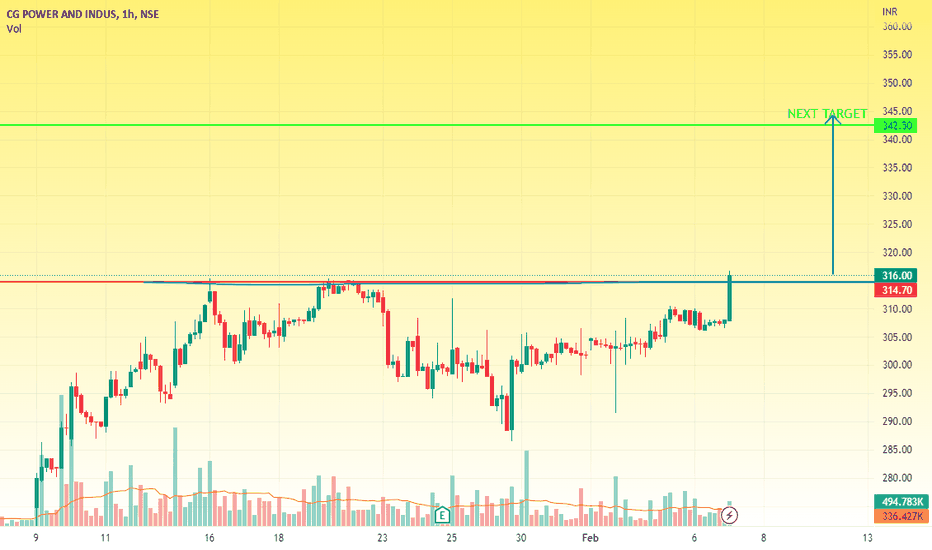

Stockstobuy

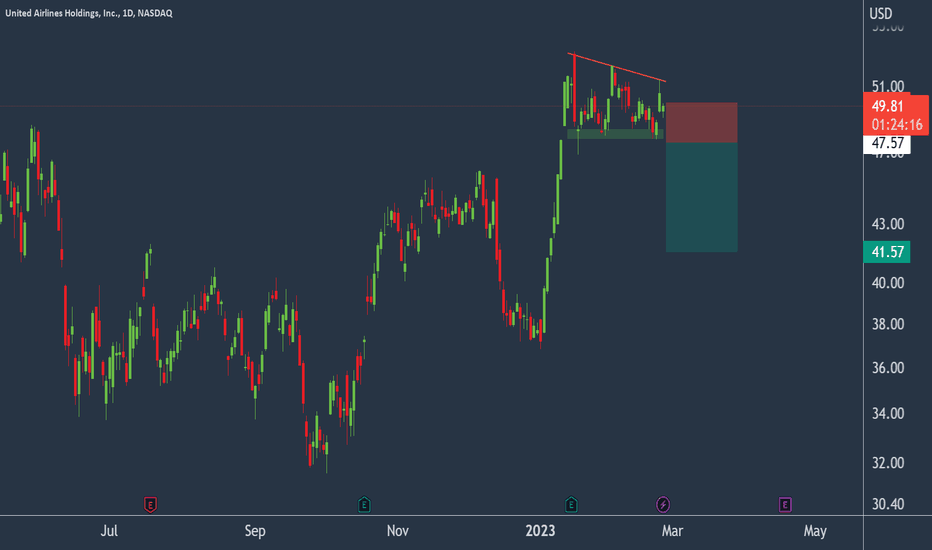

UAL in descending triangle.United Airlines Holdings -30d expiry - We look to Sell a break of 47.57 (stop at 49.87)

We are trading at overbought extremes.

Trades with a bearish descending triangle formation.

Expect trading to remain mixed and volatile.

A break of the recent low at 47.77 should result in a further move lower.

The bias is to break to the downside.

A higher correction is expected.

Our profit targets will be 41.57 and 40.57

Resistance: 51.50 / 52.34 / 53.26

Support: 49.00 / 47.77 / 46.88

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

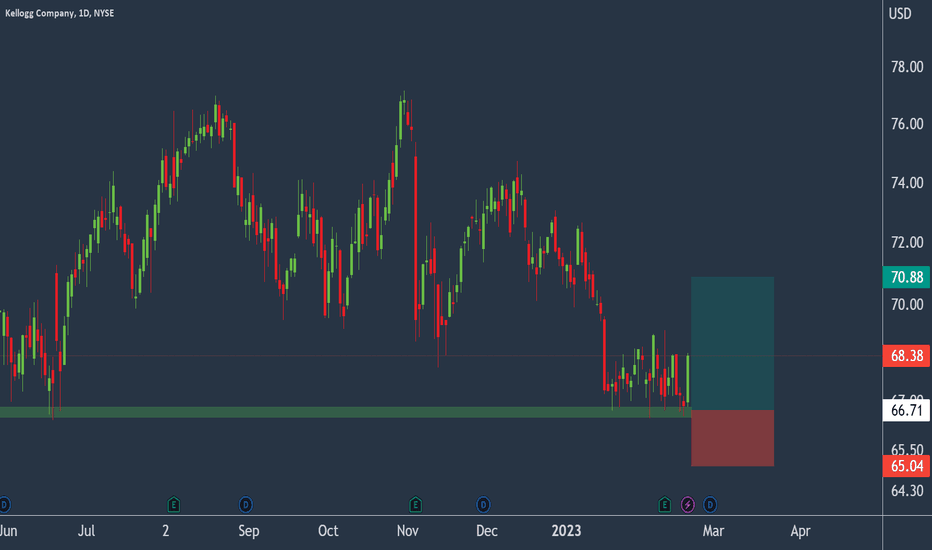

Kellogg found a strong support?Kellogg Company - 30d expiry - We look to Buy at 66.71 (stop at 65.04)

Levels below 67 continue to attract buyers.

Bespoke support is located at 67.

66.45 has been pivotal.

Preferred trade is to buy on dips.

The primary trend remains bullish.

We are trading at oversold extremes.

Bullish divergence is expected to support prices.

Our profit targets will be 70.88 and 71.88

Resistance: 68.50 / 69.20 / 70.00

Support: 68.00 / 67.00 / 66.45

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

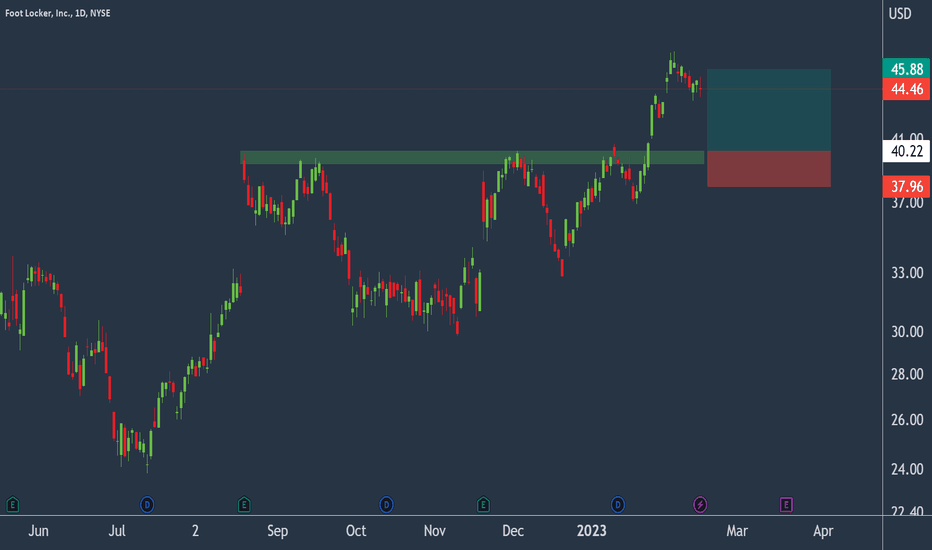

Footlocker to find support at previous resistance?Foot Locker - 30d expiry - We look to Buy at 40.22 (stop at 37.96)

Daily signals are bullish.

Previous resistance, now becomes support at 40.

50 4hour EMA is at 40.43.

Preferred trade is to buy on dips.

A later spike higher was met with further selling interest and prices settled lower to post a negative day.

A lower correction is expected.

Our profit targets will be 45.88 and 46.88

Resistance: 45.70 / 47.22 / 50.00

Support: 43.62 / 42.40 / 40.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

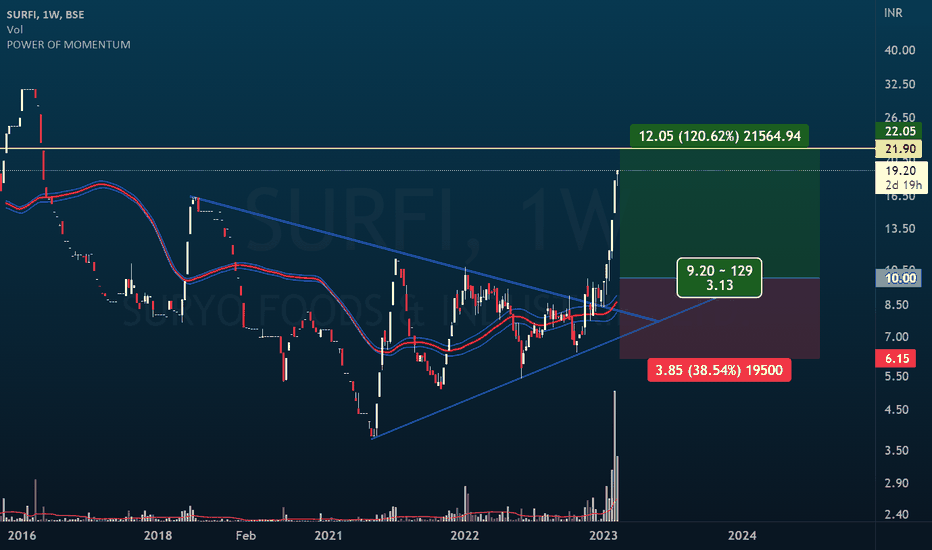

SURFI : 93% ACHIEVED IN 5 WEEKS ; TARGET 120%HELLO TRADERS!

First of all I'm extremely sorry that I was not able to post any chart for a long time for my hectic schedule.

This trade BSE:SURFI I took about 5 weeks ago and its 92% up till then. target is just to hit in a week or two. Through this chart I want to show how this pattern work.

For more detailed analysis and learnings you can watch my videos on other platfrms.

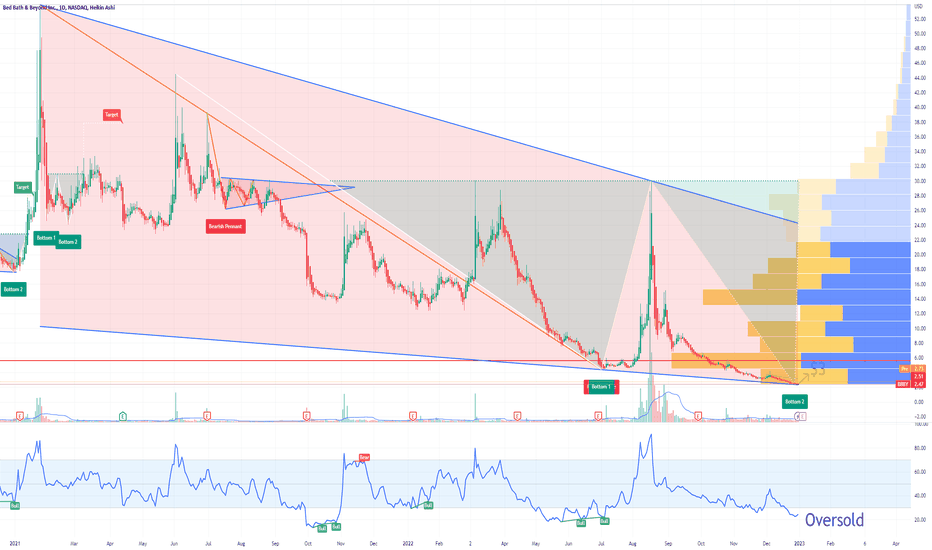

BBBY in My Top Stock Picks for 2023BBBY Bed Bath & Beyond has the potential to become the next GME GameStop or AMC Entertainment.

Heavily shorted, analysts saying that the stock May Not Make It to 2023.

Perfect for a short squeeze.

BBBY Bed Bath & Beyond is one of My Top Stock Picks for 2023!

Looking at the options chain, i would buy the $3 strike price Calls with

2023-3-17 expiration date for about

$0.70 premium.

Looking forward to read your opinion about it.

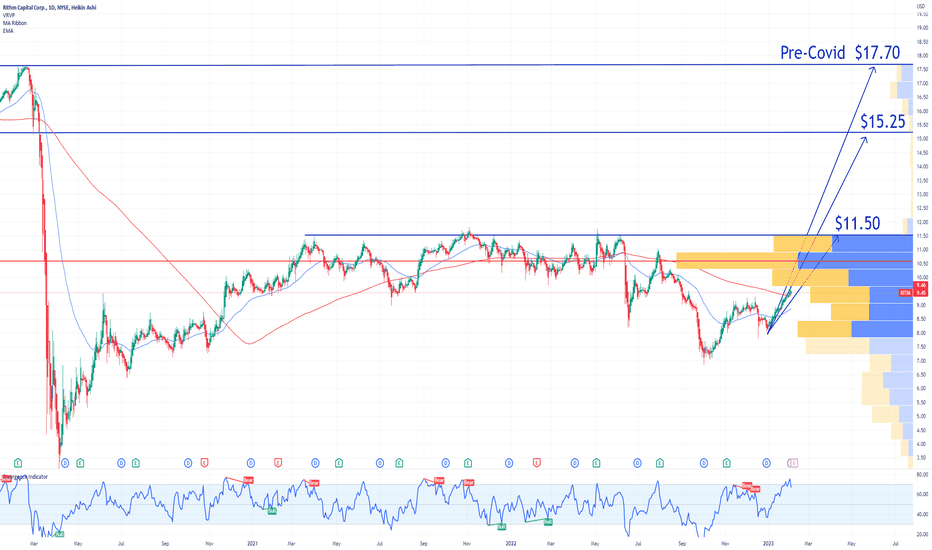

RITM Rithm Capital could be the Call of the Week! RITM Rithm Capital to report earnings on February 8, 2023 prior to the opening of the New York Stock Exchange.

If we look at fundamentals, this stock at $9.46 looks extremely cheap.

2.02 EPS

10.57% DIVIDEND YIELD

4.92 P/E ratio

But what is more impressive are the calls for this stock:

Looking at the RITM Rithm Capital options chain ahead of earnings , I would buy the $10 strike price Call with

2023-2-17 expiration date for ONLY

$0.05 premium.

In case this stock goes to $10.50 after earnings, which is not excluded considering the price history, those calls could give a return of 10X!

Looking forward to read your opinion about it.