bullish Shift after IFVG? This chart outlines a clean sequence of bullish intent where institutional accumulation is visible through structure, inefficiency, and reactive zones.

---

1. Support Zone Holds — Demand Confirmed

The previous resistance area has now clearly flipped into support , marked by multiple wicks rejecting lower prices.

- This region is a high-probability demand zone engineered through earlier consolidation.

- Price returned to this level, swept minor liquidity, and immediately bounced—confirmation that demand is active.

---

2. Fair Value Gap (FVG) — The Imbalance Magnet

A clean FVG sits above price, created during the prior bearish leg. Now acting as a rebalancing zone.

- Price is pushing into this inefficiency after finding support.

- The gap inversion (price reclaiming and holding above the FVG) would validate bullish continuation.

- Think of this as the mid-point between structure and expansion.

---

3. BSL Above — The Next Liquidity Target

A key Buy Side Liquidity (BSL) level is marked higher, acting as the next logical draw for price.

- Smart money seeks liquidity above recent swing highs.

- If price holds above the FVG, this BSL becomes the magnet for bullish expansion .

---

4. Projected Price Action Flow

The roadmap is clear and logical:

- Step 1: Bounce from support (done)

- Step 2: Push through and hold the FVG

- Step 3: Expand higher toward BSL

Each leg has purpose, and the structure confirms smart money is in accumulation mode.

---

5. Summary:

- Support + FVG + BSL = Structured Bullish Thesis

- As long as price stays above the FVG post-inversion, buyers have control.

- This is a textbook case of price engineering via inefficiency and reactive structure.

S&P 500 Daily Chart Analysis For Week of April 25, 2025Technical Analysis and Outlook:

In this week's trading session, the Index did steady to higher prices, distancing itself from the rendered obsolete Mean Resistance level of 5455 and targeting the next significant mark identified as Outer Index Rally 5550. This trend lays the groundwork for a continued upward movement; however, there is also a considerable risk of a sharp pullback to the Mean Support level of 5370 after reaching the Outer Index Rally at 5550.

Contrariwise, it is essential to acknowledge the possibility of upward momentum continuation resulting in meeting the primary target Outer Index Rally 5550 by challenging the Mean Resistance of 5672 and extending toward additional levels: Mean Resistance 5778 and Outer Index Rally 5945.

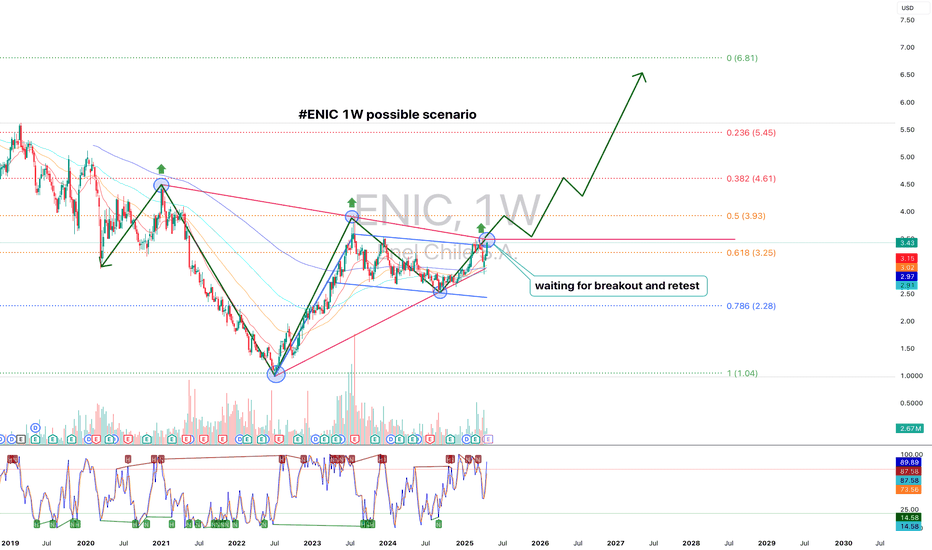

ENIC, 1W Trend Reversal Setup and Breakout AnticipationOn the weekly chart of ENIC, a broad expanding triangle formation transitioning into a base accumulation structure is visible. The price is now approaching a critical resistance zone around $3.90–$4.00, an area that previously triggered major reversals. Currently, the market is consolidating just below this resistance, forming a platform for a potential breakout and retest.

Technical structure:

- EMA 50, EMA 100, and EMA 200 are starting to converge, signaling the potential for a bullish crossover — a key indicator of mid-term trend reversal.

- The 0.618 Fibonacci retracement at $3.25 has been broken and price is stabilizing above it, reinforcing the bullish setup.

- Higher lows and higher highs have been established — a clear early sign of a new upward trend.

- Volume during the consolidation phase remains stable without signs of heavy distribution or capitulation.

Fundamental analysis of Enel Chile:

- Sector: Energy, Renewable Energy Transition

- Enel Chile is aggressively expanding into green energy, reducing its coal generation portfolio and investing heavily in solar and wind projects.

- Financials: The company maintains stable dividend payouts and holds a manageable debt-to-cash-flow ratio.

- Chile’s national energy policy shift towards renewable energy and international demand for clean energy solutions provide strong long-term tailwinds.

- Global trends favor companies with sustainable energy models, positioning Enel Chile strategically for growth.

Structural targets:

After a successful breakout above $3.90 and a retest confirmation, the next upside targets are:

- $4.61 (0.382 Fibonacci retracement)

- $5.45 (0.236 Fibonacci retracement)

- Extended channel and Fibonacci target: $6.81

Enel Chile (ENIC) is building a mature base structure for a long-term bullish reversal. A confirmed breakout above $3.90, combined with bullish EMA alignment, would unlock a strong upside scenario toward and beyond $6.00. Both technical formation and fundamentals strongly support this outlook. This is a structure you don't want to miss.

COURSERA Forming Bullish Continuation Patterns 🚨 $COURSERA Forming Bullish Continuation Patterns 🚨

$COURSERA is forming bullish continuation patterns and is approaching a key red resistance zone. A breakout above this level could signal a strong bullish move, with the first target at the green line level.

📈 Technical Overview:

Pattern: Bullish Continuation

Resistance Zone: Red area currently being tested.

🎯 Breakout Target: Green line level upon confirmation.

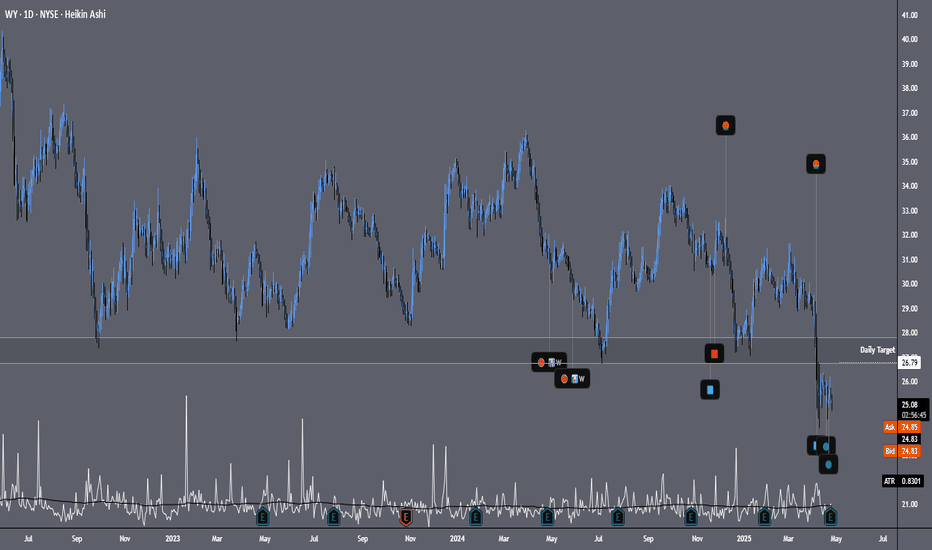

WYThe current price is near a type of support base being created possibly. Earnings just happened recently and seems like there were mixed results. Won't get too much into that. However, if you look at the "throw up" emojis, price dropped sharply and price started trading sideways before bulls came back into the market. Let's see if we can get some momentum into this potential move eventually. Bearish volume has dropped since that sharp drop and with price trading sideways while also creating a base of support of some sort, I would like to see price reach the target zone located on the chart. Since September of 2022, price has infiltrated this zone about 4-5 times. Could we get a repeat of recent history?

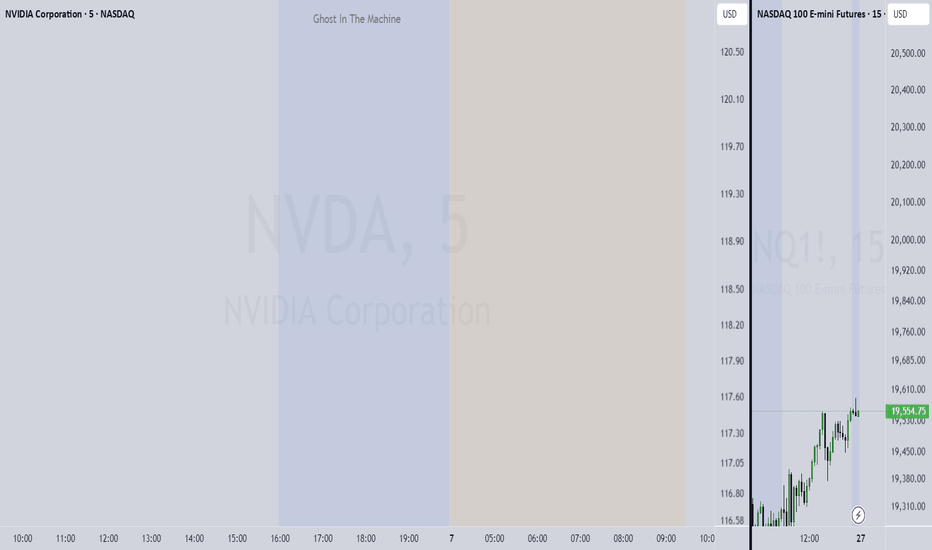

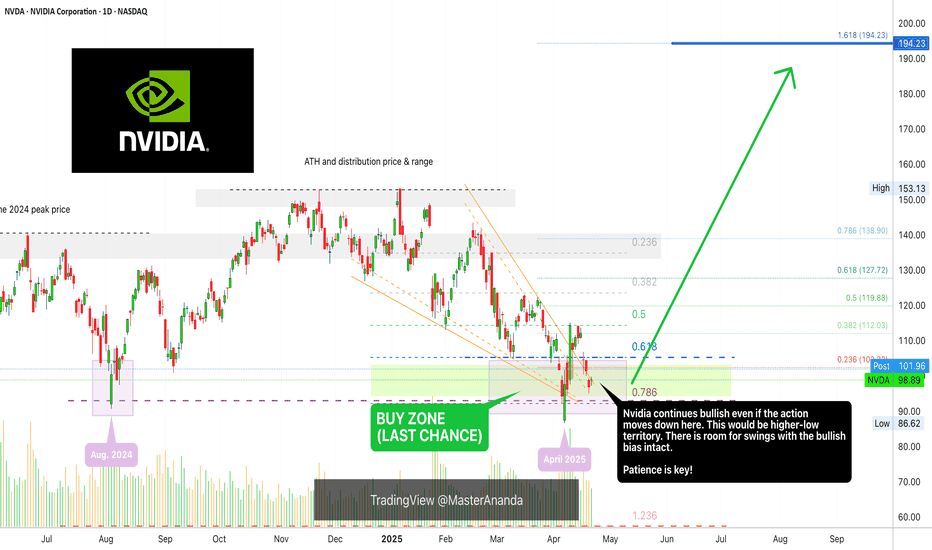

Nvidia Prepares For New All-Time High, Last Chance To Buy Low!The market always gives as second chance. This is a phrase that I love to share and it is true, it is confirmed here on this very chart.

The action for NVDA moved back down to produce a higher low —your second and last chance. This higher low is happening within a very strong buy-zone and this can mean the difference between massive profits or an opportunity that is lost. From here on, Nvidia will grow long-term set to produce a new All-Time High in the coming months.

The minimum target and price level for this rise stands around ~150 within 1-3 months. Then a correction and then higher, much higher... Up, up and up go we.

I can entertain you with tons of details I have the ability but I will not do so. I will go straight to the point.

» The next All-Time High and main target for this wave is 194, this can take a little more, or less, than 6 months.

What will happen next, we will have to wait to ask the chart.

It is my pleasure to write for you again.

Make sure to boost if you would like more updates.

If you boost and comment, we can move to daily updates as the market grow.

Go in, go now, buy-in and go LONG!

Nvidia is going up! Together with Bitcoin and the Altcoins.

Thanks a lot for your continued support.

Namaste.

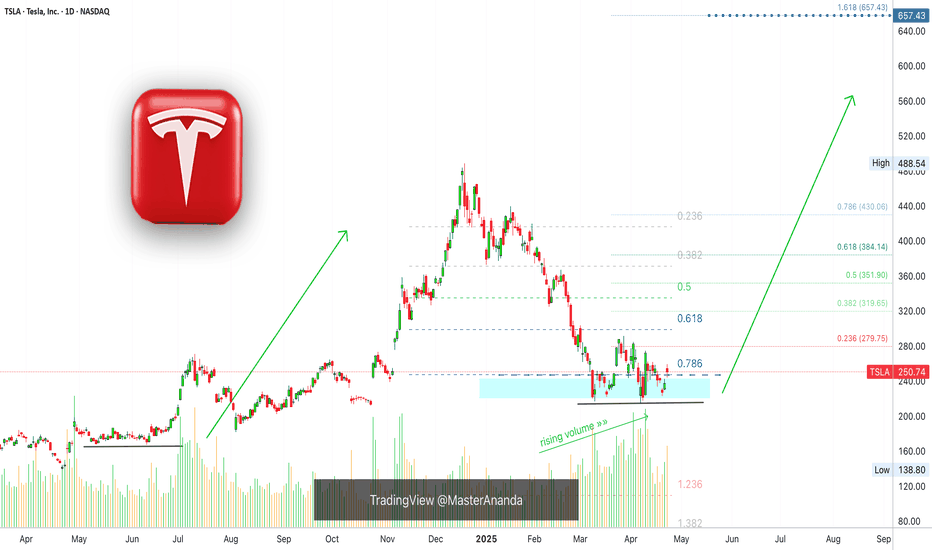

Tesla Finds Support, 657 Next Easy High & All-Time HighTesla is looking pretty good right now, support has been found. The correction amounted to -55.5%. It started in mid December 2024 and the first low was hit in March 2025.

Since March TSLA has been in the process of forming a bottom.

The action moved below 0.786 Fib. retracement level in relation to the last bullish wave. The action is back above this level now and this is pretty good. As long as the action happens above the magic blue dashed line, Tesla is good and set to grow.

This signal, perfect symmetry, is supported by rising volume.

Buy volume is rising massively as TSLA moves into a long-term support zone.

(Smart people, smart money and smart traders buy when prices are low —this volume signal reveals the highest buying in years as TSLA hits support.)

The most revealing fact from a logical standpoint is the size of the correction, a 55% correction is a lot by any standard. When a market goes through such a strong correction, it tends to reverse and produce next a new move. It moves in waves. It goes up and down, up and down. We are seeing the end of the down-move and this will automatically lead to an up-wave.

When the bottom was hit, last month, the action goes flat. Tesla was clearly moving lower but as support was found the bottom stays flat. This is another revealing signal for the logical mind. No longer a downtrend but a consolidation phase, which is part of a transition period.

» So the market was bullish and from bullish turned bearish, from bearish it went sideways and from sideways it will grow.

This is an easy buy.

Thanks a lot for your comment and continued support.

Namaste.

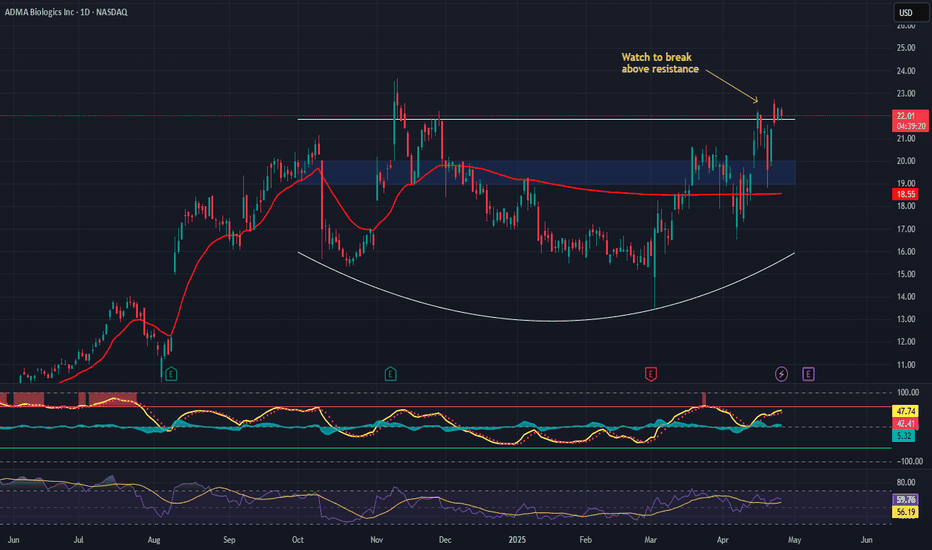

ADMA Biologics, Inc. (ADMA) – Plasma Power with Policy TailwindsCompany Snapshot:

ADMA Biologics NASDAQ:ADMA is carving out a dominant position in plasma-derived immunotherapies, with a 100% U.S.-based supply chain that delivers both regulatory resilience and logistical strength in a vital healthcare segment.

Key Catalysts:

Strategic Domestic Advantage 🇺🇸

Fully U.S.-based manufacturing and supply chain

Aligns with national healthcare policy and reduces global exposure risk

Elite Healthcare Partnerships 🏥

Works with Mayo Clinic & Cleveland Clinic

Validates product quality and ensures recurring revenue streams

Strong Insider Conviction 📈

CEO Adam Grossman purchased $1.2M in stock

Insiders own 12%, showing long-term commitment

Plasma Therapy Demand on the Rise 🚨

Growing market for immune deficiency and infectious disease treatments

Reliable production scale + strategic partnerships = compounding value

Investment Outlook:

✅ Bullish Above: $19.00–$20.00

🚀 Target Range: $29.00–$30.00

🔑 Thesis: Fully domestic moat + institutional partnerships + insider alignment = high-conviction growth biotech

📢 ADMA: A rare mid-cap with stability, growth, and a policy-aligned advantage.

#BiotechStocks #PlasmaTherapy #Immunology #ADMA #InsiderBuying #HealthcareMoat

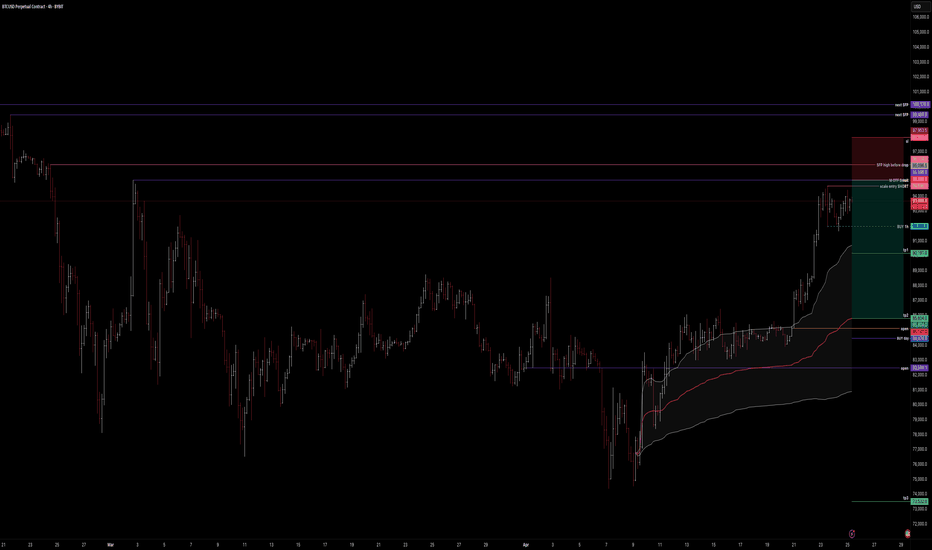

btc . w4 . fancy SHORTthe 'OTF - one time frame' Break of the monthly is still due.

There was no chance for LONGS during the week for retail buyers, only late buyers.

We've traded 2 days just under resistance, accumulating:

- late LONGS

- early SHORTS

I'm willing to SHORT now on friday, once the OTF has been hit.

Scalling in from cwHigh upwards

Invalidation would be to keep pumping and then potentialy SFP on monday for downside.

R:R is alright! I like to give myself a 3% invalidation range till SL.

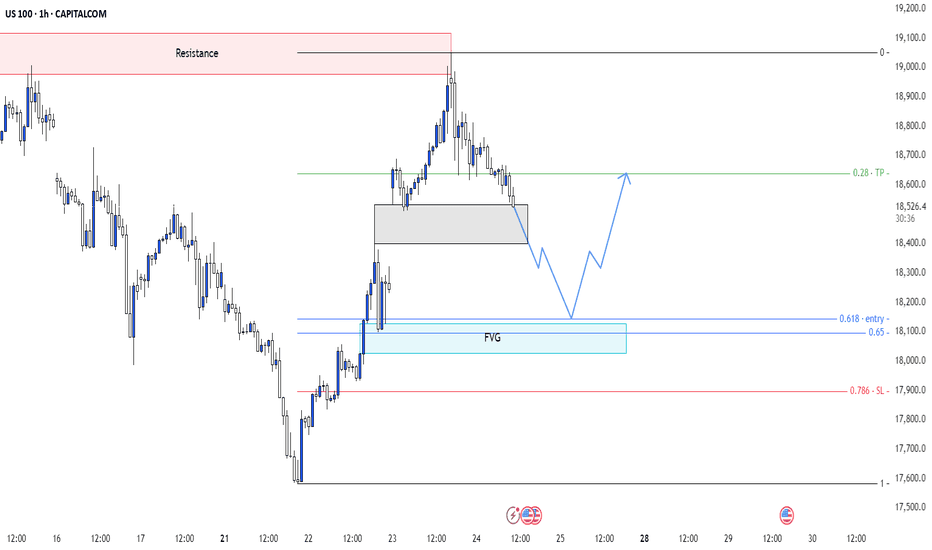

US100 - Corrective Pullback into FVG + Golden Pocket setup?This 1H Nasdaq chart paints a classic structure of retracement within a bullish leg, offering potential for continuation after a clean corrective move into inefficiency. It's all about balance restoration before the next impulse.

---

1. Resistance Reaction & Local Distribution

Price faced strong rejection at a clearly defined Resistance Zone , marking a point of supply where sellers stepped in with aggression.

- The sharp rejection indicates profit-taking from earlier longs or a short-term distribution zone.

- Structure is transitioning from impulsive to corrective, suggesting a pullback is unfolding rather than a trend reversal (at least for now).

---

2. Short-Term Demand Zone Holding Price (Gray Box)

Before reaching deeper liquidity, price is hovering above a local demand block —a previously unmitigated consolidation that supported the last push up.

- This gray zone may provide temporary support, but lacks depth of imbalance.

- It's a weak floor, and smart money typically seeks deeper fills for proper re-accumulation.

---

3. Fair Value Gap Below (Primary Draw on Liquidity)

The key area of interest lies just below, where a clean Fair Value Gap (FVG) is formed. This imbalance represents a void in price action where buy-side inefficiency remains.

- Aligned with the 0.618–0.65 Fibonacci retracement range (confluence entry).

- Price is likely to seek this inefficiency for proper rebalancing.

- It’s not just a “fill the gap” play—it’s a liquidity grab where smart money is most likely waiting.

This zone is ideal for reaccumulation before resuming the move higher.

---

4. Internal Structure Suggests Bullish Intent After Fill

Price is forecasted to:

- Step 1: Break beneath the short-term demand to draw in liquidity

- Step 2: Tag the FVG zone, tapping into fresh demand

- Step 3: Shift structure via higher low formation and breakout

This is the behavior of an engineered retracement—not panic selling.

---

5. Macro Bias Still Bullish – Controlled Pullback

While the short-term price action looks bearish, the context remains supportive of upward continuation:

- No signs of aggressive selling below structure

- Current flow is corrective, not distributive

- FVG zone is strategically placed in alignment with optimal trade entry levels (OTE)

If this zone holds, expect a return to bullish expansion targeting inefficiencies left behind on the push down.

---

Conclusion:

This setup is textbook:

- Efficient rejection at resistance

- Controlled retracement into FVG with Fibonacci confluence

- Potential structural shift post-rebalance

Watch for bullish intent to return once the imbalance is filled. Until then, this is not a breakdown—it's a setup.

Nightly $SPY / $SPX Scenarios for April 25, 2025🔮 🔮

🌍 Market-Moving News 🌍

📉 Procter & Gamble Cuts Outlook Amid Consumer Pullback: P&G shares declined after the company lowered its full-year earnings guidance, citing reduced consumer spending due to economic uncertainty and higher tariffs. CFO Andre Schulten noted significant consumer hesitation, linking it to volatility in mortgage rates and declining stock markets affecting retirement savings.

📊 Durable Goods Orders Surge, Core Spending Stagnant: March durable goods orders jumped 9.2%, driven by a spike in aircraft demand. However, core capital goods orders, excluding aircraft, rose only 0.1%, indicating cautious business investment amid ongoing tariff uncertainties.

🏠 Existing Home Sales Decline Sharply: Existing home sales fell 5.9% in March to an annual rate of 4.02 million units, reflecting affordability challenges associated with high mortgage rates and economic uncertainty.

📊 Key Data Releases 📊

📅 Friday, April 25:

🗣️ Fed Governor Neel Kashkari Speaks (5:00 PM ET):

Remarks may provide insights into the Federal Reserve's perspective on current economic conditions and monetary policy direction.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

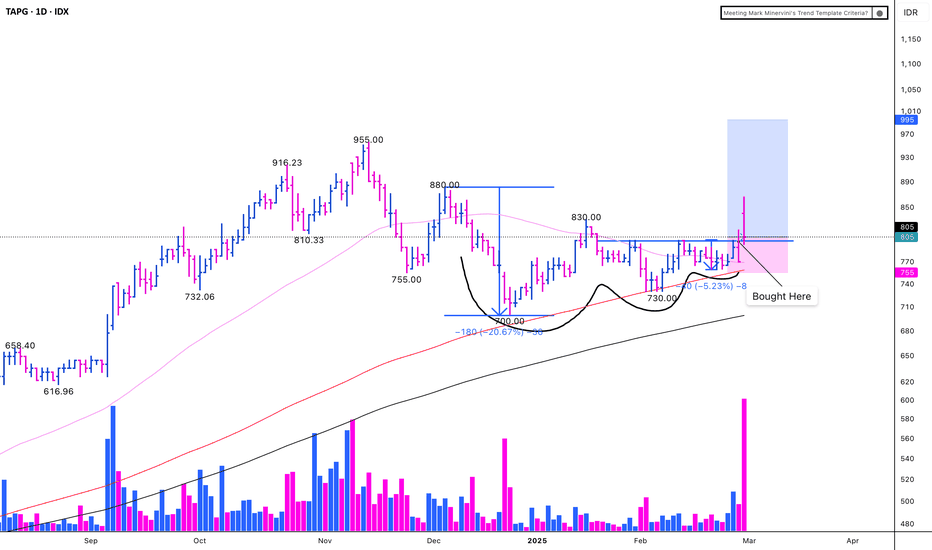

TAPG - VCP (20/5 3T)IDX:TAPG VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (84)

9. Biggest net income +197.70% on Q4 2024 vs Q4 2023

(-)

1. Breakout with huge volume but created long red candle

DAX Resistance Ahead! Sell!

Hello,Traders!

DAX is trading in a strong

Uptrend, recovering itself

From the trade-war lows

And the index is locally

Overbought so after the

Retest of the horizontal

Resistance above at 22,500

We will be expecting a local

Bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

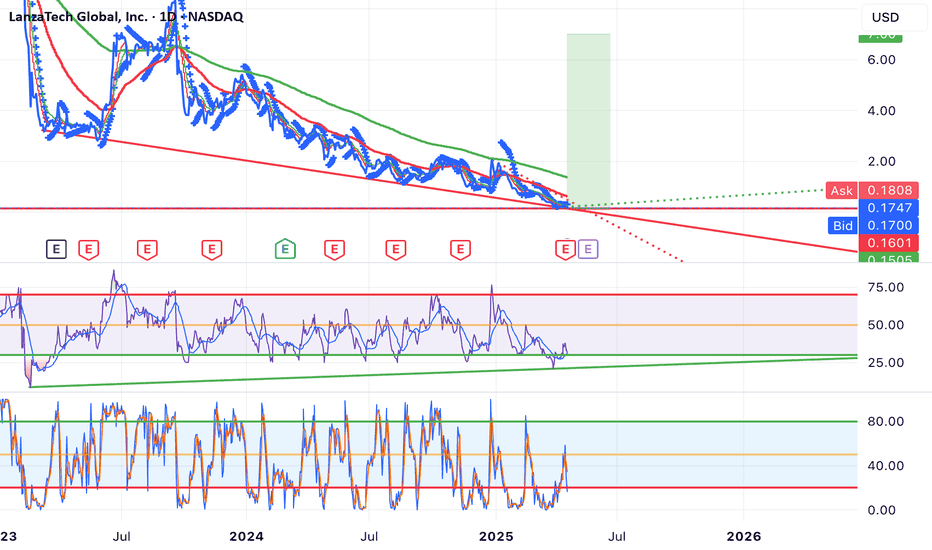

LanzaTech (LNZA). Extremely oversold! Rally incoming?NASDAQ: LanzaTech (LNZA) , based in Illinois, USA, has recently has seen a price low of $0.1401 . This waste management company in recent times, has been featured as a top pick for buys by various news outlets. Although in an extremely bearish slump, I have a bullish prediction.

In the technicals on the 1 Day Chart , the RSI appears to be indicating oversold , with a slight potential of more of a dip to come. The Stochastic seems to also be indicating oversold market conditions. A long time frame bullish RSI divergence also appears to be forming starting at the middle of Feb 2023.

LanzaTech recently declined a "lowball" offer for $0.02 a share, which could signal insider bullish sentiment. LanzaTech FY25 Q1 earnings are forecasted to be significantly higher than FY24 Q4 at this time (RH). Their website, marketing and twitter appear to show no real signs of slowing business operations in my opinion.

Analysis also appears shows that there is very little open interest on put options at this time. Conversely there seems to be a large number of call options from $1-$7 expiring in the near future signaling institutions and high profile traders may be entering the market quietly.

Given the above signals and analysis I personally am setting a speculative stretch price target of $7 with various other orders taking profit along the way at key strike price cluster levels. With LanzaTech at a discounted price, a buy now could yield significant results.

Anything can happen in the markets. What do you think? Will LanzaTech recover? Or will value become completely wiped out?

Disclaimer: Not Financial Advice

IBM Share Price Falls Following Earnings ReportIBM Share Price Falls Following Earnings Report

Yesterday, after the close of the main trading session, International Business Machines (IBM) released its Q1 earnings report, exceeding Wall Street analysts’ expectations in several key areas. According to FactSet:

→ Earnings per share came in at $1.60 (forecast = $1.42), although this was below last year’s figure of $1.68.

→ Quarterly revenue reached $14.54 billion (forecast = $14.39 billion), marking a 1% increase year-on-year.

Initially, IBM shares rose on the news, but then dropped by approximately 6% during after-hours trading, according to Google Finance.

This suggests that today’s trading session may see IBM shares open below the $230 mark.

Market participants may have been disappointed by the following:

→ IBM’s mainframe business (large-scale computing systems designed for high-volume data processing) continued its decline, falling by 6% year-on-year.

→ Revenue from software and consulting divisions increased, but only by 3% compared to the same period last year.

→ The revenue forecast for Q2 stands at $6.6 billion – a 3% decline relative to the same quarter in 2024.

Technical Analysis of IBM Share Price

The chart shows signs of seller activity above the psychological level of $250. As indicated by the arrows, the price attempted several rallies above this level with varying momentum, but each time retreated back.

At the same time, price fluctuations formed a downward channel, which was extended to the downside in early April amid news regarding new tariffs in international trade.

Price stabilisation observed between 15–17 April suggests that supply and demand were temporarily balanced ahead of the earnings release. However, the negative market reaction to the report may shift sentiment and act as a catalyst for further price movement towards the lower boundary of the channel, around the key support level of $215.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

BTC - Is there anything that can stop this bullrun?The current 4H structure presents a high-probability scenario centered around a classic liquidity sweep into premium levels, followed by potential downside rebalancing into inefficiencies. This is a clear case of price reaching for external liquidity before internal structure takes over.

---

1. Liquidity Run Above BSLs

Price has aggressively pushed upward, sweeping multiple Buy Side Liquidity (BSL) levels. These levels mark resting stop orders and breakout entries positioned by retail above recent swing highs.

- The impulsive move to the upside isn't a sign of strength—it's a strategic run for liquidity.

- These liquidity pools provide exit opportunities for large players offloading long positions initiated earlier in the structure.

- The sweep aligns with typical behavior just before price reacts to higher timeframe supply or premium Fibonacci zones.

---

2. Golden Pocket Confluence Zone (Downtrend Bias)

The orange highlighted zone represents the Golden Pocket —the 61.8%-to-65% retracement zone often associated with downtrend continuation or reversal setups.

- This level acts as a magnet in trending conditions, often leading to strong rejections.

- As price enters this pocket, the probability of a reaction increases, especially following a liquidity grab.

- The structure suggests this move is designed not for continuation, but for setting up a reversal.

The projected swing failure pattern at this level implies a shift from bullish euphoria to short-term distribution.

---

3. Internal Structure: Fair Value Gaps as Rebalance Zones

Two Fair Value Gaps (FVGs) are marked as zones of inefficiency, where price moved too aggressively to maintain balance between buyers and sellers.

- FVGs represent internal liquidity voids and serve as high-probability magnets for retracement.

- The first FVG lies just below the current price, suggesting a short-term retracement target.

- The second, deeper FVG offers a more substantial downside target and is aligned with typical rebalancing behavior after aggressive markups.

As price begins to break structure to the downside, these gaps become the logical destinations.

---

4. Probable Flow: Liquidity Sweep → Rejection → Internal FVG Fill

The anticipated flow is strategic and sequential:

- Step 1: Sweep of BSL and deviation into the Golden Pocket

- Step 2: Quick rejection, potentially forming a lower high

- Step 3: Downside expansion targeting both FVGs for liquidity rebalancing

This is not about chasing price—it’s about understanding the intent behind the move : create imbalance, sweep liquidity, then deliver price into inefficiency.

---

Conclusion:

This 4H chart outlines a mechanically driven move:

- External liquidity (BSL) tapped

- Premium level tested (Golden Pocket)

- Internal inefficiencies below acting as draw

The structure points to a transitional phase from premium to discount, with the FVGs below acting as clear objectives. Until those inefficiencies are fully addressed, the upside narrative remains reactive, not impulsive.

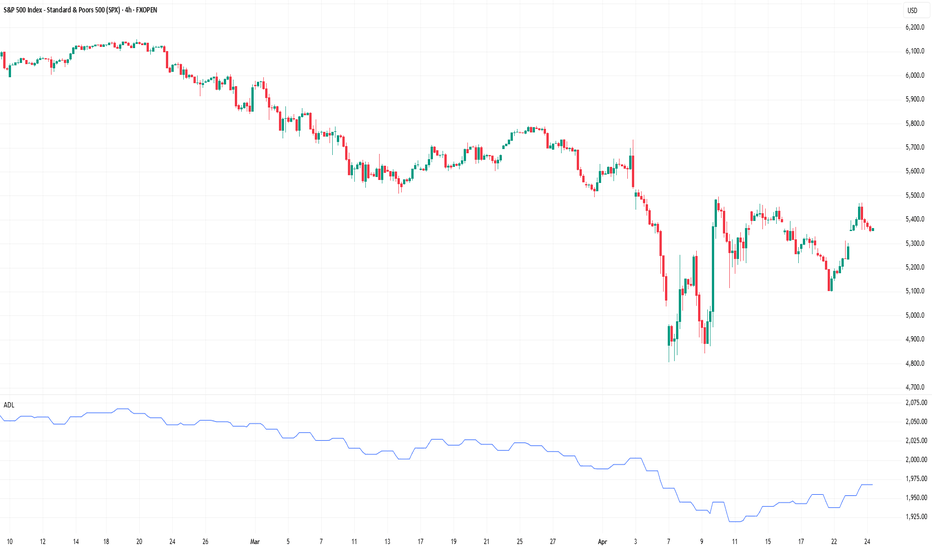

What Is the Advance-Decline (A/D) Line, and How Can You Use ItWhat Is the Advance-Decline (A/D) Line, and How Can You Use It in Trading?

The Advance-Decline (A/D) Line is a widely used market breadth indicator that provides insights into the strength of trends by tracking advancing and declining stocks. Popular among traders analysing indices like the NASDAQ, it helps identify broad participation or hidden divergences. This article explores how this indicator works and its role in effective market analysis.

What Is the Advance-Decline Line?

The Advance-Decline (A/D) line, also known as the Advance-Decline Index, is a popular market breadth indicator used to gauge the overall health of a market's movement. Instead of focusing solely on price changes in an index, it analyses how many stocks are participating in the market's rise or fall. This makes it particularly useful for traders looking to understand whether a trend is supported by widespread participation or driven by just a handful of stocks.

The indicator can be set up based on stocks on different exchanges. For example, a NYSE Advance-Decline line provides insights into NYSE-listed stocks. However, it can be applied to any index or exchange, resulting in the Nasdaq Advance-Decline line or a line based on stocks listed in the UK, Australia, Europe, or Japan.

At its core, the A/D line is a cumulative measure of the net advances of stocks on a given day. The calculation is as follows:

1. Count the number of advancing stocks (those that closed higher than their previous close).

2. Count the number of declining stocks (those that closed lower than their previous close).

3. Subtract the number of declining stocks from the advancing stocks to get the net advance.

4. Add this net advance to the previous day’s A/D line value.

Formally, the Advance-Decline line formula is:

Net Advances = Advancing Stocks − Declining Stocks

Current A/D Line Value = Previous A/D Line Value + Net Advances

For example, if 500 stocks advanced and 300 declined on a given day, the net advance would be +200. If yesterday’s A/D Line value was 10,000, today’s value would be 10,200. Over time, these daily values form a line that tracks the cumulative net advances.

The indicator provides insights into sentiment. A rising line indicates more advancing stocks than declining ones, while a falling line suggests the opposite. Traders often use this data to determine whether a price trend in an index reflects broad strength or is being carried by a few heavyweights.

Understanding Market Breadth

Market breadth measures the extent to which individual assets are contributing to a market's overall movement, providing a clearer picture of the strength or weakness behind trends. Rather than relying solely on an index's price performance, breadth gives traders insights into how widespread participation is within a rally or decline. This information is crucial for understanding whether market moves are broad-based or concentrated in a few influential assets.

A market with a strong breadth typically sees most stocks or assets moving in the same direction as the overall trend. For example, during a rally, broad participation—where a large percentage of assets are advancing—signals a robust and healthy trend. Conversely, weak breadth occurs when only a small group of assets drives the movement, potentially indicating fragility in the trend. This is especially important in large indices where a few heavily weighted assets can mask underlying weaknesses.

How Traders Use the A/D Line

The A/D Line is more than just a market breadth indicator—it’s a practical tool traders use to gain insight into the strength and sustainability of trends. By analysing how the indicator behaves in relation to price movements, traders can uncover potential hidden opportunities and spot potential risks. Let’s consider how the Advance-Decline line behaves on a price chart.

Identifying Trend Strength

One of the A/D Line’s key uses is evaluating the strength of a market move by examining overall participation. When both the A/D Line and an index rise together, it suggests widespread buying activity, with most stocks contributing to the rally. Similarly, if both the index and the A/D Line decline, it often reflects broad-based selling, indicating that weakness is widespread across the market rather than concentrated in a few assets.

Spotting Divergences

Divergences between the A/D line and price are closely watched by traders. For instance, if an index continues to rise but the A/D line starts declining, it could signal that the trend is losing momentum. Conversely, when it begins rising ahead of a price recovery, it may suggest underlying strength before it becomes apparent in price action.

Complementing Other Indicators

Traders often pair the A/D line with other tools to refine their analysis. For example, combining it with moving averages or oscillators like RSI can help confirm signals or highlight discrepancies. A rising A/D line alongside RSI rising above 50 might reinforce the possibility of a price rise.

Strengths of the A/D Line

The A/D line is a widely respected tool for understanding market dynamics, offering insights that price-based analysis alone can’t provide. Its ability to measure participation across a broad range makes it especially valuable for traders looking to assess sentiment and trend reliability. Let’s explore some of its key strengths.

Broad Market Perspective

The A/D line captures the performance of all advancing and declining stocks within an index, offering a comprehensive view of how much support a trend has. Instead of focusing solely on a handful of large caps that often dominate indices, the indicator reveals whether the majority are moving in the same direction. This helps traders gauge the true strength of a rally or decline.

Early Warnings of Weakness or Strength

Divergences between the A/D line and the price can act as an early signal of potential changes in momentum. When the A/D Line deviates from the overall trend, it can highlight areas where market participation is inconsistent. This allows traders to assess whether a trend is gaining or losing support across a broad range of assets, offering clues about potential shifts before they fully materialise in price action.

Applicability Across Markets

Another strength is its versatility. The A/D line can be applied to indices, sectors, or even individual markets, making it useful across various trading strategies. Whether monitoring a broad index like the S&P 500 or a specific sector, the indicator can be adapted to provide valuable insights.

Limitations of the A/D Line

While the A/D line is a useful tool for analysing breadth, it isn’t without its limitations. Traders need to understand its drawbacks to use it effectively and avoid potential misinterpretations. Here are some of the key challenges to consider.

Ignores Stock Weighting

One major limitation is that the A/D index gives equal weight to every stock, regardless of size or market capitalisation. In indices like the S&P 500, where a small number of large-cap stocks often drive performance, this can create a disconnect. For example, a large-cap stock’s strong performance might lift an index while the indicator shows weakness due to low-caps underperforming.

Vulnerability to Noise

The index can produce misleading signals in certain conditions, such as during periods of low trading volume or heightened volatility. Market anomalies, such as large fluctuations in a small number of stocks, can skew the indicator and make it less reliable. This can be especially problematic in thinly traded assets or at times of high speculation.

Not a Standalone Indicator

The A/D line is combined with other tools. On its own, it doesn’t account for factors like momentum, valuation, or sentiment, which can provide critical context. Traders relying solely on it may miss out on key details or overemphasise its signals.

Comparing the A/D Line with Other Market Breadth Indicators

The A/D Line is a powerful tool, but it’s not the only market breadth indicator traders use. By understanding how it compares to other indicators, traders can select the one that suits their analysis needs or combine them for a more comprehensive view.

A/D Line vs Advance-Decline Ratio

The A/D Ratio measures the proportion of advancing to declining stocks. While the A/D line provides a cumulative value over time, the ratio offers a snapshot of market breadth for a single trading day. The A/D Ratio is often better for identifying short-term overbought or oversold conditions, whereas the A/D line excels at tracking long-term trends.

A/D Line vs McClellan Oscillator

The McClellan Oscillator uses the same advancing and declining stock data but applies exponential moving averages to calculate its value. This approach makes the McClellan Oscillator more sensitive to recent market changes, allowing it to highlight turning points more quickly than the A/D line. However, the A/D line’s simplicity and cumulative nature make it more straightforward to interpret for broader trend analysis.

A/D Line vs Percentage of Stocks Above Moving Averages

This indicator tracks the percentage of stocks trading above specific moving averages, such as the 50-day or 200-day. While the A/D line focuses on daily advances and declines, the moving average approach highlights whether stocks are maintaining longer-term momentum. The A/D line provides a broader perspective on participation, whereas this indicator zeros in on sustained trends.

The Bottom Line

The Advance-Decline line is a valuable tool for traders seeking deeper insights into market trends. By analysing market breadth, it helps identify potential opportunities and risks beyond price movements alone.

FAQ

What Is the Meaning of Advance-Decline?

Advance-decline refers to the difference between the number of advancing stocks (those that closed higher) and declining stocks (those that closed lower) on a specific trading day. It’s commonly used in market breadth indicators like the NYSE Advance-Decline line to measure the overall strength or weakness of the market.

How to Find Advance-Decline Ratio?

The Advance-Decline ratio compares advancing stocks to declining stocks in an index. It is calculated by dividing the number of advancing stocks by the number of declining stocks.

How to Use an Advance-Decline Line Indicator?

The A/D line indicator tracks the cumulative difference between advancing and declining stocks. Traders analyse its movement alongside price trends to assess market participation. For example, divergence between the A/D line and an index price direction can signal potential changes in momentum.

What Is the Advance-Decline Indicator Strategy?

Traders use the Advance-Decline indicator to analyse market breadth, identify divergences, and confirm trends. For example, a rising A/D line with an index suggests broad participation, while divergence may signal weakening trends.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.